Burnbook

CONFIDENTIAL DO NOT SHARE

These were collected from internet sources. If you would like to add any please let us know.

Used to be very reputable name out of Reno who did notes. Don’t know exactly what happened but they took down the website. The firm used investors’ money to buy distressed properties, rehabilitate them and then resell or rent them out, generating profits for members of its funds. And Steve Sixberry

https://youtu.be/x5OUAXQF1U8

https://www.bbb.org/us/nv/reno/profile/real-estate-investing/hughes-private-capital-llc-1166-90021609/complaints

https://www.biggerpockets.com/forums/92/topics/1099843-experience-with-hughes-private-capital

Jay R. Gajavelli, https://appleswaygroup.com/ Founder and CEO (He’s in India now, skipped the country, had lunch with one of his lenders today – syndication Spring Brand Portfolio) “This was a student of Brad Sumrok and his apartment investor mastery. Looks like he passed the course but failed in real life!”

https://drive.google.com/drive/folders/16o8Q8GBF_60rgRMn6Erdv8Tje0WJq2FR?usp=share_link

https://twitter.com/DallasAptGP/status/1643810909905735682

Post Oak Multifamily TX LLC – Heights at Post Oak – 6/21/2021 to 3/10/2023 – Officers: Merrill Kaliser, Jay R. Gajavelli, Sridhar Sannidhi (Grow Wealth 2 Retire LLC)

Westwood Bissonnet Houston Borrower DE LLC – Reserve at Westwood – 4/26/2022 – Officers: Merrill Kaliser, Gajavelli Koteswar, Jay R. Gajavelli, Sridhar Sannidhi (Grow Wealth 2 Retire LLC)

Timber Ridge Houston DE LLC – Timber Ridge Apartments – 12/16/2021 – Officers: Merrill Kaliser, Gajavelli Koteswar, Jay R. Gajavelli, Sridhar Sannidhi (Grow Wealth 2 Retire LLC)

Redford Houston Borrower DE LLC – Redford Apartments – Officers: Merrill Kaliser, Gajavelli Koteswar, Jay R. Gajavelli, Sridhar Sannidhi (Grow Wealth 2 Retire LLC)

Heights at Post Oak was sold for $46.3M. The rest of the portfolio was sold to Fundamental Partners with new loans totaling $189M from Arbor (original lender and seller)

Minimum bids set:

– $60 mln / $65.7 of principal

– $50 mln / $68.8

– $40 mln / $47

– $46.5 / $47.8

Property Group, LLC

From Janelle J

https://retevo.com/

The marketer – https://parfundingreceivership.com/

These guys were pushed by podcasters. And Real estate guys echo system. This is why I stay out of oil and gas.

Defendants – Homebound Financial Group LP, HomeBound Resources LLC, Legacy Energy LLC, Choice Energy Holdings LLC, PetroRock Mineral Holdings LLC, Mercury Operating LLC, Minerva Resources LLC, 2X5 Enterprises LP, The 2X5 LLC, Cronus Mineral Holdings, Wealth Formula Investor Club, Prosperity Economic Partners, Foundations Investment Advisors LLC, Financial Gravity Wealth Inc, The Hidden Wealth Solution, Thomas J Powell, Stefan T Toth, Ted Etheredge, Mir Jafer Ali Joffrey, Brooke Nunes, Chris Miles, Jeff Cronin, Christopher Lynn Most, Devin Patel, Charles Oliver and Kim Butler

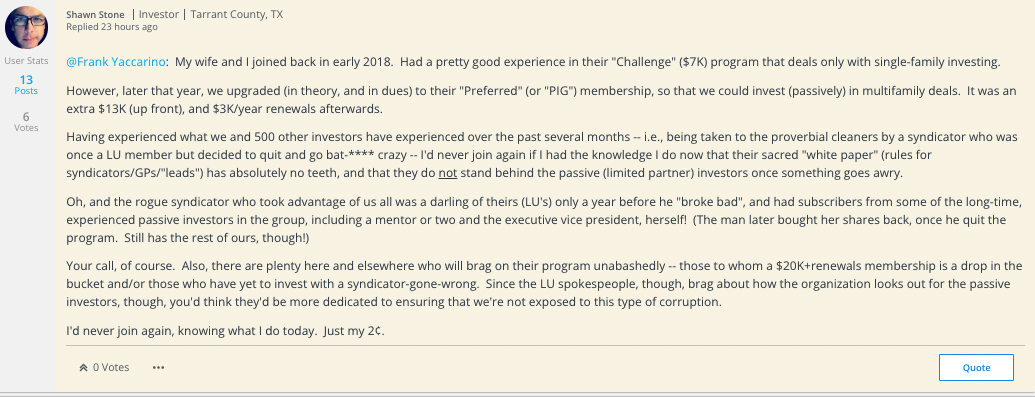

This is one of the top 3 MFH training grounds for new GPs. If you want to go down the GP route just know its a 1-3% success rate after you plop down 40-50K. The help/coaching is pretty lame. The programs are designed to have people fail and become LPs and feed the 1-3% successful students. Understand that it is like going to the barber school or massage school where you are getting a GP-in-training. Good luck!

Public criminal record for fraud and theft in 2020

When you Google him, an article pops up that he was arrested by US Marshalls that he was arrested for theft and has a history of fraud – https://www.rgj.com/story/news/crime/2016/06/01/former-lake-tahoe-brewing-owner-surrenders-theft-case/85245594/ & https://www.globemiamitimes.com/claims-arise-against-globe-house-buyersllc-and-michael-candelario/

Chimene Van Gundy refers to herself as the “Queen of Mobile Homes” and “the Mobile Home Millionaire.”

The monikers reflect the business she says she’s built buying manufactured homes on the cheap, fixing them up and then flipping them for a tidy profit.

The New Braunfels businesswoman boasts that mobile-home investing secured her a place in one marketing group’s “two comma club” for those who have earned more than $10,000,000.

Some who have invested with Van Gundy expecting heady returns, however, have a far different take on the entrepreneur. They say she’s welshed on principal and interest payments on the loans they made to her. And they allege she’s orchestrated a Ponzi scheme that has collectively cost them and others at least a few million dollars.

Their complaints were enough to get Van Gundy dethroned.

A Comal County judge recently appointed a receiver to take over control of one of Van Gundy’s firms — Outstanding Real Estate Solutions Inc. (ORES) — and her personal financial affairs. Part of the receiver’s job will be to locate assets and preserve what’s left for creditors.

There may be little to recover from her company, though.

Chimene Van Gundy started Outstanding Real Estate Solutions Inc. to buy and sell mobile homes in 2015 after she was laid off from a corporate job.

“Everything we’ve…

Attached are the following docs:

- Promissory Note: for $50k investment at 18% ROI annually for 5 years, quarterly payments. You need to fill this out as well as to have the top of page 2 signed and notarized. Once you do that, I’ll counter-sign and notarize on my end. Just scan and email to me. I’ll email you final when done on my end.

- Investor Disclosure Doc: initial, sign and fill out. Scan and email back. I’ll counter and send back to you.

- Example payout schedule if you were to come in with $50k in July. It takes us about 95 business days from the time that your funds are received, to the time we source the property, rehab it, get buyers in, and close the deal. Should you come in during July, your first quarterly payment will start in November 2019, and continue quarterly (every 3 months) for 5 years. A total of 20 payments of $2,250. Once that term is over, you can choose to get your principal back, or reinvest and continue the program for another 5 years, etc.

https://www.cbc.ca/news/canada/saskatoon/epic-company-collapses-real-estate-500-homes-1.6399770

Real estate company collapses, 500 homes affected, $10M from investors across Canada missing

Carolina Abramovich says the investment appealed to both her pocketbook and her conscience.

The Vancouver biomedical scientist is one of 120 investors who gave unsecured loans of between $50,000 and $500,000 to the Epic Alliance group of companies in Saskatoon.

“I heard about Epic Alliance with real estate investment groups, they were really everywhere,” she said in an interview.

“Excellent reviews from anybody that invested with them, small or big. Real estate investment groups, podcasts, webinars — they were everywhere.”

While it seemed to make financial sense, Abramovich said that she also fell hard for the company’s origin story.

“The story behind the company was great. Try to help investors with their investments while providing, you know, affordable housing in Saskatoon. I liked the fact that they were women and that they were promoting trades for women.”

The Epic Alliance group of companies shut down its operations at the end of January. Its investors and property partners learned of the collapse in a 16-minute Zoom call from the company’s founders, Rochelle Laflamme and Alisa Thompson.

“Everything is gone. Everything is bankrupt, guys. It’s all gone,” Laflamme said in the Jan. 19, 2022, video.

Blindside

The news of Epic’s collapse went off like a bombshell in real estate and business circles across the country.

Investors wanted to know what happened to their money, landlords across Canada wanted to know who would manage their Saskatoon rental properties and real estate professionals worried about what would happen to the hundreds of core neighbourhood homes.

According to Laflamme and Thompson, Epic Alliance controlled 504 properties in Saskatoon and North Battleford — valued at a combined $126 million — when it fell apart.

The pair spoke to investors in an “E.P.I.C. Hour” video posted in early January, only weeks before the company shut down. The majority of the properties — a combined $115 million worth — are in Saskatoon, Laflamme said on the video.

Through its network of companies, Epic acted as landlord and property manager for more than 400 rental properties in Saskatoon’s core neighbourhoods, including Pleasant Hill, Riversdale and Meadowgreen.

It managed these homes for out-of-province investors through its “Hassle Free Landlord Program.” These investors, primarily in British Columbia and Ontario, are now suddenly long-distance landlords responsible for the properties.

Two former Epic employees say that as many as half of these homes are vacant, with many boarded and in dire shape. The fear in the local real estate community is what might happen should dozens, if not hundreds, of these homes hit the market at the same time.

The head of the Saskatchewan Realtors Association says it’s closely tracking monthly stats to gauge the impact.

“We’re not seeing evidence of a crisis in the market, and I think it’s too early for that,” chief executive officer Chris Guerette said in an interview.

“I would certainly think that it’s a crisis for those who have invested, because of the quantity involved.”

Earlier this month, in a separate development, Court of Queen’s Bench Justice Allisen Rothery assigned accounting firm Ernst and Young to investigate what happened to the estimated $10 million to $20 million the 120 investors placed with Epic Alliance.

The company was not licensed to sell investments or offer financial advice, according to the Financial Consumer Affairs Authority of Saskatchewan (FCAA), which issued a temporary cease trade order on Oct. 21, 2021.

In November, the FCAA held a hearing to consider extending the temporary order. At that time, declarations and support letters for Epic Alliance “indicated that the temporary cease trade order was negatively impacting Epic Alliance’s business.”

It was lifted Nov. 16.

Saskatoon lawyer Mike Russell represented the 120 investors when they applied to have the special investigator appointed. They want to find out what happened to their money.

When asked by CBC to describe what happened with the company and its various programs, he replied with two words.

“Epic fail.”

How it worked

The Ernst and Young investigators are due to present their findings to the court in late April. Until then, a partial picture of what happened emerges through court documents, interviews with former employees and the words of Epic owners Rochelle Laflamme and Alisa Thompson.

CBC reached out to Laflamme and Thompson through their lawyer to speak to the allegations. They did not respond. However, they did leave behind hours of video sessions posted online in “E.P.I.C. Hour” episodes promoting their businesses.

The pair created Epic Alliance in 2013. It soon evolved into a web of named and numbered companies, including Epic Alliance Real Estate, Epic Alliance Electrical, Epic Accounting and Bookkeeping, and Epic Holdings. It had 118 employees.

They created and ran three main ventures: a loan program based on promissory notes, a “Fund-A-Flip” program and a “Hassle Free Landlord Program.”

Russell, the lawyer representing investors, detailed in a law brief supporting the application how it appeared the three Epic offerings overlapped and worked together. His analysis of these relationships is supported by online promotional material from Epic Alliance.

The company built up its $10 million pool of capital over eight years by enticing people to give Epic between $50,000 and $500,000 in exchange for a promissory note.

The single-page notes, of which multiple examples were provided in affidavits, were models of simplicity. They featured the loan amount, when the term began and ended, and the interest rate.

The rate of return varied from 15 to 20 per cent.

“You have a pool of unsecured funds that can be used for whatever. There’s no specific purpose given for those funds when they’re loaned,” Russell said.

The “Fund-A-Flip” program had investors buying homes through Epic, doing improvements and upgrades, and then selling for a profit. The company’s promotional material suggested a 10 per cent return on a one-year investment.

Finally, Russell said the “Hassle Free Landlord Program” had investors — most out of province — buying homes acquired by Epic through the Fund-a-Flip program. The investor took out the mortgage on the home and Epic took responsibility for everything from finding tenants to maintaining the property.

It offered the investor a 15 per cent guaranteed rate of return.

The promissory note program is what attracted the attention of the government regulator, leading to the October 2021 cease trade order.

The order stated that Epic had given information and advice on how to invest in securities, including real estate investments and promissory notes, without ever having registered as dealers or advisors.

Russell said he first became curious about Epic when the FCAA issued its October order.

“I couldn’t figure out how the products they were offering made sense together,” he said.

In her March 14 fiat assigning the inspector, Justice Rothery detailed how the company had contravened the FCAA order.

“Although the respondents had executed an undertaking to the FCAA on Sept. 22, 2021, agreeing to not conduct any further trading in securities, they continued to engage in business trading and advising in securities in Saskatchewan without registration,” she wrote.

Rothery added that, after the Jan. 19 video call dissolving the company, “As recently as February 23, 2022, the respondents have been selling assets online from their warehouse located at the corporate offices for [Epic Alliance] for cash only.”

Insider view

Adam Elliott began working at Epic Alliance Properties in August 2020 after being a property manager in Saskatoon since 2011. He filed an affidavit in support of Russell’s court application to appoint an investigator.

Elliott says he spotted red flags on his second day at Epic.

“Generally speaking, residential property management works off fairly high occupancy rates. You need to have 70 to 80 per cent occupancy to make your business make sense,” he said.

“They were running close to 50 per cent or lower, which is unsustainable if you actually want to make money.”

Further, the company used rent projections that Elliott considered out of step with the realities of the homes and their locations.

Elliott said his epiphany on how the company thrived for eight years came when he spoke with his fellow workers.

“I was, like, ‘Oh, we’re an investment company.’ I realized that most of the business, like the way the company was keeping afloat, was through investors.”

The company was able to pay investors a high rate of return, even with low occupancy rates and unrealistic rent projections, by continually bringing in new investors and fresh money, he said.

Linda Ranks began as a receptionist at Epic and then moved into the administration and property management side.

Like Elliott, she filed an affidavit and also struggled to see how the company could make good on its financial promises.

“The money didn’t add up,” she said.

“I couldn’t figure out where they would be getting that much money, especially if 60 per cent of the properties were vacant and not even able to be rented because there was so much work being needed to be done.”

Ranks reached a similar conclusion as Elliott.

“There was always more investors and more properties, and that’s how they continued to get money,” she said. She re-iterated this allegation in her affidavit.

Final video to investors

Rochelle Laflamme and Alisa Thompson organized a video call with investors on Jan. 19, 2022.

The 16-minute presentation is where the people with promissory notes learned the money was gone, and where the people in the Hassle Free Landlord Program learned they were, in fact, now landlords.

Sitting in front of a whiteboard, the pair began with a blunt message.

“Unfortunately, we don’t have any good news, we don’t have any good updates,” Laflamme said.

“We just couldn’t come back from the cease trade order. The FCAA f**ked us, so that’s it.”

Laflamme did most of the talking, telling investors how “we are trying to hand over 700 properties” and put together “investor packets” to explain how the new landlords can move ahead.

She had a grim update for financial investors.

“Everything is gone, so shareholder stuff — it’s gone,” Laflamme said.

“Everything is gone. Everything is bankrupt, guys. It’s all gone.”

Looking ahead

Justin Howard is a rental manager with Elite Property Management Ltd. in Saskatoon. He said his office started getting calls from new out-of-province landlords within days of the January video call.

“I’ve got 40 people in the queue that want to sign up with us, we’re having a hard time keeping up with all the properties that are being brought on. There’s never really been a situation like this in Saskatoon,” he said.

“It’s very rare in the property management sector to have so many properties just suddenly appear.”

Russell echoed these comments.

“I’ve never seen anything like it,” he said.

The investors he spoke with who are now landlords are still in shock, he said.

“All of a sudden, as you can imagine, your task list just increased significantly from what you intended to do that day, that week or that month,” he said.

“Because now there are a number of things, from utilities to appliances to frozen pipes.”

Russell said he remains troubled by how investors learned what happened.

“The principals blamed the FCAA and essentially said, ‘we’re bankrupt.’ And of course, people use bankrupt to mean we’re insolvent, but they’re not actually bankrupt like they’ve filed something,” he said.

“They did give back the keys to some of these properties … it’s not like they disappeared. They stuck around, they handed out keys and so forth, which was a good thing to do. But typically you’d seek advice and you’d make statements as needed. There’s a process.”

Carolina Abramovich said she’d like to get her money back, but she’s not optimistic.

She wants Laflamme and Thompson held accountable for the missing millions.

SEC Orders Resolute Capital Partners LTD LLC to Cease and Desist

The Securities and Exchange Commission charged Thomas Powell and Stefan Toth, and their entities, Resolute Capital Partners LTD LLC and Homebound Resources LLC, with making material misrepresentations and omissions in connection with more than a dozen unregistered oil and gas securities offerings. Powell and Toth were also charged with acting as unregistered brokers. All respondents have agreed to settle the SEC action.

According to the SEC’s order, between 2016 and 2019, the respondents and salespeople acting on their behalf sold debt and equity securities to retail investors in unregistered offerings based on working interests in oil and gas wells. The order finds that the respondents made material misstatements and omitted material facts in both debt and equity offerings. In particular, the respondents provided insufficiently supported projections of future oil production, made statements about potential tax benefits that were unavailable to certain investors, overstated cash reserves, and made incomplete disclosures regarding potential uses of investor funds, including the amount of funds that would be used for payments to prior debt and equity investors. The order further finds that the respondents should have known that their statements and omissions were materially misleading.

According to the SEC: “Today’s settlements provide important protections for investors, including prohibiting the respondents from participating in any oil and gas offerings for two years and requiring an independent compliance consultant to review policies, procedures, and offering materials for any further offerings for three years,” said Carolyn M. Welshhans, Enforcement Division Associate Director. “Investors are entitled to materially accurate disclosures so they can make informed investment decisions.”

The SEC’s order finds that the respondents violated the antifraud provisions and the registration provisions of the Securities Act of 1933, and further that Powell and Toth acted as unregistered brokers. Without admitting or denying the SEC’s findings, the respondents agreed to a cease and desist order and to undertakings that, among other requirements, prohibit them from participating in any unregistered oil and gas related offerings for two years, require them to post a referenced link to the SEC’s order on all of their websites for three years, and require an independent compliance consultant for a period of three years. Powell and Toth also consented to collateral and penny stock bars and investment company prohibitions, with a right to apply for re-entry after two years. Finally, Resolute Capital and Homebound Resources each agreed to pay a civil penalty of $225,000, and Powell and Toth each agreed to pay a civil penalty of $75,000.

McKinney’s alleged role in the scheme was to bring together buyers and sellers who paid inflated prices for properties based on inflated appraisals he obtained. Two sellers, Joseph Britton and Mark Speckman, were convicted for their role in the scheme on Sept. 22 after a two-week trial.In one instance in July 2002, Britton and Speckman sold 28 properties in Indianapolis to Richard Pollett and co-defendant James McClung. The transactions generated more than $1.3 million dollars in fraudulently obtained loan proceeds, which were disbursed to three companies controlled by Britton and Speckman: Aspen Group, Pacific Group, and Home Source Investments. Prosecutors said Britton and Speckman then wrote 29 checks totaling approximately $430,000 to Senicure Investment Group to fund kickbacks to the other participants in the scheme. The Senicure account was used to hide the source of these funds, with McKinney writing himself a check for $71,000 in that transaction.

https://www.inman.com/2006/10/11/three-head-prison-in-34m-mortgage-fraud-case/

G Roldoph was in the deal he said it was not going wellhttps://eluxcapital.com/projects/

Matthew Skinner and his company was Simple growth, LLC. The SEC has been investigating him for over a year, now and we have been questioned by them from the beginning for their information. We recently got an email saying he was going bankrupt. We never got the kind of reports from him like you give us. So glad we found you. https://www.biggerpockets.com/forums/847/topics/550664-anyone-invest-with-matt-skinner?highlight_post=5488699&page=2

SEC Charges Attorney with Assisting Fraudulent Microcap Scheme

“Sidoti and Individuals A and B discussed how Sidoti would profit from her participation in the scheme. They agreed that she would be paid for her services in setting up the shells, that she would be paid additionally for acting as the broker in the anticipated sale of the shells, and that she would also receive shares of stock in the shell companies so she could profit when the shells were sold to buyers. That’s insane. Should should never have brokered it and accepted stock”

Litigation Release No. 24949 / October 19, 2020

Securities and Exchange Commission v. Jillian Sidoti, 20-CV-02178 (C.D. Cal. filed Oct. 19, 2020)

The Securities and Exchange Commission today charged California attorney Jillian Sidoti for her role in a fraudulent scheme to sell unregistered securities to the public.

The SEC’s complaint, filed in federal court in California, alleges that Sidoti facilitated the fraudulent dumping of securities of penny stock company Blake Insomnia Therapeutics. According to the complaint, as an attorney for Blake, Sidoti drafted and signed documents that she knew contained materially false information regarding the operations and control of Blake, including a private placement memorandum and registration statements filed with the Commission. As alleged in the complaint, Sidoti then arranged to sell almost all of Blake’s stock to nominee shareholders to obscure that the shares were actually being sold to shareholders affiliated with Blake. The complaint also alleges that Sidoti authored opinion letters containing false statements about the control of Blake in order to induce the transfer agent to remove restrictive legends from stock certificates held by the control group. As alleged, Sidoti’s actions enabled the control group to evade legal restrictions on the sales of stock by affiliates and sell over five million shares of Blake’s stock into the public market.

On January 2, 2020, the SEC charged 15 defendants in connection with a scheme that allegedly generated more than $35 million from illegal sales of stock of at least 45 microcap companies, including sales of Blake’s stock that Sidoti facilitated.

The SEC’s complaint charges Sidoti with violating the antifraud provisions of Sections 17(a)(1) and 17(a)(3) of the Securities Act of 1933 and Section 10(b) of the Securities Exchange Act of 1934 and Rule 10b-5 thereunder and the registration provisions of Sections 5(a) and 5(c) of the Securities Act. The SEC seeks permanent injunctive relief, including a conduct-based injunction restraining Sidoti from providing legal services in connection with certain unregistered offerings, a penny stock bar, and a civil penalty.

The SEC’s investigation was conducted by Rebecca Israel, Kathleen Shields, Trevor Donelan, Eric Forni, Jonathan Allen, David Scheffler, J. Lauchlan Wash, Sheila D’Entremont, and Amy Gwiazda of the SEC’s Boston Regional Office.https://www.sec.gov/litigation/litreleases/2020/lr24949.html

I purchased a property from Spartan in Dec 2016 as a recommendation from my financial advisor in AZ. Spartan finally got it rented in April 2017. Tenant was often late, but eventually paid so I allowed them to renew the lease in April 2019. Throughout this time, I was disappointed in the lack of communication from Spartan. They never informed me prior to maintenance bills or let me know if the tenant didn’t pay. I wouldn’t know until I got the bill at the end of the month. I voiced my displeasure, but the communication never improved.

The tenant stopped paying rent in August 2020 and an eviction notice was supposedly filed by Spartan. They informed my financial advisor, not me that the tenant would be moving out Sept 1 and had broken their lease. I never received communication from them unless I asked them what was going on. I told them I wanted to sell the property and asked them to mail keys to my real estate agent as soon as they had keys. No word about keys until I emailed Spartan Sept 10 asking if they had received them. They responded saying they would verify utilities were off and confirm vacancy. On the 14th I was emailed saying vacancy had been confirmed, the tenant had dropped off keys and they would mail to my agent. Ten days later no keys so I emailed again. They said the person that mailed them was out of the office. Two days later I emailed again. Now they said there was a miscommunication and they had never received keys because they didn’t do the standard move-out procedure since I wasn’t going to allow them to manage the property any more. I emailed back telling them they had now cost me two weeks of time to get the property ready to sell and thought as a courtesy they could change the locks and meet my agent with a key. They suddenly found a key and arranged to drop it off at my real estate agent’s office 3 days later.

My agent went to the property the next day, opened the door and found furnishings still inside and a tv on. He left quickly as he thought someone was hiding. Neighbors told him one tenant had never left. I emailed Spartan again explaining the danger they’d put my agent in and asking them how they could remedy the situation since I felt getting the tenant out should have been their responsibility and suggesting they cover the cost as a courtesy, at this point, to change locks and cover my mortgage during the wasted time they cost me.

Their response was that it was me who asked to have someone else handle the property and that they had a leasing agent physically go there on the 14th and it was vacant so they knew it was vacant. Then they said they were not allowed to contact utility companies because the companies wouldn’t give them info since they didn’t own the home (although I have an email saying they were contacting them). It would be my responsibility to evict the tenant and change the locks and they weren’t paying for any of it or my mortgage. I’m on my own.

Needless to say I wrote them another email. I also contacted the utility companies and found out utilities were never turned off so that would have taken them about 10 minutes. My real estate agent contacted the Sheriff’s office, but needs the eviction notice filed. I asked for the eviction notice they filed (if they really filed) as I received a bill, but actual record of it. I have not heard back. Anyone else have a similar experience with them or any suggestions? Other than maybe reporting them to the Better Business Bureau?

Please beware if you intend to do business with them. They apparently lie and lie again to cover up the lies and place blame back on the client. If you communicate with them, get everything in writing.https://www.biggerpockets.com/forums/48/topics/882543-spartan-invest-birmingham-al-dishonest-anyone-else-with-issues?highlight_post=5164932&page=1&fbclid=IwAR0RKSV3zGM3Rii0C1_klDzHPRSoTcLdqgJLaGv0nMI92CBWajc4-_q7aMk#p5164932

https://drive.google.com/file/d/1LSoE7P8LqYlgrsv6f42DAkn3ZHOidxAY/view?usp=sharinghttps://www.biggerpockets.com/forums/311/topics/635523-grocapitus-anyone-have-experience-with-them?highlight_post=5155271&page=1#p5155271

Anyone in the Indianapolis area familiar with Honest Property Management Company or their owner Annie Scott? If so, I’d like your opinion. If not, avoid them like the plague.

The name of this company should be DisHonest Property Management Company. The owner, Annie Scott, speaks out of both sides of her mouth so often, she literally can’t remember the last lie she tells you.

We bought a property from her last year and subsequently hired HPM to manage the rental for us. As we are OOS investors, we relied on Annie to protect our best interests while also accounting for the well-being of the tenants.

Unfortunately, Annie’s standards for acceptable living conditions are FAR below anything we’ve ever seen and not what we want for our tenants. The filth and accumulation of garbage she allowed the tenants to live in was something out of the show ‘Hoarders.’ It was obvious that the annual inspections her company was contractually obligated to make of the property, either didn’t get done at all or was done and never followed through on.

As we had inherited these tenants when we purchased the property, we had to keep them until their leases expired. One particular tenant (the one who had the most abhorrent living conditions of all) was renting from us for 3/4 of market rent and when we suggested the rent be brought to close to market, she refused to do it.

The total cost to rehab the property once that tenant moved out was close to $25k. Needless to say, we fired Annie and DisHonest Property Management shortly thereafter. We’re still trying to recoup some of the damages done to our property under her watch 3 months later.

Annie is a nice person. I could never tell if she was intentionally deceiving, incompetent or both though. In any event, I would never rent from her or hire her to manage any of my properties again.

Kyle Smith

Spring isd in Harris county Houston Texas – Stw enterprises

We bought our first sfh to lease about 4 years ago. My best friend lives nearby so we kind of have boots on the ground. He is just staring to do real estate also. We payed 174k and thought we could get 1700/month (first mistake, <1%).

We chose a manager from 3 names given by our realtor. I chose the cheapest guy and he sounded nice and knowledgeable. (Big mistake, not enough vetting)

He took 3 months to find a tenant. (Mistake, should have fired him) He said it’s because we were on the wrong edge of school zones. We only got 1550$/month.

He sent pictures of 600$ of repairs. (Mistake-inspector found none of this and later our realtor recalled the home being completely move in ready)

He talked me out of bumping rent after first renewals. (Mistake) This year we told him we are going to bump rent, then suddenly the tenants were unable to pay full rent due to COVID hardships.

They paid partial rent for 4 months. Initially we were patient, then I told him he needs to collect all the catch up rent because there is ample federal money they can get to pay. They were $1650 behind.

He ignores that request and tells us we should install ceiling fans for $750.

We are pretty pissed by now. We end up contacting the tenant and find out she has been paying full rent every month plus about 200$ in late fees almost every month.

He makes her do money orders. She has 4 kids and works full time so she rarely gets the rent out on time. She writes our names on money order but he literally washes the smaller money order and cashes it himself. He sends us 1000 money order from her then 550 from him disguised.

He keeps the late fees of 25/day and this year an extra 200-550 that he claims she couldn’t pay.

Both tenant and we told him we want to do Venmo or Zelle and he brushed it off saying the other side doesn’t do that.

Our biggest mistake was not checking our income carefully. We weren’t tracking how checks were late almost every month and didn’t even think about late fees.

We can give you more details if you want. Don’t share with anyone right now because it isn’t resolved yet. We expect his license to be revoked. We figure we will never get the money. He should go to jail but figure cops and prosecutors will probably be too lazy and he will probably skate.

This turnkey provider and company works (or maybe worked) in the Chicago area. He used to focus on small multi family units in south side of Chicago, then spread to the suburban areas. Most properties seem start with CHA tenants. His company went through a bad period about two years ago when he maybe had a medical issue. Most of the employees left, and the few that I spoke with seemed very disappointed with how things were run.

I consider this a company to stay away from because I purchase a property, and am finding out now that no permit was pulled for the rehab from three years ago. Even when I first had issues with the property after initial purchase, Justin was no help with getting any issues resolved. When I posted information about my experience on BiggerPockets, several other investors with Profit from Rentals contacted me about a similar problem or situation.

Hope this helps other investors. I’ve seen other posts about bad experiences with PFR on BiggerPockets, but Justin always denies being involved, often pointing to the property management arm of PFR that broke off at some point (I’d avoid that company too, but can’t remember what it’s called).

From Hawaii

G Rodolph investing in KC syndication

UPDATE Dec 2018: Sohin Shah, one of the principals of Instalend was named as a codefendant in a lawsuit by the SEC (US Securities and Exchange Commission). The SEC charged him, along with the CEO of iFunding (William Skelly) of misappropriating more than $1 million of investor money, misrepresenting the number of real estate projects that the company had financed, misrepresenting the amount of funds they had raised, and making fraudulent claims about the use of the money.

Marquis investments Chad Duecher. – operator for Morris Invest type débâcle

Robert Morgan Ponzi scheme – Morgan conspired with three others over the span of 10 years to “fraudulently obtain moneys, funds, credits, assets, securities, and other property” from Fannie Mae, Freddie Mac, and other financial institutions, including Arbor Commercial Mortgage and Berkadia Commercial Mortgage. Morgan and his associates allegedly provided false information to those entities to obtain larger loans than they would have otherwise received on multiple properties, even going as far as to submit fraudulent construction contracts and invoices that inflated contractor payments, and faking contracts for property purchases that inflated sales prices. | |||

Dave Sanchezhttps://www.therealestatecrowdfundingreview.com/instalend-review-and-ranking | |||

Fellow Investors,

My partners and I are preparing legal action that we will be filing against real estate syndicator and coach, Dave Sanchez. I partnered with Dave on eight multi-family apartment complexes (totaling 682 units) and have come to an extreme level of frustration regarding his incompetence despite fraudulently alleging to be an “expert” and his failure to perform promised roles.

This letter is sent to you as a fellow real estate investor on my expanded list of contacts in order to ask:

Have any of you also experienced similar “over-promise and under-deliver” performance from Dave as a partner in a real estate investment OR in his role as Gold Coach under the Anthony Chara Success Classes Apartment Mentoring?

We have made contact with several other investors already who have experienced the same frustrations and negative financial impact and we are considering expanding our suit to include other plaintiffs with similar issues where we combine the grievances of many in one lawsuit or at a minimum gather additional examples that we can use in our legal action as evidence to show his pattern of behavior of false claims and non-performance.

Maybe your financial loss was small or the negative energy and legal expense too great for you to have considered your own legal actions against Dave? Whether or not you would like to join the suit, we would like to hear your story if you have been on the short end of his many promises. We are also requesting you to share with us any email lists of fellow investors (or real estate class list of students) that may have had dealings with Dave so that we may further solicit if others, like us, who have been negatively impacted by Dave and his taking of fees and equity and then not delivering on his promises thereafter.

Dave is a likable guy, is easy going, appears knowledgeable and gives a believable presentation. But that is where his real estate skills END. Dave likes to announce at real estate investor meetings and as a Gold Coach to his students and prospective students that he is a partner in 800 apartment units. The specific intent is to build his credibility and show him to be an expert. What he intentionally omits is that nearly 782 of those units are with Heather and I and another partner who all believe him to be weak in business and real estate skills, lazy, childish and vindictive. AND that we do not wish to be his partner in any form moving forward. and lastly, that we believe him to be a fraud.

In our deals, Dave invested no funds into the projects. He presented himself as an expert on multifamily rehab and was issued equity in exchange for his promises to serve as the rehab and maintenance management partner. After closing on multiple properties with us and getting equity in the projects, he simply ceased to perform his roles post-closing deciding instead to seek equity in other deals by pitching his knowledge and participation on. Since he has no funds invested, he just abandoned the projects leaving all the work for the remaining partners like myself who were obligated to stay focused given sizable capital investments and having personal guarantees on the multi-million dollar loans To give an idea of the scope of our financial involvement, Heather Stonner and I have contributed $2.2M in capital and guaranteed $20M of loans in our 8 projects with Dave. Given our investment, we are left with no option but to continue our full-time efforts managing the improprieties and find other ways to service the Rehab and Maintenance management roles that were abandoned by Dave.

Now, at one of our properties, Caspian Village Apartments (119-unit Class C) in the small town of Burlington, Iowa, Dave is organizing a group of investors to buy an apartment complex to compete directly against us. He has made no disclosure to any of the investors of his conflict of interests. And recently, he visited Caspian unannounced and as a partner, requested from the building manager our rent rolls and occupancy rate which have subsequently been used to promote an aggressive move in special at the other property.

Regardless of whether this is technically illegal or not, it is clearly a violation of ethical behavior in my opinion AND his actions clearly negatively impact EVERY fellow investor at Caspian… several of whom he is a Gold coach for.

We, of course, will not be sharing any information regarding Caspian Village with Dave Sanchez any longer but in addition, we have discussed with our attorney and are now pursuing legal action against him and his new prospective partnership group. We encourage the investors who are considering joining this acquisition to closely review the Operating Agreement and ask yourselves why Dave is getting equity in this project under three different entity names that appear to be unaffiliated entities when, in fact, they are all controlled by Dave (ROI Ventures, LLC, Aztec Holdings, LLC and Western Financial Services, LLC).

Dave has abandoned his roles at every project that I am aware of despite receiving equity to serve in those roles. Who will run the new project when he departs? Probably the credit partner will be forced to take on the role of Asset Manager (as Heather and I have been forced to do on several projects in which we invested solely as passive investors) since as the personal guarantor, he/she is financially responsible for the full amount of the loan if the project fails.

At Riverview Apartments (108-unit unit, Class C complex in Sioux City, IA), Dave received 11.33% equity to serve as the Rehab and Maintenance Partner. To my knowledge, he has not stepped foot on the property since we closed on the acquisition and contributed zero time and efforts with the $300,000 in differed maintenance budgeted for the first two years that he was scheduled to manage..

At Lindenwood Apartments (74-unit Class C- complex in Omaha, NE), Dave received 11.67% equity in the project in order to serve as Rehab and Maintenance Partner. This project also had a $300,000 post-purchase rehab budget that Dave was to execute on over a shorter period of 12 months. In the second week after acquisition, Asset Manager, Heather Stonner questioned his availability because the contractor was given only 1 hour per week on Monday in which to speak with Dave. And Dave was unavailable even to answer questions by phone leaving Heather to handle those many decisions that need to be made timely when doing a major rehab. After that, Dave failed to participate any further leaving all his duties to be handled by other partners.

Dave claims to be an expert in apartment complexes as a Gold Coach in the Anthony Chara Success Classes program and yet every project that I am aware, Dave has struggled to operate at even the mid level range as reported by IREM reports. At Terra Park Apartments (96-unit Class C complex in Emporia, KS), Dave received equity as a Sponsor to serve as the Asset Manager and Rehab Partner. After 18 months, he stepped down as Asset Manager due to low occupancy and expense ratios that were 90+% of income for every quarter Jan-Sep 2016 compared to typical expense ratio for the area of 45-55%.

At Courtyard Apartments (80-unit Class C complex in Emporia, KS), Dave served as Asset Manager (in an LLC that I was not apart of) and tax returns show that his operating expenses there were 90-110% of income for THREE years in a row. This partnership was in constant turmoil with threats of legal action and Dave abandoning the role of Asset Manager on short notice… Twice.

At Harrison Street Apartments (54-unit, Class C complex in Topeka, KS), Dave received 14% equity to serve as “Experience Partner” and his fellow sponsorship partner, Andrea Neumann received 32% equity to serve as Asset Manager and Rehab Partner. When considering to invest in this project and not knowing Andrea well, I asked Dave if we could reduce Andrea’s equity if she didn’t perform? Dave specifically told me that it wouldn’t happen but if it did he would step in himself and ensure that the rehab was completed timely and the property occupancy raised to 90%. After 18 months and all of the money that I invested for rehab spent, the property remained at 60% occupancy with 35% of units UNRENTABLE. Dave never stepped in. In order to protect my investment, Heather Stonner and I stepped in to manage the property and renovate the down units… Taking an active role despite investing as a PASSIVE investor.

In total, Heather and I now manage three properties that we were supposed to be passive, capital-only investors in which Dave was a sponsorship partner receiving equity to serve as Assert Manager or serve as “Experience Partner”. And we operate four others ourselves that Dave was supposed to be an active 1/3 partner on the sponsorship side. With all properties, he received equity to be an active partner in the operations of the project but has failed to fulfill his roles.

Over the past year, we have repeatedly attempted to resolve our grievances with Dave and even offered to buy out his unearned equity. But Dave has refused because staying in these deals allows him to continue to claim he is an expert due to his ownership in nearly 700 units despite his complete non-participation and incompetence. Every day that Heather, myself and team work hard for the projects, Dave continues to see his equity value increase at our expense. Our only tensing option is now legal action.

That is why we seek your help in our future litigation against Dave Sanchez. If you or anyone you know, has had similar negative experiences with Dave including not getting good value for your fees paid to him as Gold Coach in the Anthony Chara Success Classes program, we would like to hear from you.

Thank you!

Rocco Sirizzotti

Managing Principal

Coffee House Capital, LLC

Austin, TX 78746

Rocco@CoffeeHouseProp.com

303-917-8401

Known as a snake in the community. Providers don’t like working with him.Also peers think he is a scarcity minded prick and likes to sue competitors.

19.08.15

If you missed our last correspondence, Jason Hartman has:

- Approximately $500k in settlements and judgments against him

- Over 100 lawsuits we have uncovered in just TWO states, along with MULTIPLE ARREST WARRANTS

- A prior website and over 50 podcasts where he portrays himself as “Jake Swank.” A man devoted to helping other men become womanizers A man devoted to helping other men become womanizers

- Multiple foreclosures and evictions against him personally and his businesses

- A FAKE NEWS WEBSITE he uses to post fake stories about companies he is involved in legal disputes with!!

Visit: TheBrokeGuru.com for this and so much more DOCUMENTED EVIDENCE and now, to the latest developments

The allegation that Hartman is using FreeCourt.com to try and crowdfund his legal woes has still not been put to rest. Let’s assume it is actually a legitimate business – like, oh, say…..SwankLife is (yeah, right.) If Hartman’s recent choice in legal representation is any indicator of the legitimacy of this website, then you are going to be far better off representing yourself as a client.

In just the last few months and through just two of the 100+ legal issues Hartman has out there, we have seen one of his attorneys dismiss herself for a temporary disbarment. Same said attorney later filed bankruptcy and named Jason Hartman as one of the individuals owing her outstanding payments You can see that document here.. Later, Hartman filed a denial of that matter. Why does that matter? It doesn’t really, but it is just another sign of The Truth Behind The Fiction. Interestingly enough, the self-proclaimed multi-millionaire, Jason Hartman filed the answer himself, “pro se.” You can see that document here. We ask the question as to why a so called multi-millionaire, with a crowdfunding website designed to represent small businesses (like his) would have the time, or need to file an answer (personally) to a civil complaint? Shouldn’t he have a bank of lawyers on-call for this, or at least a representative attorney from FreeCourt.com that could manage this for him?

It gets better….Hartman replaced his disbarred attorney with another attorney who was temporarily suspended from the California Bar for “client fraud.” That attorney has since withdrawn himself for “disability reasons.” It is all in black and white, documented and here for you to read. You can see that document here.

We can’t make this insanity up…..We learned late last week that in one of his numerous ongoing lawsuits, the tables were turned and Hartman’s attorney was served with an ABUSIVE LITIGATION lawsuit (score 1 for the good guys!) As a result, Hartman has decided to continue with the litigation and represent himself in depositions this week. You know what they say, “he who represents himself, has a fool for a client!” That statement certainly holds true in this circumstance! Stay tuned for the transcripts of the deposition coming soon!

|

|

True wholesale homes.

Simplepassivecashflow.com/fail

Came on the scene out of nowhere saying that he had multiple projects. Lead a pretty good meetup. Ponzi scheme for developments. Said he was a UW grad but only had a construction certificate. Master manipulator. Was respected by having radio platform. Unused wife and self illness to drift away. Brandon Turner was sucking this guy off on the BP podcast (now removed)

See PDF.

I Don’t know for sure

503-999-8881

TK provider in KC. Consistently places his “friends” as tenants and refuses to provide full eviction history. Tenants inevitably skip out after a while.

Works with Ben Walls and other shady characters. Do not go to bat for investors over providers.

Communication and management is terrible. Very unprofessional behavior.

Have since gone out of business. Lied about average returns and didn’t fulfill contracts to market properties for seller financing

Based in KC. Scammed me and many other investors out of almost $2 Million. They embezzled funds and violated many laws. I (Jeff Green) am currently suing them in Federal Court: Green v. Blake et al./ Case No.: 2:18 CV 02247

Over several years, I invested in several real estate investment notes and equity funds with a company called Equity Build (EB), LLC, out of Chicago, Illinois. It was recommended to me by my friend and investor partner, AAA, whom I believe you also met. We did our due diligence and Equity Build had a AAA Better Business Bureau rating and also had a history of over 400 real estate projects.

- Notes: These were just loans for Chicago apartment building that were purchased, in process of renovation, rented out and resold. The notes paid out monthly interest payments, typically in the 11% to 13% range. At the end of the project, full principal was supposed to be returned.

- Equity Investments: These were investments that gave the holder an actual percentage ownership in the project, but the interest paid out was much less (8% with no payouts in the first year), and the holding period longer (5 years).

I had 4 various notes and one large equity investment, totaling over $450,000.

In June 2018, EB stopped paying out it’s interest payments to investors, admitting that it was having “cash flow” issues. EB however developed an informal plan to reimburse ALL of it’s investors fully for their principal investment within a 2-year period. Then the SEC stepped in August 2018 and charged EB with running a PONZI scheme. Immediately all EB’s assets were frozen and a Receivership was setup:

http://rdaplaw.net/receivership-for-equitybuild

So I made the grave mistake of putting all my R.E. investments eggs in one basket. Believe it or not, both AAA and I did our due diligence before investing in each project. EB was just too masterful at running it’s scheme. Plus my investment broker, was NOT even cognizant of the scheme and he has a positive, notable reputation.

At this point, we are awaiting for the Receivership to liquidate all of EB’s holdings and begin reimbursing investors. I do not expect to get all my investment back; I’m hopeful of betting perhaps 60% back, after the liquidation process.

https://www.justice.gov/opa/pr/justice-department-sues-shut-down-promoters-conservation-easement-tax-scheme-operating-outhttps://www.forbes.com/sites/jayadkisson/2018/12/20/doj-sues-to-shut-down-syndicated-conservation-easement-tax-shelter-promoters/#5c30ecc82710

Not good reputation. Shoving people into OZ fund for fees.

Media finance guru Jordan Goodman involved in $1.2 billion dollar Woodbridge Ponzi scheme. On of 18 people selling positions. Was not registered broker. Seems like he is making it right by paying fines – he just did not check his providers.

In mid-2016, I responded to an advertisement on Bigger Pockets looking for investors for a 4-unit apartment to condo conversion in Washington DC. The person who placed the ad was Stephen Hanscome, Jr. I corresponded with Steve over the course of a few months and decided to invest $50,000 into this project. It was around August 2016 when the funds were wired. We continued to converse through the fall of 2016 as he kept me abreast of how things were progressing on the project and the closing. They were supposed to close in December 2016. After that point, he fell off the radar and I couldn’t get any response from him (still haven’t). After the note was finally due and payable in February 2018, I began to do deeper research into the situation and discovered he never closed on the property. Some other entity he was not involved with bought it. So he absconded with $50k of our money. I got my attorney involved and we filed grievances with the Tennessee, Virginia, and DC securities agencies. I opted not to sue because my attorney and I believe it would be throwing good money after bad. Lesson learned. I have no expectation of receiving that money back. Chris E 19.04.30

and Pinnacle properties SFR provider/ advertiser. He is a middle man who just takes junk properties and claims they are turnkey. He lives in CA and knows nothing about the Midwest properties he pushes. I went to buy my turnkey in KC and he listed a property that looked nice on the outside but was nasty on the inside and had really poor maintenance done. When I inspected and the place was nasty he tried to convince me it was normal and it was a good deal etc. He lied in my opinion on his pro forma and also seemed to know the real tax and insurance numbers when i questioned him after I called for info during my own due diligence. Like “ why did you list taxes at XYZ when Zillow and the tax office site say it’s nearly 50% higher than that. He was like oh that’s just what the seller gave me. David B 19.04.30

Not really a scam but watched his webinar and got fired up. Hard sell to sign up now and he’d help me fund my first deal! I did, then they upsell me to mentoring ( 3k). I was assigned a mentor that sounded like he sold cars in a shady part of town. Basically, that was it. I was to register for boot camp and watch videos. I got no response from him, the mentor program, nothing when I contacted. I complained until I got a full refund. His info is actually decent, but I see the game now. He promises access to investors, partners, etc.. but it’s a sales pitch. I still get his emails and he pimps a friend of his about once per week. I think they all do that… John A 19.04.30 & from admin staff

Bob lives in Los Angeles, but he mostly does deals in Memphis (SFH, MFH, Commercial.) I partnered with Bob on two deals in Memphis in 2017 and he was verifiably untrustworthy and deceptive. I did get all my money back, but he had lied to me numerous times throughout our partnership. A year later, I had spoken to a friend who was a commercial broker in Los Angeles and he told me he knows another investor who had partnered with Bob and that investor will not work with him again. Jean O 19.05.23

Investors allege a 40% loss on 84 William Street deal (and being asked to pony-up $9.3 million more to avoid a 100% loss). This, after other problematic deals and allegations that Prodigy misappropriated $2.5 million of investor money and is allegedly “broke”…

Prodigy Network burst onto the scene several years ago in a huge way. It was the only platform to run full-page glossy ads in expensive magazines, including The Economist. Its attractive website was much easier to usethan those of the rest of the field. Their polished presentation was extremely compelling and even included professional videos (which weren’t common back then). Their deals were massive by crowdfunding standards (some over $100 million), and investors appeared to snatch them up enthusiastically and quickly. Prodigy Network appeared to be a well-funded, popular, major player.

A Fly in the Ointment

However, they also ignored my numerous requests for basic informationabout the platform. I personally found this lack of transparencyunacceptable. So despite all of its apparent strengths, Prodigy Network was ranked as the lowest ranking (“challenged”: 1 star) for many years.

About a year ago, Prodigy Network reached out to me and made a special effort to respond to all the pending questions. So this was an improvement, but at the same time, their investment volume had dried up and become virtually nonexistent. And it was extremely difficult to find any investors who had used the platform and could comment on it. So I raised their rating to the second lowest ranking (“on probation”: 3 stars), and took a “wait and see” attitude.

“From the Horse’s Mouth”

Today, I have a lot more access to investor feedback than I used to have. In addition to new sources identified below, there is also the Private Investor Club, which has exploded in size (to 2,000+ members and $2.1 billion+ in investable assets). And unfortunately, the feedback on Prodigy Network has been troubling.

The Bear Runs Over the Bull on “AKA Wall Street”

Several investors recently alleged that they have taken a 40% loss on 84 William Street. This deal was formerly marketed as AKA Wall Street when it was launched on the Prodigy Network in 2013.

It’s hard for me to think of a legitimate reason for this kind of blood-bath in the middle of an economic expansion, where the rising tide is helpingevery boat to float well. Even real estate operators who are barely competent are making money (and some of them, a lot of money). So, in my opinion, a huge loss like this is a giant red flag. And it’s also hard for me to imagine choosing to invest with such a sponsor when there are so many other competitors that aren’t having this issue.

The deal arguably looked problematic from the start.

Prodigy described 84 William Street as “a 19-story luxury extended-stay condominium project with remarkable architecture, located in Manhattan’s Financial District, three blocks from the new World Trade Center. It is currently in operation… in a prime location.”

The listing had no pro forma provided, which is typical of deals targeted at unsophisticated investors and for me is a red flag. A pro forma is a document where the sponsor projects how the investment will do over the coming years. And a sophisticated investor can challenge the assumptionsand often identify sponsors that are being overly optimistic. Without such a document, an investor is unlikely to uncover these problems until it’s too late. (More on how to analyze a proforma is in The Conservative Investor’s Comprehensive Guide to Picking Deals.)

The deal also had no sales comps, rental comps, or any other supporting documents that sophisticated investors usually require to analyze it. In my opinion, a sponsor that won’t provide these docs is unacceptable and a major red flag.

Oh, but It Gets Worse…

A 40% loss is bad enough. But investors further allege they received a letter a few weeks ago, saying that they would need to pony up an additional $9.3 million to “maintain the project solvency“! If they don’t, Prodigy will default on the senior and mezzanine debt.

When a deal defaults on its debt, the lender forecloses and takes ownership of the property. This results in a 100% loss of investor money.

So investors have a painful choice. Pour more money into the deal to try tosave it, but risk throwing “good money after bad“. Or walk away and take a complete loss. Investors report that neither option is very appealing, considering the company’s track record and recent revelations (more below).

The “Assemblage”? Or the “Disassemblage”?

Unfortunately, 84 William St. does not appear to be the only problematicProdigy Network deal. Investors allege that “The Assemblage/17 John“, which was also funded in 2013, has not made any of its promised distributions. The entire deal was projected to end and disperse all investor money in 3 to 4 years (and we are currently at year 6).

This deal also arguably looked questionable from the beginning.

The Assemblage was marketed in 2013 as an “opportunity to invest in an equity offering for the development of a prime commercial building located on 17 John Street, in Manhattan’s Financial District. The Assemblage / John Street, will combine 44,000 sq ft of coworking, social and community spaces, 79 furnished short- term apartments and 18,000 sq ft of ground retail space.”

Like 84 William St., the Assemblage also appears to have no pro forma or any of the necessary documents for sophisticated investors to analyze it. For the sake of investors in this deal, I hope there will not be another shoe to drop with additional bad news.

“You Stole the Investors’ $2.5 million! No, you did!”

A week ago, The Real Deal reported that the CEO, Rodrigo Niño, allegedly told staff that the Chief Operating Officer (Vincent Mikolay) had been fired after allegedly misappropriating $2.5 million of investor money and causing “cash difficulties” for the company.

Mikolay has countersued, alleging that Niño is actually the one at fault, and that Niño had taken “excessive personal distributions and expenses” from the company and presumably away from investors’ pockets.

We can’t know which of these two claims are accurate (or perhaps if they both are?). The bottom line is that if $2.5 million of investor money was misappropriated, then that is not good news for investors who are currently in Prodigy Network deals. It’s also not good if the company is truly “broke” as the Real Deal article alleges. And it also raises the question of why there was so much inadequate oversight to allow something like this to happen.

Downgrade

As a result of all of the above, Prodigy Network has been downgraded by The Real Estate Crowdfunding Review to our lowest rating: (1 out of 10 stars: “challenged”).

Chicago company that was recently shut down for allegedly running a Ponzi scheme.

They promised investors returns of 15% to 20% on Chicago real estate. This is a huge red flag in my opinion. Those returns are extremely tough to achieve in Chicago, even in “high yield” areas.https://www.housingwire.com/articles/46567-sec-shuts-down-equitybuild-claims-company-is-135m-real-estate-ponzi-scheme

Hitt, the former CEO of Kiddar Capital and a member of the real estate family behind Hitt Contracting, was charged in October with a scheme to defraud investors on real estate projects. He pleaded guilty in February to a charge of securities fraud.https://www.bisnow.com/washington-dc/news/capital-markets/todd-hitt-sentenced-to-over-6-years-in-prison-for-ponzi-scheme-99571?utm_source=outbound_pub_100&utm_campaign=outbound_issue_30198&utm_content=outbound_link_7&utm_medium=email#ath?utm_source=CopyShare&utm_medium=Browser

Diamond bay investing

DC Chauang

https://www.linkedin.com/in/cmaybin/

https://www.facebook.com/carl.maybin

https://authoritywebsiteincome.com/income-store-ripoff/

http://incomestorereceivership.com/

Denver

Victor Tim. lost 60k

Mitch Smith Rental Property Investor from San Diego, CA

posted over 2018

Greetings Fellow Investors,

I wanted to share a recent experience that I hope will help both current and future investors alike.

I am an out of state investor that lives in San Diego. I have been purchasing buy and hold properties in Indianapolis for long term investments for the last few years. Some I hold onto, and others I flip.

I recently purchased a duplex in a class B neighborhood of Indy. My regular contractor , whom I know and trust, has been overwhelmed and unable to do the work. I reached out to my wholesaler that I have purchased multiple properties from, for contractor bids and suggestions. He gave the name of a contractor named CURTIS L. HANSEN with RENOWNED CONSTRUCTION LLC. Mr. Hansen, looked at the property, and gave me a scope of work with a bid of 30k. Reasonable for the work that needed to be completed. I did a background check and called 3 separate references from real estate professionals in the area that know Mr. Hansen on a personal level. One of them a real estate agent that has a reputation to protect. All 3 of them relayed to me what a hard worker and great contractor Mr. Hansen is…… I had a very direct conversation with my wholesaler in regards to how important this was that I don’t get screwed and that this contractor is someone I can trust. Again.. he assured me that this guy has done multiple projects with his buyers and is 100% trustworthy………I think you know where this is going.

We set a start date for construction and we talked about the funding. Typically, I set up draws of 50%, 25% and 25% at completion. I set my first draw directly from escrow in the amount of 15k.

CLUE #1. Mr. Hansen seemed to be anxious for the funds and asked when they would be wired. His excuse was he was eager to get started.

Construction began on October 16th 2017. On October 19th, I began asking for my first photos of work completed. He sent me a few photos of the demo and said he was getting ready to start with electrical and plumbing upgrades.

CLUE #2 Mr. Hansen started making excuses about the weather being too cold to work on the exterior, and technical issues with his phone and iPad so pictures could not be sent until later that night. This is when the RED FLAGS started flying.

CLUE #3 Mr. Hansen then called me saying that he discovered termite damage and the repair was going to add another 15k to the rehab. This guy was seriously trying to get me to send him more money. On top of that, one of the references that I received backed up his story saying that the repairs would be 15k to 20k more. I immediately told him to stop work and called my termite professional to check it out. As I expected, he told me swapping out a few 2×4’s and a little work consisting of under $500 was all that was needed.

I pressed Mr. Hansen more and more each day for proof of expenditures and work completed. He started sending me pictures of jobs that were not mine and receipts for material that was purchased prior to my funds even being wired. At this point, It was obvious I was being taken advantage of. The question was, how much of my 15k was gone.

After a few more phone conversations and texts with the thief, He was no longer responding to me. I even tried to cut my losses and told him to keep 7k for a half days work of demo and return the other 8k. Still no response and gone is my 15k. Luckily, I do have an extensive text chain as evidence. What I can do with it, not sure. I know Indiana has a small claims limit of $8,000. And if I wanted to go to “big boy court” as one attorney labeled it, even if I won, I would most likely never see a dime.

As far as those recommendations. Make sure you know them well. All 3 of my references turned their back on me. I asked the wholesaler to split the loss with me in an effort to preserve future business. His response… “Take me to court”

Mr. Hansen is a fraud. My main point in writing this post today is to warn other investors to not use this guy and to please do your homework.

As of today, my regular contractor is on the job and is doing awesome. The project will be done in a couple of weeks. As far as Mr. Hansen, I have never heard back and he is most likely living on my 15k while looking for his next sucker.

As a sidenote, I did discover a great piece of software called phone view. I was able to download all of my texts and fraudulent pictures as a PDF from my phone. The cost was $29 for a one time purchase and was very user friendly and well organized. I have included the link below.

My story (situation/scope): I was up to 10 SFH when I met you in 2018? or was it 2019? 3 properties were in Honolulu, 7 on the mainland, and 4 of those 7 were in an SDIRA. Similar to you, I was frustrated with how much hassle it was managing the out of state property managers, and I was still working full time and a single mom of 2. In pre-retirement we took over management of our rentals. This was more hassle than I wanted to have in my retirement so we started researching alternatives and found out about syndications. Once we started investing in Syndications (by selling my stocks, getting a HELOC at 0.5% interest from a local bank, increasing an RMD from my bene IRA. selling a property) We were able to get us to where my investments equalled my w-2 income in 2020. So with the pandemic starting......I retired!

Next March, I'll be 59 1/2 and able to draw on my IRAs without penalty (and no tax on the Roths) so I recently started up an IBC thanks to your team. This will be my "holding tank" as I sell off my SDIRA SFHs and wait for a syndication to come up. I'll also be eligible to start drawing on my OR state pension and since I'm no longer dependent on that monthly income, I'm planning to take out chunks so I can invest my pension income. In 4 years, I'll be eligible to draw on my state pension.

At the last Hawaii Retreat we were able to sit at the same table with your legal team for lunch found that we did not inherit our parents property the right way to qualify for the step up in basis, so I had to deal with huge capital gains taxes when I sell. Luckily, your Rockerfeller deal came about at that time (And you other realitor contact just helped us sell one Honolulu property) so we invested in opportunity zones.

So that's 4 people I've met through your networking opportunities that have helped me along! And countless other contacts just by showing up at mixers. Your net work is truly your net worth!"

solicitation against agreement and trying to stuff investors into first bridge note deal at 25k, no duedilligence on deal with two partners

https://www.facebook.com/rafael.siero.7

https://www.facebook.com/rafael.siero.7