Preview 5) Sample LP analysis

Buy the eCourse

See all eCourses

Below is a sample of the Full Syndication For Passive (LP) Investors eCourse

Check out free version here

Simple Passive Cashflow Syndication Checklist

Before investing in a real estate syndication, you should carefully review all of the offering documents provided by the sponsor and look for (or ask) questions regarding the following things:

- The Sponsor’s background, education and experience with similar investments, if any.

- The team members involved in acquisition and operation of the property, including attorneys, CPAs, other members of the sponsor, property managers and affiliates that may receive fees, etc.

- Cash distributions to investors during acquisition, operation and disposition of the property, including the proposed timing and anticipated percentage returns.

- Sponsor fees and cash distributions.

- Anticipated duration of the investment.

- Property information, including its type and condition, the purchase price, financial history, proposed “value add” and exit strategies and pro forma financial projections.

- Dispute resolution provisions in the governing documents for the company selling the interests to investors.

- Voting rights of investors.

- Provisions for removal of the sponsor.

- Information about the law firm that structured the offering and drafted the offering documents, and whether the firm is experienced with securities offerings, and has errors and omissions insurance.

How It Works

- The operator will locate a property and create a syndication where he will pool investors’ capital. There will be a small (.05-5%) acquisition fee that the operator will receive for pinpointing the property and closing the deal.

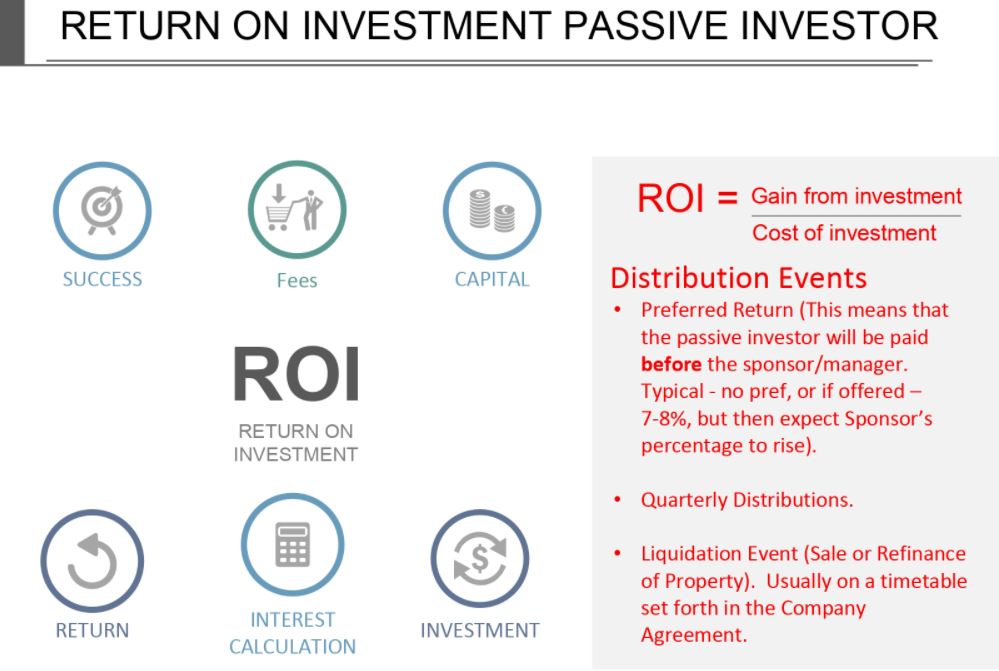

- There will be a preferred return to investors so that they get paid before the operator receives gains from cash flow and equity. Usually, the preferred return will range from 8-12%. This means, if the preferred return is 8%, the investors must receive an 8% return before the operator gets paid from equity or cash flow.

- Also, the operator will be receiving a small (1-3%) fund management fee for his duties relating to the day-to-day management of the fund.

- The real bulk of how sponsors should be making money in real estate syndications is through the equity and cash flow participation split. After the preferred return is satisfied, the remaining cash flow and gains from appreciation will be split at the negotiated rate. Usually, the operator will receive anywhere from 20-50% of the proceeds after the preferred return is met. The size of the split will depend on the track record of the operator, how much of his expertise is necessary for the performance of the fund, and how profitable the opportunity will be to investors.

When you structure your opportunities like this, the sponsor only makes good money when the investor makes money. That way, both the sponsor and the investors’ incentives are more closely aligned for the fund’s performance.

Let’s look an example where a syndication structure would be beneficial…

Let’s say that the self-storage operator, Self-Storage King, has located a 100-space property that can be purchased for $9,000,000.

Because of the Self-Storage King’s track record, the operator is able to secure a loan for 65% of the purchase price.

$9,000,000 x 65% = $5,850,000 (Loan Amount)

$9,000,000 – $5,850,000 = $3,150,000 (Capital Needed for Down Payment)

This means the operator of Self-Storage King needs to come up with $3,150,000 to purchase the property.

Most typical individual investors don’t have access to three million dollars, so the sponsor creates a real estate syndication in order to leverage other people’s capital with his expertise.

Here is a breakdown of a typical structure…

- The operator intends to buy the property and hold it for 7-10 years.

- There will be a $25,000 minimum investment.

- There will be an 8% preferred return to investors.

- Above the 8% preferred return, there will be a 70/30 split to the investors from proceeds from cash flow and equity.

Here is a typical breakdown of expected returns for an opportunity like this…

- Average Cash on Cash Return 11%

- Total IRR after sale of the Property 17%

As you can see, this structure will allow you to invest in any asset class that you can find a reliable sponsor in, regardless of your expertise or the purchase price of the asset. Not only this, but you are able to invest in real estate syndications completely passively, as there is a fund manager who will handle all day-to-day activities and decisions. In fact, that is what you pay him for!

Example MFH #1

[Coaches comments in ALL-CAPS]

Summary:

- Address: xyz, KY

- 140 unit apartment complex

- Class B-/C+ built in 1967

- $68k/unit purchase price

- 8% pref, 70/30 split

- 3% acquisition fee [SUPER HIGH]

- 1% asset management fee

- They have their own in-house property management company

- 15.15% IRR, 1.85x multiple over 5 years

Assumptions:

- 10% first year rent increase

- 3% market rent increases after first year

- 2.5% Expense Growth YoY

- 6% Vacancy YoY (8% yr 1)

- 4%, 2%, 1% YoY Loss to Lease

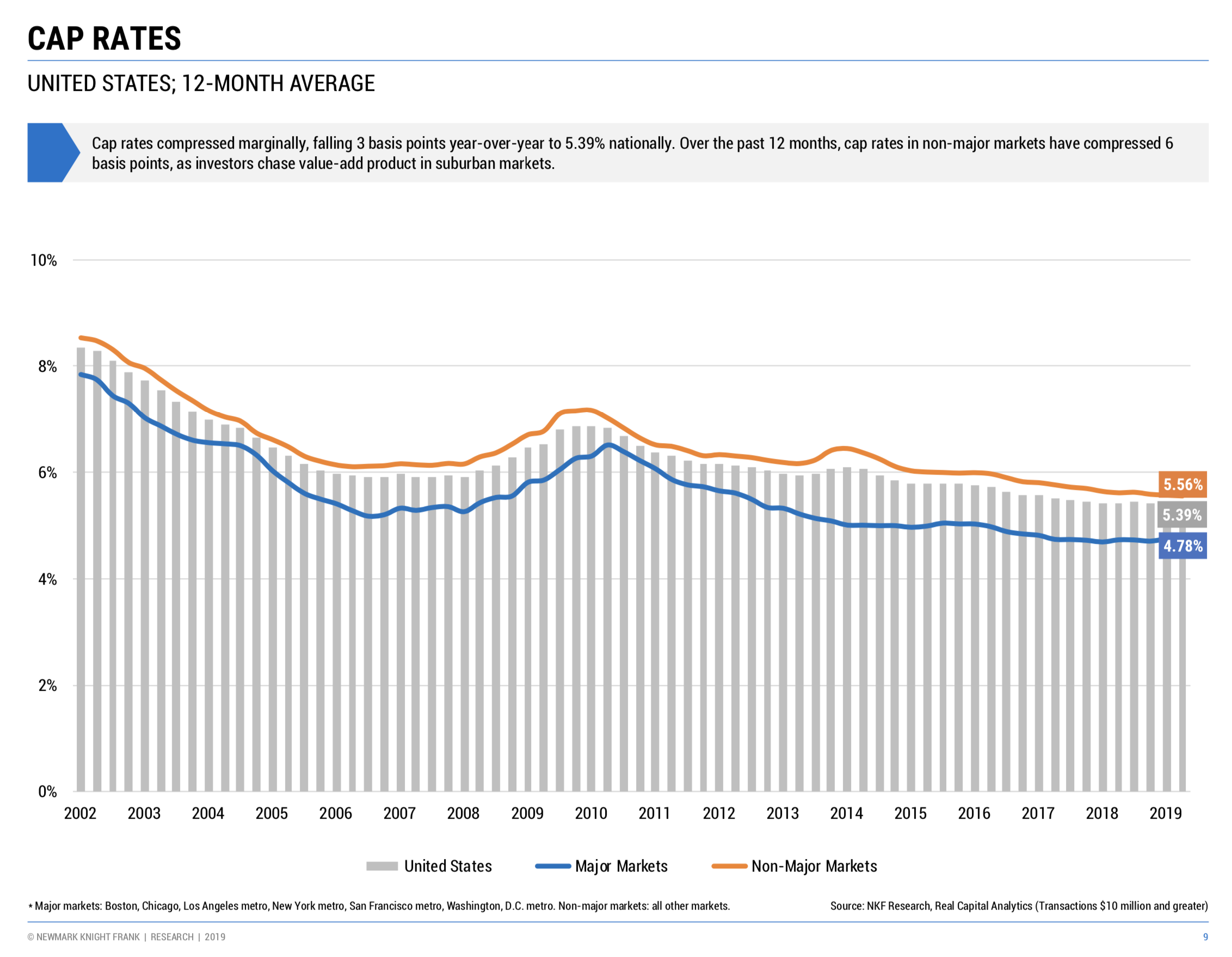

- 6.09% entry cap ASK WHAT THE REVERSION CAP… I’D LIKE TO SEE IT 6.75-7.25 for this market

Student Concerns:

- This is only a 1% rent-to-value ratio deal NO BUENO

- They are using 3% market rent increases. That seems normal from my research but just something to think about. 2% FOR THIS MARKET IS BETTER

- They are only estimating an 8% vacancy the first year during a renovation where they raise rents 10%. They aren’t renovating all the units but still seems low. Also the following years only estimate a 6% vacancy. THEY BETTER HAVE 3% ECONOMIC VACANCY IN ADDITION TO THIS

- The price per unit seems high for this class of property, which explains the 1% RV ratio.

- The estimated cash-on-cash is set at 8% (same as pref) but I don’t see how it’s exactly 8% every year. That just seems weird. IT DOES NOT MATTER. IF THE GP CAN’T PRODUCE THEN THEY OWE YOU THE PREF… UNLESS THEY CAN’T AND THEY GO UNDER 😛

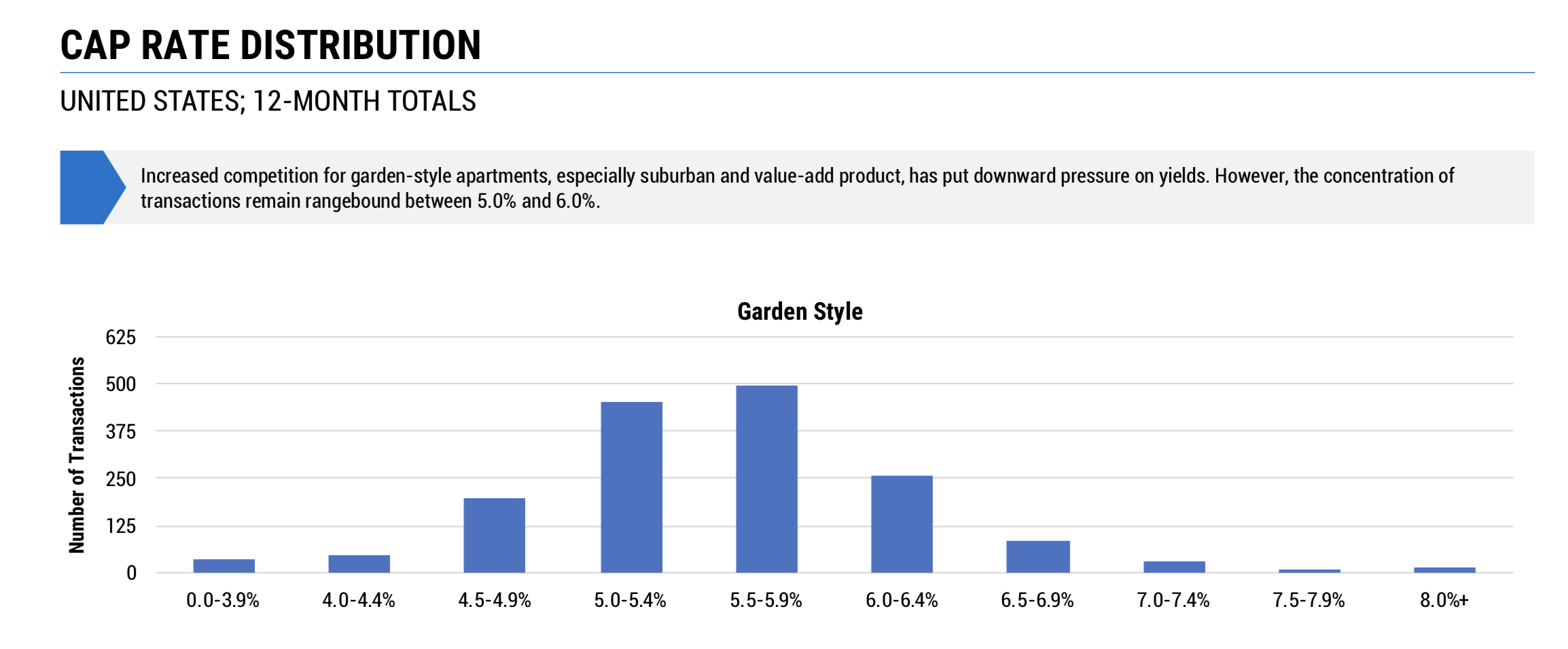

3% ACQUISITION FEE IS VERY HIGH THAT’S HOW THEY ARE MAKING MONEY What’s the difference between cap rates in Class C in Dallas or Class C in Jackson Mississippi? First ask an underwriting friend or consider this… Garden-Style is the 1-3 story Class B or C apartments that many of us like to buy for optimal returns

Garden-Style is the 1-3 story Class B or C apartments that many of us like to buy for optimal returns

Deferred Maintenance

When we underwrote this 250+ unit Huntsville deal and someone outbid us by 1M, I was very curious how these other guys were able to make the numbers work. Note: This might be a little advance for most LPs (and obviously some GPs) This is how they fudged their UW:

What about this Tertiary (or 💩-tiary [pronounced Turd-tiary]) Market?

Some investors who choose to zig when everyone zags might be on to something. Where places like Dallas and Atlanta which are excellent markets due to population and job growth are plagued by a mass of unsophisticated MFH buyers and you will always find yourself on the best and final table with 6-9 of these people. The opposite strategy is how we found Huntsville back in 2018 but investors can go totally wrong. This of Missoula, Montana or Tupelo, Mississippi or Woodward, Oklahoma (think low six figure towns). Investors looking to do deals there will think they are getting better Cap rates there or simply because they can get in with less capital.

On the on hand if the numbers work and you are using the right assumption on reversion cap, occupancy, and rent growth then proceed forward.

But you have to have an experienced investor to tell if its worth it or you are just buying a 💩 where you will not be the beneficiary of upward market trend (limited upside) and you will have little chance to improve your quality of tenant when you have so many less potential tenants to choose from.

Also consider if the US economy turns…

Will your market turn into a ghost town of the jobless?The reason we like larger 100K plus population towns is that there is an abundance of good data in terms of financials from the property when we buy which tend to be absent in these smaller markets. We buy off existing financials not proforma! In other words, what the property performance is operating today (past 12-24 months) and factoring the prevailing market Cap rates to come up with the proper offer price.

Prepayment penalty:

a clause in a mortgage contract stating that a penalty will be assessed if the mortgage is paid down or paid off within a certain period.

More info – Question on underwriting. I am newer to evaluating commercial loan terms on these private placements but it seems some people underwrite using fixed rate which has low terms but then their hold period is less than the loan term and using fixed-rate debt, your exposure to the risk of prepayment penalties (yield maintenance) is pretty massive. Do you always price in any prepayment penalties on your deals and/or opt for the more flexible loan instead that doesn’t have the penalties.

Very good expert level question…

To have a longer term is on the surface, safer because in case of a recession you are not forced to sell or refi in a down market. 8 years or more are preferred for the term. However as you seem to be aware of longer terms typically (not always) comes with prepayment penalties and yield maintenance (PP/YM) which can be pretty big. In the roaring years of 2012-2016, where rents would go up 3-6% a year, no one cared about those big prepayment penalties as it would be minor compared to the NOI increase and thus increase in property value. Most operators do not take into account the prepayment penalties when underwriting much like how we don’t underwrite or project to refinance in 3 years although we could. This is another reason why we choose to run the deal out longer since this greatly decreases the impact of PP/YM since there is typically a step down component to the fees the longer you hold on to the loan or if you use hybrid loans which we tend to pick.

As a side nuance this latest 15 year term on this past deal is so long we believe our next buyer 3-6 years from now would be happy to assume our loan which would never bring PP/YM into play.

Commercial lending

The best loan isn’t necessarily the one with the lowest interest rate. It is important to understand the term, pre-payment penalty, and supplemental loan proceeds. The agencies’ supplemental loan programs can really save investors in yield maintenance scenarios. Investors usually choose yield maintenance on a 10-year loan because it allows the lender to provide the lowest possible interest rate and highest possible leverage. In return, investors limit their options. Since yield maintenance is an extremely expensive pre-payment penalty, borrowers often find themselves unable to sell or refinance when desired, or having to sell on an assumption basis, which usually reduces the price achieved at sale.

I have seen these absent from syndicators’ 5-year underwriting analyses. I often see projected $0 financing fees upon sale, or exit cap rates that do not account for lower sale price with loan assumptions (of course, presumed exit caps are often too low to begin with). One way to accurately project levered IRR in a 10-year loan scenario while also reflecting yield maintenance is to simply underwrite to a 10-year hold. This will conservatively lower IRR expectations (due to time value of money) and also ensure that sponsor and investors are comfortable with the returns even if they are stuck holding the deal until closer to loan maturity. Another way to account for yield maintenance on a 5-year hold would be to raise exit cap (25 bps feels right) or to calculate the yield maintenance pre-payment penalty assuming a sale at 5 years. Alternatively, other permanent financing options avoid yield maintenance altogether – loans with shorter terms, more aggressively declining prepayment penalties (step-down), or floating rate loans which offer cheaper prepayment.

While permanent financing is relatively straightforward, bridge loans demand different underwriting and often have added complexity. In my view, investments financed with bridge should be underwritten to a 3-year hold, since that is usually the loan term – as typically the expectation is to sell or refinance within that period. A 5-year projection requires assuming a refinance when the bridge loan matures; refinancing creates uncertainty and complication in the model while welcoming a litany of questions from investors. Moreover, I believe it is misleading to call a 3+1+1 bridge loan a “5-year loan” and underwrite to a 5-year hold without including the necessary extension fees in the underwriting model.

Although refinances are best avoided in underwriting projections, it is nonetheless critical to perform exit tests and stress the possibility of refinancing out of the bridge loan at maturity. This can be done by stressing the property’s revenue while also raising the exit cap and interest rate to see if the projected take-out loan still has proceeds sufficient to pay off the existing bridge. Bridge loans are ideal for executing turnaround business plans, but very few deals today actually pass this stringent bridge loan exit test. To avoid this possible downside scenario, investors seeking the flexibility of a bridge loan but buying properties without high upside, should opt for a lower leverage, lower interest Freddie Mac floating-rate loan (Freddie floater). Other options exist for this type of financing but are less-discussed since they often require a recourse guaranty.

Here are some additional nuances which must be considered when analyzing a bridge loan: interest reserves, capex reserves, and replacement reserves. We always assume these reserves are fully spent in the model. Replacement reserves can often be negotiated out of bridge loans (at least for the first year), but it is still wise to factor reserves into terminal NOI to avoid overstating projected sales prices.

People first

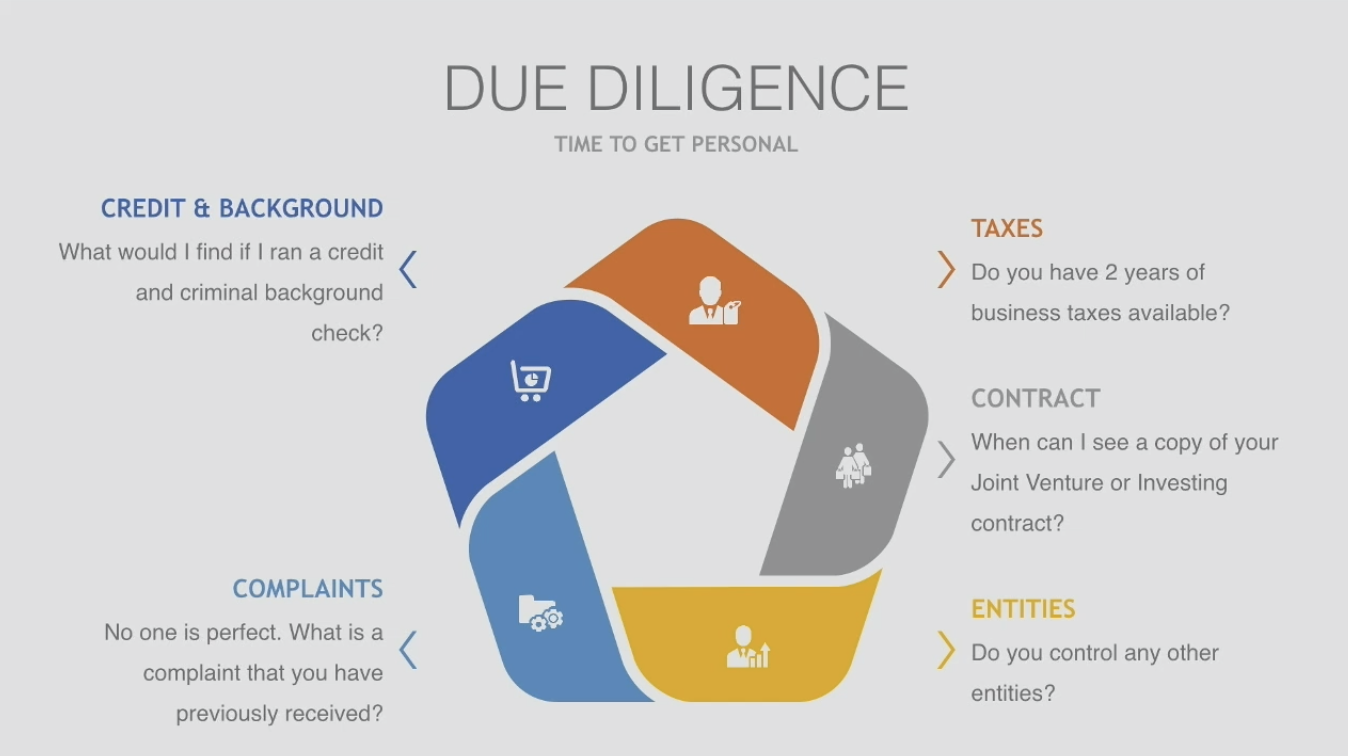

We tend to put a lot of emphasis on the numbers and checking deal assumptions like reversion Cap rates, full occupancy assumptions, and annual rent escalators because numbers do not lie… people do. But in the larger picture, who you investment is half of your due-dilligence.

Below are some steps to due-dilligence on who you are investing through. Note that some steps might differ if you are aligned as equity with the operator, what is the collateral, or if it is a single family home debt investment or 300-unit syndication deal.

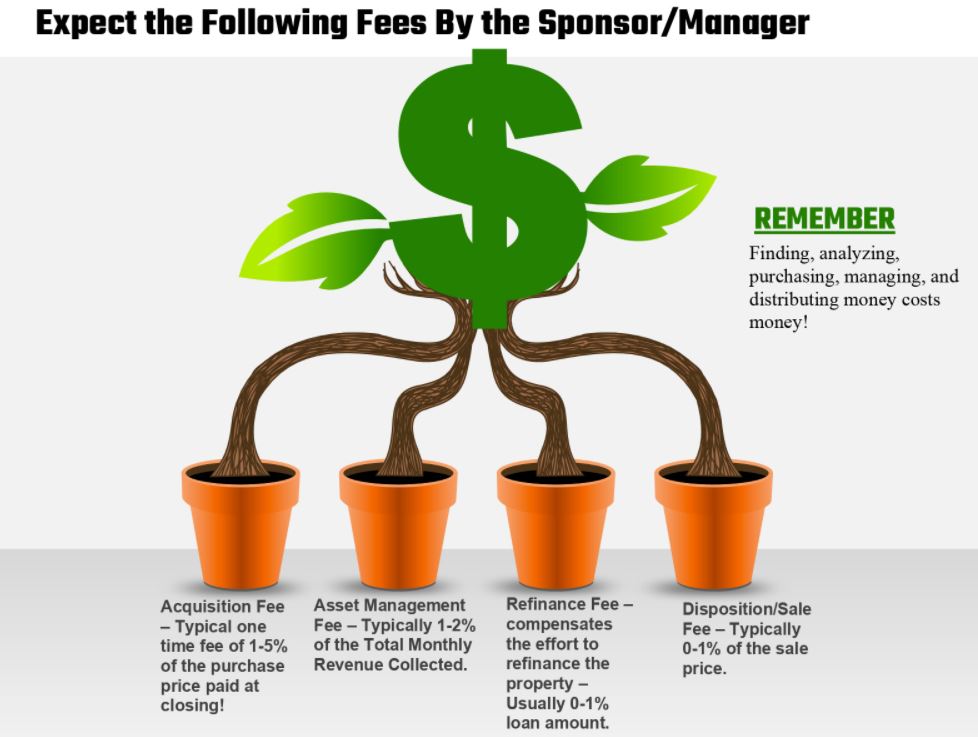

What Type of Fees Are Involved?

Syndication Fees to Know:

Acquisition Fee- Helps pay for the operating costs, staff, flights, hotels, diligence and other costs at the formation stage of the offering. This compensates the sponsor for the time, effort, and expertise used in obtaining the investment opportunity. This can range from 0-5% of the deal, with 2% being the most common.

Asset Management Fee– This covers the cost of managing the asset and management team. To be clear, this is apart from managing the real estate, instead it is the fee to manage the company. This can range from 0-3% of gross rent revenue, with 1-2% being the most common.

Construction Fee– Helps incentivize project managers to take on difficult projects that may need construction therefore compensates the project manager for the time the asset isn’t producing income. This can range from 0-2% of the construction cost.

What Should the ROI Be?

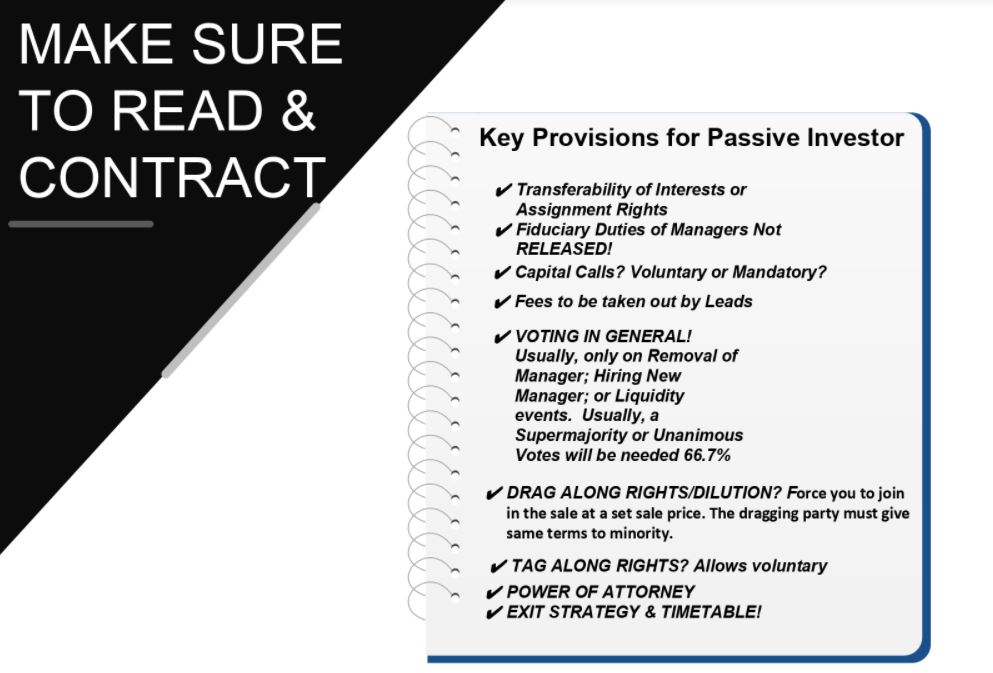

What to Look for In a Contract