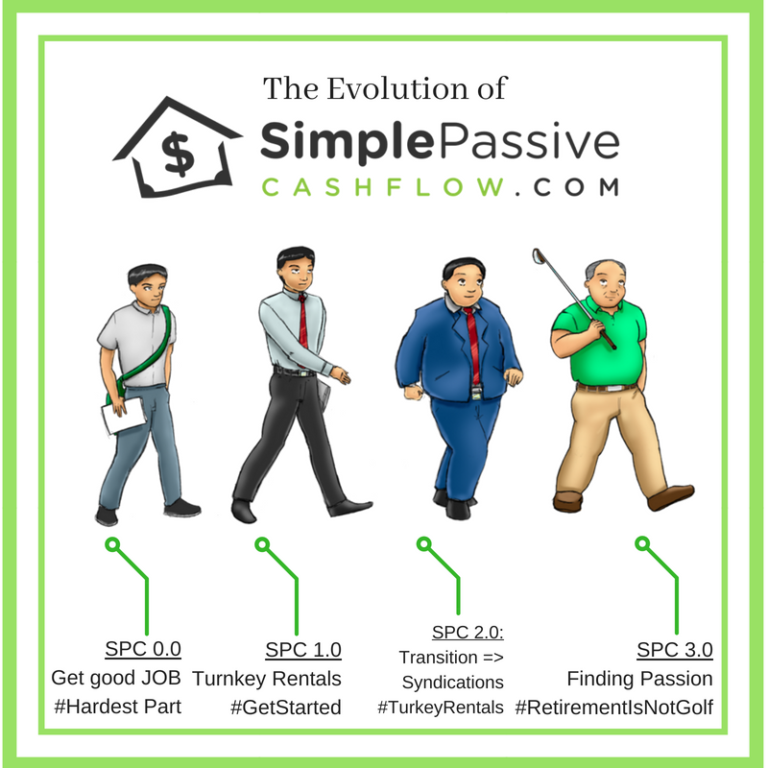

1) Introduction

Tips for this eCourse

This eCourse is designed to educate you in being the best LP passive investor in the quickest amount of time. Some more advanced (nitpicky) topics may not apply to you or the deal you are looking at but it is important that you are aware and start to speak the lingo.

There are 3 major methods to get to your goal, I suggest you make headway in all three at the same time or which route resonates with you the best:

1) “Start with the answers in the answer key” – Check out the past deal webinars and get used to seeing live deals. This is how I got my self through college by looking at the answer key and backwards engineering the solution/method.

2) The traditional method – Go thought this eCourse sequentially

3) If you are an Accredited Investor, technically you don’t need to know any thing to invest. I have seen a lot of unsophisticated Accredited investors invest this way however they do have the network of other sophisticated investors around them. At some point when you complete this course you are going to build a good high net worth peer group to get sustainable dealflow and to collaborate on due-dilligence.

Whatever you do, save the Bonus 1 through 3 for the very end at it introduces more advanced concepts and nuances.

Good luck, many people never get off the beaten path to learn this material, but they are also the ones that never get to real financial freedom.

-Lane Kawaoka, PE

Owner, SimplePassiveCashflow.com

What is a Private Placement?

To understand syndications you first must know what a private placement is. A private placement is a sale of securities to select investors who meet certain requirements.

In a private placement:

- The securities are not publicly offered (unlike IPO's)

- The securities are exempt from registration with the SEC

- The amount of investors are limited and are often required to be "accredited"

- The investment offers cash flow and appreciation

- The investment is typically backed by a tangible asset

Private placements are becoming more popular because they are uncorrelated to the volatile stock market, making them a great alternative to Wall Street and in part because the JOBS Act had made private investment opportunities more accessible to qualified investors.

Essentially syndications or private placements are private opportunites also known as the “country club deal”.

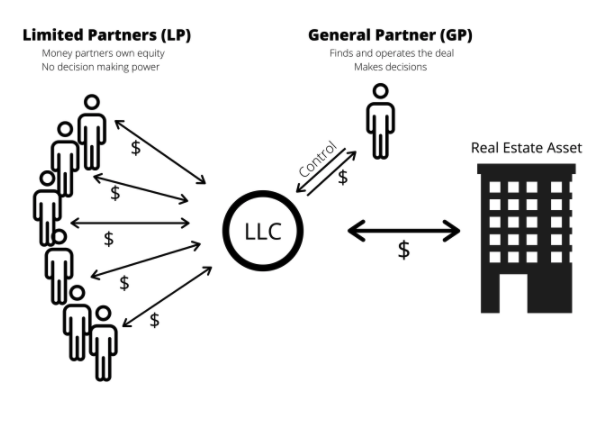

A syndicate is a group of investors pooling capital to buy a larger building collectively

Syndicates are typically structured with an LLC (a holding LLC and a management LLC)

- GP = General Partner… they assume the risk

- LP = Limited Partner… their risk is limited to their investment

Typically single-asset focus

Whereas a real estate fund (which a REIT is) is similar to a syndicate in that investors pool capital to acquire real estate

Differences:

- Typically larger in size (total capital raised)

- Focus on acquiring many assets (can be a very narrow or wide criteria)

- Investors may be able to come and go with different entrances and exits

What is an Accredited Investor?

An accredited investor is defined by the United States Securities & Exchange Commission as someone who:

- Made a minimum of $200,000 ($300,000 if filing jointly) in the previous two years

- Has a net worth of 1 million dollars excluding their personal residence.

As we will learn soon, non-accredited investors may also invest in 506B offerings.

What is a Syndication?

A real estate syndicate is formed when individuals or entities pool expertise and/or funds together to invest in real estate or any business venture. Typically, there is one or many sponsors or general partners (GP) who leverage their network and deal access, lead the effort of raising capital from investors, finding the property to invest in, managing the improvements and disposing the property to generate a profit.

The upside to real estate syndications is that it’s an effective way for a group of investors to pool their funds in order to invest in larger properties than they would otherwise be capable of as single individuals. Syndications can also leverage an operator’s expertise in a specific geographical location or asset class, which in turn can help diversify an investor’s portfolio. From a passive investor (LP) its pretty low headache and most of the effort comes in the beginning when vetting a sponsor and deal.

We like to pool together capital from private equity investors and have a competitive advantage over large clunky institutions due to our speed in acquisitions, decision making, and less middlemen/marketers/staff to pay which mean more returns for investors.

By pulling out money together we are able to get away from the crowded level of mom & pops and sophisticated mom & pop operators billing up properties under 5-10M in asset size.

Goal Investing

While it’s great to focus on investments that generate the highest possible returns, at Simple Passive Cashflow, we believe the best way to approach investing is by zeroing in on specific life goals.

Do you plan to:

- Take a special vacation?

- Pay for a wedding?

- Save for a down payment for a home?

- Donate to charity?

- Save for your children's education?

- Leave your day job?

- Build a nest egg and income stream for retirement?

- Create legacy wealth for your family?

- All of the above?

Reaffirm Your Goals

Before starting your syndication investment search, it is important to know your goals.

Access the worksheet by clicking the button below and complete it as you go along:

Do you know why there are shiny speckles in the ceiling of Bentleys? They look like starts and are reminders to keep shooting for them. What that means is to find that thing that keeps moving you forward to create that legacy or impact in the world. Let’s leave it a little better than we found it.

Complete your goal sheet here

STOP – Did you complete the above form?

Like in everything there is much to learn and you have to put in the work and learn it to get past the newbie level. Like going to the gym and beginning to lift non-weenie weight. Which is why I mentioned a while back that most people should start out with single family homes.

Personally, I am sold that syndications are the safest and most scalable way to invest for high net-worth investors. I have spoken a lot about my experience of getting to 11 rentals back in 2015 and the un-scalability and inability to optimize your return of equity when your portfolio is structured with those types of assets. When I started to join different higher level masterminds and ultimately create my own for our community, It became clear that this is how Accredited investors invest.

As of 2020, I am personally in over a couple dozen syndications. In 2018, I sold most of my rentals (for a capital gain and depreciation recapture of 200k which I did not pay taxes on because I had so many passive losses the syndication deals I was already in – more on taxes here and here)

Single Family Homes vs. Syndications

Most investors start off with single family homes or duplexes, which is a great way to start your real estate investing journey. However, the issues that come with single family homes (SFH) include:

Non-Diversified Risk

Investors are tied down to that one house, if a tenant moves out, the investors monthly income stream is at a standstill until the next tenant moves in. In fact, the investor will directly be responsible for all of the associated expenses: the mortgage, insurance, tax, etc. until the next tenant is found.

Difficult to Scale

There is a point in time when a few hundred dollars in profit margin for the first few years per property just doesn’t seem enough. An investor would have to invest in 10-20 properties to ever replace one’s salary. Additionally even if an investor acquires 10-20 homes, the time invested to dealing with broken faucets, evictions, late payments, etc. is a headache even with a property manager for the return that it provides.

Cash on Cash (CoC) Return is Limited

When investing in a single family home, one has to put down a minimum of 20% of the purchase price to acquire the home. For a 8-10% return, while it’s worthwhile to have since there is a profit margin. There are other real estate investment opportunities that may provide more return for the capital that is invested.

For SFHs, vacancies can drastically reduce your annual returns and contribute to higher returns volatility (i.e., overall unevenness in rent collections) in your investment portfolio. Syndications invest in multi-occupancy properties, therefore one or two tenants moving out of 100-300+ tenants, don’t impact the net income as heavily as it would per SFH. Syndications also provide a great avenue for scalability. Similar to SFHs, syndications provide returns from monthly cash flow as well as appreciation. However, the year over year 2-3% increase in rent for 20-30+ spaces will increase the net income of the property and your return much more than a 2-3% increase in rent for a SFH.

Pros of Investing in Syndications

There are still plenty of reasons to invest in single family homes – building legacy wealth, relatively low-cost way to learn about investing in real estate and for the most part, SFHs are a stable monthly income stream. However, investing in the right syndications can help with all of the above goals as investing in SFHs, but with a more efficient investment of time and energy. Below are some benefits of syndication investments:

-

Minimizing PITA (pain-in-the-ass) (simplepassivecashflow.com/pita): No more managing tenants, vacancies, maintenance, and managing the manager (who might be a $12-20 dollar employee whose compensation structure is not aligned with your goals). By passing the control of the day-to-day operations to true experts who are literally partners (direct alignment of compensation and motivations and not vendors like a property manager who is not really aligned with what you want as an owner), you can ensure the investment is being optimized while you spend your time on what you really want such as:

1) Making more money at your day job

2) Spending time with your family

3) Finding that one-off deal that you want to do on your own (you enjoy) while pairing with a Limited Partner strategy -

Asset Diversification: Many commercial real estate investments have high acquisition prices (think $10M+) which most people don't have access to. You want to get away from those other "Mom and Pop" investments (1-40 unit deals). When I was a syndication newbie, I thought I could do everything by myself and did not trust anyone.

I then realized in a few months that 1-40 unit deals had horrible pricing because all the amateurs were involved and the ones that looked good from a per unit price prospective were under 80% occupied and had ISSUES. Investing passively in a group can allow you to invest in multiple asset classes (e.g., apartments, mobile homes, assisted living), in multiple locations and with varying business plan durations. - Tax Deferred Status: All the deprecation tax benefits of single family homes in your DIY direct investing but even better! Bigger deals are able to pay for a cost segregation to squeeze out even more depreciation.

- Avoid Credit and Liability Risk: Investing passively allows one to avoid being exposed to credit or liability risk. No W2 documented income, no problem! You are not the one to personally guarantee multi-million dollar loans and be the fall guy. Plus, now you can get into all the travel hacking credit cards and tradelines you want (Simplepassivecashflow.com/tradelines).

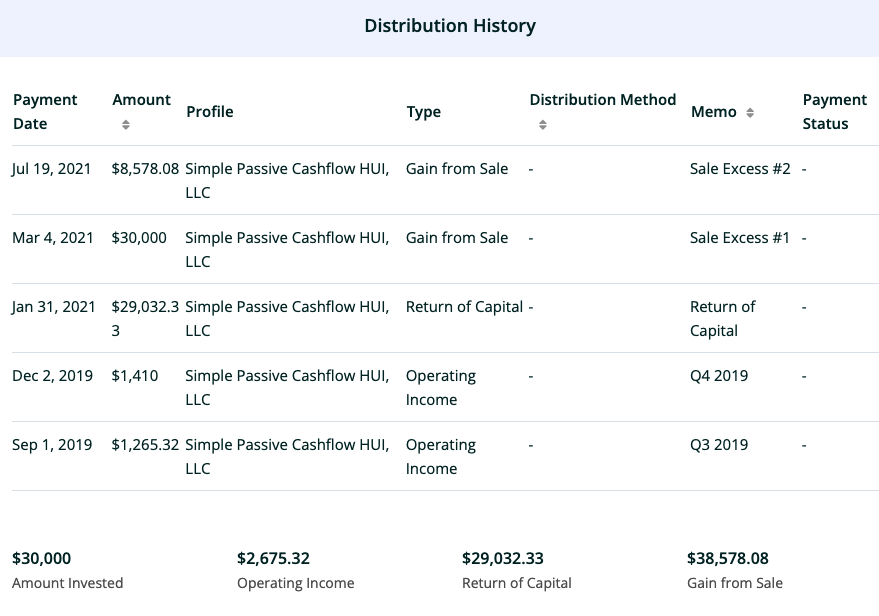

- Cash Flow: The goal of an LP syndication investor is to create a "ladder" of investments that create accumulated annual cashflow and cash-outs at different times in order to spread our your tax liability from capital gains and depreciation recapture... if timed well and you build up a large passive loss reserve you may never pay taxes. It's like your grandpa's (ordinary income) CD ladder strategy but with 10-30x returns and no taxes.

Simple Syndication Portfolio Example

$50K invested each year for 5 years, with each investment returning 10% annual cash flow and selling at $25k profit after 5 years.

Investments:

Yr 1 investment A: $50K

Yr 2 investment B: $50K

Yr 3 investment C: $50K

Yr 4 investment D: $50K

Yr 5 investment E: $50K

Returns (assuming each of A-E sell after 5 years):

Yr 1: A COC return $5K

Yr 2: A+B COC return $10K

Yr 3: A+B+C COC return $15K

Yr 4: A+B+C+D COC return $20K

Yr 5: A+B+C+D+E COC return $25K, return of capital (A) of $50K, profit (A) of $25K

Yr 6: B+C+D+E COC return $20K, return of capital (B) of $50K, profit (B) of $25K

Yr 7: C+D+E COC return $15K, return of capital (C) of $50K, profit (C) of $25K

Yr 8: D+E COC return $10K, return of capital (D) of $50K, profit (D) of $25K

Yr 9: E COC return $5K, return of capital (E) of $50K, profit (E) of $25K

Total investment (returned after 5yrs): $250K

Total COC return: $125K

Total profit: $125K

Total return: $250K. Annualized ROI of portfolio is 100% (2x multiplier of investment)

Four ways sophisticated investors diversify in syndications

- Leads/operators

- Asset classes, such as multifamily housing (MFH), self-storage, mobile home parks, assisted living

- Geographical markets

- Business plans (5-year exits vs legacy holds)

Types of Syndications/Private Placements

Open-Ended Fund

Open-Ended Funds are typically offered as an ongoing vehicle where the Fund Manager is constantly buying and selling assets for the Fund. Often, these types of Funds offer redemption features so an investor can exit the Fund, after a stated lock-up period. New investors can come into the Fund over time as well. One significant advantage for the investor is that they automatically have diversification in their portfolio because their investment into the Fund exposes their capital beyond just a single asset and across all assets the Fund owns. A disadvantage is that the investor has no day-to-day control over the assets in the Fund and is relying solely on the fund manager’s discretion. Distributions to investors may be made monthly, quarterly, or at different intervals and come in the form of cash to the investor or may be reinvested back to the Fund, depending on the fund’s specific setup.

Closed-Ended Funds

Similar to open-ended funds, typically have multiple assets in them and therefore provide an element of diversification. However, there are typically no redemption options as the Fund is designed to have a finite shelf-life, both in terms of a fundraising period and an estimated deal lifecycle. The deals the manager selects for the Fund have an expected return which is generally distributed to investors once the deal is fully completed and then distributed to the investor at the close of the Fund. After the Fund is closed, no more deals will be done and hopefully all investors receive their principal and return on investment back at that time. Regular cash distributions may or may not occur depending on the type of assets going into the Fund. If the assets are long-term growth-related assets, such as a motel conversion to affordable housing, there may not be immediate cash flows until the project is completed and rent payments are collected.

Syndications

Syndications are generally structured for the purpose of raising capital to acquire a small number of assets and/or one single asset. These structures are very commonly used for larger value assets, such as multi-family apartment complexes. Generally, there isn’t the diversification, and like a closed-ended fund, it has a shelf-life based on the syndication sponsor’s belief about when the asset will be liquidated and principal returned to investors. The syndication may or may not offer cash flow over the life of the offering.

Direct Ownership

Direct Ownership provides investors the greatest control over their assets – in that they make all day-to-day decisions. With Funds and Syndications, the investor is relying solely on the manager to make ongoing decisions. With direct ownership, all of the investor’s capital has full exposure to the asset and therefore doesn’t bring the diversification element. Depending on type of asset, there may or may not be a current cash flow component. However, it gives the investor the control to fully position the asset to the specification of their portfolio.

These four access points can offer investors many benefits that advance their individual financial freedom objectives. However, the investor must carefully assess those benefits (and risks) and how much investment capital is allocated amongst these access points, as well as the asset, asset classes, and many other components when making private investments.

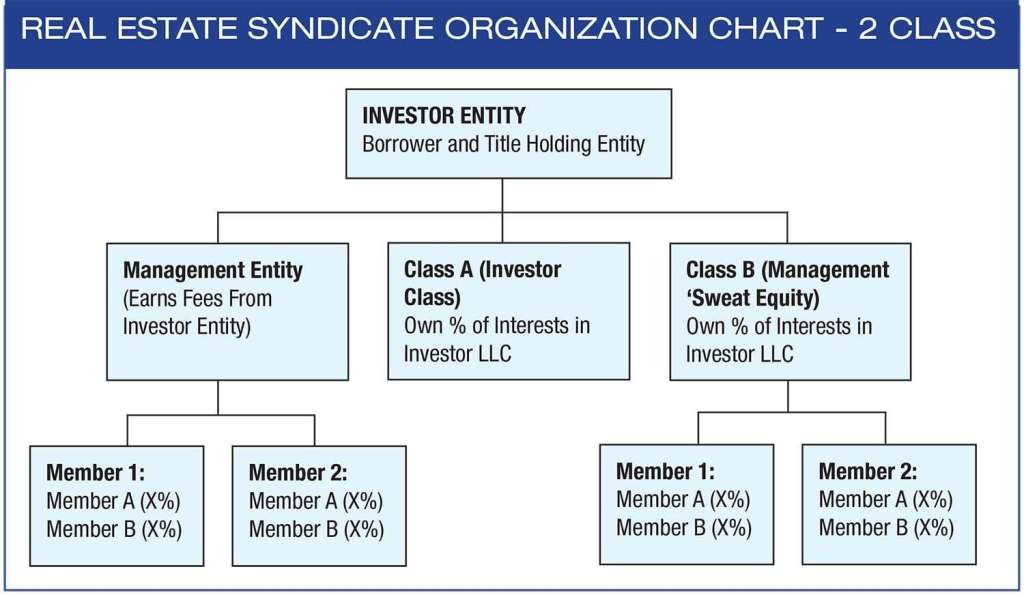

How are Syndications Structured?

There are numerous ways to structure a commercial income-producing property. The following model describes a typical two-class syndicate with equity investors and a separate management entity.

In the above scenario, a separate, title-holding entity (the “Investor Entity”) that is also the borrower on any bank loan sells interests to Investors.

A limited liability company (LLC) used as the Investor Entity will be “manager-managed” with a “Manager” management entity and “Members” as the passive Investors. Alternatively, you could use a Limited Partnership with a general partner (GP) as the management entity and limited partners (LPs) as the passive Investors. For purposes of this article we will use terminology consistent with an LLC (Manager and Members), as this is the structure most syndicators currently use.

The Investor Entity will need an agreement (the “Company Agreement”) between the management entity (the “Manager”) and Investors (the “Members”) that will govern how the Investor Entity will operate. The Company Agreement will define the Manager’s and the Members’ rights and duties and how cash will be distributed to each of them

Note: This structure stuff really isn’t too important as LPs should focus on doing due-dilligence on the deal and people involved than worrying too about these legal nuances. Passive investors need to look at deals holistically and not get bogged down in minutiae. I have seen so many detail orientated investors who have never jumped into a deal shoot themself out, get confused, or worse jump into the wrong deal because they focused myopically on the wrong thing.

Manager

For the Managers, they would typically use a separate LLC (“Manager LLC”) that includes the management team as its members. If an individual is named as the Manager, the Investor Entity can be harmed if something happens to that person, as it will no longer have a Manager until the Members can elect a replacement. If the Manager LLC is itself a multi-member LLC, the Manager LLC will continue to exist as long as it has members, and this protects the Investors because the Investor Entity will remain unaffected if something happens to one of the members of the Manager LLC.

The Manager will earn certain fees for its active role in managing the Investor Entity, including fees such as an Acquisition Fee or Organization and Due Diligence Fee, Asset Management Fees, Refinance Fees, or Disposition Fees. We will talk later on what the normal ranges are.

Members

The Investor Entity in a syndicate will typically have multiple classes of Members. We’ll call them Class A (for cash-paying Investors) and Class B (the management or “sweat-equity” class). If certain Class A Members will have different returns, Class A can be broken into separate sub-classes (e.g., Class A-1, Class A-2, etc.).

Class A

Investors will purchase Class A interests in the Investor Entity and become Class A Members. Class A Members will contribute 100% of the capital contributions necessary to capitalize the Investor Entity in exchange for a portion (e.g., 50%-80%) of its ownership interests. The Manager LLC (or its members) will retain the rest of the interests as compensation for their contributions to the Investor Entity. Both Class A Members and Class B Members will receive “distributions” based on their ownership interests.

Class A Members may be offered a preferred return, meaning they get paid their returns before Class B Members get paid any distributions. Preferred returns can be cumulative ( i.e., accrue even if no cash is available to pay it until some future event) or noncumulative (not as common). Preferred returns are typically calculated on an annualized basis but determined quarterly.

If the preferred return is “cumulative,” arrearages (if any) would be made up at the next distribution event prior to paying current returns. Or arrearages could be deferred until a “capital transaction,” such as refinance or sale of the property (depending what your Company Agreement says). In this case, arrearages are paid after refunding Class A Members capital contributions, but before paying distributions to Class B Members or splitting equity between Class A Members and Class B Members. All of this is spelled out in a distribution “waterfall” in the Company Agreement.

If the return is “noncumulative,” Class A Members get all of the distributable cash needed to make up their preferred return for the current distribution period, but deficiencies do not accrue.

When sponsors/GP/syndicators/leads put money into the deal, they are not putting it into the B side (that is not possible) but they are investing in the A side as a LP buying up those units.

Class B

Class B is the service class. This class typically includes members of the Manager and/or others who provide services to the company, as determined by the Manager. Class B Members keep the remaining ownership interests in the Investor Entity in exchange for a nominal amount (usually $100 or $1,000 total) plus their “non-capital contributions” to the Investor Entity. By paying for their interests, Class B Members can establish a cost basis for their investment so that when they do receive distributions, they may be taxable at capital gains rates versus ordinary income rates that would include self-employment tax.

Class B Members only receive their portion of the distributable cash during operations after Class A Members have received their annualized Preferred Returns (if there is a Preferred Return or “pref”). Not to get into the weeds as every deal is different in some cases, Class B Members only receive distributions after both Class A Members capital contributions are refunded and any arrearages in Class A Member Preferred Returns have been paid. Consequently, Class B Members’ returns are subordinate to that of Class A Members. Or Class A and B members can be paid out at the same time at different ratios, for example in a 70/30 LP/GP split deal, profits are sent out 70 cents going to passive investors and 30 cent going to the sponsor team for every dollar made.

You can’t buy class B shares.

Note – A and B classes can be switched in naming convention. It really does not matter what you call them or in what alphabetical order there is. It is typical to put LP investors first (make them feel special) so which is why most people use “Class A” for the passive investors.

Why Use the Two Class Structure?

- To preserve distributions for the management class if the Manager is removed.

- To segregate fees from distributions so that earnings on Class B Member distributions may be taxable at capital gains rates, versus the Manager’s fees, which will be taxed at ordinary income rates (with self-employment tax on those earnings).

- Since Class B retains a percentage of the interests, the Manager can allocate those interests as it sees fit amongst persons who provide services to the Investor Entity. This could be useful for people who find deals, participate in money raising, and guarantee loans on behalf of the Investor Entity.

- From a liability prospective, the Class B side are the Managing Members and first in line of any litigation as they are the decision makers.

In some cases, typically where loan balances exceed $10M, the lender will require a separate, single-purpose entity (separate from the Investor entity) to serve as the borrower and title holding entity. In such cases, the title holding entity will be wholly owned by the Investor Entity.

Liability in Syndications

In real estate syndications, there are typically two sides of the operating agreement: the passive side comprised of the investors who bring only capital to the table, and the active side comprised of the sponsor managing members who are responsible for the decisions behind the syndication investment.

Under no circumstance will the investors on the passive side be responsible for making management decisions of the syndication investment, and, therefore, there is very little possibility a judge would find passive investors liable for decisions made during the investment’s performance. This way passive investors are insulated from any lawsuits that may arise due to syndication-related activities.

From the sponsor’s perspective, even though the Manager LLC’s single-member LLC entity shields the sponsor individuals from liability in connection with the syndication investment, a large enough loan from a bank, will usually require a personal guarantee from a natural person, often called the “key person” (“KP”).

Imagine as a passive investor you are investing $100,000 into a real estate syndication that is purchasing a $20,000,000 apartment building. The bank is loaning $14,000,000 at a favorable 5.0% rate, which will be guaranteed by the sponsor, effectively exposing his/her credit to personal liability for the loan amount.

The bank is willing to loan the operator fourteen million dollars because of the operator’s experience, track record, and credit worthiness. As a passive investor, you thereby benefit from the operator’s experience to acquire a large loan that you could not be approved for alone, and you have no liability exposure to the loan.

Investors

Investors are often known as Limited Partners (“LPs”). Not giving you any legal advice here of course, but 80% of my investors invest in deals via their personal name because as the name implies, there is limited liability because the Investor Entity is a limited liability entity where liability from the syndication investment goes to the GP (which again is itself often a Manager LLC limited liability entity) and where the loans are guaranteed by the KPs.

Legal Structures

As mentioned before, the syndication investment may be created with a certain tax and legal structure. It is usually created as a Limited Partnership (LP) or a Limited Liability Company (LLC) to own the property on behalf of investors.

Investing in a Project: Debt vs. Equity

One of the first questions to determine when looking at a deal is if it is Debt or Equity? When you invest money on the equity side, you become a part owner in the project. This means that you are taking on greater risk, but for a greater return (upside). Oftentimes you’ll receive quarterly distributions from your investment. Of course, the risk of being an owner, is that if the project goes sideways, you could lose your entire investment.

If you invest on the debt side, you’re essentially a private lender for the project, but not an owner of the property (unless you need to foreclose on the property and take over control due to non performance). This comes with lower risk, but also lower returns. Where you could get 10%+ with an equity deal with also passive losses (tax benefits), you’ll likely receive around 3-10% with a debt investment. In most cases, debt investors get ordinary income which in our Simple Passive Cashflow universe is a naughty word because it is not tax advantaged.

For either investment, it is important to understand the timeline of the project to make sure it matches your expectations. In many markets right now, it makes more sense to buy and hold than to flip (especially in commercial or mixed-use properties) so those investment timelines could be at least two years.

To make things confusing for you… we have started it introduce a new hybrid investor class called “pref equity”. It is a fixed rate of return, shorter hold period, quicker returns, with depreciation (losses) but no up-side”.

Key definitions to know

Below are essential syndication terms to know. Later, you can check out the complete glossary but don’t let that bog you down. Let us get through the basics first! Most people only get through a fraction of these eCourses… we made this so you can buy something and become financially-free rather than to just make you feel good about yourself!

Real Estate Sponsor: A sponsor is the investment manager responsible for finding the deals, financing the transaction, performing the financial and risk analysis, and ultimately closing the transaction. After the property is owned, the sponsor will be the hands-on manager maximizing the value of the investment opportunity.

Capitalization Rate (Cap Rate): Rate of return on commercial real estate equal to Net Operating Income (NOI) divided by Current Market Value. (Example: $100,000 NOI / $1,000,000 Market Value = 10% Cap Rate).

Core Property: This syndication type is the most conservative. Core property investments use lower leverage (e.g., 60% LTV) and can generate predictable cash flows. The properties are often in good condition, positioned in strong low-cap rate markets, like thriving metropolitan areas (think LA, SF, NY), and are able to attract financing more easily. Although it is less risky, you will also see a lower return offered for these investments. Core property passive investors are likely more conservative and have a longer investment horizon. Core property investments are therefore attractive for institutional investors such as life insurance companies and pension funds, for high net worth family offices, and others seeking a stable yield and less likely to take higher risks for higher return.

Core Plus: Similar to Core Property investments, Core-Plus properties are also easily financed, are in good geographical locations and have good tenants. Core-Plus is different by heightening risk and return through less intensive improvements on the asset to increase NOI and therefore value at disposition, such as improving loss to lease or light value-add. The investors in Core Plus investments are similar to those investing in Core Investments.

Value Add: This type of syndication investment has a component of requiring higher capital expenditure to add value to the investment. This value add might mean improving the physical property itself (for example, upgrading an exterior, changing floor plans, adding washer dryers to each apartment unit) or improving the operations (for example, replacing existing property management). This deal type might mean medium to high risk with corresponding return. The value add would boost NOI and ultimately the sale price to generate the higher returns. These are less likely to attract institutional investors and more likely to be the investment type for individual passive investors looking to maximize returns in a shorter amount of investment time window.

Opportunistic: This syndication investment type carries the most risk, but would also offer the highest return. These deals might include heavy capital expenditure requirements to transform a property, such as through ground-up development, re-tenanting, land entitlement. This is also an investment realm more likely occupied by individual investors than institutional.

Capital Stack: The types of capital that make up the money required to purchase a syndication investment property. Usually, the bottom of the stack is comprised of senior debt (for example, a bank or traditional lender first lien loan) that is the lowest risk and return. Then sometimes there is bridge/mezzanine financing or preferred equity, with slightly more risk and higher return due to being subordinate to the senior debt. Then there is the limited partner/passive investors equity. Finally, there is the general partner/sponsor equity, which has the potential for highest risk and return.

Have some rentals?

Don’t be a Mom & Pop investor

Low net worth and not a Sophisticated Investor?

FAQ’s

Usually, I see investors place no more than 5% of their net-worth into any one deal. Investors who have poor networks and deal flow put larger sums of cash into less deals because of lack of options. It is more prudent to place your cash into more deals that are strong.

Invest in deals that have:

1) Cashflow with a good buffer in case of a recession

2) Forced appreciation so there is the option to get above water for exit in case the economy goes catastrophic as well as bump the value

I go into these deals understanding that they're pretty illiquid. That's unless for some divorce/death/other bad business your money is locked up in there. I know there are some mechanisms to get the money out, but I see it more of a saving face type of thing not to rock the boat. Again, I don't pay attention to the method used to pull the cash out. If you can turn your money faster than 20-25% a year with less effort and more security, then you should do that. And BTW let me know because I would like to invest in that too.

I think it’s important to realize that even though you're the small fish with other larger folks in an LP position, it might not be worth the trouble for another larger LP to pick up your portion of shares (even though $50k is nothing to that guy. You might be giving yourself a bad reputation, since the relationship between the LPs and GPs is a two-way street. If you're going to be the guy/gal who rocks the boat, GPs may think your investment dollars are not worth the headache.

That said, I would encourage you to follow your instinct because if you are unsure about getting your money out... there may be some subconscious reason you need the cash. And that is perhaps a bad sign that maybe you should not be investing. Not to sound hocus pocus or universal signs, but I sort of do the same thing when I get pitched a deal. If it’s not a “heck yes”, then I don't go into it.

But I do understand that when you are new to something, it could just be butterflies. Maybe you just need to save up an extra $25K so you have that much in reserves to feel a little better before committing to a syndication investment.

As a side note, this is the sort of question non accredited investors ask all of the time. As you can see, these are part of the headaches of a syndicator/sponsor dealing with non-accredited investors. Personally, I enjoy building relationships and helping those who need these investments the most, but I can see how some people are completely put off helping those under $1M net worth.

We stay away from a REIT.

REITs are retail investments. There is poor returns mostly because there are a lot of hidden fees. Some blind pool syndications (multiple assets) are pretty much just like REITs however the reason why we go with syndications and private placements is that it is typically done with less overhead and investor returns are stronger.

REITs also are governed to pay out 90% of revenue as distributions to investors. Sounds good but this may NOT be good for the long term of the asset. Say you need to use some of those profits to make CapEx improvements to ensure your asset keeps its desirability.

Yes you can but not its not practical...

Syndications investing in LLC (even if you are buying real estate) are businesses and not (like kind exchanges) with real estate. And therefore if does not qualify as a 1031 exchange. You can 1031 equity into a Syndication/LLC via a Tenant-In-Common (TIC) arrangement. But the reason I say the 1031 is not a viable option is because from the syndicator’s prospective a lot of unneeded work goes into doing this and when you can just raise the funds the traditional way you do that and not deal with this annoying LP investor and extra paperwork and having to explain another outside structure owning part of the deal externally of the LLC.

Caveat: if you are bringing in a huge amount of money say 50% of the raise (at least $500,000) then that might tip the scales in your favor. But in all practical sense only if the syndicator is desperate for money will they consider doing a TIC for part of the capital raise. And if someone is asking you to do this with your 1031 money and you are not bringing in that much... you need to run...

I don't know why anyone has the 1031 exchange in their toolbox if they are already investing in the world of private placements and a net worth of over $1M.

There is no normal as every deal is different. I personally try to structure the deal where my passive investors (LPs) double (100% ROI) their money in 5-6 years using conservative assumptions in a stabilized light value add deal. And on a higher risk/return deal we move fees and splits around so the maybe double their money in 3-5 years.

I cannot speak for other sponsors as they might was to give more or less to their investors. But be wary that a proforma really means nothing as a good LP digs a little to make sure the assumptions they are using are proper which you will learn in the next few modules. That said I have seen straight pref deals with no upside, 50/50 splits, and even 90/10 splits.

This is getting into the realm of what will confuse most people and really not really that important to understand in the beginning... it depends on how the deal is structured as far as what is the units of ownership. One way of thinking about is in this example where there might only 8,000 units available at 1,000 dollars per unit (8M capital raise) with the remaining 2,000 units in ownership by the GP as their carried interest in running the deal - GP did not have to put money in to acquire those units.

Terms like Sponsor/Syndicator are lousily thrown around terms and mean different things in different structures but I believe the intent of this question is trying this... you can have someone in the GP and not being a managing member. For example a Key Principal (KP) and not have voting rights or management ability. Every deal is different but this has little impact on the LP.