Policy Loans

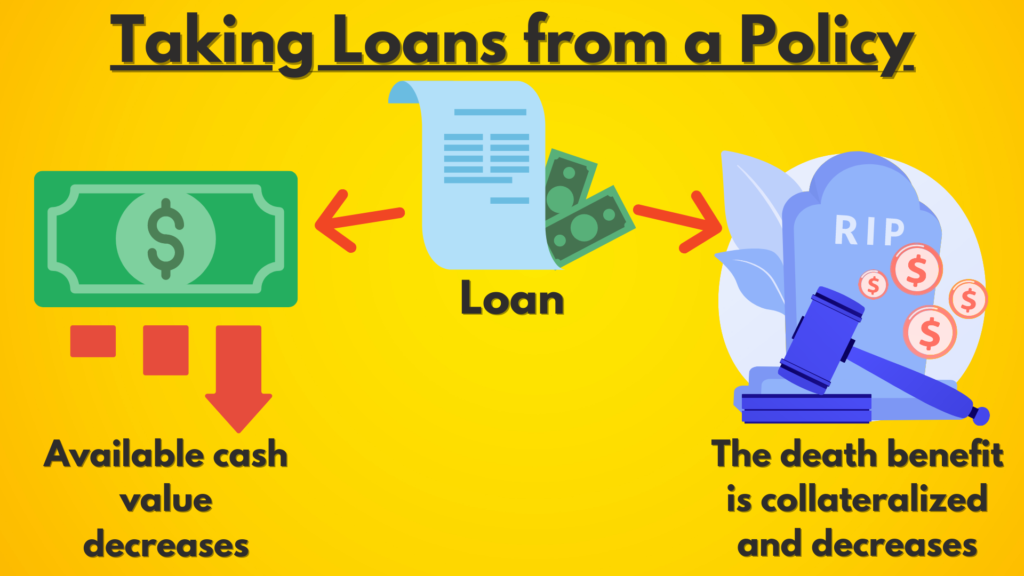

What Happens When You Take Loans from a Policy?

When loans are taken from a policy, the death benefit is collateralized. If there are loans outstanding when the policyholder dies, the insurance company will pay out a smaller death benefit.

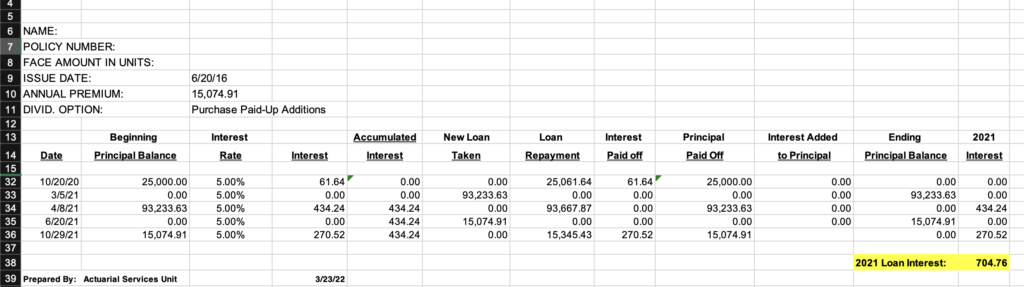

Attached is a transaction summary of my 50k policy that I started back in 2016. Everyone is going to be different on how they use the liquidity but you can get a sense of how you dip into the account and pay back again and again.

Example of Annual interest paid statement. Take note of the frequency of loans and paying back. Everyone will utilize loans and payback at different rates and this is the flexibility of using IBC as a tool to power your investing and fund your short term liquidity (emergency fund). I use this as a backup in my taxes to notate the interest paid which I deduct as a business expense. Of course not giving tax advice here but this is why you join our Family Office Ohana Mastermind to learn the best practices so you can go to your “in the box” tax/legal professionals with your gameplan.

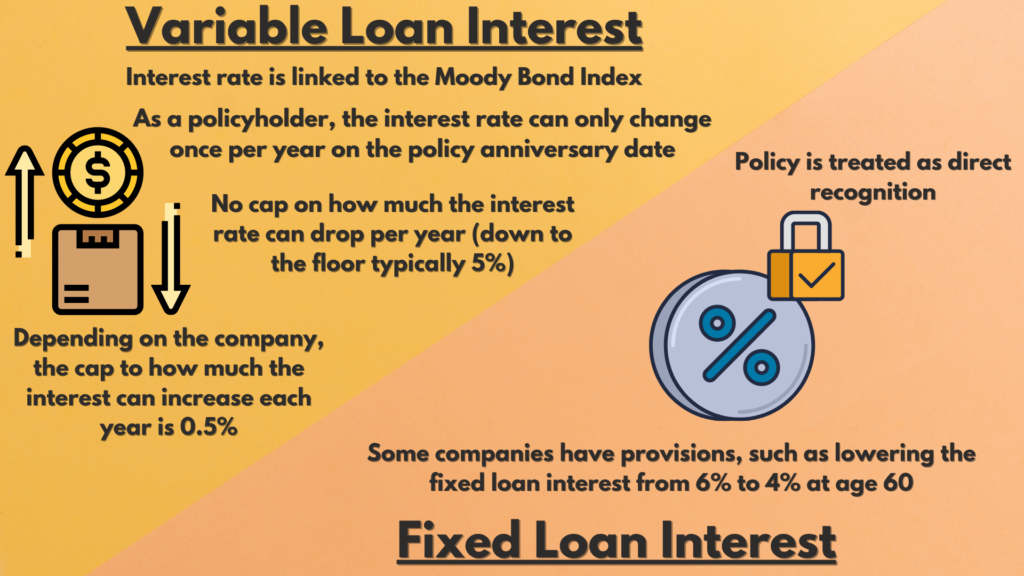

Variable vs Fixed – Loan Interest Rates

Loan interest accrues daily at annual simple interest. For example, a $10,000 at 5% accrues by $1.37 ($500/365) each day.

Note: This was one of the advanced concepts that came out of our FOOM group. Join here.

Understanding Policy Loan Rates

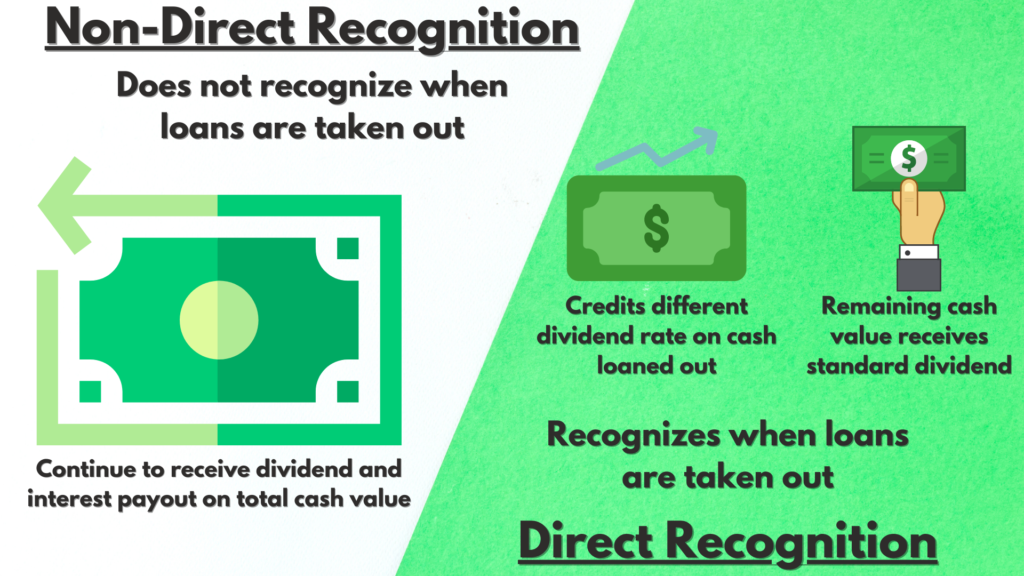

Direct vs Non-Direct Recognition – Loans

Let’s look at the two types of loans:

Which is better? In short, it doesn’t really matter which type you get, what’s more important are payment flexibility and access to funds.

Non-Direct

- Has a lower variable interest loan

- Fixed dividend rate

Direct

- Has a higher fixed interest loan

- Slightly higher dividend rate (varies by company)

Policy Loans vs CVLOC

Bank loans may have a lower interest rate, but you need to apply, these loans show up on your credit report and needs regular payments. You need to weigh the value of the “freedom” with policy loans vs the interest rate difference. An additional factor is the “asset protection” benefit that goes away if the cash value is put up as collateral.

Benefits of 3rd Party CVLOCs

– 3rd party loan rate 3-4% compared to 5-6% policy loan (this 1-3% difference can boost your rate of return by 100% if the 3rd party rate is 3% and the policy loan is 6%)

– Higher LTV, 3rd party LTV (95-100%) compared to 95% for policy loans

How Soon Can I Take Out a Policy Loan?

There has been an increased amount of scrutiny over immediate loans where the home office has been putting a hold on the loan until:

- The client’s bank account information is verified

- The client confirms that they initiated the loan

The typical rule of thumb is 10 days after the funds clear.

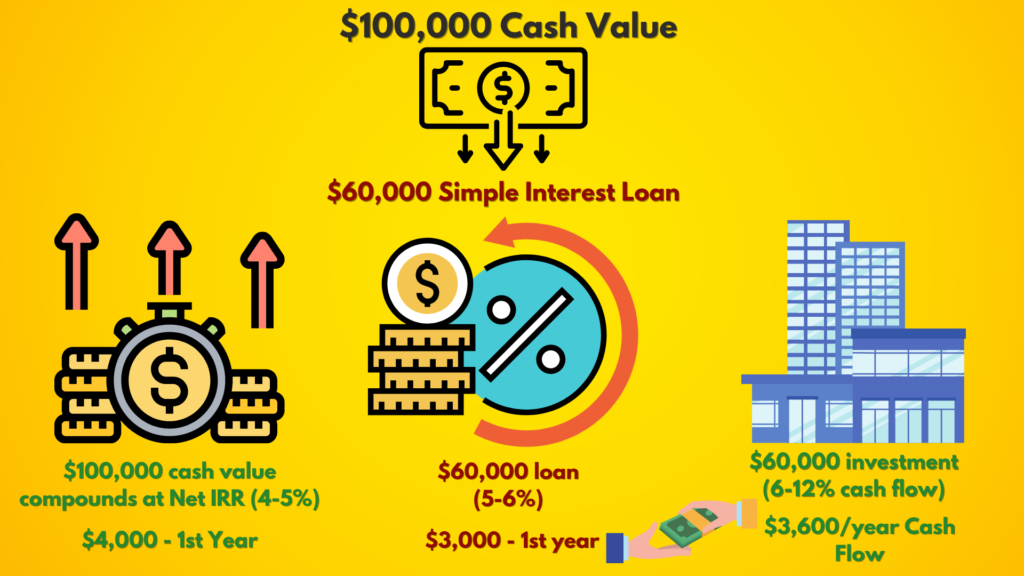

Taking Loans to Invest Real Estate

Instead of withdrawing from the cash value of the policy and losing out on the dividend, investors take loans out. You can typically take loans up to 90% of the cash value.

The cash value continues to increase while the cash flow from the real estate investment pays down the loan year over year.

It’s important to note that the loan is SIMPLE interest so it will continue to decrease each year that you pay it off.

FAQs

Let’s say you had a $10,000 loan at a 5% loan interest rate. The insurance company will bill $500 upfront. Loan interest still accrues at annual simple interest. If the policyholder pays the full $10,500 in 6 months, the company will refund $250.

The loan rate is dependent on insurance company and also what year you are in the policy.

Another benefit to doing the third party over a HELOC is that you are getting money out of the banking system which can be a little unreliable. In 2008, when things got crazy a lot of people got their HELOCs and business lines of credit pulled on them.

With this third party loan, you are are shielded from that with a life insurance company that has a better balance sheet than a bank.

In most cases the way we structure it will minimize this as long as you fund your first year (on a six year plan). Again the reason is that the base premiums are very low.

Example… take a policy 50k per year (created with a 6 year plan of 50K per year) with 10% of the payments going to base premium instead of 20-50% like how most agents structure it. If you put in 50k that first year that will satisfy the base premiums for the life of the 6 year commitment because (10% of 50k) is 5k for each year and for six years would make the total base payment (5k x 6) is 30k for the life of the policy – to which you already put in there that first year. Hopefully this insight makes you even more aggressive in how much you start up with.

If the policies structured by the other guys that have a higher amount of insurance minimums (making higher commissions for the life insurance sales guy).

If you were to take a policy loan, the current interest rates would be higher (6% but effectively 5.66% for Guardian in 2021) than the actual net dividend (5.65%-1.65% guesstimate for mortality and admin costs for a net of 4%).