#2 – Seeing The Matrix

3 Topics

#3 – More About Me

3 Topics

#17 – Investor Mindset

4 Topics

#19 – Taxes

6 Topics

#25 – Covering your Assets

2 Topics

#26 – Conclusion

3 Topics

BONUS – Syndication Insider Insights

3 Topics

25.1 – Homework

Download and complete your Family Emergency Binder (This is the “incase I die document” you will pass down to your loved ones)

We live in a litigious society. We, as Americans are sue happy.

The courts were originally designed to offer justice to a party harmed by another’s actions or make things right. However, over time, because litigation can be expensive when each side lawyers up to settle disputes, unscrupulous parties have abused the court’s powers for financial gain.

Worse than the cost of litigating a case is losing one.

The losing party can be financially wrecked from a judgment they can spend the rest of their lives paying. Unfortunately, some would take advantage of this fact and use just the threat of lawsuits to unjustly extract money from others who would rather pay the settlement than spend the money going to court.

The side effect of our society’s litigiousness is the extraordinary steps individuals and businesses take to avoid liability or to mitigate it.

There was a saying during my days at the day job that used to explain the unexplainable just so we could cut the useless chatter and get our work done just well enough so we could go home on time and that was…

“If it weren’t for lawyers we would not have to do this…”

The risk of liability consumes us. We take out insurance on our cars, homes, and businesses to protect against potential lawsuits. It seems you can’t do anything these days without signing some liability waiver or agreeing to the terms and conditions of a business to use its products or services.

Nobody is safe from the threat of litigation and potential liability – least of all professionals.

Doctors, lawyers, accountants, and other professionals take out malpractice insurance to protect themselves from malpractice lawsuits.

This threat of liability keeps them up at night. Still, it is also a motivating factor for finding alternative sources of income in case they’re forced to walk away from their practice one day – whether voluntarily or involuntarily.

Among the alternative investment options professionals often explore is commercial real estate. It’s high on their list because it offers cash flow, appreciation and is known to act as a buffer during an economic downturn or disaster – all backed by a hard asset.

However, most professionals are intimidated by investing in commercial real estate because they feel they don’t have the time or expertise to delve into it. That’s why many savvy professionals turn to passive investment opportunities to participate in the commercial real estate class without getting their hands dirty.

Once a professional expresses their interest in investing in commercial real estate to their family, friends, and colleagues, it doesn’t take long before the naysayers come out.

“What if someone gets hurt on one of your properties? Won’t you be personally liable?”

“What if the company you invest in defaults on a loan? Won’t you personally be responsible for the debt?”

This is why I moved to being a more passive investor as a Limited Partner as opposed to being the direct owner of the property. Plus as a LP you don’t have to work with fickle banks!

Limited liability is a legal concept and is accomplished through a company’s legal structure in the corporate form or a limited liability company or limited partnership.

The common shareholders of a corporation, the non-managing members of a limited liability company and the limited partners of a limited partnership all, enjoy protection through limited liability.

Without limited liability protection afforded to investors, companies would be hard-pressed to attract capital.

Can you imagine if the shareholders of cigarette maker Phillip Morris were personally liable for the company’s liability to its consumers over cancer deaths from its tobacco products?

The plaintiffs, in that case, were awarded $28 billion in punitive damages. Do you know how much of that judgment Phillip Morris shareholders were responsible for? ZERO.

Other than any effect on their share prices directly resulting from the lawsuit, the shareholders were personally accountable for ZERO of that verdict.

Passive investors in a private real estate investment fund can have the same comfort of knowing that no matter what liabilities the fund incurs in the form of debts or lawsuits, because of the business structure affording limited liability, passive investors will never be personally liable for the company’s liabilities beyond their investment capital in the fund.

So if the fund defaults on a $10 million loan requiring the company to liquidate its assets to pay a portion of that loan, your investment capital may be used to pay that loan, but you will not be responsible for any deficiencies.

Potential malpractice liabilities can keep professionals up at night – what with the potential financial and professional costs from litigation, not to mention the insurance premiums to protect against those potential liabilities.

Passive investors, on the other hand, don’t have those same worries. They can rest assured that once they invest in a private real estate fund, the most they can lose is that investment.

The U.S. corporate structure that encompasses corporations, LLCs, and LPs is what makes this possible and limits the liability and, therefore, the risk to passive investors – allowing them to invest, for the most part, worry-free.

Download and complete your Family Emergency Binder (This is the “incase I die document” you will pass down to your loved ones)

We live in a litigious society. We, as Americans are sue happy.

The courts were originally designed to offer justice to a party harmed by another’s actions or make things right. However, over time, because litigation can be expensive when each side lawyers up to settle disputes, unscrupulous parties have abused the court’s powers for financial gain.

Worse than the cost of litigating a case is losing one.

The losing party can be financially wrecked from a judgment they can spend the rest of their lives paying. Unfortunately, some would take advantage of this fact and use just the threat of lawsuits to unjustly extract money from others who would rather pay the settlement than spend the money going to court.

The side effect of our society’s litigiousness is the extraordinary steps individuals and businesses take to avoid liability or to mitigate it.

There was a saying during my days at the day job that used to explain the unexplainable just so we could cut the useless chatter and get our work done just well enough so we could go home on time and that was…

“If it weren’t for lawyers we would not have to do this…”

The risk of liability consumes us. We take out insurance on our cars, homes, and businesses to protect against potential lawsuits. It seems you can’t do anything these days without signing some liability waiver or agreeing to the terms and conditions of a business to use its products or services.

Nobody is safe from the threat of litigation and potential liability – least of all professionals.

Doctors, lawyers, accountants, and other professionals take out malpractice insurance to protect themselves from malpractice lawsuits.

This threat of liability keeps them up at night. Still, it is also a motivating factor for finding alternative sources of income in case they’re forced to walk away from their practice one day – whether voluntarily or involuntarily.

Among the alternative investment options professionals often explore is commercial real estate. It’s high on their list because it offers cash flow, appreciation and is known to act as a buffer during an economic downturn or disaster – all backed by a hard asset.

However, most professionals are intimidated by investing in commercial real estate because they feel they don’t have the time or expertise to delve into it. That’s why many savvy professionals turn to passive investment opportunities to participate in the commercial real estate class without getting their hands dirty.

Once a professional expresses their interest in investing in commercial real estate to their family, friends, and colleagues, it doesn’t take long before the naysayers come out.

“What if someone gets hurt on one of your properties? Won’t you be personally liable?”

“What if the company you invest in defaults on a loan? Won’t you personally be responsible for the debt?”

This is why I moved to being a more passive investor as a Limited Partner as opposed to being the direct owner of the property. Plus as a LP you don’t have to work with fickle banks!

Limited liability is a legal concept and is accomplished through a company’s legal structure in the corporate form or a limited liability company or limited partnership.

The common shareholders of a corporation, the non-managing members of a limited liability company and the limited partners of a limited partnership all, enjoy protection through limited liability.

Without limited liability protection afforded to investors, companies would be hard-pressed to attract capital.

Can you imagine if the shareholders of cigarette maker Phillip Morris were personally liable for the company’s liability to its consumers over cancer deaths from its tobacco products?

The plaintiffs, in that case, were awarded $28 billion in punitive damages. Do you know how much of that judgment Phillip Morris shareholders were responsible for? ZERO.

Other than any effect on their share prices directly resulting from the lawsuit, the shareholders were personally accountable for ZERO of that verdict.

Passive investors in a private real estate investment fund can have the same comfort of knowing that no matter what liabilities the fund incurs in the form of debts or lawsuits, because of the business structure affording limited liability, passive investors will never be personally liable for the company’s liabilities beyond their investment capital in the fund.

So if the fund defaults on a $10 million loan requiring the company to liquidate its assets to pay a portion of that loan, your investment capital may be used to pay that loan, but you will not be responsible for any deficiencies.

Potential malpractice liabilities can keep professionals up at night – what with the potential financial and professional costs from litigation, not to mention the insurance premiums to protect against those potential liabilities.

Passive investors, on the other hand, don’t have those same worries. They can rest assured that once they invest in a private real estate fund, the most they can lose is that investment.

The U.S. corporate structure that encompasses corporations, LLCs, and LPs is what makes this possible and limits the liability and, therefore, the risk to passive investors – allowing them to invest, for the most part, worry-free.

The Essentials:

- Legal advice for High Net Worth Investors

- 127 – Estate Planning and Asset Protection with Lawyer Andrew Howell

- General Guide

- Special link to book a complimentary session to the CPA/Legal team I use

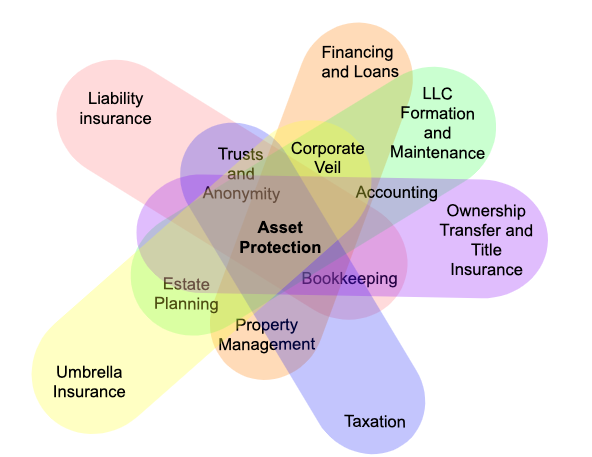

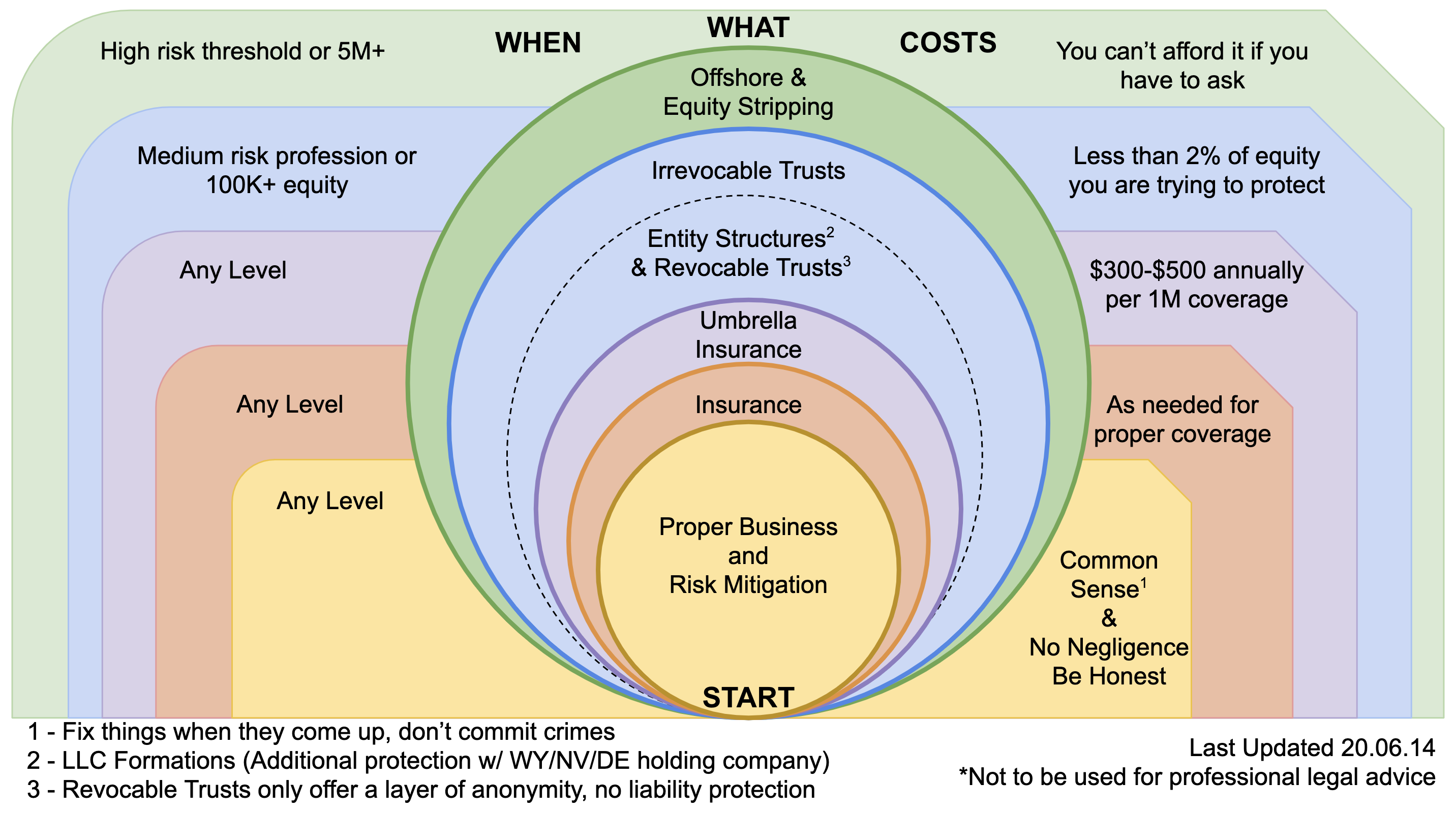

The Pillar of Protection:

- Anonymity You may not realize this, but all your information is exposed online. All I need is your name and a general idea of where you live and I can find out all about you – what you own, how much equity you have, etc… This makes it super easy for litigation attorneys to crunch some numbers and decide whether you’ll be a profitable business endeavor. If you are, they will sue, and you will most likely pay them off. Anonymity hides your information from the public eye, making you look like a beggar. And nobody sues beggars.

- Liability If you’re sued, it isn’t just your property that’s in danger. Your entire net worth is at stake. Creating a Limited Liability Company (LLC) is one of the most common ways of protecting your personal assets from a business lawsuit. It keeps your business and personal life separate – it’s the best kind of work/life balance.

- Separation You’re going to want to create decoys as well. You can do this by creating a shell company. I’m sure you’ve heard about these on the news, most likely related to shady government schemes or oil companies. The reality is much more practical. A shell company is what conducts your day-to-day operations, but it doesn’t hold anything of value. You should require tenants and others to sue your shell company within the contract language itself. That way, even if they sue you they’ll get nothing and you just need to spin up a new shell.

- Isolation Just like lawsuits can spill over from your business into your personal life, they can also spill over from one asset to the others. And just like you did with your personal liability, you’ll want to separate each asset from the others. You could do this by creating multiple LLCs and trying to manage them individually, but that gets expensive and complex very fast. Instead, you should be looking at more robust entities, like a Series LLC or DST. These allow you to scale infinitely and for very cheap, while providing the same or better levels of protection.

- Insurance Last but not least, you need insurance. It’s just important not to put your faith in it the way so many investors do. Remember: insurance companies are for-profit corporations. Think about all the natural disasters and how the insurance companies try to wiggle out of responsibility every time. They do this because they are trying not to lose money. They will do this to you as well if the opportunity arises. So yes, buy insurance, but don’t let that be your one and only line of defense.

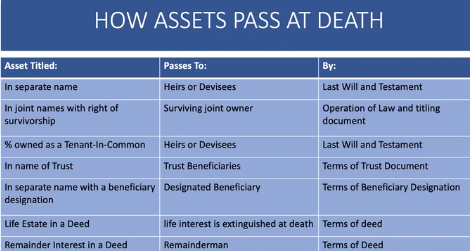

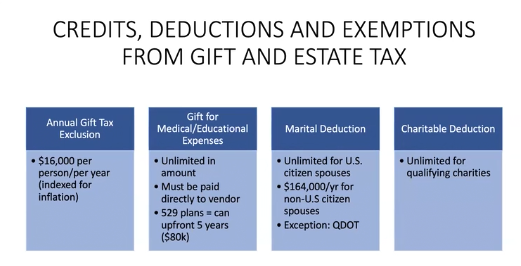

A couple of legal diagrams for adequate levels of protection

More Deep Learning:

- 064 – Fundamentals – Ask Lane – LLCs, Helocs vs Cash Outs, Working in a Sellers Market, Hedge Fund

- 172 – Legal Strategies for Real Estate Investors w/ Scott Smith

- Insurance is another way of protection and should be a 1-2 punch with your entity structure. Let me know if you are looking for a CPA or Tax referral and I can connect you with who I am currently using

For $1M net worth investors (Accredited)

Consider the International Bridge Trust. Sample of Mastermind Content below. The flaw with LLCs – Charging order protection Issues with the Domestic trust (DAPT) Irrevocable vs Revokable trust How to go overseas Choosing a oversea bank Why the Cook Islands? What is wrong with equity stripping?

California investors – series LLC

What is wrong with equity stripping?

California investors – series LLC