#2 – Seeing The Matrix

3 Topics

#3 – More About Me

3 Topics

#17 – Investor Mindset

4 Topics

#19 – Taxes

6 Topics

#25 – Covering your Assets

2 Topics

#26 – Conclusion

3 Topics

BONUS – Syndication Insider Insights

3 Topics

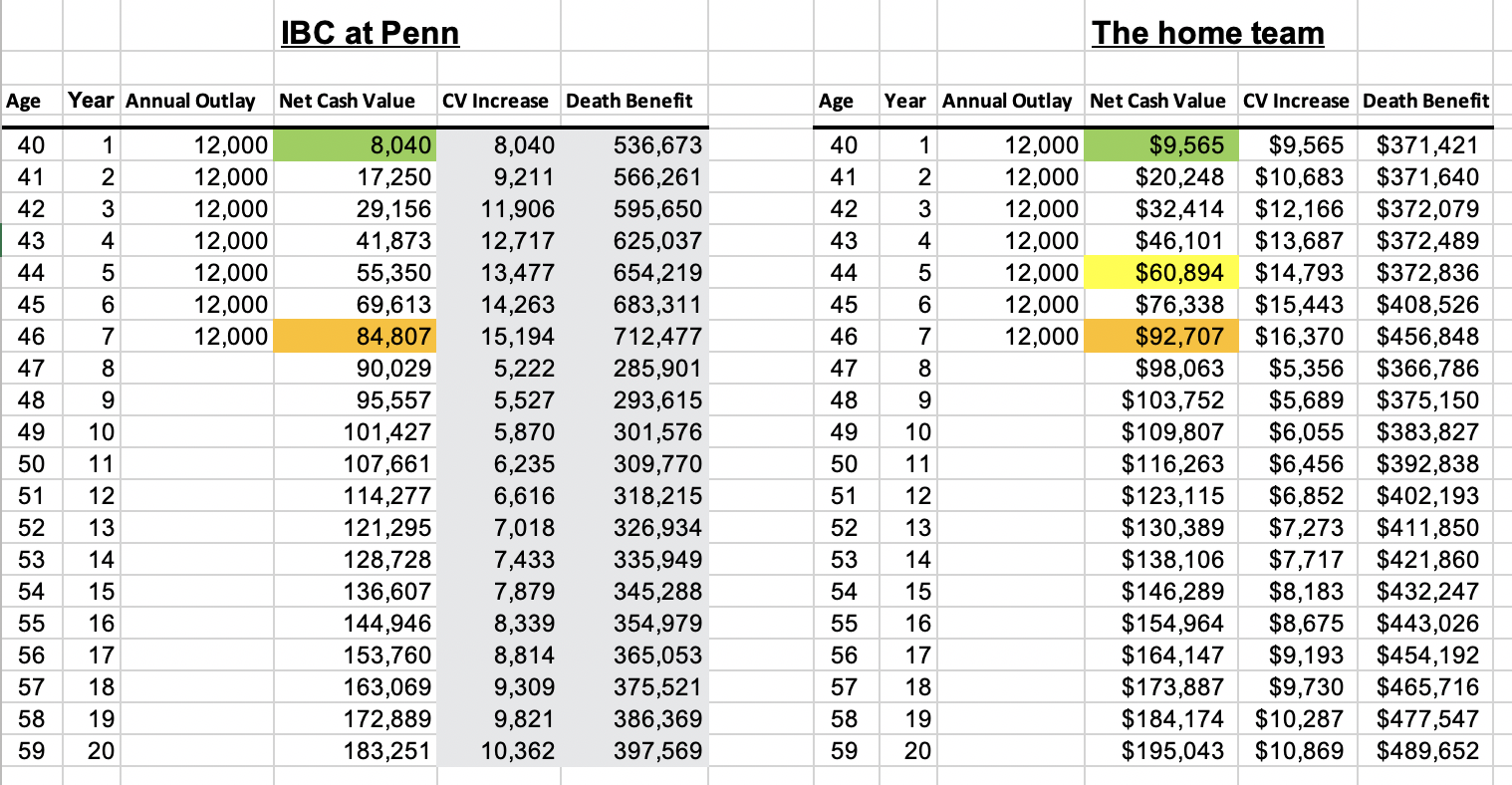

23.1 – Infinite Banking

If you need referrals to an infinite bank practitioner please email us. Its is very tough to compare apples to apples in these policies but below is one attempt by another Hui member:

To learn more about infinite banking check out this great eCourse.

To learn more about infinite banking check out this great eCourse.

To learn more about infinite banking check out this great eCourse.

To learn more about infinite banking check out this great eCourse.

Privatized Banking is a strategy of using a unique “AND Asset” that allows you to put the same money to work in two places at the same time.

This little known, but powerful secret has been used for over 170 years by the wealthy, banks, and corporations as a safe harbor during economic turmoil. (Banks

Privatized Banking, also called Infinite Banking, was popularized by Nelson Nash, who published the power of a specially designed, high cash value, dividend-paying whole life insurance contract with a mutual company.

To use this concept, you don’t have to get higher returns, take on more risk, or invest extra dollars. In fact, you don’t have to change anything about your investing strategy at all. You just add in this extra step of Privatized Banking as your place to store cash between opportunities …. And the result is that you not only secure and stabilize your finances, you also achieve an edge in your investment performance similar to the optimized engine performance of a racecar after adding octane fuel enhancer.

This ancient, traditional, no-frills, long-term wealth builder is a war chest that’s the best place to store your reserves to cover emergencies, weather a crisis, and serve as investment capital for opportunities.

It’s also a financial Swiss Army Knife that offers:

- VAULT-LIKE SAFETY: Principal protection that guarantees your money will never drop in value, in a non-correlated asset that’s not based on stock market performance.

- COMPETIVE GROWTH ON CASH VALUE: Consistent, tax-free, compound internal returns, so you can grow your wealth exponentially.

- UNLIMITED ACCESS FOR YOUR LIFETIME CASH NEEDS: Liquidity and guaranteed access, regardless of credit conditions, so it isn’t lockedup behind taxes, fees, qualifications, and restrictions.

- LEVERAGE: Borrowing against your cash value keeps your capital earning without interruption, even while you use it.

- TRIPLE TAX ADVANTAGE: Once you cash is inside the policy, it grows tax free. *Then, if the policy is utilized correctly, you’ll never paytax on the growth and distributions. At death, your beneficiaries receive the proceeds income tax free.

- GATEWAY TO INCOME-BOOSTING STRATEGIES: Life insurance serves as a backstop to hedge sequence of returns risk, allow you tospend down other assets, maximize Social Security income, complement a reverse mortgage, or provide supplemental income.

- PRIVACY FROM CREDITORS AND LAWSUITS: Safe from creditors and not attachable in lawsuits (depending on state law), doesn’t’ countagainst assets on the FAFSA application for student financial aid, and cash value growth isn’t reported to the IRS.

- LEGACY PRESERVER: The best asset to preserve and transfer wealth to the next generation, because it multiplies your net worth.