7.1 – Three Rules Of Investing

My three rules of investing:

- evaluate income and expenses for positive cashflow

- leverage with favorable debt terms

- hard asset

*gold is a hard asset but does not produce (1) cashflow or (2) leveragable… Of course you could leverage it via Mining Stocks but then you would not be (3) hard asset. Don’t get me started on Crypto but it does not produce income and not leveraged.

Key market indicators

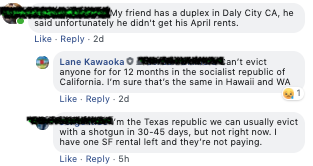

Lively commentary in our Facebook community. #Livewhereyouwantinvestwhereyoucanevict

Lowering Cap Rates

People call this Cap Rate compression. Where the yields on assets are coming down across the board. Shown below is a tertiary (third tier city, population of ~25,000). We advocate for secondary and tertiary markets but be careful that it is not a TURDtiary market. Below is an example of how theCap rates of a “TURDtiary” market has been coming down mostly due to global (macro market) improvement to the market. I would not want to invest in this type of market because I feel in a recession these are the types of the weaker/lower end tertiary markets will suffer.

Brokers/sellers/syndicators use this as a selling point but I don’t really pay much attention to it. The reasoning is that to get to that number typically expenses are always left out or income is inflated – so its bad data. Those top of the line items are again always manipulated and can throw the calculated cap +/-2.0. The only true way to determine is to get the trailing 12 month Profit and Loss Statement but at that point you have the information to underwrite it fully.On class B/C I have been using 6.5-7.5% reversion cap depending on market. For example 6.5 in Dallas whereas 7.5 in Gulfport MS.These days nothing is over 7.5% cap (unless its a truly off-market deal and a fringe deal under 60-units). I find the current prevailing caps from my friends who are apartment operators and ping them what they used on their last deal. Another way is to talk to a broker who has their pulse on the market and knows you need the number for underwriting purposes (and he is not selling you a deal).

How The Economic Machine Works by Ray Dalio

Some key takeaways from the video:

- The economy is, simple 😁 It’s comprised of just 3 elements: markets, industries, and transactions.

- The addition of loans and credit is what creates the inevitable growth and downturn cycles that we can observe throughout history. These aren’t inherently bad, especially if we chose to use debt in the right ways.

- Three main forces that drive our economy are: productivity growth, the short-term debt cycle, and the long-term debt cycle.

- The economy is a machine but the decisions within it ― productivity, debt, transactions, labor ― are driven by human nature.

Even though most of us understand the basics of this concept, seeing it in such a simple way can be eye-opening. It just goes to show how important it is to understand the system at its most basic level so that we can use debt, productivity, and these other elements in order to maximize the system ― or at least dodge the worst effects of the downfalls. If you can look at the greater picture, you are less likely to get caught up in the peaks and pits that mark these cycles. At the end of the video, Dalio leaves you with 3 main takeaways:

- Don’t let debt rise faster than income

- Don’t have income rise faster than productivity

- Do all that you can to raise your productivity