BONUS – Real Investor Questions from Past Syndications (OLD SECTION)

Update 12/2020 – The following content has been added to our COMPLETE SYNDICATION GUIDE – FOR ACCESS GO HERE

______________________________

Pre-investor Guidelines SAMPLE

- “Priority Order Determination” & Safe-wiring best practices on a 506B Deal – Read Me

- Signing of the PPM (electronic or physical) and order of wiring funds are done in different orders. See some typical procedures below:

- Investor completes soft-reserve form, investor completes PPM, investor wires money, Sponsor Team confirms with investor that funds are received and investor is confirmed in the deal as the deal could be over funded [Investors are prioritized and calibrated for larger amounts/etc].

- Investor completes soft-reserve form, investor completes PPM,[Investors are prioritized and calibrated for larger amounts/etc] investor awaits confirmation from Sponsor Team to wire money , Sponsor Team confirms with investor that funds are received and investor is confirmed in the deal.

- There are no certificates or deeds involved as the executed PPM is your legally enforcing document. PPMs are usually executed and sent out to investors shortly after acquiring the asset. Frankly, the closing of the asset with the Bank and seller is the priority. Linking dozens and dozens of investors’ $50,000-100,000 wires and signing the investor PPMs is another task that has to be completed in parallel.

Active Investors’ Memorandum of Understanding

The following does NOT trump the Private Placement Memorandum of the particular deal however it is an addendum to communicate Limited Partner (LP) rights and to set GP & LP expectations:

- Lane Kawaoka and all affiliates is a General Partner in the deal and should be the primary contact for all communications as your legal sponsor into the deal in order as part of SEC compliance is to having a pre-existing relationship with a particular sponsor.

- Lane Kawaoka wants all investors to feel comfortable with the active project but does not have the bandwidth to entertain frequent investor relation questions about the specifics of the project. As you can imagine, many people have varying levels of expectations and perhaps working with Mr. Kawaoka may not be a good fit. If you are looking for white glove treatment perhaps you should look for institutional investment that have the overhead to answer frequent emails or phone calls. Most deal’s will put out a broadcasted monthly/quarterly update. At the end of the day, Lane enjoys working with investors, investing alongside investors, and communicating the deal happenings good or bad. Lane did not quit his JOB or allow investors to join in his investing adventures to work with difficult people. If your expectations are not being met let us agree to disagree with the level of service as your Sponsor, amiably live out the active partnership life-cycles, and not work with each other in the future and I wish you the best of luck in completing your due diligence for whatever deals you find. If you are looking for a loyal Sponsor relationship that is both fun and professional, I look forward to going on this journey to financial freedom with you.

2019 Notes

Apartment investing has been extremely competitive over the last few years and despite the continual cap rate compression bringing down investor returns we strongly feel that cashflow investing in recession resistant assets is a prudent strategy over holding more than 20% of your cash/lazy equity on the sidelines. The last decade some say has been the golden age of apartment investing (especially in the state of Texas) however one has to suspect that we cannot sustain this kind of current growth. A market reversion or leveling off is bound to happen we want to protect our capital while growing it as best we can.

Our goal is to stay in the game, get cashflow, and mitigate our risk by conservative underwriting using data our network of operators, boots on the ground due-dilligence, and data that is not available to the public such as CoStar (market rent growth, vacancies, reversion capitalization rates, etc.).

In 2019, I have see a couple “tricky” methods that deal operator employ in their underwriting.

- We have discussed this many times previously especially on Passive Investor Accelerator & Mastermind calls and has been known as “Cap Rate Gate” where a lower than reversion cap rate (exit) is used. Simply stated a 0.5-1.0 increase from your prevailing cap rate to your projected reversion cap rate is known as a conservative measure to assume for a softer market at time of sale and to create a bit of contingency. Many institutional operators when asked on a panel will admit to using a -0.25 to +.25 factor on their reversion cap rate. Yikes!

- Underwriting a high reversion capitalization rate upon sale of the asset, but still being more aggressive on operational components like rent growth and expenses, compared against the projections of market analysts. Often times we take exception to bumping the rents anymore than 12-15% unless a heavy amount of value add is being completed (over $8,000 of upgrades). Every deal is different off course and you might be working with a fat deal with severely under market rents as it stands today.

- Inflating “other income” or non rental revenue such as trash valet, additional storage fees, reserved parking, vending machines, or any new type of service that may or may not be tested by the current clientele. This has been a way to sneak deals past even the most astute LPs who have an understanding underwriting.

We come up with our operating and rehab budgets (with deferred maintenance) independently using the knowledge of past projects in the same area. We are also able to utilize big data to give us insight on the operating budget of other comparable buildings in the vicinity. The second piece is that we have our property manager (even before acquisition) walk all units to come up with their operating budget and rehab budget. From there we collaborate with them to build our team’s budget and add some room for contingency. This sequence creates a level of expectation that the property manager is held accountable for with the bottom line (Profit and Loss statement) being the performance rubric.

That said overall yields might be dropping. However, we don’t undertake a project unless we underwrite it the right way and feel more than comfortable taking on investor capital.

2020 Notes – Moving away from Class C

Investing in Low-Cap Markets

Would you invest in a property selling at 4.0% cap rate? Well that is what large institutions, insurance companies, and likely your pension fund is investing in for reliability. Cap (Capitalization) Rate is a number that is calculated as Net Operating Income divided by Purchase Price. It is meant to indicate the profit or income margin you will have if you purchase the property, the rate of return you will get if you buy the property with all cash (no leverage).

Effectively, though, it is an indicator of market sentiment. It tells you what the market thinks of this property. There’s so much more that goes into a financial evaluation of a property than cap rate, but cap rate is a key metric.

Keep in mind, if you are borrowing money to buy the property, Net Operating Income is before the mortgage payment. Your NOI needs to cover the mortgage. If you’re borrowing 80% of the value of the property, or even 75%, and the cap rate is low, NOI may not cover the mortgage. And worse, the lender will still want some income left over after you pay the mortgage.

Without getting into the details of debt coverage ratios, let’s focus on “good” cap rates and explore what that means.

Most of us have heard that a target cash on cash rate around 8%+. That number generally means you have sufficient funds to pay a mortgage of 75% LTV and return income to your investors. But not always.

What if the property is in a fast-growing city? Population and jobs are increasing very quickly and they all need a place to live, so rents are going up. Who doesn’t want to invest in that. But that’s the problem, everyone wants to put their money there, everyone wants in on it, and ultimately demand is what determines pricing. Investors don’t need an 8% cap rate, or a 7%, 6%, or even 5% cap rate. They’ll settle for less. In a way a higher Cap is an indication of a less risky market and alternatively a lower Cap is an indication of a more stable market (primary market)

Why? Because when they go to sell, the market itself will have driven the property value higher. Rents are going up on their own. You don’t even need to invest in renovations. It’s all just going up and it will keep going up for as long as you plan to hold the property. That might be a safe assumption, but nothing keeps going up like that forever. Good example is Seattle and San Francisco.

If you’re investing in a property with a low cap rate, say 4.5%, a conventional lender probably won’t lend you 75% of the value. That means you bring in more capital and borrow something less, maybe 50-60% LTV, or you get a different kind of loan, maybe a bridge loan at a higher interest rate, then refinance in a couple of years at a higher valuation. That’s not unreasonable and many successful investors do this.

It is possible that you can underwrite a deal at a 4.5% cap rate and make it work. But what if you have renovations you plan to do? Let’s look at a simple calculation. As an example, you can spend $10,000 to renovate a unit and the rent increases by $100. That’s $1,200 a year in additional NOI. Remember cap rate = NOI divided by price, so therefore price = NOI divided by cap rate. You can use the same equation to say added value = added income divided by cap rate. If the cap rate on this property is 8%, assuming you will eventually sell it at the same 8% cap rate, the value you added is $1,200 / 8% = $15,000. But what if the cap rate is 4.5%? Added value is $1,200 / 4.5% = $26,667. For the same $10,000 investment. That adds up quickly and makes you look like a genius!

That’s why smart investors compete voraciously for top-tier, low-cap properties, ones that look great, are in a great area, but have outdated interiors and amenities.

Generally low cap markets are stable markets. Until they’re not. If you think the big coastal cities with low cap rates are stable and will hold up in a recession, go for it. But if you think the trend is away from those population centers, a secondary or tertiary market might be your better option.

That is the skinny on Cap Rates but as you know its not entirely one sided argument as good deals we look for have a component of under valued rents/values and potential to push rents via forced appreciation. This aspect is independent of the current Cap Rates and gets forgotten by passive investors who mostly invest off marco economic data or general market data. If you are not confused already… low Cap markets typically have a more dumb money so finding a good deal there is pretty much impossible.

Frequently asked due diligence questions

BELOW ARE QUESTIONS FROM PREVIOUS DEALS WITH SLIGHT CHANGES TO PRESERVE LIMITED PARTNERS’ PRIVACY. THE SPECIFICS ARE BY NO MEANS TYPICAL SINCE THEY ARE FROM A WIDE RANGE OF DEALS HOWEVER IT ALLOWS INVESTORS TO GAIN INSIGHTS FOR LIMITED PARTNER INVESTORS.

Here is an example of Class-C rehabbed units.

Sensitivity Analysis? What would be the breakeven point for occupancy % in event of a market downturn with current rents?

Breakeven occupancy is around 70%. Typically from deals the breakeven point on occupancy does not vary more than +/- 5%.

What is our Break Even point?

- From occupancy standpoint break-even is around 70%.

- When I stress tested based on the 5 year return, cap rate would have to go to 10% to “break-even” but since we have long term financing, I would expect we’d just hold and cashflow.

Can you provide some more info about the seller, their motivation, how long have they owned this? (if you can point me to how I can find this out myself, that would be much appreciated!)

Their business plan was to take from 70% occupancy to this point.

The current seller has owned for about 2.5 years and has a shorter term business model when he buys properties. He is focused on large value-add with more legwork. He tends to get short-term variable financing, work on distressed properties, etc. He’s taken this particular property to this point and ready to take gains and move to next. He’s looking for new deals like us.

Do we have comps of nearby properties recently sold? I see comps for rents, but wondering if there’s some data for sales in the area? How does this compare to your other projects in the area that you talk about in the webinar? Would be helpful to understand if this is being acquired below/at market rate, etc

Personally, I pay no attention to Sales comps. It’s something brokers always put in Offering Packages to fill space. These apartments are commercial assets and valued on NOI not SF, Units, or comps. As for the rents take a look at the graph in the webinar.

We are just doing a 7.8% increase. Anything over 15% is too high.

Do you have any details about the area that you may have already compiled? It would save time for me if you have this aggregated. Things like median income to rent ratio, schools, crime, etc. If you don’t have this aggregated – I’ll look into it

This is due diligence that you need to do on your own and check out City Data and crime websites. I have owned 4 properties in this side of Atlanta. It’s not the greatest area but definitely not the Southside (Along the Marta) which is where you do not want to be.

Is the capex budget based on actual bids? What is the contingency % (buffer) in the underwriting for this?

Budget came from property management company but the repairs is pretty standard and $4500/unit is a healthy budget especially with little exterior improvements which were done by seller. I’ll have to double check on contingency % but there is a cash reserve which serves as the overall contingency.

In addition to reserves ($300/unit) for the overall contingency, we plan to keep working capital in the bank equal to 1 months rent for the entire property. On the capex budget specifically, Property Management (PM) has kept roughly a 5% contingency in their numbers, but this is continually getting refined so I wouldn’t put too much stock into that.

Is the loan amount fairly high compared to the purchase price? How does this factor into some conservative analysis for a market downturn? Maybe a quick phone conversation to understand the financial after you send me some numbers would be helpful for me to get comfortable and pull the trigger

I invest in deals with upside while I get high single digits cashflow in the meantime. To be sitting in the sidelines is the mistake. Should a correction happen the business plan will not take 5 years but likely longer 7-10. The note is currently 10 years which should be more than enough to force the appreciation.

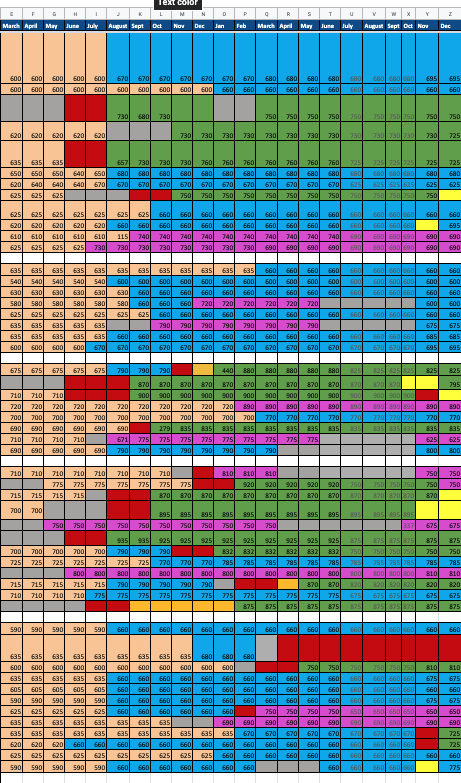

One of the first questions that always pops in my mind when I’m sent a deal is “”where does this rank vs the others I’ve been sent?”. Where does this deal rank compared to Huntsville? Or Iowa, or Texas? etc etc. It would be nice to see where it falls on your scales of a slam-dunk conservative one, or a high-risk high potential one. I’m a big rankings guy – like college baseball national rankings (you know Washington and Texas Tech are still in the tournament? Maybe you and I need a side wager to see who finishes ranked higher??)

I am working on a scorecard as I’m getting a little (loose) on how I view these deals where its more off heuristics and seeing so many I know exactly what to look for. Which is terrible to communicate with others. I realize that “I just know” is not a good answer and so is “trust me” does not work with everyone. Plus, I always afraid that I will forget it much like the motivation behind the podcast.

Using the rubric of 50% operator and 50% deal…

What’s the cap rate that it’s buying at? What’s the exit cap rate assumption?

Purchase Cap Rate is little over 6.3% on actuals, little under 6% tax adjusted. Sub-market cap rate 6.25%. Exit or reversion cap rate assumed 7.25%

Cap rates are severely over estimated in most cases from brokers/sellers/syndicators so I don’t really pay much attention to it. The reasoning is that to get to that number typically expenses are always left out or income is inflated – so its bad data. Those top of the line items are again always manipulated and can throw the calculated cap +/-2.0. The only true way to determine is to get the trailing 12 month Profit and Loss Statement but at that point you have the information to underwrite it fully.

On class B/C I have been using 6.5-7.5% reversion cap depending on market. For example 6.5 in Dallas whereas 7.5 in Gulfport MS.These days nothing is over 7.5% cap (unless its a truly off-market deal and a fringe deal under 60-units). I find the current prevailing caps from my friends who are apartment operators and ping them what they used on their last deal. Another way is to talk to a broker who has their pulse on the market and knows you need the number for underwriting purposes (and he is not selling you a deal).

In addition the mere fact that we are doing value add and buying assets that have a management problem (that we can fix) means the property is not performing what it should be.

How will profits be distributed to investors?

Profits will be split 70/30; with 70% going to investors. After 1.5% asset management fee.

Is due diligence complete?

Yes. There were no big surprises, other than some minor deferred maintenance that we are able to get a $25,000 credit for. Unit interiors need some repairs, but again nothing major. All of this has been accounted for in our underwriting.

What is the timeline for this investment?

We are oversubscribed meaning people have committed funds but in the process of signing docs and wiring in funds. There is still time to get in but email me ASAP.

Is the property in a flood plain?

No.

Who gets awarded ‘Incentive Units’? Is that something that goes to the sponsors or is it something the sponsors award for some

It is only for sponsors who don’t take their comp up front. It’s a tax thing.

Is this an “All Bills Paid” property?

No. Residents pay their own Electric and Water is billed back. Residents are also charged a Trash and Pest fee.

Is the management team investing any money?

Yes, we plan to invest alongside our fellow investors. we already have around $130K that the sponsor team has put into the deal (Deposits, etc) that is “hard” and committed. The sponsors will be at least 10% of the closing capital. The $1.3m is what we’re aiming to have total for closing, but our actual cash to close and raise is slightly lower. $1.1-1.2m. This accounts for closing costs, fees, and to ensure we have the additional working capital to start.

What excites you about the deal?

This is a great hybrid play with a proven model to increase rents in a strong market. The deal is “clean” and we can come in and do little and still cashflow.

Do I need to create an LLC to invest in this deal? If not, in your opinion, should I?

Most investors do not have an entity as an LP role. I do because I in a GP position and I have one. In a past investment group I was a part of, the general consensus was that unless you were investing more than a couple million dollars that a LLC or entity is not really needed. Of course, talk to your own Legal Professional. Most people I know investing as a LP just invest through their personal name (75-90% of them). The beauty of the LP position is as the name suggests you are a limited partner.

The one piece of legal consideration I will provide is that do not put your LP holdings in another LLC that also holds high risk assets like an operational business or other rental properties.

Will distributions be by check or electronic transfer?

Likely Check. Check is easier especially because people move around so much. But we can do ACH if the bank allows.

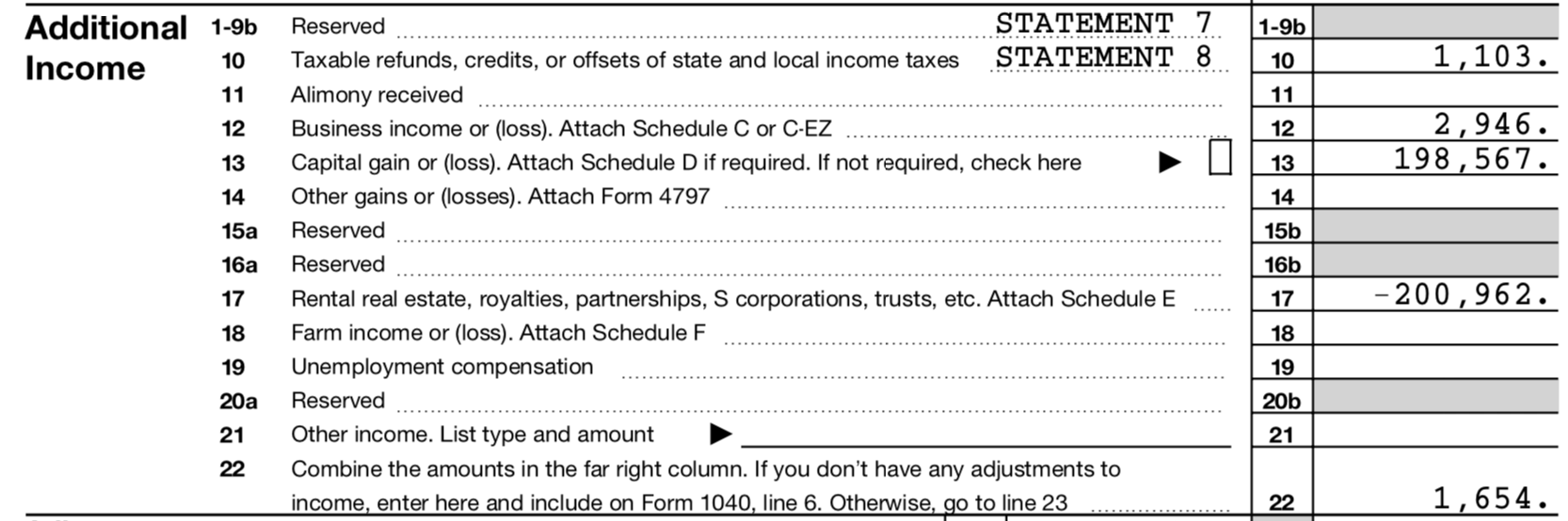

Can you explain what tax savings there are to investors that receive a K1?

Check out the webinar for best explanation. Bonus depreciation which is not really more depreciation but it is front-loaded in the beginning years. So if you believe in the time value of money and how its better to have those savings today… it’s a big deal. We will cover this in an educational section in this webinar and how the Cost Segregation is used to support the accelerated depreciation. I did a couple of quotes to do a cost segregation and I will include those examples as well. Of course, talk to your own Legal Professional.

Note in the future there will be a webinar on cost segregation from an expert. Please search the website and Youtube Channel or email me.

Is there depreciation claw-back when the property is sold?

Yes you have to pay taxes on the gain unless you are able to 1031 into the next like-kind deal. But this is the case with any investment. Sorry no magic tax evasion here.

How many tenants on section 8 / housing program? How hard is it to re-tenant in that state?

I have four of my rentals like within a few miles of this apartment. I don’t think any of mine are currently section 8 but I am a real fan of it. What you have to worry about is the LIDCA or LURA or LURK restrictions on rent. Sometimes they have credits to builders when they build these and that is a real pain to deal with if you are the best buyer. I have not met anyone who has specialized in repositioning these cause you have to be really careful for the expiration date. It’s usually something brokers trick you into buying.

The exact percentage has been around 8% total Section 8. A handful of those are carryover from the previous owner and long-term residents (5+ yrs). The property currently doesn’t rely on it to maintain or attract tenants and not high enough for us, in general, to be too concerned outside of normal resident churn. One good thing is the property has actually been getting the current asking rent from the Section 8 residents. There are always some units not repositioned to leave some meat for the next buyer so I’m sure naturally these will be it.

What’s the (economic) vacancy rate for the submarket?

Usually you plug in 10% for a regular market and 8% for an Atlanta/Dallas (hotter market). After that you deduct a few percent points to account for deadbeats. In the end this moves the needle very slightly. The Cap rate is the biggest factor on what you use for the reversion cap rate.

On the ”potential return” slide, why the drop in income on year 3?

We have 3 years IO which gives some extra juice to the cash on cash in those years. Since the IO runs out after then, our debt service increases in the following years. income, expenses, and subsequently NOI is before debt service so reason why there’s no drop seen there.

I don’t totally understand the “equity on sale” starting in year 2. Is it that you are spreading out the projected equity return based on a sale/refi at 5 yrs? For the Huntsville investment, believe that was all captured on the last year (year of sale or refi).

That is just the theoretical equity return with assumed sale/refi in that year 2, 3, etc. Should just ignore or we should probably remove that in future to avoid confusion. It is the same idea as Huntsville in that it is captured in the final year of sale (we project year 5). That piece is just showing the theoretical buildup or what you’d mathematically get if for some reason sold at that scenario. This is where things get really crazy and you are making projections off projections. This is why I like to take the average return in the life of the investment as a starting point to compare these non-apples to apples deals.

What is the cap rate on purchase?

On actuals its just under 6%.

What is the property Mgt fee?

4.5%

Issues with XYZ Property Management company

- Has given us unique insight into the property throughout the acquisition process (if there were bodies buried they would have told us), and will help for a smooth transition process.

- No difficult takeover will be needed and we can immediately implement our business plan.

- We’re taking an already efficient operation, adding our own tweaks, and infusing capital into the property.

- We’ve also utilized independent 3rd parties to for due diligence to audit their books and do unit inspections.

Why Fannie?

Rehab dollars as part of the loan and have the option for supplemental down road which may be very attractive. This property may be one we’ll want to hold.

The issue with yield maintenance prepay penalty?

Account for if we decided to sale. We’ll have an attractive asset where someone can assume loan, which with rates rising could be attractive in the future.

Crime?

- The current property manager who has managed for last 2 years has cited that crime is not bad on the property, there has just been a notable incident which were not residents, but outside instigators.

- Residents are thoroughly screened with appropriate background checks, etc.

- We’ve also called the local police department to corroborate.

- We will be installing security cameras. We’ve also been on-site, you don’t need a bullet proof vest walking around.

- I’ve driven there at night, there’s plenty of lighting thanks to recent LEDs installed and no issues.

Rebranding?

- The current owner brought up the property previously out of foreclosure that had not been taken care of, bad tenants, etc.

- There are older (3+ yr) bad reviews online from when it was run poorly prior (was bought out of foreclosure).

- Property also had an incident.

- Obviously, that hasn’t affected occupancy and performance at this point but it gives us a fresh start, signals new ownership, and we can ride the wave of a new sheriff in town.

- Rebranding, as well as the new name, were suggestions from the property manager.

- Property next door rebranded and going thru renovation so keeping suit.

PTAC (Packaged Terminal AC) – HVAC

- All the flat units have these PTAC units with electric wall mounted heaters in rooms.

- One of those units was retrofitted with central HVAC.

- All the Townhome style have traditional central HVAC with indoor air handler and outdoor condensing unit.

- Kind of is what it is, we could try to convert the flat units but that probably wouldn’t be cost effective.

- Residents pay electric anyway.

Why is the seller selling?

- Current owner owns multiple properties in area and has been selling off assets.

- He has shorter term business model focused on large value-add projects with lot of legwork and getting short term financing on it.

- Taking gains and buying elsewhere. Bought property out of foreclosure from Fannie Mae.

- Brought occupancy back up (70%) and spent dollars on exteriors including paint, shutters, roofs, and stairs/decking.

- He also started own prop mgmt so he’s doing different things.

Tenant Profile/Demographics

- $44K medium income for submarket. Workforce/blue collar housing. People working in services sector, retail, public service, food service, etc.

- For this particular submarket the major employers are the Emory conglomerate (University, Medical Center, Center of Disease control) and Dekalb County Gov and Schools (the county center is 5 min north).

Current Cap rate NOI

- Based on actual around 6%, their current NOI is around $300K.

- Depending on what source you look at, the Atlanta market for Class C property is in the 6-6.5% range. This submarket tends based on broker opinion is around 6.25% which has been compressing.

- We are underwriting our reversion cap rate at 7.25% which is a full point higher we have a stress test as shown how that affects returns. We did this because it was a bit riskier class C property.

New Revenue Opportunities / Other Income

- We’ll continue to look at with property management, some immediate things I see are that the Townhome units have full W&D hookups so we’ll look at opportunity there.

- The laundry income is underutilized.

- We’ll also look at turning the office (currently a 2BR) into an efficiency which property management thinks we could get $550/mo for.

Cost Savings Expense Reduction

- Payroll is the largest item here ($1500/door), the current property had an extra FT maintenance person. Since Provence manages the property next door will share resources which will bring that down closer to industry standard (we’re underwriting $1200/door).

- In addition M&R and turkey will go down because of capital investments, particular on interiors. (Cabinets, carpet, etc).

- Other things we’ll look at are utility savings with energy/water conservation.

How much did property trade for in the past?

- Property was bought out of foreclosure couple years ago for $26K/door but that seems kind of irrelevant. The property was purchased after the 2008 financial crisis at what we are paying today.

- Properties in area are trading for $50K/door

What new development in area is going on?

- Number of new apartments being built further northwest.

- Rent increases in that area and north are starting to drive people south.

- There’s a couple different new townhome developments within couple miles

- Path of progress so to speak.

For additional capital raises, are LP’s required to contribute as well?

This is called a cash call. The cash reserves serves as a buffer for such event. Often times in order to “save face” cash is asked from the Key Principals of General Partners but yes it is possible to have a cash call however unlikely.

What if we have a downturn in the economy. What will the GPs plan to do to minimize the effects?

That’s exactly why you do these deals. The investment goes through some vacancy but overall still cashflows until occupancy drops to 70%. This is where I would like to be in a downturn in the economy.

Are there defined roles and responsibilities of each GP?

There are roles that we signed up for however its fluid and in the end all out brands are on the line for the sake of the investment and team.

4 parts of a deal to make a guideline on who gets what: 1) who is bringing the funding 2) who is doing the work 3) who found the deal 4) whos experience/network is being leveraged

A good starting point is evening weigh each of those 25% each but its very subjective.

In extreme circumstances, can I exit before the property is sold?

Not really especially for such a small position. In my opinion, it does not happen and if you think you need the money back. Do not invest and please save everyone the hassle. This is why low net worth individuals and non-accredited investors are not brought into these deals.

How is the team planning to renovate with tenants there?

Rehab is done with natural turn over in order to optimize cashflow. In some investments there is a lot of vacancy which expedites rehab however there is a big hurt on cashflow during that period.

In your financials, how is “Equity Gain on Sale” calculated? Presumed appreciation if one were to sell in a specific year?

Commercial assets are valued on the net operating income (NOI) and not comps. If you can increase income or decrease expenses you increase the NOI and thus impact the value. The value of a property is simply the NOI divided by the cap rate (usually 4-8%). For example a property with an NOT of $50K at a 5 cap is (50,000/0.5) valued at 1 million.

With a $30K investment, how much equity am I holding in the deal?

If the total raise was 1.3 million, you $30K investment is 2.3% but since it’s a 80% LP / 20% GP split you own 1.8%. But 1.8% of 114 units is 2.1 units.

Aside from the cash flow, are you interested in MFH because of the value add opportunities that can bump up the NOI?

There are many reasons MFH is better than SFH but what I like about syndication deals is how I get high single digit cashflow which hedges my position if there is a downturn. All this while I take part in very predictable forced appreciation. The model takes little into the market appreciation into factor – most times it’s just a boring 1-3% annual rent increase.

This is part of an overall strategy on four ways you diversify in syndications:

1) Different leads/operators

2) Asset classes such as MFH, self-storage, mobile home parks, assisted living

3) Geographical markets

4) Business plans (5-year exits vs legacy holds)

*Usually I see investors place no more than 5% of their networth into any one deal

SFH investing is not comparing apples to apples because syndications as an LP is passive and SFHs is being an operator even if you are managing the manager. It is not scalable.

Does 100% Total Return mean when I break even with my initial investment? When would you think the exit will be?

100% return means if you invested 100K, if you added up your proceeds from cashflow paid quarterly and money from the sale/refi you would walk away with 100k and you original 100k.

The normal hold is because it takes two years to get all the rehab units done, two years to get the culture to change and further bump rents, and the final year to stabilize the books for the new buyer. Of course this is a conservative projection.

What is a “good” IRR for MFH?

It used to be 100% in 5 years was the gold standard. But as deals get hard to find, 80-100% total return in 2018 is the gold standard – which includes cashflow at high single digits. Of course this can be manipulated greatly based on assumptions. This is you job as a LP to determine if the right assumptions are used. See “Cap Rate Gate.”

What is “Cap Rate Gate?”

It’s when a syndicator manipulates the reversion cap rate to greatly influence the total returns, so they can attract investors to a deal.

Cap rate is the market determination of how much you should pay per NOI. It is what it is and Class A is lower than Class B and Class C. An increasing Cap Rate means it’s a softer market and you are not going to be paid as much for you NOI. To be a conservative underwriter you like to see the Reversion (exit) Cap rate +1.0% higher than the starting cap rate. For example if your starting Cap Rate is 6.25% then you want to use 7.25% as your reversion cap rate.

The Reversion is a “wild guess” to begin with. That is why you want to be conservative as assume you will sell in a softer market. By using anything less than +0.75% is simply “kicking the can” down the road. Likely what the syndicator will do is just blame the missed targets on the economy where it was just screwed from the get go.

See below how much it impacts the total return. This is why you need to look under the hood and stop taking the “sticker price” for face value.

Who’s the company doing the fixup and repair on the apartments/townhomes? How did you get connected with them?

This is thru the property manager’s contacts, who manages the process with the different trades. We will still get other outside bids after closing to make sure we’re getting the best price/service. We have other contacts in area thru other relationships and because sponsor team already owns assets in area as well.

I saw the rents are projected to increase 2%/year; is after completing rehab and increasing rents to market. Or just 2% increase from where they are now?

This is just a 2% increase from where they are now. We are getting the pro-forma rents on recent leases so rent increases will only improve our performance. Normally people use 1-5% on the model, its like an escalator in the numbers to account for inflation too.

The budget details say that $2500-3500 is planned in upgrades for each unit, but the larger budget breakdown only accounts for $250,000 worth of interior repairs. Can you please explain these numbers?

While we have an overall gameplan on the interiors, the PM will “test” units between the $2500 to 3500 range to see how the market responds to make sure we get the best bang for the buck. If we can get a $50 rent increase for a lower rehab cost, that only makes things better. We also won’t be able to immediately rehab every unit (need to wait for units to become available) so it’s a slow churn that will take time. Most projects never rehab every single unit in the complex anyway from that practicality standpoint, but also to leave meat on the bone for when we eventually sell.

Here is an example of Class-C rehabbed units.

Are the deal underwritten for a recession?

A typical Class-C stabilized value-add business plan:

While the current owner has spent over $400,000 on complex improvements, none of that has been spent on updating unit interiors or adding amenities for residents. All interior units have original finishes.

To enhance value, we will implement a value-add program to increase revenue. Most of the 174 units will be renovated at a cost of approximately $2,500 to $3,500 per unit, commanding an average $50 rent premium. Interior upgrades may include new vinyl flooring, new appliances, modern light fixtures, and new hardware and plumbing fixtures.

Building exteriors will also be updated including improving the parking lot, adding solar screens, and installing security cameras. While the property has been nicely maintained, the surrounding landscaping could use a refresh. We will also look to add a new outdoor amenity to the property such as an outdoor grilling area.

We will also rebrand the property to give a modern name and signage. Other areas we will look to find opportunities include implementing energy efficiency and water savings upgrades to reduce overall utility expenses, improving the laundry services which are currently under-utilized, and looking to create a new efficiency unit where the current office space is.

How much is GP putting in? ($250k – $300k)

Is depreciation being offered to the Class A debt investor? Not on this one. It acts like a debt investment – no depreciation… more for regular equity investors.

When will cashflow to investors start? We project to start paying investors 6 months into the deal on a quarterly basis.

So the plan would be to sell the property at year five and get back the investors money plus appreciation? We could sell or refi earlier (year 3-4) or sell refi even after year 5-6. It is unlikely we would hold past 8-10 years. Its based on how much returns we can squeeze out of the asset with the least amount of the risk. We monitor the market and try to make the best decision for everyone… this is why it is good to be aligned with a performance split with the sponsor.

Can you provide more details on the differences between the A and B investors for the Colony and also what happens in 5 years for both the A and B investors if the decision is to keep the property? A Class (debt investors) is more for conservative and very high networth investors. Its a 10% return starting right away paid monthly but no upside. Plus we try and cash out those investors out of the deal as soon as we can (2-4 years). Class B investors are traditional equity who have a split of the profits but will likely have to wait a couple quarters to start getting quarterly distributions.

Why do you say Class A is for “very high net worth investor” and how/when is the 2-4 years determined and agreed upon? I might have made a general statement but most investors follow a bit of progression where they start out looking for cashflow and then look for higher gains (no cashflow) but in the very endgame (or over 4-6M net worth) they just want a fixed return that the debt investment yields. Here is a short video in our new Mastermind Syndication secrets series coming out soon discussing this progression of an investors mindset. We look to cash out Class A investors as soon as we can refinance the property which will make Class B investors go up. We estimate this to happen 2-5 years from now.

So for the Class at the end of the (2-4 years) you only get your initial investment back along with the monthly but with the Class B you get the monthly, appreciation and initial investment? Class A gets paid in the first month so its pretty instant feedback (again Class B investors are projected to wait a couple quarters and then should be paid on a quarterly basis). Class B gets the upside in the deal so that is the tradeoff. Most investors will get the Class B unless they are higher net worth or really want cashflow.

What happens if the property is not sold year five? We continue to cashflow. If we hold longer we will refinance and basically pull all your initial investment so you are still cashflowing with none of your initial investment so you are playing with house money at that point on.

Do the payouts increase over time if rents go up? Yes, the more money the property makes the more money you make. If we make just $25 more per unit it means huge dollars for us!!! You take 80% of all profits. When the property is really preforming well above a 14% IRR the GP takes 25% of profits and LPs take 75%.

Is there a pre-payment penalty on the loan, or none like Reflections?

We are debating as a team if we want to go with a yield maintenance prepayment or a step down (5% in year one then, 5, 4, 4, 3, 3, 2, 2, 1, 1% in year 10). Right now it is yield maintenance since I think we are hoping to hold for a longer time than 5 years than a 3-5 year exit.

Is the pref cumulative, or how does that work?

Yes, but please make sure you verify this in the PPM. Is there a sponsor catch up from cashflow to get to 80/20 (like the investors would get 8% pref, then sponsors get the next 2%, then it’s split 80/20 above that?)

Yes for cashflow.

Could the cashflow be higher than 8% to investors, like if the property was cashflowing 12% (in which case i’m assuming it would just be 80/20 split?)

Yes, cashflow could be higher for investors. We projected 9 but with debt at 10 likely not in the first 3 years before we remove the debt investors. Also Class B equity players might be getting almost 17% irr counting the debt position in.

Roadmap

Phase 1 – Transition Property (0-3 Months)

- Rebrand property with a new name, good looking signage, and marketing material.

- Start upgrading property exterior by installing adding solar screens, re-sealing parking lot, and installing new landscaping throughout the property.

- With the help of the already in-place management company, begin updating interiors as units are available.

Phase 2 – Complete all Interior Upgrades (3-24 Months)

- With new updated exterior and landscaping package and rehabbed interior, we should achieve higher market rent.

- We’ll continue to upgrade unit interiors to bring them up to our upgrade package as long as we continue to get rent premiums.

- We’ll also continue to look for other efficiencies to reduce expenses and ways to add other income.

Phase 3 – Hold for Cash Flow (24-60 Months)

- Plan to hold the property for 5 years, subject to market and economic conditions.

- After the business plan has been implemented, and we’ve increased the value substantially, we can either sell or re-finance the property.

- Selling will unlock all of the equity gains (roughly 100% in 5 years), or by doing a re-finance we’ll get the majority of our initial equity back and retain the property for a long term hold.

Is it possible to see the average time remaining on rental agreements? Do we have visibility into whether tenants have signed multi-year deals, renting month-to-month, etc? What legal rights do we/don’t we have for month-to-month tenants?

Historically, in your deals, what metrics have had the highest volatility vs. your models? i.e. occupancy rates, economic occupancy rates, Y/Y rental increase value, etc?

I was unable to declare my SFH rental property ‘loss’ in my taxes last year due to having too high an income (AGI). Is cost segregation treated differently, so that I would be able to apply that to my taxes

How do I see legal proof of ownership stake? You make the example in buying/selling stocks you don’t own anything physical, but you can establish that confidence pretty quickly by selling an equity and pulling out the funds. I read much of the PPM and see ownership in the contract terms, but it isn’t very specific.