27.4 – Getting in a GP as a Key Principal/Loan Guarantor

Not interesting in doing hard work to build relationships with brokers or run a large deal and being responsible for everyone’s money in a syndications?

One opportunity for high net worth Accredited investors is to join a General Partnership as a Key Principal/Loan Guarantor.

In order to qualify you would need:

a) a net worth of over $2M or

b) to bring in at least 25% of the required capital for the deal ($300,000+)

When a GP is looking to get debt the bank giving the loan is going to look for the GPs to have a combined net worth and liquidity requirements. For larger $5+ million dollar deals it is rare for one person to have that large of a net worth and still hungry to do deals. Not to mention smart sophisticated investors have very low amounts of liquidity lying around their bank account.

Obviously as part of the GP, there would be a higher level of liability. As part of the GP you would be compensated and join our team as long term partners. Some investors use this as a means to get their coveted “Fannie/Freddie Card” or quality as a Tax Professional on their taxes. Maybe you have a lot of 1031 exchange money and you would like to do a Tenant in Common deal (TIC).

As much as I recommend most investors invest no more than 5-10% of their net worth into any one opportunity… Ultra high net-worth families don’t play by the same rules and in this case can get a little more bang for their buck.

If you are interested please apply here.

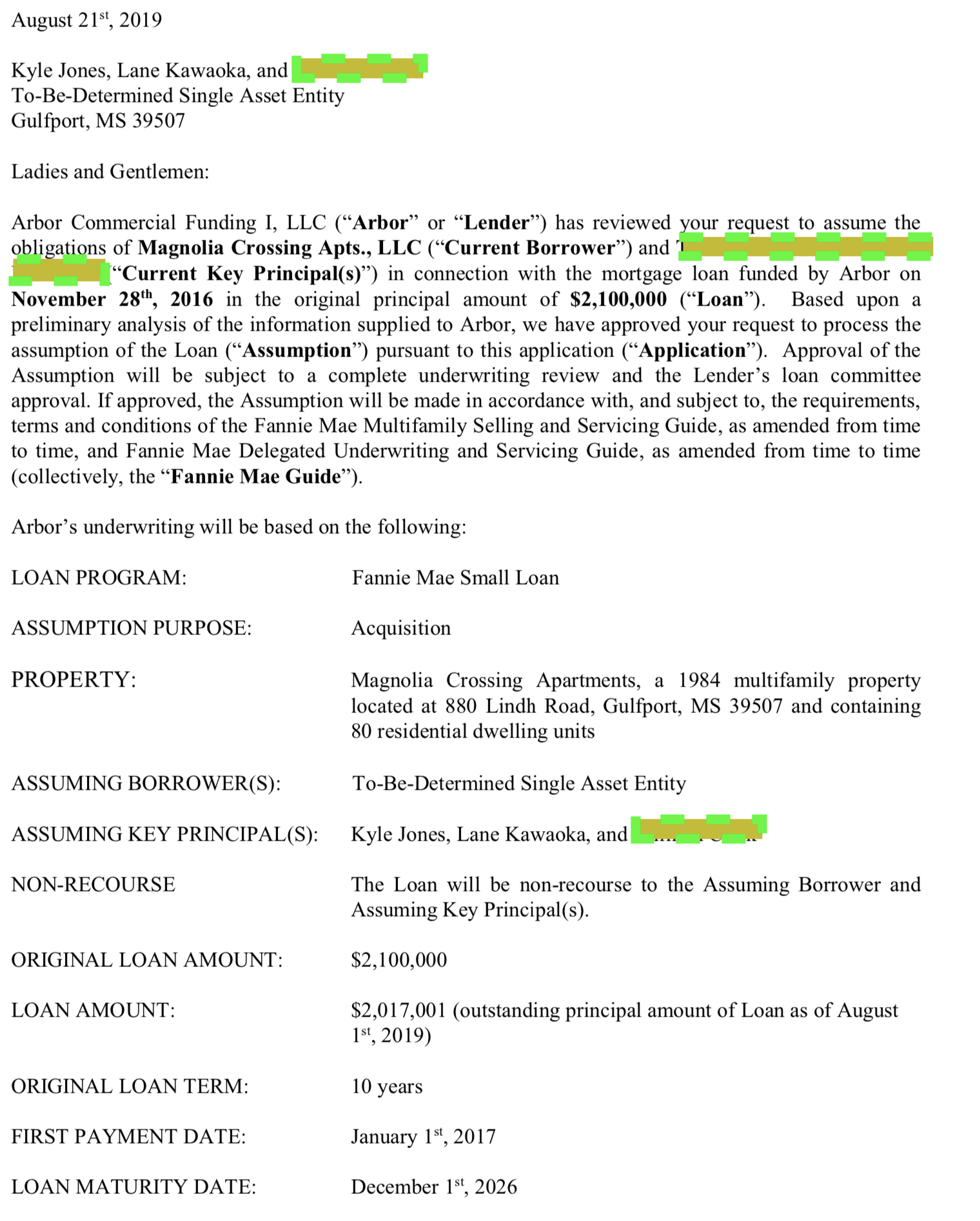

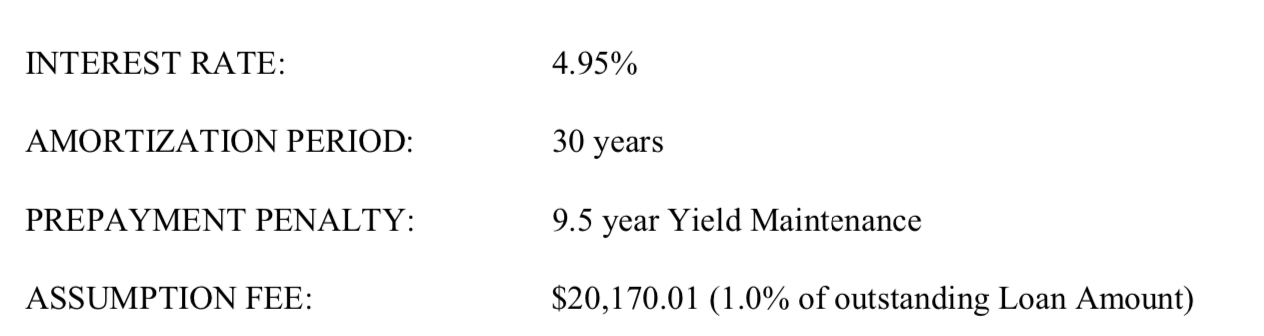

Below are loan documents that I signed to take over a non-recourse loan as a KP/Loan Guarantor. We had another high net worth guy also sign with us and he was compensated for it as part of the GP. You could be that guy…