Part 1 of 8 - Overview & Money Myths

- Overview

- My background

- Why not stocks/mutual funds

- How the wealthy run their finances

- The financial secret

- Runtime – 61 minutes

Part 2 of 8 - Success Story of a retired investor

- How Dean started

- Lifestyle design

- Common misnomers

- Runtime – 26 minutes

Part 3 of 8 - Where to invest

- Why real estate

- Active vs. passive investing

- What market to invest in

- Classes of properties, locations, tenants

- Building your team

- Section 8

- Landlord friend areas

- Basic order of how to start

- Runtime – 34 minutes

Part 4 of 8 - Analyzing properties

- Walk-though of analyzer: Rents, Expenses, Taxes, Repairs, Capital Expenses calculator

- Data collection on properties

- How much cash is needed?

- Using debt

- Formulas: Cap Rate, Cash on cash return, Rent-to-Value Ratio

- Return on equity

- Rent o meter

- Where to check your rents

- Working with brokers and what to beware of

- Where to find a lender

- Home inspections

- Insurance

- Runtime – 63 minutes

Part 5 of 8 - Property Management & Operation

- Using property management

- Best practices

- How to interview a potential property manager

- Late payment and eviction process

- Runtime – 36 minutes

Part 6 of 8 - Tax & Legal

- Estimating property taxes

- Depreciation

- Other possible deductions

- 1031 exchanges

- Bonus depreciation & cost segregations

- Tax bracket-ology

- Insurance

- Umbrella Insurance

- Entities & Asset protection

- Legal best practices

- Other resources for passive investors

- Runtime – 22 minutes

Part 7 of 8 - Exit Strategies

- Return on equity

- What high net worth investors should do?

- Progression of an investor

- Should you buy a 2-4 unit?

- How much money are you making? Total return.

- Inflation hedging

- REIT investing

- Runtime – 35 minutes

Part 8 of 8 - New investor case study & questions

- Apprehensions

- Barriers and mitigation strategies

- Why you need a mentor

- Investor questions

- General investing strategy progression to Accredited status

- General investor questions

- Barriers and mitigation strategies

- Runtime – 66 minutes

Too often people make the mistake of not taking action. Join our investor club here.

Complete your goal sheet here

STOP – Did you complete the above form?

Part 1 of 8 - Overview & Money Myths

0:01

Okay, well thank you everybody for joining this early morning. Saturday, a little bit of admin. For we get started, if you guys have any questions, type it into the question answer box, I’ll try to get it. Got another computer screen here where I can sort of monitor them is trying to put everything in the question answer box and not the chat box. But I’ve got over 250 slides to go through in the next five, six hours. And I also have a few guests going to be joining us throughout the day. And the goal today is to get you guys ramped up as much as possible in this whole remote investing arena buying turnkey rentals or going out with a broker and finding a remote rental yourself.

0:55

The little bit of background on myself I was

0:59

grew up in Hawaii. I went to med pack and went to college at the University of Washington, where I live for about 14 years. Here’s my professional resume, a Bachelors of Science in industrial engineering for university. Washington later got a civil engineering degree Master’s there. They’re got my professional engineering license a PE. After graduating in 2007, I went to work for a railroad and that’s really where I, you know, kind of cut my teeth. A lot of what I do today in my management style kind of stems from what I’ve learned back there as a construction supervisor. Here is a picture of me and my guys there I am on the left, but I would supervise some of the you know, a lot of older guys actually, these are some of the younger guys in the picture. The older guys don’t like to take pictures. That’s just how they were. So I would supervise 100% traveling union capital gang. And we change out steel we’d replace ties and the railroad we resurface and undercut the tracks and grind the rail. I pretty much did it all. From 2013 to 2015. I got out of the field a little bit and move to more in office type of job as a

2:24

project engineer, managing

2:28

projects through the design permitting and construction phase $185 million. They’re about that time I had gotten some rentals and I’ll get into that a little bit in the next slide. But 2015 to 2017 I became a city engineer, government employee, a lot easier job and then I 2018. I moved back to Hawaii, and I start working for the state for the airports but nobody really cares about my professional resume, most people care about the real estate side. So again, I grew up in Hawaii moved to Seattle 2003 2009 is when I started to buy my first property. And my past is, I would say very similar to a lot of you guys working professional. But even before that, you know, we were all taught to go to school, study hard, get a good job, or get a job for 40 years investing in the 401k and buy a house to live in, because that’s what everybody said that you were supposed to. I’m here to tell you today that a lot of that is not true. And when one of these things that I bought that first rental in North Seattle and Maple Leaf if you’re familiar, it’s this little dot right here.

3:50

It was a class rental.

3:53

It was 100 or $350,000. And it rented for 2200 a month. It was a, it was not a good rental property, but it’s still cash flowed at the time. Today to buy that same property would be double the price, and you might only get maybe 2520 $700 a month rent, but I didn’t know any better. And, you know, I was what they call an accidental landlord. And all I knew was my mortgage was 1600. And my rents were 2200. And you know, 2200 minus 1600 was like 600 bucks and two young 20 something year old kid, that was a lot of your money. So I decided I need to do that again and again and again.

4:45

Later, I bought another duplex down in South Seattle. And that was worse. I learned more about remote investing. And where, you know, that’s kind of transitions to what we’re going to be talking about today. I really Realize that sophisticated investors invest for cash flow. They may live where they want, like Seattle or California or Hawaii, but they invest where the numbers make sense. And that’s where the monthly cash flow pays for the expenses and there’s a positive income source there

5:15

every month.

5:18

So 2012 was when I started to venture out to Birmingham first, and by 2016, I had 11 single family homes in Birmingham, Atlanta, Indianapolis, New Castle, Pennsylvania. That was a little weird one did some farmland investing. But I invested a big into my education and I joined a bunch of masterminds and got around a lot of higher net worth investors. And I started to realize how they invested and a lot of the secrets that I’ll kind of talk about today’s you know, things that they do.

5:51

But a lot of things that powered me through this,

5:53

you know, buying 11 rentals was just saving. Um, if you want to go to this URL, there’s all these kind of zany things that would do back in the day

6:01

where I would, you know,

6:03

take a shower at work to save on utilities, I wash my car in the rain. If you guys have those anchor power boxes, you know, they weren’t around 10 years ago, but I had one and I would charge it at work. But that’s what I did. I didn’t really I didn’t have any lattes. You know, I subscribed by that whole theory of, you know, if you don’t eat your latte, every day, you’ll save so much money by the time you retire. I mean, I get it, but like today, you know, I try and live a life that I call like, kind of like fat phi. So F phi is financial freedom, financial independence. So I try and spread freely but I’m still like, you know, kind of spending money on value. But when you’re starting out, you’re trying to start this fire, you may have to tighten the belt a little bit. Because as much as you put to invest in you to buying rentals, the quicker you get there, and the smaller builds

7:01

like a snowball.

7:03

Like I said, in 2016, I had about 11 rentals. And

7:07

at that time I was

7:11

I was kind of

7:12

probably working for about 510 years at my day job. At that point, I realized of this whole phenomenon called the crossover point here where you’re making more money as you go along through your career, which is here in the blue, your investment term returns, even if you’re investing in something like mutual funds or the stock market. Yeah, it’ll go up over time. But you know, you’re always on this constant upward trend of spending more, which is shown here in the in the yellow. Unfortunately, a lot of times your work expectations keep going up. And if you’re like me, where, after a while with those 11 rentals, I found that I had a third monthly paycheck. You know, two from my day job and one from these rental properties. And that was where this red line came in my decreasing motivation at work. And I just started to see, see all this for what it was. And it was just a big rat race, you know, just keep working harder and harder. And you know, everybody’s trying to fight for that extra 510 percent raise for about 20 to 50% more bs like To me it just didn’t make sense. About that time in 2016 you know, all my friends were asking me Well, how I was buying all these rental properties out in Birmingham, and I didn’t even go out and visit them. It’s definitely crazy. And, and all your friends are you tell them this stuff, but nobody listens. And you start to get tired. So what does any millennial do? But record the damn thing and make go make a podcast so that’s what I started to do. Back in 2016. So if you if you look back at a lot of things like the first I was A couple dozen podcasts, or at least the first dozen were all about single family home turnkey investing. I love this stuff that I’m gonna be talking about today. Maybe even a few things I’ve forgotten along the way. But that was the whole point to capture it in the in the time that I was doing it, so that other people could benefit because I mean, this stuff changed my life and it it also changed a lot of people. I mean, I started to do the podcast, it started to get really popular. And I started to get all these like random emails from people and I made a lot of cool friends that thought the same way as myself. Then I start to see this trend with most people that you know, they, they work hard, they have to commute so far. And they’re all stressed out about finances and you know, they have kids, a lot of us that live in here in Hawaii. You know, it’s it’s paradise here, but it’s very expensive to live you drive in traffic because you can only afford to live very far away. If you want a decent house to live in, and, you know people who are moving in are more foreign and money, it’s not the local folks that are living here and buying these new developments.

10:21

Then I started to see all these like education companies, and it kind of pissed me off a little bit like, I mean, they would get you into these courses. Actually, they would give you a free seminar, you’d come down and they would have people planted in the crowd to like, get everybody riled up. And you know, like when at the end of the whole seminar, they would have people in the crowd planted to run to the back of the room, to to kind of trigger other people to run to the back of the room to plop down you know, big money on these like programs like 30 $30,000 And then it got an upsell from there up to 100 grand just to teach stuff that you can install on the podcast. It’s all out there in the internet. It kind of depends on how much time you want to take to extract it all. Yeah, I did. And and another thing that these guys will do is like through the like, around lunchtime right before lunchtime on the break, they’ll tell you to they’ll teach you how to call up your credit card companies so you can actually get an increase on your credit line so you can eventually plop down on one of these big coaching packages at the end of the day. So super messed up in my opinion and that’s what another evil that I set out to destroy as I started this simple passive cash helper at Tony Robbins a guy who I kind of look up and subscribe to his material. He says one of the most important things you can do is like contribution back to others and this is kind of I found like my my way to kind of continue Back to the world. You know, a lot of people really seem to like it. I mean, I wasn’t that great of it issue back in 2016 1718. But as time went along, I kind of created the content that you guys are going to see later today. And this became my what I call geeky guy where I think we’re all trying to find this it’s something that you love what the world needs, what you can be paid for and what you’re good at very few things align for all for those but you know, I think financial independence what it does is allows you to stop working for money. So at least it kind of makes this a little easier so now you can kind of focus on what you love what the world needs and what you’re good at. Most people never never really get past that need to make money to make a living part I feel like I’m so some people will call this on the road to enlightenment but Yeah, I just I just think, you know, money’s not everything but it sure makes life a lot easier and ensure frees up your time.

13:12

Charles Schultz also had kind of had the same idea. He says the true secret to happiness was making a living doing something you’re passionate about, and making a living doing something in which you have any talent. So I’m pretty passionate about, you know, getting people financially free. I see a wrong in the world with all these bad financial advice out there and people try to prey on other folks. And hopefully, I’m getting better at doing this. And you guys out of this, the rat race. So I started to see, you know, for most working professionals, it’s either if you’re on a lower net worth spectrum, you know, starting out with a turnkey rental, I mean, that’s what I did from 2000 That nine to 2015 60. That was my operating procedure and then eventually to transition to syndications of private placements. As a more passive investor, the problem that I saw was that some people just would not take the first step. And part of that is education, which you guys are doing here today. But, you know, as we kind of go through the content here, just kind of keep in mind of, you know, action steps to take, because education without action is pretty useless. I call that shelf help. Just kind of, you know, just absorbing this stuff. Some people call this mental masturbation. You wake up 630 early in the morning to watch something like this. And you feel good about yourself, and yeah, you’re learning stuff. But if there’s no change, there’s no action, then it’s all it’s all wasted. To cap out, you know, my profile here 2017 Move back to Hawaii continue to spend more money. I usually spend. I’m in one mastermind where it costs 25 grand a year, which sounds crazy, but I get a lot out of it. It’s where I get a lot of my contacts these days to people to work with. I started the huie deal pipeline club back in 2018. we’ve acquired over a quarter billion dollars of real estate in the group who are investors that I’ve met through my travels and kind of reached out to me through the podcasts, they’ve invested over $30 million from the group we actually just closed the deal yesterday. Yay. And then I call this that we do pipeline clubs, so we currently own over 3500 units, almost 200 Rv, RV and mobile home park units over 12 apartment buildings mostly in the south, southeast, and Midwest.

16:02

To transitioning Here

16:05

we are in a new world, some people will say, where, you know, with COVID going on and everything. You know, there on the left was how the grocery stores looked February and how quickly things change there in March as everybody read it to go get supplies, and to hunker down and do all that.

16:37

March, march 15, I think they’ll look back and say, Where were you during that time? I was in San Diego, debating if I should continue on to on my Cleveland and Huntsville trip, which I did not go on. But that week was if you look back how quickly you know, emotion, change. Dow Jones just bomb got lots of third of its value took stocks only six days to fall into correction the fastest drop in history. s&p, which is the standard and poor’s 500. Pretty much an index of the entire market, as you can see goes up and down, up and down, up and down. And you can see that some of the fastest correction on the s&p, and there was February 2020, the shortest day to volatility is going up in the stock market.

17:45

Here’s my point. And some people say I kind of bash stocks and mutual funds and stuff like that. I’ll get into this in a little bit but Here’s the game that’s being played here. Like, these things will just drop its value for no good reason. Sometimes it is some other reason after somebody with an English degree writes a story. And then it climbs back up. But if you know there’s kind of a trick with math, like you have to go, you have to have a much stronger way up to make up for the losses. And this is one big thing I like about owning real estate or any real asset. The value doesn’t really drop overnight. It doesn’t drop like over a quarter really. It’s pretty steady. I just don’t want to be in something where I have to stress out about or watch it like a hot where the value goes up and down. And I think most most responsible adults have this idea. Well, it’s more of a long term thing. But we’ll get into it with the long term gains are in the speech of funds and stocks. But look at it from this perspective. Like they want you to invest in these 401k keys and mutual funds because you’re investing in retail type of investments where a lot of the fees are going to the people in Wall Street I mean, how else are they making those big buildings? And me personally, it took me a while but I currently today do not have any stocks or mutual funds. I have it all in real assets. And I don’t freak out about anything. Here’s some more market corrections that happened since World War Two. I mean, take a hint guys, even this will continue to happen at what one of these corrections are you guys going to finally get it and make a change?

19:50

And stop doing what everybody else is doing?

19:54

Some, a lot of people in my investor club that come through will say that People, but they used to be stock traders or day traders or maybe even swing traders. And they’ve gotten out of the game because of this new virtual trading or the artificial intelligence these last few years. And they say it’s just unfair. I mean, it’s just maybe before you could read some technical analysis and kind of play along with it. But number one, you had to make it a part of your daily life. It was stressful. And now with the artificial intelligence, it’s just impossible for the little guy to play along. Of course, there’s always these guys. I’m sure we all have them that they, they had some good run up, and they think that they’re the best. Yeah, I mean, I see those guys all the time. I don’t hang out with them. They also think that they’re the best at everything.

20:56

I’m looking for something that’s repeatable where I can

21:00

kind of go in where the average person doesn’t have to micromanage that thing that much. And you’ll hear these terms from your financial planner or soar. You know, it’s kind of ingrained in our, as a society and this is how pervasive their marketing is. And then when I say it’s, you know, all these Wall Street companies like your bank guards, your fidelity’s, you know, they’re the ones who want your money because they take huge, huge fees, you know, the terms of dollar cost averaging, you know, hey, don’t worry less lost 30% this last six days, you’re just dollar cost averaging, you know, or thing that my mom uses this, you know, it always goes off in the long term.

21:47

For those of us who’ve actually picked up a book on stock investing, one of the big you know, you trying to understand this and one of the big things they always point to four fundamental Stock trading is the price to earnings ratio. So this is a ratio between the price of a company and how much it earns. Imagine that right like a price the price of the stock is dictated by how much it earns. Which is not really the case how stock prices are, but this is how it’s supposed to be. The investor pitas describes us suppose a company is currently trading at 43 bucks a share it and earning over the past 12 months were 1.95 per share. The P e ratio for this stock could be counted as $43 divided by 1.95 or 22.05. It’s simply like a valuation multiple for a given company or in real estate, we kind of call this as the cap rate. For those of you guys who are business owners, it is sort of like the beat up number. So this is what’s what’s crazy these days, like a lot of these tech companies, they don’t really make any money. The price to earnings ratio is about just off the charts, which doesn’t make any sense. It’s not a good thing. yelp.com I don’t know if this is the case today, but they had a ratio of 560. Normally businesses, is that a range of three to seven? Do you not see a problem here? Most of our apartment buildings that will buy are in the range of, you know, four to six. So you take the profits, or the earnings divided by point 05 or point 06. And that’s the value of the building. But in this case, you know, you have a P e ratio of 564. Yep. And you can you can look these up. And you can see how the tech companies are just inflated.

23:50

And that’s what a lot of people like to invest in.

23:58

Yeah, but it’d be so foolish enough to pay for such a company who, you know, only makes half a million dollars a year but be given a valuation of 280 million. But a lot of people invest in Yelp know. So 100 unit plus apartment buildings in a great market like Dallas, Texas, at the top of the market priced at less than 20 x profits or a cap rate of five or better. So, this is where you’re looking at the individual companies and their price earnings ratio is just way, way, way higher, not like a factor of two to five but like factors of 10 to 50 to 100 more than real assets. The good Facebook, I’m sure this is pretty old, but the price earnings ratios here was at over 100 Read.

25:05

And this is a, you know, lower risk stuff, I feel are real assets. Imagine that. And, you know, we saw it in 2008. And we just saw it again, just really recently how a lot of these, the air just gets deflated of these things. Because the today the price is not really dictated by P e ratios, even though people say it is it’s dictated on public sentiment and emotion. And I don’t like emotion. I like when things make a certain amount of profit and it is divided by the same ratio every time. So you take a $750,000 home and I use that price because that’s actually the price of you know, most, you know, lower middle class families. A lot of us that live in primary markets. Seattle, boy, California, that’s a big culture shock. And that’s why I introduced this price to you now earlier in the morning to get you ready for this but, you know, most of America lives in houses under $100,000.

26:15

But anyway,

26:17

it makes about $7,000 of earnings per year. You go $700,000 divided by $7,000 you get a P e ratio of 10. Right? Still on the same order of magnitude

26:32

with you know, like a five to six cap.

26:39

I don’t know if you guys remember but like, you know, Lou lemon, their CEO said something stupid about their pants a few years back and that dropped the price of the stock overnight. I don’t want to buy anything where some stupid CEO or somebody or something happens and it just drops the value to me that Makes no sense at all. Actually, it does make sense. But I don’t want anything to do with it as part of my personal portfolio.

27:15

You can see all this ups and downs of the lemon actually bought a mirror recently, I thought that was kind of cool. But still, I’m not buying any stocks. Warren Buffett said quite a while ago, if I, if I had a way of buying a couple hundred thousand single family homes, I wouldn’t load up on them. And a lot of people will will use Warren Buffett’s advice as kind of the Bible, but I think people have to realize that Warren Buffett is just a little bit different than you and I. And in fact, he’s doing sort of exactly what we’re doing. He’s buying businesses with management in place. He’s not Trading just stocks. He’s going in and infusing, you know, force appreciation. There’s things he’s doing when he buys a company that folks like you and me just aren’t able to do. So it’s not like we can really take his advice from his books, my opinion and kind of apply them to our personal situations. But yeah, Warren Buffett said, you know, if you could buy 100,000 single family homes, he would the problem there is this operation is it’s hard. But for mom and pop investors like that, us it’s very, in the realm of possibility to buy one to five or even 10 properties on our own. To start getting a piece of this, you know, real asset and getting some appreciation and cash flow.

28:58

We’re going to start to get into the secret That the rich to hear. And this is, you know, again, I started to join masterminds and got around other accredited investors, other doctors, lawyers, engineers, folks that were 1020 years older than myself. And I started to see that they invested very differently from what was taught us were taught to us in mainstream investing. So they did a study back in 2007 of the average investment portfolio, and they found that 66% equity 60% fixed income and 18% cash, they saw what the individual investors were doing, and which is here on the left. And they saw what the institutions were doing with what kind of you would call this the smart money. And one big thing that is missing from the individual on pause for this alternative investment was almost half Now, what is alternative investments? Well, that is real estate and businesses. Why do they put money into alternative assets? Well, the simple answer is that the returns are much better. And not only the returns are much better, but you don’t have to stress out about it as much because alternate investments are sort of shielded from the volatility of Wall Street. And if you look at it today, like why did to me look at look at where the Dow is today? We’re talking about beginning of August 2020. Stocks bombed from March about a third and we’re kind of retracing back up to where we were, but unemployment is still high. The country hasn’t started for really started from COVID yet we’re not really wrapped back all the way back up. Why the heck are the stocks Right where we used to be, and we’re still a lot of uncertainty over a vaccine, and the economy, but wireless stocks all the way back up. Sounds fishy to me. But as I stated in my previous newsletter, which you guys can join, you know, my commentary was all around Well, that’s where the stimulus money. I mean, the government, I don’t know how much we printed. I mean, there’s been like three or four rounds of stimulus, but it basically printed about $3 trillion of money. And that’s that the hot air that’s being blown into the stock market, I mean, that’s great if you wrote it up, but to me, I just want out of that stuff. To me, it makes no sense. I don’t want to be at the whim of government stimulus. I can go on and on about that stuff and kind of cut it off there. But you know, that’s what we have networking events. I can go on and on or what’s going on with the vehicle market and all that type of stuff. But yeah, I mean, why do you guys need to make a change here? Well, I mean, most Americans 42% will retire broke. Very people have savings. And I think this is pretty much common knowledge.

32:16

But this is for a lot of people. This is what

32:20

started the chicken armor of like this whole financial dogma that we’ve been told right? invest in your 401k invest in the stock market.

32:30

So Morgan Stanley actually got hit with a lawsuit, because they’re, they’re having their employees go into their own funds. And like I told you earlier, a lot of these these mutual funds and even these low expense ratio funds, supposedly they have a lot of hidden fees in them. And Morgan Stanley, they got, they got sued because they are putting their own employees in their own funds. And they’re making a Shipton with

33:00

all these fees

33:03

off their own employees, they eventually had, they had to put their their stuff in another person’s fun which had equal amount of fees, so they just wouldn’t get sued. But, you know, these are the kind of headlines you don’t see. And this is kind of what’s going on. I’m gonna need, you know, all the numbers. Let’s, let’s break down the true cost of a mutual fund. You got the expense ratio with sometimes this can be low, right? I think this is normally what they tell you. But on average, it’s almost 1%. But I think what you’re not seeing is all these other things, which is the transaction costs, the tax costs, other drugs and fees. And you got to remember, I think back in the 1970s. They didn’t have these these 401k or mutual funds. Wisconsin Democrat, her whole golden goose him and kind of look back, you know, can Google anything that you’re looking for these days. But he said and more and more Americans are relying on 401k plans to provide their retirement income. In spite of that there are a few requirements for fund managers to tell participants how much they’re paying in fees. And that hasn’t really changed from back then. You know, some people will say this is a bit of a conspiracy theory. But the story, this story from most investors, sophisticated investors is back in the day back in the 1980s. You know, somebody got together within the government on all these these brokerage funds and they created the mutual fund. The mutual fund is a pretty new thing. And they create this mutual fund to get you know, you know, a mom and pop investors who are working hard, hardworking Americans to put a big part of their paycheck and to put it in, in such a thing that they have access to and that they they can understand it’s free. To them, it’s it’s pretty, it’s a pretty package that they can buy. Because before that, you know your your mom, your mom and dad, your grandma and grandpa, they were never in the stock market. So somebody created this 401k plan and in these pretty mutual fund these packaged diversified funds for them to buy, but the problem is they got all gone in cahoots and the brokerages were able to hide these fees and stuff in there.

35:28

So when you add all these up,

35:30

you know, I could probably see it, the real total costs are about 6% that you’re not seeing. So you know, numbers don’t lie. So let’s run these numbers. Assume you, you know, had 110 grand invested 7% growth over 30 years. There’s a whole bunch of these calculators on the internet. I just picked one of them. But you can see you know how that 4.8 management costs comes into play. fund balance 400 15 effective fees $605,000 pretty substantial, even though it seems like a small 4.8% seems like a small number. You lost 600 grand to Wall Street. That’s barely that’s maybe half a salary of one of those higher level guys up there in New York or wherever. Now let’s say you’re sophisticated enough to go into some kind of ETF or you know, low cost mutual fund, and you’re able to get your management costs down to 2%. More than half of that, you know, you’re still going to be paying about 300 grand last to Wall Street.

36:55

Here’s another article here. How much do you pay in fees over Career let’s say you had a half a million dollar account balance, how much fees you’ll pay in 30 years and they took all the big brokerages companies Merrill Lynch Shamir pre price medtrade, Wells Fargo, etc. It’s not to say that one is better than the other I think you got to kind of look at the individual funds that you’re putting in. But um, yeah, I mean, the fees do add up. Um,

37:30

it’s kind of funny a lot of new Millennials are

37:34

you know, there’s this thing called like Robin Hood where you can play around on your app and you know, buy and trade stocks. But a lot of these like, Millennials are I don’t know, I guess I’m technically a millennial, I guess.

37:47

God dang it.

37:49

But Millennials are putting in money and they’re, you know, they were buying like Avis, who like went out went into bankruptcy putting all their life savings in there. Oh, goodness. recess for me there to buy a rental property. I made this little meme A while ago. Some people got it. Some people thought it was like animal cruelty. But yeah, this is pretty much it the poor little Ducky here is your 401k after fees and everybody’s in cahoots against you Vanguard verlinde fidelity, especially your financial planner, he might be a nice guy. He probably is a nice guy cuz he doesn’t do anything other than just tell

38:33

you what the crap that they’re giving you.

38:37

Number one rule of have,

38:41

you know that I follow is I don’t take financial advice from people who are not financially free. And that especially means a financial planner or financial planners just get paid off commissions and fees.

38:58

So we’re trying to unlearn a lot of these mindsets. And, you know, where do we get these from parents get a poor kid of their you got this from his dad,

39:08

friends,

39:10

schools, I’m not in the cubicle world anymore so I can totally see where you get this all in like from your co workers. You sitting here at work you’re just be guessing on a Friday afternoon. Like, this is where it all comes from. Some of the worst advice I heard was from when I was sitting there in my cubicle and the guy who is like, you know, 67 years old, 72 years old, who probably shouldn’t be working there but he is fat, his personal finances suck. That’s why he’s still there, trying to give some other person advice on when to you know, retire or where he should put his money and Don’t do that. Don’t take financial advice from the Uber driver or the person that cowork you know, that’s not the person you should be taking financial advice from. And then you know TVs TVs, always Another influence or two.

40:07

So this is a big perspective change for a lot of folks. It was for me, I mean, I started investing back in 2009. I would say I got proof of concept of it in the first few years. But it wasn’t until 2015 16 that I actually went through my entire retirement fund, because I realized that for a variety of reasons, I, you know, wanted my money to spend now because I was going to retire Well, before I was 40. I don’t want to wait till 6570 to get the money, because that’s a stipulation of those retirement accounts. And I, I’m going to pay more taxes in the in the future, because I’m going to be in a higher tax bracket, which is counterintuitive to what most people think. And I’m, you know, because taxes are going to be going up with all this government stimulus, and I just want my money out, and especially because of the tax benefits, you know, with a lot of cost segregations. And bonus depreciation, you don’t get that if you’re investing retirement funds. But that’s kind of outside the scope of today’s talk. I’m always looking to talk about that with my other clients. But yeah, it’s a very paradigm shift for sure. And a lot of this people will call this the red pill of Finance. If you watch the matrix. I forgot what that dude’s name was. But he gives counter Reeves, the pill and it basically wakes them up from asleep. Everybody is in these pods sleeping. And unfortunately now you guys are going to eat the red pill if you so choose. And now you could become a pretty bad employee, at least I was. People couldn’t tell me what to do because I knew my time at work was short.

42:00

was going to be out of there

42:01

pretty short.

42:05

For those of you guys who have heard of Dave Ramsey, I’m not knocking the guy. He helps a lot of people get financially free or not financially. He doesn’t do that. He gets people out of debt, which is not aligned with financial freedom, but he has some like seven big key things here that as guidelines to help his clients, but you got to remember like a lot of his clients, they just their little kids in adult bodies. They can’t manage your finances. Well. Mike, my clients are the complete opposite. They’re financially savvy. They’re good at budgeting, they can control their impulses. But the problem is they’re just investing in the wrong things. So you know, kind of going through here step one says to save 1000 dollars for your emergency fund. I’m good with emergency funds. A lot of you guys have savings, but you know, the audience he’s talking to doesn’t even have a few hundred bucks in their bank account. These are all like a lot of our class C tenants in our apartments, you know, they barely have any savings. A lot of these guys already have debt, right? And that’s in step two, he’s talking to those guys. A lot of you guys will get this confused with your student debt, or your mortgage. Now, that’s a lot lower interest rate and a part of the game and, you know, I don’t want to cast like general advice. A lot of this is you know, on your specific situation, but for the most part mortgages or student loans, it’s less than 8% interest rate. And if you can invest at 14 to 15 20% or higher, it makes total sense to invest in stable assets that produce cash flow that are on a monthly basis. basis or positive cash flow,

44:02

that the pay off the debts.

44:05

He says they have a three to six month emergency fund. I call this an opportunity fund. And there’s you can read my article there simple passive cash flow, calm slush fund on that. So that you know it’s not about playing defense, it’s more about playing offense when good deals come around or you sit around the property, you pounce on it and you have the money ready to go. He has a rule of 15% of your household income to retirement.

44:32

For me,

44:34

it’s the paradigm shift for me is different. It’s it’s not that we’re saving for retirement. We’re producing we’re buying assets that produce income today. So we’re in a way we’re creating mini pensions today.

44:52

Save for your children’s college fund.

44:54

Well, there’s a bit controversial. I don’t know if I’m a huge fan of

44:57

college these days even though I have two college degrees.

45:02

That is if you want them to be another w two drone, right? I mean, that’s if you want them to go to college or you know, have that lifestyle, that’s what you do. So I always say like, what is your goal? Right? I mean, I don’t have kids. So maybe I’m not the one who should say, but you know, you have to kind of question a lot of these advice and that’s that’s why I’m bringing this up, right question everything. pay off your home early. I’m very against paying off your home early. I mean, like the debt is the best part of this. I wrote an article in Forbes on this. You guys can check that out simple passive cash flow, calm slash debt. But this is another thing that sophisticated credit investors they use that responsibility, that’s a tool and, you know, debt. paying off debt is not aligned with financial freedom. If you were to pay off debt, well, yeah, you’d be debt free, but you still be cash for network. Hello. So, you know, these are just some there’s there’s a lot of different subscriptions out there and methods the Dave Ramsey Suze Orman approach is more for those people who trying to get out a huge consumer debt. And I think for you, the thing is like, I think most people should not invest in real estate, they should just stick to their day jobs and just save prudently. But if you do it responsibly, and you’re smart about it, you surround yourself with the right people. You know, financial freedom can come in five to 10 years, and we’ll kind of get into the math on that

46:46

later on.

46:49

But you’re just gonna have to kind of for now,

46:53

kind of just go along with this. have an open mind and trust

46:59

me, here’s kind of The big secret

47:03

on on from a high level What’s going on? And what what are the mistakes that people are doing? The most people on the top here you have your income and expenses. You know, he come on your paychecks come in, you paid for stuff. And then your balance sheet or how things are kind of compiling for you. You have assets, which put things put money into your pocket, like real estate, or it could even be stocks and mutual funds. And then liabilities are things like houses, cars like that you live in, right? rental properties. Yeah, you’re gonna have to fix stuff. They’re sorta like liabilities, but they should produce much more assets or income coming in. The house that you live in, is definitely a liability. It doesn’t put money into your pocket, takes money out and one of the biggest misnomers that people have That rent is throwing money down the tube, which is completely not true. You’re just getting that from your Uber driver or your co worker in the cubicle. Don’t take advice from them. That’s why they still have a day job. That’s why they’re stuck there. I hang out with financially free people, they say the complete opposite. So you can take that for what it’s worth. This is how most people are living, they’re taking. They’re buying liabilities. And they’re also their money is going out in a lot of expenses. So their income comes in from their paycheck, and they’re feeding these liabilities. They’re feeding that big house that they want to impress all their friends. This doesn’t this is this is a no go right here. And this is the big pile up and most people are stuck in this

48:53

evil evil cycle.

48:56

Where people make a lot may make a lot of money. They put it to their liabilities like a house or car, or private school education. And they how you look at it. And then they put it to the liabilities and maybe eventually becomes expenses. Gotta get out of this. This is the cycle of pain right here.

49:22

This is what the wealthy do.

49:24

They take their income, they’re very frugal, and they’re very value based. And they buy assets. It’s kind of funny. We did this mastermind in February,

49:38

before the pandemic.

49:40

It was a different world back then. But we actually met in person here in Hanoi, people came from the mainland. And it’s funny because most of these people actually nobody stayed in like a five star hotel. Everybody stayed in these little boutique eeper hotels. good value, right I mean, that’s that’s kind of our brand. That’s kind of folks be attractive. Yeah, they take your income, you’re frugal with it. So you can save as much of it. So you can buy assets, things that put money into your pocket. And you take that money that the assets produce, like, you know, their revenue from your income properties and you use that money to spend on expenses are your fun stuff that you know. And then you also take that money from the assets to pay liabilities that you may have. I don’t, I don’t own a house to live in. Maybe one day I will. Who knows? I don’t think it’s a good financial decision, especially for those of us living in primary markets like Seattle, Hawaii, California, or the East Coast. But maybe one day well. A good example is like a stupid car like a Mercedes, right? It’s a total liability. But you know what? I only did it when I hit a threshold where I had a certain amount of assets that produce a certain amount of income for me Could offset it. And I took 60 grand and I put it into HP and I got 1% every month, and that paid the least for this thing. That’s the way you’re supposed to do it. And I’m not a big spender. But that makes that Odyssey is what I get off on. Right? Like this thing cycled on its own. I can earn that thing. Well, I did it. My mind did right, because I put up this loop where that investment in that one deal created that income stream to pay for this

51:33

infinitely.

51:36

So this is the path

51:39

that you want to get on. This is what the wealthy do. You guys want to take a picture of this. This kind of sums it up right here. Kind of pause a little bit so you guys can do that.

51:56

All right, moving on.

51:59

If you guys are building reader there’s this book called The Richest Man in Babylon. This was this is like the Rich Dad Poor Dad before Rich Dad Poor Dad. It’s kind of boring. It’s written on English, I couldn’t really be read too much of it, because I got bored of it. But basically, they, it’s, it’s this guy, and he goes to this really rich guy, and the rich guy tells them the secret that I’m telling you right here, you know, people save 10% of their, their money, at least and they put that into assets that produce income for them. And here’s how I did it. Um, so on the left here, this is called like a Sankey diagram. You guys can Google it. You can make one for yourself. They’re kind of fun to play around with and and they’re great communication tools. If you have if your spouse is sleeping right now. They don’t care about, you know, educating themselves on this stuff. You know, and you still have to keep them involved to get any approvals or whatever. With your money but you can kind of create one of these for yourself but I you know, I roughly Maitland kind of track my progress throughout the year. So, you know years zero i was i think i was like 2223. So work wearing the orange to work every day. But you’re one on this track I bought a rental property down here it produces $300 of positive cash flow. And that increased my savings from 150 bucks a year

53:29

or a month

53:30

to 450 you too. I just I saved up another 30,000 $20,000 to buy a second rental. And you can see how this grows. year three I bought another rental. This isn’t exactly how I did it. I kind of messed up along the way. I did a lot of silly things like turn my mortgage into a 15 year mortgage. You always want to take the longest mortgage and then I eventually paused on syndications. Will you see how that savings went up from 150 bucks to this and at this point your eight is kind of a tipping point right like this is a substantial amount of cash flow right here and remember this is tax free because it’s a passive gains and a lot of the will I will show you guys later a lot of the taxes to do with this

54:29

Oh, I think I want to what I want to show you here is like you know that the cash flow will get better over time, because you’re the debt that you locked in the 30 year debt. Now isn’t worth as much as the year school along.

54:53

If you kind of caught on the guy in the orange went away and he retired. kicking back And what kind of sub this this money man myth segment and get into more tangible stuff. But here’s the secret of it all and it’s super basic, but the blue line is trading time for money. And it’s all about the difference between how much you make and how much you spend the difference. So the blue is how much you making and then the green is how much you’re spending. And if you can take the gap in between, I call it the pizza because everybody likes pizza.

55:32

You take that pizza and you

55:34

buy more assets. That’s the key. In the beginning, it’s gonna be like watching grass grow. I didn’t have 3500 units to begin with my first few years I had one freaking property. But I saved up every year I was putting away maybe 30 4050 grand a year for my day job, because I didn’t have my stupid lattes. I did spend money on all these frivolous things. But I was just saving it and buying more assets 13 things wealthy people never waste their money on buying instead of renting an overpriced house

56:13

insider magazine.

56:22

And this is the secret right like this is on this is each income group. So the lower network guys on the bottom, the higher net worth guys on the right you can see how the yellow here or we’ll call the pizza gets bigger over time and that’s why the rich get richer and the poor just kind of stay stuck on ground.

56:51

What’s the secret guys, so part of this is personal finances. You got to look at your personal budgets. I don’t really mess around with that. I mean For, for my family office clients will kind of get into this a little bit. But I don’t waste my time on things that anybody else can teach it to you guys. And you know,

57:10

you guys have to be responsible with your own money.

57:18

So, to wrap things

57:20

up, I’m going to get Dean on to kind of tell his story a little bit, who’s a bit of success story, but to wrap things up on the whole secret kind of put to put things in perspective. I was out in Maui with my buddy and his nephew, and we were all to beach and the nephew, I think at the time was, I think he was like five or six. I mean, you kind of have to watch him so he didn’t drown. Now I use probably like seven or eight weren’t that irresponsible? But you know that the surf was maybe a little bit smaller than this. And, you know, we’re trying to get out in the water. There was he had a older kid. So an older nephew That was really good in the water he and a lot older, like 1314. But the little kid, the seven year old will call it you know, he couldn’t get past this break. And I see that very similar to like most people, they get stuck in this trap of like, you know, they try and save up some money and then their car breaks and then they already have consumer debt. They maybe get a doctor spill and they just get pounded, pounded of trying to fight for it. But they’re just unable to make it past that breaking the waves. But I’m here to tell you that there’s all these people out there. Perhaps you probably don’t see them in your your daily life or your job because they don’t have day jobs. But there’s a whole bunch of people that are living financially free, that are past the break of the wave, and they’re just kicking back cruisers. You know, if you if you watch a surfer, who’s a pro, and this guy’s a pro, he’s a stud, you can tell you watch him, he knows how to get past that break with the least amount of energy. Because he’s done it before, he’s probably done it 1000 times. And so that’s what we’re gonna try and teach you guys today, we’ll even get you guys educated. So at least you know what the path is to doing a part of this is taking action.

59:30

The other half is, you know, knowing this and

59:32

kind of having somebody on your side,

59:35

which we can help provide.

59:38

You know, in a way, what I’m trying to build is something like this, where you guys could just kind of get the easy way. I mean, in fact, you guys are kind of getting the easy way, especially when you kind of work with the folks that we work with. makes it very easy for people to get over that hump. So we’re going to take a little break here. We’ll come back in.

1:00:04

Let’s call it eight minutes. So at 40,

1:00:08

and then we’ll get Dean on and he can kind of tell his story. So you can kind of see this all full circle. And then we’ll continue on with going through, you know, getting more, more granular on what markets to invest, how to buy a property, who to work with, what markets to go into, and then kind of go into the acquisition phase a little bit, and then the very end we’ll have a whole point on question and answers. And that’ll be kind of how we kind of round out the day. So let’s, I’m gonna set the clock here for about seven, eight minutes

1:00:43

and we’ll get started again,

Part 2 of 8 - Success Story of a retired investor

0:01

Okay, so kind of getting back into the content here why real estate will real estate? It’s It’s been five recessions since the 1980. I think everybody is afraid in 2008 2008 was sort of a real estate II thing but the problem people don’t realize it wasn’t. It was more to do with people speculating on houses. If you recall the, The Big Short the movie, kind of the little example they use with like in hit shippers buy multiple houses. And things are just crazy. You could you could buy houses with ninja loans, which were no income, no job, no assets. You just can’t do that today. There’s, I mean, a lot of my clients who are high pay professionals have trouble qualifying for some of these Fannie Mae Freddie Mac loans. So in 2001, in that recession, home prices actually increased. And actually in this, I think it’s safe to say that this COVID-19 back in March recession, real estate didn’t really lose a beat, to be honest. In terms of volatility, it’s pretty much as low as bonds a lot less than stocks and returns, I would say that it is on par on stocks, but we’ll get into the numbers here. Remember, we’re using leverage, and this is how we’re able to juice over stocks. I mean, you can use leverage on stocks. But, you know, I don’t, I wouldn’t do that. I mean, I’m just, I just don’t have the fortitude to kind of do those margin calls. In a high level, you know, here are all the reasons why real estate I think we’re all drinking the Kool Aid here, but just to highlight some of them. The tax benefits. One year I paid 4% effective tax rate. That was ridiculous. year before that it paid 14%. I mean, most people who are making 100 200 200 grand a year, I’d say your tax rate should be around 15 maybe 20%. at most. If you’re paying more than that, yeah, you really got to get on board. You got to get on this stuff. Yeah, but we talked about the leveraging inflation hedging. We’ll talk about more that in the future. But to me, I think real estate follows three big key things. Number one, it provides cash flow number two, it’s a real asset and number three, it’s leverageable. Very few investments hit on all three of those items. Gold is a hard asset but doesn’t produce income and you can’t really leverage it. For example, So we’re there’s a lot of different strategies in real estate. My brand is simple passive cash flow I work with higher paid professionals. We stay on the side of passive investing on the spectrum to active the passive, active investing, to just define it is wholesaling, bird dogging, fixing, flipping, wholesaling, tax liens. There’s a whole bunch of stuff and there’s all these websites on it. You know, BiggerPockets is a big one of them. But most of the people on there are, let’s call it they don’t have very much money, and they need to generate some money to invest. And again, this is past this is investing in real estate. If you don’t have money, this passive investing thing may or may not be for you right away. But I think generally this is where all roads lead to Rome. All roads lead to passive investing and some passive investing. avenues are private money investing, which I don’t really like, you know, that’s where you met lend money on a fix and flip, where they just pay you a return as a debt investor, you get no tax benefits from that it’s all active income. We’re going to be focusing mostly on rentals today. But just to kind of start out with talking more about passive investing strategies here. There are a lot of different ways of investing just even in rentals. We’re going to be focusing mostly on just doing it by herself a sole proprietor, you don’t really need an LLC to do an LLC or more of an entity for vehicle protection. still write it all off. I mean, you’re a sole proprietor.

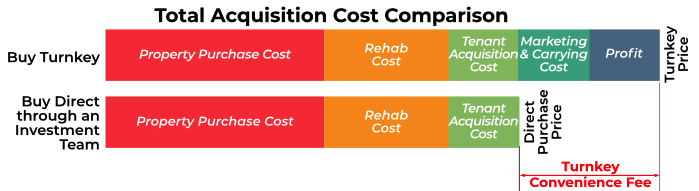

4:48

And the different you know, people will say, well, you can invest in real estate in these rates. But the problem with that are in so is the is the big problem with mutual funds and other of those instruments does the heavy fees which we kind of pounded on earlier today. You guys want to take a quick snapshot of this, but this is kind of the flow chart that I created when I was bored at work, one 110 one day a few years back, but basically you kind of just follow this this is kind of where you start, you know, do you have consumer debt? Are you aka Are you financially responsible? If you don’t this isn’t for you, man. You know, this is passive investing and you know, buying rental properties are only if you’ve got your your stuff together. If you have a lot of these properties that we’re going to be looking at, or around 80 to $120,000. So you’re going to need a 20 down 20% down payment. So you’re going to need about 20 $25,000 of liquid savings ready to go. If you don’t follow this track, you can save some money your expenses, look for some lazy assets, such as debt equity in your home, or stocks or mutual funds. Or maybe you can sell some crap that you have. For those people, I would say, look into some personal finance blogs. This is what I did back in college. In my free time, I would like to spend lots of hours as was reading a bunch of stuff. And for you, maybe no latte for you for a while. But for those of us who have some liquid savings, maybe it’s time to pick up a rental. And that’s where we’re talking about today. You is gonna need to go into a strategy that has your competitive advantage in mind. And the three things are the four things to look at or time money, knowledge and network. Now, you may not have a network today, you know me, but you don’t really have the knowledge and you may be really busy at your day job you may have all right You know, you may have a few hours on the weekends to work on it. And the ideas as simple passive casual, and a lot of my brand is, what is the very least that you can do to get the biggest bang for your buck. And with that’s the most safe way to do this. And then also, like we said, on the last slide, you need to have some money to do this. So one of the first questions and I’ll kind of hit it right away is what market Do you invest in? There are about 20,000 cities in the United States. But how do I keep coming back to these mainland Birmingham, Atlanta, Indianapolis, Kansas City, Memphis, go rock, Jacksonville, Ohio or any other secondary and tertiary market. From a high level, what we’re looking for are secondary and tertiary markets. So those are defined as non primary markets. So primary markets are places you don’t really want to invest because you’re not going to be able to get the cash flow there because things are too expensive. So places like Seattle, especially San Francisco, San Jose, Los Angeles, San Diego pretty much everywhere in California, all of Hawaii. On the east coast, you know, places like New York, Washington, DC, DC, Boston, no bread, no, it’s not going to work. You’re looking for a second tier city, like a Birmingham like an Indianapolis, Atlanta and Dallas used to be these but they’ve kind of gotten a little more pricier for the past few years. But you know, just that’s the kind of thought because we’ve been in real estate has been pretty good for the last almost decade now. You’re gonna have to go into even smaller markets potentially and you know, and that’s what we call tertiary markets. So tertiary markets are places that you may have not heard about before, but they they are places where A lot of the dumb money hasn’t gone to and you know, Dumb Dumb money will follow. They’re kind of lazy to, you know, they’ll follow into places like Las Vegas, because a lot of people just happen to go to Las Vegas from California because they can’t buy in California because it doesn’t make sense. So they’ll go to Las Vegas, have Dean purchase in Las Vegas, but he purchased at a very good time, right? That was the right time to do it. But I would say today if you’re looking at Las Vegas, I don’t think you can make the numbers work there. Certainly if you’re not established, you don’t have a network out there already. So, examples of tertiary markets might be like

9:45

Lake Charles, Louisiana, a Gulfport, Mississippi, Huntsville Alabama. El Paso, Texas. Some people would say, Oh, you know Tacoma, Washington. As a target market, no, I would still consider that part of Seattle MSA.

10:06

So it’s pretty much a primary market, for example.

10:12

But just look at the data. Look, we’re where the money is going from and going to where our out of state buyers buying. These are kind of the states. And then where are the state’s buyers coming from? I guess this isn’t really that important, but you can see where the money is coming from California, from what. Also, when you’re thinking about a market, or where to invest you need, we’re going to define these terms called property classes and neighborhood classes. So property classes are split up in A, B, C and D. So this is sort of the how you classify the building. So A is new construction. You’re going to have your highest rents in this area and your highest and amenities. Class B are seen built 1990s 1980s. Class C is older 1960s 1970s. And then Class D is the old

11:17

stuff.

11:19

Generally, you want to look for properties that are in the B and C class

11:25

building class

11:29

because the Class A stuff will probably just be too overpriced because a lot of the dumb money, you know, the the unsophisticated investors are there or you’re competing with the retail buyer. And Class D is like these properties. There’s sort of a lifespan. I mean, houses don’t last forever. I would prefer to kind of just be in the middle it just seems to be a nice sweet spot. Now let’s define neighborhood classes to class. A, B and C and D are how we grade them. But unlike the actual building quality, the neighborhood classes are defining what kind of vocation it is. And it just doesn’t mean just like oh, take a big MSA like Dallas, Texas. We’re talking about not only a sub market but a piece of the sub market like what kind of how’s the feeling on a block. So class age and most affluent neighborhood, expensive houses nearby maybe near golf course. I mean, this is a property where a lot of you guys live. Class B is the middle class part of town you’ll have a mix of blue collar white collar classy is mostly blue collar workers, their Class D and sometimes you call these war zone properties or Class F. These are high crime areas, very bad areas. And just kind of a crude way of defining these class a, you know, these are kind of the yuppie areas if you will People will be going jogging in the evenings, you’re gonna have nice expensive shops nearby. Class B I, I don’t know if I would be there at nighttime but during the daytime, I’m totally safe. Class See, I got an apartment in several classes he places when I go there in the daytime, I will only go during the day, but when I need to do what I need, I do what I do and I get the heck out of there. Class D I wouldn’t even buy and I would even consider that off course you’re gonna probably have better returns in the class C and D area. For you. We’re trying to find like the best sweet spot here. And ideally, you’re trying to find a property in a B or A area because you as a property owner or even apartment owner where you have control over 50 or 200 units. You can’t really change the neighborhood too much. You have control over the property class here. The general rule is look for a BNC property. But in a, a or b location of a better location that you can prove the property but you can’t prove the neighborhood. Here’s for those of you guys are more visual people here is how the bell curve of America falls. Most people live in class C homes. You may not realize it, but yeah, most people live in homes that are less than $100,000 houses. I think we, when I first started, it was a big culture shock. You could buy a house for less than half a million dollars. Yeah, we’re the weird ones that live out in California or Hawaii, or primary market. So the dotted line is kind of where the bell curve America is. And we’re always trying to sharpshooter strategy here right? What happens in a recession or when times get tough will people do downgrade. So this curve moves backwards. So that’s why we try and stay in this nice little sweet spot so that when things get tough

15:11

people fall back and rent from us.

15:15

And things are good today too. And that’s why we kind of stay away from the high end luxury stuff because you know, the has much very cool place to live. You know, in a recession, these are the guys who are going to move down from their 1600 dollar one bedroom apartment down to something more reasonable like that 1200 dollar a month apartment, depending on which market but I would take a screenshot of this little slide here. This is from a book called millionaire real estate investor by Gary Keller. If there is one book to read, it would be that book. And I think after reading that book, I would say, dude, like start reading books. I see this too many times. You I read so many books he listened to so many podcasts, we podcasts are essentially just marketing tools to get you invest in people in deals.

16:09

If you’ve been listening to podcasts more than a year,

16:14

you probably listen to the same thing over and over again. So read this book and kind of understand what’s going on. In here. It’s kind of saying that there’s the sweet spot that I was kind of talking about here. on the x axis, you have the property class here. Maybe B C class or or D class properties here, a class here.

16:40

st trying to stay around here,

16:42

which is probably the B and C’s.

16:45

And then here are your,

16:48

your high end, kind of tenant and tenant.

16:58

This doesn’t quite make sense. Do you maybe come back to it later and kind of ponder on it and meditate it but this is super important super super important best sources for information on these markets CT data is a great one CT data com neighborhoodscout bigger pockets I’m not a big fan of it because most people are active wholesaler flippers, do it yourselfers which

17:25

you can kind of fall into a rut in that stuff.

17:30

But it’s good way to like you know if you’re interested in a neighborhood trying to

17:34

reading some forums on that you might see some some market

17:39

information dropped in there.

17:44

Other things to look at, like crime map so in every city, you can probably find the crime map there either through the city or the police website. Now let’s get one thing straight we’re buying in class. B. The area’s for the most part, you’re going to have to Crime there. And also in terms of schools, you’re not going to have the best school. It’s like people are always like, yeah, I wanna I want a property in a good school. And that’s no crime like, dude, there’s like, you’re not going to find any search results, right? Like, we’re trying to find something that is

18:16

a good quality value for people to rent,

18:20

who’s a B class tenant, there’s going to be death, there’s going to be vandalism around the area. But what I would key in on in terms of the crime map is look for areas that don’t have too much homicide, like murderers and stuff like that. You’re going to have jugs all over the place, that’s for sure. But then just kind of stay away from the worst areas just like schools. You’re not going to be in the areas with the best schools. Those are going to be the high price a class location areas in a class areas. You’re not going to hit your metrics

18:52

to be able to cash flow.

18:58

You can’t have everything

19:00

And especially, I mean, maybe you could back in 2009. But it’s 2020 and beyond, and you’re just not going to find these things. So I say that just set your expectations now that you’re just not going to find that stuff. proximity to city center, normally we’re buying out in the suburbs, maybe about 20 minutes outside of the city center. Normally in the inner city, it’s a little bit more higher crime, lower price here, we get priced out. So numbers don’t really work out. But a lot of cities are built with a loop trap, highway system. So really, sometimes are just in that or just beyond that. It’s kind of a general rule of thumb. You want to look for a good median household income. The rule that we use on our apartments is we want the median household income in that area to be at least one third of what the rents were trying to fetch to be able to go after the majority of the public If it’s higher awesome right i mean people need a place to live everywhere so that’s that’s idea like I said you’re trying to find a good quality house in a better location needs to be near things typically this is pretty easy some deal killers are you know, you want to try and stay out of the flood zones. So you can look at the FEMA maps for that at least try and stay out of the hundred year flood maps and then you can kind of use neighborhood rankings to but again, you know, the the hottest markets were all the yuppies want to live is typically not worried about I’ll find your class VNC rental properties that some other guidelines for cities to invest in. And these these are some of the guidelines that we use from our syndication investing and how we pick markets, but generally it’s trying to find where the population is going up. At a decent In size scale, this is typically where a market is. Where do you find this data, you know, census data, but you know, Google’s cool these days, because you could just say, Well, you know, give me a population graph, or Cleveland, Ohio, and we’ll just bought it for you. And you can see it. Always try and be in a era where it’s appreciate are going up. median household income, like I said, so the data is a great resource for that. And just know like, we’re kind of getting to the new census here. So some of the data could be Oh, you might have to interpolate some of the missing data in there. And then you’re looking for prices to be appreciating. That’s always a sign of a healthy market. And then you’re also looking for job growth, too.

21:58

More information on the crime.

22:02

And the annual job growth numbers department of numbers, comments like that is a great way for places to look for that. Talked about the median household income should be around 40 to $70,000 a year. And you guys are probably, you know, most people make this most people don’t make over $100,000 a year.

22:29

And this is what I think why like,

22:32

I don’t, I don’t say it’s necessary to visit your property on the first go round, even though it probably makes you a lot more comfortable to do it. Because you go there and you’re like, oh, my goodness, what is the $80,000 property? And I think most times, especially when they come on a tour with us, they’re like, Okay, this isn’t that bad, right? I’m surprised like the value that you can buy out here in the Midwest in the southeast. This isn’t that

22:57

bad.

23:00

In fact, a lot of $120,000 houses are in great plus locations. You’re looking for median contract, rent in the 700 to 1000. And we’ll get into a little bit of the guidelines, but I generally try and stay above $900 rent. I try not to go below that, because from my experience, when you start to deal with tenants who are lower, paying tenants less than 900, you start to run into problems, especially as a single family home investor. Now we obviously do something a little bit different on our apartments. We have properties that are $600 friends, but we have a commercial property manager who is a lot higher quality than a residential property manager, and they’re kind of set up to deal with that type of tenant. But I would say you know, for a lot of you guys getting started single family homes, I would just start to stick with higher rents. Even though your numbers your caching numbers aren’t going to be as strong Fuel once you get to experience, you have more power to go after more yield with lower rents and better rent to value ratios, but as a general rule, I kind of like to kind of stick with the higher class rental properties. You know, you want to look for unemployment rates that are at least trending the right way. This COVID thing the data is cut off all over the place right now but you know, generally I think you want to look what was what was it pretty March and kind of look for something that’s less than 2% and then other you know, other intangibles poverty level and ethnic groups. Here was my first rental and Birmingham. Nothing special. For the first couple years, I didn’t visit flagship, maybe for the first year, year and a half. I didn’t visit the property and this was the best I have I had a Google Map. And I had the little Google man drive the street for me. And, you know, from the looks of it, this is what surprised me and I out here, when you get out to the suburbs, things are pretty separated and like these, this was a, I would call it a C plus asset and a B minus area. Here is another one of my properties. What I would do is I would set this stuff up on on a recurring bookmark, and I would just check in on it every quarter, so I don’t know what the heck that did for me, it just made me feel better. In the beginning, I would kind of Facebook stalk the tenants and see if they were working or I don’t know I don’t know why I would do this type of stuff. But that’s, that’s you have to get creative as a remote investor. Of course, we’re using property management but You know, maybe I just did that stuff to make me feel more comfortable so I can sleep at night. And you know, this, this thing is real estate is a people business. A lot of my investors are engineers, and a lot of them are computer programmers. And it drives me crazy how these guys get inundated with this data and they think they can create some Python coding thing. There are advantages taken away and I think that’s the beauty of real estate is anybody can do this. But you have to, you have to have a little tack you have to build a team around you. Like Dean said, make some friends, get some referrals from those friends, but eventually you have to build this team of brokers, property managers, lenders, insurance agents, attorneys, CPAs accountants. We in the incubator group, we kind of set you up with the folks that we we do we use but we can totally help you guys vet out your own teams if that’s what you want to do. You know, a lot of people are alternative rebels anyway. So they want you want to go and do this on your own, we can help you but in that group, but this is essentially what you want to do, should you do want to do it on your own. You want to look for a market that is landlord friendly. So just come out and say it. I don’t invest in blue states. I’m not going to invest in an area where I have to evict someone in the Socialist Republic of California, it’s going to take me 12 months. Now, I’m not saying that I’m heartless, but I grew up with the value system. If you don’t pay, you can’t stay bro.

27:38

In Texas, you can evict somebody, I don’t know if this if this is quite true, but yeah, in Georgia, I mean, you can’t pay you can’t stay. They could bring the sheriff around and they just evict the person. It’s much more friendly towards the landlord. So this is not only do the numbers not make sense of primary markets, but typically they’re in blue states with bad landlord laws.

28:12