19.6 – Land Conservation Easements

For those who are over $326k AGI. In a roundabout way you are buying into a lower tax bracket.

Example Tax Deductions

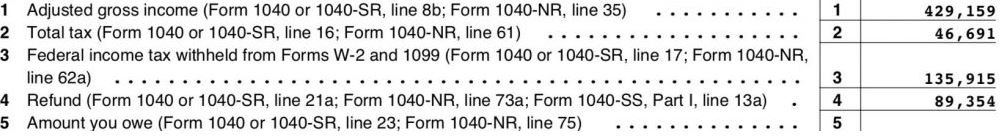

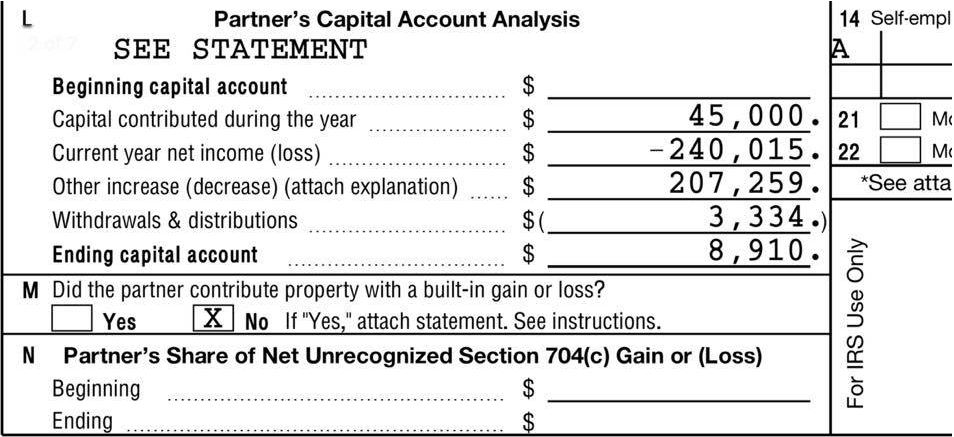

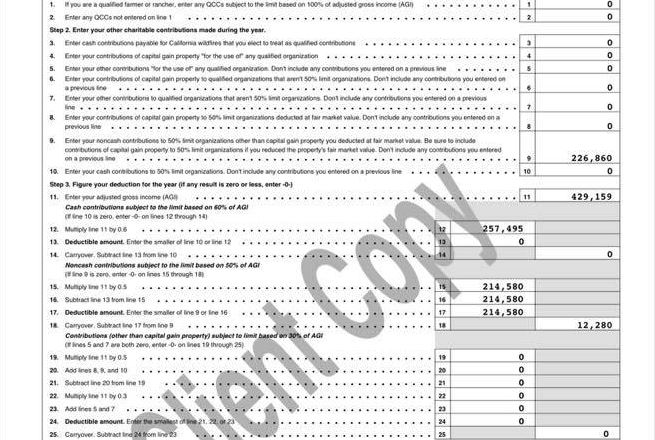

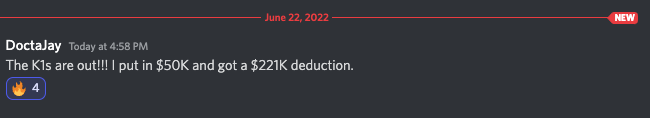

$214,590 deduction for a $45,000 investment? Why wouldn’t you do this if my Hui member made a $45,000 investment in a Land Conservation deal and got a 100% return at the 50% tax bracket?

Tax Reduction Example (NOTE: Tax Brackets are Subject to Change)

-

Filing Jointly - AGI Over $414,700

You get back $0.35 for every dollar deduction (on a 5x CE, that’s $1.75 tax reduction for every dollar invested in a CE).

-

Filing Jointly - AGI Between $171,050 and $414,700

It’s a $0.32 back for every dollar deduction.

-

Filing Jointly - AGI Under $171,050

It's a 24% tax bracket, so the same CE $1 invested saves $1.20, not nearly the same effect.

With a CE’s you can only lower your AGI by 50%. The goal is definitely a refund, but you don’t get a lot of benefit from a CE at the lower tax brackets.

For people with an AGI that is 400k+, around half the AGI is still in the 35% tax bracket so a CE is worth it.

Check out the video to the right to understand how to identify tax breaks at certain levels.

Overall comments:

Pigs get fat… hogs get slaughtered. I think 15-20% overall tax rate is healthy for “poor” people like myself, in the 100-200k active income category. The bang for your buck on Conservation Easements (CE) goes down at the lower tax levels. Remember that CE’s are not 100% risk free either.

Those over 300-400k+ AGI range, should be around a 20-28% overall tax rate range. These are just my general feelings as this is mostly an art. This does not take into account fluctuations in AGI, where you might want to pay more taxes. For instance, using less passive losses in one year and more in another (i.e. when a spouse works less, has a kid, or you take a hiatus from work for a bit).