5) Financing Properties

Using a Loan vs. Buying with Cash

You have two distinct options when buying rentals. You can pay for them with cash or finance them using a loan (a mortgage).

Buying with Cash

(Hint: we don’t recommend this)

When you buy with cash, you pay the full purchase price of the property upfront and often times you buy without an appraisal or inspection.

We always buy with an inspection and an appraisal… no exceptions.

You will have lower closing costs and many times you can come forward as a stronger buyer and get a slightly lower price.

We would rather have our Incubator students learn to “swim on shallow end of the pool” with less rehab involved and simpler properties than to dive in on higher risk/reward deals.

When Buying with Cash Makes More Sense

One situation when buying with cash may be better is when the property purchase price is less than $40,000 – $50,000.

It’s difficult to find a loan for a smaller amount and the closing costs will be about the same, regardless of the loan size, so it may not make sense to pay several thousand dollars on a loan when the purchase price is this low.

Using a Loan

When you buy a property using a loan, you will typically pay a lender origination fee upfront and need to come with a 20-25% of downpayment. Plus closing costs will be between $1,500 -$3,000 per property.

Why Financing Is Better for Growing Your Portfolio

Owning 1 or 2 rental properties will not bring you much passive income. Using leverage is what sophisticated investors use. But make sure you are being prudent with leverage and have adequate cashflow incase of rocky times.

Financing will reduce your upfront cash requirements to a minimum, allowing you to buy more rental properties quicker and the cashflow from those investments will allow you to save up additional funds quicker to buy subsequent properties.

Be sure to understand how to calculate your returns.

Should I pay cash?

One situation when buying with cash may be better is when the property purchase price is less than $40,000 – $50,000.

It’s difficult to find a loan for a smaller amount and the closing costs will be about the same, regardless of the loan size, so it may not make sense to pay several thousand dollars on a loan when the purchase price is this low.

Saying a loan to value (LTV) is too high on a deal is a blanket statement. Much like saying a steak takes 9 minutes on medium-high heat... BBQ aficionados will give you some formula based on weight, thickness, and then a core temperature.

Lane Kawaoka

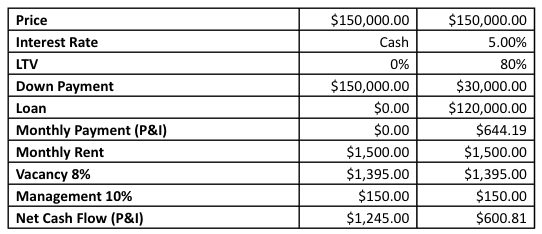

If you pay $150,000 in cash for one property, your net cash flow is $1245.00. By putting 20% down with an 80% loan to value and a 5% interest rate your

net cash flow is reduced to $600.81. Let’s not stop there. Keep in mind that 20% down payment on a $150,000 home is only $30,000. If you bought FIVE $150,000 homes and put 20% down on each with the same loan terms and monthly rents, you could increase cash flow from $1245.00 a month to $3004.05 a month. Invest your money wisely.

Incubator students let us connect you with the lender that we have been having good success. Beware… just because I have someone on the podcast does not mean we approve of them or working with them anymore.

The Most Common Financing Options

Conventional Mortgages

Conventional mortgages are the most common type of residential loans. They are amortizing loans issued by virtually all banks, credit unions, and financial institutions. In the US, they are regulated by the government-run Fannie Mae and Freddie Mac institutions. These are the gold standard of loans out there. The rates and terms on these loans really can’t be beaten because the US Government essentially insures them but you have to fit in certain guidelines to qualify. Most of our investors who have good paying jobs and good credit will not have much of a problem qualifying. Another nice thing about these Government backed loans is that there are often nice forbearance options incase things in the economy get dicey.

These programs are usually available in 15 and 30 year terms and can have a fixed or a variable interest rate. To maximize cash flow and returns, most investors prefer the 30-year, fixed rate.

Your lender that you are talking to is typically just the exterior sales guy trying to originate a loan. Make sure you are communicating with them about how your profile looks to the more important underwriting requirements which are based on your personal income and debt. The typical debt to income ratio is 50% and you currently can receive 10 per person.Determining debt-to-income ratios. If your ratios are 36/45, this means your current monthly housing expense is 36% of your gross monthly income, and your combined monthly expenses are 45% on total debt to monthly income.

This includes debts such as car and school loans, credit cards, child support and alimony.

If a person earns $60,000 per year, their monthly gross income is $5,000. Under the 36/45 guidelines, their maximum monthly mortgage payment should not exceed $1,800, while their totally monthly debt should not exceed $2,250.

There will also be requirements on liquidity and restrictions on seasoning funds for your downpayment.

Conventional mortgages will always be your cheapest and best financing option, so use them whenever possible!

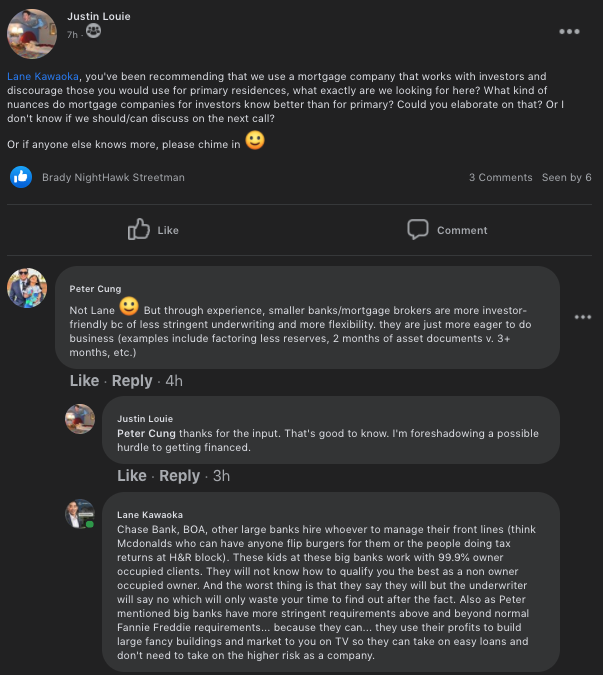

Incubator students… we can connect you with the lenders that we have had a good experience with. Generally you don’t want to go to a bank like Chase, BOA, Capital One, or the local one you bought you home from when buying a non-owner occupied property out of state.

Be sure to listen to these podcasts on lending requirements:

- 052 – Caeli Ridge – All About Financing Single Family Homes with Government Subsided Fannie Mae or Freddie Mac Loans

- 136 – Changes in the Residential Lending World with Graham Parham

- 176 – Mortgage lending questions for 2020

FHA and VA Loans

FHA and VA loans are special, low down payment programs designed for homeowners. While they allow you to purchase a property with as little as 0% down, they require you to reside in the property you buy for a period of time.

For investment purposes, they can be used to purchase turnkey multi-family properties, with you living in one of the units while renting out the others.

Depending on the program and your down payment, you may need to pay monthly or upfront mortgage insurance, which will reduce your cash flow.

If you take this route, make sure to carefully read the FHA program and VA program requirements and factor the extra mortgage insurance payments into your cash flow projections. Some investors like to move into the property, demonstrate intention to live there and start renting it out. This starts to get into the grey/backhat area a bit so we can discuss this on the Incubator calls.

Portfolio Loans

Portfolio loans are offered by some financial institutions who lend their own money (private capital) directly to investors.

They are not regulated by the government, therefore each lender can choose their own qualification criteria. For example, some portfolio lenders will allow you to finance several rental properties under a single loan. Others may be fine with a down payment as low as 10%.

Portfolio loans may be difficult to find since you will have to go to a local community bank and typically have higher interest rates than conventional mortgages. They are best for experienced real estate investors who have reached their conventional mortgage limit.

Hard Money Loans

Hard money loans are often used for property acquisitions where the property condition will prohibit conventional financing.

The average down payment is 10-25% with higher interest rates from 7-15%.

The property needs to be sold or refinanced after the repairs are completed or within 6-12 months.

They are to be used only for the short term (making it great for house flippers). Usually no lender appraisal is required and it’s quick to close. We are passive investors. Don’t worry about these for not because it is more of an active strategy.

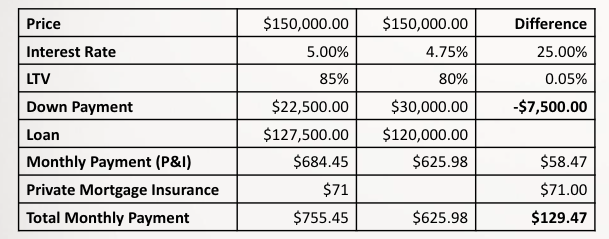

Does a 15% Downpayment make sense?

Here is an example of the benefits of putting a full 20% down versus 15%.

As you can see in the chart, for a measly $7500 more in a down payment, you would eliminate having to pay PMI for the next 44 months (44 X $71.00 = $3,124), as well as the cost of money is 0.250% better with 20% down ($7,500 @ .250% over 44 months is $951.57). \

Summary: NO, we do have a 15% down payment option available, but keep in mind; it does require private mortgage insurance and your cash flow will not be as good.

Direct Lenders vs. Mortgage Brokers

When you start looking at institutions offering residential mortgages, you’ll come across direct lenders and mortgage brokers.

Direct Lenders

Mortgage Brokers

My preference is to work with a good mortgage broker, if possible.

- They will be able to shop around on your behalf and find you a bank and loan program that offers the lowest rate.

- You will only need to submit your pre-approval documents to them once, instead of sending them to each lender separately.

What should be the prioritize, paying student loan or investing?

When you are looking at availing a loan program for real estate investment but you still have existing student loan.

How to Find an Investor-Friendly Lender

Here are the quickest ways you can find a lender that offers services in your target market:

● Ask local real estate investors or your turnkey company for referrals try searching on the BiggerPockets forums for leads.

● Check if banks you have used in the past have branches where you’re buying your rentals. You can often get better terms on your loans from existing relationship with a bank.

● Incubator students will be connected with our proven lenders

Videos: Repayment solution for student loans to solve your existing student loan concerns

How To Interview a Prospective Lender

Below are some questions to ask your prospective lender, remember to do your due diligence first, then ask any remaining questions:

- What states do you lend in?

- How long have you been in business for?

- Do you offer loans on non-owner occupied investment properties?

- How often do you work with real estate investors?

- Are you a lender who can only underwrite in-house loans, or are you a broker with access to loan programs from different institutions?

- What type of loan programs do you offer (conventional, FHA, VA, cash out refinance, portfolio)?

- What are your minimum and maximum loan amounts? Do these vary by state?

- What is the approximate interest rate I can expect on to get on an investment loan?

- Can you send me a break down on your typical underwriting and closing costs?

Getting Pre-Approved for a Loan

Once you find a lender to work with, you will need to get pre-approved for a loan.

Turnkey companies will require your pre-approval letter before they will allow you to put a property under contract.

As part of the pre-approval process, your lender will check your finances and credit to determine whether they will be willing to give you a loan and for how much. Here is a list of documents you will typically need to send them:

- Last 2 years’ tax returns and W-2’s

- 2 months of all bank account and loan statements

- 2 months of pay stubs

- For each property owned: property tax bill, HOA statement, insurance statement and lease (if it’s a rental)

- Address history for the past 5 years

- Employment history for the past 5 years

After you submit the documents to your lender, it usually takes 1-2 weeks to get your pre-approval back. Start this process as soon as possible, so by the time you find a turnkey property that you like, you’ll have your pre-approval letter ready.

For more in depth learning, check out these two podcasts where I interview a mortgage lender!

Signing The Purchase Contract

When you’re ready, let the turnkey seller (or investor friendly agent if you are using one) know which property you’d like to purchase and whether you’re buying it with financing or cash.

They will send you the purchase contract if the property is still available. Look it over, paying specific attention to the “contingencies” – the conditions that have to be met before the purchase can be finalized.

Aside from an inspection contingency, there are three other contingencies that I add to the contract.

They are explained in detail below:

If there are tenants in the property you are buying, you should have a contingency included in the contract where you get to review the tenants leases, their rental payment history, and the maintenance records for the property.

If I am buying a property and I find out that one of the tenants is consistently late on rent, I will request that the seller either reduce the price or ask the tenant to vacate prior to my closing on the property.

An appraiser (who is hired by the bank issuing the mortgage) goes out to the property and verifies that the property condition meets the lending guidelines for the loan type and that the value is at or above similar comparable sold properties.

If the property does not appraise for the contract price, the buyer and seller will have to come to a workable conclusion.

This is a list of questions that asks the seller in writing about their knowledge of the property.

I always verify the seller’s answers in the seller disclosure statement for myself.

Earnest Money

Along with a signed copy of the purchase contract, the seller will also ask for what’s called an “earnest money” deposit. This is a small sum (usually between $500 – $5,000) that you will need to send in the form of a check, money order, or wire transfer that shows your interest in purchasing the property.

If the property checks out and you end up buying it, this money will go toward paying your closing costs. If you back out of the deal for whatever reason, your earnest money deposit will typically be refunded back to you.

Once the seller has received your documents, you will go into the escrow phase and have time to do any remaining due diligence and inspections until you are 100% sure you want to purchase this turnkey.

FAQ’s

To save up for your next purchase, you can live rent free by using a minimal down loan on a multi-unit property, live in one unit and rent out the others. You can either use a gift funds from a family member or save up yourself for the down payment.

Need more cash? You might have a money problem and will need to work on your personal finances. Try tradelines.

If you used FHA on the first property, that can stay but you’ll need to use conventional on the next one, which currently has a 5% minimum down payment.

If you have equity in your investment property, you could consider taking out a line of credit and using that for the down payment on your next property. You’ll just want to be careful not to overextend yourself.

The other thing to note is that you’ll be moving a tenant into your unit, so the lender will use the new rental income on your old property to qualify you for the new property.

Property in good condition and in a good area that meets the preliminary numbers go fast. I have seen the amount of turnkey buyers go up exponentially in the past few years as everyone is jumping on the band wagon. News flash in case you missed it… Real estate has been good for the past decade.

From the rehabber/flippers prospective to complete project geared more toward the retail buyer to take part of the emotional buyer market. Selling to cheapskate and annoying investors like us just does not make sense on many fronts. So don’t we a whinny investor and don’t try to make like you have leverage.

Properties that have a tenant in them are often owned by investors and non-owner occupied owners. The good thing is that it’s a numbers game and they have a profit that they are looking to get. The bad news is that the property performs as an income producing asset (that’s why you are buying it) and the sell is content holding on to it indefinitely – after all it cashflows.

Turnkey sellers will allow minimum flexibility on their pricing. Remember, they don’t have to sell and sometimes it does not make sense so move on if that’s the case. That being said, the average discounts I have seen is about $1500 off asking price. Seller is asking $69,900 and I would suggest initial offer of $67,000 and see how he responds. Point is know what is a deal and know the price.

Within the next two weeks:

Using what you learned from this section, find 2-3 lenders, do your due diligence on the company, ask remaining question in interview, and choose the best one to use!

Incubator students we can connect you with the lenders that we many past students have worked with in the past. It is important to use a lender licensed in 30+ states so you can work with the same person and also with someone who knows how to work your file as an out of state remote investor.

They local guy or person who financed your primary residence will likely not who want to work on this one.

Remote Investor Incubator

Check out the Remote Rental workshop for additional information on “Financing Properties”.