2) Understanding the Deal

Two Typical Syndication Methods

Most deals are put together with the following structures, which follow the SEC’s governances:

Regulation D Rule 506B – 90-97% of deals out there accept non-accredited investors, but the GP cannot openly market (generally solicit) the deal to a non-private list (for example, no TV, Radio, or social media ads). You can take my word for it (if you value your time) or look it up by randomly looking at all the deals on the SEC website.

Non-accredited investors will need to build relationships and demonstrate sophistication to syndicators in order to gain access to these investments. Investors (LPs) in these 506B deals will self-certify if they are accredited or non-accredited.

The SEC limits each deal to 35 sophisticated non-accredited investors. The law defines an investor as being “sophisticated” if they have sufficient knowledge and experience in financial and business matters to evaluate the merits and risks of investments. In all honestly, one really knows what the term “sophisticated” means.

Beware: If a syndicator is taking non-accredited investors (especially at lower minimum investments of under $25k) it could signal that an operator is desperate for investors. Non-accredited investors may require a lot of education, the most litigious (because it’s a big part of their life savings), be whiny, and be less of a “returning” investor (i.e., once they go into a few deals, they have deployed all their money).

Don’t come across as a “know-it-all” or total pain ultra-sophisticated investor because syndicators worse nightmare is asking very painstaking questions regarding profit and loss statements every monthly statement. When you get on a plane, do you ask the pilots if they know what they are doing every step of the way once the plane has taken off? We discuss this in the in the Secrets of Syndications Video Series but for now progress through these first few modules before checking that Bonus section out.

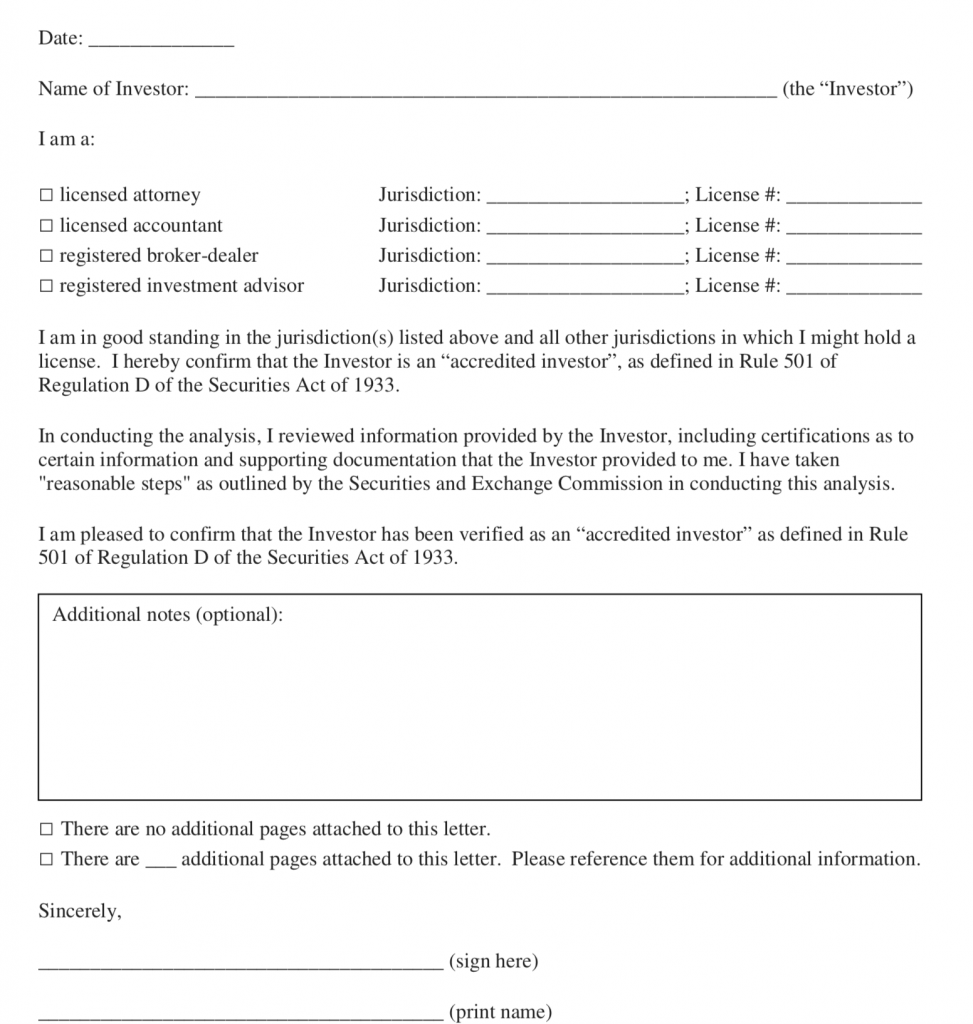

Regulation D Rule 506C – the minority of deals follow the newer rules where you can freely advertise in the world, but the SEC says if you do this, you cannot bring in non-accredited investors. Investors (LPs) will need a third-party letter from a lawyer, accountant, or third party site like Verify-Investor that validates Accredited status.

Anyone who says “there is no longer a pre-existing substantive relationship requirement and no waiting period” has confused Rule 506(b) with Rule 506(c), the latter of which does allow advertising to anyone, provided the issuer/sponsor takes reasonable steps to ensure that it only accepts funds from investors who are accredited and that their financial qualifications have been verified within 90 days of making the investment.

Above is one form of third-party verification

One of my biggest pet peeves I hear unsophisticated investors talk about when evaluating deals is 1) how its structured and 2) split/fee scheme. Passive investors really like to talk about this stuff but in my opinion it really does not really talk about the deal or business plan at all! I get it… most unsophisticated don’t even know how to underwrite deals or vet the operators so they focus on what they know (so they don’t get embarrassed talking to other sophisticated investors). But from here on out in this ecourse you will see less items discussing 1) how its structured – 506B or 506C example above and 2) split/fee scheme and more of what really matters which is the assumptions in the deal underwriting and vetting the business plan.

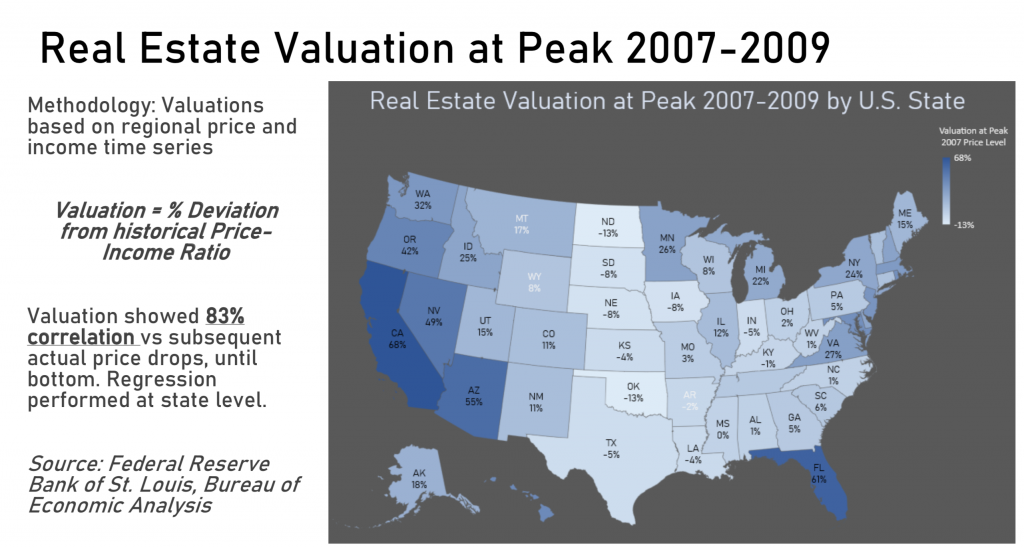

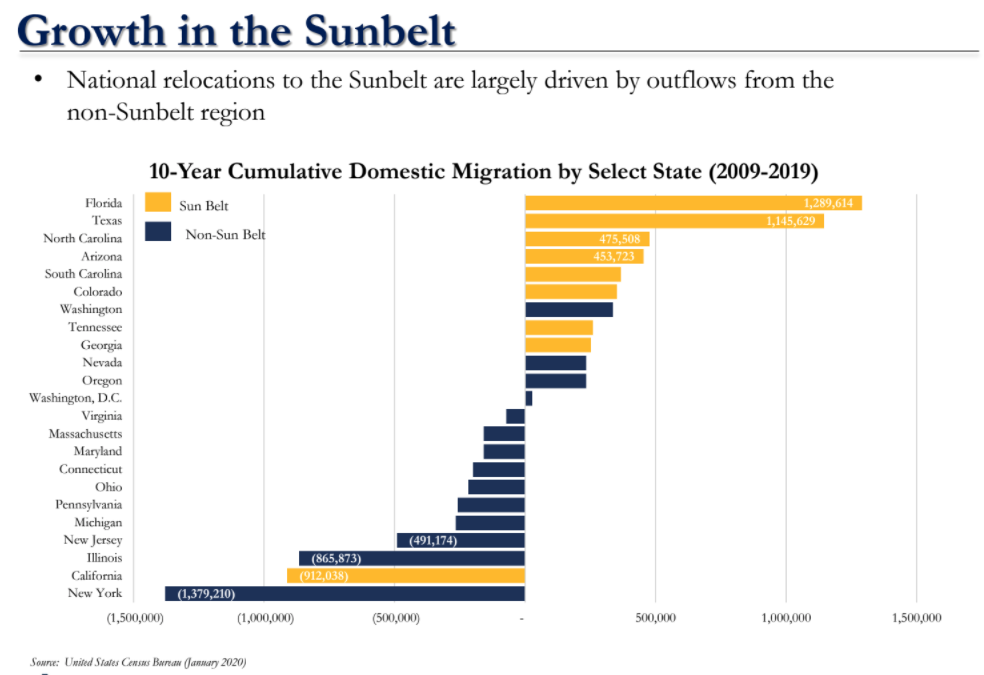

Evaluating a Market

In case you haven’t had experience with real estate investing and went straight to syndications, here’s a quick overview of how to evaluate a market taken from our Remote Rental eCourse. Owning rental properties is not a prerequisite to investing in syndications, but it does help educate passive investors at spotting sucker deals because they have some real world experience or context to rely on.

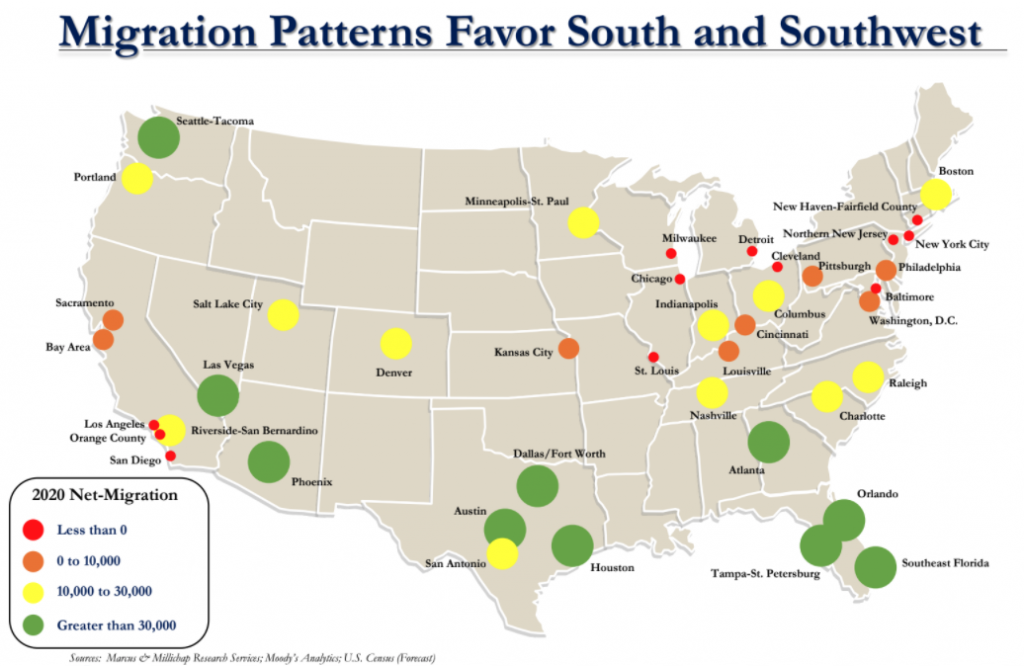

It is up to you as the passive investors to do the upfront due diligence when sponsors mention they are investing in “The #1 fastest growing city.”

Use the city data website to help you find the data below.

Cities

- Population Growth

- Has the city’s population gone up at least 20% since the year 2000?

- Examples: Phoenix, Las Vegas, etc.

- Has the city’s population gone up at least 20% since the year 2000?

- Income Growth (you can also use bestplaces.net)

- Is there 30% income growth since the year 2000?

- This means that the city is keeping up with inflation.

- Is there 30% income growth since the year 2000?

- Median House Value

- Is there a 40% increase in median house or condo value since the year 2000?

- Crime

- Were there less than 500 crimes last year? (Make sure this number goes down).

Neighborhoods

- Household income

- Is the average household income between $40k-$70k? Note this can range based on your strategy such as B or A class Apartments or mobile home parks.

- Below $40k – there will be an increase in delinquencies

- Above $70k – there will be a lower cap rate (more on cap rates in the next module)

- Is the average household income between $40k-$70k? Note this can range based on your strategy such as B or A class Apartments or mobile home parks.

- Poverty Level

- Be wary of investing in neighborhoods lower than 20%.

- Unemployment Rate (Google this)

- Make sure this is not above 2% higher than the city’s unemployment rate.

- Demographic Diversity

- You want to have at least two ethnicities in the neighborhood

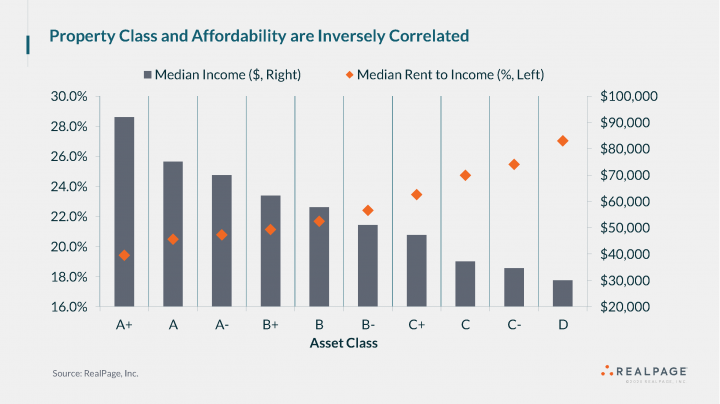

Understanding Asset Classes

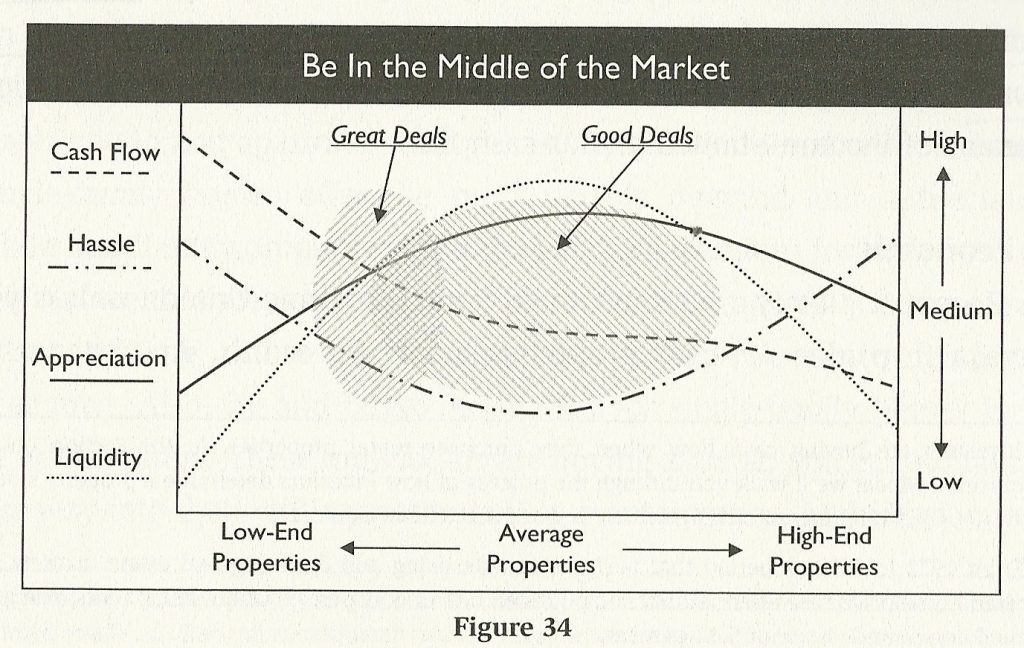

The property prices in expensive areas are usually so high that the rental properties you buy will not produce enough cash flow to cover the higher mortgage payments.

On the other hand, homes in the low-end areas are often cheap and the cash flow looks very attractive on paper. But the low quality tenants these areas attract will create a lot initially of unforeseen problems, like missed rent payments, higher wear-and-tear on your home, evictions or vandalism. Long-term, these will chip away at your cash flow and significantly reduce your profits.

The sweet spot is often in the middle – in the working-class neighborhoods that attract middle-class families. These areas have a good mix between home prices (not too expensive) and tenant quality (generally good) and will attract longer-term tenants that are not interested in destroying your home.

Multifamily Property Classes

- Class A: New construction, luxury apartments, command highest rents in the area, high-end amenities (full service gym, pools, dog parks, etc.)

- Class B: 20-30 years old, well-maintained, little deferred maintenance, often appeal to working class tenants.

- Class C: Older kitchens and bathrooms, some deferred maintenance (peeling paint, older roofs, etc.)

- Class D: You can see the neglect from far away, no amenity package, low occupancy, a lot of deferred maintenance (units are dated)

Neighborhood Class

- Class A: most affluent neighborhood, expensive homes nearby, maybe have a golf course

- Class B: middle class part of town, safe neighborhood

- Class C: low-to-moderate income neighborhood

- Class D: high crime, very bad neighborhood

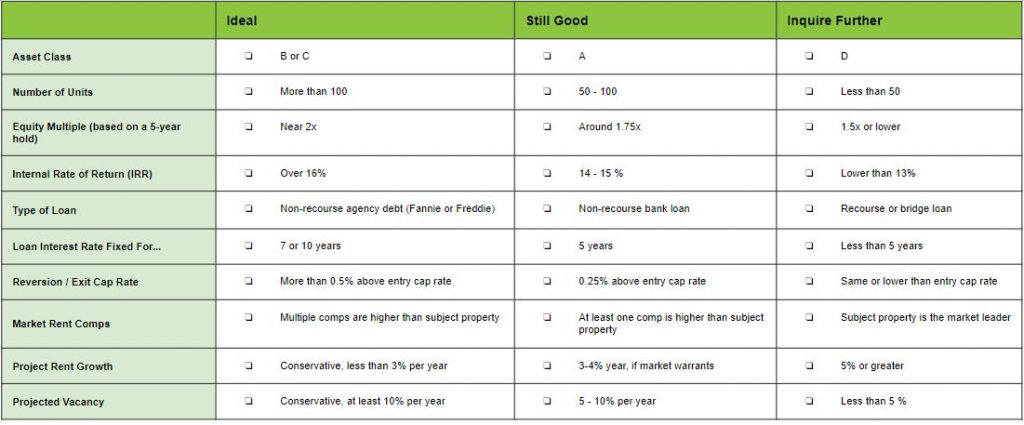

To sum it up the table below gives a general overview of what the ideal deal looks like.

Yield vs Value-add Play

Yield Plays

Yield plays offer lower rates of return because the asset is already operating well (possibly even cash flowing on Day 1) and there’s little upside other than market rent inflation and tweaking expenses.

Some ways we tweak expenses are:

- Have the tenant responsible for the water bill - When tenants aren't paying for water, they usually are less likely to conserve water. Before we purchase a multifamily property without separate meters on a yield play, we confirm that the tenant pays all utilities in the lease agreement, Owner's P&L (profit and loss) statement, and records with the utility company. Then we will know that we can tweak this expense by adding individual meters for each unit. This means that instead of dividing the total water bill by the tenant's proportional floor space, we can bill each tenant based on what they actually consume and incentivize conservation.

- Water Conservation - In addition to changing the meter, we also make sure there are no water leaks on-site, install low-flow aerators on sink faucets, and install low-flow showerheads/toilets. Sometimes the local water district may offer these conservation measures free of charge.

- Garbage - We reduce this cost by comparing prices with other companies in the area, upgrading to a larger dumpster vs. paying for individual cans, adding recycle bins to reduce the amount of garbage bin/dumpster size needed, adding a lock to the dumpster (if non-tenants are throwing away trash in the dumpsters), and negotiating the rates by adding an auto-pay option.

- Earn points on utility bills - If we have to pay for the water/sewer bill, we set the bills on auto-pay with a credit card to earn cash back or reward points.

- Create a utility bill back program (water, trash, cable, gas, etc):

Value-add Plays

Value-add plays are risker and have the potential for a higher rate of return. You may not see cashflow for 3-18 months. It will depend on the GPs to manage the property or hire a great property management company to secure those higher returns.

Note: “Value-Add” term gets thrown around a lot as a buzz word. Light value add can be loosely defined as 3k-6k of rehab per unit, medium is up to 12-15k. And heavy value-add or development is 15k-150k per unit.

- Flat fee bill back

- When the units are the same size and same number of beds/baths, a flat fee bill is easiest for the Owner and the tenants. The downside is that it may not cover every month’s bill, in which case the Owner will have to pay the difference.

- Implement radio utility bill back system (RUBS)

- RUBS divides the utility bill among tenants based on criteria such as square footage, number of beds/baths, number of tenants in unit, etc.

- Splitting the bill

- For smaller properties, sometimes it’s better to have the tenants pay for their actual utility costs.

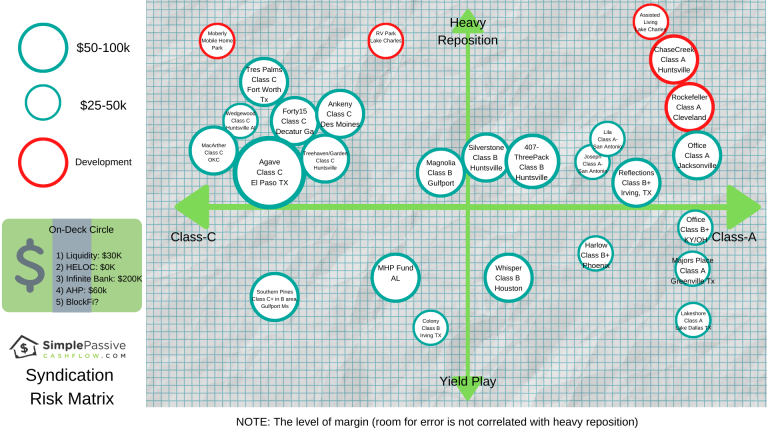

My personal holdings as of 20.12.2. I attempted to mind map my holdings. Ideally my investment philosophy would be to go into light/medium value add Class B deals (centered around the 407-Three Pack Class B Huntsville) but as you can see my investments are scatter all around. As an investor, I am trying to get my weighted average where my target investment philosophy. No deal is going to check all the boxes for you.

Typical Class-C Stabilized Value-Add Business Plan Example

The current owner has spent over $400,000 on complex improvements, none of that has been spent on updating unit interiors or adding amenities for residents. All interior units have original finishes.

To enhance value, a cap-ex or value-add program will be implemented to increase revenue. Most of the 174 units will be renovated at a cost of approximately $2,500 to $3,500 per unit, commanding an average $50 rent premium. Below are some of the ways that will be used.

Traditional value add – rehabbing units

How we add value in intangible ways which also improves tenant retention and why they end up paying more than market rents.

Interior Upgrades

Interior upgrades may include new vinyl flooring, new appliances, modern light fixtures, and new hardware and plumbing fixtures. We like to do these first because tenants will pay more if their specific unit is upgraded. We also try to tackle the clubhouse to which is the first thing new tenants see.

Exterior Upgrades

Building exteriors will also be updated including improving the parking lot, adding solar screens, and installing security cameras. While the property has been nicely maintained, the surrounding landscaping could use a refresh. We will also look to add a new outdoor amenity to the property such as an outdoor grilling area. This exterior improvements are great at the middle to end of rehab process because it does not really bump rents off the bat like the interior (low hanging fruit) but exterior improvements do a lot to solidifying the community and making it look like to potential buyers.

Rebranding

We will also rebrand the property to give a modern name and signage. This also excited good tenants that a new manager is in town as they see changes they maybe willing to pay for the community upgrade. At the same time it tips off bad tenants that their days are numbered.

Reduce Utilities

Other areas we will look to find opportunities include implementing energy efficiency and water savings upgrades to reduce overall utility expenses, improving the laundry services which are currently under-utilized, and looking to create a new efficiency unit where the current office space is. Many vendors try to reach out for low cost high efficiency faucets and toilets which are supposed to recoup costs very quickly.

Things we look for when we tour properties:

Not updated (entrance) property sign/logo – must adapt to current times not when the property was first built; must attract high quality residence

Logo not in appropriate sizing/ color, not big enough to see – logo must be emphasized so people can see hence it will bound to be useless; so people will be aware where to go

Not well maintained foliage or garden strips

Not coordinated paint scheme (exterior) of the units

Wall (exterior) stains

Furniture (owned by tenant) not well kept in front of the apartment unit

Placement of barbecue grill (personally owned by the tenant) in front of the apartment unit- fire hazard

Light fixtures (interior) must be change, must be uniform- existing lights have combination of white and yellow

Even if the bathroom and kitchen area looks fine, it needs cleaning (TLC)

Mismatched appliances (refrigerator white in color while the oven is color black) – small details make a huge difference. May change the refrigerator into black so it will match the other appliances

Changing kitchen cabinet staining- that will resemble with the appliances

Private backyard not enclosed – can charge additional in the rental fee if backyard is enclosed

Not enough accents in the pool area (ex. placement of umbrellas, gazebo, arrangement of pool chairs)

Not enough benches; repurposing of existing outdoor picnic benches and tables needed – to experience more of the outdoor area amenities

Outdoor public grill placed in a health hazard area (rusty and too near the benches)

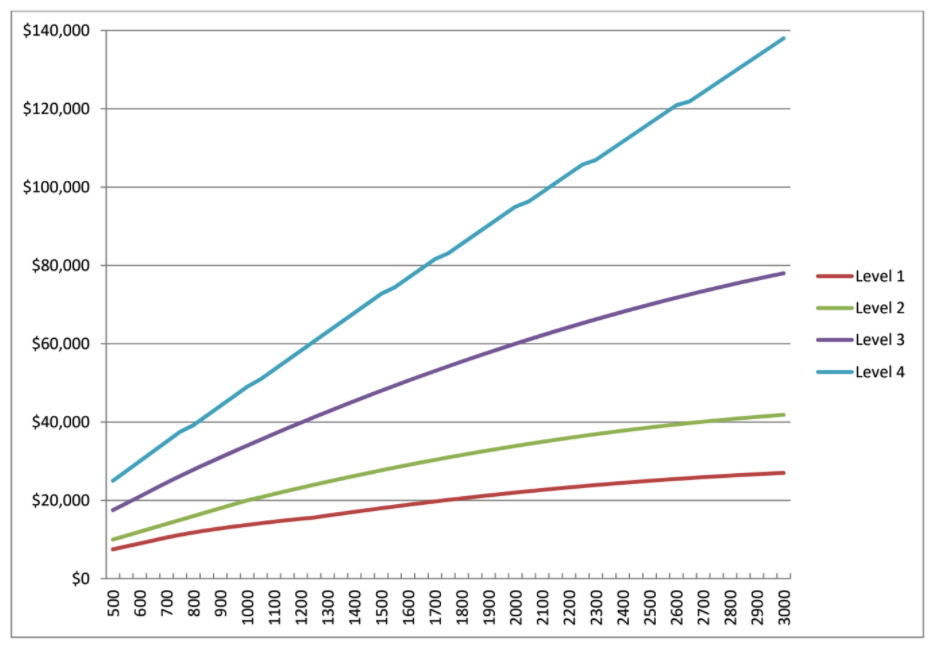

Rehab Ballpark Estimate

Level 1 – “Lipstick” will be just paint and flooring, maybe freshening up landscaping. Changing out some light fixtures and mirrors. Minimal work can be done in a week or two.

Level 2 – Cosmetic Update – in addition to Level 1, one or two additional expensive updating/repairs will be required such as window replacement, roof, HVAC replacement, kitchen cabinets, bathrooms. No structural moving of walls or plumbing/electrical components. This would be a 3‐4 week rehab

Level 3 – Moderate Updates/Repairs – Kitchen and bathrooms require updating. Two to three expensive updating/repairs will be required. Some plumbing and electrical work may be required. May include removing one wall and installing a glue lam beam to open up floor plan. This is the most common rehab level for older homes. Rehab would last 6‐8 weeks

Level 4 – Full Updates/Repairs – Entire home requires updating. Some moving of walls, removing of walls. Some rewiring and re-plumbing required. Replacement of mechanicals. May include items such as moving laundry rooms, reconfiguring kitchens, adding light circuits. Potential structural/crawlspace issues. 8+ weeks to complete the work.

Level 5 – Full Gut and/or Addition– House will be gutted to the studs and rebuilt with or without addition. All trades will require major scopes. Should be estimated case by case – not included.

*Taken from Remote Rental eCourse for Single Family Rentals (not apartments)

My Investment Fundamentals:

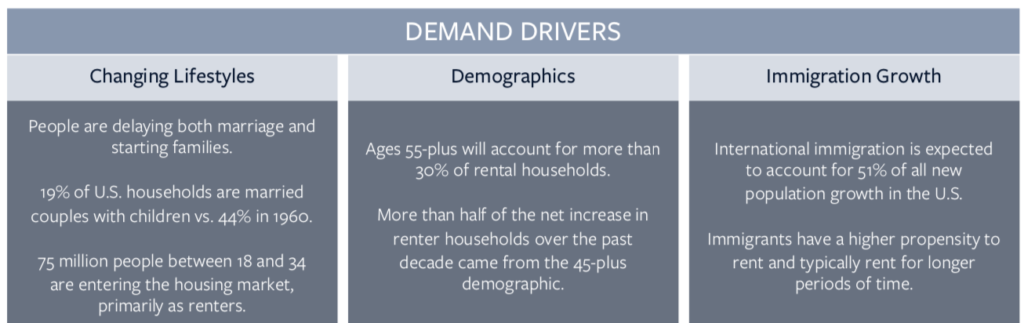

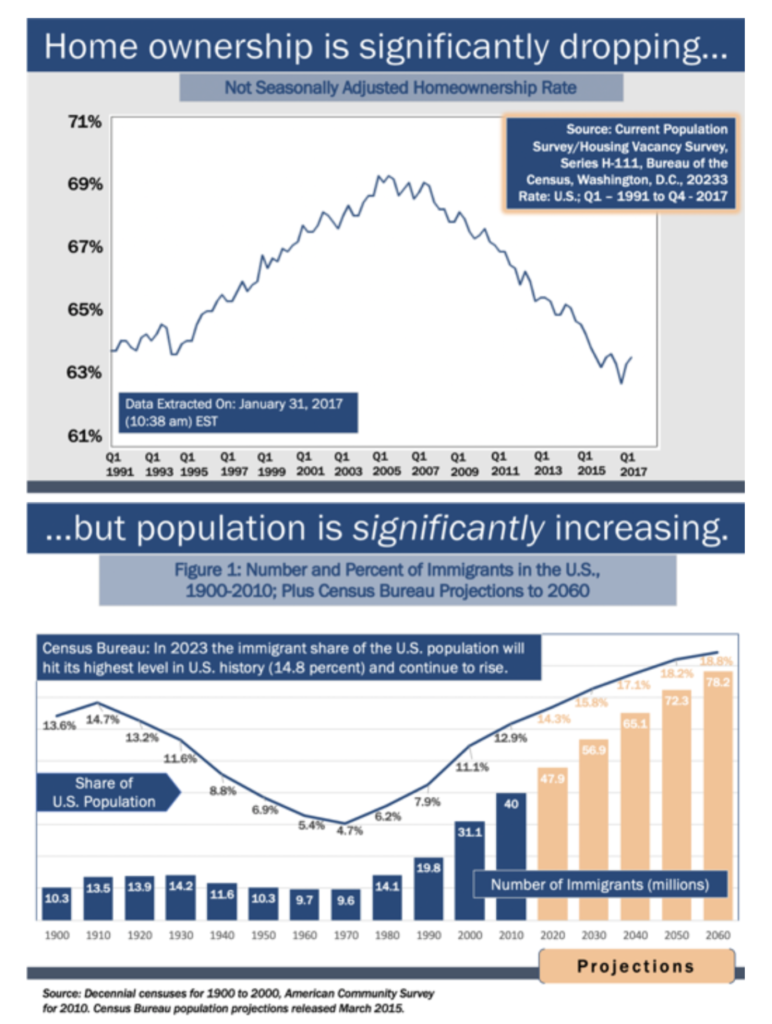

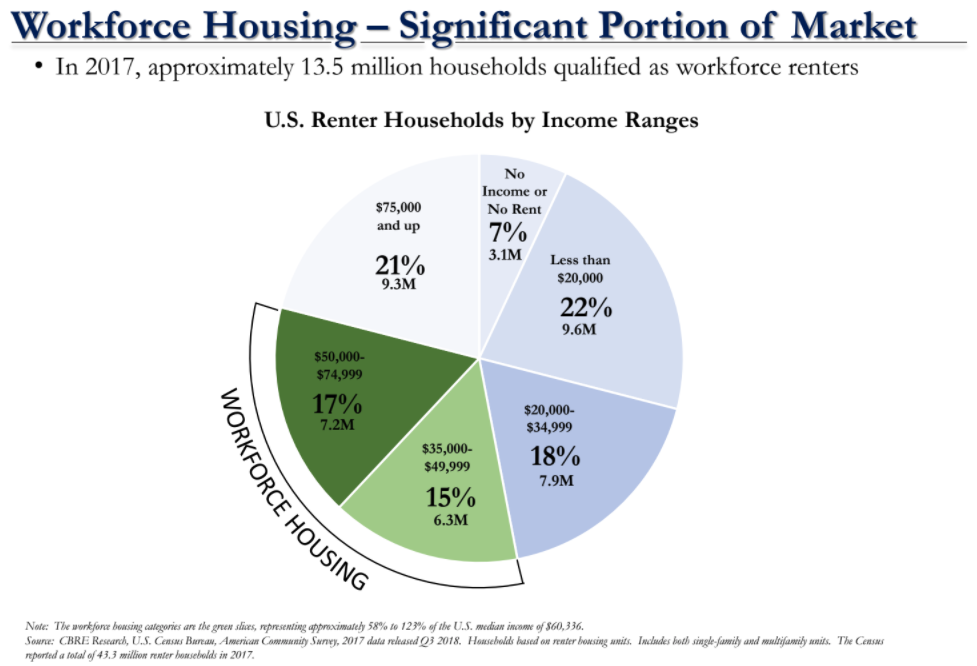

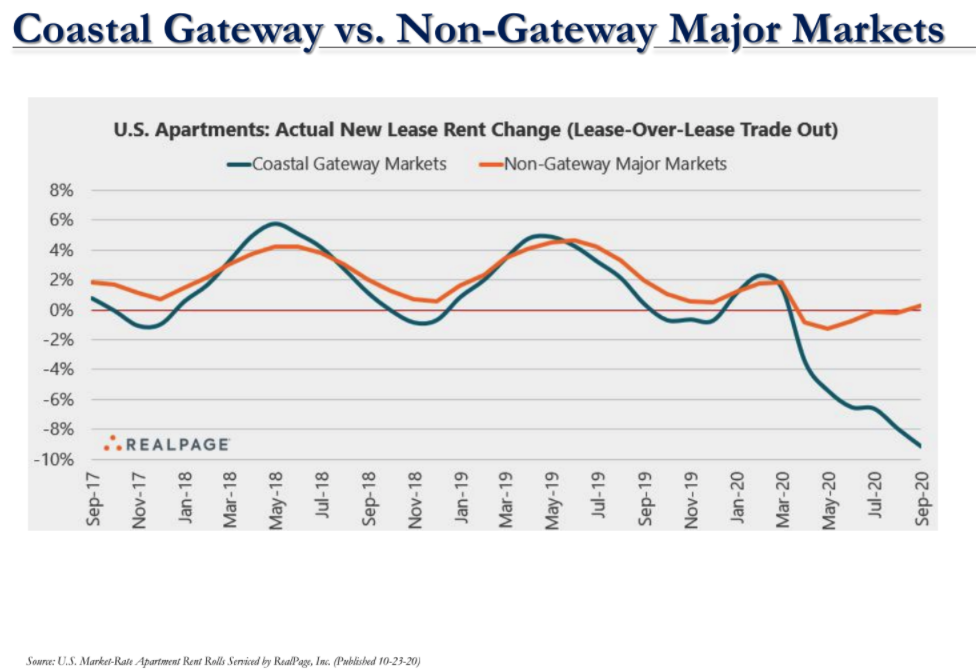

Workforce Housing & Emerging Markets

Physical vs. Economical Occupancy in Apartment Investing

Vacancy in apartments decreases top line income and getting occupancy as high as possible is the goal. There are two different types in apartment investing:

Physical Occupancy

The number of occupied units that have a tenant signed with a lease. This is shown on the rent roll with the tenant’s name next to the unit number which needs to be physically audited and verified by the project management team that has boots on the ground.

Often listed as a percentage. For example, a 100 unit property with 8 vacancies will have a 92% physical occupancy.

However just because a unit is occupied, doesn’t mean it’s generating income (i.e. tenant may not be paying full monthly rent).

Depending on the market, full occupancy is 92-100% occupied.

Economic Occupancy

- Tenants not paying rent

- Concessions ($200 move-in specials, discounts to motivate tenant prospects)

This is calculated by dividing the net rent by received the gross rents possible.

For example on a 100 unit apartment assume each unit rents for $1,000/month which gives a gross potential of $1,200,000/year. Let’s say you have 10 people not paying any money and 10 people paying half rents. That would give you an economic occupancy of 85%. Typically we assume for 3% as the normal amount of non-collections. So if we have a property “fully occupied” at 95% it is normal to see 92% of the top line rents actually hit our bank account. Still this is a lot better than a single family home rental where one dead beat tenant means zero income. This is why we like larger commercial assets because its a steady state numbers game that a lot of the variability is taken out of the investment.

In Economic Occupancy, this could entail:

- Poor Property Management

- Bad rent collection (or PM stealing money)

- Lack of maintenance (causing tenants to leave)

- Great opportunity for investors with the right business plan

Note: This is a key part of investor due-dilligence to spot check that the syndicator has accounted for economic vacancy/loss to lease.

We focus on multifamily housing properties in the $10M to $50M purchase price range. We avoid smaller properties due to the competition from unsophisticated Mom and Pop investors that push up prices. We also steer clear of large institutional investors who are willing to overpay for large assets (investing lazy retirement money for the masses). We believe that the middle market, which includes real estate projects and transactions in the $20M-$100M total capitalization range, offers the best opportunity for solid risk-adjusted returns. The middle market may be particularly attractive during a down market as there may be even less competition, and unique opportunities caused by market dislocation can be found (distressed operators).

Different Types of Deals

Below is yet another way investors discuss deal risk/reward profiles – so if you joined our inner circle or came to one of our events you would be primed to start adding value to conversations and build relationships with other pure passive investors.

The way deals are categorized below do not speak to any being “better” than each other. Of course our eCourse will help you find sucker deals (ie Opportunistic deals that have the same projected returns as Core deals). It is up to you to you as an investor to develop your own personal investment philosophy based on your values and investor goals/timelines.

As with any investment opportunity, however, real estate carries risk – sophisticated investors know that assuming the deal they are looking follows the typical Sharpe Ratio trendline that more risk you take on means more potential returns:

Core (usually lowest risk): These are new or like new properties in highly desirable neighborhoods that are often fully rented to tenants with good credit. Since they’re in new/like new condition though, there’s little to no room to improve the property to increase cash flow. These investments are usually a good fit for investors who want stable income and capital preservation.

Value-add (usually higher risk): These are typically good properties in decent areas that are at least partially rented and generating some cash flow, but that cash flow could be increased if the property or its management (sometimes both) is improved. Given the cash needed to fund improvements and the increased risk of execution for the business plan, these investments are riskier than core investments and therefore have a higher target level of returns.

Opportunistic (usually highest risk): These are generally older, often neglected properties in less desirable areas that may be partially rented or vacant. They can also be development projects with no rental cash flow. In both cases, a lot of time and money is usually needed to rehab or build the property, which makes this the highest risk (but potentially highest return) investment strategy of all.

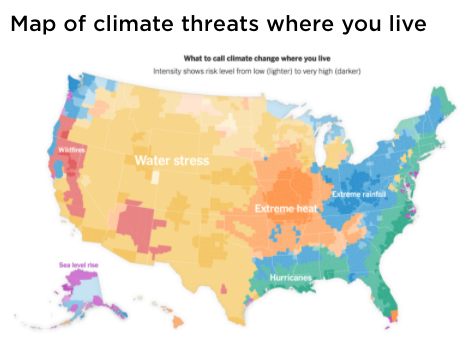

What Happens if there’s a Natural Disaster?

Flood Zones

Be careful of investing in properties that fall in the FEMA 100-year flood map. Insurance can help mitigate a loss, but this is something to check on your own.

FAQ’s

In short, its just another strange rule that governs 506B offerings. You can read Rule 501(a) of Regulation D promulgated under the Securities Act of 1933 (the “Securities Act”). Here is my best attempt at explaining this… An accredited investor is defined by the United States Securities & Exchange Commission as someone who makes a minimum of $200,000 ($300,000 if filing jointly) or has a net worth of 1 million dollars excluding personal residence. The significance of being an accredited investor is that you can invest in things that those with less money cannot. You can also be something called “a sophisticated investor” which has a much more nebulous definition but essentially says you know what you are doing even if you don’t have that much money. A 506b offering allows 35 non-accredited investors who must be “sophisticated investors.” These laws were put in place long ago to “protect” the average person from predatory activity. The irony of this all is that there is no protection for the average Joe, or pension funds for that matter, against investing in a wildly bloated stock market at record valuations. Every major trader out there knows we are in a bubble but there is no protection for individuals dumping money into their retirement accounts to buy mutual funds. It’s an archaic system which makes little sense. Certainly, there has been some recognition of this fact. The 2012 JOBS act made it easier for Main Street America to participate in “alternative” investments via crowdfunding and made it easier for sponsors to advertise previously unknown opportunities. However, we have a long way to go. I would advise you that you need to know the lead syndicator personally. None of this “we met at a local REIA and he pitched me his deal”. If a guy does not have a list of solid investors, they must lack the track record.

It all depends on what the syndicator does to market the deal which determines if the deal is a 506B or 506C.

506C allows for open marketing and general solicitation, but the SEC wants to protect average Joe from doing something dumb so only Accredited are allowed. Thus the 3rd party check.

506B is not openly marketed, and thus there is a little less scrutiny from SEC. But as the syndicator, I have to act responsibly because if I make the wrong call, you could get all your money back. Of course this is all predicated on the deal going south and as in sports… winning (a good investment) covers up a lot of things.

Typically, I see $50,000 as the minimal investment in 90% of deals I take a look at. Sometimes you can find $25,000 deals, but those are typically done by newer syndicators. Asking to get a lower minimum just to get a “good deal” is annoying and can be poor form.

The GP wants to minimize the number of investors and keep it to 40-100 investors per deal. The more investors mean more headaches, filing costs, etc.

Institutional operators with higher acquisition fees and worse LP splits usually are around $100k-250k+ minimums. Sometimes a sponsor will have flexibility to lower the minimums, but it can be bad form to always be that LP who is asking to get in for less. It is the equivalent to that guy who is always asking for a discount and the first guy left off the roster when the deal fills up. Remember that this is a relationship business.

This is a guide, not a rule. Think about it – $100k will be gone in a couple deals at $50K per investment. If you don’t have adequate cashflow coming in annually (~$30K a year), you are a sitting duck for a year or two. I would think of this as using SFHs to get you from gear 1-2 or 0-35mph in a car. People who have excess money after expenses (Cashflow) via their day job or investments (Gear 5-7 or over 55 MPH) should transition to syndications at some point for diversification and scalability if they are NOT a good operator. If they are, they should syndicate and lead deals. This transition is tricky. Yes, it’s a little uncomfortable.

It is recommended that you understand the business. Starting small with at least one SFH is recommended as a prerequisite to getting started with bigger investments. Although finding and working with good operators is great, unfortunately good operators do go into bad deals. Also, you want to be able to have a surface level idea of what is in these executive summaries of these offerings. For more ideas, check out how I manage my liquidity here.

Most deals that are NOT public (506B) but most people who don’t have a network can only see the mass-marketed 506C deals for accredited investors only (via Crowdfunding websites). If you are a non-accredited investor, you will need to put yourself out there and start shaking hands or picking up the phone (or post-pandemic get on a Zoom call). Real estate, especially syndications, are a people-based investment.

Usually you plug in 10% for a regular market and 8% for an Atlanta/Dallas (hotter market). After that, you deduct a few percent points to account for deadbeats (economic vacancy). In the end, this moves the needle very slightly. The Cap rate is the biggest factor on proformas – i.e., what you use for the reversion cap rate.

- The current property manager who has managed for last 2 years has cited that crime is not bad on the property, there has just been a notable incident which were not residents, but outside instigators.

- Residents are thoroughly screened with appropriate background checks, etc.

- We’ve also called the local police department to corroborate.

- We will be installing security cameras. We’ve also been on-site; you don’t need a bullet proof vest walking around.

- I’ve driven there at night, there’s plenty of lighting thanks to recent LEDs installed and no issues.