3) Deal Analysis

Calculating Cash Flow and Returns

When I first started investing, I did not run numbers. I did not even know what the Rent-to-Value Ratio of more than 1% was or the 50% Rule for expenses.

We are going to teach it to you here so you can be a sophisticated investor instead of learning though hard knocks.

In troubling times, such as the COVID-19 pandemic, I was barely impacted by what was going on in the market because I was a cashflow investor. Even in difficult times, most people will pay rent if you invest in the sweet spot as we outlined in Section 2. Across our 3,500+ unit portfolio, our collections dipped 3-6% from normal which left us a 25-35% in collections before we were in the red for the month.

Most so called investors buy for appreciation. But here at Simple Passive Cashflow we don’t gamble on the price of real estate always going up. It is the icing on top of the cake for us. As Warren Buffet says… the first rule of investing is never lose money. We ensure that by investing for cashflow first so we can dictate when we sell at a time that is best for us.

Most investors don’t understand that you need to be positive cashflow from the start to have a sustainable portfolio irregardless of market fluctuations.

Review these two important lessons:

Part 4 of 8 - Analyzing properties

- Walk-though of analyzer: Rents, Expenses, Taxes, Repairs, Capital Expenses calculator

- Data collection on properties

- How much cash is needed?

- Using debt

- Formulas: Cap Rate, Cash on cash return, Rent-to-Value Ratio

- Return on equity

- Rent o meter

- Where to check your rents

- Working with brokers and what to beware of

- Where to find a lender

- Home inspections

- Insurance

- Runtime – 63 minutes

Calculating Cash Flow and Returns

We encourage you to perform your own cash flow analysis, using your own estimates and calculations.

The word “Proforma” is French for toilet paper… well not really but you get the point!

Most brokers and turnkey providers provide very padded numbers to make their properties appear more attractive. They will underestimate taxes or insurance and over estimate things like the rents.

Analyzer Overview

Analyzer Walkthrough Example

Plug in properties into the Analyzer and get a feeling for the

We want to see if our investment property will cashflow after all expenses and weather an economic storm.

Below are additional definitions in our Analyzer:

Vacancy Rate: Your property will not be occupied with a tenant. There will be turnover. Most commonly, this will happen between tenants, as you search for new ones and do any repairs or upgrades on your property. The vacancy rate is a percentage of time you expect your property to remain vacant each year. For example, if you expect your tenants to change once a year and for it to take about 3 weeks to find new ones, the average vacancy rate will be 3 weeks / 52 weeks = 5.8%. The vacancy rate will depend on the neighborhood and the property type. Vacancies tend to be lower in better areas and higher in worse areas. Single-family properties usually have lower vacancy rates than multi-family homes. One of the best ways to estimate average vacancy rates for an area is to talk to other local investors or property managers. As a rough estimate, you can use 5-10% for a single-family home and 10-15% for a multi-family property or a home located in a rougher neighborhood (If your property manager charges a lease-up fee for bringing a new tenant, then be sure to include that into the analysis).

Operating Expenses: As a landlord, you will be responsible for paying a variety of expenses for each of your properties, which will reduce your take-home profits. Here are the most common ones:

Property Taxes: Every county and city will have mandatory property taxes, which are usually calculated as a percentage of the appraised value of the property. You can look up exact property tax amounts for each property on its county’s tax collector’s website. Be aware, that when you complete a purchase of a property, the county may re-assess it and increase the property taxes, so don’t rely on previous year’s values. Instead, determine the local tax rate and use your purchase price to calculate the new property tax amount.

Home Insurance: If you’re using financing, your lender will require you to carry a basic fire insurance and liability policy. Even if you’re not using financing, you should always have property insurance. Typical yearly premium for a landlord policy will be somewhere between $400 – $800, which you can use as an estimate before you have an actual policy in place.

Property Management: If you will be relying on a professional property management company to manage the day-to-day operations (which I recommend), you will pay property management fees. The base fee is usually calculated as a percentage of collected gross rent, with 8-10% being the most common. Your property manager may also have tenant placement fees, leasing fees or other charges. Ask your potential property manager for a full breakdown of their fees.

Maintenance/Repairs: Even though most turnkey properties undergo a full rehab before you buy them, you will have ongoing maintenance and repair expenses as you rent it out. Newer homes and those located in nicer areas will usually have less maintenance expenses than older homes or those located in lower-end neighborhoods. Maintenance is usually estimated as a percentage of the gross rent, with around 5-10% being common.

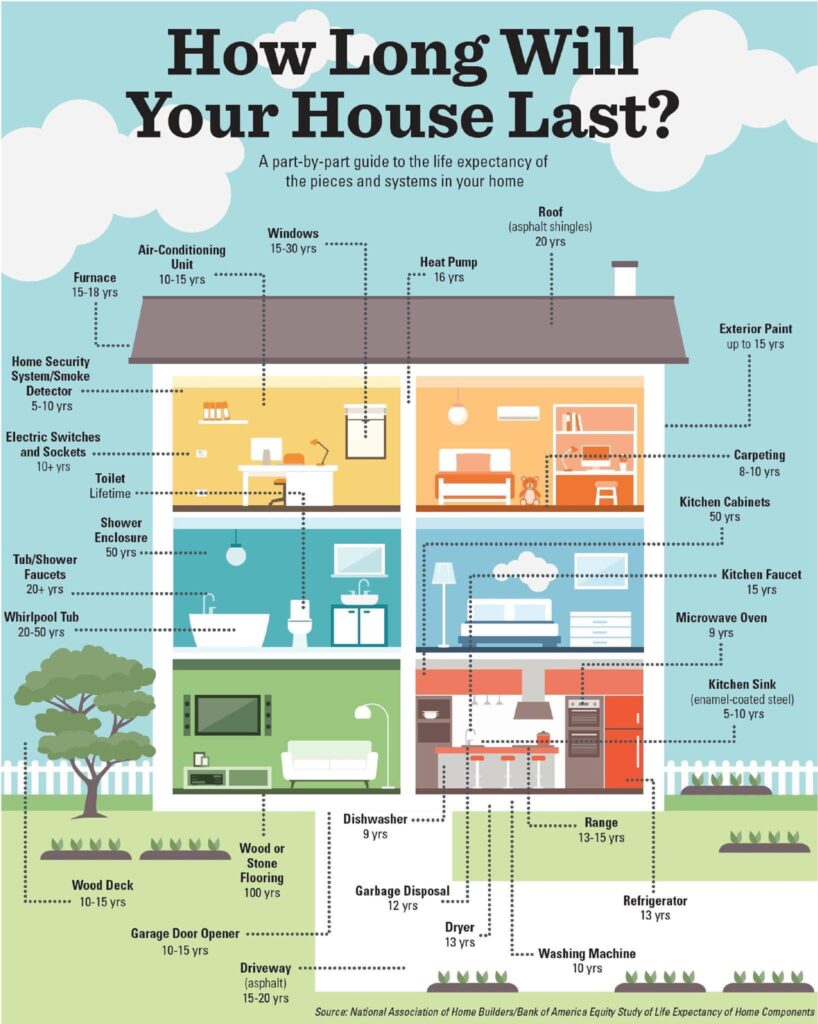

Capital Expenditures: These are larger expenses that will be necessary to replace aging components of your rental, such as a roof, HVAC, water heater, electrical panels or plumbing systems. While they may only occur every 5, 10 or even 20 years, it is common to factor in a capital expenditure “allowance” on a monthly basis, similar to maintenance. You can use a set dollar amount or about 5-10% of collected gross rent. More info.

Landscaping: Depending on the type of the property, you may or may not be responsible for landscaping expenses, such as grass, bush and tree trimming and removal of leaves or snow.

Utilities: In most cases, single-family home tenants will be responsible for paying utilities, but in some cases you will need to pay them yourself. It is more common for the landlord to pay some of the utilities for multi-family properties.

Mortgage Payment: If you are using financing, you will have a monthly mortgage payment. You can use a variety of online mortgage calculators (like this one from Bankrate) to calculate your monthly payment. All you need is your loan amount and interest rate, which you can get from your lender.

Other Analyzer Considerations

Location: Even if you pick a great city and neighborhood, the precise location of the home matters as well. Most tenants prefer quiet residential blocks and streets. You may want to avoid purchasing homes at busy intersections or near loud highways, businesses, or venues. Also consider the topography of the land. Homes at the bottom of a valley may have water drainage problems, while those on a steep slope may have foundation problems.

Property Type: Single family 1-4 units, but not condos.

Minimum Rent: Look for properties that can rent out at least $750/mo.

Year Built: I avoid homes older than 50-60 years, so if it was built before 1950, I will likely skip over it. Older homes will almost always have more ongoing maintenance issues, regardless of how good the rehab was. Additionally, older properties may have used poor or unsafe construction materials (like asbestos), which you may have to replace. Also note if the property is a newly constructed home. Newer homes seem better but the neighborhood much not be undeveloped and not stable during the next recession.

Beds/Baths: Different areas will have different prevailing bedroom and bathroom configurations. While there will probably be demand for a variety of houses, I prefer to buy rentals that are average and “expected” for that particular neighborhood. This is because, for example, if an area tends to attract middle-class families, it may be more difficult to rent out a 1 bedroom condo. 2 bedrooms is okay, but 3+ bedrooms is preferred. The more baths the more fixtures that have a potential to break. No family in their right mind will want to buy a 1 bathroom home so keep in mind the exit strategy.

Square Footage: We are trying to find “average” houses that are not too large and not too small to appeal to the largest possible group of prospective tenants. 800+ sq ft is a good baseline.

Layout: Get a floor plan from the turnkey company, if they have it, or look at the photos to get an idea for the layout of the house yourself. Focus especially on the kitchen and bathrooms, which should be functional and large enough to satisfy most tenants. Avoid properties with weird layouts, small or dysfunctional kitchens or other noticeable defects.

Parking: In order of preference, tenants prefer garages, covered parking or at least assigned off-street parking. A house with only street parking will likely be harder to rent.

Yard: Most houses will have at least some front or back yard. I don’t have a particular preference on the size of the yard, but I do prefer it to be fenced in. I also avoid properties with any sorts of yard amenities or improvements, such as pools, fountains, large trees, etc.

Construction Material: Most city blocks are built using similar construction materials, but there may be exceptions. Brick homes tend to last the longest, but may require very expensive structural repairs as they get older. Wooden homes are cheaper to repair, but can have pest infestations.

Floodplain: You can look up a property’s potential flood information on FloodTools.com. Their reports will tell you if the property is in a floodplain and likely to flood. You may want to avoid buying properties in areas that are prone to flooding or at least think about purchasing additional flood insurance. Most homes built before 2000 will not have a desirable open floor plan and will be functionally obsolescence to some degree. Be careful of investing in properties that fall in the FEMA 100-year flood map. Insurance can help mitigate a loss but something to check on your own – https://msc.fema.gov/portal/home

Occupancy: Prefer occupied, will sell vacant

HOAs: Typically, you want to avoid properties with HOA’s as this will reduce your cash flow.

Tenant Seasoning: No seasoning of tenants required

Rehab Scope of Work: Ask the turnkey company to forward you the full scope of work (SOW) that was performed during the rehab. This will give you an idea about the condition of the property before the repairs were made and allow you to hold the turnkey company accountable for the work they did.

Property Photos: Almost all turnkey companies will have at least some pictures of the property post-rehab. Avoid properties that do not come with pictures. If you’re unable to see the property yourself, this will be one of your only sources of information.

Section 8 or Straight Rent: Although it’s usually possible to find both “straight rent” and Section 8 tenants even in the lower-end neighborhoods, it may be difficult to avoid Section 8 in certain areas (which is okay post COVID-19!). Ask the turnkey provider whether the property is already rented through the Section 8 program and whether this will be likely in the future.

Cash Flow: Most investors have a minimum monthly cash flow (mine is $150/unit) and a minimum cap rate (mine is 8%) they will accept. It’s also a good idea to look at the cash on cash return of each property once you figure out how you’re going to finance it. The COC will tell you the return on your invested capital you can expect in the first year and should be higher than 10% in most cases.

Much of the information above is part of the home’s public record and can be obtained for free from the local county property assessor’s website (ex. search for “San Diego county property assessor”) or sites like Zillow, Trulia, and Realtor. It’s a good idea to verify all information through at least two different sources.

And as with the neighborhood, it’s always better to look at the property in-person yourself or at least have a trusted friend, family member, or partner do it for you. If that’s not possible, then be sure to look at as many pictures as possible to get an idea for what the house looks like on the inside and outside.

How Much Cash You'll Need for Purchase

The best financing you can get (Fannie Mae/Freddie Mac government backed loan) will require 20% downpayment for a non-owner occupied property 1-4 units.

Review these past podcasts to familiarize yourself with lending requirements. Note some requires change slightly over time:

1) Podcast #52

2) Podcast #136

3) Podcast #177

How to Calculate It

Calculating the total cash you’ll need upfront is very straightforward.

Total Cash Needed = Down Payment + Closing Costs

If you are not using financing and instead buying the property with cash, you will pay significantly more upfront:

Total Cash Needed = Purchase Price + Closing Costs

Glossary

● Purchase Price: This will be listed on the turnkey company’s website. It’s usually non-negotiable, although some turnkey providers give small discounts to repeat customers or bulk buyers (5-10%). You can ask them about it, but don’t count on getting one and it can be a little annoying and might soil your Relationship.

● Down Payment: A typical conventional mortgage on an investment property will require a 20-25% down payment. Ask the lender you’re working with for their specific requirements. Multiply the purchase price by the down payment percentage to get the dollar amount.

● Closing Costs: You will need to pay some additional costs during the closing process. These will vary depending on your lender and loan amount, so ask your lender to send you a closing cost estimate. Here are some of the items you will typically be responsible for

● Inspection Fee: As we’ll cover in a future module, it’s very important to get your property inspected by a certified home inspector to identify any problems. A single-family home inspection will usually cost around $300 – $500. A multi-family property may cost around $750 to inspect, depending on the number of units.

● Appraisal Fee: Your lender will require the property to be appraised before underwriting the loan. An appraisal usually costs around $500. In some cases, you will be required to pay this amount during escrow.

● Loan Origination Charges: Your lender will likely charge you some fees for their services. These usually range upwards of $1,000 and may be a set dollar amount or a percentage of the loan. Ask your lender for an exact estimate.

● Other Closing Costs: You will pay other fees as part of the closing process, including escrow fees, recording fees, transfer taxes, title insurance, etc. These will usually be around $1,000 total.

● Cash Reserves: Even with all the proper due diligence things can go wrong. Like someone vandalizing your property stealing your HVAC or breaking a few windows before a tenant get in there. Or it can be a tenant that gets placed but loses a job a couple weeks/months after and leaves the property in bad shape.

Calculating Return on Investment

There are many ways to measure the profitability of your investment. In all honestly, they are not all too important and can be overwhelming in the beginning. But trust me, you will get very motivated to learn it if you are like me and enjoy measuring how much money you are making.

The property’s capitalization rate (cap rate), cash on cash return (COC) and rent to value ratio (RTV) are three percentages that represents the “yields” of your rental and are similar to the returns you may be familiar with from other types of investments.

Calculating the COC

Unlike the cap rate, the cash on cash return does depend on your financing and will vary depending on the down payment and interest rate on your loan:

COC = Yearly Cash Flow / Total Invested Cash

This percentage gives you an approximate yield you will get on the cash you actually invest in this property. In other words – the return on your money you will get from this investment in the first year.

Similar to the cap rate, the higher the COC, the better the deal. You can experiment with different down payment amounts and loan interest rates to see how they will affect your returns.

As you can see this is why Real Estate kicks the 401ks butt.

Calculating the RTV

The rent to value ratio is calculated by dividing the monthly gross rent of the property by its purchase price:

RTV = Monthly Gross Rent / Purchase Price

While RTV does not take into account vacancy or operating expenses, it’s a good way to compare the income and cash flow potential of different rental properties. It’s an indicator of how expensive the home is relative to the rent it can bring in.

I typically do not consider properties with an RTV lower than 1%.

Calculating the Net Operating Income (NOI)

Abbreviated as NOI is calculated by subtracting all operating expenses from the operating income (which is gross rent, less vacancy) and represents the monthly income a property will generate without taking financing into account.

To calculate the NOI, first take all of the operating expenses and convert them to monthly dollar amounts. Next, add them up to get the total monthly expenses. Then plug them in to the following formula:

NOI = Gross Rent – Vacancy – Operating Expenses

Calculating Cash Flow

Unlike NOI, cash flow does take financing into account and can be calculated by using the following formula:

Cash Flow = NOI – Mortgage Payment

You can get the yearly NOI and cash flow by multiplying the monthly numbers by 12.

Calculating the Cap Rate

Calculating the Cap Rate

The cap rate is calculated by taking the yearly NOI and dividing it by the purchase price:

Cap Rate = Yearly NOI / Purchase Price

The cap rate represents a rate of return of a rental property that does not take financing into account, so it’s very popular for comparing different rental properties without worrying about how you’re going to finance them.

The higher a property’s cap rate, the better the return it will give you, and vice versa.

Glossary

○ Rent: You need an estimated monthly rent you can collect from the property. In my experience, the estimated rent provided by the turnkey companies is usually accurate. You can also verify it using the following sources:

○ Current Lease: If the property is already rented out, check the current lease for the monthly rent amount. Since somebody is already paying this much, this is a fairly accurate number

Resources

Using Cap Rate to determine property class

Approximate minimums by class of neighborhood. Some markets may be adjusted, but this is a general rule of thumb.

A Class = 5-6% cap rates

B Class = 6-8% cap rates

C Class = 8-10% cap rates

D Class = 10%+ cap rates

Determining Fair Market Rent

Having a relationship with a property manager is the best method for determining accurate rents.

Rentometer: This online tool will show you average rents based on the property address and size. If the rent estimate provided by the turnkey company is on the high side, it may be a red flag. We subscribe to Rentometer premium for students in our Incubator group to use.

Facebook Marketplace/Craigslist: The vast majority of tenants find places to live on Facebook Marketplace or Craigslist. Lately after 2018 more people have been finding listings through Facebook Marketplace where “weirder” tenants tend to use Craigslist. Search for comparable rental properties in the same area and look at what they are being rented for. More in our Forbes article.

Fun Activity: It should only take up to 10 minutes to complete

Steps:

1.Start with your property address and go to each website

2.Visit www.rentometer.com and type in the property address and the number of bedrooms. You can leave the rent amount blank. Click analyze my rental and you will get something like this:

3. Next go to https://www.zillow.com/rent/ and type in the property address and click search. Look for the Zillow Rental Zestimate as shown in the highlighted area:

4. Next, staying on the Zillow website click close in the property window and zoom out to see how many rental properties are available in that area.

5. Review how many rental properties are currently available in that area. This would be your competition.

6. Go to www.zilpy.com and type in the property information and click yes, that’s it

7. If you use the free version of Zilpy it will give you a range. If you use the paid version of Zilpy it will give you a close estimate along with comparable listings and an area vacancy rate.

8. Go to http://www.realtor.com/rentals and search the city where your property is located.

9. Use the map search feature on realtor to see how many listings are active and what the rental rates are.

10. Review your findings:

●Rent-O-Meter gives a median of $1126

●Zillow says $1395

●Zilpy says $950 – $1395

●There are 16 active rentals on Zillow & 6 on Realtor

●If the condition of the property is upgraded, I would assume a high of $1350. If the property is not updated I would assume $1250.

●Note: We listed this property for rent and one week later a tenant moved in at the $1250 rental rate.

Within the next two weeks:

From your market that you have chosen, look up 3-4 properties and analyze them!

Incubator students please prepare your scatter chart and spreadsheets of properties analyzed and we can check your findings on the next call.

Remote Investor Incubator

Check out the Remote Investor Incubator for additional information on “Deal Analysis”.