8) Operating the Property

Why Hiring a Property Manager Is Usually More Efficient

Here is why you should get a property manager:

- Save time: Property managers usually charge only 8-10% of the collected gross rent (and 50-100% of the first month as a lease up fee). The amount of money you will save by not having one will not justify the 10+ hours per month you will spend managing a single property doing the tasks shown on the right. The people taking this course and in the Incubator make good money at a day job and therefore should focus on being an investor not a landlord. If you managed a property on your own doing all the tasks (shown on right) you may end up spending 10+ hours a month on a single rental property.

- Reduced expenses: Most property managers are able to get discounted rates with many contractors due to the volume of the business they bring them – something you will not be able to do yourself. However lets face it as remote investors we will have to do a bit of work to keep expenses down and verify larger expenses (over $1,000) and help out will getting competitive bids to keep our property managers honest.

- Increased revenue: A property management company is likely going to be more experienced at advertising rentals and have a better understanding of the local rental rates. They are also local specialist who know the going rate for your property as this frequently changes. This puts them in a position to maximize the potential income from your rentals.

- Decreased likelihood of lawsuits: A management company will likely have extensive knowledge of local landlord and tenant laws, helping shield you from costly lawsuits. I always used them as the “bad guy” to enforce good collections and payment plans. The property manager can also be a barrier from you in some frivolous anti-discrimination claims. I always let my property managers redact information such as race, age, or whatever protected class there is these days as a means of separating myself. Having a property manager is another barrier of insurance (literally).

When I was in college I remember my landlord drive up on the weekends in the used Mercedes S class to unclog our toilets all while his poor wife waiting in the car. This is the old school way and not scalable.

Part 5 of 8 - Property Management & Operation

- Using property management

- Best practices

- How to interview a potential property manager

- Late payment and eviction process

- Runtime – 36 minutes

How Property Management Works

Managing Tenants

The first thing you or your property manager will need to do is find and manage the tenants that will occupy the home.

Here is what tenant management usually entails:

When you own rental properties, you will have two types of expenses related to maintaining them in good condition:

- Regular Maintenance and Repairs: Examples include clogged sinks, broken fixtures, painting touch ups, landscaping and cleaning. These items will be reported by your tenants or will come up during the move-in and move-out inspections. A property manager will often have a team of handymen, plumbers and electricians who can fix these items.

- Capital Expenditures: Examples include roof replacement, appliance replacement, HVAC or water heater replacement, and plumbing or electrical upgrades. These are usually large expenditures that will not come up often (for example, every 10-20 years for a new roof). You will need to plan for these ahead of time and schedule a good time to get them done, usually when the property is vacant.

Make sure to ask for pictures and documentation when major repairs are made!

Be a sweaky wheel, let them know you are paying attend but don’t micro manage and be a pain in the ass.

Paying Property Taxes and Insurance

If you used financing to purchase the property, your lender will typically pay property taxes and insurance on your behalf for the duration of the loan.

If you will be paying property taxes and insurance yourself, check the local county tax collector’s website to find out when property tax bills are mailed out and are due, it’s best to set-up auto payments or calendar reminders. Your insurance broker can tell you when your insurance is due for renewal.

You can also ask your property manager to pay property taxes and insurance for you. If you go this route, double that they in fact did so when the time comes.

Keeping Accounting Records

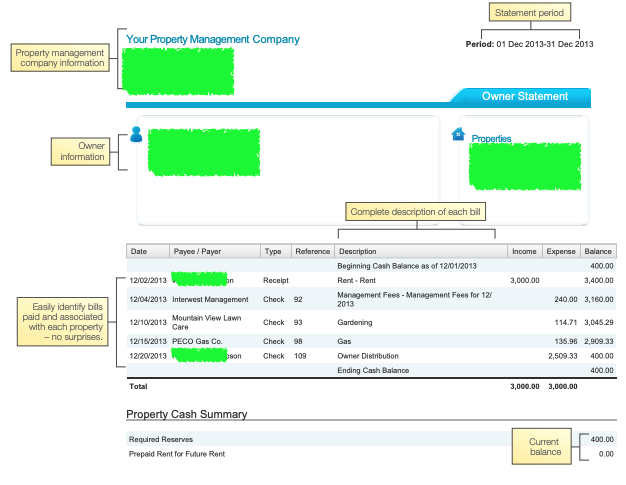

If you use a property manager, accounting will be fairly straightforward. Your property manager will send you monthly and yearly statements that will show the collected rent and all expenses paid during that time, including property management fees, maintenance, repairs, utilities, etc.

If you’re going to self manage your property, you will need to keep your own accounting records. You may want to check out software programs like QuickBooks or Wave to help you do this.

Here is a sample owner’s statement generated by AppFolio, a very popular professional property management software:

Always review these statements for accuracy, save them, and contact your property manager if you have any questions.

Dealing with Problem Tenants

No matter how good the tenant screening process is, things will happen that you and your property manager did not (or could not) foresee. Here are some examples:

- Your tenant falls on hard times, stops paying rent, and refuses to leave the house.

- Your tenant starts making unreasonable demands, requesting upgrades that go beyond maintaining the property in good condition.

- Your tenant just disappears, leaving the property a mess.

These are the steps that you and your property manager should take if the situations above do arise:

What to Look for When Picking a Property Manager

Here is what you should focus on when screening property managers:

- Communication: You want someone who is quick to return your emails and phone calls, and is transparent and proactive when talking to you or the tenants.

- Monthly Fees: Property managers charge a percentage of the collected gross rent for their services. This fee should not be higher than 8-10%. Some companies have a minimum amount they charge even when the home is vacant, so ask them about that.

- Tenant Placement Fees: These are one-time fees for finding and placing a tenant, usually as a percentage of one month’s rent. These should not be higher than 1 month’s rent.

- Lease Renewal Fees: Should not be more than $100 – $200 to renew lease with current tenant.

- Advertising Fees: Since advertising is free to do online, I would avoid property managers who charge these.

- Inspection Fees: A good property manager should not charge you for move-in and move-out inspections and should be willing to take pictures of the property while conducting these.

- Maintenance Markup: Some property managers will up-charge you on any maintenance and repairs performed on your property. This is more common in areas where the rents are relatively low.

- Number of Properties Under Management: 50-150 is a small operator, over 1,000 units is institutional grade. Small operators know the tenant by name and know exactly what happens, they often have poor systems but make it up with exceptional service. Large operators are not as personal, they might have someone different answering calls.

How to Find a Property Manager

Many turnkey companies have in-house property management departments. I feel that using their in-house property manger gives them a higher incentive to sell you better properties, since they will have you as a client for a long time after the sale.

If your turnkey company doesn’t have in-house property management, ask them for referrals to companies they closely work with. In addition, ask other local real estate investors, or search on BiggerPockets for additional referrals.

It helps to get contact information for 2-3 potential property management companies, interview all of them, and pick the one you feel will work out best.

How to Interview a Property Manager

- How long have you been in the property management business? (Three years of experience or more is ideal)

- Are you an active real estate investor in your market? If not, why not?

- In what areas do you service? (This will tell you if the manager has a thorough understanding of the area so they can advertise to tenants with the right rent prices based on where the property is located. And you want to know if you can use the same property manager if you buy another property in the same area.)

- How many properties do you have under management? How many properties does each employee manage?

- Can you send me referrals to 2-3 investors who use your service?

Neighborhood:

- Which areas or zip codes do you recommend for buying rental properties?

- What is the typical tenant quality for a given area? Are straight rent or Section 8 tenants more common?

- What is the typical vacancy rate for a given area? On average, how long does it take to find and place a new tenant in a property?

- Do tenants usually bring their own appliances or are they supplied by the landlord?

- What is the typical rent for the area and the property size that I’m considering buying?

Fees:

- What is your typical monthly property management fee? Do you charge even if the property is vacant?

- What are your other fees, including tenant placement, lease renewal, advertising, and inspection fees?

- Would you be able to do a full walk-through inspection of the property during tenant turnover and take lots of pictures?

- Can you do an annual inspection upon my request with pictures, do you charge extra for these services?

- Do you offer project management services? If yes, how much do you charge for this?

Tenants:

- How do you advertise the properties you manage?

- How do you screen tenants? What are some of the red flags you look for?

- What are the typical terms and duration of lease contracts you sign with the tenants? How do you handle security deposits? Late payments?

- How do you handle tenant problems? Disputes? Evictions?

- How many tenants do you evict, on average, every year? (A high eviction rate signals that the company lets a lot of bad apples slip through their screening process).

- What specific programs do you have in place to increase tenant retention and satisfaction?

Finally, ask the property manager to send you samples of the following documents:

- Property Management Agreement: This is the agreement that you will sign with the property management company that outlines their services. Note their rules for direct deposit, accounting statement delivery, and maximum authorized maintenance budget.

- Lease Agreement: Ask for a sample lease agreement that they use when placing tenants. Look at it’s duration, auto-renewal policies, late payment policies, and rent increase provisions.

- Monthly and Yearly Accounting Statements: Review a sample monthly and yearly accounting statements that they send to the property owners. The vast majority of good property managers use a software program called AppFolio that generates very detailed statements. If they use something else, make sure it shows all of the important information in a format that’s easy to understand.

There will be problems!

Case Study with Conflict with Property Manager

The following is a case study from one of our past students who we help resolve a dispute with the non-responsive property manager.

“My property manager has not been very responsive. I’m losing profit waiting trying to rehab the place. The tenant is telling me that she can barely reach him. I reached out to other property management companies but they cannot move forward without a cancelled contract and notice of 60 days I believe. What’s the best option to do here. I was considering calling a lawyer as my patience ran out. Last message he replied was he was dealing with taxes issues but never replied back since. Do I wait another month.” -Student

“I would have them give you a timeline to get back to your and complete the needed work. Did you define scope, schedule, budget formally? If so please send that over so I can look. Probably should look for a new PM. Again this is why I don’t advocate for non turnkey properties especially for high paid professionals.” -Lane

“No, I agreed once he asked to have 10% of the cost of the project in order to manage as we will provide scope, schedule. and cost estimate. I asked for it 2 months ago and have yet to get an estimate. I grew impatient with waiting as we are heading into 3rd month and no estimate was provided in order to move forward with the rehab. My strategy is to continue to email and text until I hear back sometimes I have to be very pushy to get things done. Some of the actions I was considering is to get my own contractors and monitor the whole project myself. which means I will need to get the contractors a place to stay near the property, and I also find a place to stay in. But that can also be an additional cost than waiting. This was before I discovered the contract needs to be cancelled before I can do anything. I attached the list of repairs and pictures of the place needed. I just don’t know what the next step is when I don’t hear back from the property manager.” -Student

First draft sent to Property Manager

Subject: Re:

Reworded correspondence sent to Property manger

Joe,

I am following up on my email sent on July 21st at 7:32PM.

Emails on Jun 19, 2020, 6:46 AM and Jul 21, 2020 at 7:32 PM.

And texts on: June 22, June 26, June 30th, July 6th, July 11th

I did receive a text reply on July 11th saying you were busy with taxes and will get back to me about the contractors soon.

If you do not contact me with a formal schedule I will be forced to engage with another property manager provider due to non-responsiveness and void our previous agreement. The safety of my tenant is my upmost concern.

Please respond no later than end of business on Thursday, July 30th, 2020.

NOTE: This is not legal advice here but it gives clear direction while creates a paper trail incase the service provider wants come to back after the breakup. Or worse claims that they should be entitled to a brokers commission should you sell the property.

What do Tenants Want?

We have put a lot of emphasis on what makes a good property but lets flex some empathy here and think about it from our tenants view point. Imagine if you are a B Class tenant where you make 35-60k a year (may or may not have kids or a supporting spouse). Here are things to keep in mind as we provide quality housing at good value:

1. Location

Location is the #1 priority for tenants. Most tenants are willing to drop off other wish list items for the right location. Tenants look for rental properties that are close to work, school, groceries and entertainment, depending on their priorities. Many investors miss the mark when it comes to location. They often try and purchase in a less expensive area, and that can result in high vacancies and lower rents. Typicaly the prime real estate is worth it’s price tag.

2. Safety

Tenants want to feel safe at their home and in their community. They look for security gates, cameras on premise, low crime rates in the area, and an attentive staff. Anything additional you can do to make them feel safe is a big win.

Also, taking COVID into account, they want their health to be safe as well. We just launched a program where a tenant can lease virtually and unlock their home with an app, so there is no human contact if they prefer it that way.

3. Parking

You have to have reserved parking and also enough parking for two cars. If tenants can’t park by where they live, they don’t want to live there. This should be one of the first things you take into account before buying a rental as well. How far away and adequate is the parking.

4. Open Floor Plan

Open floor plans are a trend I think is here to stay. Long gone are the days of a separate dining room with the hangin chandelier. If your rentals don’t have open floor plans this may be something you want to consider.

5. Clean and Tidy

A clean and well lit rental will win every time. Don’t skimp on the professional cleaning company when you turn a unit and make sure it has the just been cleaned scent. Lastly, no air fresheners. That will only make people question, what are you hiding?

6. Storage

Most landlords don’t think of storage within the unit when buying a rental. Tenants look for space for their stuff, including outdoor equipment like bikes and skis. That is why walk-in closets or garages are a big draw.

7. Pet-Friendly

A lot of landlords shy away from allowing pets in their units. In our apartments we have fully embraced our furry friends and in turn their owners. We have found with the right pet deposit and monthly pet rent we attract a nice group of tenants that responsibly take care of their fur family. We believe most pet owners are not stable in living turnover when they have a pet. Of course its a different case when you are talking about the cat-lady/guy with 6+ cats or someone with 2-3 vicious Pitbulls (fighting dogs).

8. Quality Landlord

Finally, like any business, your business start with you. You have to be a quality landlord to attract quality tenants. This means fixing items in a timely manner, being professional, and hiring quality contractors.

Within the next two weeks:

If your turnkey company has an in house property manager, make sure to interview them.

If you don’t use the in-house property manager, take what you learned from this lesson and find 2-3 potential property managers, research their website, ask unanswered questions when you interview them, and choose the best one.

Incubator students… we will help you out with referrals but it might be wise to practice on another property manager (a random one) just so you don’t come across as a newbie to a proven property manager company and they decline you as a client.

Remote Investor Incubator

Check out the Remote Rental workshop for additional information on “Operating the Property”.

Deeper Learning