BONUS 3 – Understanding Development (Heavy Value-Add)

Value-Add vs Ground Up Real Estate Projects

The real estate industry in the United States is massive and encompasses a wide range of property types, asset classes and investment strategies. There is something for everyone in the real estate world – whether you’re a conservative investor approaching retirement and focused on protecting your family’s wealth, a young and aggressive investor looking to earn outsized returns in exchange for higher risks and involvement, or something in between, investors can find a property type and deal structure that is tailored to their goals.

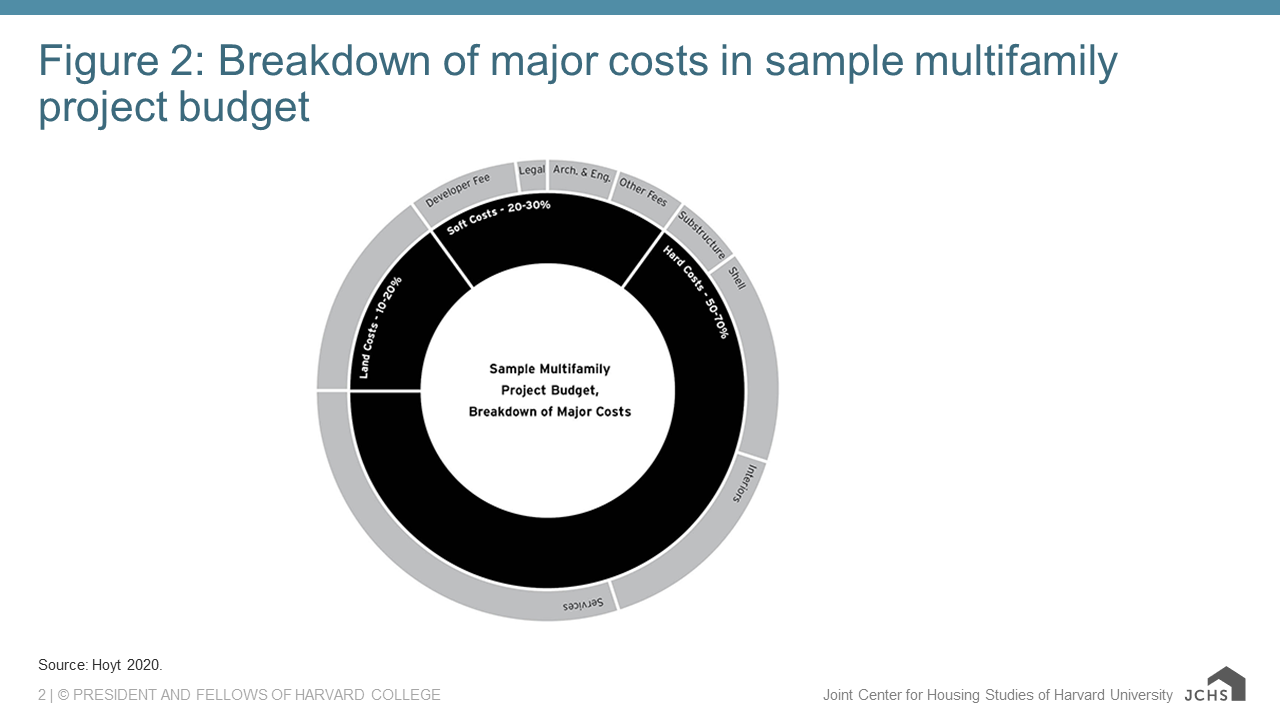

At a high level, real estate investments are usually divided into three (or sometimes four) categories, based on the quality of the asset and the associated risk involved in owning the property:

Core/Core Plus: Least Risk, Lowest Reward

Core assets are high-quality properties in excellent condition, usually newly built or renovated. Seen as stable, income-producing assets, core investments attract institutional investors such as pension funds which seek reliable passive income (typically 7%-10% annually) with minimal risk. Core Plus investments are similar, but are generally a few years older or in less-than-perfect condition, and thus are seen as slightly less stable but provide slightly higher returns (8%-11%).

Value-Add: Moderate Risk, Moderate Reward

Value-add properties are those that need “a little bit of love”. Typically older buildings that are outdated, in poor condition, or mismanaged, investors in these assets seek to increase the property’s income by making renovations or improving the management strategy. By doing so, value-add investors can achieve greater returns (11%-15%) than their core/core-plus counterparts, but they also assume the risk associated with turning the property around. Value-add deals are attractive to investors with moderate risk appetites such as middle-aged professionals and private equity funds, who are looking to earn returns greater than provided by lower-risk asset types such as index funds and core real estate assets, but who seek to limit their downside potential by investing in an asset that can be collateralized and already produces some income.

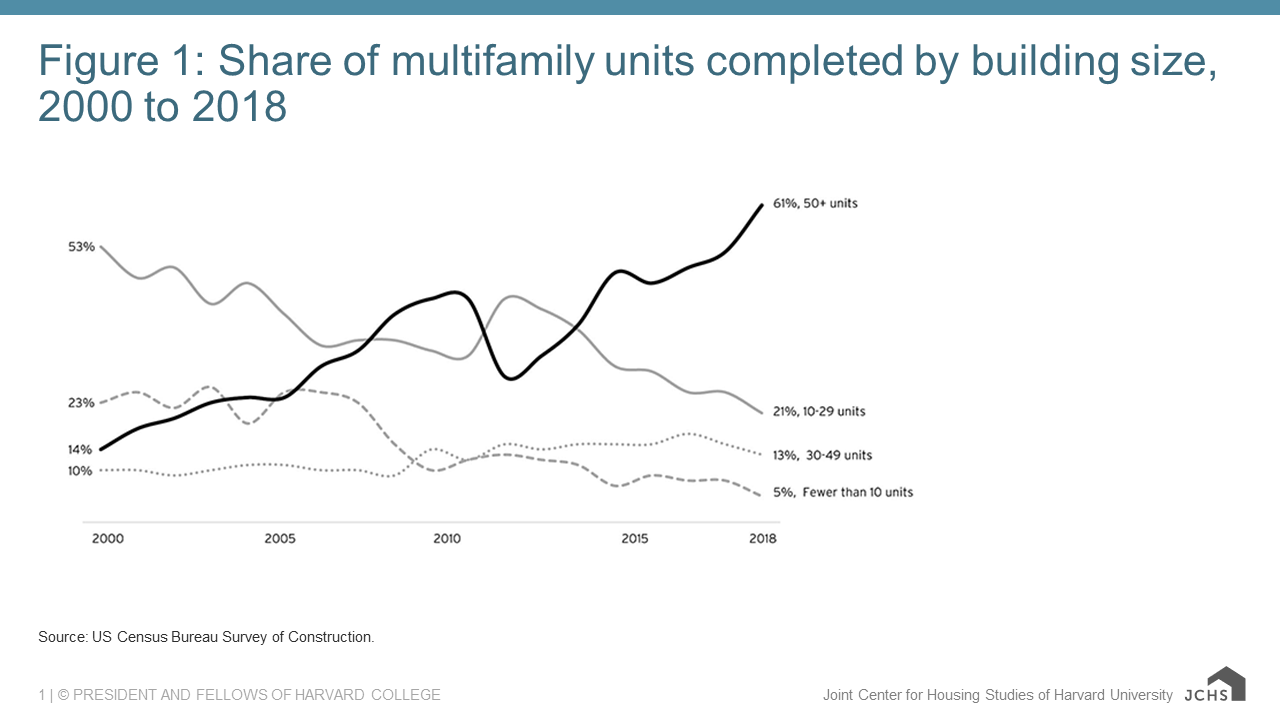

Ground-Up (Development): Most Risk, Highest Reward

Neither Core nor Value-Add investment opportunities would exist if there weren’t people investing in the construction of new buildings. These investments are known as ground-up opportunities, and they are the most profitable projects in the business. Investors in ground-up projects generally earn high returns (in excess of 20%), but with these returns comes increased risk, stemming from the time, effort, and complexity involved in constructing a building from scratch. Investors in a ground-up project rely heavily on a developer’s ability to successfully manage a complex entitlement, construction, and marketing process before the asset in question is able to produce any income. As a result, ground-up or opportunistic investors tend to be individuals with higher return expectations and an interest in actively monitoring their investments (young investors with aggressive investment goals), or organizations seeking to achieve high returns or diversify their portfolios with a mix of risk levels (private equity funds, real estate investment trusts, hedge funds, etc.).

Completed construction of our 230-unit in Huntsville, AL

Our Approach:

As a real estate investment and development group focused on creating value for our investors, we focus on best in class investments in each of the above profiles.

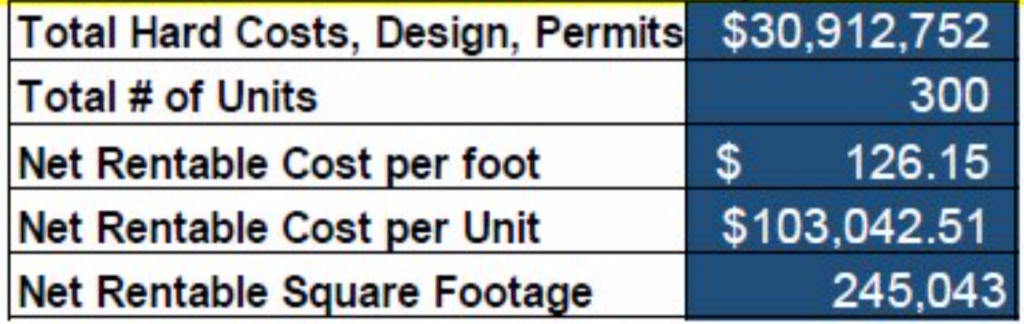

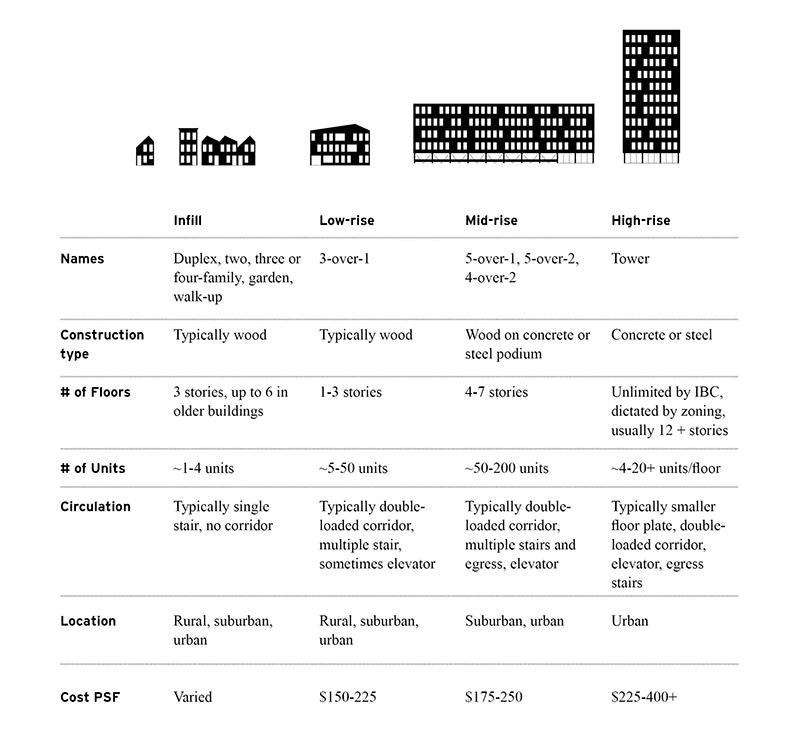

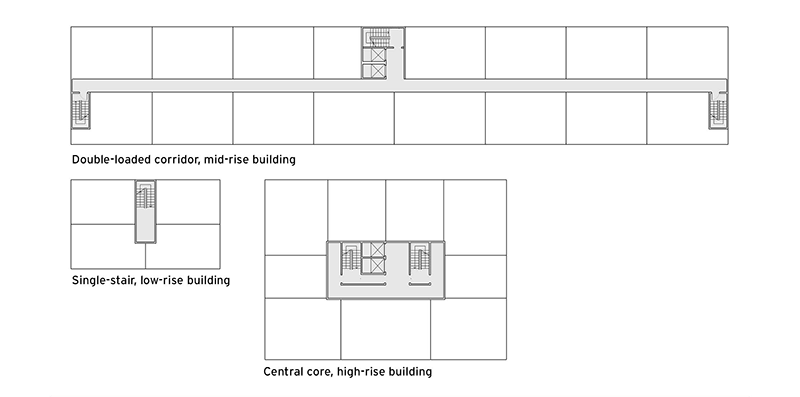

Project: Normandy 240- Unit Development

Typical construction for Class A- new build in Texas. Building for 100k a unit for a $1,200-1,500/month rental.

Advanced Structures – Development Deals

This course covers the vast majority of syndications. However, for complex deals, such as a development project staged from raw land purchase to construction to final operations, the payout structures can be quite complicated. As an investor you should take the time to understand exactly how much you get paid, in what order of preference and when. Read the documents closely, ask questions of the operator, and do your due diligence.

Most development deals are higher risk and higher returns. Whereas I tend to invest the majority of my portfolio in cashflowing stabilized assets. However, not every deal fits these generalities. As of late there has been a lot of people getting into value add apartments where the real deals (wider margins for safety) might be in these developments where you build from the ground up and thus creating more value.

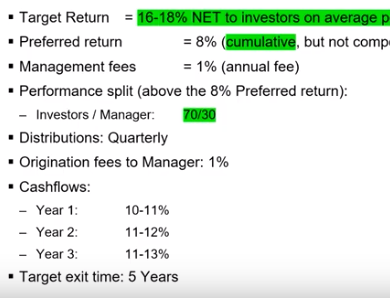

NOTE: Just looking at the areas highlighted in green below is not “evaluating the numbers”… The numbers that you underwrite the deal (annual rent increases, reversion cap rate, full occupancy assumptions) are what you want to analyze. The image with the green background shows partially “Evaluating the numbers”.

Three ways to raise funds for a land acquisition and heavy value add (development)

-

Phase 1 Raise for the Land

Do a phase 1 raise for the land. With a convertible note so there is no PPM needed and sell to syndication for a little increase to pay investors 15-20% per year. Phase 1 is the land portion:

- Secured Promissory Note between Sponsor & Investors and the Developer.

- Loan Term: Short term 60 to 90-days.

- Loan Amount: Low capital requirement.

- Interest & Points: 15% APR and 2 points at closing.

- Collateral/security: Shovel Ready/Permit Ready Land and Equity Performed secured via a First Lien.

- LTV on Land & Equity Performed: 29%.

-

Phased Capital Call

Do a phased capital call as needed. Tell investors there are several thresholds they will need to contribute capital in 14-28 day time frame. Say at 30% today and 60% in 4 months and the rest at half way through CN, Would need to create a fair system incase investors cannot preform for other investors to buy them out.

-

Fully Raise

Raise the whole thing in one go. Works for under $10M raises.

What is an example of an investor split on a Development deal?

Development deals have two huge “ifs” which are what the property sells for and how long construction will take. Typically there are huge promote fees on both acquisition/funds raised and during construction.

5% fee and 50/50 split after 8 pref where investors get 100% of their initial investment before 80/20 split takes place

Returns will be split as follows:

1. 8% Preferred Return to Class A Members

2. Return of Equity to Class A Members

3. 50% of Remaining Return to Class A Members, 50% to Class B Sponsors

Fees to the Sponsor

- Development Fee - 5% of project cost to be drawn during the construction process.

- Asset Management Fee - .25% of total project costs during the life of the project.

- Disposition fee - 1% of the sales price upon sale.

- Loan Guarantor Fee - 1% of the outstanding loan amount fee (paid annually)

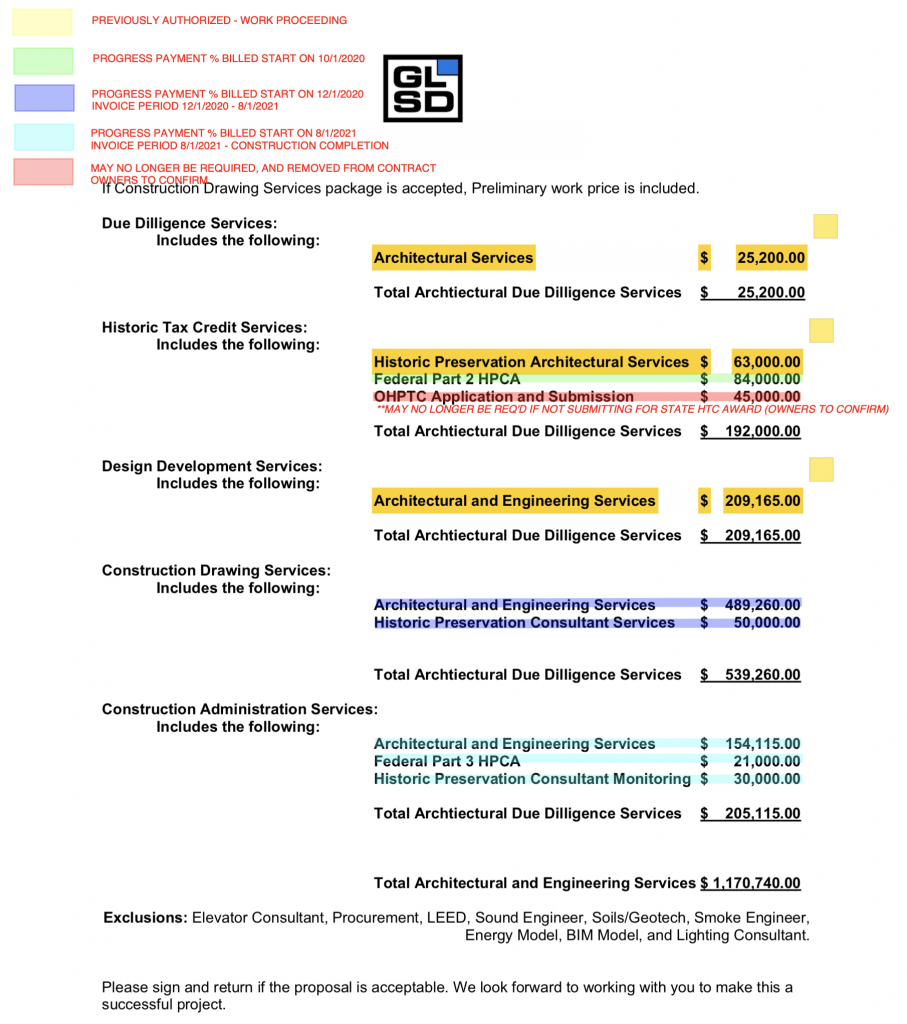

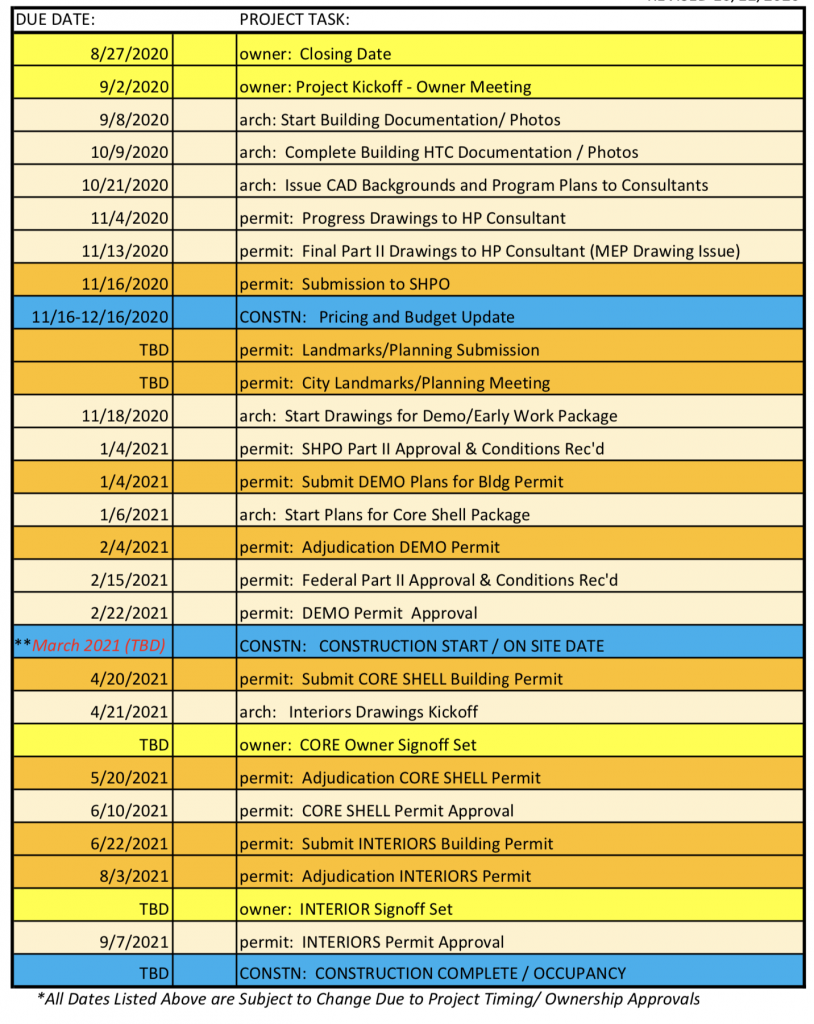

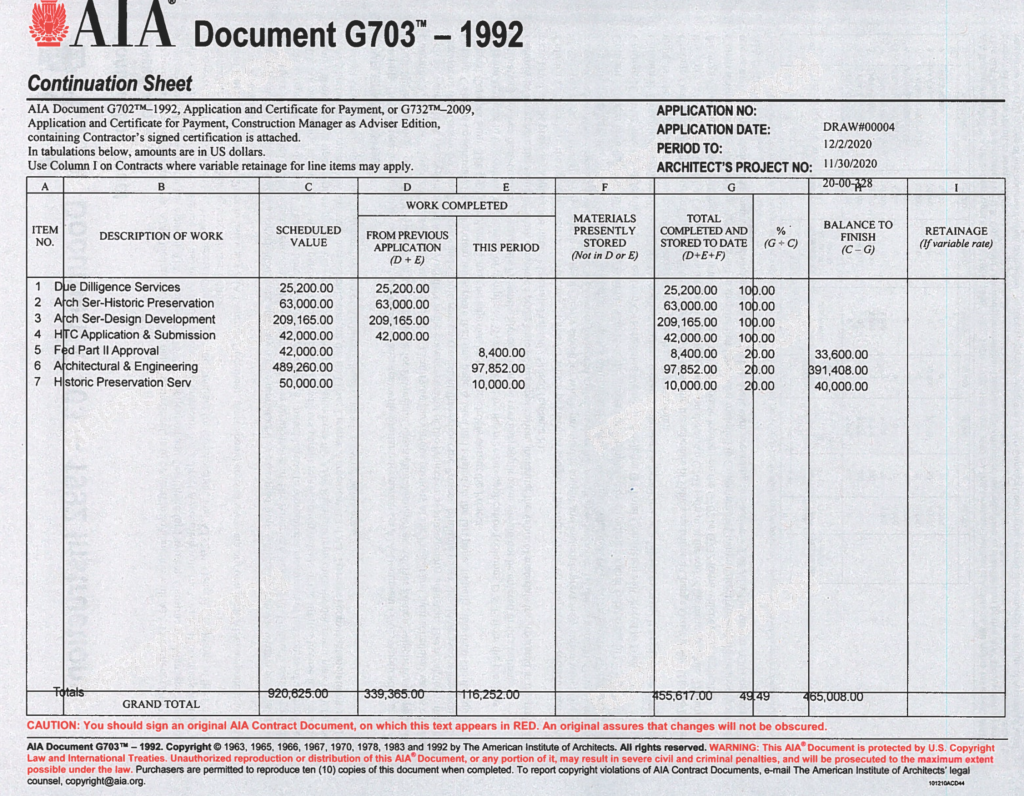

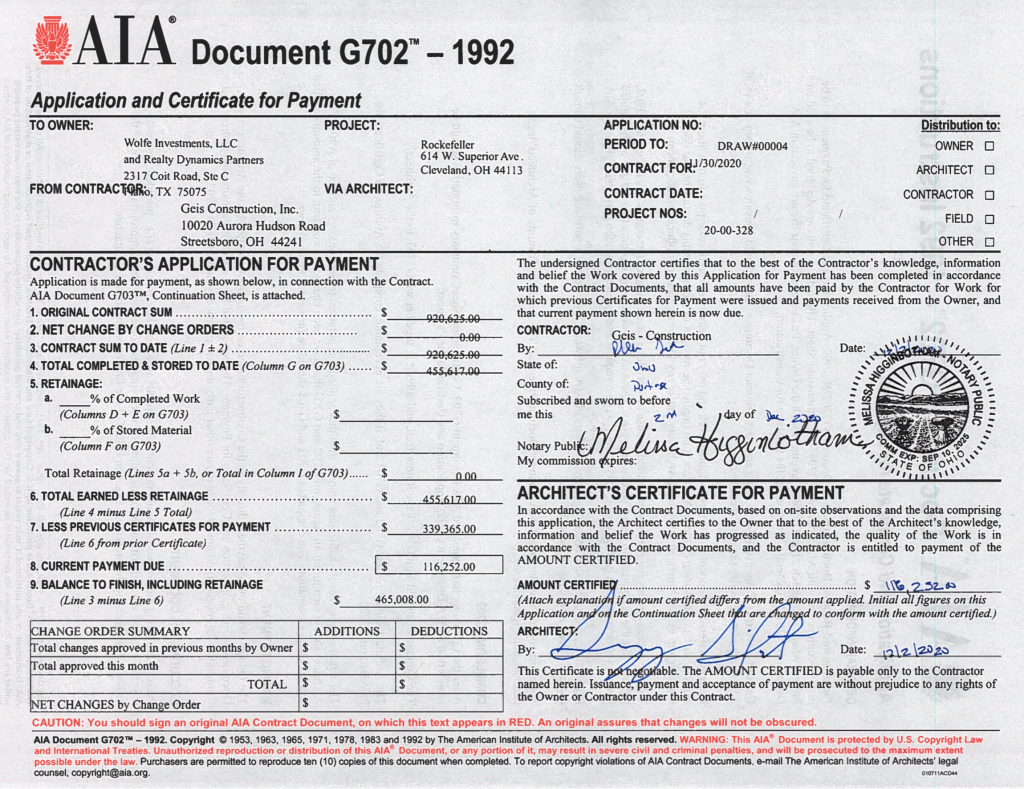

Syncing Up Consultants

Samples of payments that go out to our professional services consultants (engineers, architects, permitting firms)

Liquidated Damages numbers are penalties agreed upon contractually at the start of a project to incentivize the contractor to stay on schedule. In real life since 2010, in many private, public, and my own projects I have yet to for liquidated damages as it is difficult to enforce and requires arbitration or litigation. But it acts as a backstop to negotiate price concessions or trading weather days with the contractor. These “horse trades” is the role of the construction and project manager.

Sample assumptions to calculate a realistic LD:

- Average $900/month / 30 days in a month = $30/day per unit

- Most buildings have 24 units

- Assume 68% lease up (one standard deviation) to penalize GC

- 15 day grace period past contractual substantial completion date

- 1% asset management fee and property management salaries prorated

- Assume GC is late by 30 days on each building (total 45 days after contractual SC date)

- Does not include force majure events that includes the City widening of OG road

Once we sign a contract we set the expectations for scope, schedule, budget. In order to de-risk ourselves we like to sign guarantee maximum price contracts (GMP) so the contract takes ownership of overruns.

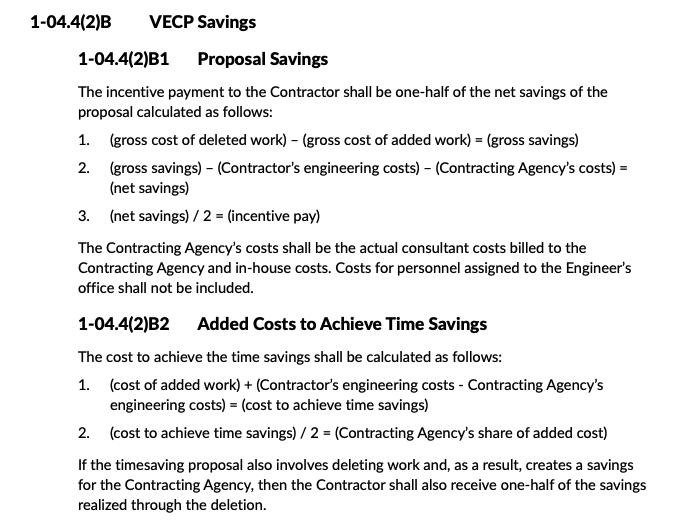

Incentivizing contractors to beat the bids by sharing cost savings with them. Breakdown is taken from WSDOT Standards. Private sector jobs can be as much as 25% profit split.

Getting Horizontal (Earthwork) before Vertical (Building Construction)

- Grading and Earthwork: To create a level surface and ensure proper drainage, the land will be graded through excavation, cut and fill operations, and shaping according to the site plan. We never plan on hitting Woolly Mammoth tusks or other historical artifacts like I did in my construction days with the railroad, but this is what little unforeseen conditions are present because it is literally buried in the ground unlike a plethora of issues that could pop up when doing a renovation (ie conversion from Office to Residential).

- Road Construction: Roads/sidewalk/curb/gutter will be constructed to tie into existing roads. In most cases there is some bartering with the local municipality and at most a improvement to the traffic light might need to be installed. Residential has little impact however in comparison to other commercial developments.

- Utilities Installation: Utility systems, including water supply lines, sewage or septic systems, and electrical and telecommunication infrastructure, will be installed. Coordination with the city and utility providers will ensure proper connections and hookups for each house.

- Stormwater Management: Implementing measures to control stormwater runoff is important. This may include installing stormwater drainage systems such as catch basins, culverts, and retention ponds. Our team is well experienced with this and a pet peeve is drainage engineering to be done to mitigate issues in construction and future operation. We will typically hire an additional drainage engineer to model the flow of water on the parcel.

- Site Amenities and Landscaping: Enhancing the appearance and functionality of the development involves installing site amenities like streetlights, sidewalks, and landscaping elements. Planting trees, shrubs, and grass will be included. This is ultimately part of the negotiation part of the deal with the City municipality. I was once an Engineer with the City of Kirkland and private side so understand this horse trading well.

Here are some steps we take to ensure we hire the right team for the job:

Define project requirements: Clearly outline project objectives, scope of work, timeline, and budget to avoid future change orders. This helps us communicate effectively and evaluate contractors accurately as well as mitigate for downstream changeovers.

Seek recommendations: Gather additional recommendations from trusted sources to enhance the vetting process. This might include getting an outside contractor to pre-bid project or give us feedback if they took the predatory “changeover approach”.

Check licenses and insurance: Verify contractors’ licenses and insurance to ensure compliance with construction work requirements in the jurisdiction. This is another condition of our lender too.

Review portfolios and references: Evaluate completed projects similar to ours to assess expertise and work quality. Request references to gauge professionalism and adherence to timelines. The bank/lender will also vet this too.

Conduct interviews and site visits: Schedule interviews to evaluate contractors’ preparedness and review bids and plans.

Obtain detailed proposals: Request comprehensive written proposals aligning with project requirements.

Verify subcontractors and suppliers: Inquire about subcontracting practices and verify the reputation and capability of subcontractors and suppliers. That said this risk normally falls under the general contractor.

Address contract and legal considerations: Take responsibility for drafting and managing contract negotiations using industry-standard contracts. We involve our legal team in all signings and document review.

Conduct regular onsite meetings: Hold regular meetings to review schedules, address change orders, discuss payments, and answer contractor questions for smooth project progress.

Material Pricing Risk

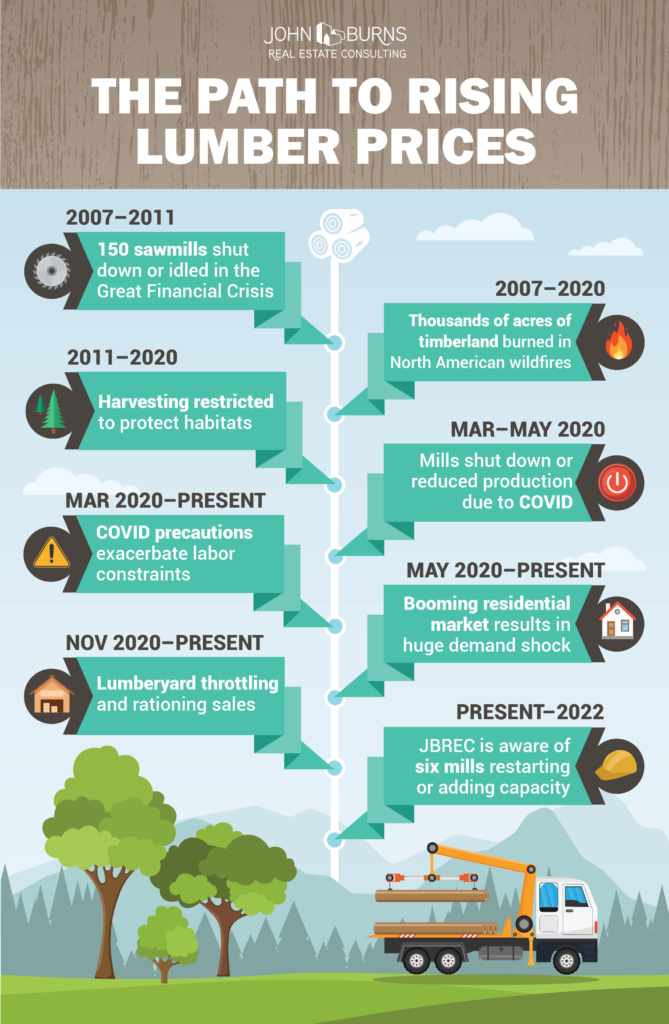

In the Summer of 2021 we felt the pinch of unprecedented lumbar costs go up. We were able to mitigate some of these material costs by strategically buying our lumbar in a few large packages along with our guarantee maximum price contract (GMP).

Advanced Concepts

What is Bond in Development?

What Is Pre-development?

Issues resolved with Chase Creek (video coming soon)

- Lumber pricing increases

- Security – added cost because of lumber prices/value

- Neighbor issues-threats of physical violence

- Civil Engineer-improper staffing on our project

- Fire-lightning strike

- City turn lane into our project-caused delays

- Utility-transformers delivered late to our site due to supply chain issues

Informal List of Lessons Learned

3) My earlier lessons learned were never to do anything out of the country (Belize, Caribbean, Cook Islands, Asia) because of different legal systems and lack of debt options outside America.. Development is already great returns…. no need to leave this side of the world into less developed worlds..