Other Investing Options

- Solar

- Conservation Easements

- Short Term Rentals – to help qualify as an active participant in a portfolio to qualify as a real estate professional for tax reasons

Senior Living

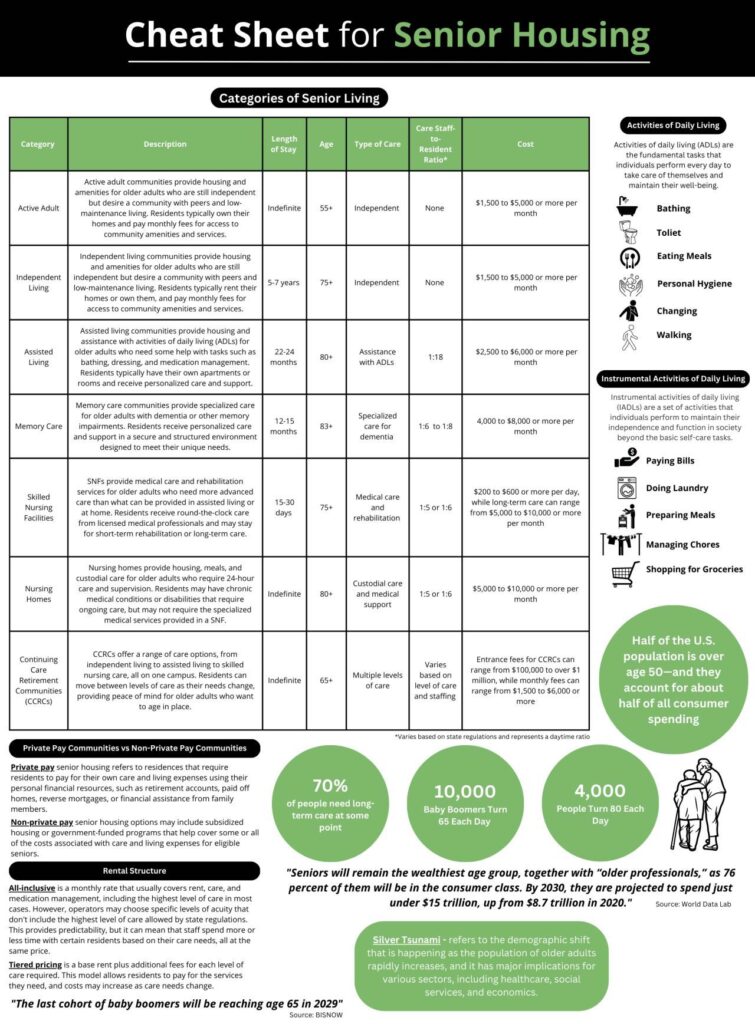

The “silver wave” of baby boomers retiring and needing assisted living services is a demographic trend that will increase the need for the asset for senior living facility asset class. However, it will be another decade or two before this trend fully materializes. Investing in senior living facilities is different from rental real estate and requires an expert level of operation. While there are groups that teach people how to create your own senior housing operation (for the GPs), a lot of these educational groups are better at teaching about marketing than operating the asset as I have not found a reliable operator that has gone full cycle on these assets like how we have in the apartment asset class. As an investor, caution should be exercised when selecting deals and operators. I would highlight especially in the assisted living space, vetting the operator is of utmost importance (more so than apartment investing) because this assisted living space is so much operational focused. Generally we recommended passive investors (LPs) to wait until there are experienced operators with at least a billion dollars of assets under their belt before investing in the senior living industry. While senior housing is a great long-term investment, investors should wait until the industry matures before jumping in.