#2 – Seeing The Matrix

3 Topics

#3 – More About Me

3 Topics

#17 – Investor Mindset

4 Topics

#19 – Taxes

6 Topics

#25 – Covering your Assets

2 Topics

#26 – Conclusion

3 Topics

BONUS – Syndication Insider Insights

3 Topics

Richard Duncan Market Updates (latest on top)

22.07.30

21.03.20

21.03.20

21.01.1

Will The Dollar Collapse?

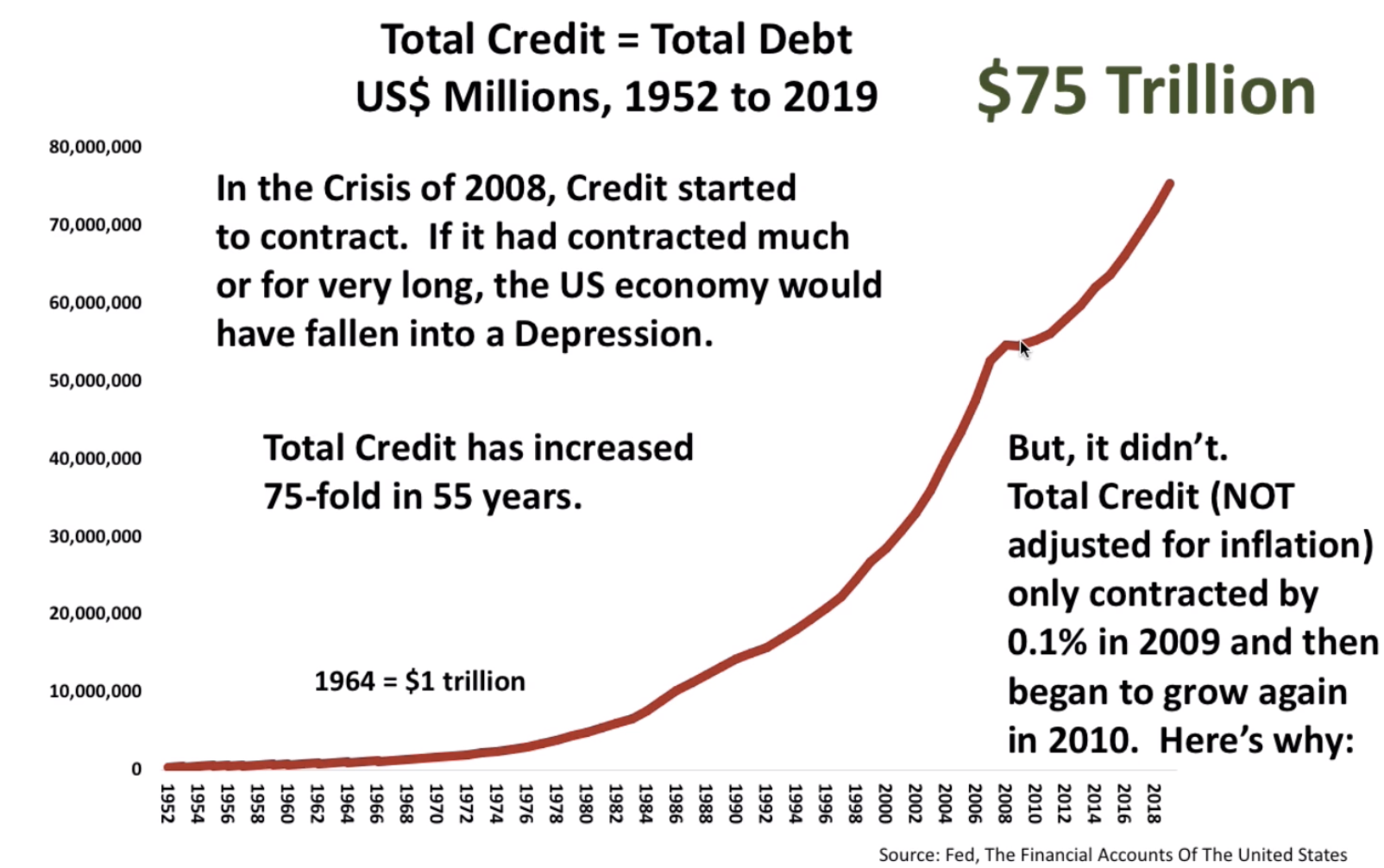

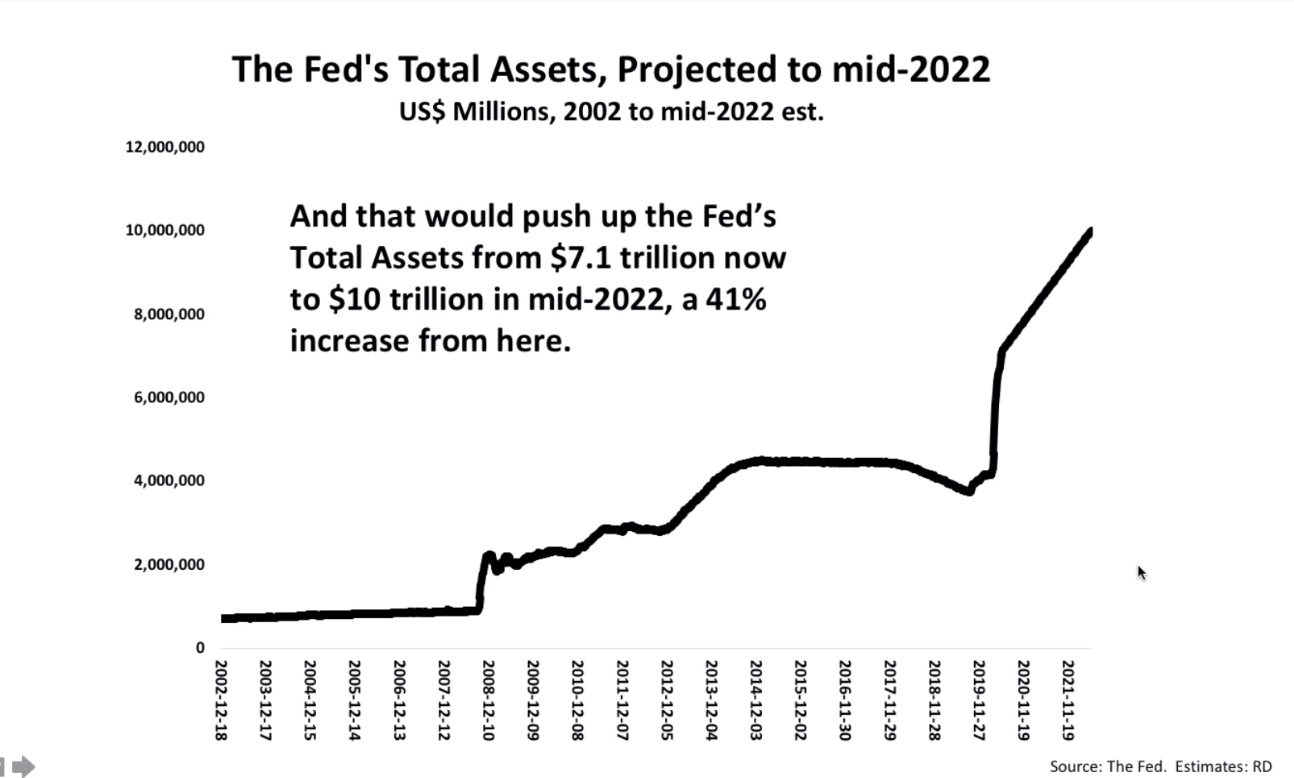

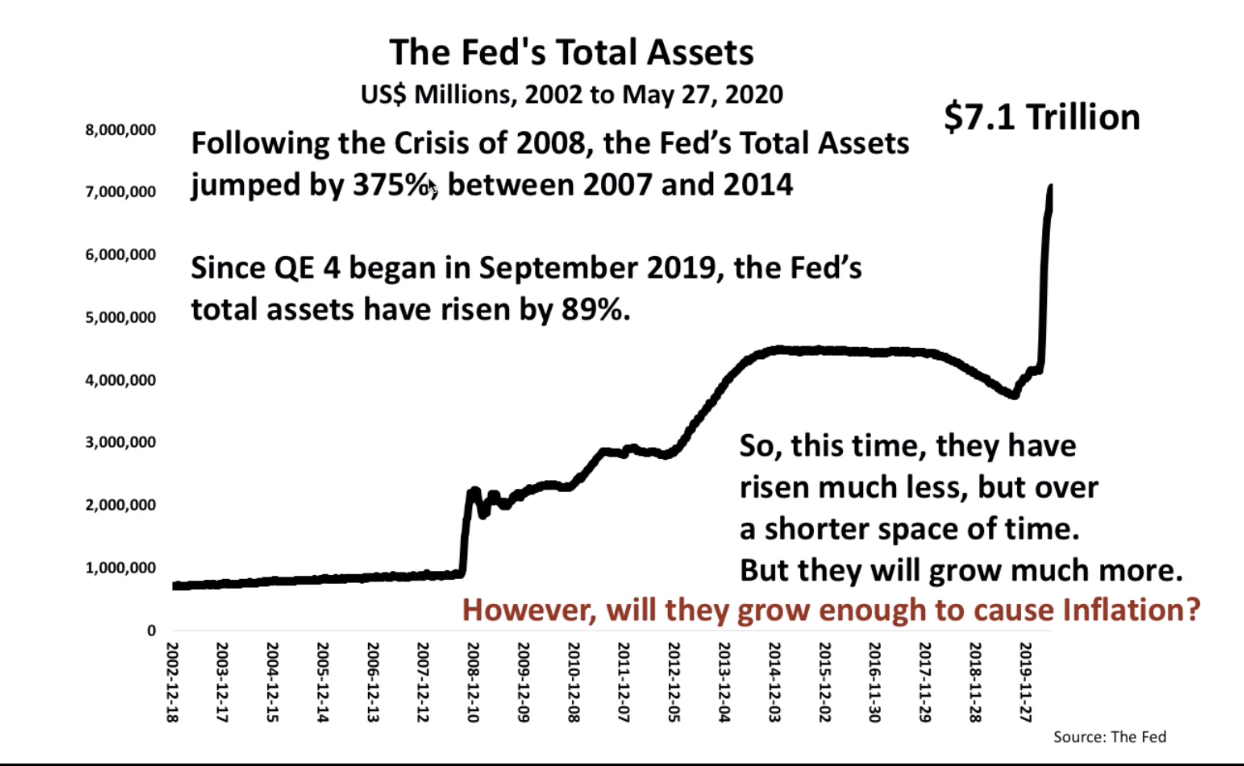

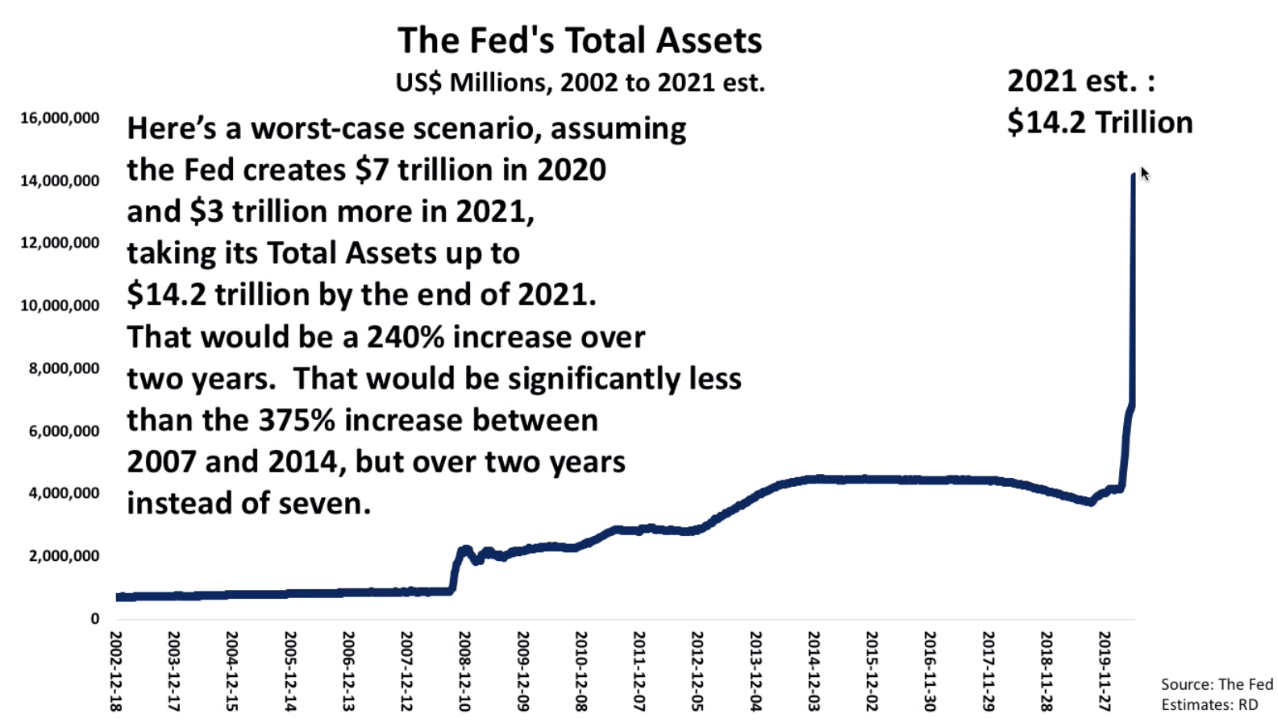

When Creditism Met Covid-19

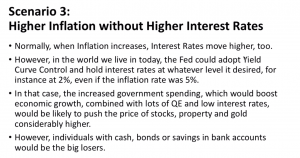

Yield Curve Control

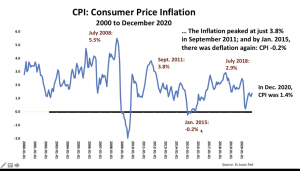

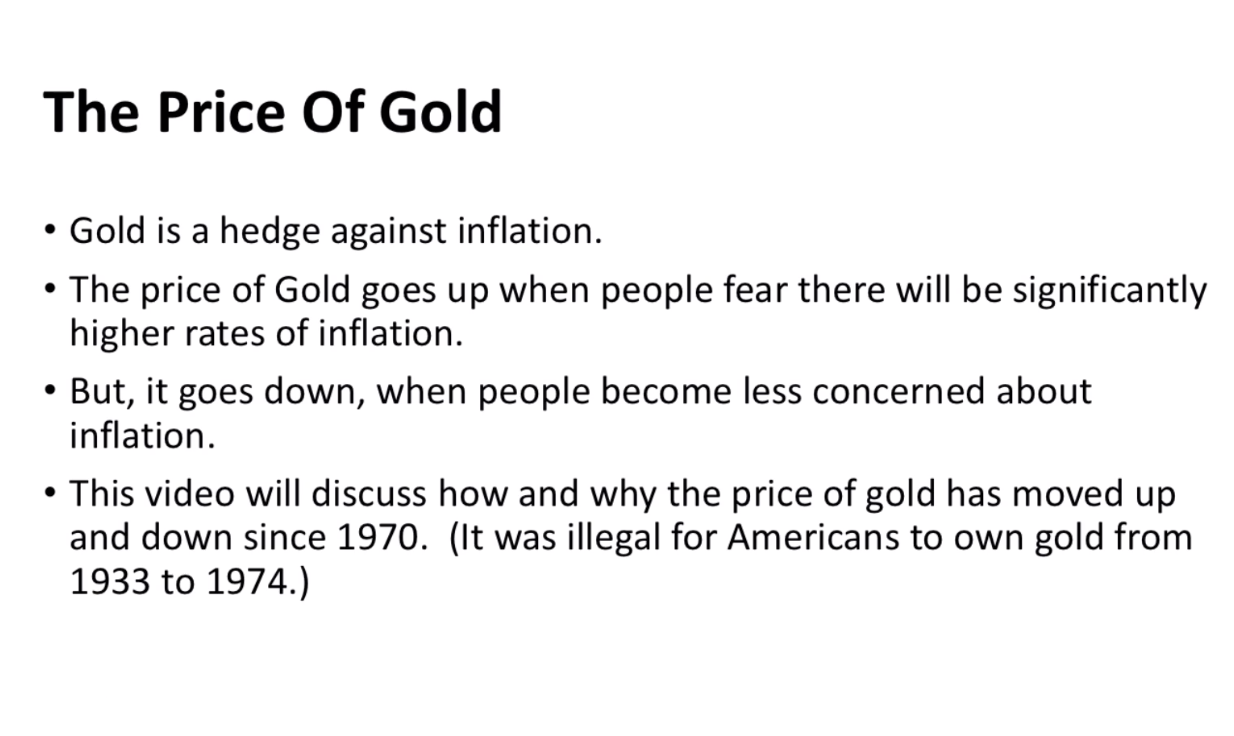

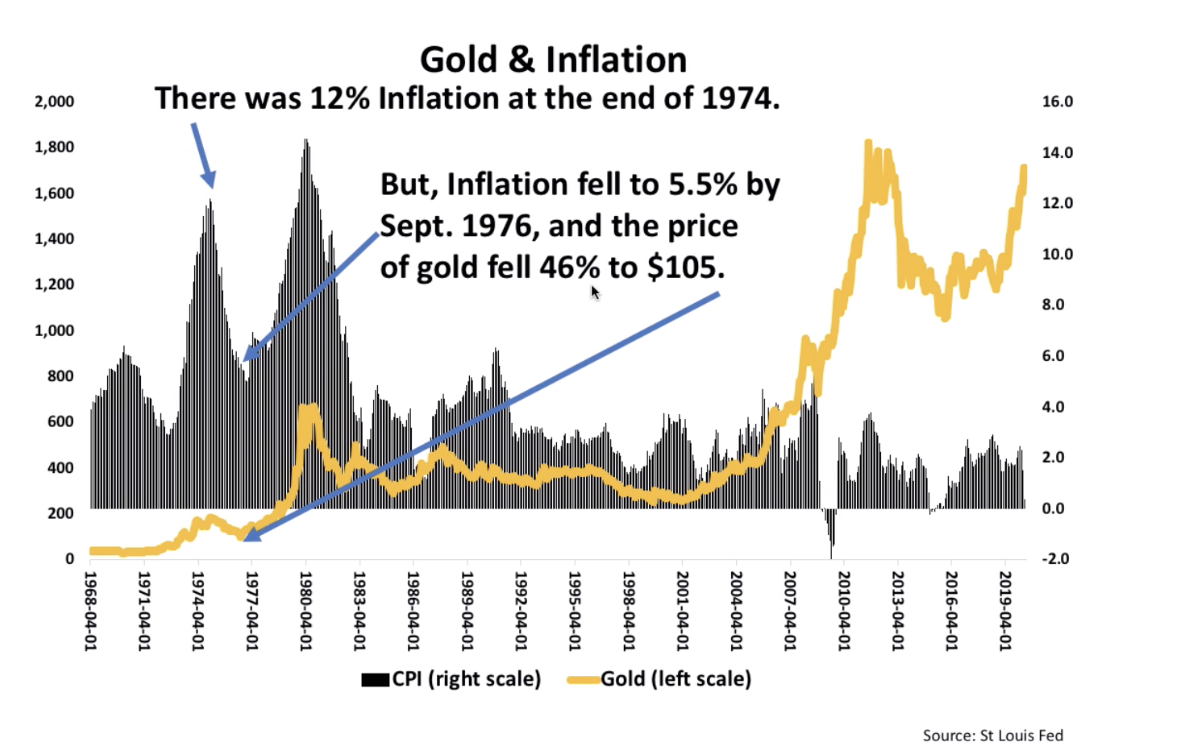

20.07.18 Gold Is Not A Sure Bet

20.05.01 When Creditism Met Covid-19

20.04.26

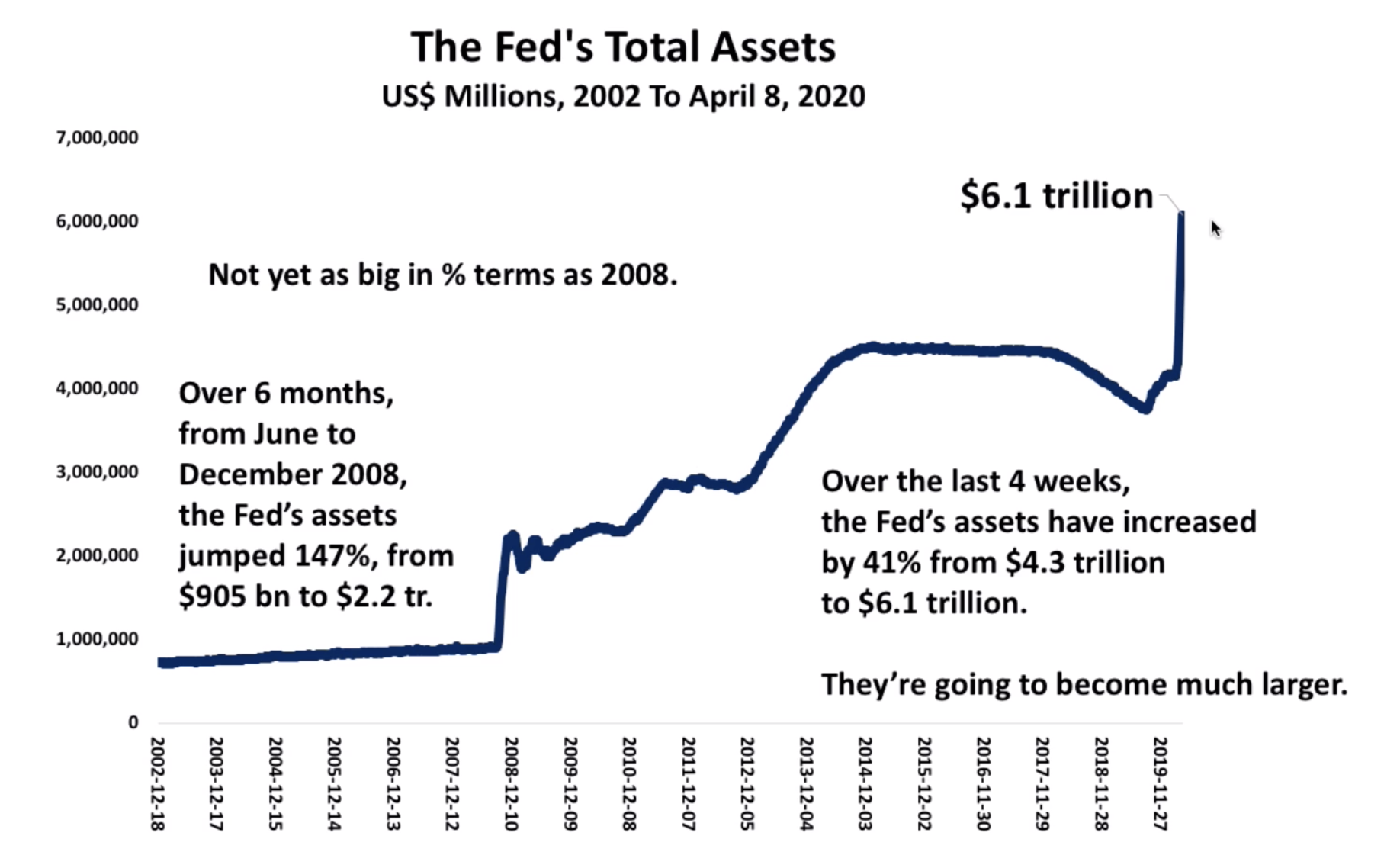

20.04.12 Fed created $1.8T

20.03.26 Life During Wartime

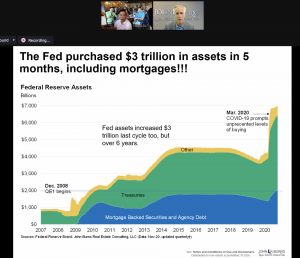

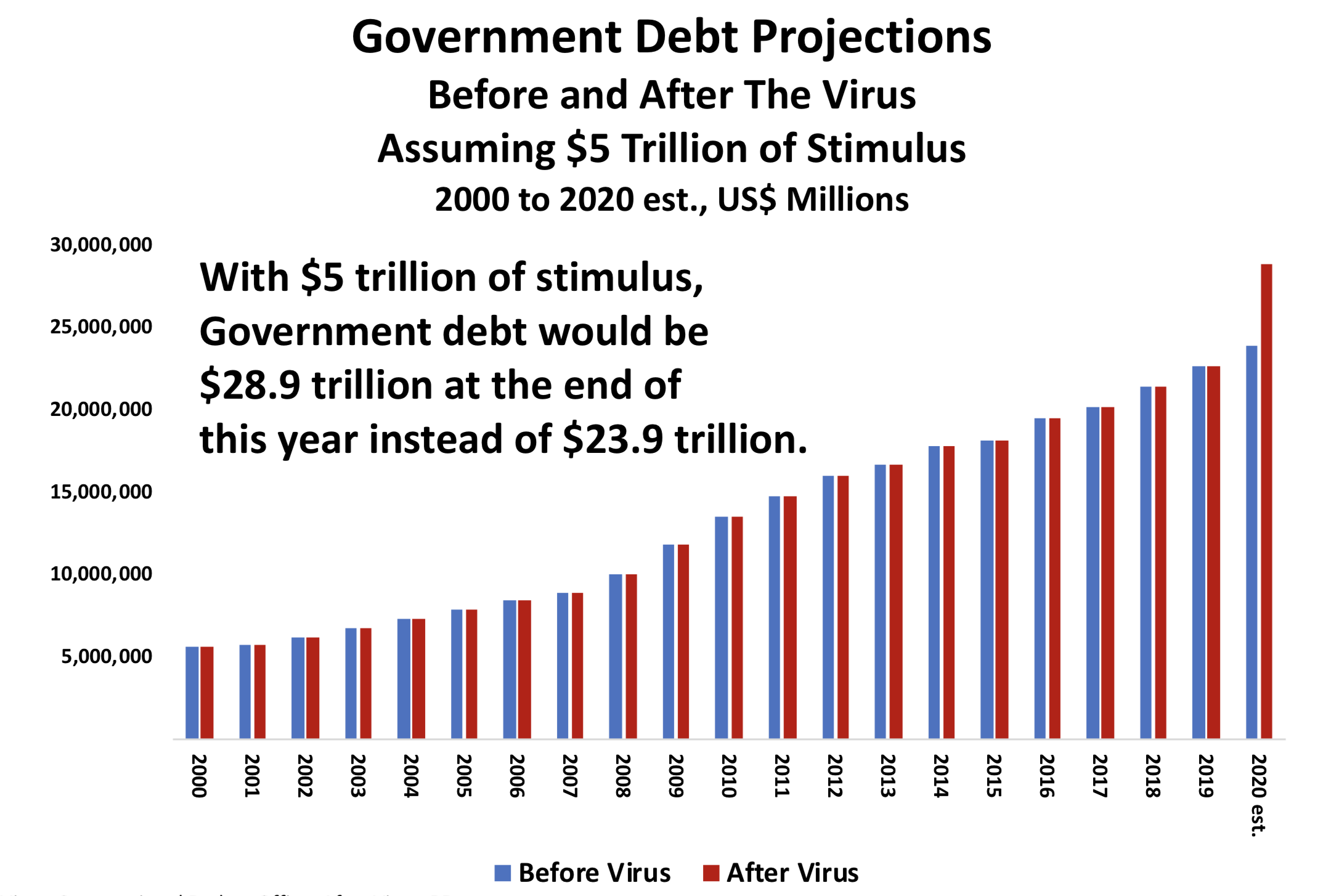

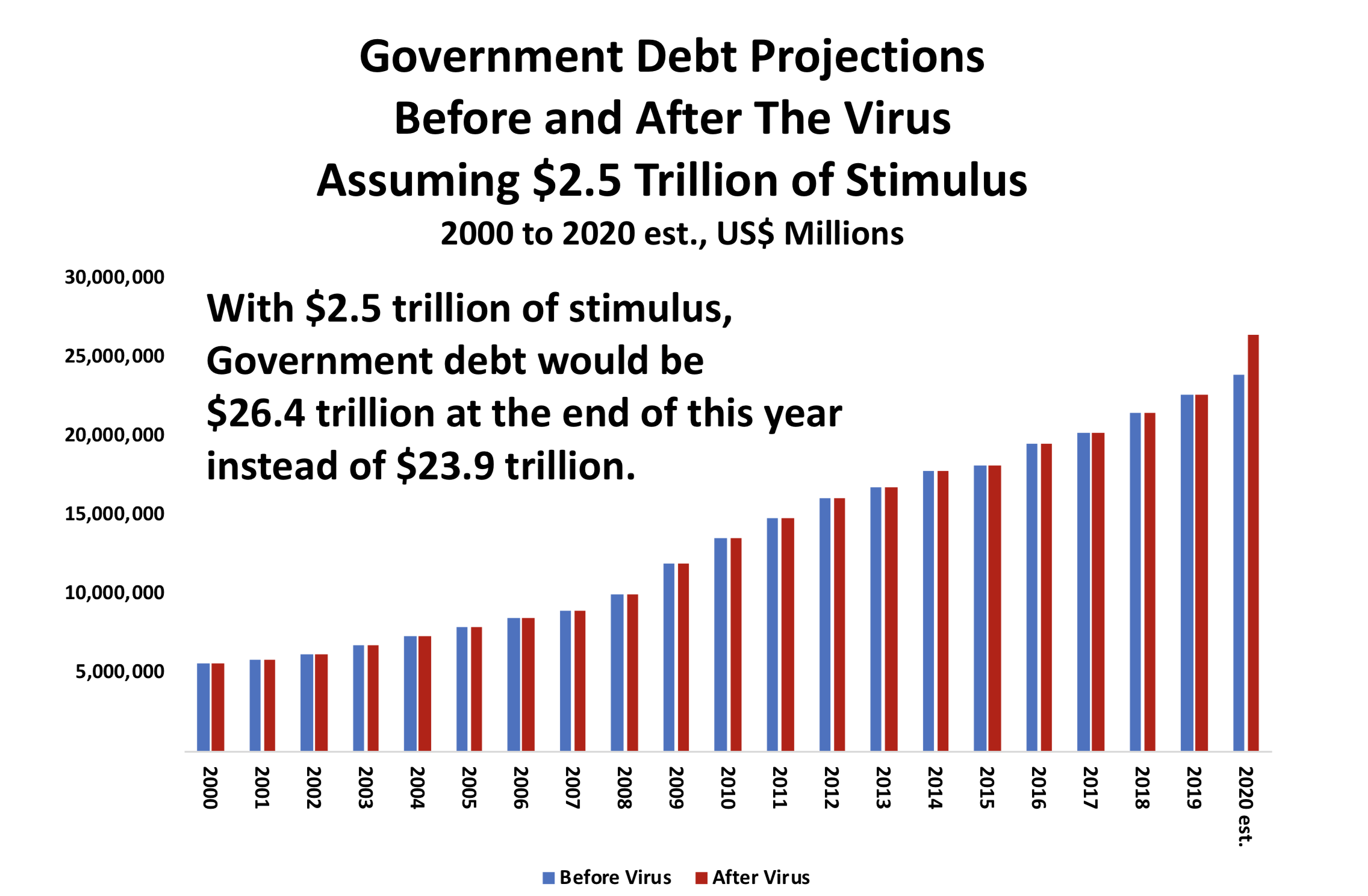

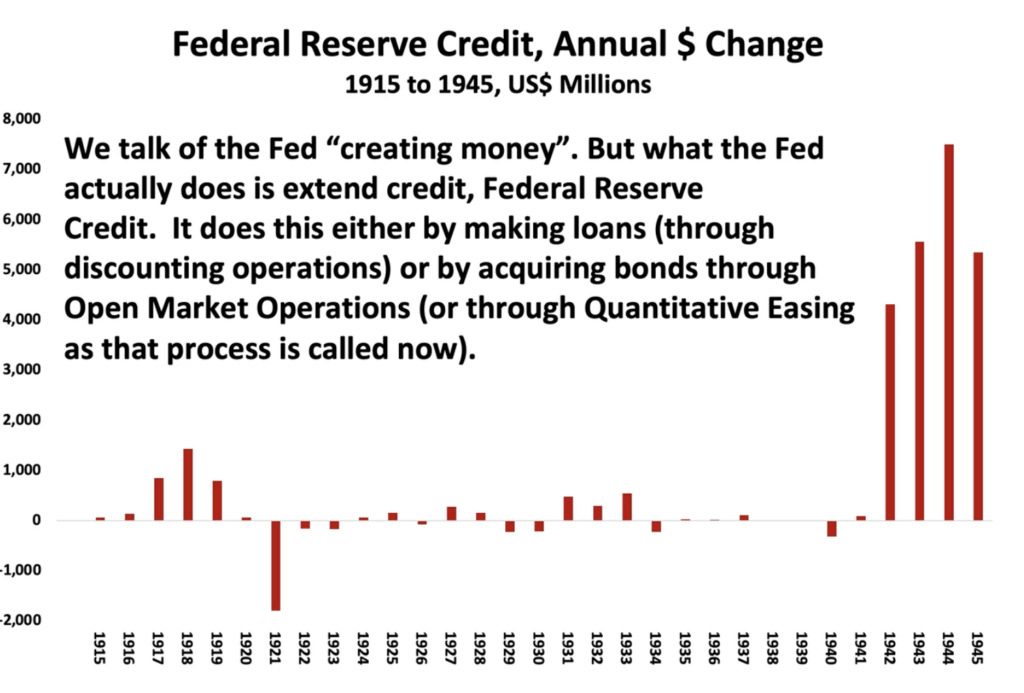

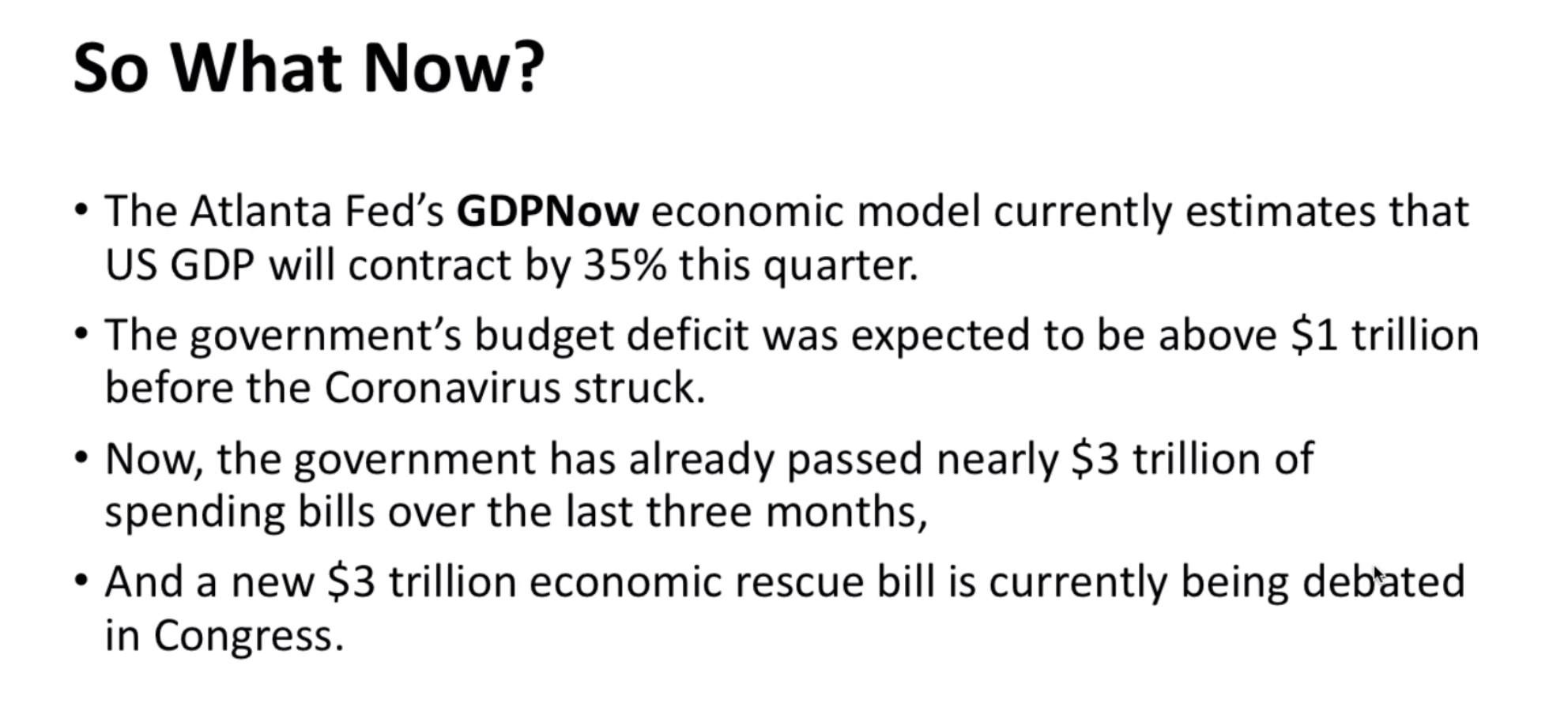

Contrasts the wartime effort to end the Coronavirus and to prevent it from throwing the US economy into a Depression with the wartime effort required during World War II. Fiscal stimulus of $2.5 trillion and fiscal stimulus of $5 trillion; as well as how each would impact the US government’s budget deficit, national debt and the Fed’s balance sheet.

Fiscal stimulus of $2.5 trillion and fiscal stimulus of $5 trillion; as well as how each would impact the US government’s budget deficit, national debt and the Fed’s balance sheet.

- Scenario One assumes $2.5 trillion of fiscal stimulus will be required. This is probably the least amount that can be expected.

- Scenario Two assumes $5 trillion of fiscal stimulus. $5 trillion is probably a more realistic estimate.

-

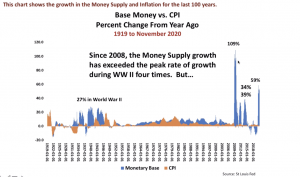

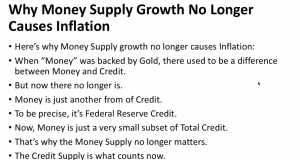

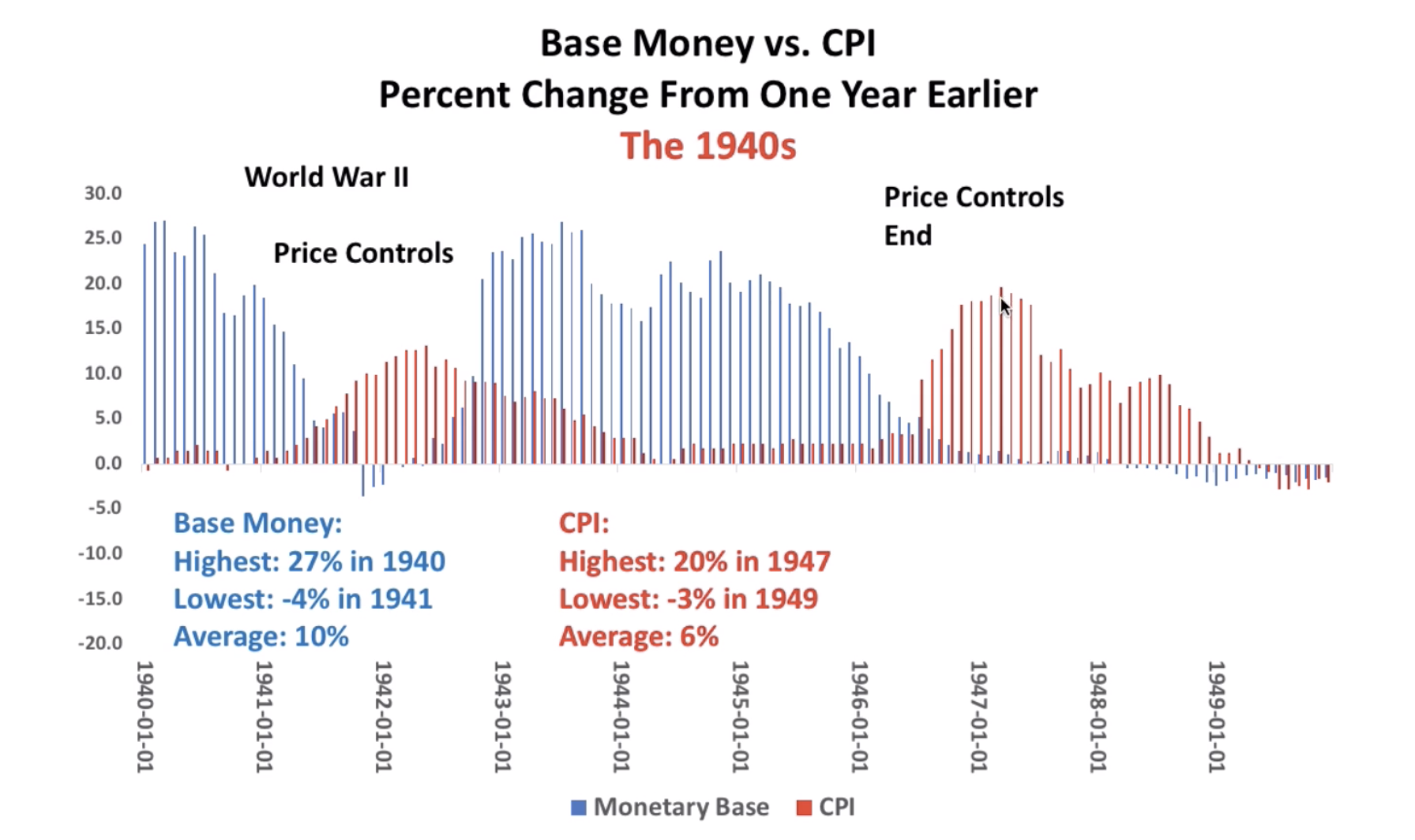

Money Supply Growth Demand Shocks

- a) Inflationary Demand Shocks that increase demand and push prices higher (like most wars).

- b) Deflationary Demand Shocks that decrease demand and push prices lower (like the Coronavirus).

- a) Inflationary Supply Shocks that decrease supply and push prices higher (like the Oil shocks of the 1970s).

- b) Deflationary Supply Shocks that increase supply and push prices lower (like Globalization).

20.03.15 Recession or Depression?

This video discusses what the US government must do to prevent the Coronavirus Recession from becoming a Depression. It also discusses the Fed’s next emergency measures and their likely impact on financial markets.- On March 3rd, the Fed announced an Emergency Rate Cut of 50 basis points, taking the Federal Funds Rate down to a range of 1.0% to 1.25%.

- On March 6th, Boston Fed President Rosengren suggested the Federal Reserve Act should be changed to allow the Fed to buy a broader range of assets.

- On March 10th, the Fed boosted its overnight repo operations to $175 billion and its term repo operations to $50 billion.

- On March 12th, something seems to have gone haywire in the Treasury Market. The yields on different types of government bonds were not moving as they should have, suggesting there was a shortage of liquidity.

- The Fed responded by announcing an offer of Liquidity on an unprecedented scale.

- It announced that it would offer $500 billion in three-month loans that day, and that it would offer another $500 billion of three-month loans plus $500 billion of one-month loans the next day, March 13th.

- Apparently, very little of this money was actually borrowed, however.

- On March 13th, the Fed said it would begin buying Treasury Securities of all maturities (instead of only Treasury Bills, as it had been doing).

- That means QE4 has officially begun, although it was really already underway from the time the Fed started buying $60 billion of Treasury Bills a months from October last year.

- The Fed also announced it would buy $37 billion of government bonds by the end of that day (i.e. more than half its normal monthly purchases in just one day).

-

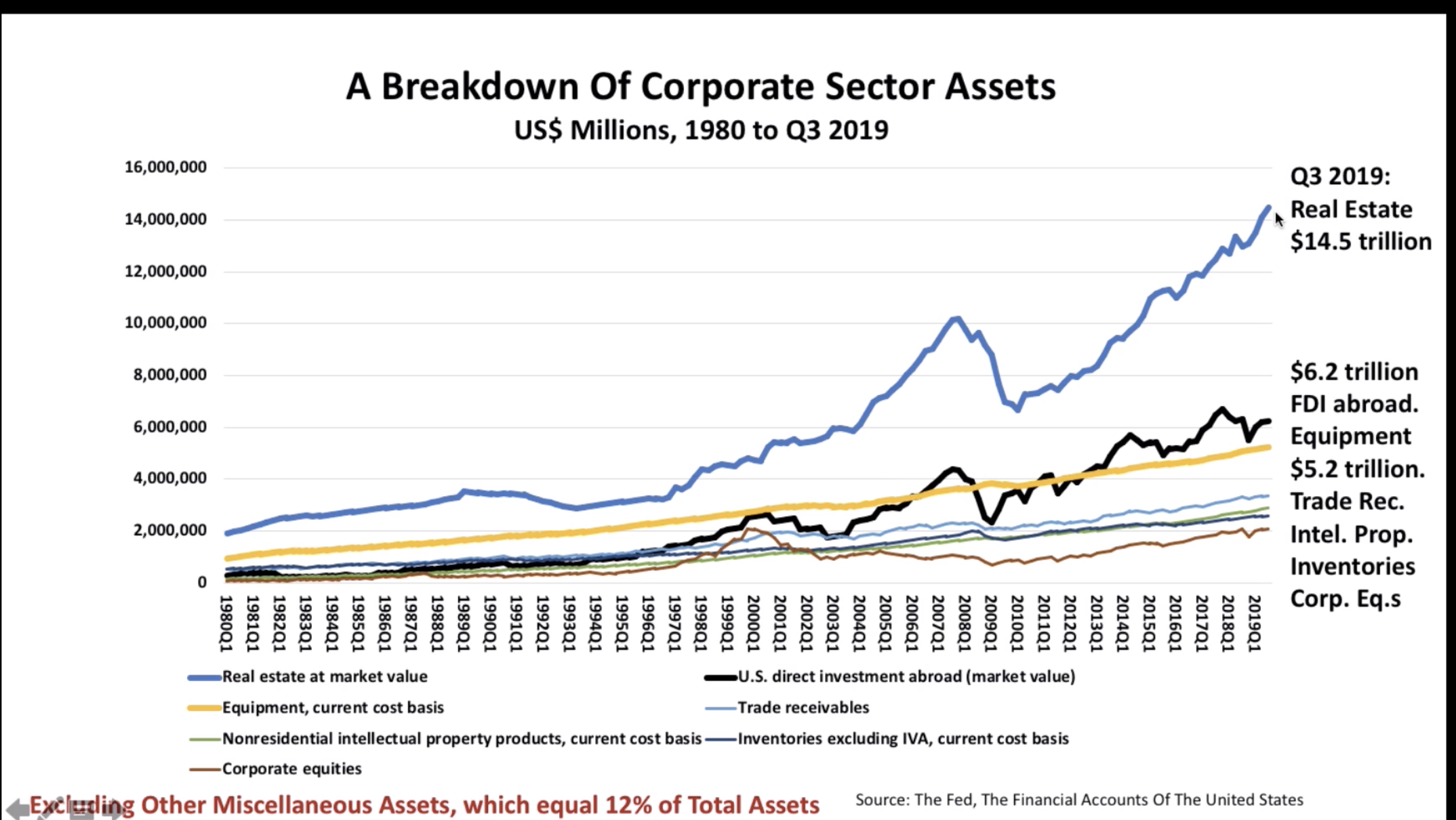

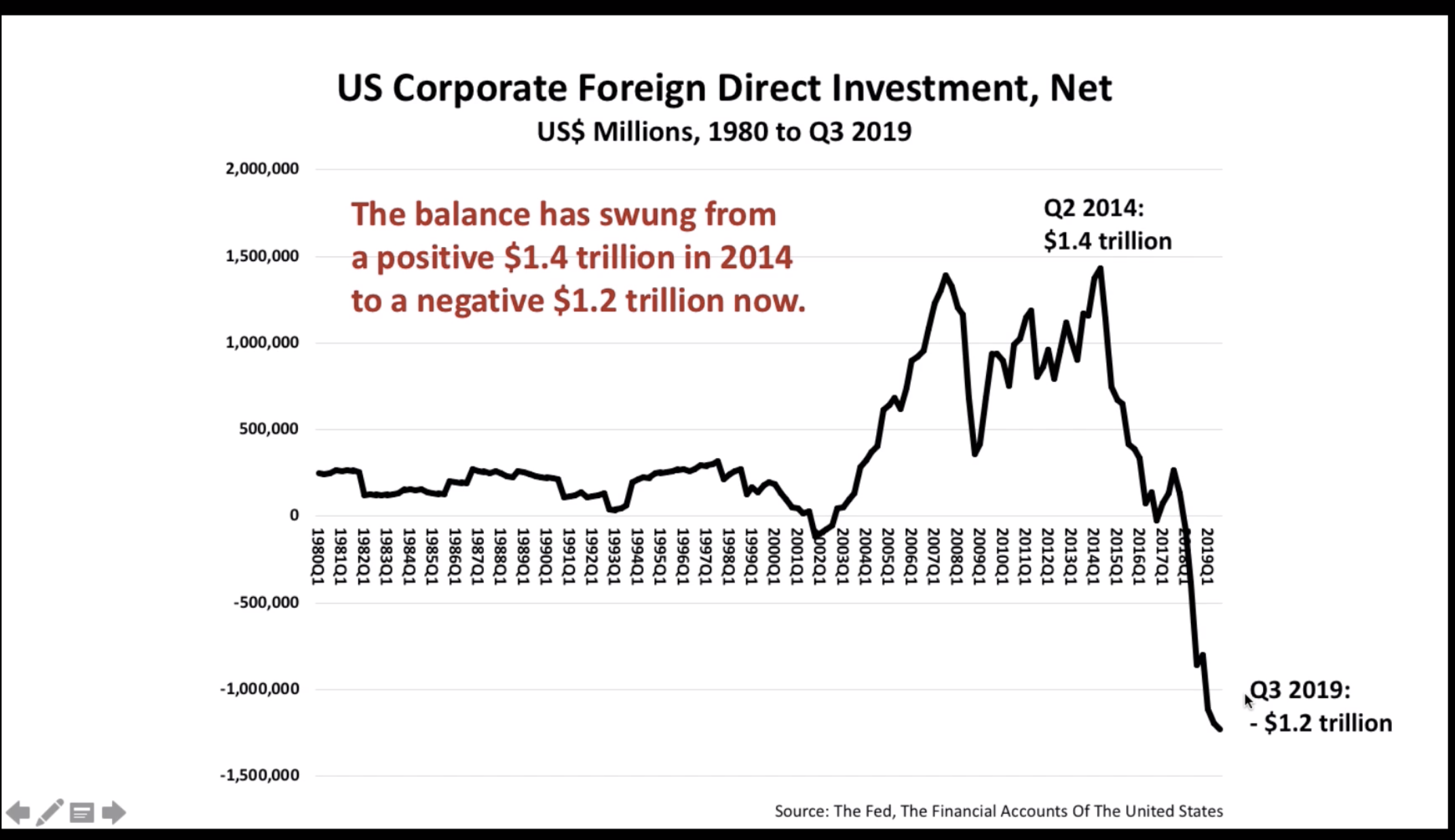

20.02.15 Corporate Sector Concerns –

The Corporate Sector is the weak link in the US economy. This video looks at concerns raised by corporate balance sheets and earnings.

Corporations Should Pay More Taxes

• If corporations had paid 2.6% of GDP in taxes in 2018, they would have paid an additional $329 billion in taxes.

• That would have enabled the government to Invest much more.

• Consider, the National Cancer Institute’s annual budget is just $6 billion.

• The total annual funding for the National Institute of Health is just $39 billion.

• The government invested only $1 billion in Artificial Intelligence last year.

Conclusion: Corporations are paying far too little in taxes.

• They should pay higher taxes and the government should invest much more.Conclusions

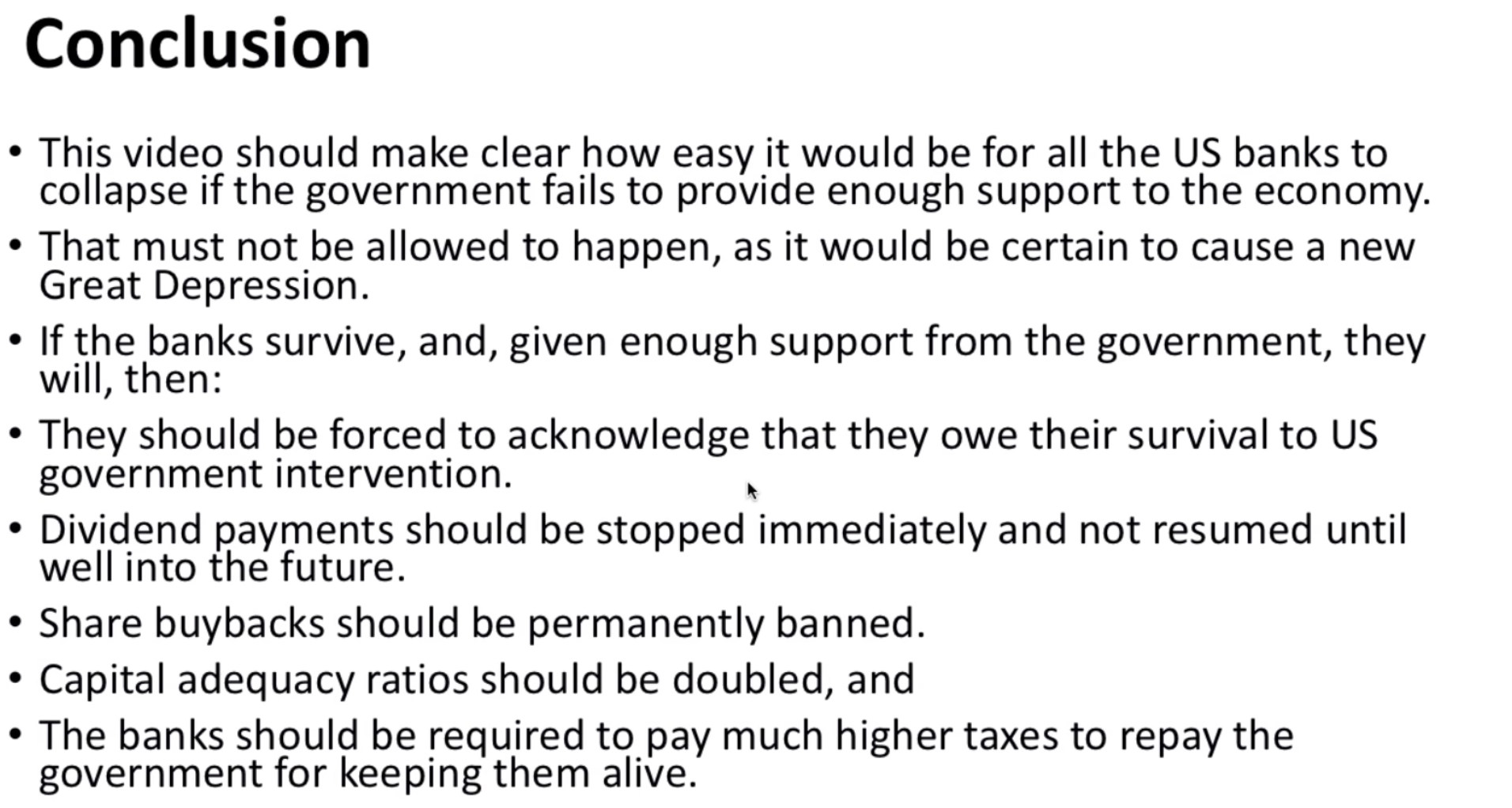

• With debt to GDP at a record high and earnings flat since 2012, the Corporate Sector is the weakest link in the US economy.

• Loans now account for only 13% of corporate liabilities, down from 27% in the late 1980s. Debt securities make up 24% of liabilities.

• On the surface, that would appear to suggest that banks are less exposed to corporate bankruptcies than in the past.

• In reality, that is probably not the case, since the banks are very likely to be exposed to the corporations through holding large amounts of corporate debt securities.

• The Corporate Sector’s high debt and relatively weak earnings are factors that probably contributed to the Fed’s decision to cut interest rates and to relaunch Quantitative Easing during the second half of last year.

• It’s also worth noting that Foreign Direct Investment into US corporations now accounts for 27% of the Sector’s total liabilities, up from 4% in 1980.

• This suggests that foreign influence over US corporations is increasing.

• Finally, large share buybacks have slowed the growth in Corporate Sector Net Worth and undermined the Sector’s ability to make long- term investments.

• Management focus on short-term profit maximization (and share price appreciation), without regard for long-term growth is a leading cause of the United States relative economic decline…

• … as is the Corporate Sector’s unwillingness to pay taxes.

• The failure of US Corporations to make sufficient long-term investments in the country’s future, makes it all the more crucial for the government to step in and to invest on a very large scale.

Corporations Should Pay More Taxes

• If corporations had paid 2.6% of GDP in taxes in 2018, they would have paid an additional $329 billion in taxes.

• That would have enabled the government to Invest much more.

• Consider, the National Cancer Institute’s annual budget is just $6 billion.

• The total annual funding for the National Institute of Health is just $39 billion.

• The government invested only $1 billion in Artificial Intelligence last year.

Conclusion: Corporations are paying far too little in taxes.

• They should pay higher taxes and the government should invest much more.Conclusions

• With debt to GDP at a record high and earnings flat since 2012, the Corporate Sector is the weakest link in the US economy.

• Loans now account for only 13% of corporate liabilities, down from 27% in the late 1980s. Debt securities make up 24% of liabilities.

• On the surface, that would appear to suggest that banks are less exposed to corporate bankruptcies than in the past.

• In reality, that is probably not the case, since the banks are very likely to be exposed to the corporations through holding large amounts of corporate debt securities.

• The Corporate Sector’s high debt and relatively weak earnings are factors that probably contributed to the Fed’s decision to cut interest rates and to relaunch Quantitative Easing during the second half of last year.

• It’s also worth noting that Foreign Direct Investment into US corporations now accounts for 27% of the Sector’s total liabilities, up from 4% in 1980.

• This suggests that foreign influence over US corporations is increasing.

• Finally, large share buybacks have slowed the growth in Corporate Sector Net Worth and undermined the Sector’s ability to make long- term investments.

• Management focus on short-term profit maximization (and share price appreciation), without regard for long-term growth is a leading cause of the United States relative economic decline…

• … as is the Corporate Sector’s unwillingness to pay taxes.

• The failure of US Corporations to make sufficient long-term investments in the country’s future, makes it all the more crucial for the government to step in and to invest on a very large scale.

20.02.01 America’s National Emergency:

China has surpassed the US in R&D investment. It will soon replace the US as the global superpower unless the US begins to invest in R&D on a much greater scale. 5G is 100 times faster than 4G. • In November, China launched 5G in 50 Chinese cities. • There are now more than 130,000 5G base stations in China. There will soon be millions. • China has an enormous lead over the US in 5G • Not only has China won the 5G race, the US isn’t even in the race. Huawei is the world leader. Ericsson of Sweden is in second place. No American companies are even in the running.

“We will do better dollar for dollar in investing in AI (than China), but if they outspend us three, four, five times, as they are doing now, we’ll fall behind in five or 10 years and we will rue the day.”

- If the US government doesn’t radically ramp up its investment in R&D, then China will win the AI race and become vastly more powerful than the United States by the middle of this century.

- Senator Schumer’s proposal to invest $100 billion over five years is far from enough. The US would still lag behind China in R&D investment.

- The United States needs to invest in R&D as if its survival depends on it. Because, ultimately, it does.