5) LP Checklist

Initial Review

Typically, the DD process starts with an initial document review to glean the basics and see if it’s worth taking the meeting. I generally start with the tear-sheet/one pager, presentation, and deal webinar. Every investor has their own limiting criteria, but depending on the investor some will pass right away due to factors such as:

-

Size of Fund or Single Asset Offering

Some investors want the sense of ‘safety’ from a large fund's diversification, while others prefer smaller set or individual assets to vet due to their higher return potential. Be careful of "hot-dog" funds where garbage assets are packaged into the larger fund.

-

Poor Track Record or (lack thereof)

Many institutions and investors require 3 years of track-record or a ‘portable’ track record from a manager's previous firm in order to get comfortable with their historical ability to perform. This can include deal going full cycle to exit. A flawless track record is not needed nor is really realistic. I like to see some sort of lessoned learned analysis from troubled projects.

-

Lack of Credible Third-party Service Providers

Third-party service providers are the checks and balances on a manager's operations. Investors do not get compensated for taking on unnecessary operational risks, so if we don't see auditors, administrators, a legal counsel, and prime brokers in place we will pass immediately. I personally put a lot of emphasis on the world of dis-interested parties that have invested with someone in the past which requires strong higher level networks and relationship building.

-

Poor quality of investor communication

If the communication from managers is sparse or uninformative it is tough to get comfortable with a strategy. I generally like to see monthly performance updates with quarterly commentary. Larger funds are more difficult to do this which is why I like single asset deals so I can underwrite them and tracking the financials is a lot easier because it is not commingled with multiple assets.

-

Unfavorable Strategy for Market Environment

The business plan needs to make sense. If the occupancy is under 80% and a lot of value add budget is accounted it may not make sense to do a long term loan. If there is a 92% occupied stabilized property with light value add using a bridge loan you might want to dig in and ask why (if not the reason might be simply because the operator could not qualify for agency debt and would not make the 5 year sale at exit project create enough returns to entice passive investors... therefore they needed to show a refinance in year 2 to show a decent proforma.

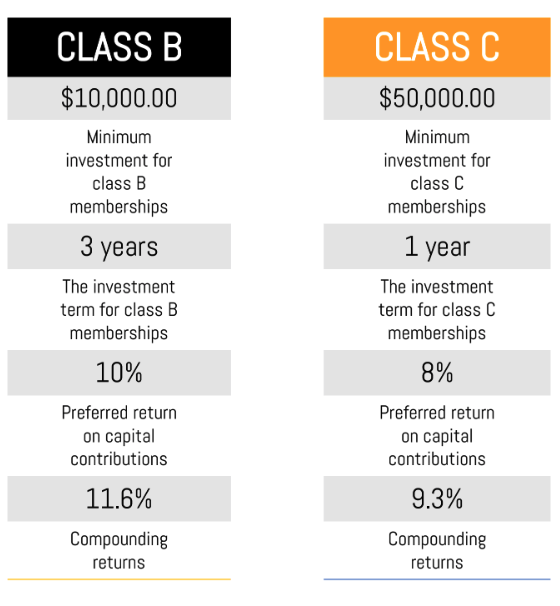

This does not have to do with the deal (on the project level) which is what we evaluate first. Secondly we evaluate the payout structure/split/fee. In this case there are different splits for those who invest larger amounts.

Things to Complete in Your Syndication Due Diligence?

- Summarize Due Diligence Checklist – Lane’s google doc – feel free to download it and tailor it on your own adding notes. Also compare with peers and point out different view points.

- Initial Review, Meeting, Marketing Material, Legal, Other, People, Operational and Investment Process, Performance

Diversification Equals Less Due Diligence

Investors often start by investing in Crowdfund website deals at 1-5k minimum investments. The thought process might make sense logically but the I have discovered that the deals are on those websites because the sponsor/operator cannot raise the money on their own and they are fishing for new investors with a RegD506C deal which allows the operator/syndicator to generally solicit (Accredtied only) on Crowdfunding websites. The Crowdfunding website acts as a broker dealer and charges the operator/syndicator fees for capital raised. As a syndicator, I inquired because I was naturally interested but discovered that those fees were very high, the Crowdfunding website’s due-dilligence was non-existence other than a few celebrity names that likely paid to be on their selection/board of members, and I was not going to access the list of investors to bring over to my future list of potential investors. The idea of Crowdfunding is a great idea but I feel is still in its infancy and where I would not go to invest as a LP. In the end as a LP, I would like to personally who know who is the operator as opposed to have a middle man in there.

Remember this is a people business and you are working with people/operators and not institutional Wall Street companies. The Simple Passive method is to grow your network with other pure passive investors to find out who to invest with and more importantly who to stay away from.

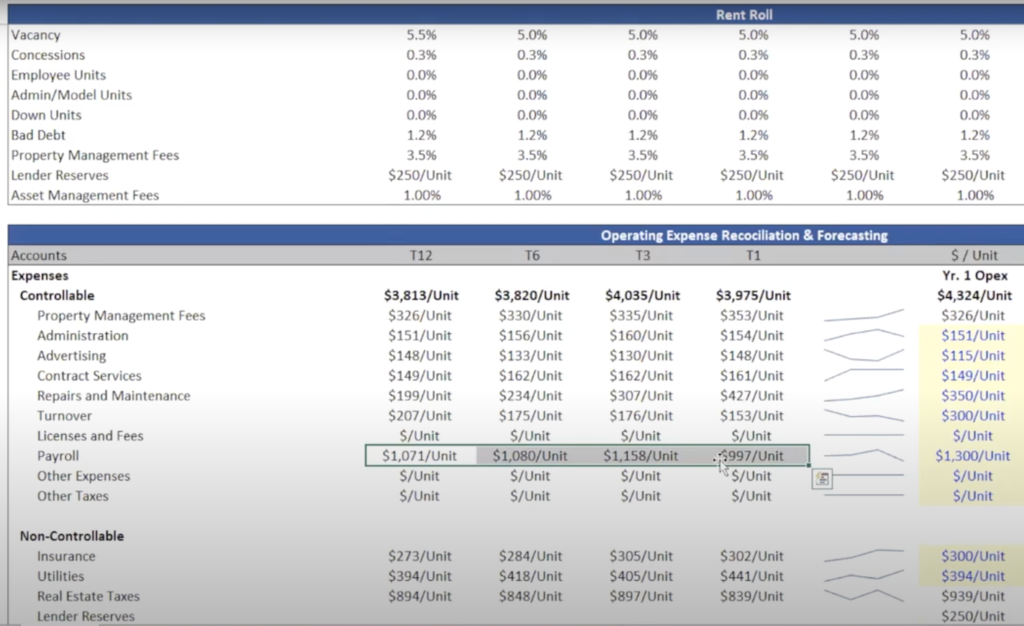

As an LP you will likely not be an underwriting specialist. For example, dig into every line of income and expenses and decide if its adequately estimated. The most astute LPs (with operator experience) might spot check that the annual operating expenses are over $4,000/year a unit.

Simple Passive Cashflow Syndication Checklist

Before investing in a real estate syndication, you should carefully review all of the offering documents provided by the sponsor and look for (or ask) questions regarding the following things:

- The Sponsor’s background, education and experience with similar investments, if any.

- The team members involved in acquisition and operation of the property, including attorneys, CPAs, other members of the sponsor, property managers and affiliates that may receive fees, etc.

- Cash distributions to investors during acquisition, operation and disposition of the property, including the proposed timing and anticipated percentage returns.

- Sponsor fees and cash distributions.

- Anticipated duration of the investment.

- Property information, including it's type and condition, the purchase price, financial history, proposed “value add” and exit strategies, and pro forma financial projections.

- Dispute resolution provisions in the governing documents for the company selling the interests to investors.

- Voting rights of investors (Majority or Super-Majority)

- Provisions for removal of the sponsor.

- Information about the law firm that structured the offering and drafted the offering documents, and whether the firm is experienced with securities offerings, and has errors and omissions insurance.

Checklist Example

- Deal overview – What

- Asset Type: C-class multifamily

- Business Plan: Light value add of $5,000 of rehab on 80% of the units. Property currently at 85% occupancy and good collections.

- Market (Sub-Market): Dallas, TX (North Irving)

- Hold time: 5 years

- Minimum investment: $50,000

- Fund Deadline: 3 weeks from today

- The numbers

- 6% preferred return with a 70/30 split

- 8% average cash return

- 16% internal rate of return (IRR)

- 9% average annual return at sale in year 6 – When divided over the 5-year hold period, we see that the average annual return is 20%.

- 2.0x equity multiple in six years (This number quickly tells you how much your investment is expected to grow during the project, using the sponsors’ assumptions. Continuing on the example above, your $50,000 investment with a 2.0x equity multiple should work out to $100,000 once the asset is sold. This accounts for the cash flow distributions plus the profits from the sale.)