How does someone invest in mortgages?

There are two loan documents created when a person borrows money to purchase a home: a promissory note, or simply, a note, and its corresponding security document. The type of security document varies by state and can be a mortgage, deed of trust, or trust deed.

Notes and Mortgages

Question: What is a promissory note? A promissory note is evidence of a promise to pay a debt and is signed by the borrower. The terms “loan” and “note” are often used interchangeably with “promissory note.”

Question: What is a security document? A security document, such as a mortgage, is a document that is recorded at the county showing that the borrower pledges the property as collateral against the loan.

Should the borrower default, the lender may exercise their rights as spelled out in the mortgage document.

Trust deeds, deeds of trust and mortgages have similar wording, and have a few differences, but serve mainly the same purpose.

These loans can be bought and sold just like any other commodity. If someone were to buy at “face value” they would be paying the loan amount remaining at the agreed upon interest rate for the remaining term. Buying at a discount means that you purchase the note for less than the face value, thereby increasing your yield.

Investing in Mortgage Notes vs. Real Property

Similarities

There are many similarities between investing in real property and investing in notes, including evaluating the collateral, and working with title, escrow and insurance companies.

Collateral

The underlying collateral for a note is the building and/or land itself. You should value the underlying collateral of your note investment as if you will own the property (because you just might). Typically you can use online resources like Zillow or Redfin to get a range of value, to get more accurate you would order a broker price opinion (BPO) to have the property valued against other local properties. Ideally you want the value of the collateral to be higher than the unpaid principal balance of the note. Why? Because if you have to foreclose you want to make sure that after all legal and liquidation expenses, you capture at least your original investment. Return of capital is more important than return on capital!

Title

Just as you want clear title when purchasing a home, so too is the case when investing in a note. For new notes, you will obtain a lender’s policy to insure your note will record in the desired lien position. For existing note purchases, you will want to review the existing lenders title policy to ensure that it is transferrable.

Insurance

Note investors should make sure the borrower has appropriate insurance for the collateral and that the note investor is listed as the Mortgagee on the Evidence of Insurance certificate issued by the insurance company. When listed as a Mortgagee on the insurance policy, the insurance company knows to issue a check to both the Mortgagee and the Borrower. In addition, if the policy is changed or canceled, the Mortage is notified and can take corrective action. If the borrower does not have hazard insurance then you as the lender should original Force Placed Insurance at your expense so that should the home be destroyed you can at least recover your original investment and expenses. FPI can be added to the borrower’s account as a “recoverable cost” if you follow the procedures required by the CFPB.

Differences

Although the investment in notes is similar to purchasing real estate, there are a few significant differences.

Lien vs. Ownership

The first difference is the most obvious. The real estate is not owned by the note holder: the note holder has a lien position against the real estate. If the borrower breaches the terms of the loan agreement, the lien holder can foreclose upon their interest and acquire title to the property.

Borrowers vs. Tenants

Note investors manage their borrowers, and real property owners manage tenants. Both tasks can be outsourced. Note investors may outsource the collection tasks to a servicing company just as real estate owners can outsource rent collection and upkeep to a property management company.

As a note holder, your main responsibility is to collect the payment and make sure taxes are being paid and insurance is current.

Taxes & Leverage

When purchasing real property it is typically easy to find 60-80% financing from a bank or private lender. Leverage is more difficult to obtain for note investors. Although it is possible to obtain a loan against a note investment (hypothecation), it is far less common and reserved only for the highest quality investors, and usually at above market rates. Most note investors should assume that they will be required to pay cash for a note or find a “money partner” to fund the acquisition.

Also, when owning real property the landlord has some great tax advantages such as depreciation, loan interest, and passive income that is taxed at a lower rate. The note investor does not receive these benefits, since a note is considered personal property and is taxed at ordinary income rates. Because of this, note investing works well with a Roth self directed IRA since the income and growth is tax free.

Credit Underwriting

When making a decision on a note investment, the borrower’s credit and capacity to make regular payments, is equally as important as the value and quality of the collateral. The process of evaluating the borrower’s credit and ability to pay is called “underwriting” the loan. Individual investors should set standards for their borrowers in accordance with their own appetite for risk.

Document Underwriting

Not only should an investor underwrite the borrower, but a full review of the loan documents should be made. At a minimum, the review of the note, the Deed of Trust (or Mortgage), any previous assignments, allonges, lender title insurance policy, servicing notes and payment history should be completed. If any gaps in chain of assignment are found, that could cause problems should a foreclosure be needed and a borrower could challenge the validity of the note if any defects/gaps are found.

In purchasing real estate, there is typically a purchase agreement and a Deed. The purchase agreement details the terms of the purchase and the deed is recorded to put the public on notice of the new owner, and that the transaction closed. In a note purchase, there is also a purchase and sale agreement which spells out the terms of the note purchase, but instead of a Deed, the instrument that is recorded is called an Assignment Of Mortgage or AOM. The previous note holder is assigning the beneficial interest of the note to the new note owner with a notarized AOM and once that document is recorded on the county records, the new note holder is now the lender of record.

Foreclosure

When a note investor is not paid, foreclosure is the final recourse. The process of foreclosure varies by state and may be judicial or non-judicial depending upon how the state statutory scheme is set up.

Foreclosures may require substantial upfront fees paid to attorneys and/or trustees and can be a stressful process for a note investor to undertake. The risk of foreclosure is directly related to the quality the note investment and the quality of the borrower. Good quality borrowers are as important to note investors as good quality tenants are to real estate investors. Generally loss mitigation tactics should be deployed to work with a borrower to get them back on track for the payments. It can be a long, time consuming process but will pay off in resumed income on the note.

Do we pay full price for notes?

The concept of “buying at a discount” is fundamental to note investing. Let’s look at an example to illustrate the point.

Why is buying notes profitable?

Example: If we were to buy a $100,000 note at face value of $100,000 and it is paying 7% interest on a 30-year term, our return would be 7%.

As a note investor, we don’t pay face value, so we discount our purchase offer. If we were able to buy this loan for 60% of the unpaid balance, or 60 cents on the dollar, the return on our money would be 13% instead of 7%.

Considering that banks are paying roughly a whopping .2% (that’s right! 2 tenths of 1 percent) on deposits, this strategy multiplies our earnings to returns that few can show.

Buying discounted notes is a powerful way to increase our passive cash flow (or, “mailbox money,” as we call it). These high returns are why the distressed and discount note space is so attractive to us as private investors.

Why do banks sell their notes?

Banks and GSE’s (Government Sponsored Entities like Freddie Mac) are not in the business of owning Real Estate and foreclosing. They are in the finance business–lending money at a higher rate than the rate at which they borrow it.

Why banks sell?

Why would banks and GSE’s sell these notes instead of holding them?

Banks and GSE’s are not good at owning Real Estate and foreclosing. They profit on the spread–the difference between the rate at which they lend money and the rate at which they borrow.

Due to government regulations (that would take up several pages), when a borrower defaults on a loan, the lender must reserve a significant amount of money to service that loan.

When this happens, that money is no longer available to lend and costs the banks the profit that they could have earned.

With the huge volume of defaulted loans in the past half dozen years or so, lenders have found it more lucrative to sell the notes at a discount than to take them through to foreclosure.

Avoiding lengthy and expensive foreclosures (the length and expense vary by state) is one of the many reasons selling loans is a viable option for lenders.

We as investors benefit by being able to work out the loan with the borrower in a variety of ways.

How can we help the homeowner?

What do we mean by “workout” with a borrower?

We have many options to help the homeowner get back on track.

How can we help the homeowner?

When we purchase a note, we are buying the payments as well as all the original rights that are spelled out in the documents. These rights include the right to modify or change the loan with the permission of both parties, and the right to renegotiate or foreclose.

Here is a link from Guild Mortgage that lists a variety of workout options.

In most cases, your returns are higher when you successfully work with a borrower to return them to the path of on time payment rather than foreclosing.

When the borrower has returned to paying on time and has done so for six months (this is called “seasoning”), we have the option of selling that loan as a re-performing loan at a higher price than what we paid. This spread is our profit.

When we cannot work out a solution to get the borrower paying on time, sometimes the lender must foreclose. Foreclosure procedures vary by state; it is important to research them to determine whether you want to purchase notes in particular states.

Foreclosure Laws

An alternative to foreclosure is accepting a deed in lieu. A deed in lieu of foreclosure occurs when the borrower hands over the property to the lender to satisfy a loan that is in default. When a borrower agrees to the deed in lieu, the borrower’s credit remains unaffected, which is why this strategy is often preferable to foreclosure.

When a lender takes a property back via foreclosure or deed in lieu of foreclosure, the lender becomes the owner of the property.

Now we own the property. What’s next?

As the owner, we now have the right to do with the property as we wish.

Now we own the property. What’s next?

Foreclosures are inevitable in the note business. Despite our best efforts to avoid them, they will happen, and you will end up with a property on your hands. Remember, you picked up the property for the discounted price of the note. That’s the beauty of dealing in Real Estate-backed notes.

As an investor, you will want to put your property to its highest and best use. Sometimes that means getting rid of it as quickly and cheaply as possible, other times it may mean renovating it and keeping it as a rental. Many factors, such as the local Real Estate market and your comfort-level with being a landlord, go into making this decision.

Below are some options, out of many, available to you.

Auction

Investors who want to deal only with paper (“paper” is another word for loan, mortgage, etc.), not properties, want to get out of the house as quickly as possible, usually through a foreclosure auction or trustee sale.

Hold and Rent

A note investor may want the rental income from a property to diversify cash flow. In this case, the investor will keep the home, renovate it, then rent it out.

Fix and Flip

To realize a high profit in the short-term, the investor may rehab the home and sell it at retail. Again, this could be very profitable due to the cost of the discounted note.

Research the home’s market before deciding on an exit strategy. Fortunately, the fact that we purchase notes at a discount gives us many options.

Having so many options is one of the reasons this business can be so profitable.

What other exit strategies do we have?

There are more ways to earn income in this business than what we have already covered.

What other exit strategies do we have?

One of the most attractive aspects of the note business is the multiple exit strategies available to the investor who buys at a discount.

Whether the borrower defaults or starts paying again, we have a variety of strategies to choose from to exit from the deal profitably. Let’s look at some of the strategies at our disposal when we have a successful workout.

Mod and Sell

The first is a simple purchase, modify, markup, and sell. As discussed earlier, when we can turn a non-performing loan into a re-performing loan we can sell the loan for a much higher price than we paid.

The “mod and sell” strategy is a very lucrative business model.

Brokering

Brokering is a method where a note seller wishes to sell a note, and you find the buyer. The buyer tells you what they will pay, and you offer less to the seller. The difference between the sale price and the accepted price is your profit.

Brokering is the best way to generate income with no money out of pocket.

Selling a Partial

“Selling a partial” refers to selling part of the income stream of the note. The note holder sells a portion of the payments (usually a set number of payments from the front-end of the loan) to another investor at a price that will result in an agreed-upon yield for the investor. After the investor receives all his payments, the payments revert to the note holder.

With partials, you get the best of both worlds–you get your money back so that you can buy another note and at some point in the future, you continue to receive payments from the note.

You can see the power of buying at a discount.

Can this get any better?

It can!

How can we use the benefits of our IRA?

You can invest in notes from a self-directed IRA, have all the profits returned to the account, and enjoy the tax benefits of the IRA. You don’t get the great tax benefits or bonus deprecation like syndication deals but it is great for a tax sheltered retirement account.

How do you vet these deals?

When vetting these types of deals here are some of the factors to take into account:

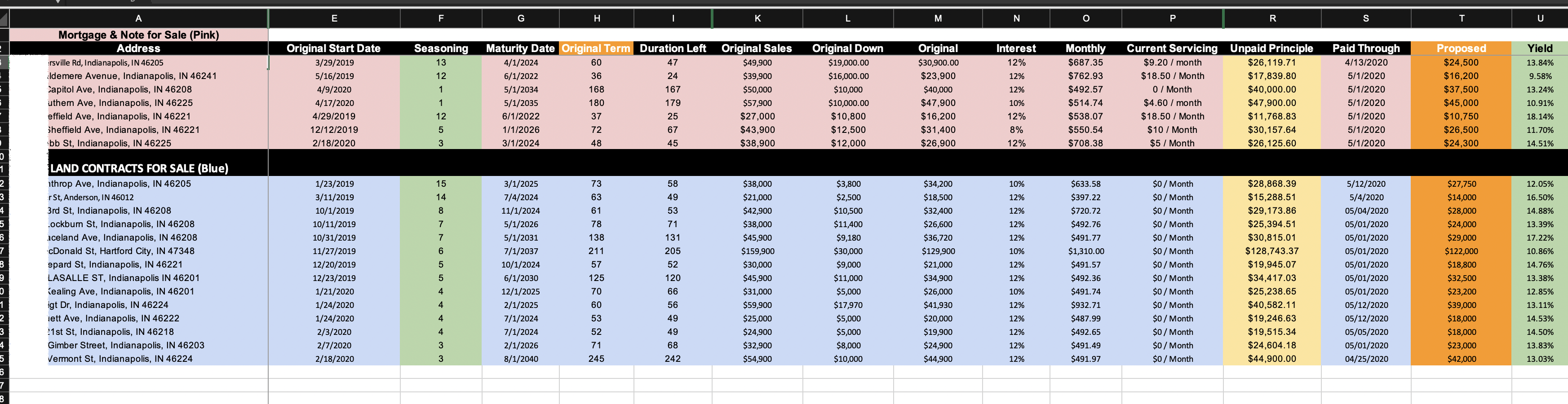

Address of Collateral Property

“Seasoning Period “is # months the Buyer has paid

“Sales Price” – what we sold the Property to Buyer for.

“Down Payment” – How Much Buyer Paid as Down Payment

“Original Principle” – How much original loan was for

“Rate” – Interest Rate Buyer is Paying

“Monthly Payment” – Buyer’s Monthly Payment

“Current Servicing fee” – Lender’s Current Fee to Loan Servicing Company

“Unpaid Balance” – How much Buyer still owes

“Paid Through date” – Buyer’s Last Payment

“Proposed Purchase Price” – What we would sell the Loan For

“Loan Servicing Company” – Company currently servicing the loan