Conclusion

Financing for Long Term Growth

While each turnkey rental you purchase may only generate a few hundred dollars a month after all the expenses are paid, this quickly adds up if you continue to buy properties. Once you have ten properties ($300/cashflow a month each) it will seem like an addition paycheck per month… without much effort.

There are two things that often limit the growth of real estate portfolios, lack of cash and the inability to get additional financing.

Below are some of the strategies you can use to ensure your real estate portfolio continues to grow:

Use Other People’s Money

This strategy ranges from:

- Borrowing money from your friends or family

- Partnering with other investors

- Attracting large groups of investors and investing as a syndicate.

- Most of our Tribe realizes that their highest and best use for their time is to go back to their six figure day job. But they go in with a lighter mind knowing they will be retiring in 5-10 years.

Use Alternative Financing Strategies

In addition to being limited by your ability to save cash for down payments, you may find yourself limited by the restrictions of conventional financing.

Most lenders will not give you more than 10 conventional loans and will also stop lending to you if your debt to income ratio exceeds 50%. Here are some alternative financing strategies you can use to overcome these limitations as you continue growing your portfolio:

Split Financing with Spouse

If you’re married and both you and your spouse work, consider purchasing properties in your own individual names instead of jointly. This will effectively double your conventional loan limit to 20 properties.

Portfolio Lenders

Portfolio lenders have a higher interest rate than conventional loans, but have less restrictions and will typically allow you to finance more than 10 properties, finance multiple properties under a single loan, and exceed the 50% debt to income ratio.

Commercial Loans

Similar to portfolio loans, commercial loans can allow you to finance entire portfolios of properties under a single loan. Although their terms are more complex and interest rates are higher.

As you continue buying additional rental properties and learning more about real estate investing in general, you will be able to judge which growth strategies will work better for you.

Buy, Save, Repeat

The simplest strategy is to buy one rental property, save up for the down payment for the next one, buy the next property, and repeat the process all over again. Most investors in our Tribe are about to save $30,000 a year which means they can buy one rental property a year.

Case Study – Buying 20 Rentals in 10 Years

Let’s look at an example of how a middle-class, full-time working individual real estate portfolio can grow in just 10 years using the buy, save, and repeat strategy!

Meet Kevin, he’s 29, married, and makes $70,000 at his full-time job. Kevin has $20,000 in savings and is able to save 20% of his salary (about $14,000).

(NOTE: this example is a simplification, it doesn’t include increase in salary, income taxes, and closing costs)

Note: This is just a sample progression. In reality, depending where you net-worth is you might think about going down the passive investor syndication route in year 3-5. See my transition here.

Part 8 of 8 - New investor case study & questions

- Apprehensions

- Barriers and mitigation strategies

- Why you need a mentor

- Investor questions

- General investing strategy progression to Accredited status

- General investor questions

- Barriers and mitigation strategies

- Runtime – 66 minutes

Life after your first Turnkey Rental?

Check out my article about the Cons of BRRR.

Note this is coming from an Accredited investors POV who used to do turnkey rentals.

I personally would not do Remote BRRR as there is just a lot of risk with 1) risk of embezzlement with contractors 2) change orders and 3) bank doing bait and switch doing a lower appraisal and/or LTV on the refinance.

This is especially true for high paid professional or those with a net worth of over $300,000. Yes you might be very educated and competent but you may not be experienced with construction contracts to be able to handle these hot messes with an unproven rehabber.

Here is an example of these issues

Rehab Ballpark Estimate

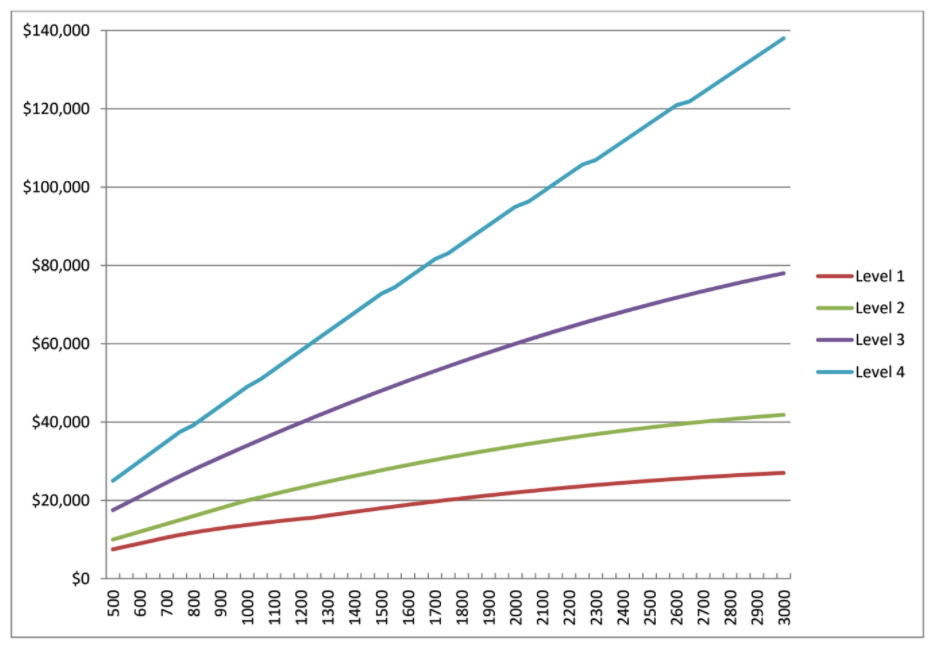

Level 1 – “Lipstick” will be just paint and flooring, maybe freshening up landscaping. Changing out some light fixtures and mirrors. Minimal work can be done in a week or two.

Level 2 – Cosmetic Update – in addition to Level 1, one or two additional expensive updating/repairs will be required such as window replacement, roof, HVAC replacement, kitchen cabinets, bathrooms. No structural moving of walls or plumbing/electrical components. This would be a 3‐4 week rehab

Level 3 – Moderate Updates/Repairs – Kitchen and bathrooms require updating. Two to three expensive updating/repairs will be required. Some plumbing and electrical work may be required. May include removing one wall and installing a glue lam beam to open up floor plan. This is the most common rehab level for older homes. Rehab would last 6‐8 weeks

Level 4 – Full Updates/Repairs – Entire home requires updating. Some moving of walls, removing of walls. Some rewiring and re-plumbing required. Replacement of mechanicals. May include items such as moving laundry rooms, reconfiguring kitchens, adding light circuits. Potential structural/crawlspace issues. 8+ weeks to complete the work.

Level 5 – Full Gut and/or Addition– House will be gutted to the studs and rebuilt with or without addition. All trades will require major scopes. Should be estimated case by case – not included.

Next Steps

From our example, Kevin can either:

- Retire with $63,000 annual passive income, in 20 years when he pays off the mortgage, the cash flow will increase!

- Continue to work at his full-time job and pay off his loans now which will delay retirement, but increase his income quicker.

- Continue investing in real estate and to earn more passive cash flow each month!

The Importance of Taking Action

This course went over all of the important concepts and steps you need to understand to buy your first turnkey.

From picking a good market and finding financing, to analyzing cash flow, managing your rentals, and more.

It’s almost impossible to know everything, but don’t let this deter you from taking action! You will learn things along your journey, I encourage you to keep networking and growing your portfolio!

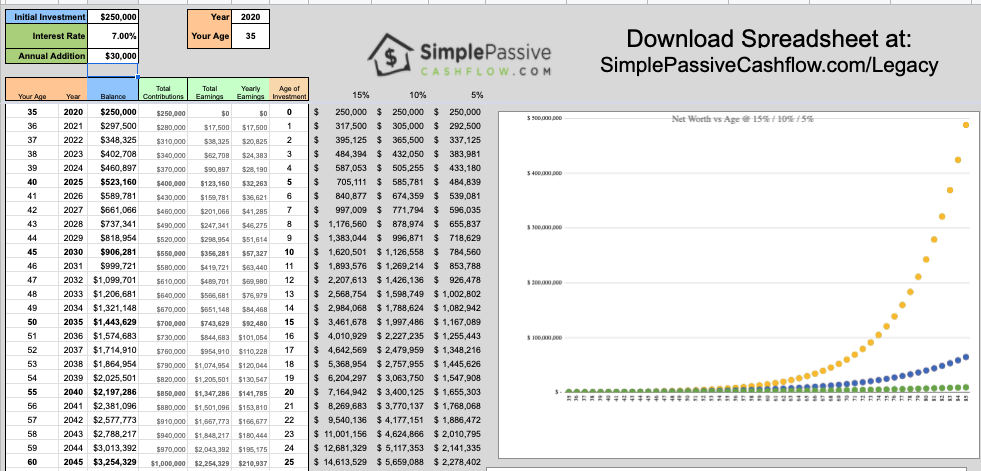

Here is a breakdown of returns that are possible in real estate investing.

Numbers don’t lie… compare 12-15% returns with 7-8% in mutual funds/401K!

FAQ’s

If you’ve followed along with this course, you’ve been given the most important fundamentals to know about getting your first rental.

Reading books, taking courses, and watching videos give you content and context, but they don’t give you experience. Experience comes with taking action, making a few mistakes, learning from those mistakes and taking more action.

Too often people make the mistake of not taking action. Setup your free strategy call here.