19.4 – REPS + What to Deduct Master List

Life is not fair 😥

The tax code is one prime example – with deductions and benefits sprinkled throughout its pages to encourage entrepreneurship vs. punching a clock.

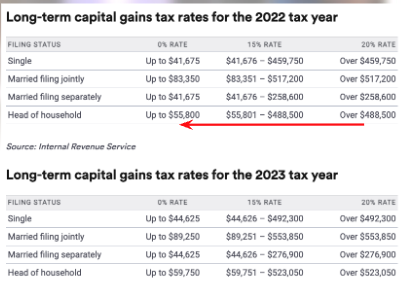

Most people complete the 1040EZ form and the only options (says your ill-informed CPA) seem to be a Roth/401K/TSP/403B retirement account. While clock punchers (salary people) can pay up to a maximum federal tax rate of 37%, where we as passive investors generating passive income (not active income) from investing in private companies, could pay the maximum capital gains rate of 20% on both profit distributions and long-term growth.

We on the other hand are looking to maximize income while minimizing taxes and turbo charging our returns with alternative investments.

For people in FOOM (accredited and semi high income) I think as a general rule everyone should be looking to drive their AGI (married filled jointly) to ~200k which is a little more aggressive than 340k as I had once said as a good starting point. A second reason is to decrease your Long-term capital gains down from 20% => 10% => 0% which is possible if you focus on driving your AGI down. Using an analogy from diet/health... as you loose weight your biomarkers and body stress does down making it easier to exercise and continue to make positive progress. Many ways to lower your AGI and I encourage you to join our Family Office Ohana Mastermind for individual assistance on your personal situation.

Lane Kawaoka

W2 vs Investor Tax Liability Comparision

Let’s compare the tax liability between a CEO of a private company and an investor in a private investment fund:

CEO of Private Company

- Income - $1M/Year

- Income Type - Earned Income

- Relative Tax Liability - $370,000 ($1M x 37%)

Investor in Private Investment Fund

- Income - $1M/Year

- Income Type - Passive Income

- Relative Tax Liability - $200,000 ($1M x 20%)

For this example, we assumed the top capital gains rate of 20%. The investor will pay a whopping $170,000 less in taxes because passive investments like private investment funds are typically set up as partnerships (LPs or LLCs). The tax code incentivizes capital to create businesses, innovations, and opportunities, which will, in turn, provide jobs for millions of worker bees taxed at ordinary rates.

Additional Passive Investor Tax Benefits

An additional tax benefit for private fund investors is the exemption from paying FICA (social security & medicare) payroll taxes. In our example, that’s an additional savings of 7.65% per year or $76,500.00/year.

NOTE: Gains from the eventual sale or redemption the investors partnership interest will also be taxed at the long-term capital gains rate.

Tax Benefits of Private Real Estate Offerings

Whether investing directly in a private real estate investment company, through a private equity fund, or a tenancy-in-common investing in private real estate offerings offer an additional layer of tax benefits.

Some of the most common real estate-related deductions include:

- Depreciation (Accelerated)

- Mortgage Interest

- Property Tax

- Operating Expenses

- Repairs

In a private real estate investment fund, these deductions are distributed to their partners on a pro-rata basis and reported on each partner’s annual K-1. Deductions that are considered passive losses can be used to offset passive income while any other deductions can be used to offset ordinary income to reduce tax liability.

So for the professional still collecting a salary from their day job, a passive real estate investment could even reduce that ordinary tax liability.

Here’s a rundown of the major real estate tax benefits:

Regular depreciation deductions allow investors a business deduction for the cost of items that have a "shelf life" like a building. The typical depreciable time-period is 27.5 years. For example, if the cost basis of a multi-family property (the building only and not including the land or improvements) is valued at $1,000,000, the annual depreciation deduction allowed over 27.5 years would be approximately $36,400. In a passive investment, this depreciation would be distributed pro-rata to all the partners. The practical effect of depreciation deductions is that a passive investor will pay little to no taxes on their periodic profit distributions.

Cost segregation is a tax strategy that dissects construction costs from the purchase price of the property that would otherwise be depreciated over 27.5 years. Cost segregation is typically conducted by an engineering company and reported on a cost segregation study. The primary goal of a cost segregation study is to identify all property-related costs that can be depreciated over 5, 7, and 15 years as opposed to 27.5 years for the building. This accelerated depreciation allows greater deductions in the earlier years of the life of an asset.

One of the major changes from the Tax Reform Act was the bonus depreciation provision, where businesses can take 100% bonus depreciation on a qualified property purchased after September 27th, 2017.

A 1031 exchange doesn’t typically come to mind when considering private real estate investment funds, but there are options for passive investors to take advantage of this tax benefit that allows a swap of like-kind commercial property to defer the capital gains. Although most private real estate funds are not set up for qualified 1031 exchanges from an investor’s personal property, this same investor could do a qualified 1031 exchange flipping his interest in one private real estate fund to another real estate fund under the same sponsor.

As part of the recent Tax Reform and to encourage private investment in distressed communities, the government has instituted significant tax breaks for investors who invest in Qualified Opportunity Zones.

By investing in an Opportunity Fund, an investor can:

- Defer taxes on the original capital gain until the end of 2026.

- Reduce up to 15% of the tax bill on the original capital gains if remain invested in the Fund for at least 7 years.

- Eliminate the tax on any appreciation (new capital gains) on the original investment after the 10-year mark in the Opportunity Fund.

Investing Tax-Free w/ Retirement Accounts

While most investors are familiar with the capital gains deferral benefits of 1031 exchanges, many are unaware of the tax deferral and even the tax elimination benefits of investing through a Solo 401 (k) or a Self-Directed IRA (SDIRA).

A Solo 401(k) plan is an IRS approved retirement plan, suitable for business owners who do not have any employees, other than themselves, and perhaps their spouse. It is a traditional 401(k) plan covering only one employee.

A Self-Directed IRA is an IRA that gives you control over your investments. Unlike other IRAs held at banks, brokerage firms, and other institutions, you’re not limited to stocks, bonds, or mutual funds.

Both the Solo 401(k) and the SDIRA allow you to invest in alternative assets including real estate, private investments, limited partnerships, commodities, etc. This is what distinguishes Solo 401(k)’s and SDIRAs from 1031 exchanges, which are limited to direct real estate investments.

Solo 401(k)’s and SDIRA’s both offer traditional (tax-deferred) and Roth (tax-free) options. Whereas the traditional options are funded with pre-tax dollars, the Roth options are funded with after-tax dollars.

Then pairing these alternative investments with a retirement plan such as through a Solo 401(k) or SDIRA could result in significant tax savings – especially through the Roth options where gains can be accumulated and withdrawn TAX-FREE.

In conclusion, utilizing Passive Activity Losses (PALs) to offset our Passive Activity Income is the basis of our strategy. But that is just the start! See below on how we can take additional deductions for items that are necessary to our business of investing.

Why do a C Corp (Not a sole prop) – “Deductible not reportable” (25k a year at least)

- Administrative Office 10-30% (not a "home" office)

- 280A - “augusta rule” use of house for corporate meetings

If democrats win…. maybe we should convert more of our retirement accounts (QRP funds) to cash NOW.. Taxes will be going up but understand that it is (mostly for higher tax brackets – 400k AGI and above)

TAX-FREE (RENT) MONEY – Augusta Rule (IRC Section 280A)

NOTE – WE ARE NOT GIVING LEGAL OR TAX ADVICE. PLEASE CONSULT YOUR PROFESSIONAL

Common business practice is to rent out facilities in order to hold board meetings and conduct important matters of business. The Internal Revenue Code 280A allows for a business to rent a home or place of residence instead of a meeting facility to conduct business. This is a tax strategy that allows an individual to rent out their home to their business.

The tax benefits can be significant. The IRS allows you to rent a home for a maximum of 14 days per year (IRC 280A(g)(2)). The tax benefits come into play because the business owner is able to write off the amount as a rental expense, while you, the homeowner, are able to receive non-taxable income. Therefore, both parties benefit significantly from this tax strategy.

- Own a profitable entity electing to be taxed as a Sub-S corporation (single-member LLC, multiple-member LLC, or Sub-S corporation).

- Have a regular office outside of your home.

- Must own your home; land contract or greater interest (Section 280A does not exempt sublease rental income).

Prerequisites

- Own a profitable entity electing to be taxed as a Sub-S corporation (single-member LLC, multiple-member LLC, or Sub-S corporation).

- Have a regular office outside of your home.

- Must own your home; land contract or greater interest (Section 280A does not exempt sublease rental income).

Augusta Strategy

The Augusta Strategy is so named because of the Augusta Golf Tournament. Under this tax strategy the IRS allows a business owner to rent their primary residence or a vacation home to their business for up to 14 non-consecutive days each year. The residence can be located anywhere in the United States and the income is excluded from taxable income for the residence owner / business owner. The rental is established with a lease agreement between the business and residence owner, with pricing supported by researching and documenting comparable space for a similar event.

1. Create a lease agreement between you and your business entity.

2. Get comparable quotes from hotels or other venues on what it would cost to rent a space comparable to the square footage of your home.

3. Choose a fair rental rate for your board meeting or other business activity.

4. Document the meeting took place in a simple memo.

5. Write a check to yourself for the rent and attach a copy to the lease agreement.

6. Issue a 1099 from your business to yourself at year end for the rents.

7. Report the income exclusion on your personal tax return.

Case Study:

Client A is a shareholder and director of Corporation B. Corporation B manages limited partnerships and other investments and holds monthly Board meetings on the third Friday of every month. For the past year, the meetings were held at the local Hyatt in one of the meeting rooms.

- A television and VCR were rented

- Food was provided

- The meeting room was rented at $1,000 a day

Client A decides to offer his home to Corporation B to hold the

meetings.

- Video system is far more extensive

- The food is less expensive

- The home has a meeting space equal in size to the one rented from the Hyatt

Client A says he will rent his residence to Corporation B for $900 per day. Corporation B agrees after checking on other similar accommodations in the area.

Client A can rent the corporation his home for 14 days without having to claim the monies as income. The corporation can still deduct the payments, so this is truly a tax-free strategy. Under the above scenario, Client A would be able to receive $10,800 as non-taxable income.

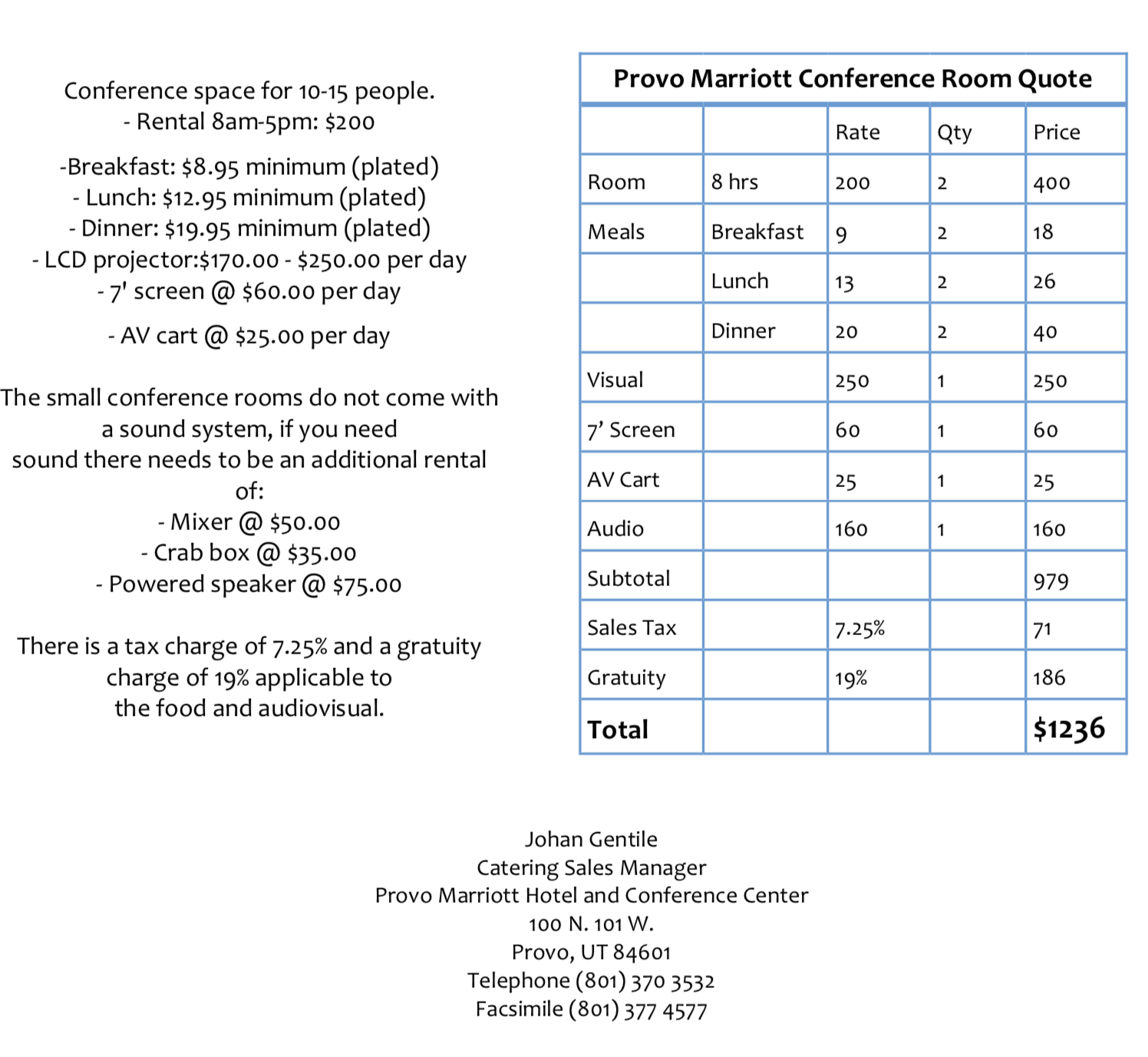

Current Market Rate – The general rule of thumb for determining the amount that you are able to charge a business that you own or control, is to determine the amount that a third party (i.e. a local hotel) is currently charging. You are able to charge an amount consistent with the current market rate of facilities located in your same area of residence. For your convenience, we have provided a quote from the Marriott hotel in Provo, Utah.

Backups:

You will need to enter into an agreement to rent your residence to your corporation; this agreement will need to be kept as supporting documentation.

There will also need to be documentation of the meeting that takes place. It is important to keep the minutes from your meetings, specific information of what was discussed, who attended the meeting, and what expenses were incurred to hold the meeting.

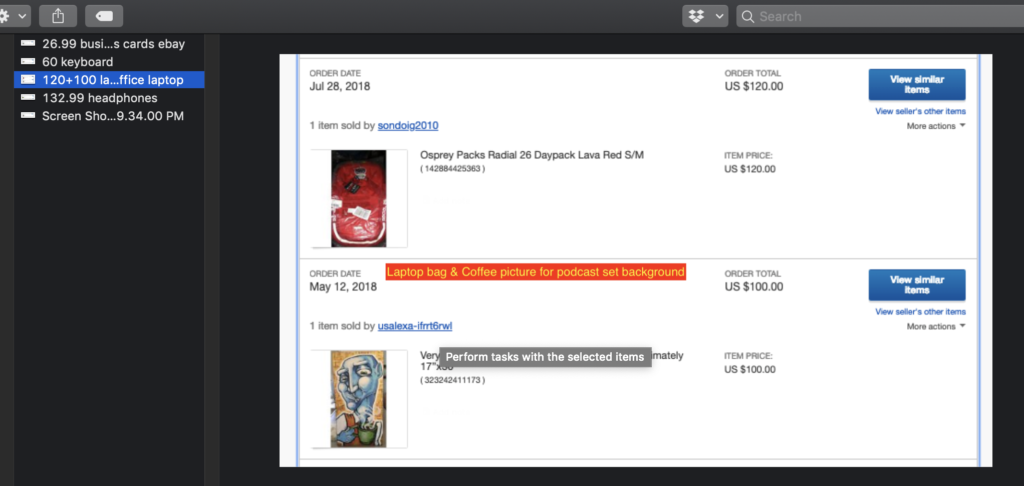

What do you deduct (Master-list)?

- Cell phone

- A drone to take pics of deals

- Internet

- Cable to watch HGTV

- SimplePassiveCashflow.com/charity

- SimplePassiveCashflow.com/retreat

- SimplePassiveCashflow.com/hui3

- Clothing (if your job/business requires it)

- Laundry while traveling

- Travel expenses while visiting rentals or networking

- Coaching or masterminds

- Postage

- Meetings and food with the team

- Infrequent retreats/team building

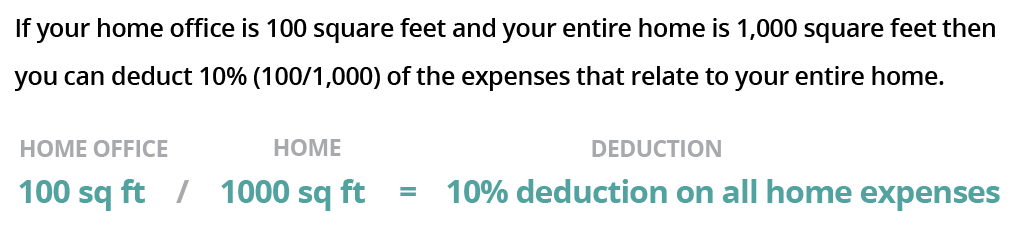

- Administrative Office (exclusive-use) - utilities, homeowners insurance, security, repairs only for the room.

- Car mileage in excess of W2 car commute that is justifiable

- Use MileIQ to track and categorize trips as non-W2 biz.

- If you’re working at home and also somewhere else, driving between those two locations becomes deductible business mileage rather than non-deductible commuting mileage. This deduction is because you are driving between two places of business (the home office and the other place of business) rather than home and the business (commuting.) Keep in mind that there is a requirement that the two places of business must be in the same industry. So just because I blog at home before going into a shift at my engineering job doesn’t mean I can deduct that mileage. Different industries, so it’s not business mileage, it’s a commute. Tom Wheelwright says if you want to change your tax, then you need to change your facts. This is why a lot of passive investors are siding real estate agents or short-term/rental property owners locally because that opens up a lot of avenues for business deductions for example talking to vendors or potential clients.

Supplies (technically you can only deduct the % of the expense that is actually used for business but many people disagree on this one)

- Office supplies

- Furniture

- Phone line

- Computer

- Books

$2500 per line item per invoice (i.e. refrigerator) to avoid having to depreciate the asset over many years - [if you can buy something under the $2500 threshold DO IT] https://youtu.be/bTRNi7QXdXU

Safe harbor for small taxpayers (SHST) A “qualifying taxpayer” may immediately expense all repairs, maintenance, and improvements cost as long as the costs do not exceed the lesser of (a) 2% of the unadjusted basis of the property; or (b) $10,000.

- Unadjusted basis = original cost of the building excluding land value

- Qualifying taxpayer” means:

- The unadjusted basis is less than $1MM

- Average annual gross receipts from three prior tax years are less than $10MM

- The annual expense limit can disqualify you… on a $200k unadjusted basis, we’re looking at a max expense of $4,000 to take this safe harbor

- Likely better to just use DMSH

- Use SHST for building with an unadjusted basis in between $500k and $1MM

More than half of your days must be “business days” - Business day = 4+ hours of business-related work (Includes door-to-door travel time)

Sandwich rule = If it would cost more to go home and return rather than to remain at your destination, these days are considered business days. Example: travel to your rental on Friday, rest Saturday and Sunday, work on the rental Monday and Tuesday. All days, including Saturday and Sunday, are travel days. Cannot deduct lodging, transportation, and meals on personal days

- When you take a business trip, you incur two types of tax-deductible costs:

- Business-day costs - the expense of sustaining life while at the business destination

- Transportation costs - getting to and from the business destination

- Some examples from the IRS:

- Costs of traveling between your home and your overnight business destination

- Costs of traveling by ship

- Costs of renting a car or taking a taxi, commuter bus, or airport limo from the airport to the hotel and to work destinations, including restaurants for meals

- Costs for baggage and shipping of business items needed at your travel destination

- Costs for lodging and meals (meal costs include tips to waiters and waitresses)

- Costs for dry cleaning and laundry

- Costs for telephone, computer, Internet, fax, and other communication devices needed for business

- Tips to bellmen, maids, skycaps, and others

Administrative Office (Home Office)

We all know we can do this but WHY is important… depending on what kind of business you are running… you can write off mileage when you go to the bank, store, client. But having a home office puts a flag in the ground as a place of business. As a rental property owner, you can dedicate a room, or a portion of a room, to a home office granting you a deduction. Having a home office also allows you to consider local transportation as a business expense instead of as a personal expense.

Home Office Reimbursement

In order to lock in the home-office deduction for an S corporation, the owner-employee must submit an expense report to the S corporation for reimbursement of their expenses. To make this easier for you, we created an Excel spreadsheet for your use that clarifies and simplifies the calculation needed for the reimbursement. Further, the request contains the audit-proofing elements you want in place to protect this reimbursement.

Employee Vehicle Reimbursement

Overview In order for the corporation to deduct an employee’s business use of a personal vehicle, you need to use an expense report.

The expense report that the employee submits must include:

a receipt for the vehicle purchase that shows the ownership and the cost of the vehicle;

a statement of recognition that the reimbursements of Section 179 expensing and/or bonus or other depreciation reduces the basis in the employee’s vehicle for purposes of gain or loss;

a statement of recognition that employees will reduce the overall annual Section 179 limits that apply to them and their spouses on their personal tax returns by the amount of Section 179 expensing reimbursed by the corporation;

a statement of recognition that if business use of the vehicle drops to 50 percent or less, the employee will reimburse the corporation for the required recapture of deductions in excess of straight-line depreciation (this requirement disappears when five years have passed or when they sell or trade the vehicle);

and a mileage log that proves the percentage business use of the vehicle

Safe Harbor for Home Office

IRS Rev. Proc. 2013-13 allows for a “safe harbor” deduction for anyone with an established home office. The deduction is $5 per sq. ft. of the home office annually. Per IRC § 280A, a home office must be used:

(1) Regularly and exclusively as the principal place of business; and

(2) Regularly and exclusively as a place to meet or deal with patients, clients, or customers in the normal course or trade of business. Also don’t forget about writing off the (percentage of home to the home office of Utilities (Oil, Gas, Electric, Water, Phone, etc.), Homeowner’s Insurance, Landscaping, Office Furniture, Mortgage Interest (Not Principal), Internet, Office Supplies

If your home office is greater than 300 square feet), but I’d try to avoid it just for simplicity’s sake. Unfortunately, that $5/square foot figure is not indexed to inflation. Also, unless you’re in a pretty inexpensive home (especially if renting) going through the 44 line Form 8829 is probably going to get you a larger deduction than the simplified method. But AT LEAST take the simplified method. The simplified method also has the advantage of not being recaptured when you sell the home, which is worth something.

Writing off Your Home

You must regularly use part of your home exclusively for conducting business,” writes IRS.gov. For example, if you use an extra room to run your business, you can take a home office deduction for that extra room.

In the unfortunate event of an audit, you might have a difficult time proving that your family room is a home business if your “office” also includes your wide-screen television and pool table.

Deduction Tip: At the end of the year scroll down your past Amazon purchases and see if you are able to deduct any!

Operating expenses that are not deductible

- Personal portion of use or travel

- Business gifts exceeding $25 per individual per year

- Fines and penalties

- Lobbying expenses and political contributions

- Education that prepares you for a new trade or business (Treas. Reg. Sec. 1.162-5)

- Charitable donations (deducted on Schedule A instead)

- Country or social club dues

- Income taxes paid

Documentation process

Come out with your own process. Dealing with auditors 101.

Example: Google Drive, images/receipts/W9, ledger, and means to divide expenses amongst business units.

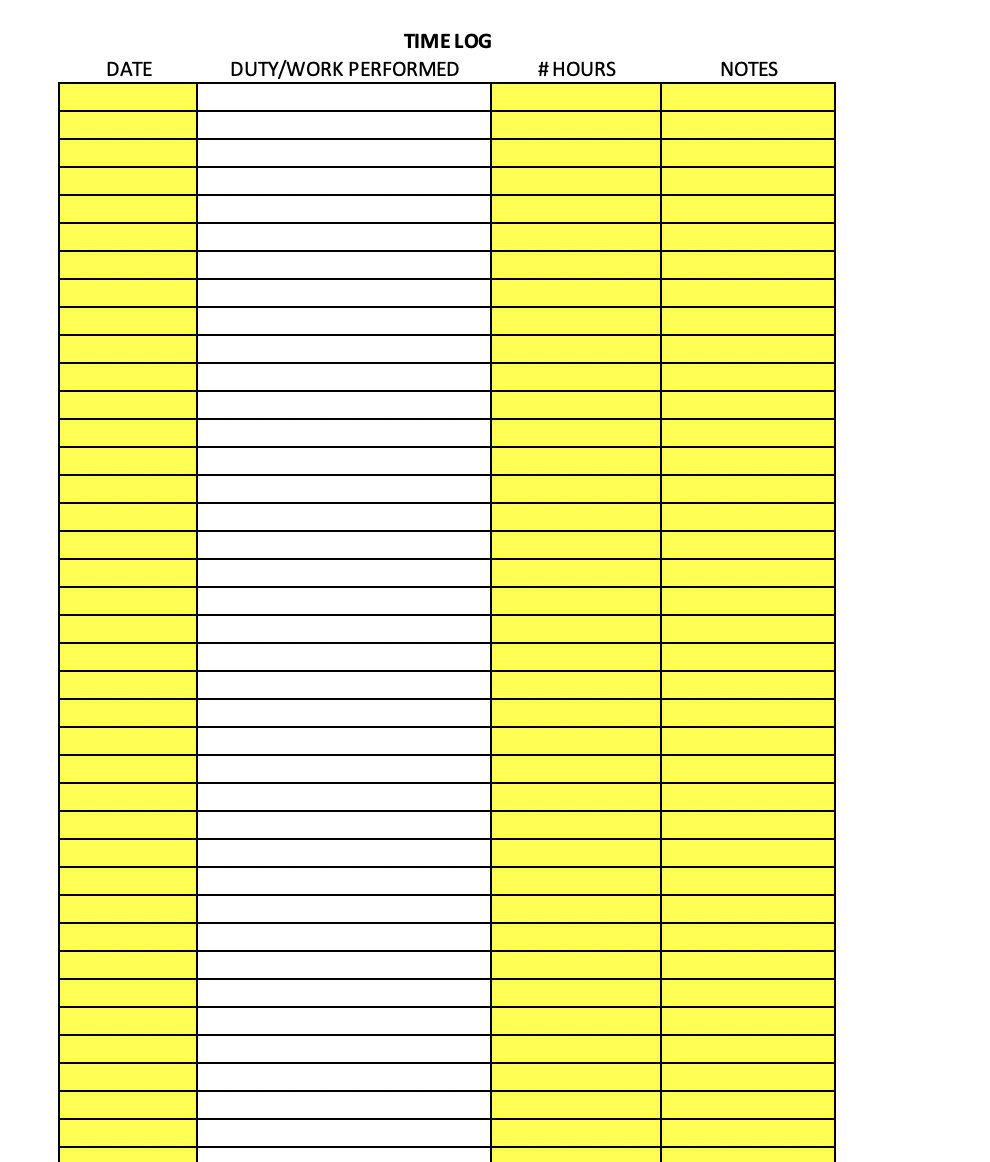

Again tie it into your Real Estate Professional Status Log:

Real Estate Professional Status

Otherwise known as REP status requires you to have 1) 750 hours in real estate + active participant in your portfolio and 2) More than 50% of the time

This allows you to use Passive Losses from your real estate deals to knock out your Ordinary income (W2, 1099). Whereas if you did not have REP status you would just be able to use Passive Losses from your real estate deals to knock out your Passive income.

Yes, it can but until you are in business (make income) you cannot use these expenses. Similar to when we purchase an asset and do a cost seg... we cannot use those losses until we put the asset into service and make a dollar of revenue.

The IRS will take the position that travel time doesn't count and will not include these hours towards these tests under audit.

How to Prepare and File Form 1099 📃

Prepare 🖥️

1. Navigate to www.track1099.com and either create an account or log in.

2. Select the Track1099 button.

3. On the 1. Add New Payer tab, select Manual Entry or CSV. Note: you may also select the QBO/Xero or “Add Many” payer buttons if

you are filing many 1099s.

4. After inputting the Payer information, click Save.

5. Enter the recipient information, click Save.

File 📂

File Form 1099

1. Click the 3. Forms Summary tab.

2. Review list of forms. If no Errors, then you are ready for e-filing.

3. Click the 4. E-File tab.

4. Select who will mail the 1099. You can mail or Track1099 can mail.

a. We recommend allowing Track1099 to mail.

5. Enter payment information and click Pay Now .

6. Click the 6. Download tab. Download the Form 1099.

7. Upload the Form 1099 to your client portal with our Firm.

- Determine the fair market rental value for your primary residence/entire home for a short-term rental (e.g. 1 day) for offsite corporate meetings, business meetings, staff retreats, or employee events (e.g. $800 – $1,200 a day). One or two times a year, you can use your home to host an annual employee Christmas party and/or summer picnic.

- Once the fair market value has been determined ($800 – $1,200 a day), document a one-day rental agreement between your Sub-S corporation (a separate legal entity) and the owners of your primary residence (you, your spouse, trustee of the trust).

- Hold the event and have your Sub-S entity pay rent to the owner of the house.

- Document the business activity that occurred. Match it up with the invoice for outside catering, if any, to substantiate the business purpose of the meeting.

- Payment from your Sub-S entity to you as the owner is both:

- 10 - 14K tax-free to you, as long as the rental is 14 days or less per year,

- A legitimate 10 - 14K business deduction for your Sub-S entity.

Where does this expense go? Part V of Schedule C (lines 48 and 27a) or lines 20 or 19 of Form 1065 or 1120S respectively. Again, that is for you to understand what inputs are needed, but you should be using a professional to do your taxes. Not TurboTax!