8) Formulating Your Investor Philosophy & Building a Network

Begin with the End in Mind

Most people will be financially free in 4-7 years pending taking action and being able to save at least 30-50k a year to put to more investments. Begin with the end in mind and design your ideal life now. You are fortunate to be on the path to being financially free and it is a privilege so please do something with it and make a positing impact in the world.

Having passive cashflow is the simple part… the hard part is figuring out what meaningful thing to after. Money and time are interchangeable resources. When you start out Money is worth more than Time. But in time, Time will transition to being more valuable.

Ben-Shahar shares four archetypes in his book called Happier outlines how we fall into these four “the happiness archetypes”:

- Rat Racer - enjoy the idea of a future destination, but neglect the present

- Hedonist - enjoy the journey (right now), but neglect the future

- Nihilist - enjoy reliving the past, but neglect the present & future (because it's hopeless)

- Happiness - enjoy the experience of climbing toward the peak

The happiness archetype is the ideal archetype

Create your own “strike zone” and evolving investment criteria

Every investor has a different life circumstance and different risk tolerances. They also have different things they like to see in deals and other things that are deal killers.

Trouble is no deal is perfect and will never fit in your “strike zone”. Especially when your funds are not fully deployed, you will have to go into deals that are not a perfect fit because either those deals are not there (unicorns) and you have to balance waiting and having your money making nothing or worse potentially sitting in the volatile stock market.

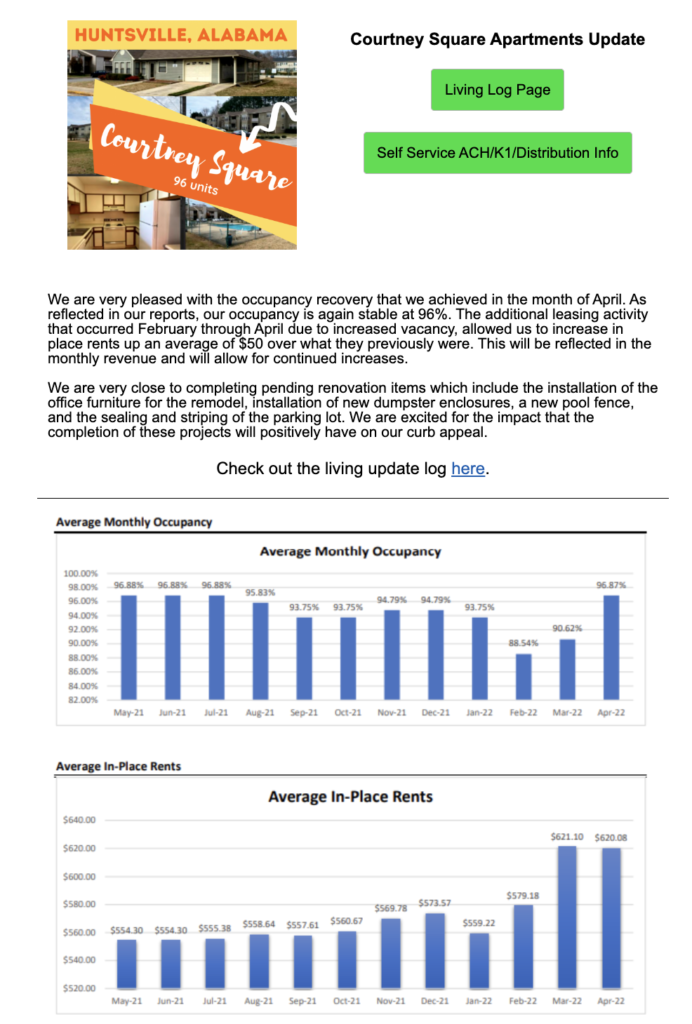

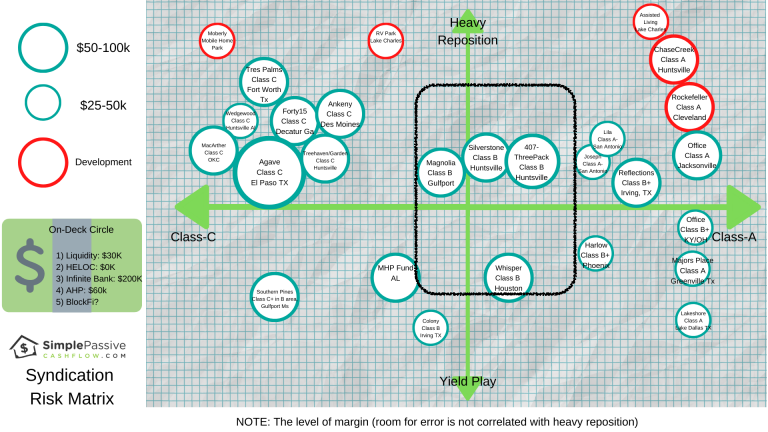

Below is one mind-map that I created for myself to help think of my portfolio as a whole. As you can see my idea “strike zone” today is centered around better than C-class assets with moderate level of value. However, most of my investments are not in that zone! My philosophy has changed slightly over time as I did not want the headache of Class C tenants who struggle to pay but overall I am trying to get my weighted average in the zone. Also something can be said for having diversification outside my “strike zone”. At the very least, wether it is possible, is to develop some sort of goal instead of looking at deals blindly.

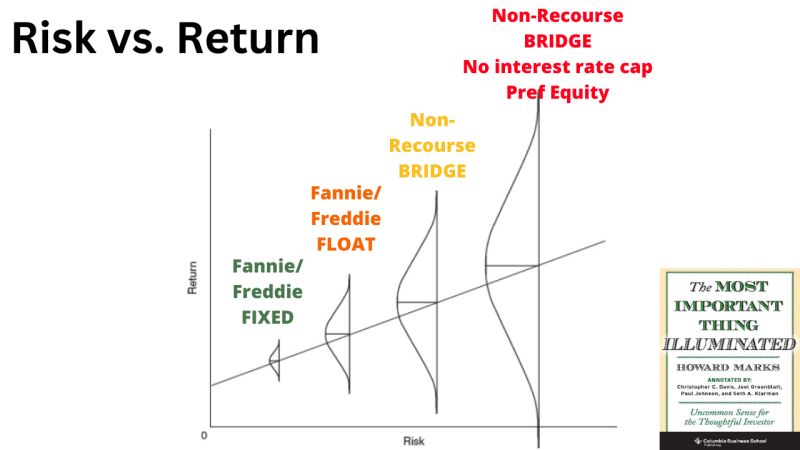

When comparing two deals, almost everyone takes the higher IRR….. the problem with this is that most don’t look at the risk-adjusted IRR

In Howard Marks book, the most important thing this chart illustrates that the further out on the risk curve the greater your range out of outcomes….

Yes you could get a 30% IRR, but you could also get a 0% IRR when you go with higher risk.. (think bridge loan with pref and no interest rate cap)

I added in color, how to think about this from the lens of a multifamily investor in terms of debt….

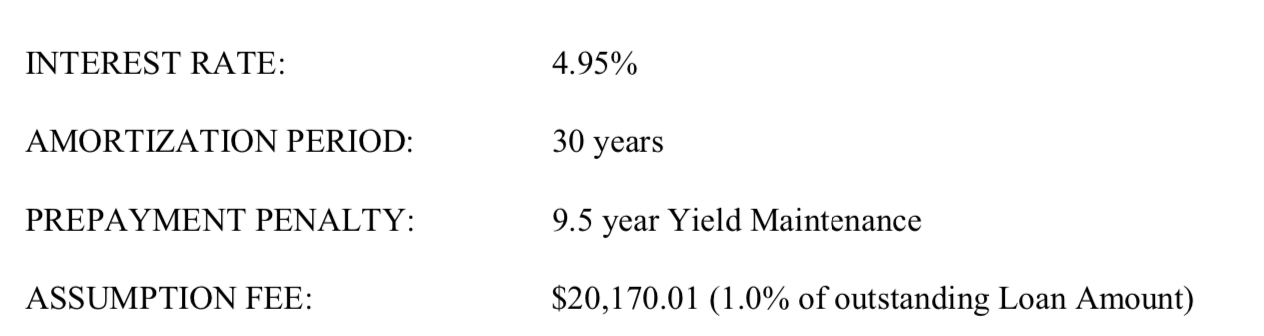

For example, on a Fannie/Freddie fixed rate loan you will have a prepayment penalty if you pay it off before maturity, BUT:

– You don’t have a loan maturity at the wrong time

– You don’t have a interest rate cap to buy

– You know your payment for the next 5, 7, 10 years

So the 15% proforma IRR will probably be +/- 5% (between 10%-20% IRR).

More risk comes more reward…

The goal of this Syndication eCourse was to have you learn the basics and be aware of some of the nuances of syndication deals so you can carry on an informed conversation with another passive investor.

Don’t be worried if for example this next section goes over your head:

Does Value-Add Really Offer Downside Protection

Capital Calls

Multi-Class Vs Dual Tranche Equity Structures for Larger LP Partners (over 250k+)

Don’t Work With Randos

People in and outside of our Mastermind bring me deals all the time. My first question is how do you know this person?

In vetting deals, it is often the people component which has the greatest amount of impact on the success of a deal. I don’t invest with anyone I don’t know personally (one degree of separation).

None of this “I know a guy that knows a guy” where that guy is not even an investor and hear it second hand.

This is another reason I don’t like the single family home investor world and that it is a lower barrier to entry and it is often filled with people trying to “get rich quick, no add value people.” I feel there is a higher rate of people who are needing to “put food on the table” from vendors, brokers, and peers. Which is why I don’t really like going to local real estate meet-ups or free online forums

Most people in this space are able to make profits off of unsophisticated investors. This is another reason . I spent thousands of dollars to travel across the country to get access to high quality people who came from the same high net worth professional pedigree and were also taking action.

Case and point: Wholesellers are famous for this. They want a proof of funds and letter of intent to purchase with no access to any financials? Who would ever offer on-a property without seeing the numbers first? The reason they do this is because they have a seller who does not even trust the wholeseller and needs to qualify the buyer first. A lot of these jokers will sell a property higher than the past listing price when the expired listing just closed a few weeks ago. If these bozos spent as much time building their buyers lists as they did actually looking of good deals… they would likely make a lot of money.

Where to Start

To use an analogy to compare our deals there are three flavors of soft serve (ice cream):

1) Vanilla 🍦- Thrive/Canopy this is your standard stabilized deal with some cash flow and a small lift on rents to do the value add. It takes a while (4-6 years) but it’s well and safe should a recession come.

The vanilla flavor is for the low risk tolerant/low risk capacity investor who is new to real estate and wants to begin investing in something outside the stock market but with a fair guarantee of some return and preservation of wealth. An even lower risk tolerant person should go with the pref equity option in these types of deals.

2) Swirl (vanilla/chocolate) 🍦🍫 – Gateway – This is an aggressive/quicker business plan with little to no cash flow. This is also known as an “Equity Accelerator”. Where you roll funds from smaller/faster deals into the next one using 1031 exchanges or Tenant-in-common structures and repeat this process over a longer time horizon. In this type of deal, you just leave your funds in there and let them grow. You are definitely looking for equity growth vs. cash flow at this point – most investors who have be in full cycle deals and those in Amara, Tres Palm, Joseph, MS deals, and El Paso this year will soon learn that cashflow however nice does not really change your life one bit.

For someone who is age 30-40, still working with semi-stable job, has younger kids, and has about $1M net worth, I think this type of strategy would make a lot of sense, especially if they could commit $100-200k and just let it ride for 5-10+ years.

The “swirl” is clearly a fit for an investor that has a very high risk tolerant frame of mind with a very high risk capacity for investing. But… I want to separate this from the “equity accelerator” model where the deal rolls into the next deal with the same investors. Think of the “equity accelerator” model as a VIP Disney World tour where you board a bus and ushered through the park and other parks in the Disney campus – at some point later today or later in the week you are dropped off back and you have to create your own magic from there – or pay your taxes on the gains. Also in the “equity accelerator” model, money is illiquid for as long as a decade, with no guarantee of returns 5-10+ years from the time of the initial investment. The market conditions 10+ years from now are unknown, the tax implications of real estate investing are unknown, and most importantly, whether or not the GPs or operators will be still running the same show are unknown as well. It provides the greatest reward of accelerating wealth, but there are too many variable factors involved. It is clearly not for the faint hearted. This is a little more aggressive play where there is less transparency and more operator control into direction on where the deal is where as the Vanilla and Chocolate deals are pretty straightforward, which is why we like to bring FOOM or more experienced VIP investors into these smaller deals.

3) Chocolate 🍫 – This would be a deal like Chase Creek where we already have a pretty lucrative offer to purchase. But in a development it could get stalled out due to permits and run into other construction change orders (not to mention lease-up phase risk). But this is the fastest deal and can be the most lucrative.

The chocolate flavor is for the intermediate risk tolerant/intermediate risk capacity investor that has invested in alternative assets before, but is looking to become more aggressive in their real estate holdings all be it with slightly more added risk.

As a side note to complicate things: I do see a lot of sucker development deals that are made to target unsophisticated investors with lofty projections and pretty artist 3D renderings. They typically are marketed as trophy assets that may or may not be a good risk adjusted return. This also reminds me of those Cannabis deals that were so prevalent in 2015 that sounded good because it was an emerging industry but was filled with a bunch of well “pothead” operators and no access to good debt because government backed banks could not lend on it being illegal in some states. Or another example would be those international deals in that were in the hotel asset class who sold people on that ego driven investment to show off to their friends. This is where having a network around you is important to vet the people you are working with.

Insights from experienced investors:

As stated earlier, newer investors will want to go for cash flow (vanilla), but after gaining some experience with a couple of deals when you see the deals dump out the retained equity in big chunks you might say “well crap, maybe I should have gone for the chocolate or swirl and made more money faster.” All in the positive progression of a passive investor 😁

Those under 1M-2M net worth, think in terms of monthly (example all of the new and scared investors ask if pref equity is monthly because they need that monthly income for peace of mind), but higher net worth or Family Office money think in terms of quarterly, annually, or longer.

On the surface, the vanilla is the “safer” deal, but in reality, the safer play could be the unique deal whether it was Chocolate or swirl and had a special aspect like a heavy loss to lease play, hedged with a great submarket or a development project, where you are building it at 60% of the sale price (ie development).

Other ways others look at these deals:

- Looking at each deal with the lens “what is the worse that can happen here.” The more perceived risk you take on the more potential returns or cone possibilities.

- Look at it from a geographical diversification perspective first see where you are heavy more or less.

That’s what I really value knowing, what are people with similar net worths to me doing?

These are the conversations that happened in Hawaii for HUI4 and on the one on one calls that FOOM members have throughout the year. I don’t claim to have the answers but I am always trying to learn what the next shelf of people are doing to compress the learning curves like how we prevent 1M folks from buying a bunch of SFH rentals. But this is where things get personal… you have a business where some are more W2 salaries plus some people have different end goals and lifestyle vision.

Thanks for that. In that analogy I definitely want to tee up more “swirl” type deals compared to the “vanilla” ones. I just didn’t know what might be most advisable for me.

At the end of the day… its all ice cream and this stuff we are investing are real hard assets that at any point (should a recession come) have enough money in the capital plan to go to a cashflow and hold position.

I’ve watched the video on Gateway so my only question was, when do you know it’s time to turn off the music? I get the idea is to buy, sell, buy, repeat, but when to determine when that final sale is the time to cash out? After reaching 7X?

From an operator on the deal level, we keep going down the road for 2-3 rollovers and wait for some opportunity in the tax code to open up to jailbreak the gains or we might simply put into a long term low return triple net deal or return your money… we don’t know but we are all aligned… no one wants to pay taxes. This is why we take a smaller amount of investors into these who already trust us because as you know the longer a marriage goes things will change and it is better if everyone was aligned for the end goal. On this particular deal the sponsors make that decision when is the best time to exit.

From your personal side, this is of course one part of your portfolio. 2-5% call it that and therefore you should be semi-disinterested as it is just a small part of the whole.

Do you have a “chocolate” in Texas or elsewhere in the South that is open now to receive funds?

You will be waiting a very long time for that. Chocolate deals are very rare because of rare land that makes sense from a use and price standpoint. This is an opportunity that we are growing the team to go after more in the future.

How to Offset Returns on This Amazing Deal We Just Exited

Here is a more recent video talking about depreciation recapture.

Multiple properties are closing up until the next quarter! So, this is a quick rundown on the tax implications and the use of your passive losses to roll that capital gain depreciation recapture forward. 0:20 Recent Closings 2:25 Tres Palms Property | Sample K-1 10:49 Tax Strategy | Potential Solutions 17:52 How long can you suspend passive losses? 20:50 Key Considerations to Consider When Doing 1031 37:00 Options for General Partners 40:15 About Cost Seg | Bonus Depreciation Going Down 43:15 Stocks & Paper Assets 47:16 Gain or Loss From Sale of Assets 48:55 Retirement Accounts 59:24 Problem With Underwriters

Wait what about 1031 Exchanges…

https://youtu.be/ziEbO_tayrU

Below is a summary of 1031s. But with the amount of bonus depreciation in deals going to LPs I don’t know why people do 1031s???

In 2018 I sold 7 sfhs and had 200k of capital gains. I just offset it with 200k of passive losses that I built up by going into syndications.

The 1031 exchange is a method of pushing forward the taxes due on the capital gains of a property. You have 45 days to identify replacement property that 180 to close on said property(s).

Its a way of kicking the can down the road with taxes. I would use a 1031 in the last case resort since you have to pay taxes at some point unless you are going to take it to the grave with you and get the step up basis (so there is an exception if you are pretty sure you are on your last 5-10 years of life) which is not very practical due to the following.

1) The 45 days is almost impossible to execute. To be able to line up a deal that is “hot”. Experienced investors spend an average of 18 months to find that elusive first apartment. Now if you are buying lukewarm deals… then be my guest. But in this seller’s market, I think its a way to lose everything.

2) Most investors that I work with are high net worth and able to cashflow income minus expenses over $30k a year and have over 50K of liquidity on hand. I believe that most people, unless they are talented at being an elite investor, should just be an LP role in a syndication due to the scalability and being able to spread their capital across different leads, business plans, asset classes, and geographical locations. That said a 1031 exchange will not allow you from going from real property to an LLC (ownership in a syndication). Although you could do what is called a Tenant-In-Common (TIC) arrangement where an investor has 1031 exchange funds and wants to parlay that money into a syndication. It’s possible but from the syndicator’s perspective a lot of unneeded work when you can just raise the funds the traditional way. Caveat: if you are bringing in a huge amount of money say 50% of the raise then that might tip the scales in your favor). We would do a TIC with you but you would need to bring in more than 1-2Mfor it to make it worth the administrative burden.

Again when we sell the asset in 5-10 years anyway you will be in the same but worse predicament. Take advantage of bonus depreciation now.

There are reverse exchanges and other more exotic exchanges but I personally not sold on the concept when the IRS comes knocking. I am not a tax professional but I feel it is tax evasion.

As a LP investor in syndications deals large enough to pay a guy 5-10K we do cost segregations in order to get bonus depreciation and write off a huge portion of the taxes from exiting the last deal. Basically bonus depreciation has made 1031s obsolete.

The order in which suspended losses are deducted is:

1. To first offset depreciation recapture and gain from the activity that was sold.

2. If the suspended losses are in excess of the total gain, the remaining suspended losses will then offset ordinary income.

3. If the suspended losses do not offset 100% of the gain from the activity that was sold, you may use suspended losses from other rental activities to offset the remainder of the gain from sale.

See full article and my 1031 story here.

Another example: Assume you invest $100,000 in a syndication and the cost segregation yields $20,000 of depreciation. You hold the asset for five years and it is sold for $150,000. You have $50,000 of capital gain and $20,000 of depreciation recapture. Assuming your capital gains tax rate is 20% and you made no further investment, you would owe tax of $10,000 on the gain and $5,000 on the recapture.

Now assume you took the $150,000 and invested it in a new syndication and got the same 20% cost seg, so $30,000 of depreciation. The new depreciation would first offset the $20,000 of recapture then the remaining $10,000 would offset some of the capital gain from the previous sale leaving you with $40,000 of gain. You would pay 20% tax on the $40,000 and the tax owed would be $8,000 rather than the original $15,000. If you have other passive loss that you have been carrying from other investments, that could be used to further defer and reduce the tax.

This is detailed in IRC Sec. 469(g)(1)(A). And if you want to have a wild Wednesday night, here’s an article that explains it in-depth:

https://www.thetaxadviser.com/issues/2008/may/disposingofanactivitytoreleasesuspendedpassivelosses.html

In summary… 1031 into Syndications is possible via a Tenant-In-Common (TIC) structure but it is a bit of a pain legally therefore we and will only do it if an investor is bringing in 2-3M+ of equity.

A 1031 exchange is a major tax benefit associated with real estate ownership, which allows the deferral of capital gains by exchanging the gain into a like-kind property upon sale rather than receiving all the sale proceeds in taxable cash. Combining a 1031 exchange with a sponsored investment allows a 1031 exchange investor to essentially become a limited partner investor in a professionally managed investment vehicle. The investor performing the 1031 exchange into the venture can also 1031 exchange out their interest upon sale. This is advantageous since typical limited partners in a real estate investment are unable to 1031 exchange their individual ownership interest upon sale and must rely on a deal-level 1031 exchange if they wish to defer capital gains taxes upon sale. The reason for this is because limited partners technically do not own real estate. Instead, they own a partnership interest in a real estate venture which is ineligible for a 1031 exchange, since 1031 exchanges must be like-kind exchanges of real property.

1031 exchanges in joint ventures or syndications are structured using a tenancy in common structure, which allows the 1031 investor to take direct title to the property, which is one of the key requirements of a legitimate 1031 exchange. A complication of the TIC structure within a management partnership is that the “tenants” in common have joint and several ownerships of the property with equal control. However, in a syndication/joint venture, the sponsor is supposed to have decision making control (this is important for the lender as well since they are lending based on the sponsor’s control and ability to oversee the success of the deal). Typical joint venture economics and control rights can be outlined through a side-letter or through other means to make the 1031 fit into a traditional syndication/joint venture structure.

Not all sponsors offer their investors the opportunity to 1031 exchange and often times those who are more desperate for investors will bend over backwards for this cumbersome arrangement.

Our team has experience structuring 1031 exchanges in our investments both with agency lenders, bridge debt, and banks. The greatest source of complexity comes from the lender requirements when it comes to the TIC structure, especially Fannie Mae and Freddie Mac. Because the 1031 TIC investor is a direct owner of the property, they are technically a borrower in the eyes of the lender and therefore must be underwritten. Being underwritten by a lender includes a credit check, background check, disclosure of personal financial statement, schedule of real estate owned, and business resume. This does not mean the 1031 investor has to be a guarantor on the loan, but sometimes lenders ask for limited guarantees.

A discussion on inflation…

In 2022, the U.S. labor department data suggested that the annual inflation rate in the US accelerated to 9.1% in June of 2022, the highest since November 1981.

Inflation is a volatile variable when it comes to managing your portfolio. The effects of inflation can devastate your assets, as we have seen in the wake of a downturned economy, war, political unrest, a disturbance in resource availability, or a chilling response to a surging global pandemic.

Inflation means that your money doesn’t go as far as it used to – you are basically losing money (buying power). This is true whether you like it or not, and while nobody likes losing money, some people always seem to profit from inflation.

Multifamily real estate can be an excellent hedge against inflation. To understand why it’s essential to know how inflation works and how it affects the value of money. And when you know those things, you may discover that multifamily real estate can help you protect yourself from inflation’s adverse effects—and even profit from it.

The four ways we make money with real estate are the following 1) cashflow, 2) appreciation, 3) principal paydown, and 4) tax benefits. Cashflow is the current and ongoing payments to the investor from rents. It is also referred to as yield. In addition to yield, there is equity growth from the appreciation of the property and paying down the mortgage each month. This equity component is realized upon liquidation of an apartment building—we’ll look at an example below to see why this makes apartment investments so attractive.

Multifamily real estate has a long track record of beating inflation. Over the last 43 years, multifamily has beaten the inflation rate 37 times. In comparison, the S&P 500 has only beaten inflation 29 times. How can multifamily provide these more stable and consistent inflation-busting returns? Let me run you through three different scenarios: one in which rent growth exceeds CPI, another in which rent growth equals CPI, and a third in which rent growth lags behind CPI.

Our hypothetical apartment investment looks like this:

100 – unit property

$10 million valuation

$1 million in gross operating income (GOI)

$500,000 in operating expenses

$500,000 net operating income (NOI)

5% cap rate (steady)

5% inflation rate (CPI)

7% rent growth (case #1)

5% rent growth (case #2)

3% rent growth (case #3)

Case #1 – High Inflation / Higher Rent Growth

When inflation rises, apartment rents tend to rise even more quickly. Since multifamily properties have short lease contracts—typically no longer than one year—they are nimble enough to respond to inflationary pressures and raise their rents in response. This is a real benefit for apartment investors that is not available to other segments of the commercial real estate space. Typically office, retail, and industrial properties utilize longer-term contracts making it difficult for them to respond to inflation. As a result, the only way for them to achieve higher rent growth than CPI is through the re-leasing property at higher rates than those specified in their leases.

In this case, we are assuming a 7% rent growth and a 5% inflation rate.

GOI – $1 million x 7% rent growth = $1,070,000

Expense growth – $500,000 x 5% inflation = $525,000

NOI – $1,070,000 – $525,000 = $545,000

NOI = $545,000

Our NOI increased by $45,000, so it is clear that our net distributable cash flow (yield) to the investors increased. Now let’s use that NOI number to see how much our equity grew.

Value = NOI / Cap rate

$545,000 / 5% = $10,900,000

Value = $10,900,000

So, in this case, our yield increased by $45,000 (from $500,000 to $545,000), and the value of our property increased by $900,000 (from $10 million to $10.9 million). We are not losing money to inflation; both values are increasing equally. Obviously, this is an ideal situation for the investor. But what happens if rent growth does not exceed the rate of inflation? What if they both go up equally?

Case #2 When High Rent Growth Equals/Keeps Up With High Inflation

In this case, both the rate of inflation and rent growth are equal at 5%. Let’s do the math.

GOI – $1 million x 5% rent growth = $1,050,000

Expense growth – $500,000 x 5% inflation = $525,000

NOI – $1,050,000 – $525,000 = $525,000

NOI = $525,000

Value = NOI / Cap rate

$525,000 / 5% = $10,500,000

Value = $10,500,000

Even when rent growth merely keeps up with inflation, the investor still wins (and profits from inflation). An increase in income of 5% equates to a less than $42 increase in rent for each unit per month. The owner’s expenses also went up 5%, costing him or her less than $21 per unit.

The increase in yield is cash in your pocket as well as an increase in the equity value of the property. Everybody wins here.

Case #3 When the Rent Growth Lags behind High Inflation

In the two previous examples, investors benefited from the effects of inflation. But what would happen if rent growth could not keep up with inflation? Would inflation win? Would we be stuck losing money? Let’s redo the math for an inflation rate of 5%, but this time, rent growth lags behind at only 3%.

GOI – $1 million x 3% rent growth = $1,030,000

Expense growth – $500,000 x 5% inflation = $525,000

NOI – $1,030,000 – $525,000 = $505,000

NOI = $505,000

Value = NOI / Cap rate

$505,000 / 5% = $10,100,000

Value = $10,100,000

While it may seem counterintuitive to achieve both higher yields and increased equity, the fact of the matter is that B-grade commercial multifamily real estate has expenses that are around half of the income it generates. So even in the worst-case scenario, this fact helps offset the effects of inflation on apartment investments.

So Is it a Good Time to Invest in Real Estate?

Investing in hard assets of value, such as real estate, protects one against inflation.

Investing in appreciating assets with positive returns counters the effects of inflation, which can cause negative returns.

Rates are still very low (We had 17% interest rates in the 80s!).

Home ownership is declining, leading to increased demand for rental properties.

Rental growth has increased yearly and is expected to continue through at least the next three years.

In the end of the day, the rich are getting richer because they are in assets like real estate that go up with inflation. The poor and middle class typically do not buy assets that do this which is why inflation acts insidiously to rob those who need money the most. Politics and morals aside… learn how the system works and do what makes sense for you and your family… and please teach this to the next generation because financial education is really what separates those in net worth more than academic education.

Where to Start to Build your Network

Try targeted meetups like my local on in Hawaii for Passive investors. But remember that you are getting what you pay for…

It took me from 2009 to 2015 to go from zero to 11 units. In 2016-2020, I acquired over 4,200 units!

Why?!? Other than spending over $100,000 in Masterminds and getting in the right rooms of higher level investors…

It was because I found a tribe of other high net worth professionals like doctors, lawyers, engineers, dentists, accountants, pharmacists, and computer programmers who were a few year ahead of me and on the same path to financial freedom. I discovered all these hacks that the wealthy do but more importantly I built relationships with these people which help be vet operators and deals.

Tip for networking – Always add value and make things better than you found it. Too many people who are new, come in, ask too many questions, and are drawing a negative social currency balance. Don’t be an Ask-hole! Give without expecting anything back and you will find those who are the good one you want to work with.

Using LP Relationship Proxy & Three levels of referrals

Starting out in any endeavor you are not going to have the know how or network to determine who to invest with. I lost $40k in my first deal because I did not have the right network that could have help me avoid working with the wrong person.

Here are three levels of referrals to think about using to help you make a decision on who to work with.

-

The Bad

Investing totally off Facebook likes or a nice website/pitch deck. You don’t know anyone who has invested with this person to verify results. Another example is that you had a couple beers with someone who mentioned someone was a good sponsor. Everyone has a podcast today or can pay someone on Upwork a hundred dollars to put together a professional pitch deck.

-

Half-Way There - "The Best you can do starting out"

You got a loose referral from someone who is potentially an unsophisticated investor on some message board or vendor or guy you met at a local REIA. The person who made the recommendation is not a close contact to you nor has skin in the game and a first hand investor in the sponsors past deals. I made this mistake in 2013 when I invested in my first passive deal by just blindly following a referral from an institutional company (IRA servicer company). More details - SimplePassiveCashflow.com/fail

-

The Best - "Gold Standard"

You are going off a referral of a trusted sophisticated investor who is going into the same deal too. The "trusted sophisticated investor" is an organic relationship that you nurtured the relationship over several months at least. Too many rich people like to seem like they know what they are talking about but when I press them with the right questions come to find out they did not invest any of their own money with the sponsor and completely unsophisticated - ie talking about fees and splits but no idea what reversion Cap Rates are.

Getting Into the GP

In order to qualify you would need:

- A net-worth of over $3M or

- Bring in at least $200,000+

As much as I recommend most investors invest no more than 5-10% of their net worth into any one opportunity… Ultra high net-worth families don’t play by the same rules and in this case can get a little more bang for their buck.

Providing Earnest Money for Syndications: High net worth investors have another option to participate in real estate syndications by providing earnest money. Similar to home purchases, earnest money is a deposit made when submitting an offer. This concept applies to commercial real estate as well. However, there can be more risk involved in retrieving the money if certain conditions in the purchase and sale contract are not met.

In competitive markets, the GP may need to put in significant amounts, such as half a million or a few million dollars, to make their offer stand out and have a higher chance of acceptance. In the hottest markets, they may need to waive contingencies like financing and inspections. If the project does not proceed and close, the earnest money becomes at risk. For this reason, make sure you have a written agreement on how your money is paid back to you defining the rate, terms, and timeline.

For newer GPs who lack substantial net worth and liquidity to provide earnest money, high net worth investors may see an opportunity to offer short-term funding in exchange for a small percentage of the general partnership. The specific percentage can range even more than being a KP, because it is widely contingent on the GP’s need.

Initially, this strategy may seem riskier compared to being a KP or loan guarantor. However, one can mitigate risks by understanding how the general partners plan to close the deal on time and where they would source additional funds to fulfill the earnest money commitment if needed.

It’s important to note that when putting up earnest money, the risk is limited to the amount deposited and within a one to three month period where things are up in the air. In contrast, being a KP or loan guarantor exposes one’s entire net worth to potential deficiency judgments in case of project failure for the life of the project (1-10 years).

Not interested in doing hard work to build relationships with brokers or run a large deal and being responsible for everyone’s money in a syndications?

One opportunity for high net worth Accredited investors is to join a General Partnership as a Key Principal/Loan Guarantor.

Super LPs, Sideletters, Loan Guarantors: For most LP passive investors, the average investment in deals tends to be around $50,000-200,000. This falls right in line with my guideline to not to invest more than 5-10 percent of your net worth or into any single project to maintain diversification. However, higher net worth investors have additional opportunities available to them.

One option is what can be referred to as a “super LP,” which isn’t an official term in the space but sounds really cool for purposes of this section and I normally buy them all the drinks they want at the events we do! These investors contribute larger amounts than typical limited partners, ranging from a quarter million to over a million dollars. This benefits the GP by enabling faster capital raising, reducing administrative fees, and minimizing the number of tax returns to be completed.

The general partnership is thus incentivized to work with these super LPs, as it’s a mutually beneficial arrangement.

As a higher net worth investor on the Rooftop, if you find a deal you like and are comfortable with the sponsor, consider making a larger investment than usual. Initiate the inquiry with a phone call or email to the GP, asking if there are any incentives for any larger investment over X amount. This may result in better treatment, such as a preferred rate of return or an equity boost. These arrangements are often documented through sideletters or email MOUs between the involved parties.

Some investors seek out new and less experienced operators and write large checks, aiming to negotiate better splits and arrangements. While this practice occurs, I personally don’t recommend it. It involves investing with newer operators who have less experience, and that always brings risk.

Key Principals (KPs) or Loan Guarantors: Another tactic employed by larger net worth investors in syndications is to become a key principal (KP) or loan guarantor on a project. In real estate ventures involving bank loans, there are qualifications to meet in order to obtain the loan. One of those is that the combined net worth of the individuals must be equal to or greater than the loan amount. Typically, a key principal group within the general partnership signs their names as recourse or non-recourse guarantors.

If you trust the individuals involved, it may not be a bad idea to sign your name as a key principle and receive a share of the general partnership in the process. However, it is not recommended to engage in this strategy with newer operators, especially if their combined net worth is below the $30 million threshold. Think about it. If the GP’s track record and success is legitimate, why is their personal net worth so low? Consider the downside should a deal go south even in a non-recourse deal with “bad-boy carve outs” which essentially means that the debt can turn to recourse if there is any foul play involved by the sponsors.

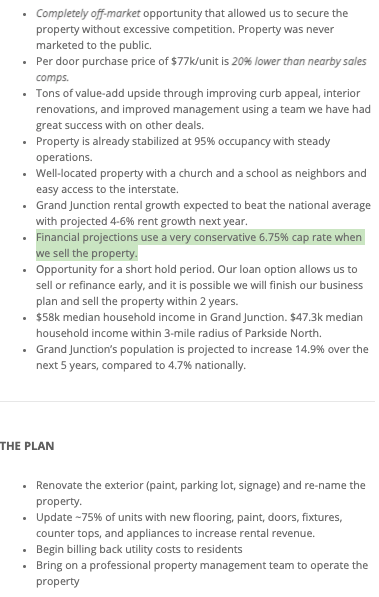

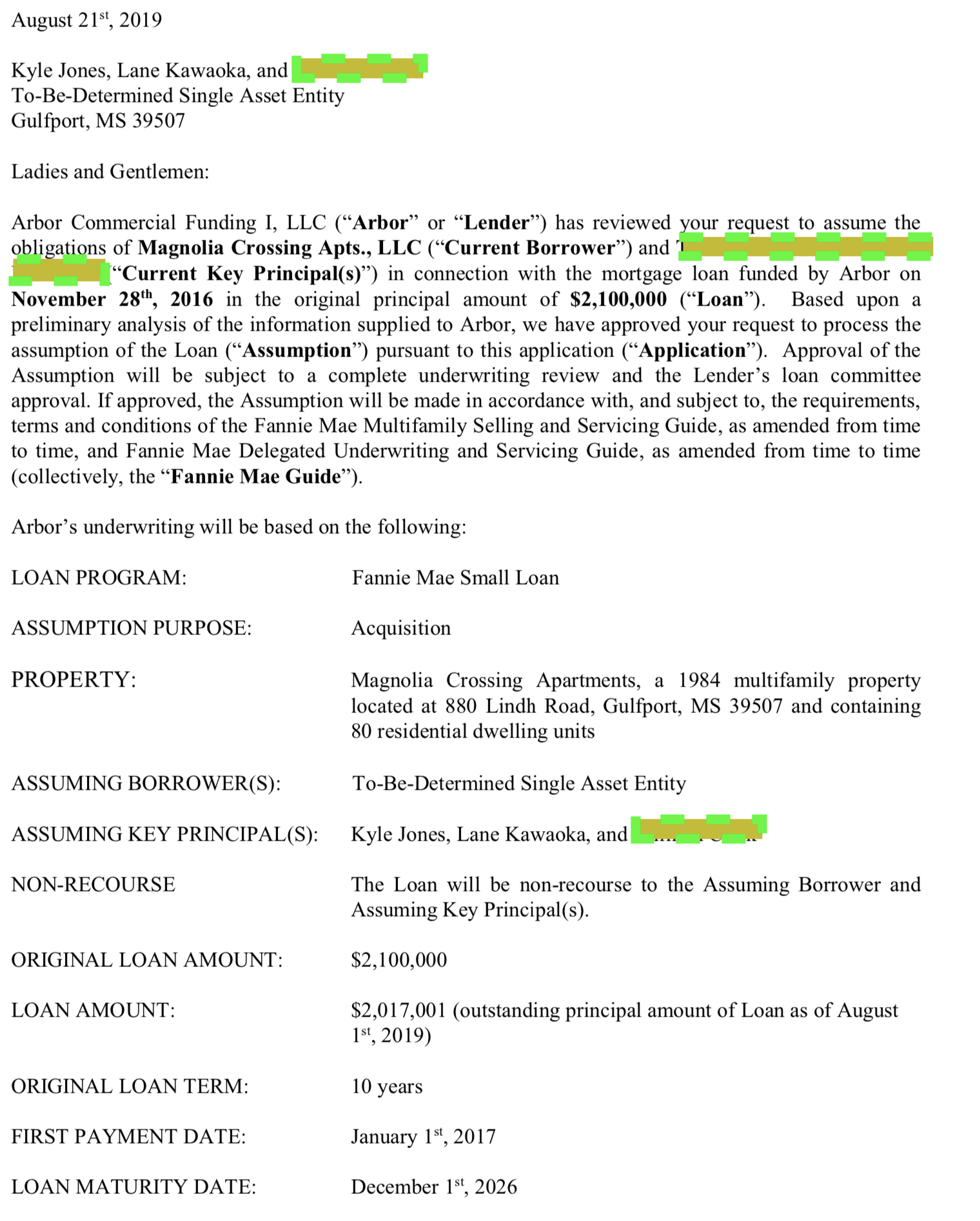

Below are loan documents that I signed to take over a non-recourse loan as a KP/Loan Guarantor. We had another high net worth guy also sign with us and he was compensated for it as part of the GP.

This could be you (minimum $3M net worth required)…

Here is a short list of some of the major impacts we have faced so far:

1) At least 5 documented fires (three of which burned down the structure – here was one of them that we eventually sold for 129% Total Return or 2.29X Equity Multiple – over the 2.5 year ownership period, that equated to an IRR of 32%)

2) Two full front hurricanes

3) Multiple tornados (these are the easiest and the least of our worries because they are the simplest claims and isolated incidents plus there is much city support when it happens)

4) One tree falling on a roof, taking out a dozen units

5) And a freak ice storm in Texas – who knew!

In progress rebuild of our our Irving property that burned down. Upgraded from 1990s to 2022 standards!

Consider the following:

1) We carry adequate insurance coverage. Even more so than we would feel is cost-effective but is mandated by the uber-conservative bank to over-insure the asset where they have the greatest amount of interest in the capital stack.

2) As with all disasters, we carry commercial-level insurance which includes loss rents. The only trouble here is paying for costs out of our operating account in the period between when the insurance company checks are cut to us the owner. This is why we have adequate working capital, cash reserves, and the sponsors are personally well-capitalized to minimize the chance for a capital call. Even in that extreme circumstance, we have countless ways to cut costs which is why we invest in this type of asset class. In past cases, units have been out of service for weeks or months however in a way we are “off the clock” racking up our loss rent checks even though the units are not occupied.

3) We always get third-party claims adjusters to maximize the claim paid to us. In our experience, we have gotten up to 2-3x what the claim settlement was originally proposed. Most amateur operators would accept these… I know when I was a single-family home investor from 2009-2015 I would have done just that and would not have the capital to pay for a claims adjustor plus the claims adjustor would not want to work my small claims anyway. In many cases, we come out ahead of where we started before the unfortunate incident! Once we were able to use a “hail storm” to get brand new roofs with just the $5,000 deductible on our already perfectly fine roof. Although we are not thrilled when any instance takes place because it stresses our asset management team’s bandwidth temporality. (it’s our job, we know!) We are cautiously optimistic that we can come out ahead!

4) When we had the unprecedented ice incident in Texas in 2021 and all the little mom and pop amateur landlords were frantically bugging their overwhelmed property managers who were trying to find any plumber in town, we were knocking out our own work orders with our in-house maintenance staff. This was a great example of our staff’s ability to be self-sufficient, of course, we do share human resources and some supplies if needed among assets in the same metro.

5) One of our fires burned down an entire building under construction. In this circumstance, it puts us in a better position because at that point, the GC owns the delivery of the final product and they are ensuring the completed product. Although it is not our job as the owner, Lane’s attitude when he was in the construction industry was that every contractor/owner wants a completed project to move on to the next one and as the owner we want the contractor to complete the project in such fashion to make a fair profit so we can do business again. It comes down to honor. So we do our part to ensure contractors are not cutting corners to ensure a properly paid insurance claim (which would probably result in a huge loss or bankruptcy by the CG) by doing the little things like recommending and in some cases paying for wifi security cameras to keep an eye on expensive materials like lumbar, quality assurance to ensure safety protocols are met, and communicating with municipalities site impacts we feel its the right way to do business and that we are all accountable to a project that is on time, on budget, and meets expectations. Lane spent 12 years as an engineer mostly on the owner’s side overseeing construction and unfortunately, a lot of it was on the boring side ensuring the project was covered insurance wise, documentation, arguing unforeseen conditions with contractors… or in other words a lot of the stuff that had to be done due to the existence of lawyers and natural disasters/acts of god/human factors errors.

Overall, passive investors should not worry about specific events, and why we always recommend diversifying your portfolio with not more than 5-10% of your net worth into any one deal. By doing that you can relax and let your GP (who is incentivized to achieve the same goals) do the stressing and leg work that is necessary to manage the asset (and property management team) to maximize the returns.

Recent Investor FAQs

We do the cost seg on the partnership level and distribute the losses on your Individual K1.

You mentioned getting a real estate professional status can help me deduct taxes even more – can you point me to where on the website that is? Couldn’t find it.

If you are able to implement a real estate professional status tax strategy (REP) you can use passive losses from syndication deals to lower your ordinary W2 income. If not (ie two full-time working spouses) your only other option is going into land conservation deals, solar deals, or oil and gas deals – all of which have some risks.

Taking step backwards depending on how verse your are in this subject…

1) There are ordinary/W2/active income on one side. Lets call that the 🙁 side.

2) And there is the happy side… passive income (syndications, passive partnerships ie medical/dentist offices) and passive losses (depreciation, bonus depreciation via cost segregations common in syndications). You can you passive losses to neutralize/eliminate passive income. Thats what this is the good side and why passive losses are called PALs too for passive activity losses.

So there is a barrier between 1) Active Income and 2) Passive Income above. You cannot offset passive losses (PALs) for active income. UNLESS you are are real estate professional status for tax designation purposes and able to create a “grouping/active participation”. We work with our FOOM folks to help them craft their individual plans if REP status is possible for them. I get frustrated because most people a) don’t stick with this and try to learn it… trust me its easier than first year college physics… but it will take you a few times to get it and after networking with real people doing this or b) they say its seems risky and listen to their lazy/ignorant CPA who by the way has been stuck in they same occupation for 20-30 years… why would you want to take financial advice from someone who is not financially free. If you came to our Bubble/Masterminds or met a few sophisticated investors in our community you would likely fire your current tax professional.

So when a deal is successful and sold (full cycle) what happens then?

All investors will have to pay back the depreciation recapture (losses taken throughout the hold) and capital gain (the big payout on the end which is sale minus cost basis). But don’t despair because although this is the case when you look at it myopically, in reality most investors go into multiple deals accumulating 100s of thousands of passive activity losses in their first few years investing. Those losses do not go away, but they become suspended to be used to offset future passive income and sales/capital events like this in the future. When you exit a deal, what normally ends up happening (like Tom Brady keep winning more Super Bowls) is that you go into two more deals (with now double the amount of capital) and you will likely find that with those new K1s you could result in you having way more passive losses you began with If you can see where this is going… yes, experienced investors with a lot of capital deployed might have 500k-1M+ suspended passive losses and have not paid taxes in years and do not appear to pay taxes for years! (you can find how much suspended passive losses you currently have on your IRS Form 8582 – which your CPA is likely not giving to you and in that case you should get a new one)

PS – I am not an CPA or attorney but I became financially free doing this for myself after 10 years working as a w2 engineer 🙁 and I am sick and tired of seeing highly educated and hard working professionals getting stuck in the rat race because we deserve financial freedom and the option to do more with it.

More info – SimplePassiveCashflow.com/tax

Ummm I’m still confused why are we doing this again?

Investing in a boring asset that is stabilized today makes sense. And that asset is something that this country needs more of which is value/budge housing for the lower class (since the middle class is shrinking). Add in the value add component to force appreciate the asset price and your capital

I’m still confused?

Look… Past performance is not an indicator of future success but here is the numbers of our most recent close (70-unit in Huntsville, Alabama).

Treehaven Sale Price. $3,000,000

Actual closing costs $131,267

Subtotal $2,868,733

Total Investor principal returned to LPs $647,500.00

Hypothetical amount remaining to split 80/20 $877,554.16

Hypothetical amount to Investors $702,043.33

Hypothetical amount to Managers $175,510.83

Total Property Return 135.52%

Total Investor Return 108.42% (For LPs in three years)

Total Property IRR 30.68%

Total Investor IRR 15.53% (Over the 3 year hold)

I still don’t understand?

Investor more than doubled their money in three years. That is what we are essentially trying to do here. We project it will take us 5 years but we try to exceed targets.

Continuously build your generational wealth

Too often people make the mistake of not taking action. Setup your free strategy call here.