Month 3 – Get Umbrella Insurance

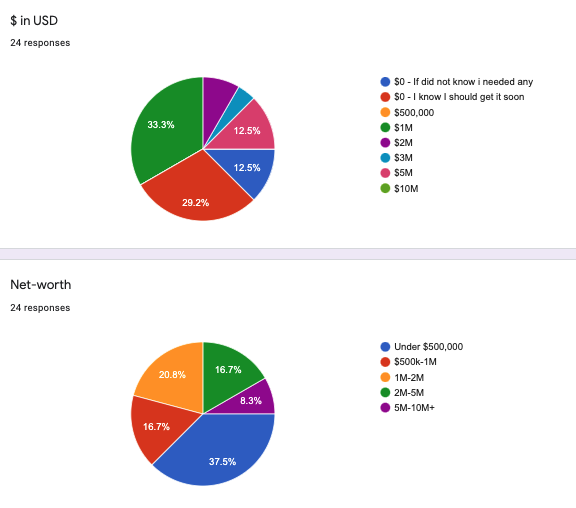

The basic rule of thumb is at the very least $1M dollars. Plain and simple… just incase you hit grandma crossing the street. It should cost $200-500 dollars a year. Don’t waste too much time shopping around. Get something in place as soon as possible.

If your net worth is more than $1M or you have a higher liability profession you might need more $2-5M+.

How much do you really need? Well this is where you need to build personal relationships in our group to find others in a similar situation as you and calibrate yourself with those in the know.

Getting your umbrella insurance should take no longer than a 15 minute phone call. Use the remaining time you have to progress your passive investing knowledge to getting on the phone with 1-2 other people in our tribe. Keep this up throughout the year or make it up at this years Hawaii mastermind!

PS – Please email Lane@SimplePassiveCashflow.com who you got your insurance from, what amount for, and how much was it so I can create a list to share with other members.

List of providers:

- USAA

- State Farm

- Allstate

- Farmers

I polled our tribe in May 2020 and got the following results. [Update: These quotes are from 2019-2020. For my properties, I see insurance costs at $600 a door where now its $850 a door (2023)… which is about almost a 45-50% increase. Now I don’t know if that carries over to personal liability insurance but I am willing to bet its all connected and impacted by inflation.] Please email me to add your results to the below for others:

Accredited:

- $3M umbrella policy with USAA with a $266 premium

- $1M umbrella policy from USAA for $201.64 a year if you want to add that to the list. I had to bump up my auto liability insurance premium though.

- $2M umbrella policy w/ State Farm for $236/yr

- $4M through GEICO for $944

- Allstate 1M – 2 residences, 3 cars, 2 Mature Drivers. $394/yr

- $1M Allstate – 300

- $5M CUP, $1000 annually. 4 properties (O’ahu). State Farm (Honolulu)

- StateFarm Insurance, $1M, $157 annual premium

- Travelers. $1mm coverage me and wife. 2 vehicles and 3 residences. $406 annual premium.

- $282 for $1M coverage with Geico (bundled with home & auto), up from $252 in 2019.

Non Accredited:

- Safeco, 1 million (I think), around $200

- Hawaii carrier $2M limits $225

- $1M through State farm for $361

- Geico. $1 million coverage. $106 annual premium. 1 driver, 1 vehicle, no rental properties

- Geico, $1 million coverage, $233 annually. 2 drivers, 2 vehicles, 3 rental properties. Hawaii.

- $1 MM policy from State Farm for $240/year

- $160 a year for 1M through Travelers when bundled with my home. I had Nationwide in the past and it was around $180.

$1M, $383/yr + $16 for house increasing home insurance policy to min coverage

$2M – $634/yr+ $16 for house increasing home insurance policy to min coverage

$5M – $1177/yr+ $16 for house increasing home insurance policy to min coverage