BONUS 1 – Syndicator Lies from Real Deals

Most bad investments are made out of the fear of missing out or greed. While good deals are hard to find, it’s better to wait a year or two for the next opportunity than to invest in a bad deal. Never allow yourself to feel rushed. If you miss out, you miss out.

I see a lot of deals come by my inbox. Syndicated deals from other sponsors. You have seen them… yup I’m on that list and saw it too. I see a lot of bad deals come my way and here is where I capture my frustrations and record what I see.

Below are a list of these exceptions we found.

Just because a deal you are looking at is doing one or many of these does not mean you should not invest. Every deal is unique and working with the right honest operator should always be the primary reason for investing in a deal.

We discuss these frequently nuances in our Family Office Ohana Mastermind as they come up we get a dialogue going, which helps people truly understand the concepts below:

See "Syndicator Lies Video - Example 1"

(FAMILY OFFICE PRIVATE CLIENTS only) – email me Lane@simplepassivecashflow.com for the video link

Syndicator Lies Video – Comments

Calculate Exit Valuation (Sale Price) Using Forward NOI and Exclude Replacement Reserves From the NOI Calculation

The projected sale price has a huge impact on total projected returns. Projected sales prices are typically determined via an exit cap rate. We have touched on it a couple times in this eCourse to look for at least a 0.50% cap rate expansion at exit (some leeway there for more heavy value add and shorter hold times… but still).

Now this is another cat and mouse game where the syndicator will make the projected sale price higher in other ways than simply lowering the exit cap rate by increasing the assumed NOI, or the NOI used to derive projected sale price.

The standard method is to use the trailing 12- month NOI for the projected sale year. For example, a sale projected in Year 5 should use Year 5 NOI but the tricksters are using Year 6 NOI with a 3% rent increase and 2% expense increase.

Further more you can omit replacement reserves from the terminal NOI calculation. Whether you account for replacement reserve above or below the line (as operating expenses or as capital expenditures) doesn’t really matter in a cash flow context, but it makes a substantial difference in valuation. For example, if I’m going to put the standard $300/unit/year of replacement reserves below the line, I just “increased my NOI by $300/unit. If this income is valued at a terminal cap rate of 6%, I just increased the projected sale price by $5,000/unit ($300 divided by 6%). For a typical $100,000/unit property value, that is a 5% swing in value!

Modeling Rent Growth Based on Aggressive Research Reports

Syndicator uses a very aggressive but reputable research report that claims the market or submarket you’re buying is going to see 3-6%+ rent growth over the next year. You then plug in this growth assumption on top of the aggressive pro forma rents you’re projecting.

Not Hitting the 7-8% First Year Cashflow? Do This to Appease Unsophisticated Investor Who Want Returns in the First Month of Ownership | Raise a Little Extra in Your Operating Reserves (200-500K) Or Capex Budget

This is pretty much a Ponzi Scheme but if done with the right disclosures… its legal to do. But it is effectively like carrying an extra loan in the beginning.

This is often tipped off by unusually high cashflow in the very start of the deal or cashflow before month 6 of ownership. Remember that lenders restrict distributions in the first two quarters of ownership in order for them to protect them (the lender) and to be conservative.

There are a couple ways to spot this out as a LP which is 1) examine the “sources and uses for cash” and make sure there is not too much padding and 2) look out for unusual or very artificial cashflow projections. For example 1st year cashflow of 8%, 2nd year of 8%, 3rd year of 9.45%, 4th year of 9.65…

Side note: This has been a very frustrating thing for my company to deal with. Some investors expect very early payouts because of this aggressive tactic and are non the wiser.

Underwrite Cheap Financing With a Yield Maintenance Prepayment Penalty but Exclude Any Financing Fees or Prepayment Penalties From Projected Sale Proceeds Calculations

Most deals are financed with 10 to 15-year note yet are underwritten to a 5-year hold. This creates a mismatch between the business plan and the debt since there is often a major prepayment penalty to reckon with if the loan is prepaid early on in its term. Combine this with the fact that most “sorta” sophisticated LP investors are looking for long loan term periods of 12+ years.

Syndicators do not underwrite any prepayment penalty in their model. Sponsors assume they will sell the deal with a loan assumption, forcing the buyer to take on the existing debt. There is no cost to the seller in terms of financing fees or prepayment penalties if the loan is assumed, however, the debt may be less attractive than what is available in the open market and therefore will reduce the sale price potential as the value can be held back by things such as amortization, low LTV, and high interest rate. If you want to include 10-year fixed rate financing with a yield maintenance prepayment penalty in your business plan, the best way to underwrite this is by forecasting a 10-year hold, making the business plan and loan coterminous, thus avoiding the omission of any brutal prepayment penalties in your model.

In the past, Cap Rates have lowered which have made for explosive evaluations which launched the profits of a deal to more than over come for this oversight. But its when things are tough when these small oversights come to light. We normally take a hit on the rate and lower the term length from 15 to 12 years which we feel is good enough to go into a hybrid loan which allows for more flexibility to sell early without a large pre-payment penalty. Overall this is not a deal killer but something to be aware of and not to think one sided that you want “non-recourse 15-year notes!!!”

Misleading Acquisition Fees

Normal acquisition fees paid to the sponsor at deal close ranges from 1-3%. But be careful that there is not a separate 1% lending fee, 1% funding capital fee, 0.5% marketing fee, etc… which all are the acquisition fee. Just make sure you add them up to take them into account. Not saying that a high fee is not justified by a sponsor but make sure the track record justifies that.

Inflating Other Income

An easy way to boost your numbers without too much trouble is to assume easy increases in Other Income categories, such as reserved parking, utility billbacks (RUBS), pet fees/rent, valet trash, storage closets/garages and furnished rentals. While being creative with ways to create additional income is great, it is easy to get too aggressive and assume the successful implementation of these various Other Income strategies across an entire property. However, these numbers are easy to overstate and are often overlooked by those evaluating deals.

*In 2020, in some syndication mentoring groups (newbie investor academies) there are coaches that spot check student’s underwriting. It was a little secret that students would get around their loose coaches’ overview by doing this tactic.

Underwrite an Unrealistically Fast Stabilization/Renovations Period While Maintaining Impossibly High Occupancy

Scrutinize a sponsor’s business plan by making sure they are being realistic with turnover numbers. You can’t bump up the rents by more than 10-15% with making the current tenants unhappy and unhappy residents balk by moving out. That might be a good thing in the long run by having lower end tenants leave but keeping occupancy/economic occupancy over 80-90% could be a challenge. As an LP, make sure that if units with 100-150+ dollar rent bumps or more than 5% of the units are being turned per month that the underwriting did not assume for over 95% occupancy or 90% economy vacancy.

Incorrect Expenses Assumed

The price of the property in the future is predicated on the NOI or net operating income. NOI is based on income minus expenses. Focusing on the expenses specifically a sponsor may greatly underestimate the expenses. In most cases, expenses will go up because you are increasing the product for tenants which makes sense why it costs more to operate. Running a class B or C building for under 4k a unit per unit is extremely rare and should be used as a low end on checking expenses.

We use our own properties to bench mark this and we use our property managers wider portfolio to come up with good estimates.

Aside from that taxes should go up. In some cases this can double in a few years.

Economic Vacancy

Sponsor might say that they are assuming a healthy amount of vacancy 5-10%. BUT they are not assuming any economic vacancy. Economic vacancy is basically the amount of people not paying their rents even though they are occupying a unit. Or they are dead beats. Just because you are assuming 92-95% as your full occupancy you should also be assuming that a small percentage (2-4%) of tenants that don’t pay. There is more on bad collections on class C properties than class B. By asking what the economic vacancy is, is a great way to get around the BS.

Under this same thought, be wary on when a sponsor says the break even occupancy is 65%. In reality that needs to be economic occupancy to include these non collections which is a few points less than the break even occupancy.

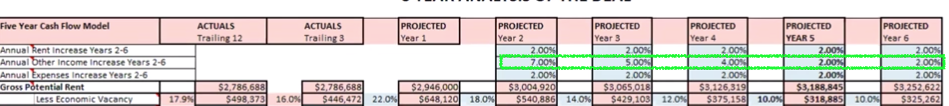

Rent Increases per Year (Annual Escalator)

In most good markets we will use not higher than 2% annual rent increases per year. This escalator is to account for inflations. A sponsor might grab some sort of industry publication to justify a 2.5-3.0% annual rent escalator every year and I would be wary of that. Great if it happens but not a good practice.

Also be wary if sponsors get cute on how they underwrite 0-5 years where they use 4% rent increase in the first two years and 2% in years 3-6. And they say the average rent growth is 2.5. If you follow the math an increase earlier in the time frame has a greater impact than at the end of the time horizon.

This also applied to “other income” and “expenses increases”.

Assumed Loan Terms and Interest Rate

In agency debt (Fannie Mae/Freddie Mac) you don’t lock in your rate and loan process until a few days before the deal is closed which could be weeks after LP investor space is allocated.

Its our best practice to use rates and terms from our peers, past deals, and lending broker (who is upfront with us) to underwrite with wiggle-room for the rate to increase 0.25%. In most cases the loan closes with better than expected terms.

Overall the terms of the loan (+/- 0.3% rate) does not have a huge impact on the numbers at the end of the day.

Assumed Rent Bumps on New Rehabbed Units

Specifically discussing light-medium value (2k-8k of upgrades per unit)… Say the rents are currently averaged 800 dollars a month, it would be a pretty big stretch to bump rents over 15%. Giving the sponsor the benefit of the doubt, you definitely want to see economic vacancy bumped up 5-10% more in the first year. Tenants are going to be upset and move out or balk on the higher rents. This is to be expected but needs to be modeled. We do not live in a perfect world where every unit gets filled right away so we need to ensure that the underwriting is conservative.

Also it is questionable to see other income growth in year one.

Working Capital

Working capital is extra money in the bank to help float invoices from contractors. This is above and beyond the capital expenditure budget.

But if you raised all the capex budget at the onset of a deal why would you need this working capital? Well the lender is typically holding this capex budget hostage unless the sponsor shows proof to release the funds. Often the sponsor will need to complete the work and submit for reimbursement from their own capital account. Also the lender (the bank), is not always the easiest to work with and can be slow to process requests. They can also be very difficult to work with (even predatory which is why a good relationship and legal assistance is needed) despite being a key part of our capital stack. In the end, they want to have controls on spending and the success of the project.

On small to medium sized projects the order of magnitude that you want to see as a LP is 20-100k. There are some rules of thumb out there such as a few hundred dollars per unit but once you get to larger buildings there is less need for larger set asides of working capital. Too much working capital can also dilute investors returns. Just make sure working capital is accounted for and its not too fat because you also might have a situation where a sponsor is raising extra capital to “float the pref”.

General News From Media or Brokers/Lenders

Robert Kiyosaki has a saying, “there are three sides to a coin”.

People argue that its a good time to buy or bad time to buy. For example “mfh” is overheated or commercial is getting killed by Amazon and e-commerce. I think these are mental justifications by tire kickers not to do anything.

Sophisticated investors live on the edge of the “coin”. They buy deals out our reach of amateurs due to the lack for network/knowledge. These opportunities are undervalued, with undermarket rents, with value add opportunity. Again the deals you want to get into are unique deals that hit the marks on underwriting irregardless of market. You are buying individual assets and individual sub-markets (block to block in fact) where rents or value is purchased at a lower cost basis.

Extra credit: “The guy not investing right now and hoarding cash (with net worth of under $1M… because if you can live off your cashflow then cool you can do what you want) is just afraid and lacks deal flow. Its like the person who complains that there is nothing to do during the weekend in LA (insert city with a vibrant scene) when in actuality they don’t have any friends (lack dealflow)… and by the no one likes (has a bad attitude and that person who makes excuses”

The news is filled with headlines to “day-trade attention.

Throughout this pandemic, even the year or two prior, we have heard brokers tell us over and over that nothing hits the market, it’s bought up before anyone even knows about it. And all of the value-add properties have been bought and renovated. Nothing could be further from the truth. We have a many 20-30+ year old properties with great structure, nice location, and in good condition, but the interiors were clearly dated. These are terrific opportunities to renovate and create a killer apartment, features that tenants today will pay for. When you see properties that were renovated just a few years ago, don’t ignore them. The seller wants you to think they’re worth more because they’re renovated, and you want a value-add deal, but there could easily still be an opportunity for you to improve it.

Also don’t believe everything about rent freezes and no upside as were the headlines in even the Wall Street Journal.

More resources:

https://www.multihousingnews.com/post/multifamily-refinancings-top-trends-and-strategies/

https://www.globest.com/2020/11/10/why-apartment-rents-have-remained-strong-through-pandemic/

Over Zealous Deals

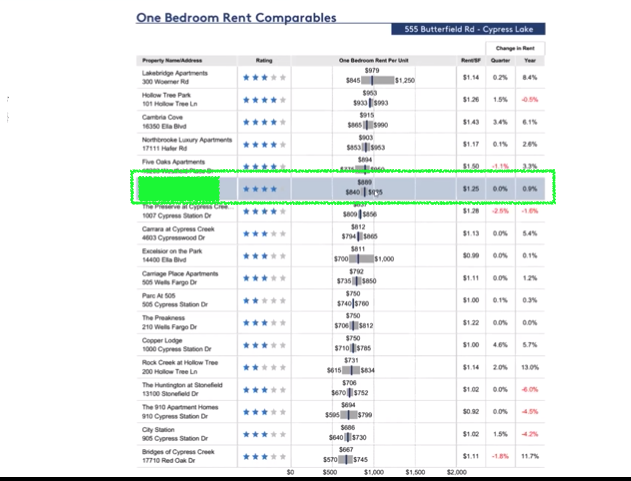

“We did not include a large bump to overall rents (6%)”

Lane: Well the market really could not support a rent bump to begin with.

*Verifying rental comps and rents is the hardest thing LP will do and it may not be possible. There this is where you fall back on the experience and due-dilligence of the sponsor

Other Income Greatly Expanding

Over Zealous Deals

Beware in a market where amateurs are doing large deals but when you take a look at the numbers, you are left with a high acquisition price due to aggressive bidding wars where pricing was stretched because of sharpening underwriting on expenses or overzealous rent projections. In this case, it might be better to accept 60-80% return in 5 years in a properly underwritten deal than a badly underwritten one.

Investors who were either banking on rent growth or the ability to renovate and raise rents by $200 may not be as successful given the recession caused by a post pandemic environment.

“Ringing Out the Towel”

Multiple Capital Raisers

Distributions Like Clockwork

Stated in a different way… When you ask most passive investors do they want “monthly distributions (rather than quarterly or yearly payouts) on passive investments” the answer is duh I want to be paid monthly and earlier as possible say the week after I invest. #Facepal

Here is where we stand:

From a marketing point of view it makes sense. If it motivates/excites people especially unsophisticated investors however, in practice, monthly distributions require a compromise on deal structure.

GP/Sponsors wanting to offer the benefits of frequent payouts and perceived stability are going to have to OVER-RAISE in some form or another. By over-raising, they are essentially taking more money from investors than they necessarily need… and then turning around and immediately paying back those investors with their own extra money. Essentially its like another loan take out just to make investors happy.

This is most easily explained when you look at some offers that promise returns right away — perhaps 1-2 months — after close.

A non-stabilized property (the classic value-add multifamily deal), then even though it may be currently cash-flowing, it’s going to take 3-6 months of capex renos and upgrades and just general operational fine tuning to start humming along. And that is contingent by the Bank who will not allow distributions to go out unless the syndicator over-raises and hides the money in a separate account.

During the first few years of a property value add cycle, cash is inconsistent. This is why we have traditionally gone with quarterly payouts.

Running a lean operation (more returns for passives due to less admin staff) and promising monthly payouts — especially in the first few years, as I just mentioned — is going to mean scrambling each month and in practice it will mean some payouts the first week of the month, others the last week, and everything in between.

A sponsor may as well tell his investors “I’ll pay you when I feel like it.” But this will upset most passive investors but could honestly be the best thing for the deal to have the professional operator make that call because after all they know what is best, aligned with the success of the project, and have the most to lose by a failed investment.

Sponsors offering monthly distributions must over-raise at the start, and always keep money in the kitty for this very purpose, to be able to meet their promise of frequency and timing of payouts.

That said many investors still say they would prefer monthly payouts. But you at this point in this Syndication LP ecourse are a lot smarter than the average Accredited investor.

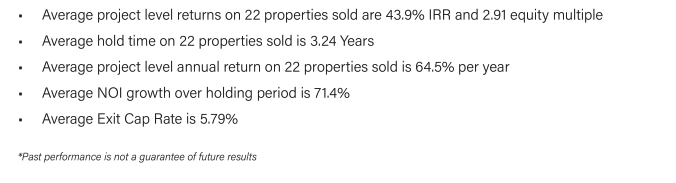

Project Level Returns vs Returns for Passive Investors

Understand the difference between project level returns and what actually goes in (you) investors pocket. Project level returns (before sponsor cut) should obviously be fat but don’t get tricked by thinking that is what you get or could get as a LP investor.

Here is an example of a sponsor playing some games with “43.9% IRR and 2.91 Equity Multiple” but this on the project level… not what passive investors got. It might be a 50/50 split and LPs might only be getting 22% IRR or 1.4 EM which is not that great.

Live Webinars

Some investors like to come on LIVE webinars and ask “stump the chump questions” to see how sponsors respond. Most of our investors 80% of them will never come to the LIVE webinar because most passive investors are busy and just catch up on replay. From our data a good portion of repeat investor don’t even watch the webinar. A smooth talking presentation does not correlate at all to the operators ability to run numbers and safeguard your capital.

I am sorry if you still believe in Santa Clause and the Easter Bunny but most “live questions from the audience” at live webinars are plants from the sponsor. Even if the questions are not planted, we can choose to answer the ones we like and ignore the others that are “too much information.” Confused minds say NO and many things just are over the head of passive LP partners… at the end of the day it comes down to track record and they making the investor happy.

Side note… when I am bored I will attend some lower level operators and watch their presentation so I can be entertained by other operators asking ridiculous questions to troll the competing operator.

Live Events Show Me How Legit an Operator Is

Truth is most real estate conferences are manufactured and fake where most of the speakers are newbies. I personally stop going to these because even I can’t tell who is legit on the stage or who shows up to these things. In my opinion, nothing replaces a pure passive investor peer group who actually invests in these deals.

The only real ones are industry level conferences put on by National industry leaders. The audience is not retail investors (like you) but family offices and institutional Wall Street people.

Again, a Live in-person spectacle does not correlate at all to the operators ability to run numbers and safeguard your capital.

Limited Time Offer

Do not get wrapped up in the “we are 79% filled…. 97% filled… 3 more spaces left” marketing speak.

Sometimes the fact that an offering gets filled so quickly is because you have 2-8 daisy-chain syndicators (illegal per SEC) that is brought in to raise 1M which should be done in a few hours anyway.

That said it should not take you more than a few hours to complete due-dilligence as a passive investor so there is really no reason to get your commits/sign/wire in the first 48 hours an offering is open.

Capital Stacks + Crowdfunding Websites + Sponsor Bias

Its a 'cat & mouse' game... MORE TO COME!

Vetting a Sponsor

In my opinion the sponsor of a deal is the most important component, if you focus on the deal or the asset class or the opportunity at the expense of underwriting the sponsor, you will most likely regret it. So of course, most of my advice is related toward sponsor vetting.

- Ask for a list of every deal they have ever sponsored. And if they can produce it, analyze performance data on each deal.

- Interview them about their track record. “What’s your best deal to date? Why do you think that deal was so successful? What’s your worst deal to date? Is there anything you felt you could have done to make it perform better? What changes have you made since that deal ensure pro-forma performance can be achieved?"

- Ask for their financials - a lot of sponsors would say no to this request but it doesn’t hurt to ask. Banks get it on every deal and they have superior capital stack position so if banks can get financials, investors should at least ask. “I’m betting on you, can you share some high level financials like personal financial statement or global cash flow summary?"

- Ask for prior investor references on all the good deals and especially the bad deals, and actually contact them. It will mostly be a highlight reel so find a few good questions that aren’t softballs. “In your opinion, what’s the sponsors biggest flaw? Is there anything about how they do business or communicate you would change”.

Bet on the jockey, not the horse. When you find a good sponsor, stick with them. If they perform well for you a few times then try and invest in all their subsequent opportunities, even if small amounts spread over multiple projects.

This allows your investments to have some diversity. The truth is, if a sponsor crushes the pro-forma 9/10 times and you are invested in the 1/10, well, yikes…

Pref-Equity Partner

Not to be confused with A1 or LP investors that are given a fixed rate of return that mimics a debt investor in a deal. That sort of “pref-equity” is just a marketing term.

The true “pref-equity” term is talking about a large hedge fund, family office, or insurance company coming in with some GP controlling interests or option to take over, should certain metrics not be met.

Sometimes these “pref-equity” partners can replace the need for the larger bank note taking up 90%+ of the equity stack. I have seen it some times where no LPs are aware that this even is happening (although it might not matter).

If anything… ~3/4ths of the time having a “true pref-equity partner” is a good thing where the “pref-equity” partner is “smart money” and knows that what we have is truly a deal. Sometimes having a “pref equity” partner can be the complete opposite where they are sort of like predators and can control the entity.

An LP has really no way of knowing so I would not really pay much attention to it. The syndicator can spin it either way.

Multi-level Marketing & Daisy-Chain Deals

A lot of people realized that making a podcast was a great way to find unsophisticated investors on the internet and stuff them into deals.

We have been following this trend for sometime where multiple capital raisers (3-10 people!!!) jump on a deal just to bring in $250,000-1M each. This is frowned upon by the SEC. And rumor has it that many big names have been investigated and cited.

An LP might feel isolated from this SEC non-compliance, but they don’t realize that any legal battle within the partnership can impact everyone. This is why myself as a syndicator chose to stay away from these shady characters. Plus their deals weren’t that good anyway which is why they needed everyone and their mother to raise money for the deal.

You can attempt to block this by simply asking “What is your role?”

In the Hui Deal Pipeline Club we have brought in over 10M on a deal and control the capital stack. We are not one 1-4M dollar group amongst other groups doing god knows what. I personally sign on the debt too.

Update August 26, 2020 the SEC is looking to widen capital raising rules.

Should this law be adopted be on the lookout for even more mass sharing of deals and expediting of daisy chain deals (non good deals that get passed along till it finds a sucker).

Below is the legal write up: