Advanced Topics

KISS - Keep it simple

Family Office Clients have in the past gone down the rabbit hole with this topic. However in the end most will agree to just get started to get the hang of utilizing the system in conjunction with your personal liquidity and investing.

Below is one comment from one client who got really confused at first and came full cycle to simplistic understanding:

Client Questions

- Private Placement Life Insurance, or PPLI (really only applies to higher net worth – over 5M net worth)

- Does cash value in a life insurance policy count toward your net worth calculation to determine if you qualify as an accredited investor?

- Can I carry a term life and a whole life policy at the same time?

- Why not buy term and invest the difference?

- Is it true that the guarantee dividend will change by the end of the year and do you know by how much? yes… companies are changing it from 4% due to tax law change. we will cover this during the 7702 section. the amount of change will vary company to company

- We currently have a term life policy since we have young kids. We only wanted this until our kids our 18. If we started to do the IFB, would we need to cancel the term life policy?

- Why would you not want to fund it every year when it is compounding and you lose that aspect.

- So how much money does someone need to contribute to build up the cash value to make it worthwhile to then borrow against it and use this strategy successfully?

- What happens if interest rates go up over 4%?

- Makes sense why to use IBC policy for an investment opportunity… but don’t understand why some folks (not Lane or Tyler) recommend it for liability purchases (car, vacation, etc)… Does it ever make financial sense to use the IBC loan for something smaller (car, vacation) that could be purchased with cash?

- What do you mean by $100K per year policy? Do you mean you pay in that amount in premiums for the year?

- What will the inflation or hyperinflation affect the life insurance?

- So the growth from the investments benefits are not taxed? Vs Investment growth from HELOC money which is taxed?

- Under what circumstances can you access the money if you need it?

- What was the law change and impact on IBC?

- How do you figure out your max death benefit?

- If you are just out of college in your first jobs when you should consider the WL IBC?

- So is MEC irreversible? Can you MEC a year or two to turbo charge and then get back under the MEC limit?

- Wouldn’t it be advantageous to continue paying the premiums even after the the 7 years?

- I agree with the 10/90 split too but Nash Institute people are against it. Do you have an opinion about this? 🙂

- How is the 90% PUA tax reported?

- Are we supposed to over-pay the policy loan as a way to backdoor fund the cash value?

- You can also use its as Long term care insurance?

- It would be great to have it help before you’re dead.. assisted living, LTC..because of unforeseeable things like Alzheimer’s etc

- How long is the loan term?

- Can you setup a 1 year paid up policy vs. a 6-7 year policy?

How does the loan usually need to be paid back? annually? quarterly?

- Which bank are you working with for the loan?

HELOC and IBC banking strategies is like having two different credit cards with varying cash back rates, depending on the category you’re playing in the credit card hacking game.

In the past, HELOC had a lower rate, while infinite banking usually pegged around five to five and a half percent for borrowing. However, recently HELOCs have become more expensive, sitting at around 7%. But don’t worry, some banks offer great teaser rates, especially here in Hawaii, which can get you under 5% for a limited time.

Both HELOC and IBC are fantastic sources of lazy equity that can be turned into 10-15% more through value add deals and other real estate opportunities. That’s what we’re aiming for, right?

Personally, I use both HELOC and IBC. However, I’ve moved beyond relying solely on a HELOC. Once you reach a certain point, it’s better to either refinance the house if you plan to stay long-term or sell it and venture into more real estate and investments, rather than owning the house you live in.

The great thing about a HELOC is that there are no fees involved, unlike refinancing, where hidden fees can catch you off guard. However, one downside is that when the economy takes a little dip, banks can retract those HELOC. This is the upside to the IBC policy loans.

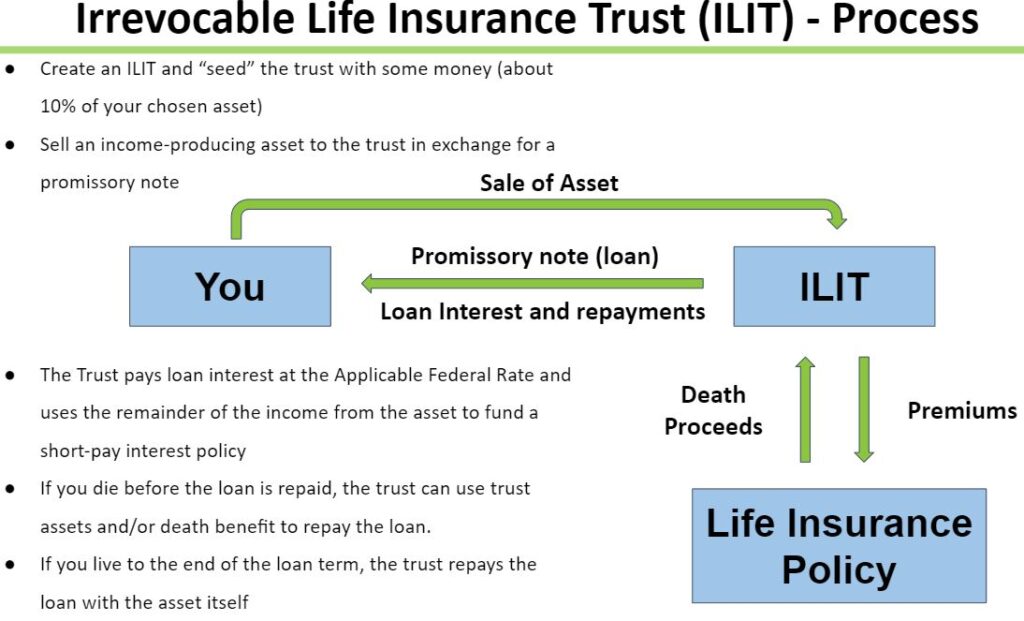

Irrevocable Life Insurance Trust (ILIT) – Overview

ILITs are a way to buy life insurance within a trust so that the income grows income and estate tax-free

It’s a useful tool for those who have a very high net worth, are over the estate tax exemption, and will need to pay estate taxes. The estate tax exemption is currently $12.06 million (2022), but will drop back down to $5 million by 2025. Keep in mind that this exemption does change so if you have a high net worth, this may be a strategy that you might use.