1) Introduction

Start Here

I recommend that most people (especially those with a net worth under $500,000) start out with single family homes as opposed to multi family due to the following reasons:

- Learn the basics

- Learn to be a remote investor

- Obtain experience with less on the line

“Turnkey rentals… its like climbing Mount Fuji…. It’s good to do once, but you never do it again”

Be careful of the marking propaganda out there (see below) trying to force you to take the leap.

Turnkey rentals or syndications are better than the stock market, so lets get educated and then go in eyes wide open!

If your net-worth is over $500,000, you should start learning about syndications and understand when you should make the jump to becoming a limited partner (LP) in multiple private placements.

NOTE: We will get more into this later. It is not that 2-4 units require more experience, but the tenant class is lower and the exit strategy is worse especially for an investor who is going to progress their net worth to accredited investor status soon.

Part 1 of 8 - Overview & Money Myths

- Overview

- My background

- Why not stocks/mutual funds

- How the wealthy run their finances

- The financial secret

- Runtime – 61 minutes

Reaffirm your goals

Before starting your turnkey search, it is important to know your goals.

Access the worksheet by clicking the button below and complete it as you go along:

Complete your goal sheet here

STOP – Did you complete the above form?

Part 2 of 8 - Success Story of a retired investor

- How Dean started

- Lifestyle design

- Common misnomers

- Runtime – 26 minutes

Are your finances in order?

Real estate not a risk free endeavor. However it is one of the best risk adjusted ventures anyone can do!

Unlike stocks, you may not be able to sell it quickly and you may be on the hook for large expenses if something is in need of repair.

It’s a good idea to take this time and look over your finances to make sure they’re stable enough to support your real estate investing pursuits. Here is what you should look at:

- How much cash do you have to invest right now? This will put a limit on how much you can pay for your first rental property.

- How much cash are you able to save per year from your full-time job (or other income)? Additional savings will help you buy more rental properties in the future.

- Do you have an emergency fund? An emergency fund is a stash of savings you can use in case something unexpected happens. While it is always good to have one, it is even more important if you are going to own real estate. For example, a new roof may cost you $3,000 – $5,000 and that money will need to come from somewhere. Make a goal to set aside $5,000 – $10,000 for emergencies if you don’t have a fund set up already.

- What is your debt to income ratio? To calculate this, take all of your monthly debt payments (car payment, student loans, credit cards, mortgages, etc.) and divide them by your total monthly income (salary, dividends, rental income, etc.). Most conventional loans require a debt-to-income ratio of 45% or lower.

- What is your current credit score? You can get it for free from Mint or Credit Sesame. If it is below 600, you may have to pay a higher interest rate on your mortgages. The best rates for mortgages are in the high 600’s so you might want to look at one of these techniques to get your score as high as you can.

Isn’t a Turnkey Rental easy?

In a perfect world, a turnkey provider will fix up a property to perfect specs like it were their own and spare no expense. This is obviously not the case as there is really no standard for what a turnkey is.

A turnkey can mean all, some, or very few of the following:

- Renovated roof, electrical, plumbing, and major systems.

- Installed renter grade materials

- Vetted tenant in place

- Property management from the same company or a third-party one

- Every single item on the punch list taken care of because your happiness is valued over the vendors livelihood – you get the point 😉

Even after takeover, you are in operation mode there is no such thing as a 100% passive investment. You are the asset manager and you have to manage your staff (mainly the property manager) and often battle for the best pricing on repairs.

We cannot eliminate all risks, but we can try to take the steps to educate ourselves to mitigate them. If it were easy and risk-free… everyone would be doing it. Financial independence is not for everyone… we need people to trade their time/energy for money in order for this world to function.

Key definitions to know

Below are essential Turnkey Rental Terms to know. Later, you can check out the complete glossary but don’t let that bog you down. Let us get through the basics first! Most people only get through a fraction of these eCourses… we made this so you can buy something and become financially-free rather than just make you feel good about yourself!

Purchase Price: The price of the property you are purchasing. With turnkey properties, this is usually listed directly on the turnkey company website and is non-negotiable.

Market Value: The actual current value of a property. The market value is not necessarily equal to the purchase price. For example, if you are able to negotiate a discount with the seller, the market value will likely be higher than the purchase price. Most turnkey properties are sold at around their market value and it’s not common to get a discount.

Equity: The actual portion of the property’s market value that you own. If you are using financing, your initial equity will depend on your down payment. It will increase as you pay down your loan and as the property’s market value increases.

With Financing: Equity = Market Value – Loan Balance

Without Financing: Equity = Market Value

Purchase Costs: All costs and fees associated with purchasing a property, sometimes also called closing costs. Examples include appraisal fees, property inspection, finder’s fees and underwriting fees.

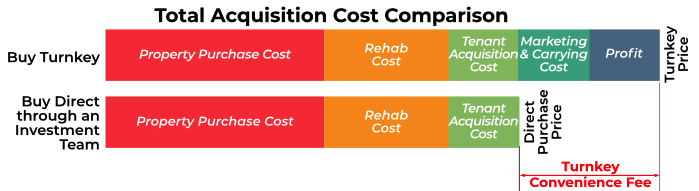

Rehab Costs Expenses: Rehab expenses you expect to incur after purchasing a property to improve its condition and make it rent-ready. You will typically not have any rehab costs when purchasing turnkeys, since the seller will conduct the rent-ready rehab.

Total Cash Needed: The total amount of money you will need to purchase a property. This will also be your total initial investment or total invested capital.

With Financing: Total Cash Needed = Down Payment + Purchase Costs

Without Financing: Total Cash Needed = Purchase Price + Purchase Costs Purchase Criteria

50% Rule: A purchase criteria commonly used by real estate investors when analyzing rental properties. According to this rule, the operating expenses of a rental property should be less than or equal to 50% of its operating income.

Operating Expenses <= Operating Income / 2

1% or 2% Rule: A purchase criteria commonly used by real estate investors when analyzing rental properties. According to this rule, the rent to value ratio of a rental property should be 1% or higher.

Rent to Value >= 1%

Debt-to-Income Ratio (DTI): A ratio commonly used by conventional lenders during loan qualification. It is based on comparing your total monthly debt payments (ex. credit card payments, mortgage payments, student loan payments, car payments) to your total monthly income (ex. wages, rental income, other investment income). A DTI of no more than 45% is typically required to qualify for a conventional mortgage.

DTI = Total Monthly Debt Payments / Total Monthly Income

Mortgage Insurance (PMI): Some loan programs (such as FHA and VA loans) require you to pay mortgage insurance, which is typically calculated as a percentage of the loan amount. Mortgage insurance can be a one-time upfront payment which is added to your loan or a recurring fee added to your monthly mortgage payment.

Gross Rent: The rent collected from your tenants before subtracting any operating expenses or accounting for vacancy.

Vacancy Allowance: A percentage of time you expect a rental property to remain vacant. It may remain vacant while you are searching for a new tenant or performing any required repairs or upgrades. For example, if you expect the property to remain vacant for 1 month each year, the vacancy allowance will be 1 / 12 = 8.3%.

Vacancy Allowance = Time Vacant / Total Time

Vacancy Expense: The dollar amount you will lose in a given time period due to vacancies. While vacancy isn’t a direct expense in the sense that you do not pay it to anyone, it will result in a decrease in collected gross rent and should be accounted for.

Vacancy Expense = Gross Rent x Vacancy Allowance

Operating Income: Total income generated by a rental property, less the vacancy expense.

Operating Income = Gross Rent – Vacancy Expense

Operating Expenses: The expenses you will incur while renting out a property. Examples include property taxes, insurance, property management fees, maintenance, capital expenditures and utilities.

Net Operating Income (NOI): Income generated by a rental property. While NOI takes into account all operating expenses, it does not account for loan payments and can therefore be used to compare rental properties irrespective of financing terms.

NOI = Operating Income – Operating Expenses

Net Cash Flow: The net amount you will receive from a rental property as income. Cash flow accounts for all sources of income and all expenses, including loan payments.

With Financing: Net Cash Flow = NOI – Loan Payment

Without Financing: Net Cash Flow = NOI

Capitalization Rate (Cap Rate): A rate of return of a rental property based on comparing the yearly NOI to the purchase price. Since the cap rate does not take into account loan payments, it can be used to compare rental properties irrespective of financing terms.

Cap Rate = Yearly NOI / Purchase Price

Cash on Cash Return (COC): A rate of return of a rental property based on comparing the yearly net cash flow to the total invested cash. COC represents the return you will receive on your invested capital.

COC = Yearly Net Cash Flow / Total Invested Cash

Return on Investment (ROI): A rate of return of a real estate investment based on comparing the total profit from your investment to the total invested cash. ROI takes into account the cash flow, equity accumulation and loan pay down and gives the total return on your invested capital, should you decide to sell the property.

ROI = (All Cash Flows + Total Equity – Selling Costs – Total Invested Cash) / Total Invested Cash

Rent to Value (RTV): A rate of return of a rental property based on comparing the monthly gross rent to the property’s purchase price. The rent to value ratio is used by the common 1% rule.

Rent to Value = Monthly Gross Rent / Purchase Price

Gross Rent Multiplier (GRM): A rate of return of a rental property based on comparing the property’s purchase price to the yearly gross rent. GRM represents the number of years it will take for the yearly gross rent to add up to the original purchase price. GRM = Purchase Price / Yearly Gross Rent

Simple Passive Cashflow Remote Investor Acquisition Checklist

- Get pre-approved for financing and have 20% down payment ready ($20k minimum). Use an estimated property value in mind or estimate for the pre-approval. We recommend a B-class property in a secondary and tertiary market. This will cost around $80-120K and be near the 1% Rent-to-Value Ratio. Currently, some popular secondary and tertiary markets include Birmingham, Atlanta, Indianapolis, Kansas City, Memphis, Little Rock, Jacksonville, Ohio, etc. (we saved you a lot of time and trouble right there). A lot of people get stuck in analysis paralysis only to subconsciously delay themselves from taking that leap of faith. As a student in the Incubator group, we can help connect you with those we trust and have done past business with. If you are looking to purchase multiple properties at once, make sure to get pre-approved for multiple properties up-front. This does not mean you have to purchase multiple properties at once, but it will keep your options open. We have a network of excellent lenders that offer exceptional loan rates & terms. Feel free to ask for our recommendations.

Research properties in our current inventory that fit your investment criteria. Incubator students: lets connect and let us assist you. Or if you want us to simply make the connections let us know we are here to drive you toward results!

- Engage with a property manager who will eventually manage your rental property.

Understand how to use the Analyzer and create a database of rents and properties so you understand the value of properties so you know when to spot out a sucker deal.

Once you see something in your buy box, engage with an agent or sign a purchase agreement. Putting a property under contract does not mean you have to buy it. But for now, you control the property to ensure no other investor can purchase it. This is where the true due diligence period begins with the inspection, appraisal, title work etc.

Keep your lender engaged on where you are at in the process.

Wire-in earnest money deposit to title company to hold in escrow. This must be done immediately after putting a property under contract. This is refundable if you exit the contract for any of the three major contingencies (financing, appraisal, or inspection). We always recommend our students to buy with a third-party inspector and have an appraisal completed.

Hire a third-party inspector. Because we are under contract, we are on the clock to ensure we are buying what we intended. Thus, hiring a property inspector to inspect the property is absolutely necessary before closing. We can help you vet this in the Incubator group. You should receive a detailed inspection report which may request any necessary repairs. We will address all reasonable safety items and major components. Do not be unrealistic on the inspection results as real estate is a relationship business. The main point of it is to ensure there are no large items that need to be repaired immediately, and no safety items that could affect a tenant living in the home.

Get rental insurance quotes. Your lender will require this to be finalized prior to closing, and they will need a copy!

Ensure property title is clean. Your mortgage lender will be working with the title company to ensure the property title is legit. The bank/lender has the most to lose in this transaction since they are lending often 80% of the home value.

- Talk to your lender about not messing up your lender profile before closing. They might take exception to large withdrawals or deposits in your bank account. But big fluctuations to your DTI is a “no-no” before closing.

- Advantageous of LLC’s/Entities. We are not CPAs or Lawyers, but we do see best practices from a lot of clients for LLC or entity structures so don’t worry about this… Incubator students will be guided in our group sessions and connected with our preferred professionals.

Be available to meet a mobile notary to sign the closing documents. It always seems like the SPC tribe is always enjoying life and taking fun international vacations around closings!

- Celebrate you closed! Your property manager should be running the day to day show. We can assist in the incubator on managing the situations that come up. Now its just going to take some time to get your net worth up to join us in the

FAQ

It all depends on your goals. If you don’t mind living in a multi-family property and want to acquire as many units as you can in the beginning that would be the best way to go.

Also keep in mind that if you buy a property for yourself to live in first, minimum down loans will not be available to you and you will always have to have 20-25% down to buy an investment property. This may be harder to do if you are spending the bulk of your income on your own home.

I'm generally bearish on short term rentals, however if you do decide to do this, I suggest you educate yourself with the basic education or formal training out there. I have answered this question in detail in this article

Within the next two weeks:

Finish your 1st reading assignment, complete reaffirming your goals, and familiarize yourself with the terms in the real estate glossary.

Incubator students please refer to our 5-Month plan document which we will sync up our bi-weekly calls with. We will use peer pressure here to make sure everyone is on the same page and pushing toward a productive 5-month blitz to purchase a rental! We got you!

Deeper Learning