BONUS – Past Coaching Calls (On-Boarding Call Required for Access)

These coaching calls are arranged from lower net worth (top of page) to higher net worth (bottom of page).

We are always looking for volunteers who are willing to put themself out there so reach out if you are interested in doing one.

Live Coaching Call - Tips for Getting Your First Remote Rental

Jennifer is a management consultant living in New York. She’s been in the Hui mastermind group for a couple of years and has been struggling to purchase her 1st rental property. We go over some of the mistakes she has made such as making over-complicated spreadsheets, buying a property close to home (when you live in a primary market), and much more! If you’re also struggling to buy your 1st rental, check out simplepassivecashflow.com/turnkey to get started. We’re also launching the 5-month remote investor incubator where we guide you to buying your 1st rental https://crowdfundaloha.com/incubator/

Inspection report #2

Mr. Gunter lives in Northern, Virginia. His properties located in Norfolk, Virginia not a multi-family but a two built single families. A big concern of his that he talked with the property inspector is a major components such as plumbing, electrical, a few leaks on the roof and no fall off either. Lane gives him a practical step by step process on how to avoid a long way negotiation with the inspector and seller as well. Also, Lane shows what is an important factor to consider when you invest in a rental house. He discussed a good rental Property must be in a good location, a good property condition, especially in the maintenance of the property and the safeness, property value, price in the market, and of course the property management.

Pref Equity vs Traditional Equity explained

We’ll discuss the pros and cons of each and how investment approaches can be customized depending on your risk appetite. Unite with other professionals on the same investment wavelength and join our community.

Cap Rates explained in commercial real estate

The investor identify what is the relation between the High Cap rates and the Lower Cap rates. The chart shows that the investor chooses the higher rate of Cap rate, the better it is for the investor. But the higher cap rates the bigger risk because it is not more establish like Dallas and San Francisco. There are no clear ranges for a good or a bad cap rate, and they largely depend on the context of the property and the market. Cap rate is calculated by dividing a property’s net operating income by the current market value. This ratio, expressed as a percentage, is an estimation of an investor’s potential return on real estate investment.

Non-Accredited Investors Below

155 Live Coaching Call w: Non Accredited Investor

Jason Ricks started in the industry in 2008 as a commercial real estate, basically, a broker focused on retail and industrial leasing primarily. During 2008- 2012 he got interested in stock in the market. In the year 2012 he lost three big transactions, he realized he needs to be closer to his goal. He switched to a real estate investor, started reading podcasts that confused him to figure out the power of now and the ego to understand his big WHY. After having some experience as an investor of small residential units he’s now transitioning to syndications and Lane explain the big advantage of syndication like a seedy ladder.

Live Coaching Call w/ Non-Accredited Investor (Engineer) EP159

Ross is a Software Engineer at San Francisco Bay, he finished Software degree. He started with a big Corporation with roommates. He tries to educate himself by doing research to fully understand what other people do thru podcasts. After 5 yrs he started to maximize his 401k. He invests in his 401k and Roth IRA. He moved his investment outside of the stock market. Lane builds a good relationship with the investor and advised him to put it into deals the 401K and for simplicity’s sake.

Live Coaching Call w/ Non-Accredited Investor having trouble with Lender

Two lessoned learned to qualify for loans:

- You need two years of clean W2 income

- Issues with too high housing costs impacting DTI

Live Coaching Call w/ Another Engineer (Non-Accredited Investor) Ep 165

Patrick is an Engineer. He works as an IT in a Government Contractor. He starts with a salary of $65 bumped into $170. He loved his job but this is not his ideal job at 40 years of his age. He hasn’t very much net income but he makes a good salary. He got a great opportunity and he won’t want to screw and waste this. Patrick starts to listen to podcasts and started looking for Turnkey providers.

250k Net Worth Chemical Engineer Coaching Call Ep 263

Richard is a Chemical Engineer, in his 20’s, who has 250k net worth (not big FOR NOW!). He started with a duplex house in Houston. For sure in a few years’ time, he’ll be on the next level of being a millionaire.

Live Coaching Call (Non-Accredited $300k net-worth)

Jason Painter was born and bred from Chattanooga, Tennessee. He currently work at the nuclear plant and have a decent and great salary that’s been able to give him some extra income to be able to put into passive income. But then he has a swing shift schedule operating the plant and it’s a big drawback about the job. He tried to find other jobs within the plant but it was kind of short-staffed and awe and not let people out of operations. He owns a few rentals and properties now all started back in 2016. Lane gave him a great and practical advice when it comes to his finances including the life insurance, syndication deal matters that he appreciated all.

Coaching Call - HELP! My Wife Wants to Buy a Home Ep 278

As a couple, having a synchronous mindset with your spouse plays a major role in becoming a real estate investor. In today’s coaching call, we are joined by Willie, who is a great example that when you achieve having a substantial net worth ( in his case he’s a little under $500,000) nothing is stopping you from becoming a passive investor yourself. Since he’s married, he MUST consider his partner before jumping in and be sure that they’re on the same boat. Nothing is more tragic than an uninformed spouse! As they say, a happy wife leads to a happy life.

Coaching Call - Remote Investor Incubator Student Round Up Ep 300

𝗜𝘁’𝘀 𝗼𝘂𝗿 𝟯𝟬𝟬𝘁𝗵 𝗲𝗽𝗶𝘀𝗼𝗱𝗲!!!

Celebrate with us and get access to our FREE giveaway!

Undoubtedly, this coaching call with Marianne is worthwhile. Due to the variety of valuable questions and information that we tackle: tax in real estate investment, short-term and long-term rentals up to exit strategy. In which, you can relate much if you went through the e-courses. Nonetheless, this is juicy and meaty in itself.

Coaching Call: Transitioning From Turnkey Rentals and Networking Tips Ep. 326

Lane and Aaron talk about transitioning from buying turnkey rentals to becoming syndication investors in this coaching call.

Buying single-family homes is an excellent way to start as an investor, but later on, you’ll realize the disadvantages it has, like being your own broker (besides your actual job).

So, as you dig deep, you’ll start to understand that there are better and more productive ways to invest in real estate.

Coaching Call: High Income + $500k Net Worth

Do you want to know more about real estate investing but don’t know where to start?

Watching or listening to coaching calls like this can help you with that!

In today’s podcast, we’re joined by Nate. You might be in the same net worth or situation as he is. He has half a million of net worth, with $20,000 of income.

Coaching Call: $1M Net Worth + HELOC and Passive Losses Education

Venturing out on your own and seeing how far you’ll get is one way towards freedom, and it’ll be easier if you follow the simple passive cash flow path.

Coaching Call: From 400K To $1.4M Net Worth in 2 YEARS + Ditching The Rentals!

Going from $200K to $1.4M net worth, Jackson, who’s a Nurse, realized he prefers financial freedom over working at his job until retirement.

Coaching Call: High Income Medtronic Medical Sales Person

Do you know what it takes to start being a passive investor? Well, you need to have a high income plus the discipline on how to handle your money well.

In this coaching call

we’re joined by a salesperson in the medical field, a 6-figure earner and a 6-figure saver (per year) as well.

Coaching Call: 2.5M Doctor Getting Started in Syndication + Infinite Banking

This doctor thought traditional investment like retirement funds, stocks and bonds are the way to go. Investing in syndication and getting used to the IBC strategy takes time and Derek accepts the challenge to figure them out.

Coaching Call: Starting Out In Syndications | Should You Do 1031 Exchange

In this week’s podcast has another coaching call from a couple with approximately $2.5 M to $3M net worth. They want to replace their active income from their day job with passive income that they get from real estate investment and syndication.

Accredited Investors Below

Coaching Call with a Million Dollar Investor (Chris) Ep 271

Rents offer stability so if you’re a professional with high net worth like Chris, who from being a mobile home park rental owner transition to becoming an Limited Partner (LP), do not settle for an ordinary income. You can have your day job and invest on the side if that’s what you prefer initially.

1.5M Accredited FOOM Member Coaching Call | 1031 Exchange/ Infinite banking / Goals Ep 299

Eric is an accredited investor and FOOM member, he continuously searches for a greater avenue to invest his money and expand his network. In the different stages of his life, he realizes that there are better uses of his money rather than just managing properties of his own. Better to realize it now than never!

Coaching Call: 1.5M Net Worth But Playing It Too Safe With Triple Net

In this coaching call, Ron, a commercial real estate lawyer, did the SFR investment and Triple Net. He has never invested in syndications. But then, he started to realize that there is a loss when there’s no rental fee increase in the lock-in lease period of tenants. And he has this question, “how to grow and plan for the next phase”.

Coaching Call - Accredited Investor/Pilot | Military Retirement | Infinite Banking Ep 298

As a couple, having a synchronous mindset with your spouse plays a major role in becoming a real estate investor. In today’s coaching call, we are joined by Willie, who is a great example that when you achieve having a substantial net worth ( in his case he’s a little under $500,000) nothing is stopping you from becoming a passive investor yourself. Since he’s married, he MUST consider his partner before jumping in and be sure that they’re on the same boat. Nothing is more tragic than an uninformed spouse! As they say, a happy wife leads to a happy life.

Do you need Umbrella insurance?

Lane compared what does umbrella insurance cover.He makes a simple passive cashflow to identify how some other investor did with Umbrella Insurance and How does an umbrella insurance policy work? According to the respondent some investor claimed Umbrella insurance in how they covered their liability policies. Umbrella provides coverage beyond the limits of other insurance policies or for claims that may not be covered by liability policies.

Accredited Coaching Call - CPA from Hawaii

Brian is a CPA who grew up in Hawaii and got his accounting degree in Oregon. He moved back to Hawaii after college and started working for a firm doing audit work. He owns 5 properties and he currently does accounting work for a real estate developer. Brian has around 1.2 million dollars in networth and his “dead” equity is 1.1 million dollars which is not good. Lane advises Brian on how to start deploying the “dead” equity.

Withdrawing My Retirement Money

In this coaching call, you’ll meet Emmanuel where we discussed conservation easement and pulling money out of retirement funds especially for those with gross income under $300,000. We believe that most hard-working professionals are supporters of this financial dogma. You can have the most money, but if you’re not maximizing the possibilities of what your money can do, then it’s bound to be useless.

Coaching Call: Doctor With 2M Net Worth + Dozen & More Deals!

In this podcast, Brian is a doctor/physician and an accredited investor heavily invested in private placements. He was taught the traditional path when he was starting. But when he had a vacation in Asia, he realized that he didn’t want to work forever and had an epiphany that he wanted to retire at 55.

Accredited Engineer & Hui OG

Mike is a construction manager in Seattle with a Civil Engineering background. He started investing in turnkeys in 2017 and has moved on to syndications. Lane and Mike discuss renting vs buying a home and investing with spouses.

Dumping your 401k, Helocs, 529s, IBC, Spouse Help Accredited Investor Coaching Call

In this coaching call, we talked about understanding syndication laddering, dealing with spouse support (negotiation) and should you carry over 401k to 529. You have to come to the realization that you need to do the math and the numbers speak for themselves. Another thing, negotiate and don’t forget to settle with your boss (aka spouse)!

Coaching Call w/ W2 & Business Franchise Owner

Ahmed’s life story is the “American Dream” moving to America in 1989, getting a high-paying job, and now he is close to becoming financially free! Ahmed started off in accounting and currently is a software quality assurance manager for a consultant company. Ahmed shares how he embraces frugality, personal responsibilities in finance, as well as how he sees real estate as an important vehicle to get to the next level. Ahmed built his passive wealth by partnering up with others who complement his weaknesses and purchasing single-family homes and later then transitioning to townhomes.

Live Coaching Call Scarcity Mindset

The investor thinks that people’s perceptions of investing so much make so much fear, what could happen, and their much afraid of losing something than what you are gaining. Lane tried to realize to people that to make money you have the platform and you have the control to start growing it.

Live Coaching call w/ Accredited Investor Lawyer

John was a lawyer by trade. After law school he did 5yrs at a big law firm with a very intense 80 hour a week job and so he doesn’t see much his friends & family. Trading his time and all, it gets up & brings him down. Then he started listening to podcast might be 3 yrs ago & then came upon to Lane probably 2 yrs ago. He once made this switch job wise & freed of all his time and started to settle down more likely in a sustainable environment and wanted to pursue investing more seriously about a year ago. He’s been talking with Lane about getting his first turnkey property. Lane helped him to understand to put this on the firm or not the firm but just the lease as possible which is a lot. John get a rate and try to refinance last year, so it’s a personal loan now. He also learned from Lane “spread it out as long as you can”. Also the network is the most critical thing “your network is your net worth”.

Money talks... Wealth whispers

I noticed that Non accredited LPs like to post on social media that they are in certain deals to show off… contrary Accredited investors are in so many deals they don’t get too excited and they want to keep their privacy which is why they want to be a LP in the first place. Money talks... wealth whispers.

Lane Kawaoka

3-5M+ "Endgame" Investors Below

When is it time to Retire? Accredited Investor Live Coaching Call

Lee is an engineer for a general contractor in Hawaii for about 20 yrs. Then he started investing 5 years ago, started with get funding for houses in Hawaii. Now he’s an accredited investor keeping houses, all over the US in different cities. His goal is to accelerate his portfolio for retirement and he figured out real estate investment might be a good idea to meet the retirement goals. Lane helped him to decide put his money in to do long-term equity and get real estate professional status now.

Live Coaching Call with a Doctor going 45 to 75 MPH! (Episode 151)

Matt is a Doctor he is 4yrs in Atlanta for his internship and after 4yrs in Residency training and Radiology in Oklahoma City. People think about him “”you’re making a lot of money”” but it’s not. He’s internship he works close to 80 hours a week and in his 6th year of postgraduate training he maybe 55. He started at about two hundred fifty thousand dollars student loan and wanted to start repayment right after medical school to capitalize the interest before really start accruing. In the beginning, the interest was growing more than he was paying so he finally refinanced it about a year and a half ago, now he pays $2,600 a month and his balance is still over 225,000. He planned to buy a single-family home before he graduated. Matt wants to have time freedom. Lane encouraged him to visit her website to know more about how can we have time freedom.

Accredited Coaching Call w/ 3M Business Owner (Ep. 235)

Coaching call walkthrough with Steve, a construction company owner, whose net-worth is a couple million dollars. Learn how Lane breaks down how to get rid of lazy equity, save taxes, all while working the day job!

Mindset

Those who are living paycheck to paycheck (although they make 300-500k+ a year) think in terms of monthly/quarterly income. They fixate on what the dividend/yield/distribution is every month or quarter. Higher net worth or experienced investors who have seen their deals go full cycle know that 2-5% of cashflow on their deals is small potatoes and does not change their life one bit. These investors tend to view investments on a longer time horizon in terms of 2-5 year increments or longer as opposed to monthly/quarterly/annually. They also tend to invest in higher equity growth investments where they optimize for velocity of money as equity growth (ie developments with no cashflow).

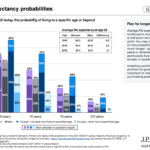

Morbid ideals

The older you get the less unknowns you have for needs of money. For example you don’t have kids and potentially your kids are financially independent. Plus from a life expectancy standpoint the years remaining that you need to spread your net worth out is less and less but also less uncertainty. As a result, “endgame” for someone in their 40’s might be 5-6M net worth whereas someone in their 60’s might be a mere 2-3M independent of lifestyle needs.

Coaching Call - Engineer With a 4M Net Worth Getting Started (Ep. 306)

‘John’ is an engineer and has a little bit higher net worth.

His story shows that the road to financial independence is at a slow pace from 0 to $2million. People don’t realize that!

But once you’re up to 4million and above, your net worth (plus your network) expands and moves a lot quicker too.

10M+ "Endgame" Investors Below

Our goal of our FOOM community is to take investors from 1M net worth to 10M net worth.

If you would to to keep pushing the pedal to 50-100M+ net worth and greater. We would recommend you joining a group like Tiger21.

If you are a looking for a group getting to that 10M number and looking to cruise at that altitude, reach out to Team@simplepassivecashflow.com about applying for our Family Office Ohana Mastermind.

Mindset

Those who are living paycheck to paycheck (although they make 300-500k+ a year) think in terms of monthly/quarterly income. They fixate on what the dividend/yield/distribution is every month or quarter. Higher net worth or experienced investors who have seen their deals go full cycle know that 2-5% of cashflow on their deals is small potatoes and does not change their life one bit. These investors tend to view investments on a longer time horizon in terms of 2-5 year increments or longer as opposed to monthly/quarterly/annually. They also tend to invest in higher equity growth investments where they optimize for velocity of money as equity growth (ie developments with no cashflow).