19.1 – Homework

WARNING tax techniques for the wealthy are not very common, so make sure you have an open mind!

For example, waiting to file your taxes in October, and not like most people in April. See video.

ALL INFO HERE IS NOT TO BE TAKEN FOR LEGAL/TAX ADVICE. YOU SHOULD SEEK TO GUIDANCE OF SUCH PROFESSIONAL. WHAT THIS PAGE IS FOR IS TO OPEN YOU TO THESE IDEAS SO YOU CAN HAVE THE EDUCATED CONVERSATION WITH YOUR CPA.

Book a complimentary session to the CPA/Legal team Lane personally uses – https://bit.ly/2Jyf8Sk

PS – 95% of CPA’s are the run of mill take the least past of resistance crowd. Perhaps a reason why they still have a day job. Of the good ones or should I say even a good one will not be able to give you full financial planning advice such as how much to pull out of retirement accounts or what deals to go into. Think about it… its unfair for them because 1) They don’t know the deal risk profiles nor the operators, 2) They don’t know your future deployment plans to account for your estimated Adjusted Gross Income (effective tax rate) for the next few years, and 3) they don’t know how much depreciation is going from the plethora of investments you look to go into. This is where I tell my investors that it is your job to understand what you can and cannot do and lead your professionals whose JOB is to complete the technical paperwork. CPA/Lawyers are Contractors but you need to be or outsource someone to be your Architect. In other words, I don’t advocate to working for a good CPA and trusting them to do it… their job is to fill in the right forms but you need to be in control as the owner and not let the consultant dictate the scope of work. In the Passive Investor Accelerator, Mastermind Events, and done for you full service for you as a Family Office client you are empowered to be your own architect and connected directly with the rolodex of able professionals. We (myself and our community) raise your financial IQ to be able to advise your tax professional on what to do so they can implement the strategy instead of them strong arming you into a conservative and poor tax play. One item that you need is the Form 8582 from your current accountant which has your suspended passive losses (PALs) – beware they don’t give it to you or with all the backend calcs because it’s their way of preventing you from leaving.

How can I reduce taxes on W-2 Income?

- Car washes

- Gas stations

- Laundromats

- ATM machines

- Fitness centers

- Vending machines

- HSA or FSA contributions

- Retirement contributions (401(k), IRA, etc)

- Charitable deductions (if you itemize)

There are of course other run-of-the-mill ways, but these are example of how most people play Checkers where we play Chess. More info.

How to Offset Returns on This Amazing Deal We Just Exited

Multiple properties are closing up until the next quarter! So, this is a quick rundown on the tax implications and the use of your passive losses to roll that capital gain depreciation recapture forward. 0:20 Recent Closings 2:25 Tres Palms Property | Sample K-1 10:49 Tax Strategy | Potential Solutions 17:52 How long can you suspend passive losses? 20:50 Key Considerations to Consider When Doing 1031 37:00 Options for General Partners 40:15 About Cost Seg | Bonus Depreciation Going Down 43:15 Stocks & Paper Assets 47:16 Gain or Loss From Sale of Assets 48:55 Retirement Accounts 59:24 Problem With Underwriters

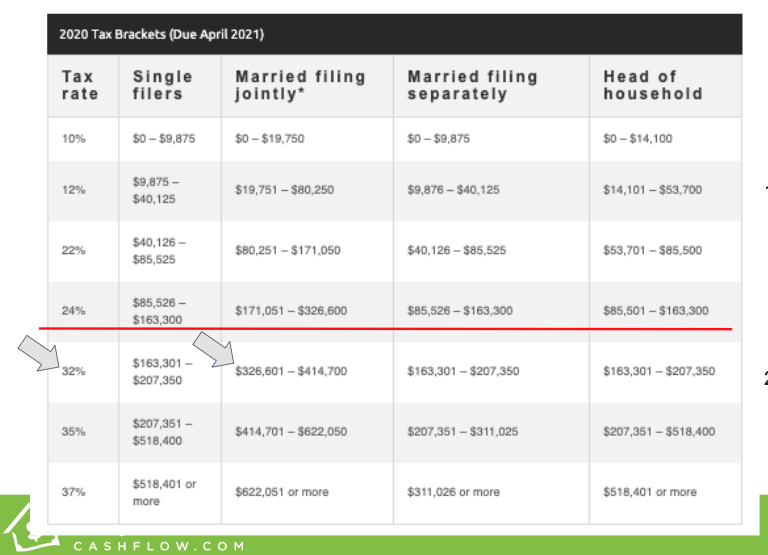

Understanding Where the Tax Brackets Are

Tax planning is based around the tax brackets and utilizing your passive losses to effectively lower your AGI to a certain tax rate.

There is a big jump from the 24% to 32% level indicated by the red line. Those making over $326K (2020 tax year) need to be wary of taking out retirement funds or realizing taxable gains, if it bumps you up over the red line. It may make sense because ideally the investments you are going into are making way more money, but it is a reason why clients take the Family Office consulting services to make a holistic plan.

What is the difference between an NOL and a Passive Loss?

A passive loss is a loss generated from a business activity you don’t materially participate in.

It’s also a loss from a rental activity as all rental activities are passive by default under the US tax code.

Passive losses can only offset other passive income. This means generally won’t offset your W-2 or other active income.

And when your passive losses exceeded your passive income in any given year, these passive losses are suspended and carried forward and be used when you have passive income or gains.

However, a net operating loss (aka an NOL) is generated when losses from an active trade or business exceed your income for the year.

This means the loss offset all of your other income and there was still a loss remaining.

This becomes known as an NOL.

In the past, you were able to carry back NOLs to prior tax years, but under current law, you can only carry them forward.

And when they are carried forward, they are carried forward as non-passive. This means they can offset your non-passive, or active income in future years.

However, there is a limit in place under current that NOL carryforwards can only offset up to 80% of your income. This means that an NOL carryforward can’t reduce your income to 0% and 20% of your income would still be taxable.

To sum it up, an NOL is a loss from an active trade or business that can offset both active and passive income in future years, whereas passive losses can generally only offset your passive income in future years.

Can passive losses offset dividend income?

When you buy a publicly traded stock or REIT, you usually don’t have to do much work to receive “dividends”???

So this leads many to believe that dividends are passive income.

Its “passive work” but not Passive Income.

Under Sec. 469(e) ” gross income from interest, dividends, annuities, or royalties…” is “income not treated as income from passive activity”.

Dividends are considered non-passive income, at least as far as the tax code is concerned.

This means passive losses from rental activities will generally not offset the income generated from dividends.

Unless of course, you qualify for the real estate professional status (REPS), STR Loophole, special loss allowance, or another exception that turns rental losses non-passive.

Passive Losses Example (Note: This tip is for those under 100-150K AGI)

- AGI - $106k

- AGI over 100K - $6k

- Phaseout 50% over 100k - $3k

- Passive Rental Loss - $15k

- Adjusted Deduction Amount - $12k

- Approving Tenants

- Deciding on Rental Terms

- Approving Expenditures

If you are under 100k AGI you will be able to deduct up to 25k from passive losses. The amount of losses you are able to take, start to phase by 50% for every dollar you make over $100k. So at 150k AGI, all of 25k passive losses phase-out.

The example on the left shows the total amount that person can deduct is $12k!

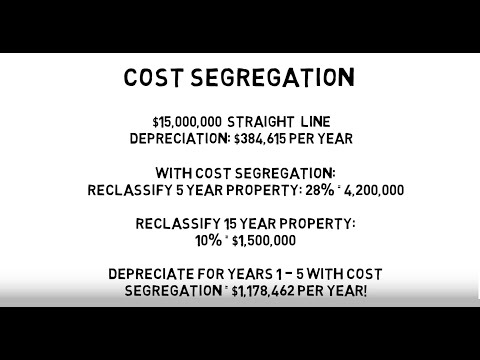

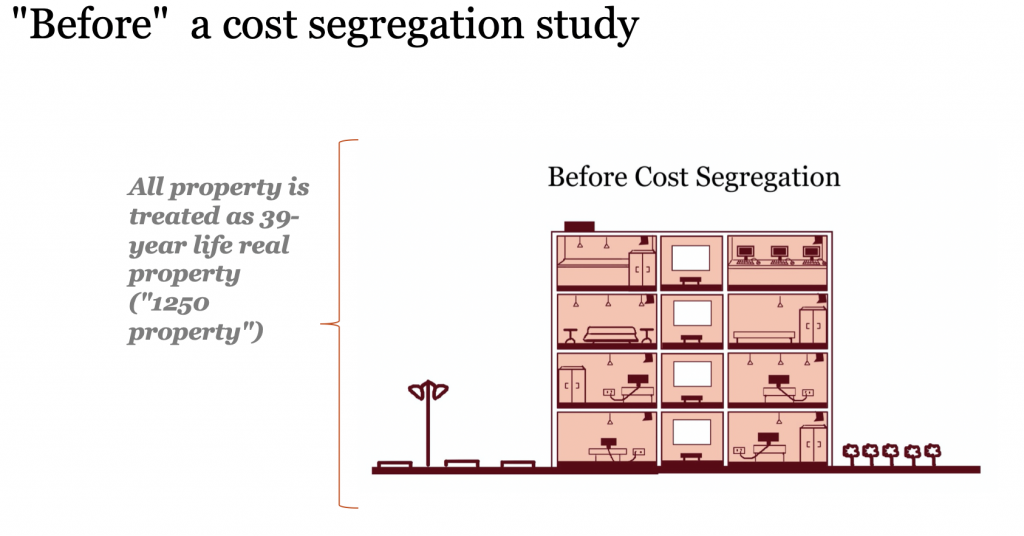

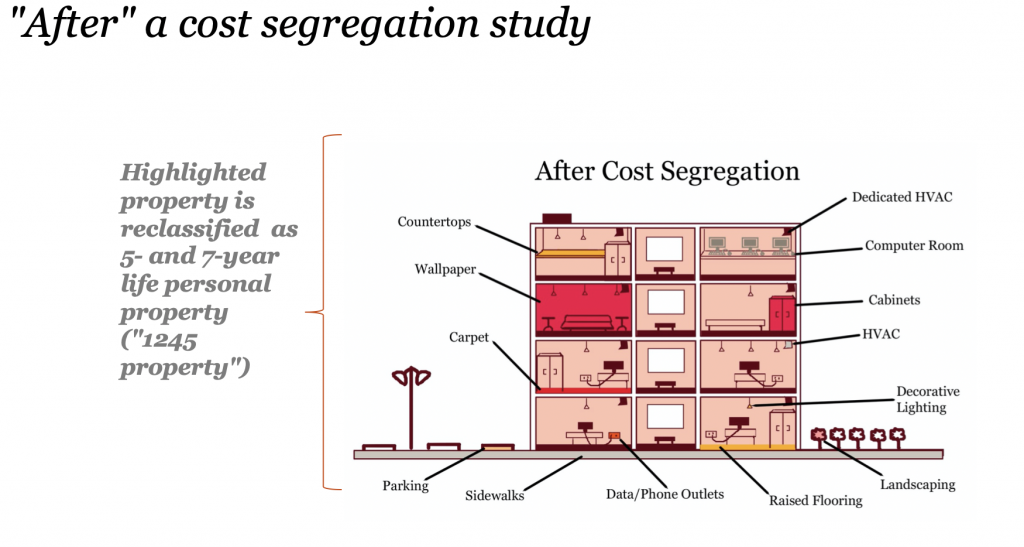

Cost Segregations

Definition for the academics: Property owners of commercial and investment real properties typically depreciate their real estate holdings over 39 years (commercial property) or 27.5 years (residential property).

The IRS provides guidelines to reclassify certain components of a building as shorter-life assets. The reclassification could mean the property owner can take larger tax deductions over a shorter period, i.e., tax savings and improved cash flow.

What it means?

Property owners can reclassify property on the tax books to improve cash flow.

Why it’s important?

Extract 10-20x what you normally would be able to deduct in the first year alone! Take these passive losses and employ the “Simple Passive Cashflow Gravy Train” strategy where you offset your ordinary/W2 income with real estate profession status.

At the end of this module there is a link to our cost segregation article where you can learn more!

Cost Segregation Example

In short, this concept allows us to front load a lot of the depreciation in the investment which in turn can greatly reduce our tax bill. For many newer alternative investment investors, this can offset selling other assets to turn into more cash flowing investments or can be paired with the Real Estate Professional tax status to offset even W2 Active income!

Lessons from a CPA/Tax Attorney

Property Aggregation – Writing Off Your Real Estate Passive Income!👈

Can passive activity losses from other deals be used to offset the capital gain on a sold property

How to Best Utilize Passive Losses w/ Brandon Hall

What is the most tax-efficient way for a 401k to Roth 401k conversion?

Do I need to have an LLC to take tax benefits?

Admin office not home office + REP tax benefits. Plus example of a couple where one spouse cuts back on work and implements REP status.

100k Withdrawals from your retirement funds without penalty

And check out SimplePassiveCashflow.com/covid19 for info about the 100k withdrawals. The webinar with Clint was pretty useful.

If I am a real estate professional in 2020, can I offset previous years PALs?

California Investors: How do I get around the $800 CA LLC fee for my rentals?

PS: Don’t invest in the Socialist Nation of California:

- Rent-to-value ratios don't work there

- It's a blue state, meaning it's a very anti-landlord.

- They tax you like crazy

The essentials below are some of the many common tools that we use in real estate investing that allow us to maximize the dollars that we have in our pocket today.

Note: We are not tax professionals and we are not giving professional tax or legal advice. But I do know that a lot of them still have JOBs. If you have specific questions about your specific scenario you should contact your CPA or Attorney or ask for a referral.

And if your CPA/Tax Attorney is infatuated with IRAs or 401Ks as the best way to minimize taxes. You need a new attorney! Remember that is likely the reason they still have a JOB