BONUS – Venture Capital Lessons

How Terms Can Affect Returns

welcome everyone. Today we are here with 10 capital for our investor info session. We’ll be talking about how terms affect returns. My name is Ashley . I’m the director of outreach and I am joined today by Paige Sudano at 10 capital and hall team Martin, our CEO, who will be giving the presentation.

Holly, if you want to go ahead and start introducing yourself, I will bring up the slides. Great. Thank you guys for joining us today. I’m hall Martin. I’m the CEO and founder of tin capital. We’ve been helping investors and startups connect for funding for over 12 years now. And looking forward to talking to you today about how terms can affect returns.

I find this as a key topic for both startups and investors. It’s there’s over 125 terms in the national venture capital association, glossary for term sheets, and it’s easy to get lost in all of those, but the reality is in most term sheets, there’s only five to 10 terms that really come to the fore and are used often and make a difference.

And that’s what we’re going to do today is talk about those key terms. So if you look at it I would propose that the following six terms are really the ones you ought to look for in the next term sheet or talk with your team about and negotiate with investors. And the first one, and the most important is valuation.

That’s the price you pay for equity. And it’s the one that has the biggest impact on the return to the investor. And that’s called that’s pre money and post money pre money is what was the business worth before the investment? There’s the investment. And then pre-money plus the investment equal post-money and the investor gets the investment divided by the post money number.

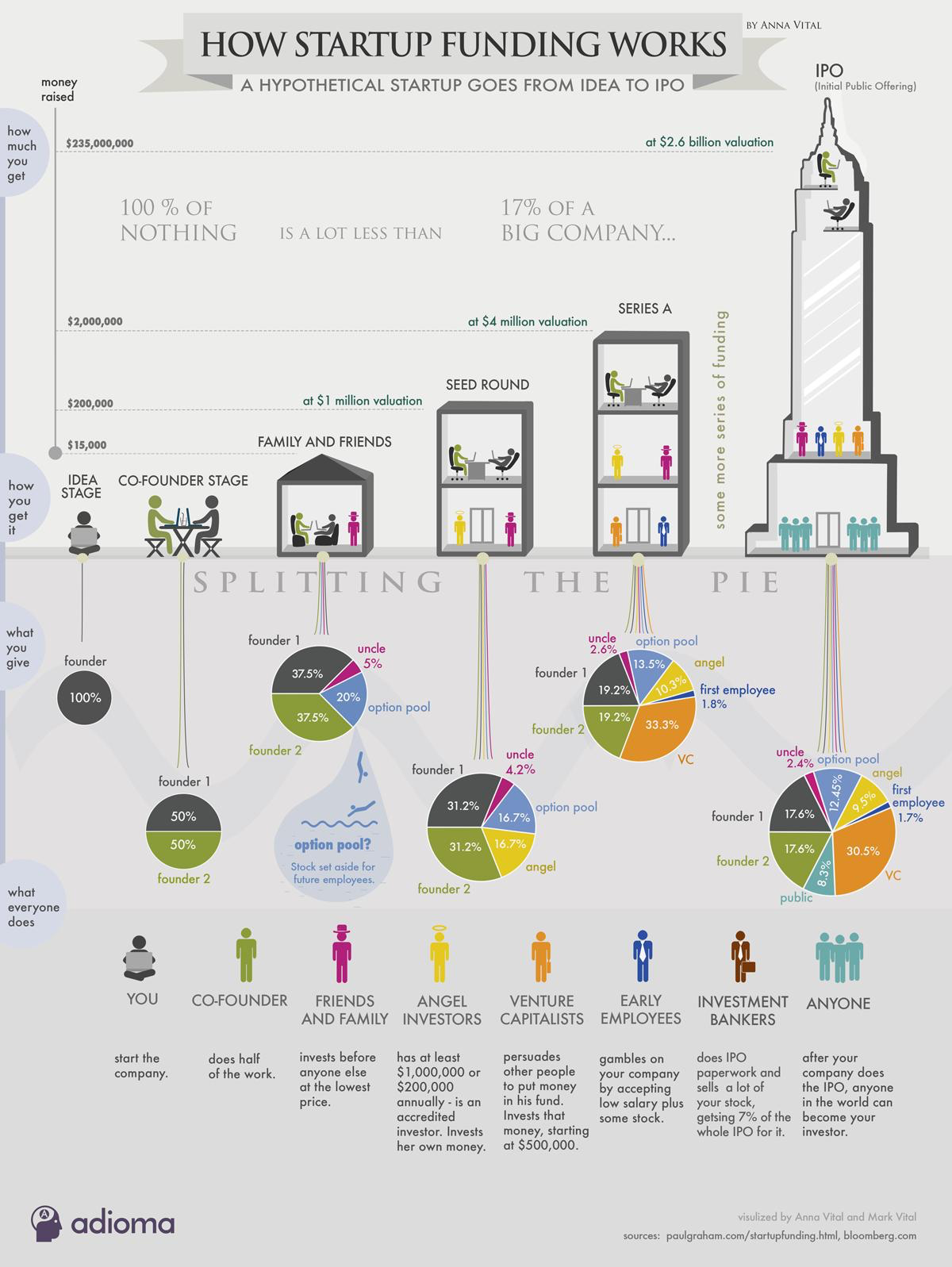

And that valuation is therefore is you’ll see this, the startup pushing that pre-money valuation up and you’ll see the investor push the pre money valuation down because that determines who’s going to get how big a piece of the pie at the end. The second one is participation rights, and this is a key one because it defines the investors right to invest in future rounds.

And most jobs investors invest a smaller amount at the seed level, but then as the company makes progress and they go through a series a and series B, they invest larger. Amount. So it’s important to maintain your position in a successful startups. So you have to understand the participation rights and how they’re being defined.

Some term sheets require you to continue investing others. Don’t the third one is board and information rights, and this is where investors get a voice in the company. And yeah. What information they expect to receive information rights typically refers to the cap table. Who’s on the ownership list the income statement and the balance sheet or the coord numbers that they’re looking for.

And they usually get that either monthly or quarterly as a regular course of events. The fourth one is liquidation preference, and this pays back a investor first. And then the remaining funds are allocated to the rest of the investors based on their percent ownership. So you often see things like one X or two X as a liquidation preference.

So if I put in a hundred thousand dollars and there’s a two X liquidation preference, when it comes time for the exit, I get my 200,000 times two back or $400,000. And then I actually get to. The rest of the money gets divided. Pro-rata based on the ownership. So as simply the amount of money times, a one X, two X, or three X that might be in the contract that you get paid first.

And we’ll talk about why you use that here in a moment. And then the fifth one is redemption rights, and this gives the investors the right to sell their shares back to the company that they want to exit before an acquisition. And that’s a key term too. That’s coming up more and more these days. And then the sixth one is investing founder’s shares.

And this is something that many founders are not familiar with, but when you go through a venture capital fundraise or even angel fundraise, what you’ll find is that they often want the founder to invest some portion of the share and earn them back over the next three, five years. And the reason for that is if the founder leaves early, you don’t want them taking all that equity with them.

You want them to leave the equity behind that they did not yet earned, right? To pay the follow on CEO to do the work. If they take, they have half the shares, they walk out half the half. The equity is gone. If you’re investing 25% of those shares will then, and they leave halfway through then there’s some portion that’s left behind for the follow-on person to take over their work, which is a key issue as well.

Let’s go to the next slide. As you, if we go along, if you have questions, just pop those in and we’ll be glad to answer those as well. So next is terms affecting the returns. These are the six terms that I find had the biggest impact on what you’ll get back. And number one is the pre money valuation that we talked about is the biggest factor.

That’s the valuation of the company before. For the investment goes in. This is the number that’s often bandied about between the startup and the investor as to where they’re thinking the valuation is going to be at then liquidation preference. As we talked about before, it gives the investors some peace back before the others, but the third one is options pool.

And this is a key one. When you start moving into a series, a round is important to set aside some portion of shares, typically 15% for options. And this is to compensate employees and others based on that. And that’s the key thing to have. It’s not something you want to go without, as investment companies, without options pool.

And what you’ll find is that you have to compensate the employees out of cash, all compensations out of cash. And that’s very hard. If you have some options there’s non-cash incentives, you can put out for the employees. So it’s important to have one. When you get to the series they raised. And set aside typically 15%.

The question is who pays for that in a founder friendly term sheet, the investors are paying for it in a investor-friendly term sheet. The founders are paying for it because those shares have to come out of somebody’s ownership, stake. And the question is who’s and, or it could be split evenly as well.

Quickly. Describe what might be some examples of non money options. So if you have a stock ownership for example, you have an option to buy stock and that’s what an options pool is. I give you 50 shared 50 options. You can then later convert those to shares the key. There is that’s I’ve got the stock already set aside for that and handing them to you does not cost the company any cash.

So as simply stock options is what they are. And you hand those out to people. And in most often cases they’re vested over a period of time, two, three years, something like that. And when they’re vested, you can then have the option to go buy a piece of stock, say it’s a at $40, but the stock is now at 60.

Okay. I I exercise those options. I get the 60 minus 40. I get basically $20 per share. For for myself or I can pay the 40 and keep the shares by one to hold on to them. But there’s a non-cash incentive that you can give to the employees. And it’s pretty standard in a growing company to have the employees invested in the company at some level.

But at some point you have to set those shares aside the key issue. Cool. Thank you. Sure. Let me go back. So let’s see. So the next one is to protect your provisions. This is when you include electing board members and who can influence the operational decisions such as approving future fundraising rounds.

So these are tools about around who makes decisions what. The voting rights do people have who’s on the board. These are key factors that go into it. And they primarily come into two factors. One is setting compensation for the team and the employees, and two is approving future fundraising rounds.

And sometimes the third is, do we sell the business? We have an offer to buy the business. Do we sell it? And those are, who makes those decisions is a key factor in these deals that determine. Compensation or what value you get out of the business as well? The next one is co-sale rights and drag along rights.

These give the investors options for either exiting early, if they want to sell their shares, or if they want to stay in the business longer and go for a higher valuation in drag along rights, forces everyone else to go along with them, or if they want to sell the business at an M and a, they can drag along everyone else.

And this is typically the bigger investors making the decisions and the smaller investors. Or having to go along with it. And finally there are dividends dividends are not common in early stage fundings, but they are a source of return for the investors. In most cases, they’re not paid out as you go, but they’re accumulated and paid out added a liquidation event down the road.

So is. Good. Shexie. Are there any questions so far on this? If so, feel free to raise your hand and we’ll dig into those, next slide. Let’s talk about convertible notes. We use convertible notes a lot. We find that’s a great way to kick off a fundraise. I find some people are casting about finding a lead investor in and until they do, they’re not taking any money.

And that can be a while. You never know the. Lead investor is going to walk in the door as the first or the fifth or the 25th investor. And what we coach on is that you should start day one with a convertible note is a debt instrument that converts to equity later, and you start picking up checks on and funding on that because there’s a lot of people that just want to be in the deal, but they’re not going to sit down and negotiate the price and put the term sheet together and do all the diligence.

They just want to be in the deal. And at some point somebody will walk in the door and they’ll say, Hey, I want equity. And I’m willing to put in a hundred K or more. Okay. For you we’ll have that discussion. And I find that there’s just a lot of people before that person that comes in that will.

Drove 25 50, maybe even a hundred K on there, but they’re not going to do any work and that’s fine. We’ll gather up that money. And then when the lead investor comes in and negotiate the price and sets that up, all that convertible note money will convert over into that price round. And that makes a big difference for a lead investor.

When they walk in the door, if they see 300 K of funding already in the deal, this gives them confidence. They’re in a good deal because others are in it. That’s money. They don’t have to raise. So it’s a strategy to get out there and always be in a place where you can take money. Cause you never know when somebody is going to pull out the checkbook and say, Hey, I want to be a part of this.

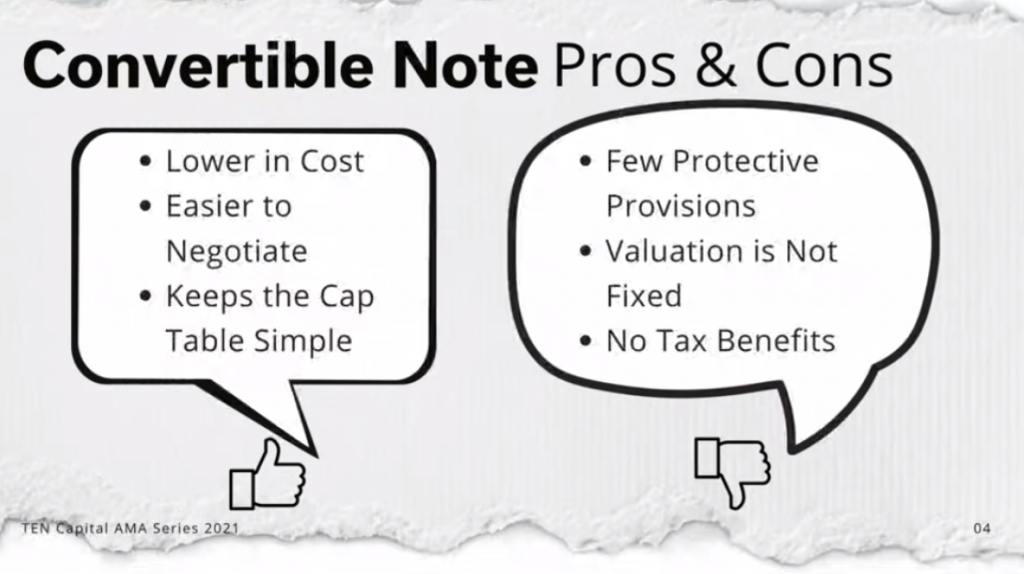

So one reason why people also use convertible notes is that they’re lower cost. If you go to an equity term sheet, you have to start putting in a lot of terms around board and some of these protective provisions and other things we just talked about. Convertible notes are much simpler than that in most cases.

And the key thing is they don’t set the price. There is a valuation cap, but fundamentally the follow on equity investment is going to set the price. And so someone else gets to work on that. They’re hipped in debt form until they either mature or they convert with a follow-on funding round. So they’re pretty simple.

The thing to watch out for is that you don’t usually have a lot of protective provisions in a convertible note. There’s usually no board seats and there’s no other factors that protect you in that evaluation is not fixed. That valuation can go up or down a valuation cap that is included can be a protection for you for it, but it’s not fully set at that time.

And finally, there are no tax benefits. There are tax benefits for qualified small businesses like the 1202. Okay. But they only apply to equity investments, not convertible note investments. So you give that up convertible notes are useful for launching these raises, but eventually the, that money will move into an equity place on the cap table.

And so you need to look out for that as well. And equity rounds can be done, set the valuation and then give you the tax benefits and the protective provisions later itself. Let’s see. Okay. So let’s move on to the next slide and talk about term sheets to mitigate risk. One of the reasons why there’s 125 terms in the NVCA glossary is that there’s a term to mitigate every risk you find in the deal.

And when you go in, for example, if you see the valuation, you consider that to be too high, you admitted negate that risk by adding a liquidation preference. If you think the team needs oversight. You can mitigate that risk by adding board seats to fill it with advisors who can help. And so it’s a great way to maintain a investors position in the deal because you can actually put in tools that will counteract any challenges you think there are already in the deal.

And most startups there are challenges. And so for maintaining oversight over the operations, you can ask for more information rights, board seats and founder vesting terms. For achieving an exit you can put in drag along rights, redemption rights and registration rights to get it. Many of these are standard, but you always want to check.

And that’s the key question and diligence is where’s the risk in the deal and what can we do about it? Sometimes it can be negotiated out directly sometimes. It must be actually written into the term sheet as well. And so this is a way you want to look at these is what’s the risk. And then how do I mitigate it with these terms?

So it’s considered a toolbox. That’s helping you do that. Let’s go onto the next slide and talk about negotiating the terms and negotiating the terms of a startup investment. The investors should develop a standard term sheet and then modify for each deal. I’ve worked with groups where we actually tried to create a unique term sheet for every deal that came through.

And I can tell you that is not the way to do it. Figure out as an investor or a startup, what is important to you and think come up with a term sheet that has those terms in it, those protective provisions and so forth. And so key elements and investor will consider in negotiating terms are one. The valuation is something that needs to be on the table, right?

And it’s always going to be a question. What you’ll find about valuation is that it’s really not a formula. Yes. There are formulas and calculators that help you generate a number. The valuation is really a negotiation is coming, has two sides coming together. And so don’t be surprised if you’re a startup and you put out a number and you get pushback.

I guarantee you always get pushed back, no matter what number you put out there, the other side will say, how do you arrive at that? And now what they’re really saying is. Let’s negotiate that number. It doesn’t mean you have to give it up, but you do have to go through the process. So mentally prepare for that.

Next is vesting founder shares. If you’re an investor, I do recommend you invest. Founder’s shares to cover the amount of time for the project you expect them to do in the seed stage. You’re expecting to be there three to five years to get the company up and off the ground. Series a same thing.

Many of these projects are three, four years long. You want to put in. Equity in have them unvested enough equity that they earned back over the next three to four years. So when they finish the project, they will have their equity at that point, if they want to leave, that’s fine, but make sure you’re matching the vesting of founder shares with the project you have in mind for them to do.

Next is options, pool. Like I said before, it’s important to put in an options pool. To compensate employees. Don’t go without that. That’s not a good thing and negotiate out. Who’s going to pay for it. One, the other, both sides. And finally our next board of directors, make sure you get a board of directors or at least a board of advisors that can provide oversight to the business.

I find about half the startups I deal with have no board. And at some point at things become challenging. It becomes a problem and they need help. And that’s when the board comes to bear to really make sure things are on the up and straight. And next is liquidation preference. If you feel like you need a floor on your investment, then negotiate a one or two X liquidation preference.

Those are very common to do out there. And then finally it growth strategy that the thing you want to work on is how are we going to grow the business? And this may not be written into the term sheet itself, but I often hear from startups saying half my board wants me to grow organically. The other half want to raise a lot of money and hit the gas and drive hard.

And every board meeting is a fight and an argument make sure you get clarity up front, what the growth strategy is going to be, and that people are on board with that. So you have productive meetings, not nonproductive meetings as well. Next is the LLCs versus C corporations. There’s two structures you’ll see out there.

When someone starts a business, we always say, start with an LLC, just go in and put an LLC together and start doing startup ideation and start doing. Minimum viable products and tested and just get that out there and work on it. As you start to grow you’ll be able to do pass through accounting with that.

And at some point you’ll want to raise institutional money such as venture capital. And the key is they’re going to want to have you be in a C Corp format. And what you do is you start with an LLC and then when you get to that stage and somebody wants to invest, you switched to a Delaware C corporation.

The thing to recognize here is that most investors groups have all of their documents set up for Delaware, C corporations. And they’re not changing it for you. You have to fit into their model. And the key is to offer to change. If they’re going to invest people, come in and ask me all the time. I’m an LLC now.

And in three years I might raise money. Should I go ahead and convert to Delaware? C not necessary. Let’s wait till we get closer to it. Let’s go find the investor that really wants this. And then we’ll pull the trigger and move over. It’s not hard, but it does cost some money. It does cost some time, but you always make clear to the investor.

If you’re investing a substantial amount of money, I’m converting to a Delaware C and you do it in a timely manner, which is when the investors paying for it to do the differences that you’ll see on this slide is see corporate tax at the corporate level. LLCs are typically pass through structures that allow losses and profits to flow to the members.

And so when you get to a certain scale or size, you have to give up that password structure and just go to the corporate taxing structure. So there are some advantages of starting with an LLC like that one, the Delaware C Corp is the venture capital standard. And so you’ll see all the documents are set in it.

So you will want to stay with it. And then, upon exit LLCs can be preferable to the owners because you can build up losses from the early days to reduce the tax burden upon selling the business. I see many company when they get near the exit that they start trying to move most of their. A company back under LLC structures to avoid the taxation that comes at the end.

So you realize that there are tax issues that go with this as well. And if you’re in C corporation, you can take advantage of the tax laws such as 1202, 10 45 and 1244, which basically, gives you. Reduces your tax burden gives you zero capital gains on some of these and lets you do let’s you take gains from one startup and put to another startup without having to pay tax on it.

But those only work with a C corporation and then the C Corp is, are very good about setting up boards and providing stock options. LLCs are not so good at that. Technically you can do that with an LLC. I rarely see that, but you can do that with an LLC, but they’re more difficult to do. If you are taking equity.

C corporation, you’ll call them shares. If you take equity and LLC you’ll call them units. It’s the same math, same calculation, but you’ll see it listed differently based on the structure. So are there any questions so far? Not yet, but if you do let us know. And then next slide is the soft side evaluations yet.

Like I said before, there are financial calculators and there are formulas out there that people use for this. But what you’ll find is that there’s a soft side to this, which is. What are the current market conditions? Evaluations do ride up and down primarily with the stock market. When the stock market’s very high, people have a lot of enthusiasm, they have extra cash.

And so you can ask for more for your valuation, for your startup. When the economy is in a recession and the stock market’s down, people have less cash. Then you’ll see valuations go down with it. It’s not a direct correlation, but it’s pretty close. Next is predictability. If you can get a business going on recurring revenue, SAS model with a predictable revenue stream and a low churn rate, you’ll find that devaluation goes up because yeah.

There’s some predictability to that. I always tell the startup, investors don’t look for big revenue. What they want is predictable revenue. So the more you can predict it for them and show it’s repeatable, even if it’s not SAS, but I get a re a market that is continuing to buy at a repeatable rate.

You can ask more for that type of business. The other factor is customer concentration. If you have five customers and one of them is 80% of your business, investors will look at that as a risk. That one investor, one company, when a customer goes away, your business will suffer for that dramatically.

And so you want to watch out for customer concentration and make sure it’s spread out across multiple customers. Otherwise they will not lower your valuation for that. And then those a and pre profitability for early stage companies. Those who can. Get to break even, or profitability sooner will command a higher valuation because if there’s a recession that comes up like the COVID we saw last year, those that were close to profitability, just cut back expenses, went to break even, and they can continue executing those who were very far away, had to shut down because they can only live on, they had more cash coming in or more investments coming in and they didn’t have that at some point.

Okay. And then next one is yes. Oh, how we did have a question come through. Cynthia would leap would like to know what a, B Corp is. So a B Corp stands for B stands for benefits. And this is a corporation that has set environmental and social cause as part of the company’s mission. And they take that into account when all decisions and all processes, and you can actually get a public benefit corporation, a PDC designation, if you want.

So instead of calling it an LLC, you call it a PBC and you’ve written into the corporate documentation that. A social environmental ESG, they call it decision-making will be taking as a part of it. So the company has a stated goal to provide some social benefit that goes forward. And if you go to a group called B labs, they’ll give you an assessment.

And if you pass that assessment, then you can actually put certified B. Corp on your website to say you’ve passed that you’ve are actually giving back to the community in social and environmental ways with your business. And so B Corp and benefits are two different things. B Corp is and accreditation by B labs.

And the B Corp is basically a certification that you’ve actually not a certification, but actual legal entity. You’ve set up out of Delaware called. Know PBC, for the benefit of the of the community itself. So it’s a little bit different from LLC, but it basically puts the ESG back into the business as well.

And one other quick question from Cynthia, what does it mean that my convertible notes are not quote certified? I’m not sure what that means. When you say he’s not certified. I’ve not heard that before. Who said that you’re a convertible note is not certified. I think they may mean something else.

Clarify. Yeah. Can you hear me? Yes, go ahead. Okay. This was in an offering memorandum and a subscriber agreement, and it says listing the zillions of risk factors. And it said these notes will not be certified. And the only thing I could think of is that maybe they referred to the fact that they’d be registered with the trustee or something.

Potentially, it could be something like that. Convertible notes, a debt instrument is not an equity instrument. Certified. It means somebody is not recognizing that as a valid structure. And there are some groups that don’t recognize debt as a valid equity structure, even though it converts later, upon maturity or conversion.

So it could be something like that. Or it’s for example, suppose it has a, a callable feature or Something like that, maybe it won’t be treated as a debt in the cap table. Or it could be treated as dead. Yeah. So technically on a cap table, a convertible note should be put in there, but it’s listed as debt.

And w if you run, what’s called a fully diluted cap table. That’s when you take all convertible notes and warrants and other debt instruments and say, what if all of this were actually exercised and converted to equity? What would it look like then? So a cap tables, a cap table, but you can show it in its current form.

Verbal note is in debt. We’re going to show it in its fully diluted form, which means everybody’s executed or converted to equity. What is my ownership in that case? And those are two ways of looking at the same cap table. And you should always look at it as a fully diluted to know what it might look like.

And if the verbal note never converts will, then it’s is taken back off of the cap table and not shown as equity. If it was never converted is just says, is that, thank you. Cool. Cool. If you have any other questions, just bring them up. Love to catch up with you guys on that. And then to go ahead and wrap up the slides here.

We have, I think one more, which I call deal breakers. When you’re in the negotiation with a startup, there’s there’s there’s things that come up that can give you pause about it. The number one, is there a major surprise comes up. You find out the company has a significant debt that they did not close properly.

And I find it’s not so much the amount of the debt is that fact that they didn’t tell you that the integrity issue becomes a bit, the bigger issue than the amount of the debt. Two as the major hole, sometimes we sign up for these startups to invest because they have a certain team and then you get through the process and find out that some of the team members are.

Are you going to go off and do something else? They’re not going to stick with this deal. They’re doing something else for all kinds of reasons. But now there’s a hole in the business that we weren’t counting on. What do we do about that? If it’s a big enough hole, it can derail the investment for sure.

Next is integrity issues. It’s mismatch between what the founder tells you and what is in the business. I get this a lot with in a small way with revenue. I get lots of numbers thrown out and find out later that some of the numbers are really they’re forecast, not actually booked or build a revenue.

And so it can be hard to define what is now and what is in the future. But if it’s a big issue, then it can derail the investment as well. And then sometimes you in diligence, you find that there are significant changes. The market’s not as big as you thought. The competition was not as weak as you thought the company is not as strong as you thought the product is not as far along as you thought.

And this is one of the biggest issues you hear about the product ready to go to the market. And can you go look at it and then realize no, it’s really not ready to go to the market and won’t be for another year that’s a significant change to look out for. And then the final reason is just the inability to come to terms, valuation being the key one, the startup wants $10 million investors want five and we can never close the gap.

Right? And that can be a problem as well, but any other questions you guys have from me on terms? And if not, you have any other questions of any topic you’d like to talk about. Love to answer those here as well. Yeah. Yeah, we know it’s just about one 30. So if anybody has to hop off, we will get to the recording afterwards.

So you can review this information, but we’re happy to stay on for a little bit of extra time to get anyone’s questions answered. Feel free to ask them aloud or put them in the chat box, turn your video on and we can continue this conversation. I would like to throw one more out there. This company has that I’m thinking of has got a kind of bifurcated capital raise plan, number one, they’re on a crowdfunding site.

And, they are offering the convertible notes there. And then number two, they’re going to make a standard institutional pitch to venture capital companies. That feels odd to me. It used to be that people would do family and friends and funding. First. They do crowd funding second. And when that was all finished and complete, they would go out and start talking to angels and venture capital third more and more as crowd funding comes up, it grew by 50% in the pandemic.

And I’m talking primarily about title three crowdfunding not Kickstarter or Indiegogo, which is rewards for payment, but title three crowdfunding where you’re. Anybody can invest for equity is becoming a bigger thing. It’s growing faster because it’s all online and so forth. And so I actually have people coming to me that want to raise from angels at the same time, the raising on their crowdfund campaign.

And if the terms are the same, I think it’s okay. They’re taking a credit investor money and putting through a crowd funding channel. The average investment in a crowdfunding campaign is a 100 to $500. The average investment in an angel channel is 25 to $50,000. But so you can actually take that money on a title, three crowdfunding campaign.

If you want, you do have to pay the crowdfunding platform, a backend fee for that, but you are going to pay that anyway, in most cases, but the terms are the same. I find that it’s really not a problem. I think sometimes it’s an issue of I want to get a heads-up. Start on my next raise. The crowdfunding campaign has another 30 days.

So I’m going to go ahead and get my documents ready and go start talking to angels about the next raise. That’s going to happen when the crowdfunding campaign closes. So it’s not that unusual. That goes on out there at this point. It’s I think more and more of those two worlds are going to blend and merge together where the angel can be either on the crowdfund or on the seventh one, because I do talk to startups that they’re going to run a crowdfunding campaign.

And then in parallel, they’re going to try to, what’s called a reg D offering that’s for the angels and the VA angels in the VCs. And those are starting at it. About the same time, but that they’re mostly just wanting to get a running start on it for when the crowdfunding campaign ends. Most crowd funding campaigns last 90 days, not a day more.

And when that day is up, boom, you’re off the portal and you’re into the next raise. No matter what happens with reg D there is no time limit. You can go as long as you want. Okay. And then this is curious. I imagine there are a lot of people that don’t want to go read all the fine print, but if a person did want to know details, and do some pretty detailed due diligence, is there a relationship between the amount of you’re going to invest and the amount of information they’ll give you without NDA.

If you’re looking at the term sheet, you should be able to look at that without an NDA. Everybody should get that. If you’re looking into their diligence room or what they call it data. A data room or diligence box, which is, has their income statement and balance sheet, their forecast, or patent filings and so forth.

Some startups consider that information to be confidential or part portions of it. My patents, they consider me somewhat. Confidential. The customer list is often highly confidential. They don’t want to see it. Just have anybody go look at that and they will ask to sign an NDA because of that.

You’re right. If they’re just raising two, three, 500 K, then you know, they, they probably, aren’t going to put an NDA on it. If they’re raising a million dollars or more. There’s often an NDA involved because they’re bigger. There’s more customer names at on the list and there’s more sensitive information and the IP that they don’t want to get out.

And so they’re more, more sheltered on that. Thank you. Anybody else have a question for us

while we’re waiting for any last minute questions? I did launch a poll. So if you guys could answer those questions, that would be great. And hall, if you want to just briefly describe 10 capital spending as a service platform before we head out. Sure. So tin capital is not your ordinary fund. In fact, we’re not a fund, we’re a funding as a service company.

And what we do is we help startups. connect for funding on the startup side. We help them get their documents together, pitch, deck, and diligence box, et cetera, and fundraising strategy put together. And then we go out and we make introductions to investors. And then on the investor side, we offer term sheets and.

Facilities management. Like I say, most companies don’t have a board. And so we step in and fill that role of watching over the company with Sylvie’s management, we have access to the bank account and the QuickBooks, and we can pull out your information rights and you can keep track of it that way, because companies are just so busy with.

Running the day-to-day business. They, the information rights don’t always get done timely. And so we do that for the investors. We got, we have syndicates with different types of investors in there. If you want to join a syndicate or look at all the deals that go across tech, healthcare, consumer product, good range that we have, and we have 16,000 investors in the network.

And so we a third VC, third angel third family office, and we also go out and connect with. Corporate venture capital crowdfunding portals. There’s over 50 that are title three related and there’s many more coming up all the time. They’re becoming more niche. And so we can help start is find the right investor group to go to and then run a campaign on that.

Group as well. And like I say, we do investor relations and introductions and investor relations is keeping the investor up to date on what you’re doing, because that’s what closes is when they get a sense that there’s momentum and traction behind your deal. And we can help with that as well. So if you have any questions, just contact us@infoattinandcapital.group, and we’ll be glad to give you help on your deal.

We have a page for the companies, a page for the investors. You can see more about the specific services we offer there. All right. And I feel, I believe that is it. Thank you all so much for joining today. Like I said, we’ll get this recording out to you. If you’d like to review the information, you can check out our website@tencapitoldotgroupandreachoutwithanyotherquestionsatinfoattencapital.group.

Thanks everybody for your time. Thank you guys so much. Thanks, bye. Bye.

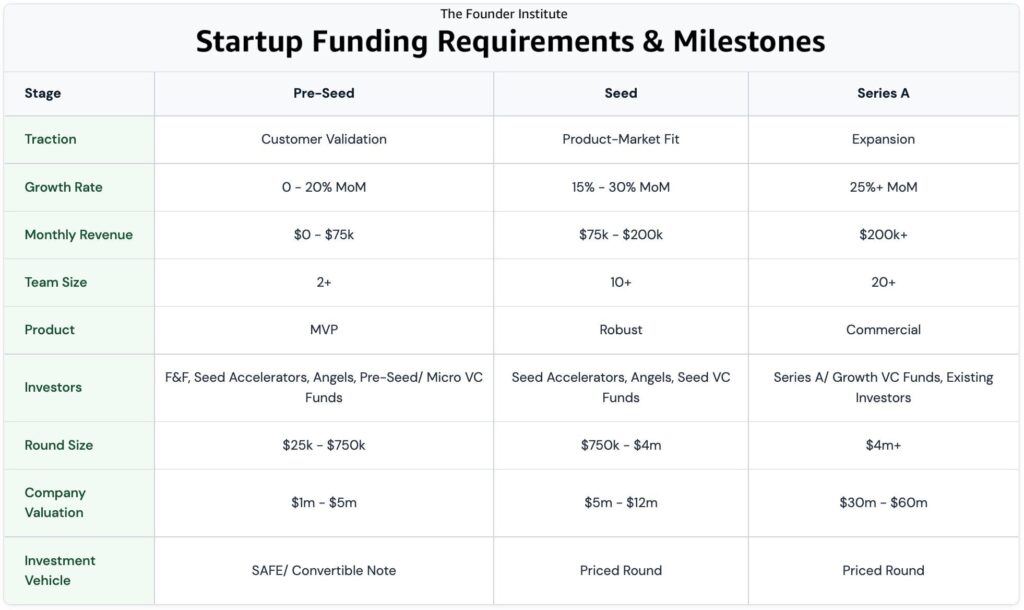

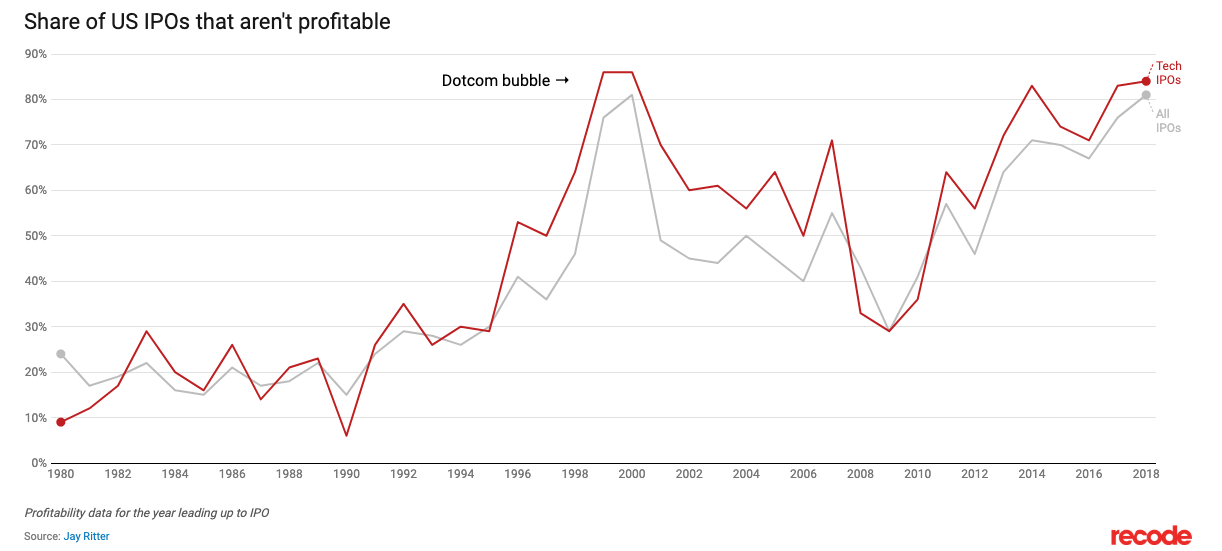

Early-stage valuations are rising – Companies with premium economics are ratcheting early-stage valuations higher, pushing Seed and Series A rounds to levels previously reserved for later-stage raises. This means that for VCs to have opportunities for generational winners, they’ll need to take on more risk by investing in earlier rounds.

The right amount of concentration makes a difference – It’s always important to balance risks by being diversified through different vintages within portfolios across sectors and geographies, but GPs need to ensure there is enough concentration so as not to dilute the impact of high multiple returns. This balance between downside and upside risk is critical to overall success.

Co-Investments are key for J-Curve risk mitigation – Today’s environment doesn’t lend itself as easily to fund buybacks, so the opportunity for co-investment plays an important role in generating alpha potential and distributing risk.

For fund of fund managers, manager and brand reputation matters most – Firm brand is paramount when considering allocations to VCs – with a close second being the strength of the team. The level of excitement within the manager’s portfolio companies is a great way to assess manager brand reputation. Understanding incentives is an important part of manager due diligence, especially when it comes to assessing succession planning.

Need to understand and identify competitive advantages – What sector expertise, technology, or other competitive advantages are at play to generate deal flow? What about the funds’ network, past experiences, or sourcing engine that makes the fund unique? Those who have the best deal flow have the highest probability to generate the best portfolio.

Bet on best in class – In the tech world due to the transparency of competition from the customers view point there really one or two viable options to invest in. Platform businesses, SaaS companies, and two-sided marketplaces that are evolving today: co-integration is a key component of these businesses. So a rule of thumb may be to look first for the makings of the dominant player, and second for complimentary pieces. The risk here, of course, is an IRR one. VCs who invest in companies who are likely to be prematurely acquired will see lower return multiples and potentially lower IRRs (a medium sized return made quickly is likely to be higher IRR than a somewhat larger return but over a longer time period – this is a balancing act for GPs) – so the emphasis on deal flow should remain on the potential for big wins, which more and more require finding the one winner in the industry (or those creating new markets). Investing in late stage and mature private companies, these companies will not only continue to soak up VC money but also build a moat by eliminating competition through acquisition or better market economics.

Asset-light companies: These companies offer the best potential to quickly achieve scale, a first-mover advantage, and network effects.

Early-stage valuations are rising – Companies with premium economics are ratcheting early-stage valuations higher, pushing Seed and Series A rounds to levels previously reserved for later-stage raises. This means that for VCs to have opportunities for generational winners, they’ll need to take on more risk by investing in earlier rounds.

The right amount of concentration makes a difference – It’s always important to balance risks by being diversified through different vintages within portfolios across sectors and geographies, but GPs need to ensure there is enough concentration so as not to dilute the impact of high multiple returns. This balance between downside and upside risk is critical to overall success.

Co-Investments are key for J-Curve risk mitigation – Today’s environment doesn’t lend itself as easily to fund buybacks, so the opportunity for co-investment plays an important role in generating alpha potential and distributing risk.

For fund of fund managers, manager and brand reputation matters most – Firm brand is paramount when considering allocations to VCs – with a close second being the strength of the team. The level of excitement within the manager’s portfolio companies is a great way to assess manager brand reputation. Understanding incentives is an important part of manager due diligence, especially when it comes to assessing succession planning.

Need to understand and identify competitive advantages – What sector expertise, technology, or other competitive advantages are at play to generate deal flow? What about the funds’ network, past experiences, or sourcing engine that makes the fund unique? Those who have the best deal flow have the highest probability to generate the best portfolio.

Bet on best in class – In the tech world due to the transparency of competition from the customers view point there really one or two viable options to invest in. Platform businesses, SaaS companies, and two-sided marketplaces that are evolving today: co-integration is a key component of these businesses. So a rule of thumb may be to look first for the makings of the dominant player, and second for complimentary pieces. The risk here, of course, is an IRR one. VCs who invest in companies who are likely to be prematurely acquired will see lower return multiples and potentially lower IRRs (a medium sized return made quickly is likely to be higher IRR than a somewhat larger return but over a longer time period – this is a balancing act for GPs) – so the emphasis on deal flow should remain on the potential for big wins, which more and more require finding the one winner in the industry (or those creating new markets). Investing in late stage and mature private companies, these companies will not only continue to soak up VC money but also build a moat by eliminating competition through acquisition or better market economics.

Asset-light companies: These companies offer the best potential to quickly achieve scale, a first-mover advantage, and network effects.

Investing in this space is difficult because companies are evolving faster than ever before, leading to new business models with changes from how companies generate profits to how they are valued. Two new firm types are emerging and taking center stage: the asset light (i.e. high percentage of intangible assets as value-drivers) and the all-star (i.e. one clear market leading). Commonly one and the same when looking at the intersection of where VCs invest and high growth markets, the shift away from physical capital and importance of intangible assets as well as the continued emergence of winner-take-all environments has changed the paradigm of success for newly launching companies.

We normally like Real Estate because there is valued physical assets as they in turn have provided a means to higher valuations (because the more assets you have, the more stuff you can eventually convert to sales and therefore cash flows). Intangible assets (data, brands, intellectual property, etc.) are generally viewed as secondary means of value when considering company valuation as the value of these assets is harder to define. However, with the rise of technology-first, big data-driven, network effect-y, and platform-driven business models, investors are rethinking the value of these intangibles. Using the S&P 500 as a proxy, it is clear that intangibles as a percentage of total assets now dominate. On the other hand with less real estate or real property (tangible assets) launching a product is less costly.

Investing in this space is difficult because companies are evolving faster than ever before, leading to new business models with changes from how companies generate profits to how they are valued. Two new firm types are emerging and taking center stage: the asset light (i.e. high percentage of intangible assets as value-drivers) and the all-star (i.e. one clear market leading). Commonly one and the same when looking at the intersection of where VCs invest and high growth markets, the shift away from physical capital and importance of intangible assets as well as the continued emergence of winner-take-all environments has changed the paradigm of success for newly launching companies.

We normally like Real Estate because there is valued physical assets as they in turn have provided a means to higher valuations (because the more assets you have, the more stuff you can eventually convert to sales and therefore cash flows). Intangible assets (data, brands, intellectual property, etc.) are generally viewed as secondary means of value when considering company valuation as the value of these assets is harder to define. However, with the rise of technology-first, big data-driven, network effect-y, and platform-driven business models, investors are rethinking the value of these intangibles. Using the S&P 500 as a proxy, it is clear that intangibles as a percentage of total assets now dominate. On the other hand with less real estate or real property (tangible assets) launching a product is less costly.