– End of Trial Sections –

Congratulations on completing the first three modules of the “Journey to Simple Passive Cashflow eCourse”!

Please contact me at Lane@SimplePassiveCashflow.

If you would like to continue with the rest of the 27 modules plus 5+ Bonus sections please enroll here to get access.

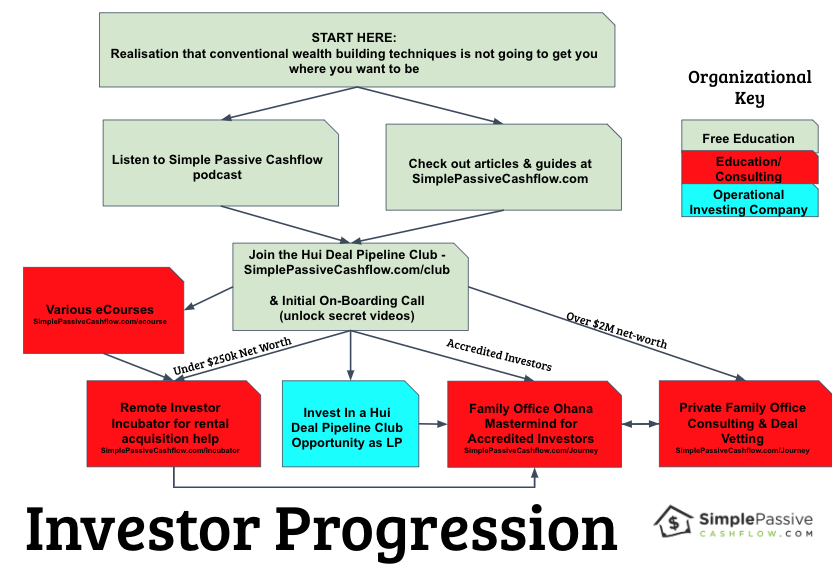

Or if you serious about getting to Financial Freedom and getting your network up to a higher level. Apply for the Family Office Ohana Mastermind.

Non-Accredited investors looking to your first rental? Join our Remote Rental Incubator!

What is a Family Office?

Most 100 million net worth families have a team of financial professionals advising the family on all aspects of investment, tax/legal, and legacy creation. Think of Alfred to Batman without all the crime fighting and gadgets. But what is a 1-50M net worth person to do? No professional of that caliber (unless paid off commission like most financial planners) would really bother having you as a client. Our solution is is the Family Office Ohana Mastermind to create the environment for you to do this on your own and surround yourself who are on the same trajectory. Apply for the Family Office Ohana Mastermind.

What is the Family Office Ohana?

Your Family Office ← Only ONE point of contact to the professional specialists for us regular guys under $50M net worth 😁

- Wealth Planning

-

-

- Succession Planning → Continuity of the company/business/values

- Estate Planning

- Gifts during lifetime

- Life Insurance

- Prenuptial Agreements & last wills

- Trustee services

-

- Deal Vetting

-

-

- Who to work with and what to invest in

- Access to a rolodex of providers

- Access to lenders and operators

- Burn Book of people not to work with

- Walk through of individual deal analysis

-

- Wealth Management

-

-

- Investment Strategy & Asset Allocation

- Private Equity/Dealflow

- Consolidated reporting

- Investment advice

-

- Tax Planning

-

-

- Filing tax returns

- International relocation

- Real estate structures

- Double tax treaty planning

-

- Trust & Corporate Services

-

-

- Corporate incorporation

- Trust administration

- Structures

- Real estate management

- Family shareholding

- Nominee services

-

- Family Governance

-

-

- Family assemblies

- Family council

- Family constitution

-

- Charity & Philanthropy

-

- Giving Strategy

- Grant-making foundation

- Non-Profit entity creation

The On-Your-Own Method?

Here is a special link to book a complimentary session to the CPA/Legal team I use. But it is the belief of most sophisticated investors and those in our Mastermind that YOU have to drive you own ship and not rely on your tax/legal professional on general advice on your situation. Instead you need to know what you want and they make it happen. More on this distinction below:

95% of CPA’s are the run of mill take the least past of resistance crowd. Perhaps a reason why they still have a day job. Of the good ones or should I say even a good one will not be able to give you full financial planning advice such as how much to pull out of retirement accounts or what deals to go into. Think about it… its unfair for them because 1) They don’t know the deal risk profiles nor the operators, 2) They don’t know your future deployment plans to account for your estimated Adjusted Gross Income (effective tax rate) for the next few years, and 3) they don’t know how much depreciation is going from the plethora of investments you look to go into. This is where I tell my investors that it is your job to understand what you can and cannot do and lead your professionals who JOB is to complete the technical paper work. CPA/Lawyers are Contractors but you need to be or outsource someone to be your Architect. In other words I don’t advocate to working for a good CPA and trusting them to do it… their job is to fill in the right forms but you need to be in control as the owner and not let the consultant dictate the scope of work. In the Family Office Ohana Mastermind, Mastermind Events, and done for you full service for you as a Family Office client you are empowered to be your own architect and connected directly with the rolodex of able professionals.