2.2 – Homework

All decisions you make should help move you from being a laborer to being a capitalist.

Charles Farrell, in his 2010 book Your Money Ratios:

Laborer

As a laborer, you are paid a wage for your services. It does not matter if you are a police officer, factory worker, doctor, lawyer, scientist, clerk, landscaper, or baseball player. You are paid a wage for doing some form of work. You are exchanging work for money, which means you must labor for your money, and are thus a laborer

Capitalist

This is how labor and capital are related. You must start out as a laborer to generate income. You then save a portion of that income every year. Those savings become your investment capital. As your capital builds, the payment for the use of your money grows. Once your capital is large enough, the payment for the use of your money will replace your wages, and you can retire….This is generally a 40 year process that starts in your mid 20s and ends sometime in your mid 60s. It usually takes each of us that long to build up enough capital such that the income from that capital can replace our wages.

To make that journey from laborer to capitalist, you must effectively manage the core issues of personal finance:

- Deciding how much to save each year

- How much capital you should have accumulated at each age

- How much debt to carry

- How to prudently invest your capital

- How to purchase insurance to protect your capital

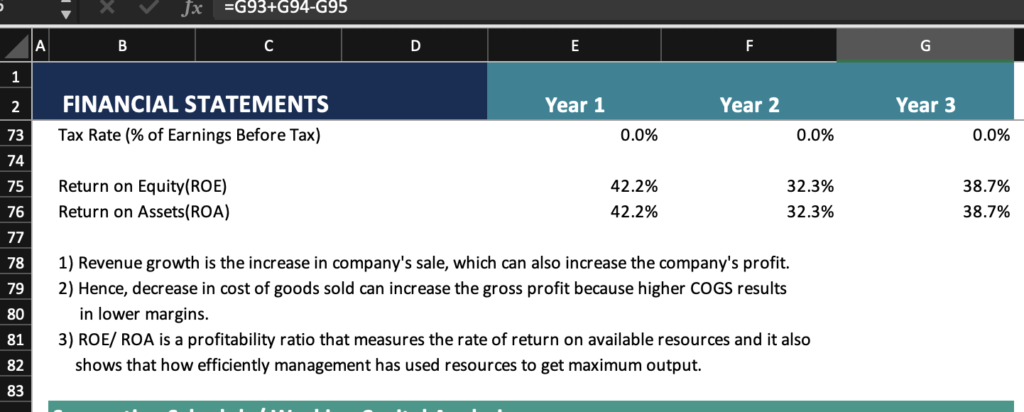

Most so-called investors make the mistake of not looking at their return on equity. They focus on paying off debt which is the wrong way that hurts your progression to financial freedom. People need to let go of the old financial wisdom and emulate what healthy businesses do and optimize their return on equity while, having adequate cashflow incase of a market dip, and maximizing their net worth growth (after all that is the score/goal).