9) Tax & Legal

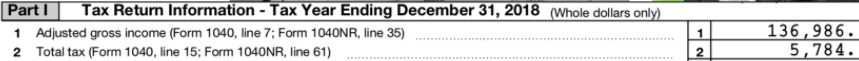

Part 6 of 8 - Tax & Legal

- Estimating property taxes

- Depreciation

- Other possible deductions

- 1031 exchanges

- Bonus depreciation & cost segregations

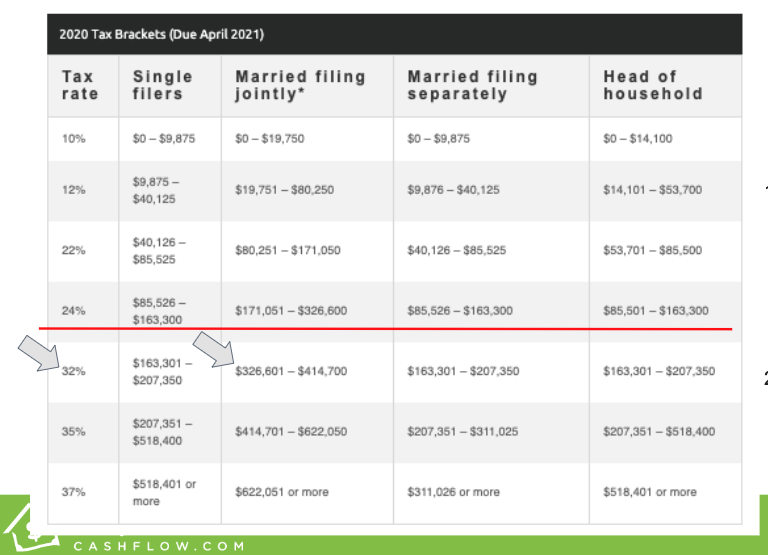

- Tax bracket-ology

- Insurance

- Umbrella Insurance

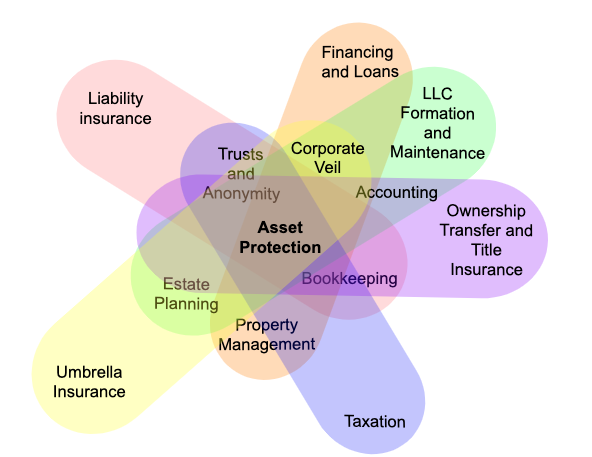

- Entities & Asset protection

- Legal best practices

- Other resources for passive investors

- Runtime – 22 minutes

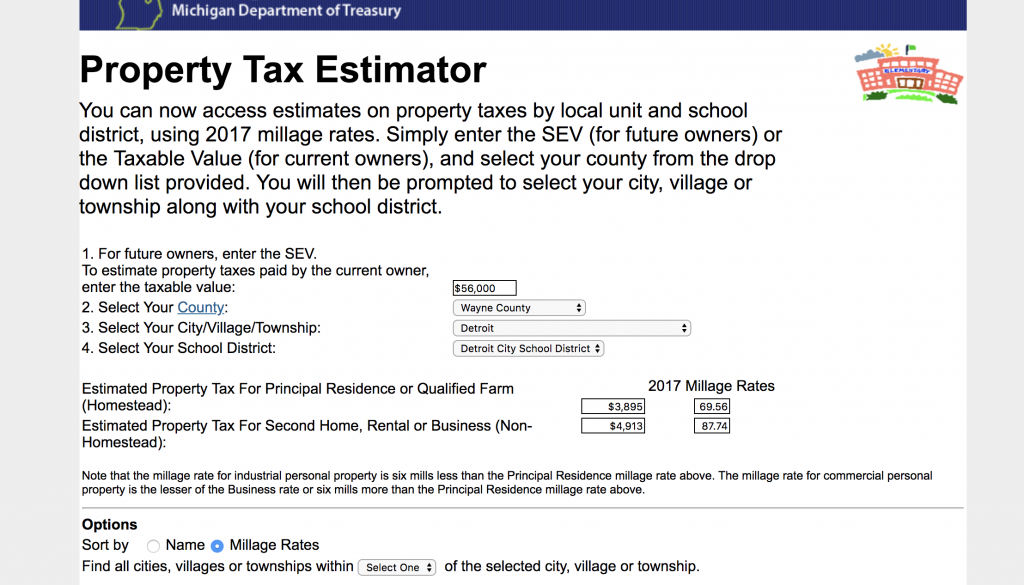

How Much Property Taxes Will I Pay?

Taxes are based on the value of the property. You have to assume the property value will come up and you need to calculate out the increase on taxes.

Every State/County/City taxes is different and requires some digging.

This is where having a network to support you and co-source within our Incubator group you due diligence is important.

Tax Benefits

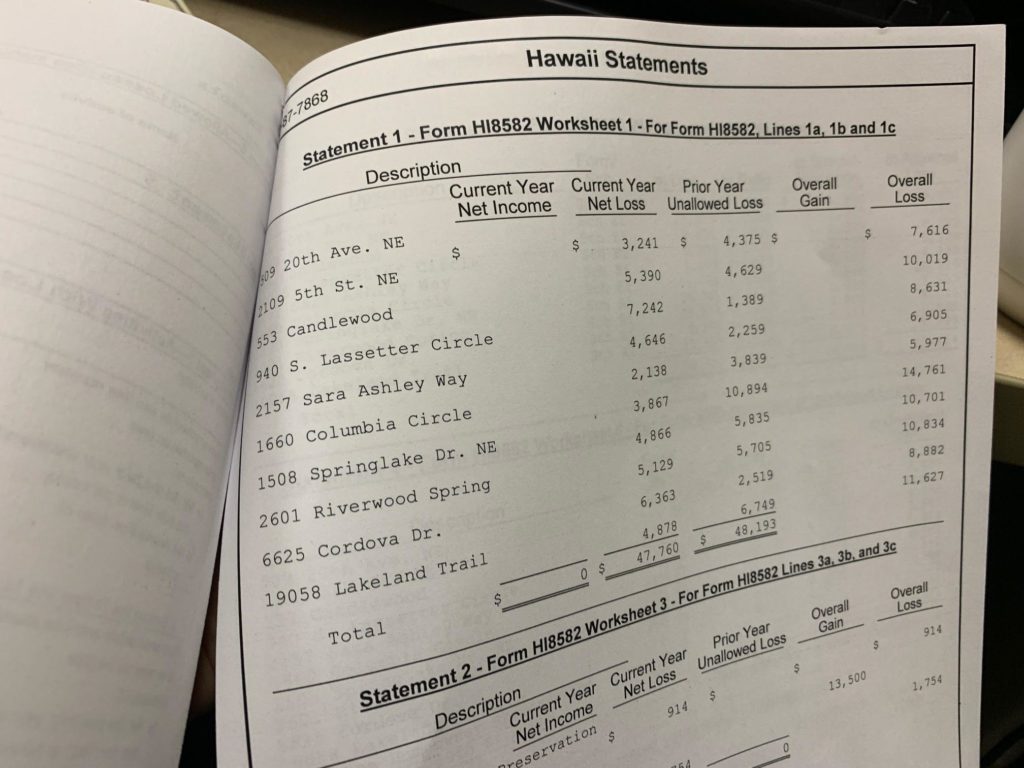

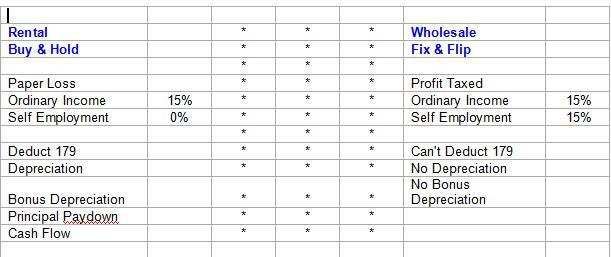

The cool part about rentals is how you are able to create a paper loss.

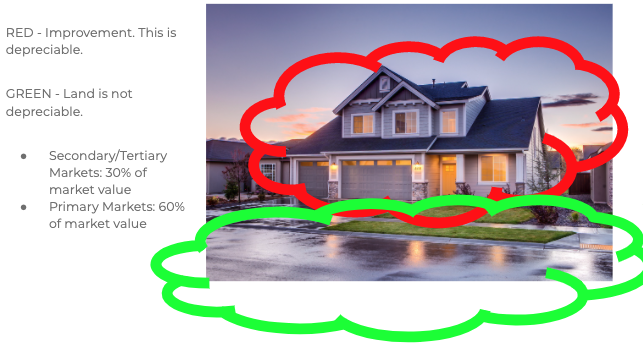

For single family homes, you can take 1/27 the value of the property (minus land value because that does not devalue over time) per year for 27 years. This is what is shown to the above.

We ❤️ house flippers… they pay our share of taxes!

A cost segregation juices this deduction as it puts the asset on a more aggressive depreciation schedule which front-loads as much depreciation as the tax code allows.

This is one of the reasons why bigger deals are better because they can support a 5-8K cost segregation study.

Tax Deductions

What tax strategies should a startup real estate investor be aware of or plan ahead for?

Deminimis safe harbor – $2500 per line item per invoice (ie refrigerator) to avoid having to depreciate the asset over many years – [if you can buy something under the $2500 threshold DO IT]

Legal

Purchasing Under Your Own Name or an LLC

Purchasing under your own name: When you purchase under your own name, you are personally responsible for the mortgage on the property and you may be subject to litigation if sued by tenants. Most investors close under their personal name because Fannie Mae/Freddie Mac will require a person not an entity to sign for the debt of a rental. Then once they close they swap the title into their entity should they decided that is an appropriate means of protection.

Purchasing under a Limited Liability Company (LLC): An LLC is a separate legal entity that can also own real estate. When you purchase a property under an LLC, the LLC becomes the property’s owner.

Some mistakes that new investors make when investing under an LLC:

- They are the sole owner of an LLC, which will most likely be considered a disregarded entity and lose all of its liability protection

- Most conventional lenders only work with individuals, so your personal name will be listed on the loan documents, so it eliminates any liability protection provided by the LLC.

Do I need to have a LLC to take tax benefits?

LLC’s may not be appropriate for beginner investors because they have a lower net-worth and may not receive the full liability protection. Of course consult a profession who will likely be trying to set you up with a costly entity*…

*Consult your lawyer

If your loan is Fannie Mae, then you are allowed to transfer the underlying property to an LLC at least majority owned by the borrower. You still need to notify your mortgage servicer and they may charge you fees to get some type of consent or authorization letter for the transfer. (Source)

As you purchase 5-10 or more rental properties (net worth goes over 250-500k), and looking into a more complex legal structure that can provide liability protection and tax benefits will make sense. When you get to that point, enlist the help of a good real estate attorney to help you figure out what will work best in your situation.

Of course every situation is different and we can help you think through what is most appropriate for you in the Incubator calls.

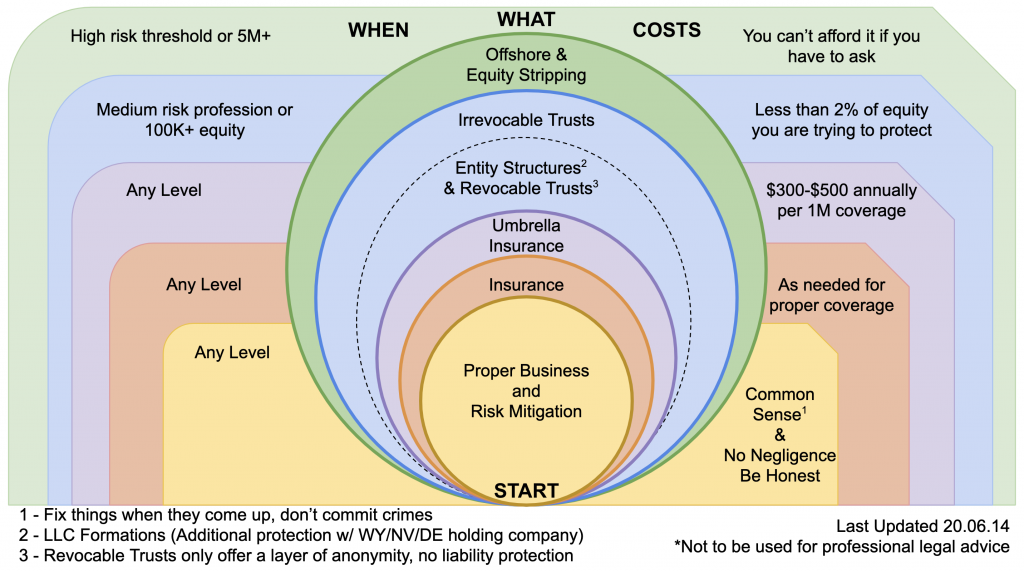

*Lane’s non professional opinion: One of the best forms of asset protection is to not be a target and you can achieve that by not having much money to go after in the first place. Many people under $250-500k net worth are not big targets for litigation in the first place. And often times the clientele in our rentals are not financially solvent to fund a heavy litigation. Often times the biggest liability comes from outside the investment (hitting someone in your personal vehicle on the way to the supermarket). One of the first initiates in our 12-month Passive Investor Accelerator program is to get $1M Umbrella Insurance exactly for this. Wherever your net worth is you should have this… even before about thinking of any entities.

If I have two rentals how many LLCs should I get? (Note this depends on your net worth, equity, and risk tolerance)

The Essentials:

- Legal advice for High Net Worth Investors

- 127 – Estate Planning and Asset Protection with Lawyer Andrew Howell

- General Guide

- Special link to book a complimentary session to the CPA/Legal team I use

The Pillar of Protection:

- Anonymity

You may not realize this, but all your information is exposed online. All I need is your name and a general idea of where you live and I can find out all about you – what you own, how much equity you have, etc… This makes it super easy for litigation attorneys to crunch some numbers and decide whether you’ll be a profitable business endeavor. If you are, they will sue, and you will most likely pay them off. Anonymity hides your information from the public eye, making you look like a beggar. And nobody sues beggars. - Liability

If you’re sued, it isn’t just your property that’s in danger. Your entire net worth is at stake. Creating a Limited Liability Company (LLC) is one of the most common ways of protecting your personal assets from a business lawsuit. It keeps your business and personal life separate – it’s the best kind of work/life balance. - Separation

You’re going to want to create decoys as well. You can do this by creating a shell company. I’m sure you’ve heard about these on the news, most likely related to shady government schemes or oil companies. The reality is much more practical. A shell company is what conducts your day-to-day operations, but it doesn’t hold anything of value. You should require tenants and others to sue your shell company within the contract language itself. That way, even if they sue you they’ll get nothing and you just need to spin up a new shell. - Isolation

Just like lawsuits can spill over from your business into your personal life, they can also spill over from one asset to the others. And just like you did with your personal liability, you’ll want to separate each asset from the others. You could do this by creating multiple LLCs and trying to manage them individually, but that gets expensive and complex very fast. Instead, you should be looking at more robust entities, like a Series LLC or DST. These allow you to scale infinitely and for very cheap, while providing the same or better levels of protection. - Insurance

Last but not least, you need insurance. It’s just important not to put your faith in it the way so many investors do. Remember: insurance companies are for-profit corporations. Think about all the natural disasters and how the insurance companies try to wiggle out of responsibility every time. They do this because they are trying not to lose money. They will do this to you as well if the opportunity arises. So yes, buy insurance, but don’t let that be your one and only line of defense.

California Investors: How do I get around the $800 CA LLC fee for my rentals?

PS Don’t invest in the Socialist Nation of California – 1) Rent-to-Value Ratios don’t work, 2) Its a very anti Landlord blue state, 3) They tax you like crazy.

Within the next two weeks:

Read through this article to learn different types of tax strategies for beginners and experienced investors!

Consider jailbreaking your 401K/IRA

And check out SimplePassiveCashflow.com/covid19 for info about the 100k withdrawls in 2020.

Remote Investor Incubator

Check out the Remote Rental workshop for additional information on “Tax & Legal”.