10) Exit Strategy

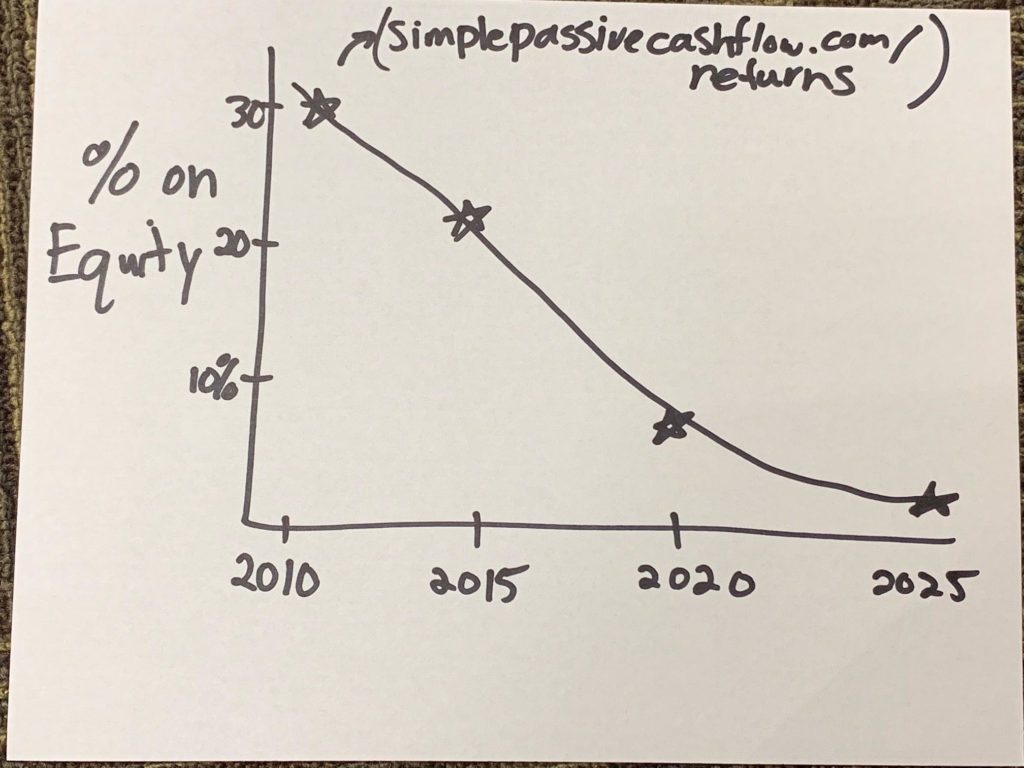

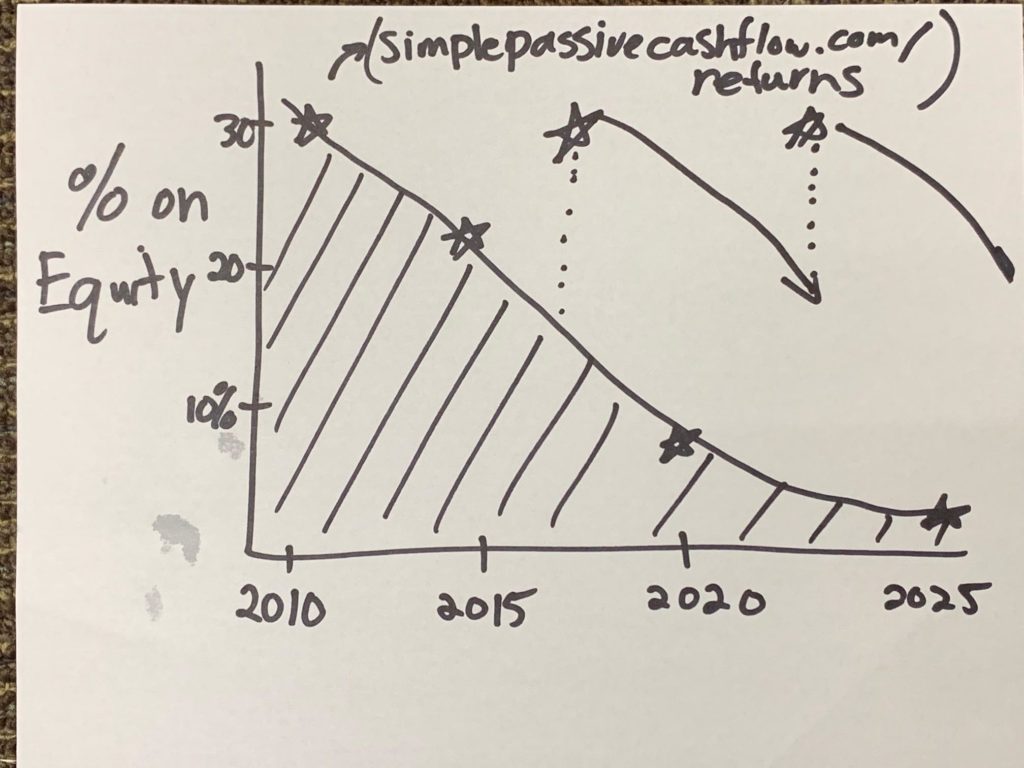

Sophisticated investors always monitor their Return on Equity. Personally when my ROE falls under 10-15% I look to re-leverage my equity to maximize my net worth while staying in positive cashflow. This is an important concept that most investors do not understand and embody.

Return on Equity = Profit (Cashflow) / Total Deployable

Part 7 of 8 - Exit Strategies

- Return on equity

- What high net worth investors should do?

- Progression of an investor

- Should you buy a 2-4 unit?

- How much money are you making? Total return.

- Inflation hedging

- REIT investing

- Runtime – 35 minutes

When your property appreciates and your tenant pays down your mortgage your equity position goes up

To get your lazy equity working again you have three options which we will go into more depth:

- Sell the asset

- 1031 exchange

- Cash out refinance

Where is your lazy equity?

Download worksheet – SimplePassiveCashflow.com/ROE

Too much lazy equity that you bought timeshares…

When You May Want to Sell Your Properties

Here are some situations when you may want or need to sell your rentals:

Getting Rid of Underpermforming Properties

Re-evaluate your portfolio every 3-10 years and sell off properties that are not performing well to free up cash to buy better ones. Or if the total returns (cash flow, tax benefits, appreciation, and mortgage pay down) get below roughly 15% than the next best investment. A quick rule of thumb is to unload any properties that do not meet the 1% Rent-to-Value Ratio.

Consolidating Your Portfolio

If you decide to venture into residential or commercial multi-family investing in the future, you may want to sell your single family homes and consolidate your portfolio by buying fewer, but bigger multi-family buildings.

Leave Real Estate Completely

If you decide that being a landlord is not for you and you’d rather move your money into other investments or become a completely passive investor where the pros operate the investment for you in a syndication.

Common Ways to Sell Your Property

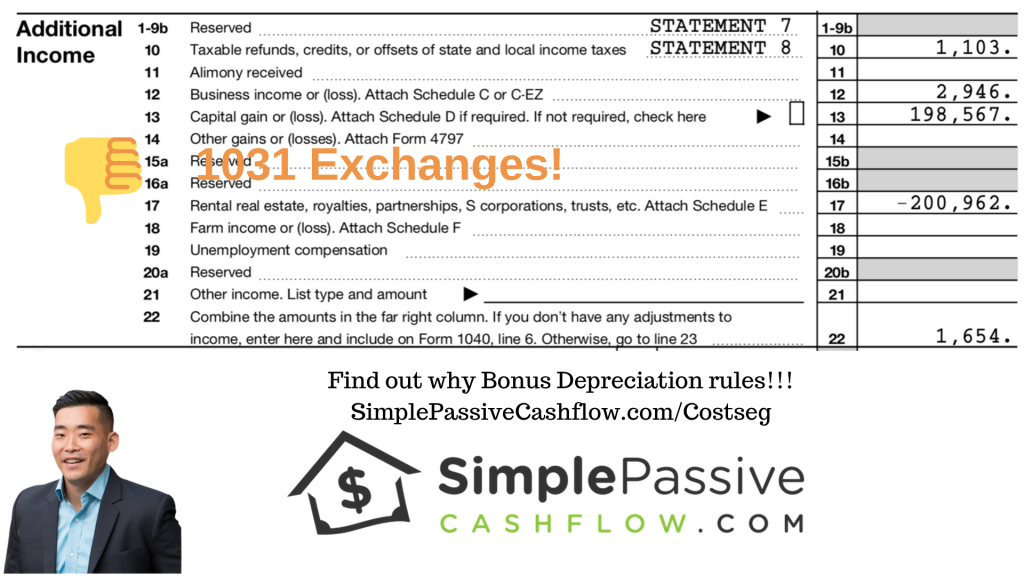

1031 Exchange

You sell one property and use the sales proceeds to immediately buy another similar property.

With this strategy you can replace an underperforming property or consolidate your portfolio. You will not be required to pay capital gains taxes on the sale, provided that you follow all of the rules and regulations of this exchange program.

You can check out the full guide here.

Cash-out Refinance and HELOC’s

These are both ways to leverage the equity built up in your properties.

Cash-out refi is a strategy that allows you to obtain a new loan to pay off the current one and also take out the equity.

Home equity line of credit (HELOC’s) use the equity in your home as collateral. It works like a credit card where you replenish the available credit when the balance is paid. You can borrow from it when you want and however much you want (up to the balance) until the draw period ends.

A HELOC is an excellent means of getting lazy equity out of your current primary residence if you own your home. We don’t really recommend owning your primary residence anyway especially if you live in a primary (tier 1) market. But anyway I digress… (I am passionate about younger families buying a large home to live in which blows a big chunk of liquidity and getting stuck with a large house payment). HELOCs are a great temporary solution to get equity out of your current assets to deleverage to additional properties. It does not require any expensive re-origination fees associated with a new home loan by doing a refinance and you can reverse it by paying the loan back. This is a great option when starting out and you don’t have much liquidity other than what is in your current home. At some point, you will have to make the irreversible decision to do a refinance or sell the asset. But hopefully we have empowered you to get started and then you can have real life proof of concept for yourself.

See which one is best for you in this article

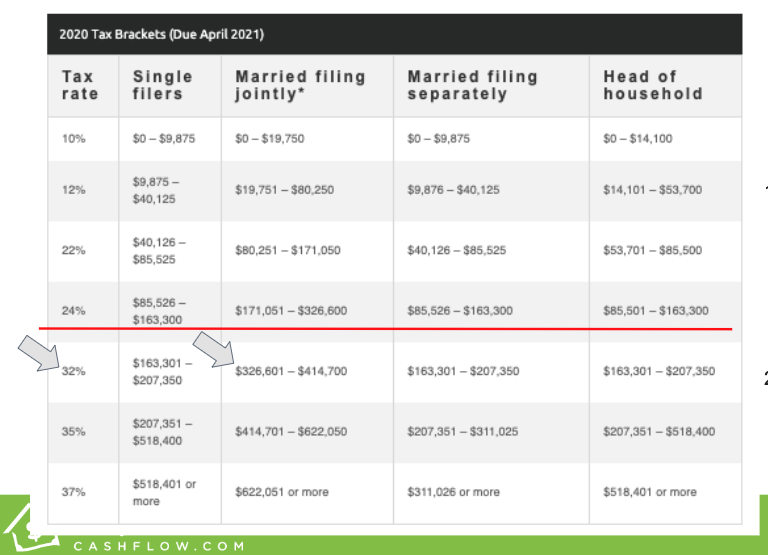

Investors who make over $100,000 a year or net worth over $250,000:

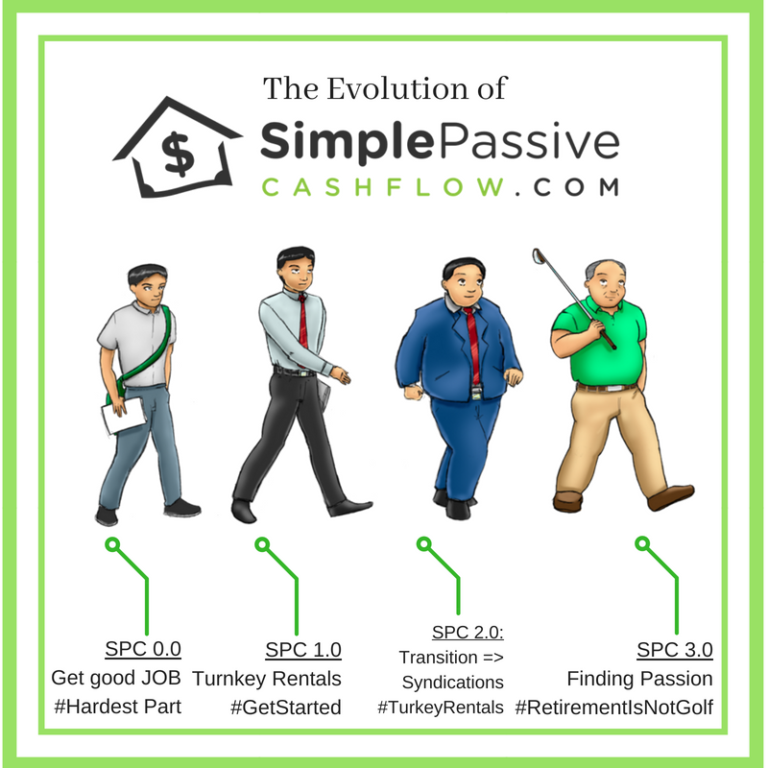

From 2009, I bought single family home rentals as I grew my net worth from $0 to $600,000 in 2015. Six years later, I owned 11 rentals, I realized that buying rentals were not scalable past 20-30 rentals. I also joined masterminds with other doctors, lawyers, engineers, and other professionals who had a much higher net worth than myself. Through these groups I learned a lot of techniques that the wealthy do that I share in our Mastermind. One of these is that there is a certain point where you transition to syndications.

The numbers on 2-4 units seem to be stronger why should I buy a single family home rental?

As we have been hinting… as an investor you will eventually gravitate to being a more passive investor. For those who are able to save more than $30k a year or have substantial liquidity (over 200k), being a landlord is a lot of work. Do the math here… with 300 dollars per property (2 months of work to buy a turnkey rental) you are going to need 20-40 of these to replace your income. I have 10 of these and have systems in place but have 1-2 evictions a year and 3-4 big things that happen. Image if I had 30, just 3 x those numbers.

If your net worth (income minus expenses) is under $200,000 or barely save $30,000, syndications are not for you. Stick with these Turnkey rentals despite what Gurus (who are trying to sell you their program) tell you for now. They have a little higher gains (a lot more volatility) but a syndicator who is willing to put you in a deal with more than 10-20% of your net worth is asking for trouble. But for those investors who make over $100,000 a year or net worth already over $250,000 stick with single family homes because the exit sale is much easier than a multifamily 2-4 unit which will sit on the market 2-4x as long and only go to a cheapskate investor like us. You might even hold onto these first few rentals for as little as 1-4 years.

Within the next two weeks:

Read through both articles for 1031 Exchanges and Cash-out Refi vs HELOC’s and understand the differences between them!

Deeper Learning

Build wealth for the next generation

Remote Investor Incubator

Check out the Remote Rental workshop for additional information on “Exit Strategy”.