BONUS – Lessons Learned from Past Deals

There is guarantee in investing. We enjoy real estate investing because we can control our outcome and mitigate things that are outside of our sphere of influence. In the spirit of constant improvement here is our living report of Lessons Learned.

Exception Date & Description

Lesson Learned

23.05.1

Stagflation (Rents/Income relatively flat these past few quarters after double digit growth post pandemic and mostly inflation (see visual example) eating into our profits – most notably 2-3x in insurance costs) has resulted in decreased cashflow/distributions. All the economic information that we follow from industry publications tell us that there is going to be a recession in 2024. We are in the first wave feeling those impacts now and when the recession does hit everybody (watch out for your stocks!) we will be glad we were in these workforce housing assets because the demand for more value housing options will increase. For us in deals now, we are strategically ‘playing it conservative’ the next few years and focusing on the original business plan of adding value to the asset and selling at or still above proforma. Unfortunately the cashflow along the way may not be here, as we intend to put it back into the asset or cash reserves to be ready for a hard 2024 recession.

This is one of the reasons why we are focusing more on developments in the future because the are insulated by market undulations (stagflation, delinquency cycles, misc headwinds which are essentually the headlines that take up the news every few weeks), ground up developments have larger profits/margins for error, and we don’t have to contend with less experienced operators under 1B in AUM in the space purchasing apartments who are very eager to get into the game which ultimately bid up the prices on future acquisitions. If you look at the pre-unit cost of buying a 50-60 year old class building is only 10-20% less than building a zero capex, low operation expenses new build – the answer is clear that we should just build it on our own and continue to swim upstream.

We understand that it can be frustrating that as a Class A investor that you went into that class for stability but this is the reason why we started the PEP fund as a diversified pool of these Class A type holdings to achieve a much higher level of stability.

23.04.15

Difficulties working with smaller/community banks that have stricter loan governance expectations. Might be best to work with a large Fannie/Freddie lender. That said its really hard to tell who are the difficult and predatory lenders are.

23.01.30

Many of our projects had debt rates that were fixed, however there is always standard language to give the lender the ability to increase the rate should unforeseen conditions happen (such as interest rates increasing 3% in 6 month period). Also to note anything higher than 2% will typically trigger these clauses to come in. Similarly 2-3% is the range that most operators will purchase rate caps for as anymore would be cost-prohibitive.

21.10.01

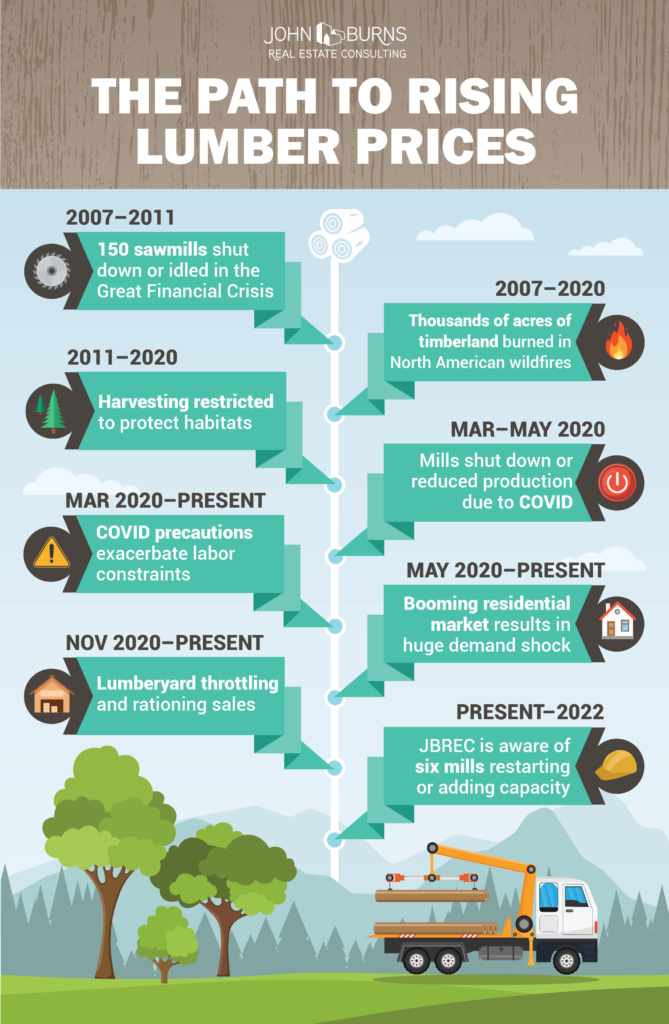

Material Pricing Risk

In the Summer of 2021 we felt the pinch of unprecedented lumbar costs go up. We were able to mitigate some of these material costs by strategically buying our lumbar in a few large packages along with our guarantee maximum price contract (GMP).

21.09.01

Insurance Costs Surge

We sold several assets in the Gulf due to surge in insurance costs due to a bad string of hurricanes. Insurance costs are cyclical in nature with a 4-8 year peak to troth cycle.

21.02.14

Discussion on exceptions on deals. (3 out of 30 deals)

20.03.01

General Partner was officially removed as asset manager after poor performance.

Operating partners will be selected based on past performance.

Mr. Kawaoka will take a closer role in operations and engage legal team without hesitation.

Hui Deal Pipeline Club will be primary capital source in order to swiftly ban to unite our collective voting rights to kick out a non-preforming partner.

19.12.01

We suffered an unexpected leak in the pool and leak issues when was caused by minor settlement issues. This exhausted cash reserves by $15,000.

Proper due-diligence costs $2,000-3,000 during inspection phase and above and beyond normal inspection.

Going forward we will pay for these checks in locations in the Gulf (Texas and Mississippi) where settlement issues are common. On other locations and properties larger than 250-units we will preform spot checks on a random sampling of buildings.

13.03.01

Operating partner runs deal into ground.

See story here.

Only with those who you know, like, and trust. Build a relationship with other passives as the gold standard of verifying track record. This was why the Passive Investor Accelerator & Mastermind was created.