BONUS – Downloadable Resources & Glossary

Link #1 – The First 30-Day Kit to Simple Passive Cashflow

- Buy Hold Analyzer

- About Lane docs

- Podcasts in MP3 Form

- Mortgage and Retirement Calculators

Link #2 – The Next 30+ Day Kit to Simple Passive Cashflow

- More Calculators

- Turnkey Rental Kit

- Examples of organizing files

- Much more…

***This section is under development – in an effort to not leave any poor working stiff behind to a destiny of financial bondage please email me Lane@SimplePassiveCashflow.com with any terms you would like more clarification on***

Active Investing: Taking part in real estate activities to find and/or operate an investment. There are different degrees of “trading time for money” and at some point you realize it is not scalable. A turnkey rental is known as a more passive investment however is still an active form of investing.

Accredited investor: defined by the United States Securities & Exchange Commission as someone who makes a minimum of $200,000 ($300,000 if filing jointly) or has a net worth of 1 million dollars excluding personal residence. The significance of being an accredited investor is that you can invest in things that those with less money, cannot. You can also be something called “a sophisticated investor” which has a much more nebulous definition but essentially says you know what you are doing even if you don’t have that much money. These laws were put in place long ago to “protect” the average person from predatory activity. The irony of this all is that there is no protection for the average Joe, or pension funds for that matter, against investing in a wildly bloated stock market at record valuations. Every major trader out there knows we are in a bubble but there is no protection for individuals dumping money into their retirement accounts to buy mutual funds. It’s an archaic system which makes little sense. Certainly, there has been some recognition of this fact. The 2012 JOBS act made it easier for Main Street America to participate in “alternative” investments via crowdfunding and made it easier for sponsors to advertise previously unknown opportunities. However, we have a long way to go. I would advise you that you need to know the lead syndicator personally. None of this “we met at a local REIA and he pitched me his deal”. If a guy does not have a list of solid investors they must lack the track record. Also I did a podcast with Amy Wan a syndication attorney talking a lot about this topic.

Acquisition Fees: Upfront fees charged by the GP as part of their compensation for finding and operating the deal. This cal also include Finance Fees or other made up fees so be careful to add them all up. Typical ranges 1-3% where some deals can be as high as 4-7%. Financing fees are the one-time, upfront fees charged by the lender for providing the debt service. Also referred to as a finance charge. Typically, the financing fees are 1.75% of the purchase price. Sometimes there can be even a loan guarantee fee.

Analysis paralysis: a situation in which a person is unable to make an investment decision because they overthink and overanalyze the data. This is a common ailment that plagues newbie real estate investors.

Agency loan/debt: a long-term mortgage loan secured from HUD, Fannie Mae, or Freddie Mac and is longer-term with lower interest rates compared to bridge loans. Typical loan term lengths are 5, 7 or 10 years amortized over 20 to 30 years. We look for longer term loans greater than 7 years so that we are not forced to sell or refinance in a downturn in the economy. The downside of these loans is often prepayment penalties or yield maintenance. More info in the Lending/Debt Selection section.

Appreciation: an increase in the value of an asset over time. There are two main types of appreciation: natural and forced. Natural or market appreciation occurs when the market cap rate “naturally” decreases. Forced appreciation occurs when the net operating income is increased (either by increasing the revenue or decreasing the expenses). When underwriting out deals we try to exclude the market/natural appreciation factor. That is the icing on top of the cake.

Asset management fees: Fees charged by the GP to operate the asset which is a percentage of the income brought in. This is separate of what the property manager is paid. Typical ranges 1-3%.

Asymmetric Risk – Also known as high-growth or high-beta. A higher risk reward type of investment that is highly volatile and you can lose all your money but at the same time make a killing. Venture capital deals, wild-cat oil wells, Bit-coin/Cryptos, or tech start-ups are examples of these high asymmetric risk type of deals. Here at SPC we like passive and simple deals that are somewhat predictable which is why we like stabilized cashflowing assets. Real estate developments where you are building something from nothing is an example of a higher risk reward profile or asymmetric risk type of deal in the real estate world. New investors may want to build up cashflow first in more conservative deals first their their spouse does not kill them or they can buy food to put on the table on a monthly basis. Higher net worth investors, certainly Accredited investor’s lives don’t change for better or worse if their investment makes 8% cashflow or 14% so they may want to try one of these asymmetric deals out of pure boredom. Shouldn’t we all aspire to have those #FirstWorldProblems!

Average annual return: a rate of return metric that is calculated by taking the total profit received and dividing it by the original amount invested and then dividing that by the number of years an investment was held.

This is not to be confused with “annualized total return”, which is the geometric average amount of money earned by an investment each year if the annual return was compounded.

Bad debt: the amount of uncollected money a former tenant owes after move-out.

Beneficiary: The individual(s) who will receive the property/assets.

Blind pool fund (or private placement real estate fund): a direct participation program or limited partnership that lacks a stated investment goal for the funds that are raised from investors. In a blind pool, money is raised from investors, usually based on the name recognition of a particular individual or firm. They are usually managed by a general partner who has broad discretion to make investments. A blind pool may have some broad stated goals, such as growth or income, or a focus on a specific industry or asset.

Breakeven occupancy: the occupancy rate required to cover the all of the expenses of an apartment community. The breakeven occupancy rate is calculated by dividing the sum of the operating expenses and debt service by the gross potential income.

Bridge loan: a mortgage loan used until a person or company secures permanent financing, which are short-term (6 months to three years with the option to purchase an additional 6 months to two years). They generally have a higher interest rate and are almost exclusively interest-only. Also referred to as interim financing, gap financing or swing loan. The loan is ideal for repositioning an apartment community and should not be used from the get go unless there is significant upside in rents that can be quickly captured.

Capital expenditures: Also known as CapEx, are the funds used to upgrade an asset. An expense is considered to be a capital expenditure when it improves the useful life of an apartment and is capitalized – spreading the cost of the expenditure over the useful life of the asset. Capital expenditures include both interior and exterior renovations. Examples of exterior CapEx are repairing or replacing a parking lot, repairing or replacing a roof, repairing, replacing or installing balconies or patios, installing carports, large landscaping projects, rebranding the community, new paint, new siding, repairing or replacing HVAC and renovating a clubhouse. Examples of interior CapEx are new cabinetry, new countertops, new appliances, new flooring, installing fireplaces, opening up or enclosing a kitchen, new light fixtures, interior paint, plumbing projects, new blinds and new hardware (i.e. door knobs, cabinet handles, outlet covers, faucets, etc.). Examples of things that wouldn’t be considered CapEx are operating expenses, like the costs associated with turning over a unit (i.e. paint, new carpet, cleaning, etc.), ongoing maintenance and repairs, ongoing landscaping costs, payroll to employees, utility expenses, etc. More info.

Capitalization rate, typically referred to as cap rate, is the rate of return based on the income that the property is expected to generate. The cap rate is calculated by dividing the property’s net operating income (NOI) by the current market value or acquisition cost of a property (cap rate = NOI / Current market value) For example, a 216-unit apartment community with a NOI of $742,245 that was purchased for $12,200,000 has a cap rate of 6.1%.

Cap rates are severely over estimated in most cases from brokers/sellers/syndicators so I don’t really pay much attention to it. The reasoning is that to get to that number typically expenses are always left out or income is inflated – so its bad data. Those top of the line items are again always manipulated and can throw the calculated cap +/-2.0. The only true way to determine is to get the trailing 12 month Profit and Loss Statement but at that point you have the information to underwrite it fully.

On class B/C I have been using 6.5-7.5% reversion cap depending on market. For example 6.5 in Dallas whereas 7.5 in Gulfport MS.These days nothing is over 7.5% cap (unless its a truly off-market deal and a fringe deal under 60-units). I find the current prevailing caps from my friends who are apartment operators and ping them what they used on their last deal. Another way is to talk to a broker who has their pulse on the market and knows you need the number for underwriting purposes (and he is not selling you a deal).

In addition the mear fact that we are doing value add and buying assets that have a management problem (that we can fix) means the property is not performing what it should be.

Capitalization Rate = Net Operating Income / Current Market Value

Cash flow: Revenue remaining after paying all expenses. Cash flow is calculated by subtracting the operating expense and debt service from the collected revenue. San Francisco, Hawaii, Los Angeles, Seattle, Boston are examples of primary markets which are NOT ideal for cashflow investing. It could appreciate but I consider that gambling. Sophisticated investors invest on cashflow where the rents exceed the mortgage plus expenses (and enough money to pay for professional property manage to do our dirty work). Sophisticated investors look at the Rent-to-Value Ratio and look for at least 1% or more to be able to cashflow after expenses. You find the Rent-to-Value Ratio by taking the monthly rent dividing by the purchase price. For example a $100,000 home that rents for 1,000 a month would have a Rent-to-Value Ratio of 1%. Most people I work with live in primary markets (as opposed to Birmingham, Atlanta, Indianapolis, Kansas City, Memphis, Little Rock, Jacksonville, Ohio, or other secondary or tertiary markets) where the Rent-to-Value Ratios are under 1%.

Cash-on-cash: (CoC) return is the rate of return, expressed as a percentage, based on the cash flow and the equity investment. CoC return is calculated by dividing the cash flow by the initial investment. For example, a 216-unit apartment community with a cash flow of $330,383 and an initial investment of $3,843,270 results in a CoC return of 8.6%

Cash-on-Cash Return – Cash-on-Cash Return (CoC) is the ratio of the annual return an investor makes on a property relative to their investment in the property.

Cash on Cash Return = Annual Pre-Tax Cash Flow / Total Cash Invested

Cash Reserves: To account for the unknown and unknowable. This is different from Working Capital.

CMBS loan: commercial mortgage-backed securities, or conduit loans, that are used to purchase commercial real estate buildings and are typically non-recourse and fully assumable. The minimum loan amounts are higher than for agency loans.

Complex Trust: Contains provisions for charitable gifts, an income stream, or concerns other types of wealth distribution.

Closing costs: expenses, over and above the price of the property, that buyers and sellers normally incur to complete a real estate transaction. Examples of closing costs are origination fees, application fees, recording fees, attorney fees, underwriting fees, credit search fees and due diligence fees.

Class of Properties: See this lesson

Concessions: are the credits (dollars) given to offset rent, application fees, move-in fees and any other revenue line time, which are generally given to tenants at move-in.

Cost segregation study: a tax strategy that allows real estate owners to utilize accelerated depreciation deductions to increase cash flow, and reduce the federal and state income taxes they pay on their rental income.

Critical Mass: Also know as the “freedom” number. The point at which you have reached or on the “flight path” to reach your cashflow goals. Most investors with modest means have a critical mass number of $8,000-15,000 per month. At which point your risk tolerance might change. This is the point where you start to put more emphasis on tax and asset protection strategies as opposed to finding the best equity deals out there. Legacy also becomes an emphasis.

Daisy Chain: When a deal is sent through a series of people or syndicators. Typically it is a sup par deal that is having a difficulty finding unsophisticated investors to bite. It can mean two things 1) a wholesale deal sent around various by wholesalers or 2) a syndicated deal sent around by various wholesellers. Many times syndicators are desperate to raise the money or be faced with losing their own money if the deal does not close so they are willing to pay out commissions for those in the daisy chain who bring investors. This is essentially what Crowdfunding websites do. This non-sponsor based compensation is a big no-no in terms of SEC laws. See examples here.

Debt service is the annual mortgage paid to the lender, which includes principal and interest. Principal is the original sum lent and the interest is the charge for the privilege of borrowing the principal amount. For example, a 24-month $11,505,500 loan with 5.28% interest amortized over 30 years results in a debt service of $60,977 per month.

Debt service coverage ratio: (DSCR) is a ratio that is a measure of the cash flow available to pay the debt obligation. DSCR is calculated by dividing the net operating income by the total debt service. A DSCR of 1.0 means that there is enough net operating income to cover 100% of the debt service. Ideally, the ratio is 1.25 or higher. An apartment with a DSCR too close to 1.0 is vulnerable, and a minor decline in cash flow would result in the inability to service (i.e. pay) the debt. For example, a 216-unit apartment community with an annual debt service of $581,090 and a NOI of $960,029 has a DSCR of 1.65.

Depreciation: an important tool for rental property owners that allows them to deduct the costs from taxes of buying and improving a property over its useful life, and thus lowers their taxable income in the process.

Due diligence: the use of reasonable care in an investigation of the relevant facts, assumptions, parties, conditions and subject matter pertinent to a transaction. In a real estate transaction, due diligence would include an investigation into the ability of the parties involved to conclude the transaction, a confirmation of the market and financial assumptions underwriting the property, an investigation into the condition of the subject property, and the fitness or regulatory restrictions applicable to the subject property’s intended use.

Economic Occupancy: Percentage of units occupied by paying tenants.

You can actually calculate your effective tax rate here. For example, if you live in MN and make $39,000 a year, your effective tax rate would be nearly 22%,

Employee unit: a unit rented to an employee at a discount or for free.

Equity: The actual portion of the property’s market value that you own. If you are using financing, your initial equity will depend on your down payment. It will increase as you pay down your loan and as the property’s market value increases.

With Financing: Equity = Market Value – Loan Balance

Without Financing: Equity = Market Value

Equity Multiplier: (EM) is the rate of return based on the total net profit (cash flow plus sales proceeds) and the equity investment. EM is calculated by dividing the sum of the total net profit and the equity investment by the equity investment. For example, if the limited partners invested $3,843,270 into a 216-unit apartment community with a 5-year gross cash flow of $2,030,172 and total proceeds at sale of $6,002,116, the EM is ($2,030,172 +$ 6,002,116) / $3842,270 = 2.09.

Exit strategy: the plan of action for selling the asset at the end of the business plan. For example I tell most high net worth investors getting started to not go after duplex/triplex/quads despite their good Rent-to-Value Ratios is because people who buy them are not emotional retail buyers but cheap investors therefor the exit strategy is weak.

Executive summary: a syndication’s marketing packet discussing the particulars of a real estate investment. No two look the same but all will include an overview of investment including photos, detailed metrics and forecasted numbers, the business plan, and information on the management team.

Expense ratio: a measurement of the cost to operate a piece of property, compared to the income brought in by the property. It is calculated by dividing a property’s operating expense (minus depreciation) by its gross operating income.

(Operating) Expense Ratio (OER): A measure of profitability, the operating expense ratio tells you how well you’re controlling expenses relative to income. Take all operating expenses, less depreciation, and divide them by operating income to get your OER. It’s one of the few ratios used by investors which includes depreciation, which makes it more inclusive of the property costs.

A lower OER reflects that you’ve minimized expenses relative to revenue. If your OER has been rising over time, it could indicate many issues. Perhaps annual rent increases haven’t matched expense increases. Or, your management company isn’t keeping up on routine maintenance, leading to more serious problems down the road. Calculating OER using specific expenses can help you narrow down the reason for its rise and help you get it back under control.

Freeze Trust: Freezing the value of your estate and giving it to your beneficiaries. You are the grantor in the irrevocable trust. Used for minimizing taxes and preventing surviving children from taking a large tax burden.

General partner (GP): an owner of a partnership who has unlimited liability. A general partner is also usually a managing partner and active in the day-to-day operations of the business. In apartment syndications, the GP is also referred to as the sponsor or syndicator. The GP is responsible for managing the entire apartment project. There is liability to this position.

Grantor: The party who created the trust.

Grantor Trust – Creator of trust (the Grantor) is responsible for the taxes on the trust. Non-grantor Trust – Either the assets in the trust will be taxed or the beneficiary pays the taxes.

Gross Lease (aka Full-Service Lease): In a gross lease, the rent is all-inclusive. The landlord is responsible for all or most of the property expenses, including taxes, insurance, and maintenance. This type of lease is convenient for the tenant, but the tenant must weigh the cost of this convenience to avoid overcharge.

Gross potential rent: (GPR) is the hypothetical amount of revenue if the apartment community was 100% leased year-round at market rental rates.

Gross potential income: the hypothetical amount of revenue if the apartment community was 100% leased year-round at market rates plus all other income.

Gross rent multiplier: (GRM) is the number of years the apartment would take to pay for itself based on the gross potential rent (GPR). The GRM is calculated by dividing the purchase price by the annual GPR. We also use the Rent-to-Value Ratio in the same manner to quickly compare across two investments.

Internal rate of return (IRR): the rate, expressed as a percentage, needed to convert the sum of all future uneven cash flow (cash flow, sales proceeds and principal pay down) to equal the equity investment. IRR is one of the main factors the passive investor should focus on when qualifying a deal. A very simple example is let’s say that you invest $50. The investment has cash flow of $5 in year 1, and $20 in year 2. At the end of year 2, the investment is liquidated and the $50 is returned. The total profit is $25 ($5 year 1 + $20 year 2). Simple division would say that the return is 50% ($25/50). But since time value of money (two years in this example) impacts return, the IRR is actually only 23.43%. If we had received the $25 cash flow and $50 investment returned all in year 1, then yes, the IRR would be 50%. But because we had to “spread” the cash flow over two years, the return percentage is negatively impacted. The timing of when cash flow is received has a significant and direct impact on the calculated return. In other words, the sooner you receive the cash, the higher the IRR will be.

International Trusts – A higher form of asset protection for $1M+. More info.

Irrevocable Trust: You can’t revoke the trust, it is a non-grantor trust set-up for somebody else.

Interest-only payment: the monthly payment on a loan where the lender only requires the borrower to pay the interest on the principal as opposed to the typical debt service, which requires the borrower to pay principal plus interest. This sounds good and juices cashflow returns however you do not have the payment to principal in the long run.

Internal Return on Investment (IRR): The IRR (internal rate of return) is a time-weighted return metric that is common in both financial accounting and real estate investing, where the time value of money and liquidity risk are major factors in investment decisions.

IRR partitioning: breaks down the cash flow of the internal rate of return into its two components – cash flow from the operations of the asset (i.e. rent) and capital gains from its sale. The importance of this metric is to help assess the level of investment risk. Cash flow from rental income is more predictable because of the past earnings history. The expected cash flow from the sale is less certain because the exit cap rate can vary significantly in 3 to 10 years when the sponsor decides to sell.

Personally, I don’t really look at IRR. It is a function of returns over time where the sooner you get money the higher the IRR goes cause its weighted appropriately. The best way to explaining this is for you to download an IRR calculator spreadsheet or build your own simple one and play around with one. Showing an unrealistic refinance in year 2 instead of year 3-4 will likely turn a 13% IRR deal to 16-17%. Magic!

For what its worth most deals I deem meeting minimal IRR standards is 13-15% but you have to dig a little deeper to uncover the real placements of cashflows and capitalization events… and then dig even deeper to verify the assumptions such as occupancy, rent increases per year, and what reversion cap rate was used.

Again I don’t look for IRR cause its manipulated a lot instead I look at total return on a 5 year basis. Its like sampling a NFL players 40 yard dash but for apartment underwriting. I’m sure there are other ways to do it but weather its right or wrong… I try to be consistent and I’m just trying to go in and pick the best in the field.

ISD: School district

Key Principal (KP): Also known as a loan guarantor is a higher net-worth individual (usually over $2M) who helps the GP quality for the bank loan. Banks typically require all the KPs to have the combined net worth of greater than or equal to the loan. More info and to sign up to be a KP with us.

Limited partner (LP): As a partner whose liability is limited to the extent of the partner’s share of ownership. In syndications, the LP is the passive investor and funds a portion of the equity investment. Most of our investors invest via their personal name however connect with your legal profession for your own advice.

Limited Liability Company (LLC): a limited liability company (LLC) is a business structure whereby the owners are not personally liable for the company’s debts or liabilities. Limited liability companies are hybrid entities that combine the characteristics of a corporation with those of a partnership or sole proprietorship.

Loan to Value Ratio: The LTV is determined by what percentage an asset’s sale price or value is attributed to financing. Loan to Value Ratio = Mortgage Amount / Appraised Asset Value

London Interbank Offered Rate: (LIBOR) is a benchmark rate that some of the world’s leading banks charge each other for short-term loans. LIBOR serves as the first step to calculating interest rates on various loans, including commercial loans, throughout the world. Many seller financing terms are based off LIBOR.

Loss to lease: (LtL) is the revenue lost based on the market rent and the actual rent. LtL is calculated by dividing the gross potential rent minus the actual rent collected by the gross potential rent.

Logical Biases: See Mindset section.

Managing member: a managing member is a person who is involved in the daily management of a company (usually a limited liability company). The managing member has an interest in the business as an owner. This person is also in an authoritative position that allows him or her to represent the company in contract negotiations and agree to the terms of a binding contract.

Market Value: The actual current value of a property. The market value is not necessarily equal to the purchase price. For example, if you are able to negotiate a discount with the seller, the market value will likely be higher than the purchase price. Most turnkey properties are sold at around their market value and it’s not common to get a discount.

Metropolitan statistical area: (MSA) is a geographical region containing a substantial population nucleus, together with adjacent communities having a high degree of economic and social integration with that core, which are determined by the United States Office of Management and Budget (OMB). It can hold many Submarkets. There are over 384 MSA in the United States. As investors we are able to obtain data on MSAs however we really are interested in what is really happening in the submarket. In each MSA there could be 2-4 dozen sub-markets. Additional info.

Model unit: a spruced up apartment unit used as a sales tool to show prospective tenants how the actual unit will appear once occupied. When we reach full occupancy we typically take these offline.

Modified Gross Lease: The modified gross lease is similar to a gross lease in that the rent is requested in one lump sum. This can include any or all of the “nets” – property taxes, insurance, and CAMS. Utilities and janitorial services are typically excluded from the rent, and covered by the tenant. Ultimately, tenants and landlords negotiate which “nets” are included in the base rental rate.

Net Lease: Unlike gross leases, net leases transfers one or more property expenses, in addition to rent and utilities, to the tenant.

As the name implies, in a triple-net (NNN) lease arrangement, the tenant is responsible for most of these property expenses, and as a consequence, the rent payments are net of:

- Property Taxes

- Property Insurance

- Maintenance

A double-net (NN) lease is a net of property taxes and insurance.

A single-net (N) lease is a net of property taxes.

From the landlord’s perspective, NNN leases are the most desirable forms of net leases since only NNN leases free the landlord of maintenance obligations.

Net operating income: (NOI) is all revenue from the property minus operating expenses, excluding capital expenditures and debt service. For example, a 216-unit apartment community with a total income of $1,879,669 and total operating expenses of $1,137,424 has a NOI of $742,245.

Net Operating Income – Net operating income (NOI) is annual income less expenses.

NOI = (Rental Income + Other Income – Vacancy and Credit Losses) – Operating Expenses

Property expenses include expenses required to operate and maintain a property, including utilities, property management fees, insurance, and property tax.

Note: The mortgage note that is an IOU that can be purchased at a discount in the right situation. Preforming notes are when the borrower is current on payments and non-preforming is when the borrow is late or in default. More info.

Non-accredited investor: any investor who does not meet the income or net worth requirements set out by the Securities and Exchange Commission (SEC) [see Accredited Investor]. In Rule 506(b) of Regulation D, private offerings are restricted to an unlimited number of accredited investors and a limited number of non-accredited, sophisticated investors, defined as those investors with sufficient knowledge and experience in financial and business matters to make them capable of evaluating the merits and risks of the prospective investment.

Non-recourse loan: a loan where, in the case of default, a lender can seize the loan collateral, but, in contrast to a recourse loan, the lender cannot go after the borrower’s other assets—even if the market value of the collateral is less than the outstanding debt.

Non-revenue units: units that do not produce any sort of income – e.g. employee units (for the property staff/managers) and model units (for showing prospective tenants).

NNN (Triple net) lease: a lease agreement on a property whereby the tenant or lessee promises to pay all the expenses of the property including real estate taxes, building insurance, and maintenance. These payments are in addition to the fees for rent and utilities, and all payments are typically the responsibility of the landlord in the absence of a triple, double, or single net lease.

NPV (Net Present Value): the difference between the present value of cash inflows and the present value of cash outflows over a period of time. NPV is used in capital budgeting and investment planning to analyze the profitability of a projected investment or project.

Occupancy: The percentage of units occupied by tenants. Not to be confused with Economic Occupancy where it is the percentage of units occupied by paying tenants.

Operating expenses: Costs of running and maintaining the property and its grounds. This does not include the mortgage or debt service. Nor does it include capital expenditures to upgrade the asset. When acquiring an asset you have to be careful to account for deferred maintenance when looking at the past operating expenses were on the profit and loss statement. When assessing a deal we look at the past 12-24 months of monthly profit and loss statement – called the “T-12 or T-24 P&L.”

Operating agreement: a document that customizes the terms of a limited liability company according to the specific needs of its owners. It also outlines the financial and functional decision-making in a structured manner. It is similar to articles of incorporation that govern the operations of a corporation.

Operator: the team (usually a company) that are experts at analyzing markets and deals. They select the property, do the underwriting on a deal to determine if the asset should be acquired, and can make themselves and the investors a good return for the given risk. Operators develop a business plan to add value (optimize the asset) by managing all aspects of the plan. In addition, they have an asset management role to oversee the project for the hold period to ensure the property gets optimized and increases in income and value by their efforts.

Other Income: Income that does not come from a company’s main business, such as utilities, trash valet, vending machines, late fees.

Passive Investing: Placing one’s capital into a syndication as a LP or limited partner that is managed in its entirety by a general partner. More info.

Physical occupancy rate: the rate of occupied units. The physical occupancy rate is calculated by dividing the total number of occupied units by the total number of units.

Prepayment penalty: a clause in a mortgage contract stating that a penalty will be assessed if the mortgage is paid down or paid off within a certain period.

More info – Question on underwriting. I am newer to evaluating commercial loan terms on these private placements but it seems some people underwrite using fixed rate which has low terms but then their hold period is less than the loan term and using fixed-rate debt, your exposure to the risk of prepayment penalties (yield maintenance) is pretty massive. Do you always price in any prepayment penalties on your deals and/or opt for the more flexible loan instead that doesn’t have the penalties.

Very good expert level question…

To have a longer term is on the surface, safer because in case of a recession you are not forced to sell or refi in a down market. 8 years or more are preferred for the term. However as you seem to be aware of longer terms typically (not always) comes with prepayment penalties and yield maintenance (PP/YM) which can be pretty big. In the roaring years of 2012-2016, where rents would go up 3-6% a year, no one cared about those big prepayment penalties as it would be minor compared to the NOI increase and thus increase in property value. Most operators do not take into account the prepayment penalties when underwriting much like how we don’t underwrite or project to refinance in 3 years although we could. This is another reason why we choose to run the deal out longer since this greatly decreases the impact of PP/YM since there is typically a step down component to the fees the longer you hold on to the loan or if you use hybrid loans which we tend to pick.

As a side nuance this latest 15 year term on this past deal is so long we believe our next buyer 3-6 years from now would be happy to assume our loan which would never bring PP/YM into play.

More info in the Lending/Debt Selection section.

Pref (Preferred return): refers to the order in which profits from a real estate project are distributed to investors. Preferred return indicates a contractual entitlement to distributions of profit. The priority of this distribution is maintained until a predetermined threshold rate of return has been met. Once met, profit distributions are made to any other subordinate stakeholders in the project.

PPM (Private Placement (or Offering) Memorandum): a legal document that states the objectives, risks, and terms of an investment. This document includes items such as a company’s financial statements, management biographies, and a detailed description of the business operations. The PPM/OM serves to provide buyers with information on the offering and to protect the sellers from the liability associated with selling unregistered securities.

Pro forma: a method of calculating financial results using certain projections or presumptions.

Promote (Promoted interest): a sponsor’s share of profits (separate from the syndication fees) that is significantly greater than the sponsor’s capital investment. The promote is generally given in exchange for the sponsor’s having created value through finding and managing the opportunity, and in some cases for bearing a disproportionate share of the downside risk.

Price per unit is the cost of purchasing an apartment community based on the purchase price and the number of units. The price (or cost) per unit is calculated by dividing the purchase price by the number of units. For example, a 216-unit apartment community purchased for $12,200,000 has a price per unit of $56,481. Sophisticated investors should be able to break down the cost per unit and analyze how much are the income to expenses there are and apply the Rent-to-Value Ratio rule.

Private placement memorandum: (PPM) is a document that outlines the terms of the investment and the primary risk factors involved with making the investment. The four main sections are the introduction, which is a brief summary of the offering, the basic disclosures, which includes general partner information, asset description and risk factors, the legal agreement and the subscription agreement. It protects both the GP and LP. GPs essentially sign up for fiduciary responsibility and LPs sign off that they understand that there is risk and they can lose their money.

Promissory note: evidence of a promise to pay a debt and is signed by the borrower. The terms “loan” and “note” are often used interchangeably with “promissory note.”

Property management fee: an ongoing monthly fee paid to the property management company for managing the day-to-day operations of the property. This fee ranges from 2% to 8% of the total monthly collected revenues of the property, depending on the size of the deal. Don’t forget that many property managers also charge 50-100% of the first months rent as a lease up fee.

Property and neighborhood classes: a ranking system of A, B, C, or D given to a property or a neighborhood based on a variety of factors. These classes tend to be subjective, but the following are good guidelines:

Purchase Price: The price of the property you are purchasing. With turnkeys, this is usually listed directly on the turnkey company website and is non-negotiable.

Property Classes

- Class A: new construction, command highest rents in the area, high-end amenities

- Class B: 10 – 15 years old, well maintained, little deferred maintenance

- Class C: built within the last 30 years, shows age, some deferred maintenance

- Class D: over 30 years old, no amenity package, low occupancy, needs work

Neighborhood Class

- Class A: most affluent neighborhood, expensive homes nearby, maybe have a golf course

- Class B: middle class part of town, safe neighborhood

- Class C: low-to-moderate income neighborhood

- Class D: high crime, very bad neighborhood

Pro-forma: the projected budget of an investment with itemized line items for the income and expense which is an output of the underwriting. We tell investors to scrutinize most pro-formas to use the right assumptions to come up with the outputs.

Profit and loss statement: a document or spreadsheet containing detailed information about the revenue and expenses of the apartment community over the last 12 months. Also referred to as a trailing 12-month profit and loss statement or a T12.

Private Equity: The name “private equity” explains much of what these funds do. Private equity companies like ours raise capital from private parties, usually individuals, rather than “going public” and raising public capital on Wall Street. The benefit is lower operating expenses and less regulatory red tape, although we are still subject to specific regulations as stipulated by our Regulation D exemption granted by the SEC.This exemption allows both accredited and non-accredited investors to participate in our fund. Private equity funds are illiquid and managed by active investors. If you’re familiar with common index funds such as those ordinary investors might hold in their investment portfolios, you might be led to believe an investment in private equity funds is a fools game. History has shown that private equity investments generally turn out to be very good investments. Here’s why: Some of the main operations of large private equity firms include buying out financially struggling companies and turning them around through involvement in management and restructuring, or by directly investing in companies and facilitating mergers or initial public offerings (IPOs) once a healthy return has been established.

Ration Utility Billing System: (RUBS) is a method of calculating a tenant’s utility bill based on occupancy, apartment square footage or a combination of both. Once calculated, the amount is billed back to the resident, which results in an increase in revenue.

Real Estate Investment Trust (REIT): a company that owns, operates, or finances income-generating real estate. Modeled after mutual funds, REITs pool the capital of numerous investors. This makes it possible for individual investors to earn dividends from real estate investments – without having to buy, manage, or finance any properties themselves.

Rent comparable analysis: the process of analyzing similar apartment communities in the area to determine market rents of the subject apartment community. This is also knows as shopping your comps by walking the properties or calling those competitors to see what they are renting similar units for. For single family rentals or smaller properties Rent-o-Meter is a good tool or check out this article.

Rent-to-Value Ratio: Also known as the RV ratio, 1% is needed to be able to cashflow after expenses. You find the Rent-to-Value Ratio by taking the monthly rent dividing by the purchase price. For example a $100,000 home that rents for 1,000 a month would have a Rent-to-Value Ratio of 1%. Most people I work with live in primary markets (as opposed to Birmingham, Atlanta, Indianapolis, Kansas City, Memphis, Little Rock, Jacksonville, Ohio, or other secondary or tertiary markets) where the Rent-to-Value Ratios are under 1%. More info.

Rent premium: the increase in rent after performing renovations to the interior or exterior of an apartment community. The rent premium is an assumption made by the general partner during the underwriting process based on the rental rates of similar units in the area or previously renovated units.

Rent roll: a document or spreadsheet containing detailed information on each of the units at the apartment community, along with a variety of data tables with summarized income.

Returns: More info.

Return on Investment: ROI measures the amount of return on a particular investment, relative to the investment’s cost. To calculate ROI, the benefit (or return) of an investment is divided by the cost of the investment.

Revocable Trust: You can change your mind, you can write “Revoked” on the front page of the trust and it no longer exists.

Refinance: the replacing of an existing debt obligation with another debt obligation with different terms. In apartment syndication, a distressed or value-add general partner may refinance after increasing the value of a property, using the proceeds to return a portion of the limited partner’s equity investment.

Sale of Business: This is a capital gain. Capital gains can only be offset by capital losses.

Simple Trust – Must annually distribute to the beneficiaries any income it earns on trust assets, the trust can’t distribute the principal of the trust, and the trust can’t make distributions to charitable organizations.

Security document: such as a mortgage, is a document that is recorded at the county showing that the borrower pledges the property as collateral against the loan.

Shape Ratio: A way of comparing the risk vs reward profile of investment. This is obviously impossible because non stock market investments are not commodities. Therefore the Sharpe Ratio is a ideal to understand as a fundamental on how we decide to go into a deal or not. More info.

Submarket: a geographic subdivision of a market. For example, Richardson, Carrolton and Arlington are submarkets of the Dallas-Fort Worth market. We purchased an apartment in Irving which had a submarket of Valley Ranch in a great school district. Even in Valley Ranch there were multiple submarkets.

SFH: Single Family Home

Sophisticated investor: A sophisticated investor is a person who is deemed to have sufficient investing experience and knowledge to weigh the risks and merits of an investment opportunity. We accept a limited number of sophisticated investors in most deals we do within the Hui Deal Pipeline Club.

Sponsor: the person or team that champions all aspects of a commercial real estate project on behalf of the equity investors. In a limited partnership (LP), the sponsor is often referred to as the General Partner (GP), whereas the rest of the investors are Limited Partners (LPs).

Spendthrift Trust: Provisions in the trust that limits how the trustee can use the assets.

Subscription agreement: an investor’s application to join a limited partnership. It is also a two-way guarantee between a company and a subscriber. The company agrees to sell a certain number of shares at a specific price, and in return, the subscriber promises to buy the shares at the predetermined price.

Syndication: a technique for aggregating capital for an investment where multiple owners acquire an equity share in an entity that owns the investment asset.

TK: Turnkey Rental

Trust: an arrangement where one party entrusts another party the right to hold title to property or assets for the benefit of a third party. NOTE: trusts must pay taxes.

Trustee: The party who is given the right to hold title to the property or assets

Turnkey Rental: A semi passive type of investment where an operator sells to the end buyer (you) fixed up. It can consist of varyings degrees of 1) rehabbed level, 2) tenanted, 3) Property management in house or third party. Learn more.

Underwriting: the process of financially evaluating an apartment community to determine the projected returns and an offer price.

Vacancy loss: the amount of revenue lost due to unoccupied units.

Vacancy rate: the rate of unoccupied units. The vacancy rate is calculated by dividing the total number of unoccupied units by the total number of units.

Value Add – Opposite of a Yield Play. More of a risker but potentially higher return project with larger rehab/development.

Waterfall: describes how money is paid, when it is paid, and to whom it is paid in commercial real estate equity investments. Distributions from cash flow and distributions from a capital event (i.e. a refinance or sale) of the investment property are allocated to the General Partners (GPs) and Limited Partners (LPs), primarily based upon the roles they play in a real estate transaction.

Working Capital: Should be included in your cash reserves to account for floating expenses before bills come in. Sometimes you might be able to float costs a long time if you are waiting on insurance payments or late rents from tenants.

Yield Maintenance: See pre-payment penalty

Yield on Cost: the net operating income (or sometimes cash flow from operations) at stabilization divided by the total project cost, whereas the capitalization rate (cap rate) is the stabilized net operating income (or sometimes cash flow from operations) divided by the market value of the property

Yield play: Typically Yield strategies are looking for a safe, secure asset that will produce a very predictable return. When we end up selling our assets they are typically very stable and someone looking for a yield play with not a lot of maintenance will be our buyer. Value add strategy, which we actively look for, allows for us to improve the asset in a given way that produces more return for what work we put into the asset. The reason that these often work well is because of leverage with using secured bank money. If we are able to increase rents by 10-20% by only putting in 5% of the asset price there is an inherent gain in value, especially when we are leveraged 4/1 on the financing. The most typical ways to add value to an asset is through construction upgrades and reduction of costs.

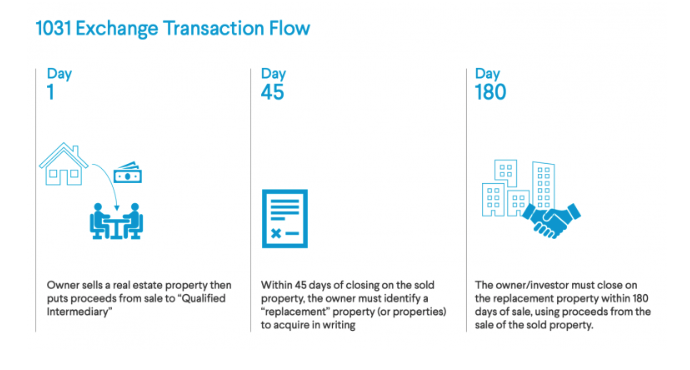

1031 Exchange:  more info

more info