Preview 1) The End In Mind & Taxes

Buy the eCourse

See all eCourses

Below is a sample of the Full Syndication For Passive (LP) Investors eCourse

Check out free version here

After over 2,000+ strategy calls with investors and coaching clients over the past few years here is what I tell W2 employees… For those who are able to save more than $30k a year or have substantial liquidity (over 200k), being a landlord and especially flipping is a lot of work. If you like it cool/good for you… but just remember why we got into this… To be free from a JOB. A lot of us (80%) who stumbleupon simplepassivecashflow.com and start drinking Kool-Aide will be financially free in 4-7 years pending taking action. So I always urge people to start with the end in mind and take a more passive approach.

Directly investing in a turnkey rental or small MFH is a good way to start to learn and build up the war chest to go into my scaleable investments such as private placement syndications. Whatever you do, try to be as close to the investment as possible. This is the fundamental problem I have with Wall Street who takes too much fees off the hard-working efforts of the middle class.

If your net worth (income minus expenses) is under $200,000 or barely save $30,000, syndications are not for you. Stick with these Turnkey rentals despite what Gurus (who are trying to sell you their program) tell you for now. They have a little higher gains (a lot more volatility) but a syndicator who is willing to put you in a deal with more than 10-20% of your net worth is asking for trouble. Mostly because it is a sign of a desperate syndicator with little to no track record and/or the deal is not strong. I call these deal sucker deals as it prays on new investors who have little experience and more importantly little peer investor network (other LPs around them).

Do the math here… you with 300 dollars per property (2 months of work to buy a turnkey rental) you are going to need 20-40 of these to replace your income. I have 10 of these and have systems in place but have 1-2 evictions a year and 3-4 big things that happen. Imagine if I had 30, just 3 x those numbers.

*PS never like the idea of wholeselling where you basically steal houses from people at 50 cents on the dollar and say you are “helping people solve problems”

Syndications vs. Single Family Homes

Most investors start off with single family homes or duplexes, which is a great avenue to start a real estate investing journey. However the issues that come with single family homes (SFH) include:

Non-Diversified Risk

Investors are tied down to that one house, if a tenant moves out, the investors monthly income stream is at a standstill until the next tenant moves in. In fact, the investor will directly be responsible for all of the associated expenses: the mortgage, insurance, tax, etc. until the next tenant is found.

Difficult to Scale

There is a point in time when a few hundred dollars in profit margin for the first few years per property just doesn’t seem enough. An investor would have to invest in 10-20 properties to ever replace one’s salary. Additionally even if an investor acquires 10-20 homes, the time invested to dealing with broken faucets, evictions, late payments, etc. is a headache even with a property manager for the return that it provides.

Cash on Cash (CoC) Return is Limited

When investing in a single family home, one has to put down a minimum of 20% of the purchase price to acquire the home. For a 8-10% return, while it’s worthwhile to have since there is a profit margin. There are other real estate investment opportunities that may provide more return for the capital that is invested.

Syndications invest in multi-occupancy properties, therefore one or two tenants moving out of 20-30+ tenants, don’t impact the net income as heavily as it would per SFH. Syndications provides a great avenue for scalability. Similar to SFHs provides returns from monthly cash flow as well as appreciation. However the year over year 2-3% increase in rent for 20-30+ spaces will increase the net income of the property and your return more than a 2-3% increase in rent for a SFH.

Pros of Investing in Syndications

There are still plenty of reasons to invest in single family homes – building legacy wealth, relatively low cost way to learn about investing in real estate and for the most part SFH is a stable monthly income stream. However investing in the right syndications, can help with all of the above issues with investing in SFH.

- Minimizing PITA (simplepassivecashflow.com/pita): No more managing tenants, vacancies, maintenance, and managing the manager (who is a $12-20 dollar employee who’s compensation structure is not aligned with your goals) By passing the control of the day to day operations to true experts who are literally partners (direct alignment of compensation and motivations), you can ensure the investment is being optimized while you spend your time on what you want which is:

1) Making more money at your day job

2) Spending time with your family

3) Finding that one off deal that you want to do one your own while pairing with a Limited Partner strategy. - Asset Diversification: Many commercial real estate investments have high acquisition prices (think $10M+) where most people don’t have access to. You want to get away from these other Mom and Pop invests like these 1-40 units.

When I was a syndication newbie and thought I could do everything by myself and did not trust anyone.

I then realized in a few months that 1-40 unit deals had horrible pricing because all the amateurs were involved and the ones that looked good from a per unit price prospective were under 80% occupied and had ISSUES. Investing passively in a group can allow you to invest in multiple asset classes (apartment/mobile home/assisted living), in multiple locations and with varying business plan duration. - Cash Flow: The goal of a LP syndication investor is to create a “ladder” of investments that create accumulated cashflow and cashouts at different times. It’s like your grandpa’s CD ladder strategy but with 10-30x returns.

- Tax Deferred Status: All the deprecation benefits of single family home being your DIY direct investing but even better! Bigger deals are able to pay for a cost segregation to squeeze out even more depreciation.

- Avoid Credit and Liability Risk: Investing passively allows one to avoid being exposed to credit or liability risk. No W2 documented income no problem! You do not need to personally guarantee multi-million dollar loans and and be the fall guy. Plus now you can get into all the travel hacking credit cards and tradelines you want (Simplepassivecashflow.com/tradelines).

Liability in Syndications

In real estate syndications, there are typically two sides of the operating agreement: the “A Side,” which lists the managing members who are responsible for the decisions behind the fund, and the “B Side,” which lists the investors who bring only capital to the table. Under no circumstance will “B Side” investors be responsible for making management decisions of the fund, and, therefore, under no circumstance would a judge find the “B Side” investors liable for decisions made during the fund’s performance. This way you are completely removed from any lawsuits that may arise due to fund-related activities.

Even though single-member LLCs provide significant asset protection, if you are going to receive a large loan from a bank, the bank will usually require a personal guarantee from a natural person.

Let’s say you invest $50,000 in a real estate syndication that is purchasing a $9,000,000 student housing building. A bank is providing a $6,300,000 loan at a favorable 5.5% rate, which will be signed by the managing operator and, therefore, his/her credit will be on the line. Because of this access to inexpensive leverage, the returns will be notably higher than buying the property in all cash.

First of all, the reason the bank is willing to loan the operator more than six million dollars is because of their experience in the field, track record, and credit worthiness. If you do not have a similar track record, it is unlikely that you would be accepted for a similar loan size. This way, you are able to take advantage of the operator’s experience to acquire a large loan that you probably wouldn’t be approved for, but you still have no liability on the loan.

Adding another layer of protection between you and the asset allows you to leverage another’s expertise with your capital, distance yourself from the liability of the fund, and receive sizeable gains as a passive investor. This concept encompasses the whole ideology behind real estate syndication investments.

What is a Syndication?

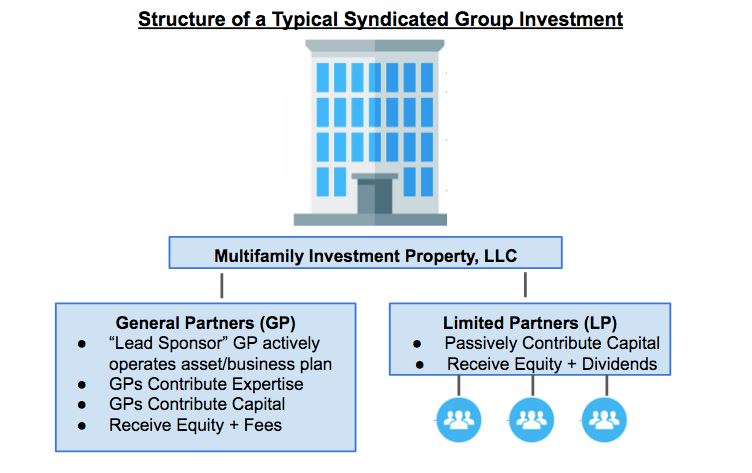

A real estate syndicate is formed when individuals or entities pool expertise and or funds together to invest in real estate. Typically there is a sponsor or general partner (GP) who leads the effort of raising capital from investors, finding the property to invest in, managing the improvements and disposing the property to generate a profit.

The upside to real estate syndications is that it’s an effective way for a group of investors to pool their funds to invest in larger properties than they would as individuals. Syndications can also leverage an operator’s expertise in a specific location or asset class, which in turn can help diversify an investor’s portfolio.

Like in everything there is much to learn and you have to put in the work and learn it to get pass the newbie level. Like going to the gym and beginning to lift non weenie weight. Which is why I mentioned a while back ago that most people should start out with single family homes.

Personally I am sold that this is the safest and scalable way to invest for high net-worth investors.

I use an airplane analogy when I explain these syndications.

In an airplane, there are the General Partners (GPs) in the cockpit who fly the airplane (find deal, negotiate, find investors, line up lending, manage the 3rd party property management, operate the investment). They are typically signing on the debt and their net worth needs to be greater than the loan size.

In coach, you have the passive investors or Limited Partners (LPs) who come on the plane and go to sleep. LPs provide most of the money to finance the deal and in return they receive equity, a monthly or quarterly cash dividend, and receive profit shares when the property is sold (based on their equity shares).

Change later (Copyrighted image)

Syndication Property Types and Deal Structure

Property Type: Most commonly bought are large “multifamily” rental properties (apartments). They have “value-add” opportunities (adding amenities, remodeling unit interiors, fixing up exteriors, or improving management). These “value-adds” ensure forceable appreciation which increases the property value regardless of market conditions.

Property Size: These deals can range from 100-500+ apartment units that have amenities such as pools, gyms, management offices, etc.

Location: They are bought in growing cities that have diverse economies and large populations. The properties and locations are typically Class B which attracts the largest group of potential working class tenants.

Price: Deal prices can range from $5-$75 million. 20% of the deal price plus a little extra for those “value adds” needs to be raised to fund these deals.

Equity Split: The common share in ownership between LPs and GPs is a 70/30 split. LPs get 70% of the total equity for providing most of the money to fund the deal while the GPs get 30% for finding, executing, and maintaining the deal.

Timeline: The typical investment time frame is 5 years.

How are Investors Paid in Syndications

Preferred Returns

Preferred Returns refer to the threshold where profit sharing between the investor and sponsor begins. Investors receive 100% of the distributable cash flow until this threshold (usually a percentage such as 8%) then above that threshold, the sponsor receives some of the distributable cash flow.

The distributable cash flow is the gross revenues minus expenses, debt service, and fees.

At or below the threshold, the sponsor will receive zero profit share. This is an incentive for the sponsor to do their job. If the deal does go south, it’s the investor that takes the risk, so to correct that, when the sponsor also puts his/her own capital in the deal that fully incentivises them to do everything they can to make sure that project goes well.

Example: Let’s say Simplepassivecashflow is giving 8% cumulative preferred return then a 70/30 split.

Year 1: The distributable cash flow is 5%, investors receive all 5% and will be paid 3% in a future distribution (8% preferred – 5% actual = 3%)

Year 2: The distributable cash flow is 7%, investors receive all 7% and will be paid 1% in a future distribution (8% preferred – 7% actual = 1%)

Year 3: Let’s say that the GPs refinance and sell assets so the distributable cash flow is 16%. Investors will receive 8%, and 4% (3% from 1st year + 1% from 2nd year). The remaining 4% will be split between the investors and GP, investors will also receive (70% of the remaining 4%) while the GPs will receive (30% of the remaining 4%).

Year 4: The distributable cash flow is 10%, investors receive the first 8% then split the remaining 2% will be split 70/30 between the investors and GPs.

This is just a simple example there are some exceptions, some syndications don’t have a cumulative preferred return, where they only pay based on the current year of cash flow, so investors won’t make up returns on down years.

Most syndications have a dwindling principal in which the outstanding principal is taken into account in the preferred return calculation, if the principal is paid down through payments above the preferred threshold, then the preferred return would be calculated as a percentage of that lower principal.

Also there may be a catch-up provision, if investors receive their preferred returns, all returns above that threshold are paid to the GPs until the total split reaches 70/30 (or whatever split is agreed upon).

Equity Splits and Profit from Sale

The ultimate goal is to sell the investment property at a higher valuation than what it was bought for. If the property sells for $10 million and it is a 70/30 split, the LPs and GPs will receive profits based on their equity splits; LPs would get 70% ($7 million) while the GPs would get 30% ($3 million).

The equity split and profits from sale is where most of an investor’s projected return comes from.

Investing in a Project: Debt vs. Equity

You have two options for investing in a project: Debt or equity. When you invest money on the equity side, you become a part owner in the project. This means that you are taking on greater risk, but for a greater return. Often you’ll receive quarterly distributions from your investment. The risk, of course, is that as an owner, if the project goes sideways you could lose your money.

If you invest on the debt side, you’re essentially a private lender for the project, but not an owner of the property. This comes with lower risk, but also lower returns. Where you could get 10%+ with equity, you’ll likely receive around 3% with a debt investment.

For either, it is important to understand the timeline of the project to make sure it matches your expectations. In many markets right now, it makes more sense to buy and hold than to flip (especially in commercial or mixed-use properties) so those investment timelines could be 2 years+.

How does a Non-Accredited Investor Get Into the “Country Club”

I’ll be blunt, non-accredited investors are painful to work with from a syndicator’s point of view due to the following reasons:

- Require special handling due to protections enforced by the SEC

- Require education because non-accredited investors are in low net worth peer groups and not privy to sophisticated/accredited investor knowledge

- Often times the minimal investment is a great amount of their net worth and along that comes with a lot of emotional ties to the money. I.e. they bug the syndicator all the time.

- A few deals will exhaust the Non-Accredited investors funds. Minimal customer lifetime value.

- Their peer group is filled with more… Non Accredited investors

Some tips for getting into 506B – Deals that accept non accredited investors.

- Understand that many syndicators will have a no Non-Accredited policy

- Be serious and get educated so when you build a relationship with a syndicator you separate yourself from the rest of the “tire kickers”

- Always give a reason for not investing, always close the communication gap

- Be forthcoming if you are “kicking the tires”

- Add value to the syndicator, respect their time. They are interviewing you as much as you are interviewing them.

But what about taxes?

As a passive real estate investor (who is greater than $500,000 net worth or making over $150,000), it’s essential to understand the tax implications and benefits of investing in a private investment fund/syndication/private placement.

These investments are typically organized as partnerships in the form of LPs (limited partnerships) or LLCs (limited liability companies).

The investment fund invests the money it pools from investors, and each investor shares in the profits and losses in proportion to the investor’s interest in the investment company. Investors are treated as passive partners for tax purposes.

This structure allows you to compound 100% of the fund’s proceeds for years, as long as you do not distribute the gains outside of the fund. For instance, let’s say you are investing in a syndication where the sponsor is purchasing a fully occupied apartment building and holding it for cash flow. Because of depreciation, interest payment write offs, expense write offs, and so on, your annual tax exposure for this opportunity will usually be zero or even NEGATIVE, even if you receive thousands of dollars in distributions from the property’s cash flow. Of course, when the property is sold, the investors will pay taxes on the gains they receive from distributions, but giving your money the chance to compound without paying taxes can completely change your portfolio’s trajectory.

Most investment funds prefer the partnership tax structure over the corporate structure to avoid double taxation and to allow for the fund’s income to be taxed at the investor level and provide for the flow-through treatment of income, expenses, gains, and losses.

Each investor receives a K-1 tax form at the end of the year, reporting the investor’s allocated share of these income, expense, gains, and losses items for inclusion in their tax returns. As a general rule, an investment fund’s profits and losses are allocated to investors on a pro-rata basis unless there is a special allocations of income, expenses, gains, losses, etc. as agreed upon in the partnership agreement. Examples of these K1s are here.

Also as a general rule, profit distributions (including preferred returns) from income that is connected with the fund’s trade or business are taxed as ordinary income. However, this regular income can be offset by the partner’s allocated share of deductions and depreciation.

Also, thanks to the 2017 tax reform, taxpayers who earn less than $157,500, or $315,000 for a married couple, can deduct 20% of the income they receive via pass-through businesses from their overall taxable income.

If a partner receives a distribution from the partnership that is above the partner’s share of the fund’s income as reported on the K-1, these distributions will be considered a return of capital.

While any distributions considered a return of capital is not taxable, the distribution lowers the basis (i.e., original cost) of the partnership interest, which will affect the amount of capital gains realized when the interest is sold or liquidated.

Capital Gains or Distributions from the sale or liquidation of a partnership interest will be treated as capital gains – short-term or long-term, depending on the holding period. The amount of recognizable capital gains will be directly impacted by the partner’s basis in the partnership interest (i.e., outside basis, capital account balance).

Tax Basis (Capital Account) – A partner’s original basis in his/her partnership interest begins with the original capital contribution, and then over time, taxable income and additional contributions will increase the basis.

At the same time, depreciation, expenses, and distributions will reduce it. The basis is further enhanced by the partner’s share of partnership liabilities and reduced by repayments of liabilities.

Example: An investor makes an initial capital contribution of $1,000,000 in exchange for a partnership interest; his initial tax basis will be $1,000,000.

The fund has generated $400,000 in annual revenue, $200,000 in operating expenses, and has allocated $100,000 in depreciation over the life of the investment.

Total taxable income amounted to $100,000 ($400,000 – $200,000 – $100,000). The investor’s share of income that income is $50,000 distribution payments totaled $100,000.

The partner’s ending basis in the partnership will equal $950,000 as outlined below:

If the investor receives $1,000,000 for his partnership interest from a sale or liquidation, that will result in capital gains of $50,000 ($1,000,000 – $950,000).

If you’re considering investing in a private fund, we recommend you consult your tax advisor for a complete discussion of the tax factors of passive investments.

Key definitions to know

Syndication Terms To Know:

Real Estate Sponsor: A sponsor is the investment manager responsible for finding the deals, financing the transaction, performing the financial and risk analysis and ultimately closing the transaction. After the property is owned, the sponsor will be the hands on manager to maximize the value of the opportunity.

Capitalization Rate (Cap Rate): Rate of return on commercial real estate based on Net Operating Income (NOI) divided by Current Market Value. (Example: 100,000 NOI / 1,000,000 Market Value = 10% Cap Rate).

Core Property: Lower Risk/Lower Returns. The most conservative and lowest risk of the four classifications, core property investments utilize lower leverage and tend to generate predictable cash flows. The properties are often positioned in strong markets, like thriving metropolitan areas, and are easily financed. There is a lower probability of sustaining loss of investment on core properties, but this also means the potential for outsized returns is also on the lower end of the spectrum. As such, this category of real estate investment is the wheelhouse of conservative income seekers.

Core Plus: Moderate Risk/Moderate Return. A core-plus investment has some similar attributes as a Core investment. Like Core investments, Core-Plus properties generally have few to no issues with securing financing, are well located and typically have a strong tenant base. The difference is found in a limited elevation of risk and potential for increased NOI, like upcoming lease rollover or light value-add opportunity. Core-Plus will appeal to much the same investor as Core opportunities — mostly conservative, with lower risk tolerance.

Value Add: Medium-to-High Risk/Medium-to-High Return. This class of investment is characterized by the opportunity to improve the investment in some way. In other words, to add value to it. This improvement often comes in the form of enhancing the physical property itself or increasing the operational efficiency. The increased risk of Value Add opportunities stems from the expectation that this improvement will generate higher cash flows and returns.

Opportunistic: Higher Risk/Higher Return. These properties require the most enhancement in order to generate the expected level of returns. What this entails depends on the specific property, but can range from ground-up development to redeployment of existing structures. The potential for outsized returns here is very high, but accordingly the risk is highest as well.

Capital Stack: Describes where the money comes from to buy a deal. The capital stack is typically made up of senior debt (typically a bank or traditional loan), possibly mezzanine financing or preferred equity, then limited partnership, or “LP”, equity and finally the equity contributed by the Sponsor, often referred to as General Partner, or “GP” equity. Generally, the bottom of the capital stack (debt) has the lowest return and lowest risk profile and as you move up the capital stack to Equity and GP, the return and risk potential will both increase.

Question: I am considering investing in a 506c investment on a multifamily property. They are raising a 1 million from investors, then getting a loan and making improvements to the property and repositioning it over 5-7 years.

I wanted to use my funds from my SEP IRA which is currently in a qualified intermediary trust. What is the UBIT tax? Will I be subject to that on this deal? Also, should I set up an LLC that then loans the money to their LLC? How can I structure this for tax and liability benefits?

Answer [Note: From CPA and not this is NOT legal or professional advice]: When you invest in a business (syndicate = business) with your IRA, the IRA will be subject to UBIT (unrelated business income tax) and UDFI (unrelated debt financed income).

For our purposes, UDFI is produced when an IRA uses debt to purchase real estate. Essentially, the portion of the property’s income considered UDFI is based on the percentage of rental income derived from debt.

For example, Property A is purchased for $100,000. You put down 25% of the purchase price as a down payment and finance the remaining 75% with a traditional mortgage from the bank. The property produces $10,000 in net income for the year. $7,500 (75%) of the net income is considered UDFI and is subject to UBIT.

There is a deduction for the first $1,000 of income subject to UBIT. Income subject to UBIT over $1,000 is taxed at trust rates. For 2017, trust tax rates start at 15% and max out at 39.6% after just $12,400 of income subject to UBIT.

UBIT is paid by the IRA account. If for whatever reason UBIT is paid directly by the taxpayer, the amount paid is considered a contribution to the IRA.

Follow up question: Is there any difference in how the UDFI will apply for these:

1) SD IRA

2) SEP-IRA

3) Solo 401K

4) SD IRA (operated as an LLC) so this one is confusing… My LLC owns an LLC (syndication) which owns a property

I’m trying to decide if one is better than another for tax purposes.

Answer: The solo 401(k) is not subject to UDFI but it subject to UBIT. The IRAs are all subject to UBIT and UDFI. Note that generally the passive income flowing back to you is very low and the as a result we don’t see a huge UBIT tax.

Another idea would be to take a debt position (lending) rather than equity. The interest you would receive is free of UBIT and UDFI tax.

(This suggestion of a “debt” position or note investment with the SEP IRA to avoid UBIT and UDFI tax is a creative one… but it’s a very low chance of happening because it’s just too complicated and honestly not worth the effort from the syndicators side. It’s a very similar case of to a Tenant-In-Common (TIC) arrangement where an investor has 1031 exchange funds and wants to parlay that money into a syndication. It’s possible but from the syndicator’s prospective a lot of unneeded work when you can just raise the funds the traditional way. Caveat: if you are bringing in a huge amount of money say 50% of the raise then that might tip the scales in your favor. In the real world, I just spoke to someone who did a TIC and brought a serious percentage of the total raise into a deal. They said they were lucky and the lead told them that it was not worth it and they would never do it again… and to consider it a personal favor)

Question: Why do syndications have the limit of number of people using retirement funds?

Answer: ERISA CONSIDERATIONS

GENERAL

When deciding whether to invest a portion of the assets of a qualified profit-sharing, pension or other retirement trust in the Company, a fiduciary should consider whether: (i) the investment is in accordance with the documents governing the particular plan; (ii) the investment satisfies the diversification requirements of Section 404(a)(1)(c) of Employee Retirement Income Security Act of 1974, as amended (“ERISA”); and (iii) the investment is prudent and in the exclusive interest of participants and beneficiaries of the plan.

PLAN ASSETS

Under ERISA, whether the assets of the Company are considered “plan assets” is also critical. ERISA generally requires that “plan assets” be held in trust and that the trustee or a duly authorized Manager have exclusive authority and discretion to manage and control the assets. ERISA also imposes certain duties on persons who are “fiduciaries” of employee benefit plans and prohibits certain transactions between such plans and parties in interest (including fiduciaries) with respect to the assets of such plans. Under ERISA and the Code, “fiduciaries” with respect to a plan include persons who: (i) have any power of control, management or disposition over the funds or other property of the plan; (ii) actually provide investment advice for a fee; or (iii) have discretion with regard to plan administration. If the underlying assets of the Company are considered to be “plan assets,” then the Manager(s) of the Company could be considered a fiduciary with respect to an investing employee benefit plan, and various transactions between Management or any affiliate and the Company, such as the payment of fees to Managers, might result in prohibited transactions. A regulation adopted by the Department of Labor generally defines plan assets as not to include the underlying assets of the issuer of the securities held by a plan. However, where a plan acquires an equity interest in an entity that is neither a publicly offered security nor a security issued by certain registered investment companies, the plan’s assets include both the equity interest and an undivided interest in each of the underlying assets of the entity unless: (i) the entity is an operating company or; (ii) equity participation in the entity by benefit plan investors (as defined in the regulations) is not significant (i.e., less than twenty-five percent (25%) of any class of equity interests in the entity is held by benefit plan investors).

Benefit plan investors are not expected to acquire twenty-five percent (25%) or more of the Units offered by the Company. Management of the Company intends to preclude significant investment in the Company by such plans. Employee benefit plans (including IRAs), however, are urged to consult with their legal advisors before subscribing for the purchase of Units to ensure the investment is acceptable under ERISA regulations.

Question: I am reading 5.61% Cashflows in the first year and that’s a little low. Where are my high teens returns coming from? Why don’t I just get 12% in www.investinAHP.com ?

Answer: Your 5.61% COC is an incorrect assessment of what this investing is going to kick off once we get running in 3rd and 4th gear. We are projecting high single digits conservatively once we get to quarter 2 to 3. Of course this does not include the majority of returns coming down the road via sale or refi. We are conservatively thinking more than 80% in 5 years on this one for total return. So if you take 80% divided by 5 years… That’s a good way of evaluating these things comparing apples to apples.

AHP is a good “on-deck” circle to use a baseball analogy. I use AHP as a waiting room as these types of deals arise. The projected IRR on this one is higher.

I don’t really know anything that cashflows more than 12% these days with equity upside. Self-storage, mobile home, and assisted living are three I am looking at (cashflow on self-storage and MHPs are higher but not much and I believe there is a little less appreciation than in apartments).

From what I know of your situation being a higher wage earner I feel you should be being more aggressive. I’m starting to come around to investments that are zero cashflow, 3 year holds, 25% IRRs because that’s what higher level guys are going to. Again I still like cashflow but I see why they are moving that direction.

Question: If I need to be liquid for whatever reason, how could I get my capital back? I realize I should invest with not that in mind. I see a common clause in the PPM stating that I enter the deal with the intent not to sell, however, if necessary, shares could be sold with the GPs approval and that the group would have 90 days for first right of refusal.

Answer: I go into these deals understanding that it’s pretty illiquid. That unless for some divorce/death/other bad business your money is locked up in there. I know there is some mechanism to get the money out but I see it more of a saving face type of thing not to rock the boat. Again I don’t pay attention to the method to pull the cash out. If you can turn you money faster than 20-25% a year with less effort and more security then you should do that. And BTW let me know because I would like to invest in that too.

I think it’s important to realize that being the small fish with other larger folks in a LP position it might not be worth the trouble for another larger LP to pick up your portion of shares. Even though $50k is nothing to that guy.

That said I would encourage you to follow your instinct because if you are unsure about getting your money out… there is some reason you need the cash. And that is already a bad sign that maybe you should not be investing? Not to sound hocus pocus or universal signs but I sorta do the same thing when I get pitched a deal. If it’s not a “heck yes”, then I don’t go into it.

But I do understand when you are new something it could just be butterflies. Maybe you just need to save up an extra 25K so you have that much in reserves to feel a little better.

As a sign note, this is the sort of question non accredited investors as all the time. As you can see the headaches of a syndicator dealing with non-accredited investors. Personally I enjoy building relationships and helping those who need these investments the most but I can see how some people are completely put off helping those under 1M net worth.

Question: Is $100k enough liquidity for a non-accredited investor?

Answer: This is a guide not rule. Think about it 100k will be gone in a couple deals at 50K investments. If you don’t have adequate cashflow coming in (~$30K) a year you are a sitting duck for a year or two. I would think of this as using SFHs to get you from gear 1-2 or 0-35mph in a car. People who have an excess money after expenses (Cashflow) via their day job or investments (Gear 5-7 or over 55 MPH) should transition to syndications at some point of the diversification and scalability if they are NOT a good operator and if they are they should syndicate and lead deals. This transition is tricky. Yes, it’s a little un-comfortable.

It is recommended that you understand the business. Starting small with at least one SFH recommended as a perquisite to getting started with bigger investments. Although finding and working with good operators unfortunately good operators do go into bad deals. Also you want to be able to have a surface level idea on what is in these executive summaries of these offerings.

Don’t be a Mom & Pop investor

Join us in a larger deal

FAQ

How Much of My Net Worth Should I Put in a Deal

Usually I see investors place no more than 5% of their networth into any one deal. Investors who have poor networks and deal flow put larger sums of cash into less deals because of lack of options. It is more prudent to place your cash into more deals that are strong.

Invest in deals that have

1) Cashflow with a good buffer in case of recession

2) Forced appreciation so there is the ability to get above water for exit in case the economy goes catastrophic as well as bump the value

Should I rent out my property as a short term rental?

I’m generally bearish on short term rentals, however if you do decide to do this, I suggest you educate yourself with the basic education or formal training out there. I have answered this question in detail in this article

Deeper Learning

Syndication Chart

Syndication Comparisons

Understanding 506(b) vs 506(c) Deals

Understanding Cost Segregatoin & Bonus Depreciation

Checkout All Current Holdings

Checkout All Past Projects

Checkout Past Deal (San-Antonio 192-Unit Webinar)

San-Antonio 192-Unit (Images)

Checkout Past Deal (Iowa 52-Unit Webinar)

Iowa 52-Unit (Images)