How the Wealthy Manage Their Money

Wealth is All About Control

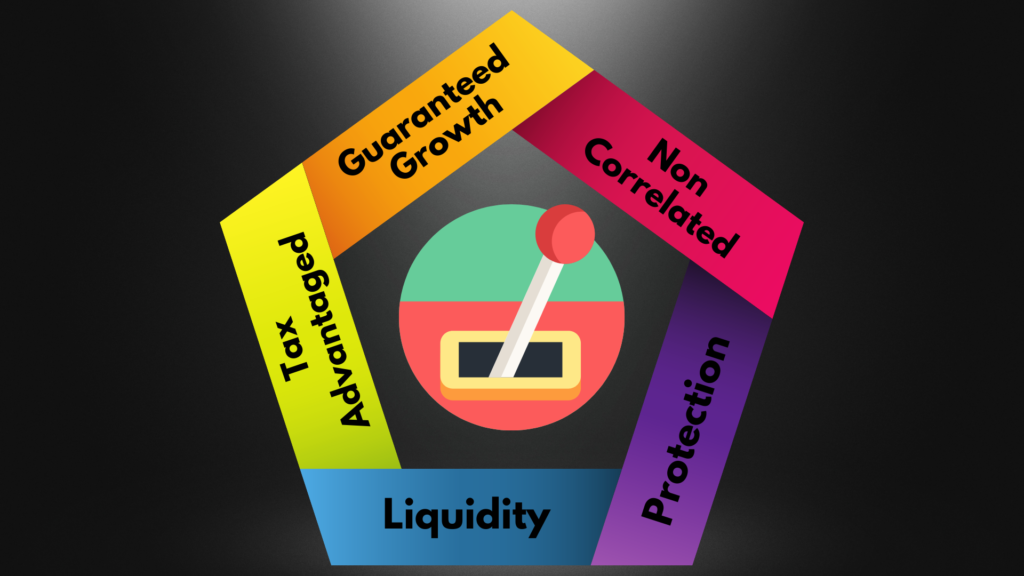

The wealthy look for the following factors when deciding where to hold their cash:

Attached is a transaction summary of my 50k policy that I started back in 2016. Everyone is going to be different on how they use the liquidity but you can get a sense of how you dip into the account and pay back again and again.

Why Hold Your Cash in Life Insurance?

The life insurance companies that we work with are not publicly traded. Their ability to pay the 2-4% guaranteed interest is based on the performance of the company and non-correlated assets.

In addition, there is also a non-guaranteed dividend return of 1-2%.

Growth on the cash value within the life insurance policy is not taxed.

Cash value is accessible for withdrawal at any time for any reason. You can also take a loan out on the cash value.

You’re in control, if the policy is designed properly the equity can be accessible without:

- Age restriction

- Credit Checks

- Financial Statement Audits

- Reasons for Loans/Withrawals

There are no restrictions on high-income earners, unlike 401(k)’s, IRA’s, etc. which have contribution limits.

You may contribute as much as you want.

Life insurance is a private agreement, so it’s not listed on your balance sheets, credit report, etc.

In most states, life insurance is not seizable as property, so in most cases, the cash value in the policy will be protected from bankruptcy, divorce, etc.

With traditional retirement accounts, assets, bank accounts, etc. there will be an inheritance tax.

However, in life insurance, the death benefit is 100% tax-free, making it a great tool to pass on wealth to the next generation.

Control Your Wealth

If you are ready to get a quote to create a policy please send an email to Bank@simplepassivecashflow.com.

Book your complimentary 1-hour “Simple Passive Cashflow Banking” call here. And email team@simplepassivecashflow.com to get free access to the Infinite Banking eCourse.

Entrepreneurs and Life Insurance

Walt Disney

When banks would not initially fund Walt Disney's dream, he became his own bank and borrowed from his own life insurance in order to develop Disney.

Ray Kroc

Ray Kroc was able to pay key employees and McDonald's branding campaign through the liquidity in his whole life insurance policy.

Companies put life insurance on their top talent which acts like golden handcuffs. In exchange for the business using the cash value in the policy to grow the business, the company can offer the employee a retirement pension from the policy’s cash value if the executive stays with the company for a certain number of years. The employee will need to pay income tax on payments from the policy’s cash value.

Average vs Actual Returns – Stocks

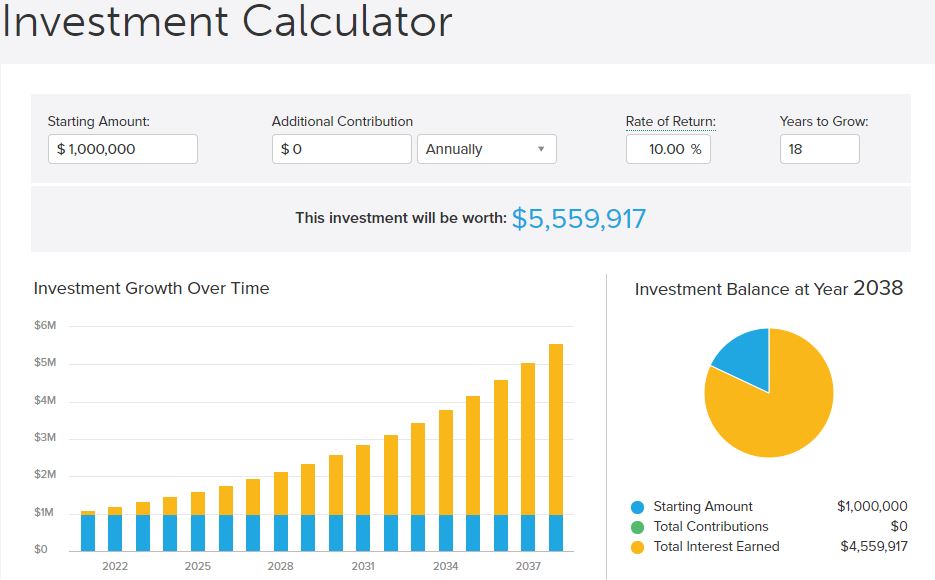

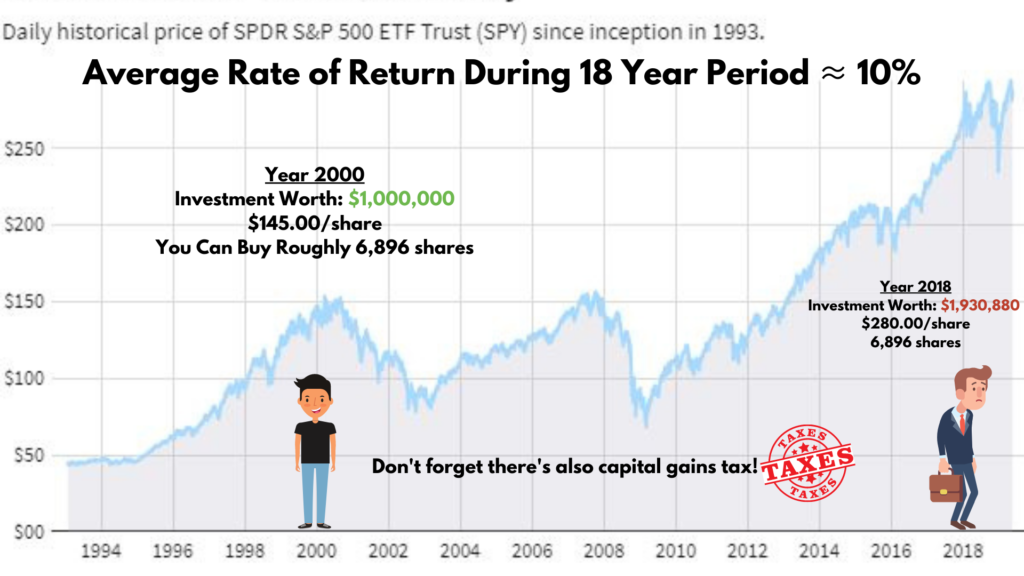

You’ve probably heard multiple times that the AVERAGE return for the S&P 500 is roughly 8-10% and you were shown some investment calculator showing how much your money would grow if you leave your money in stocks or a retirement account.

Let’s compare that to the ACTUAL returns you would receive given the same starting amount and rate of return (to simplify things we are not including additional contributions).

Because of the “catch-up” periods during dips and especially during recessions in the market, you actually earned $3,629,037 LESS than what was projected using the average return! To re-cap, the fluctuation in account value, capital gains tax, and inheritance tax (when transferring wealth to the next generation) are reasons why the wealthy stay away from holding their cash in stocks.

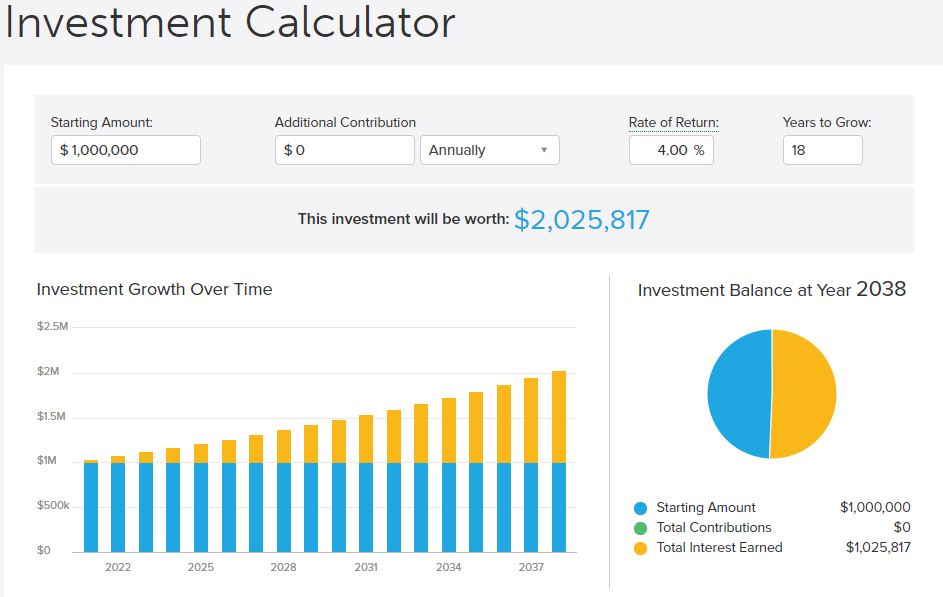

Storing Cash in Life Insurance

As long as you don’t withdraw money from your life insurance policy, the cash value will compound on itself tax-free!

Plugging in the numbers from our previous example, you would have actually made more money in that 18 year period. But remember that this is just where we hold our cash, in upcoming lessons we will show you how we design and utilize the cash value.

Other Applications

- In lieu of 529 education plans or 401k/retirements use this policy

- Own your own cash but take a policy loan to keep the debt there

- Fund your crypto yield farming

- Other uses for short term liquidity (Opportunity Fund)

You can use infinite banking to plan ahead not only for real estate investing (or other investments) but also for your senior years.