4) Vetting a Property Provider

Start finding your deal here

Pick 2-3 potential real estate markets and find a good turnkey company or broker to work with.

Put emphasis on the referrals from other unbiased sources. There are many fly by night turnkey operators out there on popular internet forums.

Over the last few years, the entire turnkey industry got a bad rap because of a few dishonest, shady turnkey companies.

Ultimately, they want to buy houses at the cheapest prices, spend as little as possible on the rehab, and sell it for as much as possible so they can maximize their profits and move on to the next property.

I am in an invite only Mastermind called the Collective Genius ($25K a year membership fee) with the top 1-2 operators from each major MSA in America. The caliber of guys in the group are top notch and basically you can’t get in unless you flip 100+ properties a year… I know know how they let me in!

Anyway we talk a lot about how in the progress of a flipper/developer, turnkey rentals are a starting point to start building a business because the scope is less and overlays of cash are less as opposed to higher end flips. Most of these guys will transition from lower level properties (lets face it turnkeys are lower level rehabs) and go to bigger projects. So that is the reason for the turnover in the space.

That said, I try to find operators were turnkey products are just on piece of their business. They mainly have a wide band of dealflow (50k-500k+ properties) and they have systems in place to take whatever the opportunity and process it to a turnkey buyer like us on smaller projects in lower end communities or larger project that go to the retail market.

Your turnkey rental is not going to be in the best desirable locations. If that is being sold to you… run!

Start finding your deal here

Avoid companies that are not realistic with their pro forma’s (i.e. they don’t include vacancy or maintenance projections). Here are some of the most common ways brokers/turnkey sellers inflate cash flow projections:

1. Vacancy Percentage Too Low: Vacancy rates advertised at around 5%, even in C class neighborhoods. Don’t take the listed rate as-is, do your own research and use the footnotes we have in our property analyzer. Common advice out there says to contact 2-3 property managers and ask them how long it takes to find a tenant for similar properties in the same area but obviously you are going to get bad data because they are trying to sell their services. It is still worth the exercise and worth having that open dialogue discussion. Here are some other top questions to ask your property manager (note: don’t be a bonehead and ask this in a sterile interview environment… just use these questions as a conversation starter. Remember relationship first!). You can also get an indication from rental listings on Hotpads, Facebook Marketplace, Craigslist, Zillow or Trulia to see how long they have been up.

I personally use at least a 10% vacancy rate for most of the turnkeys I look at. I use 15% for properties located in B- or C neighborhoods. A bit on the conservative side? Sure. But I’m not going to be surprised when it takes 4 weeks to find a new tenant. Another way of looking at it is that most tenants stay on average 1-2 years… some will be there 5 months and some will be there 2-3 years.

2. Omitting Vacancy in the First Year: Many turnkey providers will use a 0% vacancy rate for the first year’s cash flow projections. The rationale is that if a property is already rented out, the current tenant “should” stay there for at least a year, so you will have no vacancies. Better to not run your numbers with this “rolling start” assumption. You know what happens when you ASSume?!?

3. Inadequate Maintenance and Cap Ex Allotments: Turnkey company will argue that they have fixed many of the minor maintenance expenses and have taken care of much of the capital expenditures that will happen in the first 3-5 year. This is just not going to happen… if it does consider yourself lucky.

We separate maintenance and cap ex projections. As a general rule assume 1 month’s rent going to fixing up random stuff around the house. And you can calculate the Capital Expenditures here and come up with an annual estimate. For older homes that are older than 1960 or have Section 8 tenants, you might want to bump that up to 15%. Again use the footnotes on our Analyzer.

4. Using A Past Year’s Property Tax Numbers: Turnkey providers list last year’s property tax values… the one based on the appraised value before the value add rehab occurred.

Property taxes are based on the county’s assessed value of the property and in most states, that value will be equal or close to the last sales price. When you buy the home, you’re always going to pay more than what the turnkey company paid for it, so its assessed value and property taxes will go up.

In some areas like Texas for our apartment buildings we often double the property tax to account for this. You might be able to purchase the LLC (entity) that owns the property so the taxing authority does not trigger a reappraisal event however that loophole does not always work as appreciating areas are getting more and more aggressive to extract revenue via property taxes.

This is all just a part of the game so we as investors have to run the numbers. In the analyzer there is a general footnote what to use but once you are serious about a property spend the 10 minutes to better estimate the taxes. Here is how you calculate property tax:

Find the county’s property tax records online (they are all accessible to the public).

Look at the previous 2-3 tax bills and figure out what percentage of the home’s assessed value is due as taxes each year. Some of these calculations can be rather complicated to follow.

Use the percentage and your purchase price to calculate the new tax, removing any exemptions in the process.

5. Inflated Yearly Rental Income Increase: Rent tends to go up in most cities across the US due to economic growth and inflation. But this increase is not guaranteed. Turnkey sellers write in a 3% or 5% rental income increase in all of their cash flow projections. Just because they provide a very pretty pdf report with a bunch of numbers don’t get excited… its really easy to make those reports. An astute investor looks at the assumptions and in this case what is the annual rent escalator.

A good annual rent escalator is 1-3%, depending on the area and the property. On our large apartment syndication we try not to assume anything is higher than 2%. We feel we are being conservative since many people believe pure inflation is at 3% however don’t believe all the data you see from the government.

If you recall from the great American classic “Aladdin” you have to as some point trust!

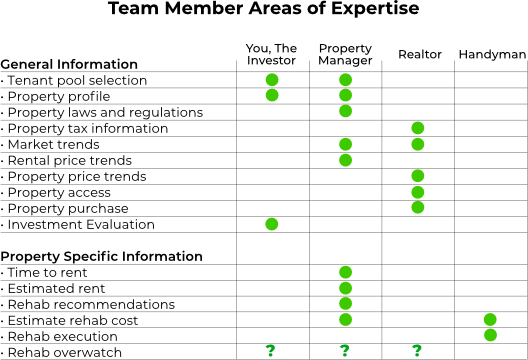

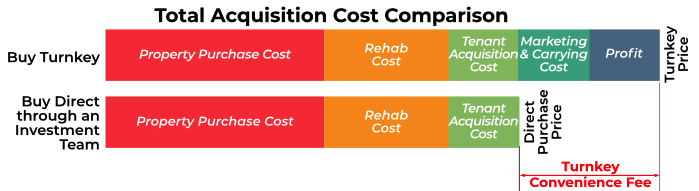

Direct Turnkey Sellers vs. Marketing Agencies

As you start looking at turnkey providers in your target markets, you’ll come across two types of companies and it’s important to understand the difference between the two.

Direct Turnkey Sellers

These are the guys who actually buy, rehab, and sell homes. They are almost always local to their city. They will be able to answer all of your questions directly, provide first-hand market insight, and in many cases manage the property for you.

Ways to tell if a company is a direct turnkey provider:

- Read the “about” section on their website.

- They typically list properties from just a single city

- Contact them directly to verify they do the purchases and rehabs themselves.

Turnkey Marketing Agencies

Turnkey marketing agencies call themselves “turnkey companies”, but they are not.

They do not own any properties, and are hired by direct turnkey sellers to advertise their properties which can be a bad thing because the turnkey provider does not have a track record. I have seen the same properties marked up 5-10k to pay the turnkey marketer so you are paying more.

As far as marketers I would only work with Marco. Let me know if you would like an email intro.

The benefits of these agencies are:

- Large networks – they can refer you to a variety of real estate professionals in different cities

- Convenient – you can look at properties from several markets at once

- Resourceful – they can help narrow down your market selection by speaking with their representatives

Vetting a Provider

Building your network in our incubator is critical to co-sourcing due diligence on the buy and in the future as problems arise. Those in our incubator won’t need to go the marketer route since you will likely use our rolodex or brokers, property managers, and turnkey rehabbers.

The most important factors to focus on when interviewing prospective turnkey companies:

● Communication: You should have no problems getting quick responses to your emails and phone calls. Avoid companies that are not transparent or are not willing to answer your questions. A good response time on legitimate emergencies is 1-2 days by phone or 2-4 days by email.

● Quality of Rehab (or Construction): Pretty much all turnkey companies will perform cosmetic repairs. The really good ones will also look for and correct plumbing, electrical, structural, and foundation problems. You can get a sense for this by reviewing several “scope of work” documents for their latest rehabs or by visiting the rehabbed properties in-person. The only way to verifying this is to have a 3rd party inspection.

● Years in Business: I tend to avoid newer companies that have been in business for less than 5 years, as that doesn’t give me the opportunity to look at their long-term track record. And I don’t work with anyone unless someone I trust and have a relationship with vouches for the operator.

● Availability of Properties: 1-2 rehabs a month is not enough and a sign of bad systems.

● Maintenance Warranties: Some turnkey companies may offer 6-month or 1-year maintenance warranties on their properties, covering any maintenance and repair expenses for that period. Ask the turnkey company if they do warranties but beware if they are just going to buy you a Home Warranty program that is third party it is just not the same to back the product as a company.

● Rent Guarantees: Some turnkey sellers will provide a “rent guarantee” – in other words, they will pay you the monthly rent amount for a certain time (usually 6 months or 1 year), even if the property is vacant. I’m not a big fan of this program, as it is often offered on properties in very bad neighborhoods which are difficult to rent out.

● Tenant Placement Before Purchase: Not all turnkey companies place tenants in their properties before selling them to you. I think it’s better if they do, as that enables you to start collecting rent immediately after purchase… if anyone has been a parent to step children or can imagine… its just not the same as laying down the LAW from the start. Tenants are like kids they know how to test the new property manager. And this way your property manager does not have the excuse they it was not their fault for placing a sub par tenant.

● In-House Property Management: I have mix feeling with an in-house property management, as I feel that gives them an incentive to do better with me, since they will be dealing with me as a client after the purchase. But the property management side of the house can be hiding bad rehab work. I like to build as many relationships for a longer term horizon so by building a relationship with a third part property manager you are able to go to them for critical feedback when you are going back to XYZ turnkey company or perhaps getting your own broker and building off the MLS.

● Investor References: Speaking with other investors who have bought from a turnkey company you’re considering is essential. This will give you first-hand feedback about all of the other criteria above.

NOTE: We put emphasis on referrals from other passive investors first. Every turnkey provider good or bad can do a good interview

Finding Turnkey Sellers

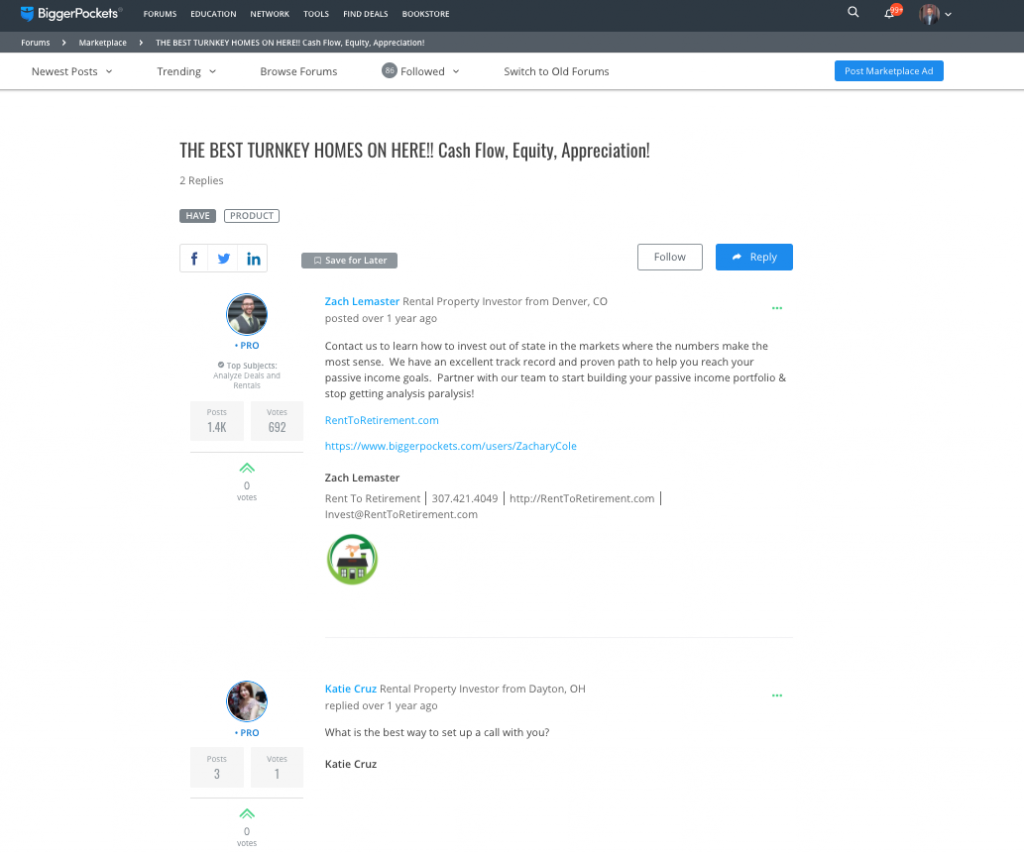

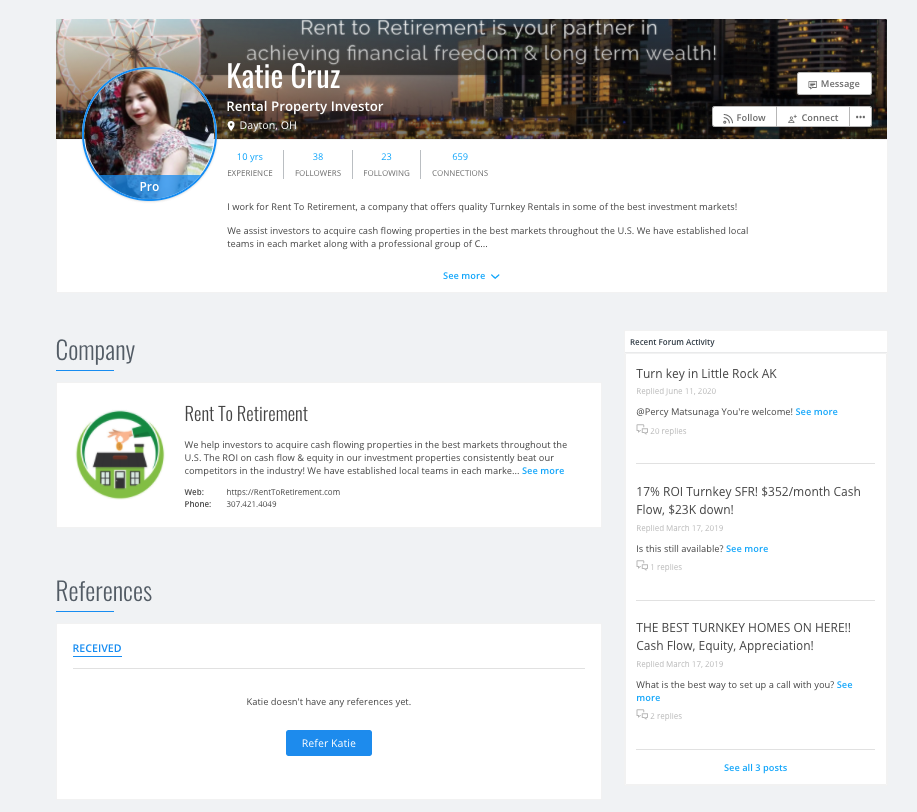

You can quickly find turnkey sellers in almost any city via an online search (ex. “turnkey properties in Dallas, TX”). Alternatively, you can search for them on the BiggerPockets website. But again be careful with that.

Stuff you see on BP - Turnkey Marketers' VA's replying to their bosses post. 🤦

Progressing forward!

List of questions to ask:

General Information

- How long have you been in business for?

- How often do you work with real estate investors?

- Can you provide 2-3 referrals to investors who bought turnkey properties from you in the past?

- Do you own the property and do you do the renovations? (A top tier company will purchase the property under their name and renovate it before they even offer it for sale).

- Do you allow financing? (Don’t allow financing or a finance contingency, it can be a good indication that they are selling above market value).

Market

- How do you select which neighborhoods to buy properties in? (Avoid companies that only sell in cheap, low end neighborhoods).

- What is the forecast for the next 1 to 5 years as far as property prices, rents, economic and population growth are concerned?

- Can you send me a detailed market overview report?

Rehab Process

- Can you provide a detailed scope of work for each turnkey property you are selling? (Avoid companies that make you pay for any renovation upfront).

- Can you provide purchase receipts or warranties on all new appliances you purchased?

- What are some of the things you do NOT repair when rehabbing properties?

- Can you provide a full set of before and after rehab photos or videos for each property

- Can you provide comps and appraisals for property price and rent?

Tenant Placement and Management

- Do you offer in-house property management?

- If not, can you provide a list of local property managers you recommend?

- Do you lease your properties before selling them?

- Do you offer rent guarantee programs? Why or why not?

Questions for Turnkey Marketing Agencies

- Why should I go through you instead of working with a turnkey seller directly?

- What are the current best real estate markets for buy and hold, turnkey investors? And Why?

- How do you select the local turnkey companies that you work with?

Getting an Investor Friendly Agent

If you don’t plan on using a turnkey company for whatever reason or you have progressed as an investor and want to work with an investor friendly agent to help you source deals.

Working with an agent offers you the following benefits:

- They know the after repair value of a property and what it would rent for (always double check this number with your property manager)

- You will get the knowledge and experience from someone who looks at properties all day long (and sometimes own rentals themselves)

- The seller almost always pays the real estate commissions, so you get a free negotiator working on your behalf

- You get access to their business partners and vendor database (sometimes off-market deals)

NOTE: It is rare that agents are investors themselves. Many says they are but likely you might know more about analyzing deals than they do. I don’t take any advice from anyone who has not done what I have or financially free. I would not take investing advice on properties from an agent that does not have a cashflowing portfolio themself.

What is an Investor Friendly Agent?

There is a huge difference between an agent finding a home for a buyer to live in versus a rental property that will produce an income and increase in value. They require entirely different skill sets and knowledge of rental rates, determining return on investment and what goes into a good deal.

How To Find Investor Friendly Agents

Once I’ve identified an area that I want to invest, I call a few local property managers and tell them that I’m an investor from ______ (state you live in) and that I’d like to buy 5-7 houses in their area and that I’d like a referral to an agent who specializes in working with investors. Since the property managers would get a good amount of business if I do buy several properties, they want to make sure they give a good referral. I’ve gotten some of my best agents from these property manager referrals, and most of them send me off market deals.

Once you get referred to this agent, call them, and make sure they know that you were referred to them by the specific property manager (they likely receive a lot of referrals from this property manager).

Now that I’ve identified the benefits of working with an investor friendly agent, I want to cover the questions you’ll want to ask agents to see if they have the knowledge and skills to help you achieve your investing goals.

Questions to ask agents to find out if they will be a good fit:

- How long have you lived in X (area you’re looking in)?

- Do you own any rental properties?

- Have you done any flips?

- About how many investors do you work with currently?

- How many off market deals do you do each year? Where do they usually come from?

- How well do you know rents in the area?

- Do you have referrals for contractors and property managers?

- Describe the last good deal you came across.

Optional area specific questions:

- Does the city require rental inspections or special permits for owning rentals?

- How important are the school districts in each area?

Be Clear About Your Criteria

Hopefully you have found a great investor friendly agent who can help source good investment opportunities for you.

The next thing you’ll want to do is be super clear about your criteria and give them feedback when they send a rental listing your way.

In the very first section we discussed setting real estate investing goals. This is where you want to go back to those goals and the criteria of the properties that you are looking for that will fit those goals.

Make sure you share this criteria with your agent to help them narrow the searches to that criteria so that you are not receiving single family homes and condos which might distract from the goal.

FAQ’s from one of our Turnkey Providers

We are largest direct to seller advertiser in our market. We are able to acquire properties that others can’t find. In our decade plus in business, we have fix and flipped and wholesold more than 1,500 homes in and around our MSA. We pick the properties in the right neighborhoods to turn into rental holds. We own and manage more than 300 doors and our staff doesn’t know if the property belongs to us or to you. So you are literally treated like we treat ourselves. We renovate to a standard that is rental specific and one that maximizes returns while minimizing customer touch and costly repairs. In addition, we promote a sense of pride of rentership in our renters and 90%+ of our renters renew year over year.

We buy rental properties in emerging neighborhoods, still within close proximity of the city center, often in the path of progress. We do not buy in dangerous neighborhoods, but we do buy in neighborhoods that are emerging. There are two huge benefits to purchasing in these neighborhoods. The renters feel comfortable here and want to make it home. And in some instances, property values can multiply exponentially because a neighborhood can look quick different five or ten years into the future.

Every property is purchased in a different state or set of conditions. Our rental portfolio is designed to be safe and affordable for the resident first and then to maximize profits for the investor. Some of these properties are absolutely beautiful in photos, however the vast majority are not. The homes are renovated in a way where capital expenditures are nearly always addressed during the value add period and before a resident would move in or a property would be sold Turnkey. We aren’t perfect and things can happen, but we renovate to a standard where all major systems or Capital Expenditures are addressed up front and it is the goal to have at least 5 years remaining life on all major systems at the time of Turnkey sale, no matter the level of finish.

We have a standard sheet that we can provide with our up-to-date pricing. Suffice it to say that our pricing is aggressive and fair and set in a way that the owner can maximize profit.

Due to our method of renovation and tenant accrual, we are able to greatly outperform industry standards. As a whole, we retain 90%+ of our residents year over year. Our expense ratios are in the high 20’s or low 30’s. For a point of reference, industry standard for expense ratio is between 35% – 45%. As a frame of reference, we have studied property owners and managers that have between 1000 and 15,000 doors. We have taken the best of their practices and incorporated those into our property management standards. These numbers beat industry standard because we are intentional with finish and product delivery and this greatly impacts retention and returns.

- Section 8 is a housing assistance program under HUD, The U.S. Department of Housing and Urban Development. In its simplest terms, residents who need assistance get assistance from the government to afford housing. In the world of landlords, Section 8 is either viewed negatively or favorably. We think this is a matter of execution on the part of the owner or operator. Section 8 is a wonderful program for allowing residents in need to afford appropriate housing. However, all renters are not created equal. As a company, we are very good at screening to find the right resident and one who will stay and will treat the property with a sense of pride. If the resident turns out to not be a good renter for us, the voucher is a leveraging chip that allows owners to negotiate in a way with residents and in many instances will force an amicable split as the resident wants to part on good terms and keep the voucher. Managing Section 8 is an artform, properly utilized it allows the resident safe and affordable housing and allows the owner great returns. Last, the government guarantees all or a portion of a resident’s rent.

Our Turnkey Investment properties come with a one year rent assurance. If anything should happen with the resident, Our rent assurance covers not only missed rents, but also costs incurred during evictions, property turnover, and new tenant placement. We also have a 1-year workmanship warranty starting from the date of purchase. The Workmanship warranty covers all improvements from the property specific renovation list including but not limited to electrical, plumbing, HVAC, roofing, windows, flooring, and cabinetry. Lastly, we also provide a 1 year home warranty which cover most of the major systems in the property.

Although proformas are estimates, 75% of the time we meet or exceed the proforma numbers we provide. The biggest difference we see when potential buyer’s run their own proformas and their numbers do not match include our expense ratios being much lower than the industry standard.

Yes, we have relationships with best in class providers that provide their services well below rates viewed as industry standard and we are happy to provide these introductions upon request.

Within the next two weeks:

Using what you learned from this section, find 2-3 potential turnkey providers, research them, ask any remaining questions when you interview them, and choose the best one to use!

Incubator students… we will help you out with referrals but it might be wise to practice on a random broker that you find on Google just so you don’t come across as a newbie to a proven broker or turnkey provider.

Deeper Learning