Oil & Gas

Oil & Gas – Primarily due to tax deductions (offset active W2 income) due to the government subsidizing exploration for oil and secondarily for harvesting the oil

Most people (environmentalists included) do not realize that petroleum-based NOT only the gas in your car’s tank.

- Most plastics are also made of petroleum. This long list includes:

- Umbrellas

- Bicycle Tires

- Solvents

- Curtains

- Mops

- Roofing

- Toilet Setas

- Deodorant

- Basketballs

- Golf Bags

- Perfumes

- Refrigerant

- Paint

- Hair Coloring

- Ice Cube Trays

- PETROLEUM HAS NO SUBSTITUTE

Oil and gas is a commodity, which means there is a limited supply — and high demand.

Pros

There are significant tax benefits investing in oil and gas — specifically to owning a producing oil and gas well. A few of the tax benefits are:

The structure of the oil and gas investment will dictate the amount of tax benefit. For example, a drilling program could result in 75%-100% write off against your active income in the year that you invest.

Cashflow from producing wells or royalty interest can have a 10%-15% yearly depreciation allowance.

Tax breaks based on passive income

Apart from the tax write-offs, investing in oil and gas provides diversification of your portfolio, and can be seen as a hedge against inflation.

Additionally, certain oil and gas investment types can provide consistent cash flow, similar to real estate. One good well can pay you for passive income decades and produce exponential returns.

Cons

Despite all the wonderful pros of investing in oil and gas, it is important to take note of some of the cons.

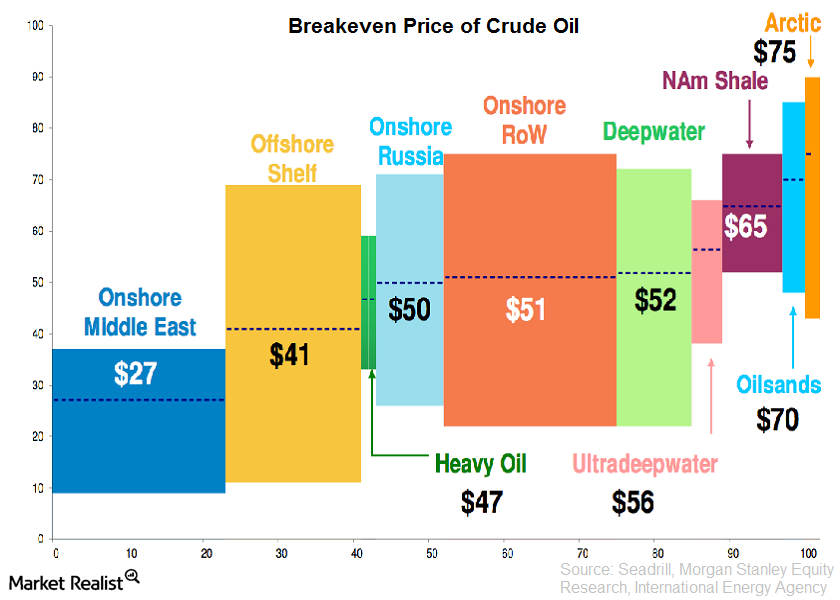

As you’ve seen in the news, the price of oil can be very volatile. Since oil is a global commodity with many other countries also producing it, global tensions can directly affect its price.

This could directly affect any cashflow producing investments because your cash flow is directly tied to the price of oil and gas.

Another disadvantage: depending on the type of oil investment and size of the project, it can be a big barrier to entry financially; it can cost hundreds of thousands to millions of dollars to drill a single well.

Also, there is an environmental factor: there is potential for large liability issues if there is a spill caused by one of your oil and gas wells.

Here are a few companies you could buy stock from that are doing the deep well drillings:

Exxon Mobil (XOM)

Chevron (CVX)

ConocoPhillips (COP)

British Petroleum PLC (BP)

Unfortunately as we know investing these ways is not direct or project specific projects.

If you are an investor who wants to take a more “hands-on” approach to oil and gas investing, consider taking a look at an oil and gas direct participation program (DPP). DPP’s are designed for people to invest directly in oil and gas production and exploration.

It is a type of investment that allows the investor to gain the benefits of the cash flow and tax advantages for the investment.

DPP’s require a substantial amount of due diligence by the investor and can have varying levels of risk.

In a DPP, you actually own a percentage of interest and assets of the operating company — what’s known as working interest. You have all the advantages of owning a percentage of an oil company without having to set-up the company, manage the day to day operations or be an expert in the oil and gas space.

If your investment is profitable, the DPP’s are generally passive investments and can result in steady cash flow.

Let’s look at the types of Direct Participation Programs you can be involved in.

Exploratory Drilling Program is a “high risk, high reward” type of investment and is the riskiest type of program.

This is when an operating company structures a deal to explore a new area for oil. Usually, new wells are drilled in areas that have no previous activity or drilling.

While there is a chance that the exploratory wells could hit a lot of oil and could result in insane returns, there is also the possibility that the well is a “dud” and produces little or no oil.

In exploratory programs, your investment is usually 75% to 100% tax-deductible.

Developmental Drilling Program – This is the most common type of DPP. Normally an operating company is looking to drill more wells in an already proven area.

Since there are already producing wells and historical trends in these areas, the chance of drilling a “dry hole” is much less — but again, nothing is guaranteed.

These types of drilling programs are usually chosen by investors who want an immediate tax write-off against income in the same year.

The tax benefits can yield 75% to 95% write-offs.

Based on steady or increasing oil prices, this type of investment can also yield a steady cash flow.

Working Interest Program is where the developmental wells have already been drilled and are already producing.

Usually, other working interest owners are looking to cash out and sell their interest to another investor. This is similar to buying real estate that is already generating a rental income.

There are no major tax advantages with this type of investment, apart from the depreciation allowed on the assets.

Re-work programs are not as common. Re-working programs normally involve operators taking already producing wells which have low production rates, and “re-working” or revitalizing them.

This normally involves:

- cleaning the well

- drilling into new zones

- restimulating (fracking)

- making casing or tubing repairs

- These types of investments can be risky because it is not guaranteed that the well production rate will increase or will result in substantial production increase with this rework.

On the other hand, a small investment may result in very large returns on a well or group of wells.

Overall, investing in the correct DPP can prove to be very lucrative, though it is important to note some of the risks associated with DPP’s.

Similar to real estate, your working interest is relatively liquid because you would need to find a buyer for your working interest if you are looking to cash-out.

Since you are a “part-owner” of the company or project, you can be liable for costs that arise from the project.

For example, if the operating company runs out of the money that was initially raised from all the working interest owners, they can issue a “cash-call” which would result in working interest owners needing to invest more in order to keep the project alive.

This is why it is important to involve an oil and gas attorney before you invest in these programs to ensure you understand all the risks associated with the investment.

Owning Mineral Rights

Apart from the DPP options we just explored, there is one more option for investing in oil and gas.

This is owning oil and gas mineral rights. Simply put, “mineral rights” mean you own the oil and gas rights beneath the surface.

Mineral rights give you the right to explore (drill) or produce oil and gas on a piece of land. Mineral rights also include the right to lease the land for oil and gas production.

Normally investors can buy mineral rights through an authorized broker, however, the cost to buy mineral rights can be quite high.

Once a person owns mineral rights, they can enter into mineral rights ownership agreements with oil and gas companies.

One of the most common types of ownership is known as a royalty interest. This is when the mineral rights have been leased to an oil company for oil and gas exploration and production.

The owner keeps a certain percentage of the revenue when the operator starts producing oil and gas. A royalty owner does not bear any costs associated with drilling or operating the wells.

This type of ownership provides a very lucrative passive income for investors, however, good mineral rights deals are not very easy to come by.

Oil and Gas Investment Strategies

If you are interested in the approach of oil investing through stocks, mutual funds or ETF’s, one popular strategy is considered portfolio diversification, such as a percentage allocation of your money to one or more of the options. This also means having investments in other financial sectors and not just oil and gas.

When looking at the DPP options, consider a program that is a combination of both development and working interest ownership — This type of program would hedge your risk, so you can sleep easy at night.

It’s also worth noting that if you’re investing in physical wells, then go there and inspect the lease. Talk to the operator. If you can, find locals in the area that know the history of the area and better yet the lease itself.