20.1 – Helocs

Most investors we work with… pretty much everyone has a Return on Equity (ROE) problem where they are not fully optimized. Every dollar you have is a solider for you. As higher net worth investors we don’t need to have every solider working at 15-25%+ but we need to have everyone pulling their weight. Most people have dead equity (deadbeat soldiers) making under 5-10% and that need to be the first priority.

Common sources of dead equity:

- Equity in Primary Residence

- Stocks/Bonds and Mutual funds in non-retirement accounts

- Stocks/Bonds and Mutual funds in 401k’s

- Equity in rental portfolio

- Other items in your possessions where you might be able to liquidate via eBay

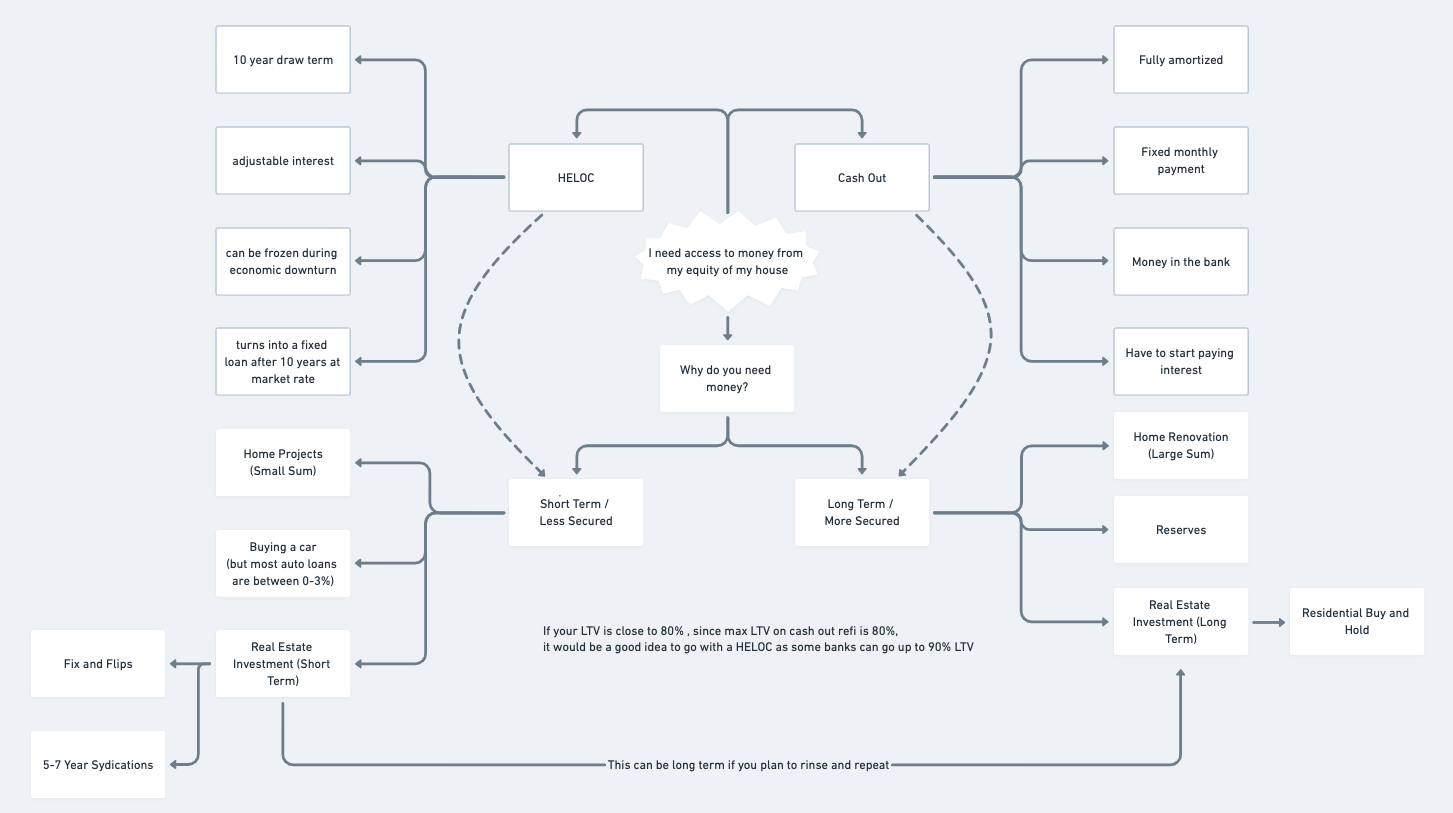

Let’s talk about #1 and #4 above. You have three options to accessing that equity:

- Sell the Asset

- Refinance the Asset (pull equity out)

- 1031 exchange (we do not recommend this due to passive losses in syndications today)

- Get a HELOC on the Aseet

A HELOC (Home Equity Line of Credit) can give you leverage to invest in more opportunities in real estate with a lower interest rate. This is a strategy is very common and one of the first ways I would recommend new investors tap into their equity due to the low cost, ease, and how it does not require a permanent change in your portfolio because you are not refinancing or selling the asset. We use this strategy for most new clients who need to get their spouse on board because it gives them the ability to get the oh so important “proof of concept.”

The benefit of a HELOC is that you are able to borrow money from the equity of your house and then pay it down on your own terms. The HELOC works like a checking account, so if you use the money, you pay interest on it, if you don’t use it, you don’t pay anything. Where as a regular mortgage with a cash out you would start paying interest on the money right away even if you didn’t have an investment ready to invest in, the HELOC provides you the flexibility to find the right investment when it is needed. The major con to a HELOC is that the interest rate is typically higher than a mortgage and almost always is variable and tied to the federal bank.

This is a great starting point to start cold calling. We have an internal list and warm contacts in the FOOM.

Say you bought your house 10 years ago for 250k and now it’s worth 500k. This means that you have 250k of equity in the house. The bank will not allow for you to loan that entire 250k as they want to have some cushion in case the market turns, but for a primary residence some banks will loan up to 90% of the value of the home. If you were to get a HELOC on your house you would be able to loan up to 225k (250k*90%). We know that banks typically want to have at least 20% of equity in a house if you were to refinance so it would be prudent to only use 200k (250k*80%) of the 225k. But that could be a nice down payment for another investment property that provides you money each month to pay down the HELOC. After you have the new investment property working for you, you could refinance your primary residence to change the HELOC from a variable interest rate to a fixed interest rate. In order to refinance, it’s important to note that in order to refinance the property as an investment you will need to maintain a LTV of 80% (75% for investment properties) or you will have to pay it down at closing.

Some key things to think about when utilizing this strategy:

- Select banks will allow for HELOCs on investment properties.

- HELOCs provide access to a lot of extra money, make sure to live within your means or use the money to create additional revenue to cover the future payment.

- HELOCs can provide you the ability to take time to search for a house or investment. You are not paying interest on the money unless you use it.

- If you have specific questions about the type of products out there you will need to talk with your bank and a mortgage professional.

- Because HELOCs are a loan, you don’t have to pay taxes on the money that you use from them. Taxes will be due when the asset is sold.

The Cons of HELOCS:

- You are at the mercy of the bank who can pull your line at anytime. Look I know you have contracts but I have seen banks pull the carpet under those who were counting on the HELOC being there

- You never really get at all the equity since if you notice banks only give you 75-95% of the value. Plus they give you appraisals which “sandbag” your property value.