2.1 – Being Open Minded

This week please be open minded to the fact that most financial advice has been engineered by those institutions to keep you working at your job.

In the 1990s the low fat diet (high carb) was in. Now we know the truth, those studies that lead to that dogma were funded by the sugar companies. The same can be said with “Big Pharma” and pushing of anti depression drugs.

Get ready to get your mind blown!

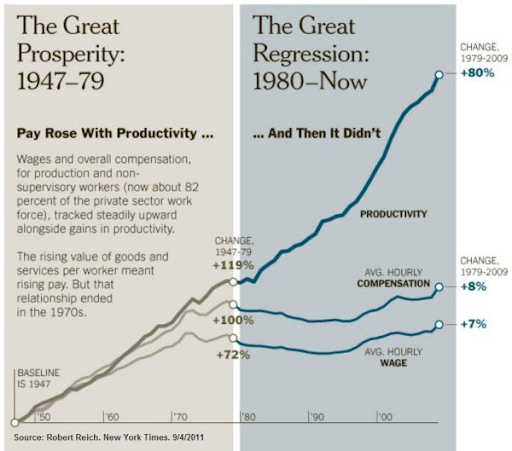

NPR highlighted that 2015 was the first year since 1970 that the middle income bracket was no longer the majority.

Ideals on building financial wealth came from whom?

Parents

Friends

Schools

Co-Workers

TV

Golden rule: never take financial advice from anyone who is not financially free!

The reason I say these investments are like the “Matrix” is because this marketing dogma is so prevalent in the mainstream media, I think that it is very similar to the movie “The Matrix” with Keanu Reeves where only a few see the system and able to take the “red pill” and escape.

Warning!

You may want to stay sleeping in your current arrangement and there is nothing wrong with that. I don’t want to pop people’s happy paradigms but if you are unhappy and want to “Journey to Simple Passive Cashflow,” and get off to linear path to get free and start living a life of choice to do what you want, with who you want, and when you want then read on.

Sophisticated investors don’t care about debt or interest rate they look at cashflow and increase to net worth. They monitor the return on equity and make transaction accordingly when it out-weights taxes and friction costs (commissions/headaches).

Check out SimplePassiveCashflow.com/roe. Smart investors never buy and hold an asset forever.

You may like or dislike your job but either way what will you do after you don’t worry about money?

PS – FORBES – Is All Debt Bad Debt? – By Lane Kawaoka – 19.03.29