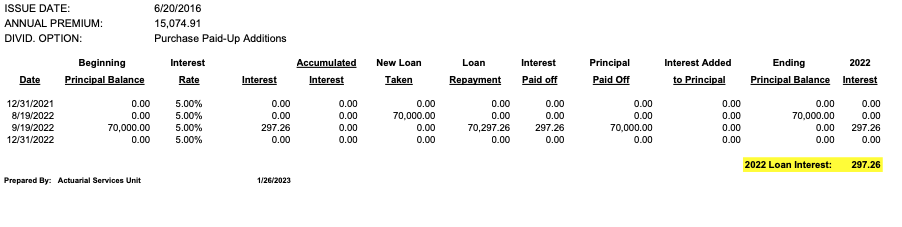

As long as an expense is reasonable and necessary for you to pursue business revenue for example taking a loan to make more money in another business endeavor you should be able to deduct the expense as a business expense. It is best practice to be able to “trace” expenses so you can deduct the business interest. Similarly remember in 2020 when everyone was taking 100k withdraws from your 401k… it was best practice to have a clean line of “tracing” between what you took out of the 401k and where the money went for which was supposed to be used for some “covid hardship” and boy was that list of unnamed reasons large. With business interest expenses that might come from lending money from a buddy at 10%, 6% from your HELOC, 4% from your mortgage note, or 5% from your IBC you “should” have the same type of (at the very least loose) tracing so you can show a clean usage of the funds – incase the event of an audit which is very low likelihood of happening. Most people will nod our heads and know exactly what do because we don’t sweat the small stuff and are not worried about any audit because in essence we know we are not doing anything illegal, others will get catch up with this technicality and spend their time making this line super clear. Experience share… every year in January, I send an email to my life insurance company requesting the amount of interest that I use as my tax backup since a lot of times the life insurance company will not issue any tax form with the interest paid. I then take a note to the PDF and say some reason where the money went to like “Huntsville Country Club April 2022” just like how I scribble the name of the person I went to lunch with on my receipt as I deduct it as a business expense. This is not legal/tax advice, seek the counsel of your CPA/Attorney but beware they will charge you for the advise and often side on the cautious side.

Note 1: Notice (if I am ever audited) I have a consistent processes (If I wanted to be an over-achiever) I probably should have documented SOPs for this but I have better things to do with my time). Note 2: There is common confusion over writing things off and not having an “active business”. My legal team tells me that active or non dealer or passive LP holdings only… you have a business (which is an entity…. EVEN if you do not have any LLC (in which case you are a sole proprietor business). LLC are legal entities that have nothing to do with taxes – its for asset protection. Of course your business needs to make income or investment returns as a passive investor (ideally not have a huge negative before depreciation) so if you are not maximizing the expenses running then through you business you are leaving a lot of deductions/tax-savings on that table.