Policy Design

Policy design is everything, you can have the same life insurance product from the same company, but if you have a poor design you could have drastically different results.

Design Objective

The goal of good policy design is to maximize cash value both upfront and long-term, while not creating a Modified Endowment Contract (MEC) by exceeding the tax favorable limits.

Where Do Premium Payments Go?

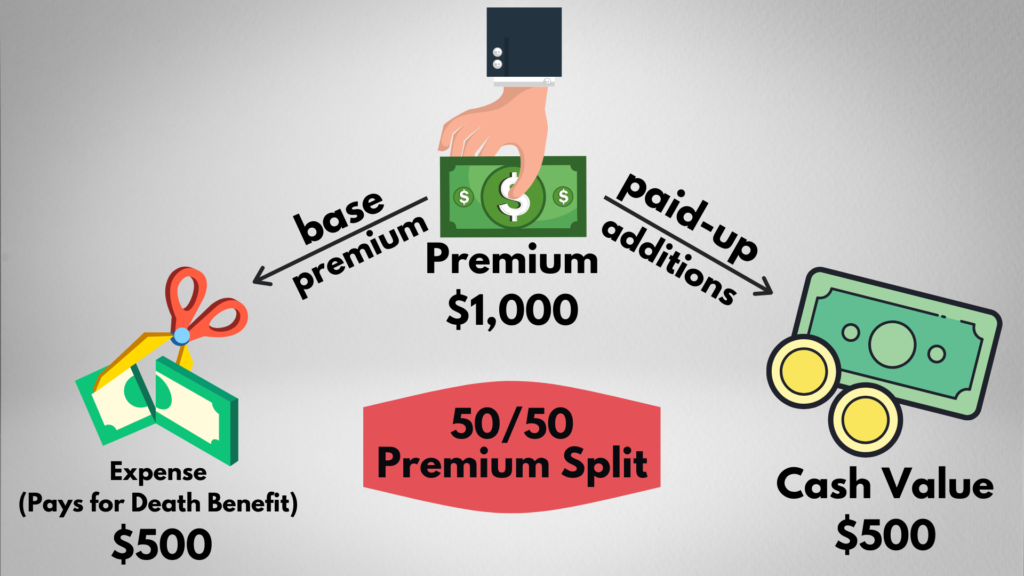

Some whole life insurance policies out there that market themselves as “High Cash Value Policies” don’t actually provide the most cash value and only provide a 50/50 premium split!

- Minimal Cash Value for Policy Owner

- Long break-even point between cash value and premiums paid (15-20 Years w/ traditional life insurance)

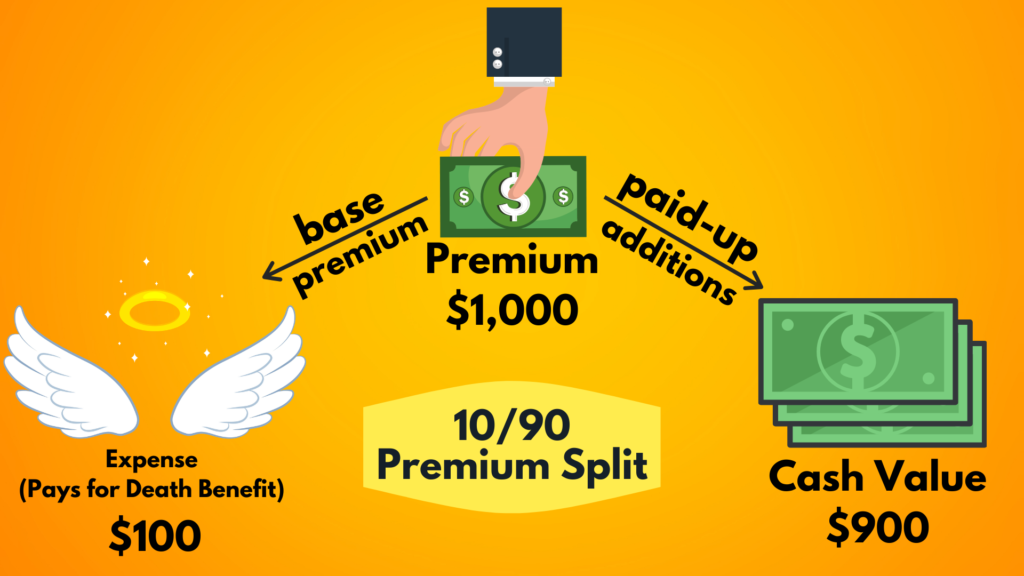

- Premium split of up to 90%

- Immediate access to cash value

- Cash value breaks even in 3-5 years

- Strong cash value in the long-term

- Minimizes expenses/Maximizes flexibility

Increasing Your Cash Value – Paid-Up Additions Rider (PUA) and Term Rider

To get a better understanding of how we maximize the cash value in the policy with riders, let’s look at the following example:

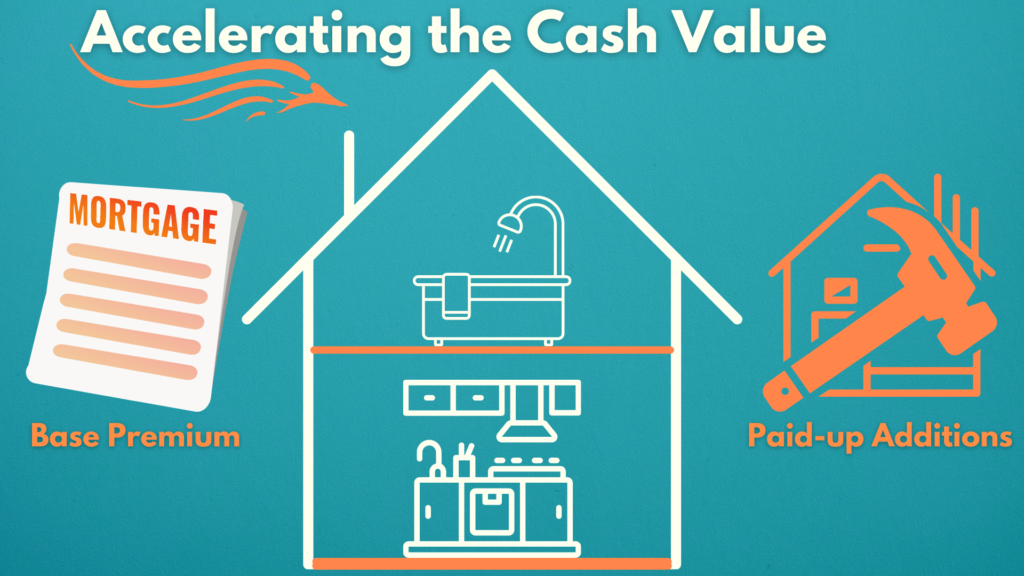

The mortgage for a house is a required payment in order to keep the house. Mortgage payments slowly build up equity over time.

If you were to make upgrades to the house like updating the kitchen/bathroom, that would immediately increase the value of the home.

With life insurance, the base premium is like the mortgage, in order to keep the policy in force, you must make these required payments which slowly build up the cash value.

Paid-up additions are an optional payment that immediately contributes to increasing the cash value.

Term riders increase the death benefit for a set amount of time (i.e. 5, 10, 20 years) depending on how long of a period you would want to max fund the policy. Think of term riders as the foundation that allows you to add on paid-up additions, the stronger the foundation (larger the death benefit), the higher amount of paid-up additions you can add.

When utilizing paid-up additions, dividends should still be used to purchase additional PUAs to keep the compounding from being interrupted.

Scheduled vs Unscheduled (PUAs)

Scheduled

Pay PUA at the exact same time as the base premium.

Unscheduled

Flexibility to pay PUAs at leisure. Depends on the company, but payments may be limited to a certain number of transactions per year (i.e. quarterly, once a year).

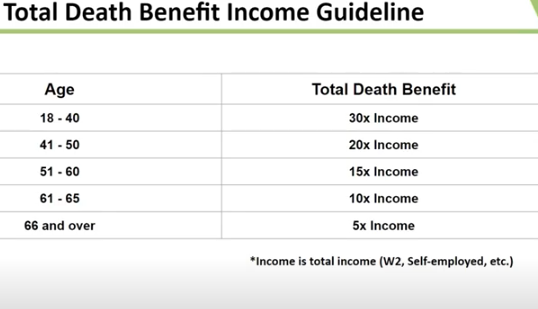

This table shows approximately how death benefit you could receive based on your age and income (whether that is W2 or self-employed income).

Understanding the Underwriting Process

FAQs

Applicants will have to qualify for the policy by completing a medical exam and having the insurance company review their application.

Other requirements may be needed depending on the amount of insurance being applied for.

In general, the cost of insurance is lower on this savings product, and the underwriting requirements are less stringent, making this policy easier to qualify for and also more affordable.

If you are personally not able to qualify for the insurance policy, you could have a healthy individual that you might have an insurable interest in, create the policy (such as your spouse or children).

This depends on much do you want the ability to pay in a given year. You will see with company limits that some companies allow you to pay 10X your base premium. For example with a $5,000 base premium and a $45,000 PUA (10/90 split) that gives you the ability to pay up to $50,000 a year.

You are required to pay the base premium every year, however the PUA is optional.

Yes it is possible with paid-up addition limitations.

By spreading payments out we lower the base premium. If you wanted to make a large payment upfront, you would need a high base premium to obtain a high MEC limit. Then you would need to continue to pay that high base premium until year 7 where you can then add a reduced paid-up rider.

It depends, you can ask the insurance agent to create illustrations to model both scenarios.

Most companies require third party verification for a death benefit of about $10M. Less than that, you will need a signed statement by the prospective insured and the agent.

This is also dependent on stated W-2 income. For example there was a teacher who had a stated income of $400K/year (from other sources of income) and the insurance company wanted proof from past tax returns.

Most companies with apps or online access wouldn’t really make any difference as you would log on and all policies with that company would be visible.