7.2 – Homework

My Investment Fundamentals:

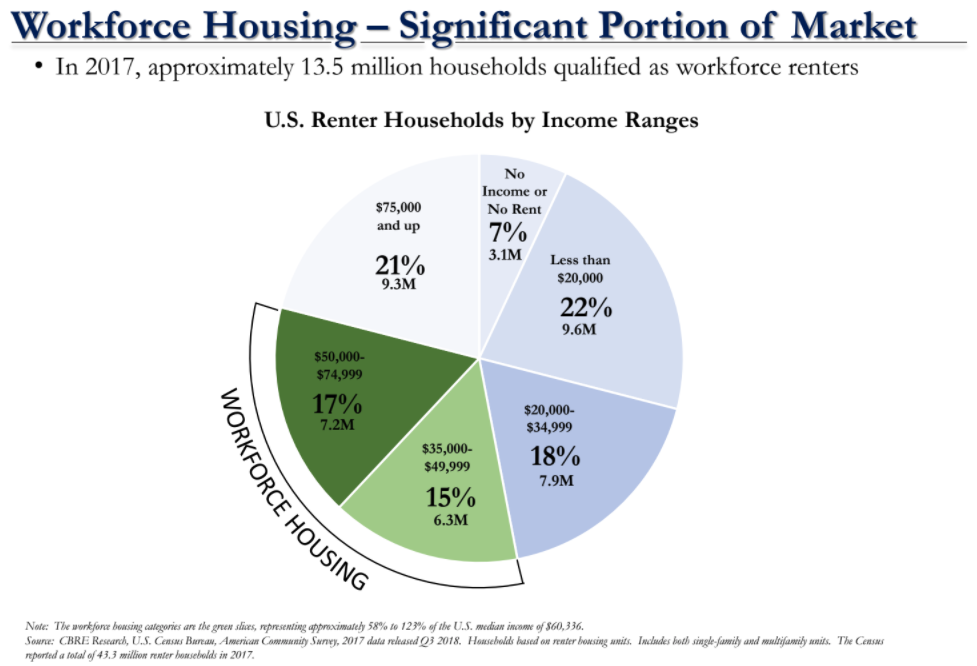

Workforce Housing & Emerging Markets

This week’s podcast/articles will dive into the nitty gritty basics every investor needs to know. Now would also be a good time to start reading “Millionaire Real Estate Investor” by Gary Keller.

Classes of Assets

Class A-D Properties – According to this classification system, properties are graded according to a combination of geographical and physical characteristics.

These letter grades are assigned to properties after considering a combination of factors such as the age of the property, location of the property, tenant income levels, growth prospects, appreciation, amenities, and rental income.

Class A

Class A properties tend to be new construction or built within the last 5 to 10 years, with top of the line amenities and professional management. They are also located in the most desirable areas with a high potential for appreciation with high-quality tenant profiles and with little to no deferred maintenance issues.

The prime locations and condition of these properties command high rents and experience low vacancies. Because of their premium condition and locations, Class A properties also come with premium prices.

Class B

These properties are generally 15-20 years old, with lower-profile tenants, and may or may not be professionally managed. Rental income is lower than Class A, and there may be some deferred maintenance issues. These buildings are typically well-maintained.

Class C

Class C properties are typically more than 20 years old and located in less than desirable locations. These properties are generally in need of significant renovations for repositioning in the market to achieve steady cash flows.

Class D

Class D properties are old, run-down, and typically, without exception, in need of significant repairs. They are located in distressed communities with high crime and poor schools.

Tenants have low income and bad credit, with many even having criminal backgrounds. These properties are relatively cheap to acquire but also experience high vacancies and low appreciation.

Diagram credit goes to Millionaire Real Estate Investor by Gary Keller

We as an operational real estate company try to stay in the “sweet spot” C+ to B+ properties in better than B areas since we will typically have decent tenants, good collections, and the best return per headache ratio. That said there is a lot of money comes in Class D or C deals however most novice to intermediate investors and especially passive investors are recommended to stay away from these types of classes.

There are an endless amount of investment options out there and the risk vs reward spectrum of each must always be considered and carefully analyzed.

Core, Core-Plus, Value Add and Opportunistic Assets

Assets under this classification system are differentiated by their levels of risk vs. reward with Core real estate investments on the low end and Opportunistic real estate investments on the high end of the risk-reward spectrum. These terms are used on an institutional level.

- Core

Core investments are typically low-risk and require no improvements or active management. Along with the low risk, they also offer lower returns than other investment types.

These properties generate stable, consistent cash flow from established, high-quality tenants locked in with long-term leases. For example, a national drug store with a 30-year lease would be considered a core property. Core properties require little to no maintenance.

The majority of expected return is generated mostly from cash flow, as opposed to appreciation. Core investments generate between a 7% and 10% annualized return.

- Core Plus

Core Plus investments are low to moderate risk. Unlike Core properties, Core Plus properties offer the ability to improve cash flow through slight property or management improvements or by improving the tenant profile. Core Plus properties tend to be of high-quality and well-occupied from the get-go.

Unlike with Core properties that are occupied by long-term, established tenants, Core Plus cash flow is less predictable with more diverse tenants, and these properties require active management by ownership.

A 10-year-old apartment building with a good track record or occupancy and quality of tenants in need of light upgrades is an example of a Core Plus investment opportunity.

Core Plus properties will generate higher rates of cash flow than Core properties, but some of that cash will be needed for deferred maintenance. And unlike Core properties, a higher portion of the property’s expected return will be generated from appreciation because of the property improvements. Core Plus investors can expect to achieve returns between 9% and 13% annually.

- Value Add

Value Add investments are considered moderate to high risk. Value add properties underperform in terms of cash flow and occupancy but have the potential to see big bumps in occupancy and rents and, as a result, cash flow once the value has been added.

At acquisition, most of these Value Add properties have occupancy issues, management problems, infrastructure and maintenance problems, or a combination of all three. These investments require real estate expertise, strategic planning, and active management. Total expected returns are generated both from cash flow and appreciation. Investors can expect annual returns between 13% and 18%.

- Opportunistic

Opportunistic investments are the riskiest of all types of CRE investment strategies. Opportunistic properties involve the most complicated projects like ground-up developments, land development, of repositioning a building from one use to another.

Opportunistic typically involve dealing with entitlement, zoning, and rezoning issues that can last for years. As a result, investors may not see a return on their investment for three or more years. Opportunistic properties have the potential to generate annual returns of over 20%.

There is no perfect investment, all involve risk, and all have at least one variable that is less favorable.

We as an operational real estate company try to stay in the Core Plus to Value Add zone. These real estate investments are where you can grow the property value without relying solely on speculative market appreciation. Core Plus investments often require less operational improvements while Value-Add investments tend to need more work. Both strategies can result in forced asset value appreciation.

The Essentials:

- 029 – Fundamentals – Markets & Grades of Buildings and Neighborhoods

- 038 – Fundamentals – Insurance w Ed Babtkis – Deductibles, actual cash value vs replacement cost, liability coverage, umbrellas, bad-blanket policies, additional insured or insured beware

- The Analyzer Video Walk Through

- Download 2018 Buy & Hold Analyzer Spreadsheet

More Deep Learning: