6) Syndication Documents

Syndication Investment Process

Signing of the PPM (electronic or physical) and order of wiring funds are done in different orders, sometimes investors will wire the funds first, then be confirmed in the deal and sometimes it’s the other way around.

Frankly, the closing of the asset with the Bank and seller is the priority. Linking dozens and dozens of investors’ $50,000-100,000 wires and signing the investor PPMs is another task that has to be completed in parallel.

Below is an example timeline of the syndication investment process:

Understanding a Syndication Deal (PPM)

A Private Placement Memorandum, or PPM, discloses everything an investor needs to make a decision to provide funding. This is going to be your “go to” document for everything as it traces and depicts the provisions of an investment opportunity and incorporates the task subtleties, potential contributors, course of events, foreseen rate of profitability, legitimate revelations, and likely dangers.

These legal documents are required by the SEC when making an offering to the public.

Overall, the PPM documents can cost $10,000-30,000 for one deal.

It’s important that your deal has a PPM, make sure it’s coherent, professionally put together, and free of false information. I have yet to see one PPM without a few immaterial typos. Most lawyers use a cookie-cutter PPM format and slightly alter sections depending on deal specifics and payout structure.

The SEC says the lack of a PPM is one of the top 10 red flags that you’re being scammed. If the documents don’t even pass this initial smell test, it’s time to move to the next opportunity.

PPM Outside Structure: The Regulatory Side Of A Deal

When reading through a PPM, you will see the following sections:

- Summary of the Offering

- How to Review the Offering

- Investor Suitability Standards

- Regulations and Investor Qualifications

- Summary of the Company

To properly understand the deal, you need to go through them all.

Understand that all PPM’s are different so this is a high-level overview of how most PPM’s are organized.

Summary of the Offering (Executive Summary)

This is your introduction to how the syndication company is being structured to manage the investment.

A typical summary offering includes:

- Photos of the property and area

- Overview of the submarket

- Liquidity (for multifamily syndications, one drawback is limited liquidity, you should plan on keeping your money in the investment for the entire hold period)

- Summary of principal terms (outline of organization of company, what fees the investor will pay for and what fees the sponsor will pay for, how profits will be split, and the business plan summary)

- Risk factors and conflict of interest

- Projected returns and exit strategies

- Use of proceeds (how the company plans on purchasing the property, improve, operate, and sell the property)

- Management Team Bios

How to Review the Offering.

Pay attention to the following agreements, these will help you understand the offer:

Limited Partner Agreement

This describes how the Company will be run (voting, meetings, distributions, etc.). It lists all the rights and duties of the LPs and GPs.

Subscription Agreement

This describes the investor to the GPs, giving details about their qualifications to invest, how much they will be investing, etc.

Investor Suitability Standards

Make sure the syndication is suitable with you. Are you an accredited investor? If you’re not, but you are a sophisticated investor then you must invest in a 506(b) deal.

Review Module 2 if you need to review 506(b) vs 506(c) deals.

The PEP Fund will be 506C and therefore Accredited only so start working on your accreditation letters if you want to grab founders shares bonus.

Accredited investors… this means that you will to get third party proof of Accreditation which is a pretty since process which will be a seamless process in our signing portal but wanted to give you the heads up now.

I don’t want to go to jail or at the very least pay 200k to fight a legal battle with them. You can thank your government for that… I just don’t want to end up like a lot of those daisy chain syndicators that got busted. A lot of those guys are or too small for the SEC to go after but then again they don’t have anything to lose whereas we are a substantial investment group it is not in my best personal interests to keep operating as I once have… sorry.

- Take a series 7 or 66 test as I hear this will satisfy you to be Accredited.

- Easy method – Get a letter from a licensed professional (CPA/lawyer). This is probably the easier method if you are right on the edge.

- Difficult method – A website like VerifyInvestor.com will be able to third party certify you. However I hear they only last for less than a year and they will ask for a lot of documentation.

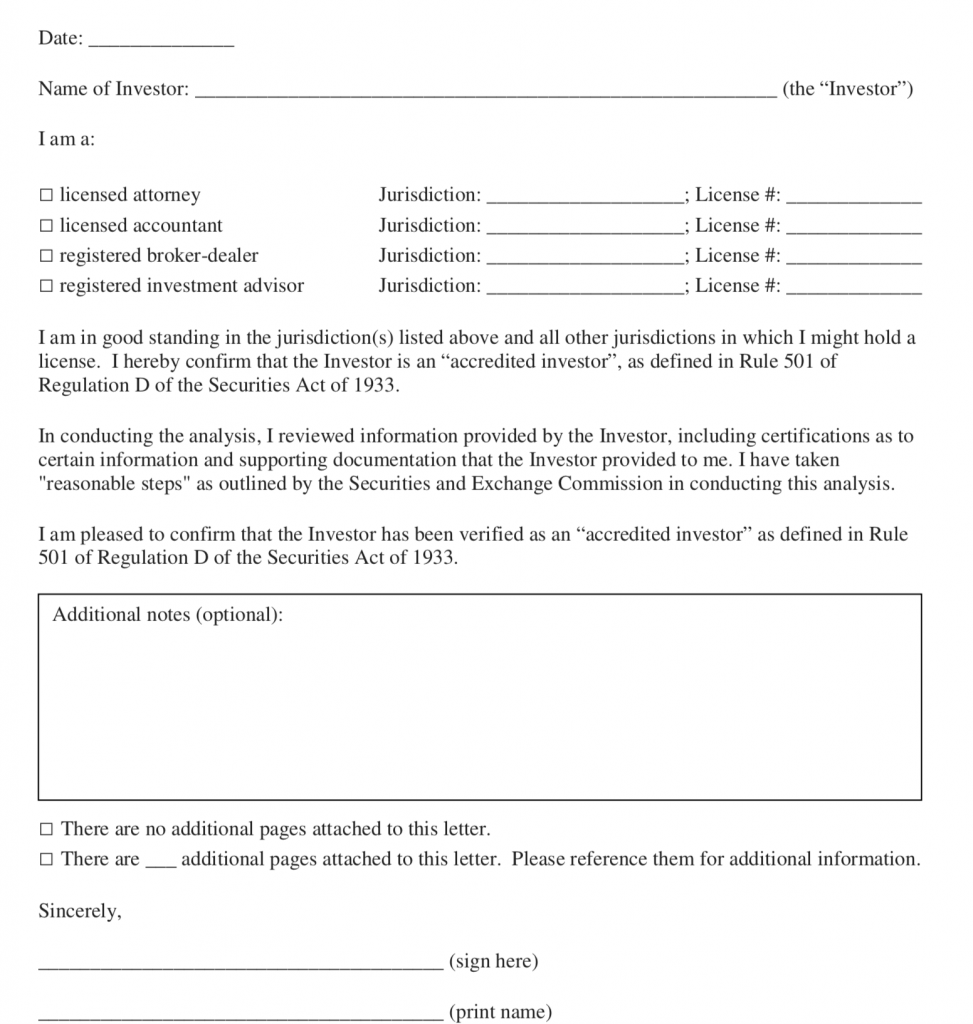

Above is one form of third-party verification

Regulations and Investor Qualifications

SDIRA Account Holders

For an entity such as an Individual Retirement Account (IRA) or Self Employed Person (SEP) Retirement Account, all of the beneficial owners must meet the requirements for either the 506(b) or 506(c) deals. The beneficial owners may be either natural persons or a corporate entity.

1031 Exchanges

Be sure to vet syndicators who promise to do 1031 exchanges upon sale.

If you were to do a 1031 upon sale of a property or entity, you would have to declare a new property (typically within 45 days) to invest in. Upon the sale the capital gains would be deferred to the next property. However, it should be noted that this is an unlikely scenario.

1031s are very rare and in most cases do not make sense. If you are trying to 1031 into a deal from a previous property please review this.

What Type of Investors are Not Allowed in Syndications?

It’s the GPs job to know the investors in the deal and make sure that they are in compliance with all regulations.

Acts such as criminal convictions, citations, cease and desist, or other final orders issued by a court, state, or federal regulatory agency related to financial matters, securities violations, fraud, or misrepresentation should be flagged by the GPs. GPs also take reasonable measures to make sure money entering the deal is not being laundered from unscrupulous investors.

Summary of the Company

PPM Risks & Rewards: How You Get Paid

Now that we’ve established the regulatory side, and perhaps freaked everyone out, we can jump into why we are doing all this in the first place.

We’ll discuss how both you and the syndicator get paid, as well as the associated risks:

- Risk Factors

- Sources and Uses of Proceeds

- Distributions to Limited Partners

- Fees and Compensation

- Conflicts of Interest

- Duties of the GP to LP

Risk Factors

There are many risks involved with investing, these are the most common you will find in real estate syndications:

-

GPs Ability

The success of the deal depends largely on the Syndicator's ability to properly execute the acquisition, management, operation, finance, and disposition of the property.

-

Lack of Control

If you're a Class A LP, then you don't have control of the day-to-day operations and your voting power is limited. You are not a Managing Member but this can be a good thing for liability reasons.

-

Liquidity

As mentioned before, you are locked in for the hold period of the investment. But there should be provisions to sell your shares (likely at a big discount) to other individuals. Note: If you are looking to sell your shares please contact your sponsor if they are able to move your shares but depending if the deal is going well or not you should be looking at taking at least a 10% cut to defer the administrative headache to assign your shares.

-

Lack of Capital

Unexpected expenses could be detrimental to the business plan and delay financial targets. There are a lot of parts of the PPM which discusses interest rates of new capital brought in which could be a stop gap between a LP capital call by bringing in a private lender to bridge the asset over to better times.

-

Not Receiving Distributable Cash

If there is not enough cashflow, you may not receive any distributions. This can be an outcome from the management not being able to collect rents from all tenants. All investors should understand that in any investment there is risk.

-

Inaccurate Financial Projections

Projections aren't guaranteed, this is where you vet a conservative syndicator rather than an optimistic one. There is a large variance in returns too, sometimes you can be pleasantly surprised (2x in 2.5 years). Conditions change the day after the deal closes so thinking you are still going to get exactly 6.87% cashflow in year 2 is not realistic.

Sources and Uses of Proceeds

The projected use of funds and financial statements should be clearly outlined in a spreadsheet or table.

Included with most PPMs are pro forma financial statements showing the fund’s projected income for at least 3-5 years and sometimes longer. The failure by a fund to provide financial statements or coherent ones should be a red flag.

If there’s a leap in projected net income from one year to another, are these projections based on sound economic principles, or are they based on speculative factors? Beware of overpromising by the manager.

Raising Capital – Minimum and Maximum Dollar Amount

For every syndication model, there is a minimum and maximum dollar amount to be raised in order to acquire the property, with corresponding expenses. The amount of capital raised can play a role in distributions and reserves. Most investors freak out when the sponsors says they are raising 9M for a deal and the PPM states the max capital raise is 11M. It is pretty standard for the PPM to be written with some flexibility to avoid having to create a brand new ($10-20k cost) PPM and/or write an Addendum. So chill out… no one is lying to you, these are just one of those things to understand with these types of documents.

Minimum Dollar Amount

The GP can lower this amount at their discretion, but this will tell you the low threshold of the capital raise, in order for the GP to use investor funds. Some things that can happen when the minimum is raised are the GP deferring fees, advancing funds, or getting a loan from a third party.

Maximum Dollar Amount

The GP will not raise any more money than this and can terminate the offer at any point before the maximum is raised.

Closing Costs

This section will explain how the proceeds of the offering will be used to pay the GP back for costs they may have incurred in the acquisition.

There is usually a table or appendix that shows the estimated closing costs of the deal.

You may also find a provision that states the GP will advance funds to close (if only the minimum dollar amount is raised) and, how much interest they will charge until repaid.

Working Capital and Reserves

If there is excess cash raised above what is needed to acquire the property, then the excess may be held in a bank account as working capital/reserves.

If the minimum amount is raised, the cash flow from the property may be used instead.

Deferral Of Fees / Reimbursements

If only the minimum amount is raised, this section talks about how the GP’s fees will be handled.

Distributions to Limited Partners

This is probably the most interesting part of the PPM, where the LP can find out how much and when they will be paid. You can review distributions back in Module 4

Capital Transactions

There will also be a payout structure for when the property is sold or refinanced. It’s important to note how the returns are affected by your initial capital contribution.

Dissolution And Termination

This will outline the next steps after the final settlement is made on the property.

Fees and Compensation

The fees will be typically outlined in a table. Pay attention to the rate of the property management services and whether they will be hiring a local company or if the GP has an in-house property management division.

Conflicts of Interest

Sometimes there will be conflicts of interest listed which sounds worse than it is. Some examples are:

GP Involved in Similar Investments

This is just telling you that the GP is involved in other deals. Which can be a good thing so you as the LP can check out their other deals to see how they are doing. On the other hand if the GP is spread too thin, this can be a negative.

Perhaps the syndicator is buying the property at an inflated price from themselves?

GP Raising Capital for Others

If the GP has a larger network of investors, it’s common that they may have helped someone raise money on a deal. Be very careful with this as if there are a lot of people doing this in a deal it multiplies the chance for some rogue LP to sue the whole partnership. This is why we (Hui Deal Pipeline Club) have stayed away from these deals where they get multiple internet/Podcast/Guru celebrities together to raise money from unsophisticated/litigious investors who have not been properly educated.

GP to LP Duties

The GP is legally obligated to act in your interest.

The GP can not be held liable for damages from the regular course of business events or unforeseen events, however they will be held liable if they engage in willful misconduct, bad faith, or fraud.

Your Role as an LP – Limited Partnership Agreement

-

Capitalization

This is the different interest classes in the deal commonly seen as Class A and Class B investors. One class will have capital only (LPs) and the other will be capital and services (GPs)

-

GPs Rights and Duties

This will outline what the GPs responsibilities are.

-

GP Removal

The two most common ways a GP is removed are GP willingly resigns giving a notice to the LPs or they are voted out for "Good Cause" by a certain amount of LPs. The number of days notice, percentage of votes required, and definition of "Good Cause" will be in the agreement.

-

Accounting Policies

The company's fiscal year will be defined. LPs will have access to the accounting records and the agreement will explain how LPs can make a reasonable request to see them.

-

Disassociation of an LP

This will outline the conditions in which an LP can be removed. This can include engaging in purposeful conduct that is harmful to the Company. However this is very rare.

-

Termination of the Company

The company is only terminated by the sale of the property or by a majority vote to dissolve. The agreement will describe the distribution of the company assets upon termination.

-

Tax Documentation

Profit and loss allocations from operations/capital transactions will be detailed. A "tax representative" from the GPs will be designated.

-

Dispute Resolution

The limits of what can be sought by a disputing party is defined, should there be a dispute between the LPs and GPs. You should seek your own legal counsel to look over the PPM and agreement.

PPM Signing Guide

Below are steps you can take to prepare for investing.

STEP 1 – TALK WITH YOUR CPA/ATTORNEY ABOUT TITLE & INVESTMENT

- Talk with your CPA &/or attorney to confirm that how you plan to take title(legal name under which you will invest) is best for your situation. Consider both tax and estate planning perspectives.

- You will not be able to change title for one year from the date of acceptance.

- Sponsor should not provide tax or legal advice throughout the life of the investment.

STEP 2 – MOVE FUNDS PRIOR TO SUBMITTING PAPERWORK

- Ensure the full investment amount is in the account from which you or your Custodian will wire to sponsor.

- Be aware of mail time & check clearing periods required by all parties involved in moving your funds.

STEP 3 – GATHER PROOF OF ACCREDITED INVESTOR STATUS

- In 506(c) offering, which requires proof of accreditation.To protect the investment and all investors, you will need an outside company like VerifyInvestor confirm accreditation. Here is a video on steps to getting certified.

- The expiration date on verification expires 90 days after the date of evidence sent to VerifyInvestor.com.

- If a deal is 506C here is a video on steps to getting certified.

Have an Attorney/Accountant/Broker-Dealer/Investment Advisor complete the letter as per the template & return to you. You should obtain one (1) letter per each equity owner (see Third Party Verification Letter Instructions by Title Type) document based on your title.

- Keep the letter(s) to submit to VerifyInvestor during the investment process.

- If you choose not to obtain a Third Party Verification Letter, you will need to upload other proof of accreditation to Verify Investors that they require based on your title type.

STEP 4 – ADDITIONAL PREPARATIONS REQUIRED BASED ON TITLE TYPE

ALL TYPES

- For all title types below, you will need to collect ACH instructions for the account where our future distributions will need to be sent. This account must have common ownership with the account from which you will send us your wire to fund your investment, or we may require additional paperwork. In addition, the bank to which we send the ACH must be a United States bank.

- Ensure your title is fully set up, including any legal documents, tax IDs, and bank accounts required.

Individual or Separate Property

- If you are married & live in a Community Property State (AZ, CA, ID, LA, NV, NM, TX, WA, WI, PR), then your spouse must sign a Community Property Waiver in front of a Notary. Instructions will be provided.

Joint or Community Property

- Both spouses / partners will need to execute the Subscription Booklet, & both will need to prove they are Accredited Investors.

- Plan to provide a unique email address for both spouses / partners as well as their unique SSNs.

LLC or Corporation

- Gather & prepare to submit the fully executed Operating Agreement (LLC) or Articles of Incorporation, Minutes, & By laws showing all signers (Corporation).

- All members / owners will need to prove they are Accredited Investors, if the entity is not Accredited.

- Prepare to send names of all signers & their unique email addresses for paperwork purposes.

- Contact your CPA to identify how your entity does or will file taxes, as this is required for the K-1: Partnership (Form 1065), C-Corporation (Form 1120), S-Corporation (Form 1120-S), Retirement (Form 5500), or Disregarded Entity (Single-Member). Since a Disregarded Entity does not file a turn, you will also need to provide the legal name, tax ID, and address of the actual Beneficial Owner that includes the tax information on its tax return (required on K-1).

Trust

- Gather & prepare to submit the fully executed Trust Agreement, Certification of Trust, or TrustAbstract.

- All equity owners will need to prove they are Accredited Investors, if the Trust is not Accredited.

- Prepare to send names of all signers & their unique email addresses for paperwork purposes.

Self-Directed Retirement Account

- Contact your Custodian to know how you are required to document the title, the Custodian mailing address to use, as well as Custodian’s EIN or investor’s created Self-Directed IRA EIN to use on investment paperwork.

- You will also want to obtain the Custodian’s incoming ACH instructions to provide on ourSubscription Booklet for future distributions we will send to you.

- Gather & prepare your Custodian’s paperwork that they require to initiate an investment, selecting to “expedite” your investment and to obtain a physical signature from your Custodian(you will send these Custodian documents to Sponsor to review first).

STEP 5 – SET ASIDE TIME TO COMPLETE INVESTMENT PAPERWORK

- Once the Offering is available online, set aside 1 hour to complete the paperwork necessary to invest.

- Once submitted, you will receive an email requesting that you reply with key information. Responding quickly will speed up the review of your paperwork.

- Be prepared to respond to emails within 24 hours when additional items are required.

Third Party Verification Letter Instructions by Title Type

Note: Many of our opportunities are put out at 506(b) deals therefore we do not need third parties verification.

In a 506(c) investment, all investors will need to prove that they are accredited in order to be accepted into this investment. To ease the accreditation verification process for you, we recommend you obtain a Third Party Verification Letter (template provided) in advance of our equity raise to help you when you submit to Verify Investor during our Subscription process. Letters expire within approximately 3 months.

- If investing as an individual/separate property, you will need to obtain one Third-Party Verification Letter in your legal name (matching the way you are taking title).

- If investing jointly, there are different rules with VerifyInvestor.com based on if you and your co-investor are legally married or not.

- If married, you will need to obtain one Third-Party Verification Letter referencing your names as a married couple (i.e. John Smith and Jane Smith). Use the “Additional Notes” field in the ThirdParty Verification Letter to state that you and your co-investor are married.

- If unmarried, each individual will have to obtain his/her own Third-Party Verification Letter. Each letter should reference only one individual

- If investing with an entity (i.e. LLC, Corporation), it will be accredited in one of two ways: the entity itself is accredited, or the entity is accredited via the Natural Persons that make up the membership of the entity.

- If the entity itself is accredited(assets exceed$5MM), only one Third-Party VerificationLetter referencing the legal name of the LLC/Corporation is required.If the entity was recently formed, follow the Natural Persons instructions below.

- If the entity is accredited via the Natural Persons who make up the membership, each person will need to obtain a Third-Party Verification Letter.If the equity ownership is represented by another entity or trust, drill down to the lowest entity or trust to identify theNatural persons who make up equity ownership. If your Third-Party is willing to do so, have the letter made out in the name of the entity.

- If investing with a trust, it will be accredited in one of two ways: the trust itself is accredited, or the trust is accredited via the Natural Persons that make up the equity ownership (typically Grantors/Settlors for Revocable Trusts).

- If the trust itself is accredited (assets exceed $5MM), only one Third-Party Verification Letter referencing the legal name of the Trust is required.If the trust was recently formed, follow theNatural Persons instructions below.

- If the trust is accredited via the Natural Persons who make up the equity ownership, each person will need to obtain a Third-Party Verification Letter.If the equity ownership is represented by another entity or trust, drill down to the lowest entity or trust to identify theNatural persons who make up equity ownership.If your Third-Party is willing to do so, have the letter made out in the name of the trust.

- If investing with a self-directed IRA, you will need to obtain one Third-Party Verification Letter in your own legal name (as if you were subscribing individually).

- If investing with a Solo 401(k) or a Checkbook IRA LLC, please refer to your legal documents. If an LLC was used for the retirement account setup, please follow the instructions above for “entities”. If a trust was used for the retirement account setup, please follow the instructions above for “trusts”.

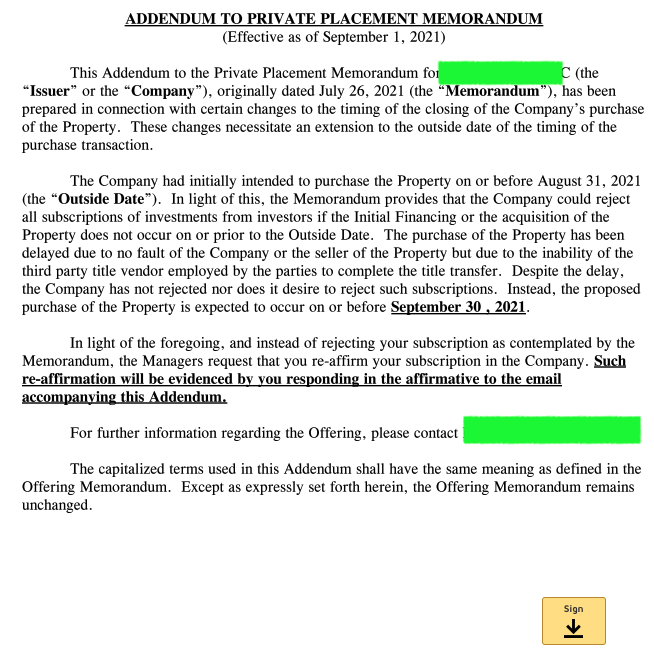

Immaterial Errors & Addendums

There are no legal documents that are perfect. Often times PPM documents are form documents with sections changed out and customized but never written from complete scratch. Common errors that are immaterial are incorrect spellings, difference in minimal investments (override by management approval), or grammatical errors. Again no document is perfect but if there are more than a handful of errors it is up to you to as an investor… at the end of the day you should not be working with anyone you do not trust and a perfect legal document does not mean jack if you are working with dishonest people. We are not giving you legal advice in anything here but one practical way of dealing with this is to get a memorandum of understanding to clarify some of the inconsistencies you found. Just going through this exercise can see how the operator works through and communicates the inconstancies – think of it as working with your spouse on a pre-nuptial… if you can’t do it amicably then maybe you should not get married.

Small issues that are inflexible or material are stated maximums of the capital raise or capex budget numbers that are not caveated as estimates or hard capped. These are hard numbers and will require an Addendum signed by all investors – see example below (where the silly mistake that the legal/GP team made was hard typing a closing date (without leaving it open). A practical lawyer will write the PPM to allow for some variability to avoid a complete rewrite and re-filling of the PPM documents.

FAQ’s – (Real investor questions from past deals)

Please consider this investment illiquid. It is possible should divorce or some extreme circumstances to transfer ownership at some convenience fee loss to a private buyer within my investor group but people who are not ready to commit long term likely need this money to survive and put food on the table. Maybe the shorter term Pref Equity option is a better option for you? But I don’t know where else you will find a better risk adjusted return where you need the time to allow the investment to blossom. As far as proof… there are no certificates with stock and not with this either.

The PPM and subscription docs is your proof in the deal and you can look up the validity of the syndication in the SEC Edgar website. Should there be any foul play, your first move would be engaging with an attorney and working with your local SEC office. I personally believe that doing traditional JV deals go bad all the time and there is little recourse compared to messing with Federal Securities laws.

***We are not giving legal advice here***

Most times this is explicitly allowed in the operating agreement so nothing formal needs to happen. If it’s late in the year it might be smarter to wait until January 1st to make the change to minimize thus years form. The investor would need to need to hire someone to draft the transfer documents transferring the LLC interest from him individually to his LLC. Then they would need to get the EIN. The sponsor team would need the name of the new LLC and the EIN in order to properly issue a correct K-1.

I see most LPs just going in as an individual since they are “Limited” in terms of liability and have lower legal and financial risk.

Your 5.61% COC is an incorrect assessment of what this investing is going to kick off once we get running in 3rd and 4th gear. We are projecting high single digits conservatively once we get to quarter 2 to 3. Of course this does not include the majority of returns coming down the road via sale or refi. We are conservatively thinking more than 80% in 5 years on this one for total return. So if you take 80% divided by 5 years… That’s a good way of evaluating these things comparing apples to apples.

AHP is a good “on-deck” circle to use a baseball analogy. I use AHP as a waiting room as these types of deals arise. The projected IRR on this one is higher.

I don’t really know anything that cashflows more than 12% these days with equity upside. Self-storage, mobile home, and assisted living are three I am looking at (cashflow on self-storage and MHPs are higher but not much and I believe there is a little less appreciation than in apartments).

From what I know of your situation being a higher wage earner I feel you should be being more aggressive. I’m starting to come around to investments that are zero cashflow, 3 year holds, 25% IRRs because that’s what higher level guys are going to. Again I still like cashflow but I see why they are moving that direction.

Most investors do not have an entity as an LP role. I do because I in a GP position and I have one. In a past investment group I was a part of, the general consensus was that unless you were investing more than a couple million dollars then a LLC or entity is not really needed. Of course, talk to your own Legal Professional. Most people I know investing as a LP just invest through their personal name (75-90% of them). The beauty of the LP position is as the name suggests you are a limited partner.

The one piece of legal consideration I will provide is that do not put your LP holdings in another LLC that also holds high risk assets like an operational business or other rental properties.

I invest in deals with upside while I get high single digits cashflow in the meantime. To be sitting in the sidelines is the mistake. Should a correction happen the business plan will not take 5 years but likely longer 7-10. The note is currently 10 years which should be more than enough to force the appreciation.

The opposite of a legacy hold is a 3 to 6-year business plan to force appreciate a property and sell it. Or 5-year pump and dump. Sometimes certain properties line up better for a long term play (higher grade properties such as B or higher, also what type of location). And the conditions of the market always change. I think of it as going with flow and taking the best exit strategy at a time.

On this past deal the operator lived there and saw it as an opportunity to pick up the 2% asset management plan. That’s a real retirement plan! Personally I try to align myself with the operator as much as I can and nothing makes me feel more comfortable that in the lead investor has a long term outlook.

Legacy can mean anywhere from 5-20 year hold. In MFH/Commercial anything longer than 5 years is a really long time. Think of it like dog years.

In the end it’s all a personal portfolio question. If you have a lot of 2 year developments or 5-year pump and dump investments, you might want to think of diversifying in terms of hold lengths too.

Tax Hack: Use passive losses to save on your taxes!

Deeper Learning