Preview 6) Homework

Buy the eCourse

See all eCourses

Below is a sample of the Full Syndication For Passive (LP) Investors eCourse

Check out free version here

I broke up this topic because 99% of investors have never heard about private placements.

Here is a bunch of syndication doc examples which includes an example K1 that shows the bonus depreciation in the first few months of ownership: Share folder

Being an good LP (not over the top one who wastes a lot of time analyzing a deal) requires you look at the right things for example:

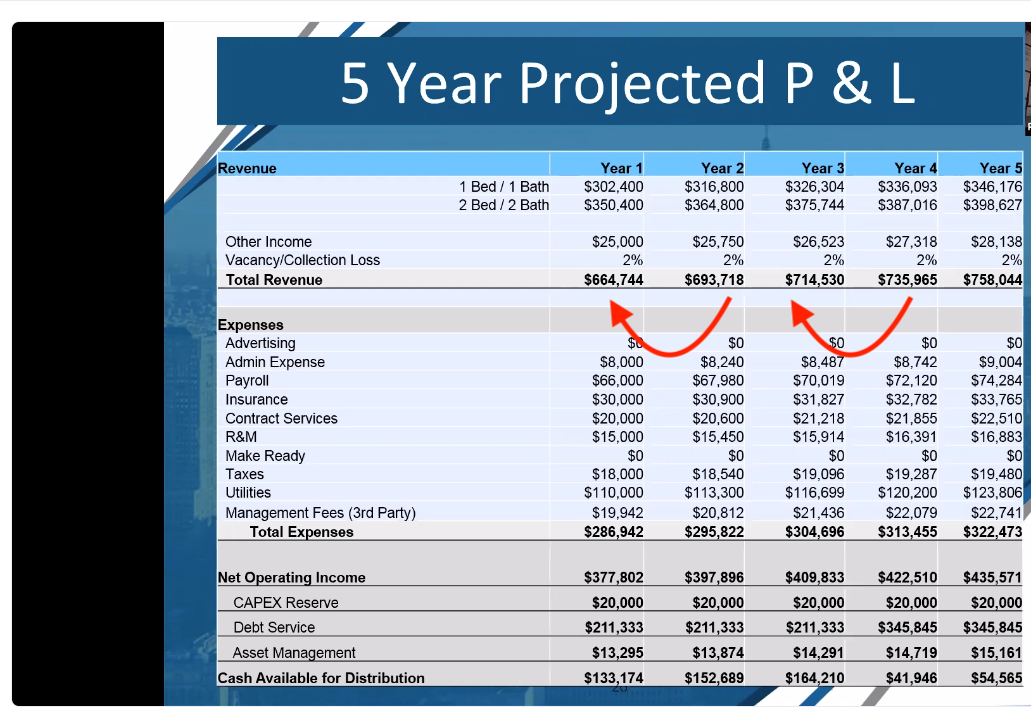

3% rent increases per year

You may have to calculate this for yourself as most syndicators will not openly point this out because they might be being too aggressive. 3% here is a very high estimate.

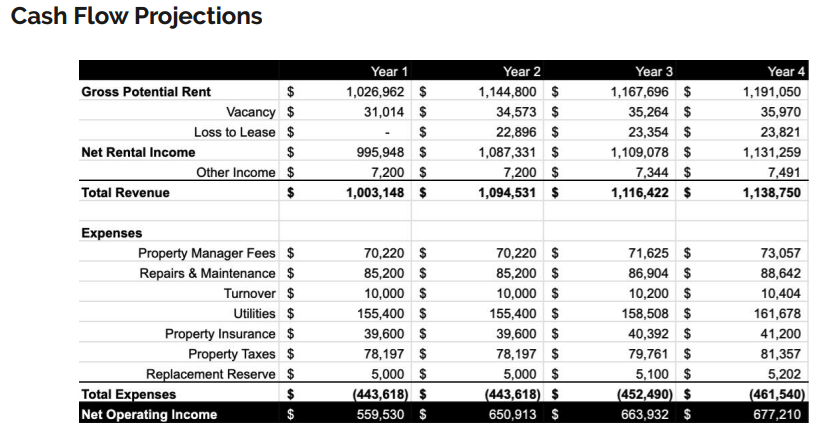

Here is another example… See if you can spot out what does not working in terms of Income, Vacancy, Loss to Lease, or Expenses.

The annual rent increases after the first year bump is 2%. This is acceptable for this good market however the Vacancy & Loss to Lease (people not paying) is too low. Usually we like to see a Vacancy of 5-10% depending on the market with 10-15% in the first year as we kick out bad tenants. The Loss to Lease (or deadbeats not paying) is typically 2-5% with a surge of 3-8% in the first year.

Expenses at a bit over $4,000/unit is good.

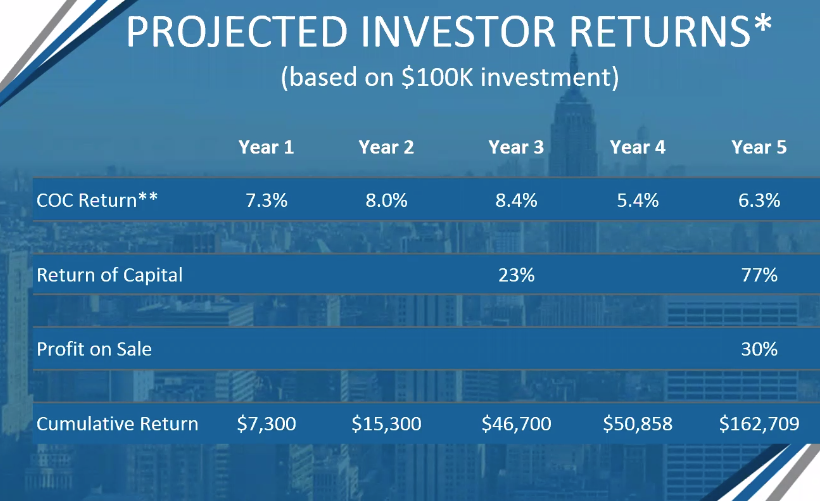

A cash out refi part of proforma in year 3 to come up with the total return. A refinance is a big “if.” I would rather see how the property preforms without a refinance event.

Discussion on IRR

The IRR (internal rate of return) is a time-weighted return metric that is common in both financial accounting and real estate investing, where the time value of money and liquidity risk are major factors in investment decisions.

Investors like to use IRR because it seems to take into account the length of hold and how hard you money is working. It is inherently understood that there is no two similar investments because they are not commodities and therefore every deal has different timeframes. IRR is not always useful as an apples-to-apples comparison between two equity investments. If two equity investments have two different target hold periods and different business plans, IRR may not be a useful device for assessing which is the more appealing investment.

Take the example of two hypothetical realized investments:

- A common equity investment into a value-add redevelopment and repositioning of a Class C multifamily property. The Sponsor expects to execute an aggressive project improvement plan, bring rent rolls positive, and exit through sale after a 3-year hold. The Sponsor expects to earn the vast majority of profits through exit, and ultimately hopes to achieve a project-level IRR that would result in a net 20% IRR to LP investors on the project.

- A portfolio of mixed assets, primarily in gateway markets, stabilized, and yielding present cash flow. The manager of the portfolio expects to achieve cash flow and make distributions throughout the term of the project amounting to an annual average of 9% per year across a 10-year holding period with a modest exit resulting in a net 10% IRR to LP investors.

If these two investments play out as intended, the projects will yield a net 20% IRR and net 10% IRR to LP investors, respectively. However, this does not mean that the former value-add project is 2 times as good as the latter portfolio investment. Which one is more appealing, and to what degree, depends on the preferences and strategy of the investor evaluating these two opportunities.

Limitations of the IRR Metric in Real Estate Investing

Here are several dimensions that are critical to real estate investors, but are not expressed adequately by the IRR metric alone:

- Business Plan Risk: Generally risk and return potential are positively correlated; in order to achieve an IRR in the ~20% range, investors will need to assume a higher level risk of principal loss. The project must entail significant business plan execution risk with capital expenditures in redevelopment, while offering little or no cash flow throughout the early part or the entirety of the hold period. This is two sides of the same coin: in order to carry out significant improvement, and thus realize significant appreciation at exit, there must be significant vacancy, and thus room for substantial NOI growth. Or, in the case of a more ambitious value-add redevelopment or ground-up development, the project may require 100% vacancy in order to execute on the business plan. Conversely, a stabilized property (or portfolio of properties) entails significantly less business plan risk which carries less vacancy risk, and less liquidity risk on the part of investors. As such, it generally cannot offer the same opportunity for significantly improved rent rolls and appreciation at exit.

- Interest Rate Risk: Commercial Real Estate transactions generate return in several ways, most often cash flow and exit sale proceeds. A shorter duration redevelopment business plan carries greater interest rate risk due to the majority or entirety of the investment yield being dependent on the exit sale price, which in turn depends on the exit capitalization rate (generally abbreviated as “cap rate”) which the eventual buyer will agree to pay. Cap rates refer to a simple year 1 yield on total purchase price investors are willing to accept and in commercial real estate transactions, while they do not exactly track market interest rates, they are generally very positively correlated. Just as in bond math, a higher exit cap rate would yield a lower project return. Just evaluating the prospective IRR of an investment ignores the timing of the sources of return which generate that IRR.

- Total Yield: Because IRR places such emphasis on time, a large IRR does not necessarily mean a large profit harvested at the exit of an investment. In order to assess the total profit potential, the project IRR must be viewed in combination with the equity multiple. The equity multiple is the simple representation of how much profit was generated in relation to the investment or a whole dollar return on that investment decision. In our hypothetical example above, the breakdown could be as follows:

- Value-add: the riskier project yields a 1.73X equity multiple ($7,280 plus return of principal on a $10,000 investment) after a 3-year hold with no intermediate cash flow.

- Stabilized Portfolio: the significantly lengthier hold period weighs down IRR. While the IRR is only 10%, the investment yielded consistent cash flow throughout (9% per year, an average of $900 on this hypothetical $10k investment). The equity multiple is a more favorable 2.06X, while the investor assumed significantly less risk by participating in a stabilized portfolio of properties which derived its IRR from multiple sources of cash flow (intermediate distributions and exit sale proceeds).

In this hypothetical example, the value-add investment would have yielded an IRR in the neighborhood of 20% (depending on exact timing of exit), significantly higher than the stabilized portfolio. However, the realized total yield and equity multiple of the stabilized portfolio was significantly higher, albeit over a much longer term.

The Bottom Line:

This hypothetical example does not prove that either profile of investment is better, as each should be examined through the lens of the investor’s risk preference. It does illustrate that IRR can be misleading when evaluated in isolation. A single return metric should only be used for apples-to-apples comparison when the risk profile and target hold period of two potential investments are similar. To evaluate more disparate real estate investments, it is more valuable to examine all available return metrics in the context of your investing strategy, risk preference, and composition of your individual portfolio.

The simple way:

Sarcastically put… I can make whatever IRR you want to see! I just have to assume or slide up cashflow a bit earlier and magically my IRR will go up 2-3% a year but the total equity multiple or total return (say 100% ROI in 5 years) stays the same.

Personally, I don’t really look at IRR. It is a function of returns over time where the sooner you get money the higher the IRR goes cause its weighted appropriately. The best way to explaining this is for you to download an IRR calculator spreadsheet or build your own simple one and play around with one. Showing an unrealistic refinance in year 2 instead of year 3-4 will likely turn a 13% IRR deal to 16-17%. Magic!

For what its worth most deals I deem meeting minimal IRR standards is 13-15% but you have to dig a little deeper to uncover the real placements of cashflows and capitalization events… and then dig even deeper to verify the assumptions such as occupancy, rent increases per year, and what reversion cap rate was used.

Again I don’t look for IRR cause its manipulated a lot instead I look at total return on a 5 year basis. Its like sampling a NFL players 40 yard dash but for apartment underwriting. I’m sure there are other ways to do it but weather its right or wrong… I try to be consistent and I’m just trying to go in and pick the best in the field.

People

At the end of the day the number analysis (what assumptions were used) is only 1/2 of the battle in vetting a deal to invest in. The first is people. Never work with anyone you don’t know, like, or trust. That is how I lost $40,000 in my first LP deal.

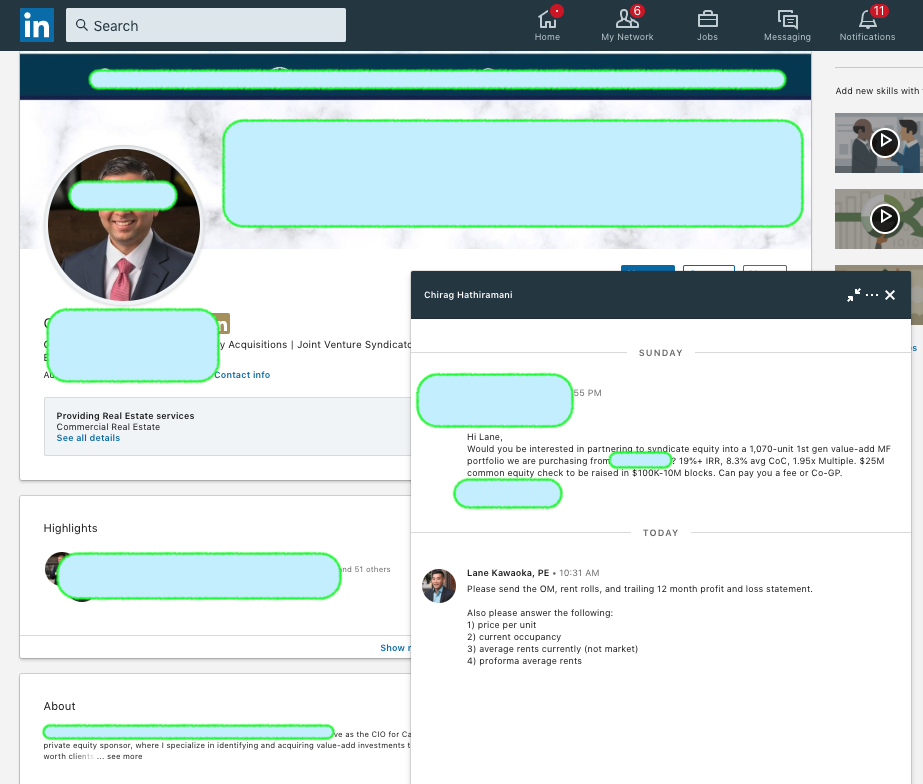

Whenever I get a pitch-deck… first off I usually know if I’m going to invest in it even before I run the numbers because I know the people and I know them personally and we have a relationship outside of real estate. But if its a cold intro I always as “how the heck is this guy/gal?”

It sounds basic but I Google stalk them and find them on Facebook and Linked In. In this day and age if someone does not have a digital footprint that is their authentic self I don’t want to work with them plus I want to work with real people not robots.

Real estate is all marketing wether its a $500,000 primary residence or a $20M syndication. Don’t get mislead my good looking people in suits with a blue or nature back drop.

#BluePantsBrownShoes

Another random above. Its is very rare that these COLD pitches ever lead somewhere. Most times it is just a waste of time. Everyone can create a nice logo, website, and take a pretty profile picture.

As I am looking up their profiles I am searching for common connections who I can ping and get more information. This is where it is critical to build real relationships where it spans more than real estate. Here are some tips for that. In addition the Group Coaching Mastermind should be a great start for that.

Your network is your net worth is uber important once you cross over a net worth of over $500,000 and start to become a more passive investor.

Other things to be mindful are is this a “student & celebrity” sponsorship team where the student is doing a deal (something you don’t want) and the celebrity is taking a big part of the General Partnership and just lending their profile picture and has little of the day to day management. As a new passive investor you are likely to be presented junk. See Bonus section for more info.

I repeat for emphasis… real estate is a people business. It is not like buying a stock where you can get wherever. You cannot apply some fancy AI or algorithm. You have to create a network to vet out good operators. You are investing in non-commodity investments where no two are alike.

The Essentials:

- Going from “Active-Passive” Investor to an LP in Syndications and Private Placements

- 006 – The Key Take Away from the Board Game “Settlers of Catan”

- 059 – Interview – Amy Wan – Advises on syndication/crowdfunding law & fights for the bootstrap entrepreneur

- 094 – Fundamentals – Ask Lane: MFH latest underwriting hacks, GP/LP Splits, reading an executive summary, mobile homes

- 098 – How I lost $40,000 as a Passive LP Investor

- Sample PPMs

- 167 – Commercial Multifamily Lending w/ James Eng

- 171 – Cap Rates in Real Estate Explained

More Deep Learning:

- Get out and get some!

- 030 – Patrick Herbig – My Co-Worker and 18-Plex Owner Going Big with Apartment Syndication

- 035 – Dave Zook apartment syndicator and author of Chicken Coops for Dummies

- 036 – Will Crozier – Flipper to MFH Syndicator in Dallas

- 048 – Interview – Kenny Wolfe – Got $50K? Move over SFHs!

- 050 – Interview – Mark Kenney – CPA to Apartment Syndication

- 069 – Interview – Gerry Swartz – Living in Seattle but investing in Texas | Severance package to Manufacture homes to SFH to MFH | Facebook ads to fill vacancy

- 072 – Interview – Rod Khleif – 800 Class D SFHs to Apartment Mogul

- 078 – Interview – Sarah May – Aerospace Engineer transitioning out of the Day Job in Denver

- 084 – Interview – Mark Walker – Verify shady characters – that’s a scare tactic title 😉

- 088 – Flipping is just a JOB and going Large Apartments with Jason Yarusi

- 122 Apartment Investing with Michael Blank

- Tips for LP investors – Webinar

- 111 Video – Interview – Brent Kawakami – Saying NO to a measly $300 a month & Networking on Facebook

- Join the movement! (Circa 2017)

- 107 – Fundamentals – The MFH Broker who takes flowers to 80-year-old ladies and the brokers point of view from Mark Allen

- 126 – Gino Barbaro talks Apartment Investing

- 150 – Apartments to Mobile Home Parks with Paul Moore – Don’t forget about other asset classes

- 152 – Kyle Jones Apartment Investor & 7 lessons learned

- 158 – Assisted Living Facilities w/ Gene Guarino

- 166 – Engineer investing in SFH then MFH – Jacob Ayers