Dividends

Insurance Company Dividend Rate

The company’s listed dividend rate is made up of the guaranteed rate and the nonguaranteed rate.

The guaranteed rate always will be paid, while the nonguaranteed rate is based on the company’s performance that year.

Net Internal Rate of Return (IRR) – What You’re Actually Getting

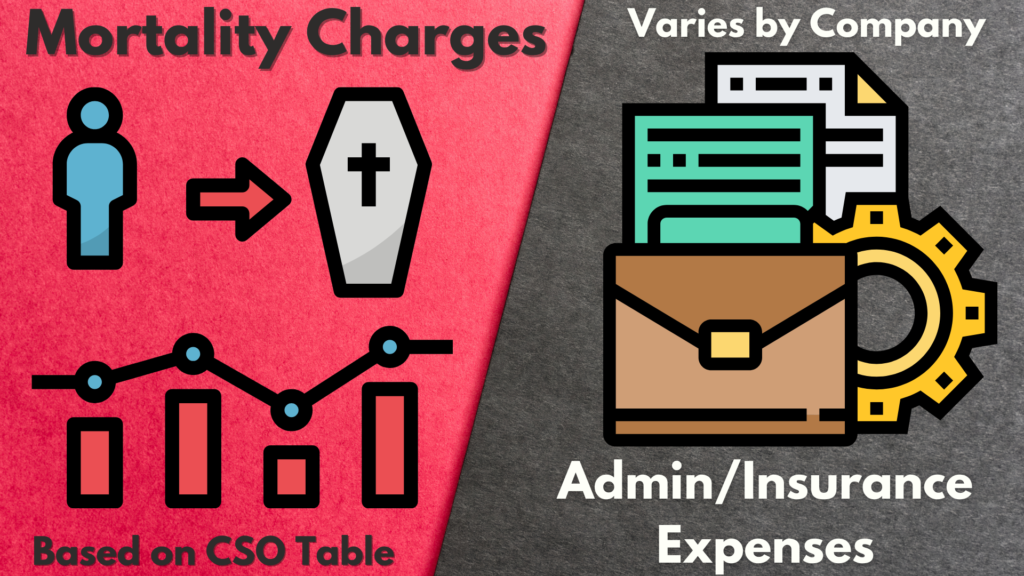

You can expect to receive between 1-2% less than the listed company dividend rate due to the following factors:

Your net IRR is the company’s listed dividend rate less mortality and admin/insurance expenses.

Knowing this is important so you don’t pick a company based on their listed dividend rate.

Large vs Small Insurance Company

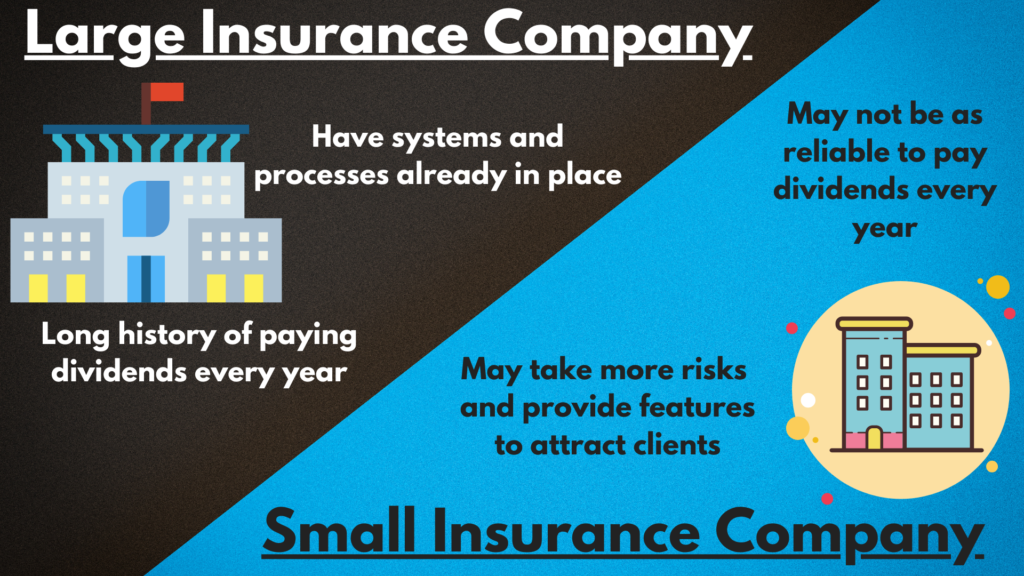

Large companies typically have a proven track record and systems and processes already in place which reduces variability.

Smaller companies may take more risks or provide attractive features to draw clients, however, those may not be permanent features or features good for the overall insurance company/client.

Changes for Whole Life Insurance Policies – 7702 Rule

With the 7702 Rule in effect, the guaranteed 4% interest rate no longer applies, in the video below we go over some of the potential impacts, this rule brings to whole life insurance policies.

FAQs

In the 1980’s insurance companies used to invest in bonds, nowadays companies are investing in high-end commercial real estate, multi-family real estate, and cash flowing businesses.

The top insurance companies have been paying a dividend for over a 100 years through many downturns in the economy, a small percentage of their holdings are in stocks.