7) Insurance

Finding Property Insurance

An insurance policy is always required if you’re using financing. But even if you’re not, it’s pretty much a given that you need it to protect yourself against major damages and lawsuits. You level of protection is ultimately up to your risk tolerance but just know that companies provide insurance at a cost where they make money on it.

Since you will be a remote investor, what you’re looking for is a landlord, fire, and liability policy. If you will be living in one of the units of a multi-family home, you need a homeowner’s policy instead.

Home insurance comes in two types – replacement cost value and cash value. Let’s look at the differences between the two.

How much would it start to really hurt to pay and 2X it to get your deductible amount ($1,500-5,000)?

Replacement Cost Value (RCV)

These policies are the most common and insure your home for the total amount it will take to repair or rebuild it. In the case of a total loss, you will be given the cash to build a new similar home from scratch.

The replacement cost is calculated using the insurance company’s internal formula and depends on the size and layout of the home, location, and the building materials used to construct it. It is usually non-negotiable.

Best For

RCV policies usually provide the maximum protection and are the safest bet for most investors. Your home will be restored to its original condition in case of any damages or total loss.

Cash Value Policies

Unlike RCV policies, cash value policies only insure the home for the cash amount you specify. It doesn’t matter how much it will actually cost to repair or rebuild the home.

Best For

Many real estate investors prefer cash value policies in areas where homes cost less than what it takes to rebuild them. In these cases, they typically set the cash value of their policy to about the purchase price of the home.

In the case of a total loss or significant damages, they usually demolish the property and sell off the land instead of rebuilding it, using the insurance payout to purchase another property.

For example, if the turnkey you’re buying is worth $75,000 but it would take $150,000 to build a similar home from scratch, it makes more sense to get a cash value policy for $75k – $85k instead of a much more expensive RCV policy.

Just be sure to check with your lender if this is allowed, as many require an RCV policy to give you a loan.

What Types of Coverage Will You Need?

- Dwelling Coverage: This is the primary insured amount on any policy. For RCV policies, this will be set by the insurance company (verify that the home details they use for calculating this are accurate). For cash value policies, you can specify any amount, but insuring the home for at least the purchase price is the most common.

- Other Structures: If the property includes additions other than the building itself (ex. porch, deck, external stairwells, free-standing garage, storage shed), get enough “other structures” coverage to cover their replacement or repair.

- Personal Property: For rental properties, this will typically only include appliances, so estimate their combined cost (usually around $5,000 – $10,000).

- Loss of Use: This covers your loss of rental income or extra expenses (like paying for the tenant’s hotel) while your property is being repaired or rebuilt. I typically use about 6 months of gross rent for this value, although sometimes it is automatically calculated based on the primary dwelling coverage.

- Premises Liability: This amount covers any liability claims in case of accidents by your tenants or their guests (for example, if they fall, hurt themselves, and sue you). This is an essential coverage to have as a landlord, so don’t skip it. I recommend at least $500,000 per occurrence.

- Medical Payments: Similar to the coverage above, this will cover any medical payments incurred by the tenant or their guests in case of accidents. This should be at least $1,000 per person.

- Deductible: This is the out-of-pocket amount you will have to pay before your insurance kicks in. Set this to a number you’re comfortable paying yourself, but keep in mind that lower deductibles will increase your yearly premium. I usually use $2,500.

What About Additional Insurance?

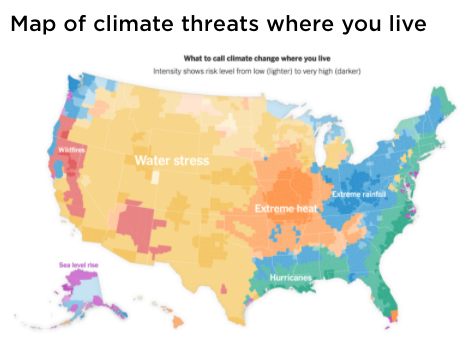

Basic landlord policies do not usually cover damages incurred due to earthquakes, tornadoes, hurricanes, hails or floods. Check with your insurance broker to find out for sure.

Whether you need additional policies largely depends on the location of the property and the likeness of natural disasters in the area.

For example, if the home is in a coastal area or flood plane with past cases of severe flooding, you should get additional flood insurance (or perhaps not invest there at all).

All of these policies will cost extra, so you will need to re-run your cash flow calculations to check how they will affect your NOI, cash flow, cap rate and COC returns.

Some Thoughts From the Hui Deal Pipeline Club:

How to Find an Insurance Agent

There will likely be many insurance agents in the city you’re buying in, so finding one should not be difficult.

You can search online, ask the turnkey company for a referral, or ask other local real estate investors.

It’s also worth checking if any insurance companies you already use for your home or car offer policies in the city where the turnkey property is located. You can often get discounts for sticking with the same provider for multiple policies.

Get quotes from at least 2-3 different companies, compare their coverage and pick the most cost effective policy. A typical single-family landlord policy should not cost more than $600 – $800 in most cities.

Here are couple National Insurers we use in the Incubator:

Within the next two weeks:

Got back to your analyzer and re input the insurance line item as well as review the other assumptions in the model/spreadsheet. Examine your numbers if you are comfortably cashflowing.

Remote Investor Incubator

Check out the Remote Rental workshop for additional information on “Insurance”.

Deeper Learning