21.1 – What is a 1031 Exchange?

The Essentials:

Before you waste your time learning about this just know… with Bonus Depreciation via Cost Segregations it makes 1031 Exchanges obsolete. For higher net worth investors I don’t recommend these. It is just another example of people who get paid when you execute these is why you hear about these on the “podcast-circuit” or from unsophisticated investors so much.

A 1031 exchange (also called a like-kind exchange) is a form of tax-deferred real estate investing.

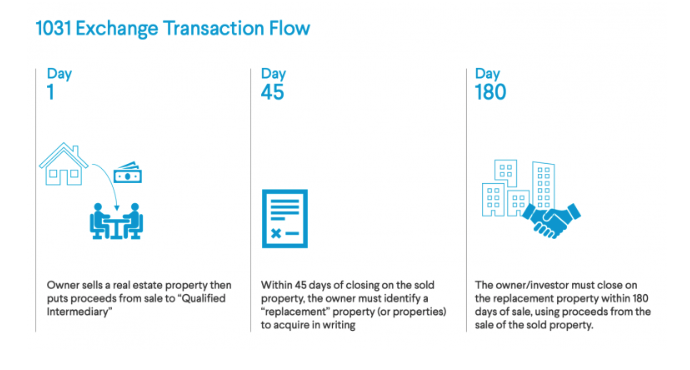

The basic order of operations for executing on a 1031 exchange transaction are as follows:

- Owner sells a real estate property.

- Owner puts the proceeds from sale in the hands of a third party—known as a “Qualified Intermediary”

- Within 45 days of closing on the sold property, the owner must identify a “replacement” property (or properties) to acquire. This must be documented in writing.

- Generally, an owner is limited to identifying three potential “replacement” properties to target, though there are some exceptions and nuances here.

- The owner/investor must close on the replacement property within 180 days of sale of the relinquished property, using proceeds from the sale of the sold property.

A key consideration is what qualifies as “like-kind property.” As with other IRS-defined classifications, there is some flexibility in this qualification. The main qualifications that replacement property must meet in order to be considered “like-kind” are:

- Replacement property must be used for business or as an investment; primary residences may not be considered like-kind property.

- Replacement property must be within the United States.

- Per IRS terminology, the replacement property must be “of the same nature, character or class” as the relinquished property.

1031 Exchange Benefits

The primary advantage of a 1031 exchange real estate investment is the deferral of capital gains tax on the sale of property. Deferring taxes owed today can allow for greater investment activity in the near term, which can have a compounding effect over time and accelerate the cash flow growth of a given investor’s portfolio.

There are several other less obvious benefits of 1031 exchanges that real estate investors should be aware of:

Potential to upgrade undesirable assets: Investors may be able to exit out of underperforming or onerous assets and acquire more appealing real estate

Potential for greater diversification: Related to the above benefit, a 1031 exchange may allow a passive investor to exit out of a single managed property and into a variety of passive investments, spreading risk across markets and reclaiming time that otherwise would have been spent maintaining and managing property.

Legacy wealth: Investors who have deferred taxes via 1031 exchange can pass on property to heirs tax-free.

The 1031 exchange program provides considerable benefit for real estate investors. These advantages differ quite a bit from benefits afforded by the Opportunity Zone Investing Program. We encourage investors to get to know the key differences between these two methods of tax-deferred real estate investing.

Legal Structures for Collective 1031 Exchange Investment

Many investors seek out and execute on acquiring replacement property through 1031 exchanges on their own. Over the past several decades, 1031 exchanges have become more accessible and more popular among syndicates of real estate investors.

Let’s touch on the main legal structures for collective 1031 exchange real estate investing.

Delaware Statutory Trusts (DSTs) for Real Estate Investing

Again this does not apply to most people. If you need a guy… clients… we have a guy for you.

A Delaware Statutory Trust (or DST) is a separate legal structure—established under statutory law in the state of Delaware—that allows members to enjoy in-common ownership while protecting trustees from liability. Much like an LLC, DSTs allow for common ownership while providing individual members (trustees) the ability to operate with legal remoteness.

The overwhelming advantage of exchanging into properties held in a DST is the opportunity to invest in a portfolio of properties instead of just one to diversify risk and insulate income. And just like investing in a private equity real estate fund or real estate syndication, you can invest headache-free by leveraging the expertise of others and letting someone else deal with the day-to-day management of this portfolio.

The major disadvantage of DST’s cited by many investors is illiquidity. Most DSTs have long investment windows of five or more years, so be prepared to relinquish control for the long run.

Although considered a disadvantage by many, this same illiquidity is what shields DST and other private investments from broader market volatility.

How Tax Law Treats Delaware Statutory Trusts & Their Members

Much like an LLC or S-Corp, DSTs are considered “pass-through” entities by the IRS, meaning that all profits and losses are passed through to individual beneficiaries of the trust. In other words, a Delaware Statutory Trust is not a taxable entity. This structure allows for partial ownership and can facilitate passive fractional investment into a real estate asset without constituent members of the DST having to hold title or actively manage property. This ruling also established that eligible DST investments can qualify as the replacement property in a 1031 exchange; in other words, interest in a Delaware Statutory Trust may suffice as the “like-kind” asset in the eyes of IRS, and so can be traded for real property or vice versa in a legal 1031 exchange. Hence, DSTs have become the primary mechanism for passive investors to access high-quality real estate assets at relatively low minimums while still qualifying for 1031 exchange benefits.

How Delaware Statutory Trusts Work in Practice

Typically, a lead investor (often referred to as a ‘Sponsor’ in industry parlance) acquires the underlying property, then offers beneficial interest to passive investors in the DST. Like other legal entities that facilitate syndication, the DST structure allows beneficiaries of the trust to own stake in much larger commercial real estate (CRE) properties than they would normally be able to access—such as multifamily assets with hundreds of units, office buildings, mixed-use property, or niche CRE assets.

The DST structure allows for individual passive investors to access institutional-grade real estate via 1031 exchanges at a much lower barrier to entry. However, beneficiaries of a DST can participate without pursuing 1031 exchange benefits.

Tenants in Common Real Estate Investing

Tenants in Common is another legal structure for ownership interest in real estate. Like a DST, the arrangement allows for partial ownership of underlying property and can facilitate syndication to passive investors. Both structures allow groups of investors to pool equity to acquire property on a tax-deferred basis via 1031 exchange, and both structures satisfy the program’s “like kind” qualification.

There are some key differences between the two structures:

- Investor Limit: Per IRS guidelines, a Tenancy in Common (or TIC) structure only allows for 35 investors. For institutional-grade property this may result in a prohibitively-high minimum investment for many individual investors.

- Bankruptcy Protection: Each TIC investor must set up a single-member LLC to ensure personal protection from liability, whereas a DST structure affords individual members bankruptcy remoteness.

- Voting Rights: The TIC structure requires unanimous consent from members when making decisions regarding the property – including refinancing, raising additional capital, or selling. In the DST structure, decision-making authority rests solely with a signatory trustee (typically the sponsor) while all other beneficiaries are strictly passive investors.

For these and other reasons, Delaware Statutory Trusts tend to be the preferred vehicle for collective investment into replacement property in a 1031 exchange.

Like DSTs, TICs also allow for greater diversification of your investment portfolio. Fractional or co-ownership interests in real estate through TICs allow you to acquire, together with other investors (no more than 35 co-owners), a larger, potentially more stable, secure and profitable real property asset than what you could have acquired and afforded on your own.

The one most cited drawback of TICs is personal liability. Because all co-owners must be named on the title and must be listed as a co-borrower on any mortgage on the acquired property, each co-owner can potentially be held responsible for the full outstanding amount of the mortgage as well as for any potential property-related liabilities like personal injury and hazardous wastes.

So what is a 1031 again?

Here is a summary of the most important points of a qualifying 1031 exchange:

- The property must be exchanged for “like-kind” property. Commercial real estate is the most common type of property exchanged.

- A third-party intermediary is required to execute the exchange.

- 45 days to identify replacement property.

- 180 days to replace the relinquished exchange property.

- The price of the replacement property must be equal to or greater than the equity in the old property plus an outstanding debt.

Don’t Forget the Clock is Ticking

Timing is crucial in qualifying for 1031 treatment. The 45-day rule for identifying the replacement property and the 180-day rule to finalize the exchange are the most critical.

A 1031 exchange can be either simultaneous or deferred, with a deferred exchange being the most common by far – for its flexibility.

In a deferred exchange, an investor can sell an existing property but is not required to find and close on a replacement property until later. Think 45-day and 180-day rules.

In a deferred exchange, the investor must use a qualified intermediary to act as an agent for holding net proceeds from the relinquished property before they are reinvested in the replacement property.

Like-Kind Property

Misconceptions about what constitutes like-kind property are the biggest because of the anxiety for owners of commercial property contemplating a 1031 exchange. What if I can’t find a like-kind property in time? That’s the biggest concern.

Many investors believe that like-kind property must be of the same type, be in the same geographic location, and be held through the same ownership structure in order to satisfy the 1031 exchange requirements. This is a common misconception.

In fact, not only does the property not have to be the exact same type in the exact same location, but you can also exchange for multiple properties or even swap into a co-ownership situation with other investors. Knowing this will expand your options and allow you to find a replacement property fast and close on that property within the required time frames.

The most important thing to remember with a 1031 exchange is that the main criteria for establishing like-kind property are that both properties in the exchange must be held for productive use in a trade or business.

Based on that definition, there is no requirement that the properties be of the same type, be in the same location, etc. In fact, the IRS has been pretty liberal in determining what qualifies as like-kind property.

The following non-comprehensive list of real estate assets would qualify as like-kind property:

- Unimproved property

- Vacant land

- Net-lease property

- Commercial buildings

- Rental properties

- Farms or ranches

- Resort property

- Industrial property

- Retail property

- Office buildings

- Self-storage facilities

- Senior-living centers

- Hotels or motels

- Restaurants

As you can see, the possibilities are almost endless and there are no geographic requirements other than that the properties be located in the United States.

More Deep Learning:

The 1031 exchange is a method of pushing forward the taxes due on the capital gains of a property. You have 45 days to identify replacement property that 180 to close on said property(s).

Its a way of kicking the can down the road with taxes. I personally that you have to pay taxes at some point unless you are going to take it to the grave with you which is not very practical due to the following.

- The 45 days is almost impossible to execute. To be able to line up a deal that is “hot”. Experienced investors spend an average of 18 months to find that elusive first apartment. Now if you are buying lukewarm deals… then be my guest. But in this seller’s market, I think its a way to lose everything.

- Most investors that I work with are high net worth and able to cashflow income minus expenses over $30k a year and have over 50K of liquidity on hand. I believe that most people, unless they are talented at being an elite investor, should just be an LP role in a syndication due to the scalability and being able to spread their capital across different leads, business plans, asset classes, and geographical locations. That said a 1031 exchange will not allow you from going from real property to an LLC (ownership in a syndication). Although you could do what is called a Tenant-In-Common (TIC) arrangement where an investor has 1031 exchange funds and wants to parlay that money into a syndication. It’s possible but from the syndicator’s perspective a lot of unneeded work when you can just raise the funds the traditional way. Caveat: if you are bringing in a huge amount of money say 50% of the raise then that might tip the scales in your favor)

There are reverse exchanges and other more exotic exchanges but I personally not sold on the concept when the IRS comes knocking. I am not a tax professional but I feel it is tax evasion.

ULTIMATE SPC GUIDE TO 1031 EXCHANGES – SimplePassiveCashflow.com/1031guide